Professional Documents

Culture Documents

Allowable and Disallowable Expenses PDF

Allowable and Disallowable Expenses PDF

Uploaded by

BensonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allowable and Disallowable Expenses PDF

Allowable and Disallowable Expenses PDF

Uploaded by

BensonCopyright:

Available Formats

Allowable and Disallowable Expenses

Allowable Expenditure Disallowable Expenditure

Staff related costs Not wholly & exclusively incurred for trade

Employers NIC Your own wages, salary or drawings

Insurance The initial cost of buildings

Rents Council tax relating to the private use

Heating, Lighting, Rates of your home

Security Alterations & improvements to business

General maintenance of: premises (Capital Allowances)

business premises and machinery Travel between your home & workplace

Telephone, mobiles Entertaining

Postage, printing Legal fees and fines if you break the law

Trade & professional journals General reserves for bad debts

Car insurance, servicing, repairs The cost of clothes which could be worn

Road fund licence for non-work purposes

Petrol/Diesal Payments to clubs, charities

Parking fees Depreciation

Rail fares, air fares, taxi Capital (Pre-acquisition)

Hotels Gifts to customers- £15 max

Accommodation & subsistence No food, drink or tobacco unless

Advertising, mailshots conspicuous advertising under certain limits

Accountancy fees Hire charges for expensive cars

Solicitors fees Lease premiums

Professional indemnity insurance Theft by Directors & senior staff

Unrecoverable debts

Interest on business bank loans

Bank charges, credit card charges

Pre-trading expenditure

Use of home as an office

Music cds, videos, dvds

Laundry

Grooming

Christmas parties (Up to certain limits)

Allowable Deductions

Expenses incurred solely for business purposes are generally allowable. This expenditure is

usually referred to as 'Wholly & Exclusively'.

Disallowable Deductions

Expenditure which is not wholly and exclusively intended for trade purposes, is not allowable.

An easier way to remember what is allowable is to use the Tax Return itself. On the Tax Return,

the Inland Revenue lists the items, which should be included as expenditure items.

This is a good indication as to what the Inland Revenue will allow.

www.fitnessindustryaccountants.com

For resources articles and free downloads, visit the website.

advice@andrewjamesconsulting.com

You might also like

- Analysis of Company, Products and Competitors of Vishal Mega MartDocument55 pagesAnalysis of Company, Products and Competitors of Vishal Mega Martaleyateeq100% (2)

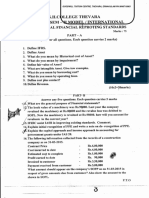

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Questions On Value PF SupplyDocument4 pagesQuestions On Value PF SupplyMadhuram SharmaNo ratings yet

- JDDocument2 pagesJDJeet ChaudhuriNo ratings yet

- Bme Term PaperdocDocument6 pagesBme Term PaperdocVamshi Krishna MallelaNo ratings yet

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Lesse Evaluation ProblemsDocument3 pagesLesse Evaluation ProblemsAnshuNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- Areas of Research in Commerce & ManagementDocument25 pagesAreas of Research in Commerce & ManagementAnonymous FKWVgNnSjoNo ratings yet

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATNitin ChoudharyNo ratings yet

- Educational FundDocument3 pagesEducational FundAnamika Rai PandeyNo ratings yet

- Equity ValuationDocument42 pagesEquity ValuationSrinivas NuluNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- Financial Accounting: Semester - IvDocument63 pagesFinancial Accounting: Semester - IvKARANNo ratings yet

- Capital and RevenueDocument20 pagesCapital and RevenueDr Sarbesh Mishra100% (1)

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- Bandhan Bank Limited IPODocument3 pagesBandhan Bank Limited IPOVeena AcharyaNo ratings yet

- FLIP Finance and Banking Practice Test 2Document14 pagesFLIP Finance and Banking Practice Test 2Aaditya Chawla100% (4)

- Contract Costing - SumsDocument9 pagesContract Costing - Sumskushgarg627No ratings yet

- Kingfisher Airlines Annual Report 2011 12Document85 pagesKingfisher Airlines Annual Report 2011 12Neha DhuriNo ratings yet

- SecuritisationDocument31 pagesSecuritisationAbhishek MalikNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Manappuram General Finance & Leasing Ltd. (Gold Loan)Document14 pagesManappuram General Finance & Leasing Ltd. (Gold Loan)Rushabh ShahNo ratings yet

- Political Risk-Concept, Measurement and Management of Political RiskDocument10 pagesPolitical Risk-Concept, Measurement and Management of Political Riskshreya26janNo ratings yet

