Professional Documents

Culture Documents

Thiru T. Jacob, I.A.S.

Uploaded by

heyaanshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thiru T. Jacob, I.A.S.

Uploaded by

heyaanshCopyright:

Available Formats

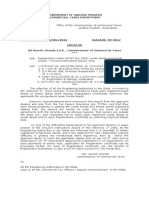

COMMERCIAL TAXES DEPARTMENT

From To

THIRU T. JACOB, I.A.S., Tvl. SVS Classic Foods,

Commissioner of Commercial Taxes, No. 7, Gandhi Road, Hastampatty,

Chepauk, Chennai-5. Salem – 636 007.

Lr. No. VAT Cell / 23722 /2007 (VCC No. 613) dated 31.5.2007.

Sir,

Sub: TNVAT ACT, 2006 – Rate of tax clarification under

TNVAT Act, 2006 - Requested by Tvl. SVS Classic

Foods, Salem - Sent – Reg.

Ref: Letter dated 17.4.2007 from Tvl. SVS Classic Foods,

Hastampatty, Salem.

******

Tvl. SVS Classic Foods, Hasthampatty, Salem have requested rate of tax

clarification under the TNVAT Act, 2006, for which the following clarifications are

issued.

(1) If interstate sale is made to an unregistered dealer, the rate of tax under CST

Act will be the rate of tax applicable under TNVAT Act, 2006. i.e. 4% for the goods

mentioned in Part B of the First Schedule or 12.5% for the goods in Part C of the First

Schedule as the case may be and not at 4% only as stated by the dealers.

(2) If the goods are sold to interstate dealer at 3% against ‘C’; form and the

purchasing dealer is unable to furnish ‘C’ form, the selling dealer in Tamil Nadu has to

pay tax at the local rate of tax applicable under the TNVAT Act, 2006 i.e. 4% or 12.5%

as applicable and not at 4% only as stated by the dealer. If the local rate of tax applicable

is 12.5%, the dealer has to pay CST at 12.5% only for the sales not covered by ‘C’ form.

(3) If the interstate sales are covered by ‘C’ form (i.e. sales to registered dealer),

then only the dealers are eligible for input tax credit on the respective local purchases. In

other words, interstate sales to unregistered dealers are not eligible for input tax credit on

the respective local purchases according to Section 19(5)(c) of the TNVAT Act, 2006.

Sd./ G. Shanmugam,

For Commissioner of Commercial Taxes

Copy submitted to the Secretary to Government,

Commercial Taxes and Registration Department, Chennai-9.

// Forwarded / By Order //

COMMERCIAL TAX OFFICER (VAT)

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Cms - Tn.gov - in Sites Default Files Gos Ctax e 132 2012Document5 pagesCms - Tn.gov - in Sites Default Files Gos Ctax e 132 2012Karur SaranNo ratings yet

- VAT Booklet F.Y.2012-13Document20 pagesVAT Booklet F.Y.2012-13ankur2706No ratings yet

- GST Pre RequsitesDocument22 pagesGST Pre RequsitesAswathyAkhoshNo ratings yet

- GST Flyers: Central Board of Excise & Customs New DelhiDocument468 pagesGST Flyers: Central Board of Excise & Customs New DelhiPrerna YadavNo ratings yet

- Flyer On GST by CBECDocument468 pagesFlyer On GST by CBECAbhinavNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- PT Challan MTR 6Document1 pagePT Challan MTR 6mak_palkar772No ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- GST Registration ProcessDocument11 pagesGST Registration ProcessSalil BoranaNo ratings yet

- 2019891982838814salestaxcircularno.3of2019 StrninvoiceDocument1 page2019891982838814salestaxcircularno.3of2019 StrninvoiceinocentNo ratings yet

- Anheuser Busch Inbev India LTD Vs CCTDocument5 pagesAnheuser Busch Inbev India LTD Vs CCTAsma HussainNo ratings yet

- The Jurisdiction of Customs Commissionerate, AhmedabadDocument2 pagesThe Jurisdiction of Customs Commissionerate, Ahmedabadsanjiiva8531No ratings yet

- How To Register For GST OnlineDocument11 pagesHow To Register For GST Onlinerishank52No ratings yet

- 1) Rate Structure Under GST: GST Rates For Supply of Goods: For Inter-State Supply, IGST Rates Are: Nil, 0.25%Document2 pages1) Rate Structure Under GST: GST Rates For Supply of Goods: For Inter-State Supply, IGST Rates Are: Nil, 0.25%Mohit BNo ratings yet

- Topic 6Document35 pagesTopic 6saravanan_kkNo ratings yet

- Annual Report of Taxation 2017Document5 pagesAnnual Report of Taxation 2017aneshNo ratings yet

- Issues of Compliance in GSTDocument8 pagesIssues of Compliance in GSTMahiya Ahmad100% (1)

- Chapter 1: Understanding Goods and Services Tax 2Document49 pagesChapter 1: Understanding Goods and Services Tax 2Vasanth VNo ratings yet

