Professional Documents

Culture Documents

A5 - Fringe Benefit Taxation

Uploaded by

Jomer FernandezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A5 - Fringe Benefit Taxation

Uploaded by

Jomer FernandezCopyright:

Available Formats

FRINGE BENEFIT TAXATION

PROBLEM 1

Rubio Company leased a residential house for the use of Ms. Collantes, its branch manager.

The rent agreed upon under the lease contract was P 120,000 per month.

Compute the following:

1(a). Fringe benefit tax for the month if the branch manager is a resident citizen.

Value of Fringe Benefit per month 120,000

Monetary Value rate x 50%

Monetary Value 60,000

Gross-up rate ÷ 65%

Gross-up Monetary Value 92,307.69

Fringe Benefit Tax rate x 35%

Fringe Benefit Tax per month 32,307.69

1(b). Fringe benefit tax for the quarter if the branch manager is a resident citizen.

Fringe Benefit Tax per month 32,307.69

Months x 3

Fringe Benefit Tax per quarter 96,923.07

1(c). Fringe benefit tax for the month if the branch manager is NRA-ETB.

Value of Fringe Benefit per month 120,000

Monetary Value rate x 50%

Monetary Value 60,000

Gross-up rate ÷ 75%

Gross-up Monetary Value 80,000

Fringe Benefit Tax rate x 25%

Fringe Benefit Tax per month 20,000

1(d). Fringe benefit tax for the quarter if the branch manager is NRA-ETB.

Fringe Benefit Tax per month 20,000

Months x 3

Fringe Benefit Tax per quarter 60,000

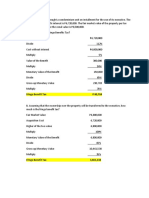

PROBLEM 2

Cortan Company bought a residential house and transferred the title of it to Mr. Lim, its President.

The house was acquired at a cost of P3.5million. Its zonal value is P3.2million and assessed value

is P3.4million.

Compute the following:

2(a). Fringe benefit tax if the president is a resident citizen.

Value of Fringe Benefit 3,400,000

Monetary Value rate x 100%

Monetary Value 3,400,000

Gross-up rate ÷ 65%

Gross-up Monetary Value 5,230,769.23

Fringe Benefit Tax rate x 35%

Fringe Benefit Tax 1,830,769.23

2(b). Fringe benefit tax if the president is NRA-ETB.

Value of Fringe Benefit 3,400,000

Monetary Value rate x 100%

Monetary Value 3,400,000

Gross-up rate ÷ 75%

Gross-up Monetary Value 4,533,333.33

Fringe Benefit Tax rate x 25%

Fringe Benefit Tax 1,133,333.33

PROBLEM 3

Bolo Company purchased a property at an installment price of P3million and allows its use to

Mr. Lezano, President of the company.

Compute the following:

Scenario 1: Property is REAL PROPERTY (e.g. House and lot)

3-1(a). Fringe benefit tax if the president is a resident citizen.

Value of Fringe Benefit(5% x 3M)/12 12,500

Monetary Value rate x 50%

Monetary Value 6,250

Gross-up rate ÷ 65%

Gross-up Monetary Value 9,615.38

Fringe Benefit Tax rate x 35%

Fringe Benefit Tax per month 3,365.38

Months x 3

Fringe Benefit Tax per quarter 10,096.14

3-1(b). Fringe benefit tax if the president is NRA-ETB.

Value of Fringe Benefit(5% x 3M)/12 12,500

Monetary Value rate x 50%

Monetary Value 6,250

Gross-up rate ÷ 75%

Gross-up Monetary Value 8,333.33

Fringe Benefit Tax rate x 25%

Fringe Benefit Tax per month 2,083.33

Months x 3

Fringe Benefit Tax per quarter 6,249.99

Scenario 2: Property is PERSONAL PROPERTY (e.g. CAR)

3-1(a). Fringe benefit tax if the president is a resident citizen.

Value of Fringe Benefit(20% x 3M) 600,000

Monetary Value rate x 50%

Monetary Value 300,000

Gross-up rate ÷ 65%

Gross-up Monetary Value 461,538.46

Fringe Benefit Tax rate x 35%

Fringe Benefit Tax per month 161,538.46

3-1(b). Fringe benefit tax if the president is NRA-ETB.

Value of Fringe Benefit(20% x 3M) 600,000

Monetary Value rate x 50%

Monetary Value 300,000

Gross-up rate ÷ 75%

Gross-up Monetary Value 400,000

Fringe Benefit Tax rate x 25%

Fringe Benefit Tax per month 100,000

THEORY

4-1: What type of tax is Fringe Benefit Tax (FBT)? ____Final Tax_____________________________

4.2: When is FBT required to be filed? ______Quarterly_____________________________________

4.3: What BIR form or return needs to be filed for FBT? BIR Form No. 1603 – Quarterly Remittance

Return of Final Income Taxes Withheld (On Fringe Benefits Paid to Employees Other than Rank

and File)

POINT SYSTEM:

PROBLEM: Two (2) points for each item with correct solution and answer, otherwise zero (0)

THEORY: 1 point each

TOTAL: 23 points

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- 06 Task PerformanceDocument2 pages06 Task PerformanceKatherine Borja67% (3)

- For The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Document2 pagesFor The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Aleksa FelicianoNo ratings yet

- Assignment #1 Solution (Chapters 3 and 5)Document5 pagesAssignment #1 Solution (Chapters 3 and 5)aklank_218105No ratings yet