- Tybbi Fra TheoryDocument5 pagesTybbi Fra TheoryNavin Saraf100% (1)

- India Home Loans LTD Credit Policy of India Home Loans LTDDocument9 pagesIndia Home Loans LTD Credit Policy of India Home Loans LTDvinayak_cNo ratings yet

- Factoring and ForfaitingDocument21 pagesFactoring and ForfaitingDilip RajNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Articleship Exam QuestionsDocument33 pagesArticleship Exam QuestionsVarshiniNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument9 pagesFINANCIAL MANAGEMENT AssignmentMayank BhavsarNo ratings yet

- TRB MCQDocument6 pagesTRB MCQDurai ManiNo ratings yet

- Bangalore University Previous Year Question Paper AFM 1Document3 pagesBangalore University Previous Year Question Paper AFM 1Ramakrishna NagarajaNo ratings yet

- Electronic Data Interchange: Nature, Benefits of E.D.I, Demerits of E.D.IDocument36 pagesElectronic Data Interchange: Nature, Benefits of E.D.I, Demerits of E.D.IutkaljyotiNo ratings yet

- Chap 8 - Advanced Issues in ValuationDocument50 pagesChap 8 - Advanced Issues in Valuationrafat.jalladNo ratings yet

- Appraisal of Promoters & ManagementDocument37 pagesAppraisal of Promoters & Managementmanik_mittal3No ratings yet

- Profits and Gains From Business and ProfessionDocument4 pagesProfits and Gains From Business and ProfessionAyaan AhmedNo ratings yet

- JCL INTERNATIONAL LTD V/S BHARAT PETROLEUM CORPORATION LTDDocument9 pagesJCL INTERNATIONAL LTD V/S BHARAT PETROLEUM CORPORATION LTDAkshay PillaiNo ratings yet

- 4 FM AssignmentDocument3 pages4 FM AssignmentGorav BhallaNo ratings yet

- Pre and Post Shipment Unit IVDocument15 pagesPre and Post Shipment Unit IVvishesh_2211_1257207100% (1)

- 6-Notes On Credit Rating ServicesDocument21 pages6-Notes On Credit Rating ServicesKirti GiyamalaniNo ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Fund Based ActivitiesDocument35 pagesFund Based Activitiesyaminipawar509100% (3)

- The Handbook of Financial Modeling: Printed BookDocument1 pageThe Handbook of Financial Modeling: Printed BookThanh NguyenNo ratings yet

- JD-COM - General Banking Officer - Clearing & Collection PDFDocument3 pagesJD-COM - General Banking Officer - Clearing & Collection PDFfaexasultanaNo ratings yet

- Tax Benefits To Ssi SectorDocument13 pagesTax Benefits To Ssi SectorHarshVardhan AryaNo ratings yet

- KPIT TechnologyDocument41 pagesKPIT Technologysanjayrathi457No ratings yet

- Fifco Usa Brands Breweries Job Application FormDocument6 pagesFifco Usa Brands Breweries Job Application FormAnishaNo ratings yet

- Mbo HerohondaDocument22 pagesMbo HerohondavithanibharatNo ratings yet

- Factoring ServicesDocument22 pagesFactoring ServicesamygurlNo ratings yet

- ForfeitingDocument18 pagesForfeitingAchal KhandelwalNo ratings yet

- Insurance Claim - Notes ClusterDocument4 pagesInsurance Claim - Notes ClusterPriyanka0% (1)

- Market Segments of National Stock ExchangeDocument9 pagesMarket Segments of National Stock ExchangePNo ratings yet

- Adv & Disadv of M CommerceDocument10 pagesAdv & Disadv of M CommerceGaurav KumarNo ratings yet

- IT Income From Other Sources Pt-2Document7 pagesIT Income From Other Sources Pt-2syedfareed596100% (1)

- SFM May 2015Document25 pagesSFM May 2015Prasanna SharmaNo ratings yet

- Merchant Banking SyllabusDocument4 pagesMerchant Banking SyllabusjeganrajrajNo ratings yet

- Expenses GuideDocument3 pagesExpenses GuidehknavinNo ratings yet

- Startup Business Cost WorkoutDocument7 pagesStartup Business Cost WorkoutNatarajanThirunavukkarasuNo ratings yet

- Tally Ledger List in Excel Format - Teachoo PDFDocument6 pagesTally Ledger List in Excel Format - Teachoo PDFAMIT KUMAR DUTTA100% (1)

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs TemplatePatrick OppongNo ratings yet

- Datos Tecnicos Planta OLYMPIANDocument4 pagesDatos Tecnicos Planta OLYMPIANLuis CastagnetoNo ratings yet