- How To Comply With Summary Lists of Sales and Purchases - Tax and Accounting Center, IncDocument8 pagesHow To Comply With Summary Lists of Sales and Purchases - Tax and Accounting Center, IncJames SusukiNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- Guide To GST Registration Ask Your ProfessionalDocument15 pagesGuide To GST Registration Ask Your ProfessionalAmisha khandelwalNo ratings yet

- GST Booklet KutchDocument34 pagesGST Booklet KutchBhavik MehtaNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- ELP Tax Update - Recent Clarifications To Settle Certain Issues Under GSTDocument4 pagesELP Tax Update - Recent Clarifications To Settle Certain Issues Under GSTELP LawNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- Vision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaDocument24 pagesVision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaAnam FatimaNo ratings yet

- Unit I.4 - Levy and Collection of GSTDocument38 pagesUnit I.4 - Levy and Collection of GSTFake MailNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- Kar HC TP SoftbrandsDocument80 pagesKar HC TP SoftbrandsGVKNo ratings yet

- Reply To DRC & GSTR9 ErrorDocument3 pagesReply To DRC & GSTR9 ErrorVinay KalagarlaNo ratings yet

- GO88 - 101008 TN Samadhan Sale TaxDocument2 pagesGO88 - 101008 TN Samadhan Sale TaxVenkatasubramanian KrishnamurthyNo ratings yet

- GST in India: A Comprehensive Guide BookDocument77 pagesGST in India: A Comprehensive Guide Bookgaurav dhallNo ratings yet

- GST Invoice Formats by Teachoo PDFDocument15 pagesGST Invoice Formats by Teachoo PDFaasha1000No ratings yet

- Custom Duty in IndiaDocument29 pagesCustom Duty in IndiaKaranvir GuptaNo ratings yet

- GST NotesDocument39 pagesGST NotesCrick CompactNo ratings yet

- Compostion SchemeDocument6 pagesCompostion SchemeK S RNo ratings yet

- PCBUDocument1 pagePCBUchityalasriaktnh0000No ratings yet

- Total Philippines vs. CIRDocument4 pagesTotal Philippines vs. CIRAnonymous uMI5BmNo ratings yet

- 6 Goods and Services TaxDocument15 pages6 Goods and Services TaxKumarVelivelaNo ratings yet

- Service TaxDocument2 pagesService TaxManoj BishtNo ratings yet

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawDocument9 pagesDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghNo ratings yet

- How GST Would Impact Startups & Small and Medium Size BusinessesDocument12 pagesHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNo ratings yet

- Consumercharter TV PDFDocument9 pagesConsumercharter TV PDFJay JainNo ratings yet

- Consumer Charter: GTPL Hathway LTDDocument9 pagesConsumer Charter: GTPL Hathway LTDArnab BhowmikNo ratings yet

- 2012CT - CC 25Document4 pages2012CT - CC 25Diya PandeNo ratings yet

- Iv Sem Tax ProjDocument9 pagesIv Sem Tax ProjVagisha SharmaNo ratings yet

- DECLARATIONDocument1 pageDECLARATIONMandeep SodhiNo ratings yet

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNo ratings yet

- Manual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitDocument29 pagesManual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitshaouluNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- Appeal No. C/11799-11801/2017-DBDocument7 pagesAppeal No. C/11799-11801/2017-DBCESTAT, Ahmedabad Commissioner ARNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Exemption Under GSTDocument2 pagesExemption Under GSTWelcome 1995No ratings yet

- Commercial Taxes-Tamil NaduDocument40 pagesCommercial Taxes-Tamil NaduharidasskNo ratings yet

- VAT To Remedies of A Taxpayer (95%)Document61 pagesVAT To Remedies of A Taxpayer (95%)Yrjell ObsiomaNo ratings yet

- SCN Medworld TechnologiesDocument2 pagesSCN Medworld TechnologiesFAIZ AliNo ratings yet

- Accurate Umayal Sales 2019-20Document2 pagesAccurate Umayal Sales 2019-20heyaanshNo ratings yet

- Project: Jay FarmsDocument21 pagesProject: Jay FarmsheyaanshNo ratings yet

- Failed To Establish Connection To The Server. Kindly Restart - GST ForumDocument5 pagesFailed To Establish Connection To The Server. Kindly Restart - GST ForumheyaanshNo ratings yet

- MCQ Miscellaneous Provisions by Amit Jain SirDocument5 pagesMCQ Miscellaneous Provisions by Amit Jain SirheyaanshNo ratings yet

- TDS On DividendDocument14 pagesTDS On DividendheyaanshNo ratings yet

- TDS U - S. 195 On Grant of License For Copyrighted Software For Internal Business PurposesDocument9 pagesTDS U - S. 195 On Grant of License For Copyrighted Software For Internal Business PurposesheyaanshNo ratings yet

- Documents Required For Current AccountDocument1 pageDocuments Required For Current AccountheyaanshNo ratings yet

- TDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowDocument10 pagesTDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowheyaanshNo ratings yet

- On Job Training Region Sumbagsel Week 1,2,3: Gede Sena Prabawa PutraDocument27 pagesOn Job Training Region Sumbagsel Week 1,2,3: Gede Sena Prabawa PutraSena PrabawaNo ratings yet

- Vmware Certified Professional Sample Questions and Answers: Mikelaverick@rtfm-Ed - Co.ukDocument23 pagesVmware Certified Professional Sample Questions and Answers: Mikelaverick@rtfm-Ed - Co.ukpaulalbert10No ratings yet

- Channel ConflictDocument30 pagesChannel ConflictmustafaNo ratings yet

- Tofiz BillDocument27 pagesTofiz BillHabibNo ratings yet

- Mai Anh 1Document8 pagesMai Anh 1051: Phạm Thị Ngọc HàNo ratings yet

- 1347875384webfinal - County Seat September 2012 28 PagesDocument28 pages1347875384webfinal - County Seat September 2012 28 PagesCoolerAdsNo ratings yet

- VTU Exam Question Paper With Solution of 18CS33 Analog and Digital Electronics March-2021-Dhanya ViswanathDocument43 pagesVTU Exam Question Paper With Solution of 18CS33 Analog and Digital Electronics March-2021-Dhanya Viswanath1DT20CS072 MANISHA POONIANo ratings yet

- Advanced Intelligent Systems For Sustain PDFDocument1,021 pagesAdvanced Intelligent Systems For Sustain PDFManal EzzahmoulyNo ratings yet

- Metro Jobs Clearance Form BlankDocument1 pageMetro Jobs Clearance Form BlankTj Daquigan100% (1)

- Binding MechanismsDocument24 pagesBinding MechanismsPratyush NagareNo ratings yet

- Educational Video: A Multimodal Approach in Teaching Secondary Social StudiesDocument11 pagesEducational Video: A Multimodal Approach in Teaching Secondary Social StudiesInternational Journal of Arts, Humanities and Social Studies (IJAHSS)No ratings yet

- The Health Insurance Portability and Accountability Act of 1996 (HIPAA) Privacy and Security RuleDocument24 pagesThe Health Insurance Portability and Accountability Act of 1996 (HIPAA) Privacy and Security RuleTylerDesjarlaisNo ratings yet

- TED End-of-Trimester Test Paper 2020-21Document14 pagesTED End-of-Trimester Test Paper 2020-21Jemmy RobertNo ratings yet

- Set A - EteeapDocument16 pagesSet A - EteeapRomina GravamenNo ratings yet

- Schengen VisaDocument4 pagesSchengen Visajannuchary1637No ratings yet

- Comprehensive 1 2 Chapters 1-4Document38 pagesComprehensive 1 2 Chapters 1-4api-35603600250% (2)

- Strategies of Philippine National PoliceDocument5 pagesStrategies of Philippine National Policemichael angelo cayabyabNo ratings yet

- Icje 4 3 29 34Document6 pagesIcje 4 3 29 34Akira MiyazonoNo ratings yet

- Comba ODV2-065R18J-G V1Document1 pageComba ODV2-065R18J-G V1RogerNo ratings yet

- BCA2 DbmsnotesDocument96 pagesBCA2 DbmsnotesMohd TausifNo ratings yet

- Karl-Deutsch - Katalog Głowic UTDocument32 pagesKarl-Deutsch - Katalog Głowic UTjar_2No ratings yet

- GK Power Capsule Sbi Po Clerk Mains Bob Rbi Grade B ExamsDocument100 pagesGK Power Capsule Sbi Po Clerk Mains Bob Rbi Grade B ExamsjigneshNo ratings yet

- A320 TakeoffDocument17 pagesA320 Takeoffpp100% (1)

- Measure Theory Notes Anwar KhanDocument171 pagesMeasure Theory Notes Anwar KhanMegan SNo ratings yet

- Rerum Novarum - Cled 4Document2 pagesRerum Novarum - Cled 4Melprin CorreaNo ratings yet

- The Subject of International LawDocument8 pagesThe Subject of International Lawpriyankkothari123No ratings yet

- 6.5.2.3 Packet Tracer - Troubleshooting Static Routes Instructions PDFDocument2 pages6.5.2.3 Packet Tracer - Troubleshooting Static Routes Instructions PDFaakash muthurama lingamNo ratings yet

- Declaration of Cyber AdvisoryDocument5 pagesDeclaration of Cyber Advisorydeeptanwar1997No ratings yet

- Italian in 30 Days - The WorkbookDocument254 pagesItalian in 30 Days - The WorkbookMariia Okseniuk100% (8)

- Amilan® CM3001G30Document3 pagesAmilan® CM3001G30agungNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Heart and Hustle: Use your passion. Build your brand. Achieve your dreams.From EverandHeart and Hustle: Use your passion. Build your brand. Achieve your dreams.Rating: 4.5 out of 5 stars4.5/5 (48)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (91)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)