- Combustion EjeciciosDocument13 pagesCombustion EjeciciosHectorRdzNo ratings yet

- Emotional Happiness - Pastor-Teacher Jim Borchert - (AG)Document27 pagesEmotional Happiness - Pastor-Teacher Jim Borchert - (AG)ilacatdNo ratings yet

- Troponin I and Troponin TDocument4 pagesTroponin I and Troponin Tdebbie o. azcunaNo ratings yet

- Homoeopathic Materia Medica Similima - 5a2074371723dda2e5b9a236 PDFDocument5 pagesHomoeopathic Materia Medica Similima - 5a2074371723dda2e5b9a236 PDFSom NathNo ratings yet

- Slide #: NotesDocument6 pagesSlide #: NotesTonyo LinaNo ratings yet

- Minimal Model: Perspective From 2005: ResearchDocument9 pagesMinimal Model: Perspective From 2005: ResearchEddy CorNo ratings yet

- 8 Reasons Why The Pork Barrel Funds and Other Presidential Funds Should Be AbolishedDocument14 pages8 Reasons Why The Pork Barrel Funds and Other Presidential Funds Should Be AbolishedDiana AbalosNo ratings yet

- Oral Histo SiteDocument2 pagesOral Histo SiteLiau Chu SengNo ratings yet

- Ensci 1100Document2 pagesEnsci 1100Zester MabasaNo ratings yet

- Reducing Healthcare Costs: The Physician Perspective OnDocument7 pagesReducing Healthcare Costs: The Physician Perspective OnJeddy Zawadi GeeNo ratings yet

- Jagaroo & Santangelo - Neurophenotypes Advancing Psychiatry and Neuropsychology 2016Document305 pagesJagaroo & Santangelo - Neurophenotypes Advancing Psychiatry and Neuropsychology 2016Jaime Fernández-Aguirrebengoa100% (1)

- Increase Op-Amp Output Voltage Swing Boosting OutputDocument7 pagesIncrease Op-Amp Output Voltage Swing Boosting OutputmammolloNo ratings yet

- ADMN-2-001, Issue 01, Procedure For Building Management SystemDocument2 pagesADMN-2-001, Issue 01, Procedure For Building Management SystemSmsajid WaqasNo ratings yet

- Anodising Vs Powder CoatingDocument3 pagesAnodising Vs Powder CoatingCgpscAspirantNo ratings yet

- CPG Dengue Infection PDF FinalDocument82 pagesCPG Dengue Infection PDF FinalTIong Tung WeiNo ratings yet

- 3 - Self-Determination TheoryDocument26 pages3 - Self-Determination TheoryOnur GökNo ratings yet

- 05 AIB ME BOQ Rev AFDocument14 pages05 AIB ME BOQ Rev AFelias workuNo ratings yet

- Finishing Workshop: TCI Powder CoatingsDocument10 pagesFinishing Workshop: TCI Powder CoatingssavioNo ratings yet

- Adhd Research PaperDocument29 pagesAdhd Research PaperEunice Doctolero100% (1)

- Mediassist Ecard PDFDocument1 pageMediassist Ecard PDFKameswara Rao TallapragadaNo ratings yet

- (Specification For Shotcrete (ACI 506.2-95 PDFDocument8 pages(Specification For Shotcrete (ACI 506.2-95 PDFRonaldo Hertez50% (2)

- Zygospore: Phylum: ZygomycotaDocument16 pagesZygospore: Phylum: ZygomycotaDavid NindiNo ratings yet

- Kalipay: B. Mendoza ST., Bgy. Kalipay, Puerto Princesa City, PalawanDocument43 pagesKalipay: B. Mendoza ST., Bgy. Kalipay, Puerto Princesa City, PalawanShōya IshidaNo ratings yet

- Chapter 9 PolyurethanesDocument43 pagesChapter 9 Polyurethanesaslı aslanNo ratings yet

- Swissotel Training ReportDocument64 pagesSwissotel Training ReportAnirban Majumder100% (2)

- Strength of Materials - Simple Stresses - Hani Aziz AmeenDocument23 pagesStrength of Materials - Simple Stresses - Hani Aziz AmeenHani Aziz Ameen100% (1)

- Anthem Silver Preferred Blue PPO 3000 20 7250 W HSA NH PPO Small 6UPP 01 01 2023 English SBC CYDocument12 pagesAnthem Silver Preferred Blue PPO 3000 20 7250 W HSA NH PPO Small 6UPP 01 01 2023 English SBC CYsantiagomNo ratings yet