- Junior Philippine Institute of Accountants: Rizal Technological UniversityDocument4 pagesJunior Philippine Institute of Accountants: Rizal Technological UniversityA BNo ratings yet

- Aswath Damodara - Talk - PPT PDFDocument34 pagesAswath Damodara - Talk - PPT PDFRavi OlaNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- Theories: B. 2 and 3 OnlyDocument5 pagesTheories: B. 2 and 3 OnlyLucille Mae EndigaNo ratings yet

- Source: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementDocument5 pagesSource: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementSuhas VaishnavNo ratings yet

- Bài tập chap 17 18Document3 pagesBài tập chap 17 18huanbilly2003No ratings yet

- Eff Super 150 MvsirDocument53 pagesEff Super 150 MvsirJames BondNo ratings yet

- Answers - Chapter 4 - Provisions, Contingent Liab. & Contingent AssetsDocument2 pagesAnswers - Chapter 4 - Provisions, Contingent Liab. & Contingent AssetsLhica EsterasNo ratings yet

- Bond and NoteDocument22 pagesBond and NoteEyuel SintayehuNo ratings yet

- Submissions 05. Taxation TAX.06 DIY DrillDocument9 pagesSubmissions 05. Taxation TAX.06 DIY DrillLovely SheenNo ratings yet

- INCOME TAXATION Chap 5 PG (184-192) PDFDocument2 pagesINCOME TAXATION Chap 5 PG (184-192) PDFnazarene moralesNo ratings yet

- Chapter 5 PercentageTaxes - WithillustrationsDocument12 pagesChapter 5 PercentageTaxes - WithillustrationsCathy Marie Angela ArellanoNo ratings yet

- FIN330Document3 pagesFIN330Hà Phương PhạmNo ratings yet

- Cost of Capital Dr. Ankit JainDocument25 pagesCost of Capital Dr. Ankit JainKhanal NilambarNo ratings yet

- Taxation 6Document9 pagesTaxation 6Bossx BellaNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Fringe Benefit Taxes Sample ProblemsDocument4 pagesFringe Benefit Taxes Sample Problemscharlene marie goNo ratings yet

- 2.4 Mock Exam Jun 06 Answer-AJ PDFDocument20 pages2.4 Mock Exam Jun 06 Answer-AJ PDFsaeed_r2000422No ratings yet

- Fringe Benefit ExercisesDocument6 pagesFringe Benefit ExercisesGet BurnNo ratings yet

- De Minimis and Fringe BenefitsDocument14 pagesDe Minimis and Fringe BenefitsCza PeñaNo ratings yet

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- 06 Taskperformance 1 TaxationDocument2 pages06 Taskperformance 1 TaxationTrisha DomingoNo ratings yet

- Adrac Ifrs Training ProgramDocument6 pagesAdrac Ifrs Training ProgramfrancoolNo ratings yet

- 2017 May Exam SolutionDocument9 pages2017 May Exam SolutionSimbarashe MupfupiNo ratings yet

- IRA No. 4 Answer KeyDocument3 pagesIRA No. 4 Answer KeyProlen AcantoNo ratings yet

- Answers For Workshop 13Document5 pagesAnswers For Workshop 13Jeevika Basnet0% (1)

- FM2 EndtermDocument22 pagesFM2 EndtermSuraj RanaNo ratings yet

- IND AS 33 Addl QuestionsDocument6 pagesIND AS 33 Addl QuestionsTejas RaoNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- Solution To Prob 3 On Provisions PP 189-192Document2 pagesSolution To Prob 3 On Provisions PP 189-192Martha MarieNo ratings yet

- Econ S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1Document6 pagesEcon S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1ADITYA MUNOTNo ratings yet

- Quiz EiDocument3 pagesQuiz EiJOY LYN REFUGIONo ratings yet

- Managerial Finance 4B - Assignment 1 - 0Document8 pagesManagerial Finance 4B - Assignment 1 - 0IbrahimNo ratings yet

- BAMA 1101, CH7, Insurance and InvestmentDocument24 pagesBAMA 1101, CH7, Insurance and InvestmentWijdan Saleem EdwanNo ratings yet

- Fin440 Final CompetitionDocument8 pagesFin440 Final CompetitionNguyễn Thùy DươngNo ratings yet

- Fiman. WC AssignmentDocument9 pagesFiman. WC AssignmentKii-anne Fernandez100% (1)

- Fin 200Document8 pagesFin 200rashiNo ratings yet

- Tax Rates 2079 80 PDFDocument16 pagesTax Rates 2079 80 PDFrabin khatriNo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Tla-7 1Document17 pagesTla-7 1Trisha Monique VillaNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Quiz 10 - CH 16Document4 pagesQuiz 10 - CH 16JamNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationEricah DumalaganNo ratings yet

- Finman Activity1 SantosDocument9 pagesFinman Activity1 SantosJken OrtizNo ratings yet

- Discussion QuestionsDocument34 pagesDiscussion QuestionsCarlos arnaldo lavadoNo ratings yet

- Income From Houseproperty A.Y. 2022-23Document4 pagesIncome From Houseproperty A.Y. 2022-23Vivek LedwaniNo ratings yet

- ACFA-TCF-Workshop-2-Answers (Read-Only) PDFDocument21 pagesACFA-TCF-Workshop-2-Answers (Read-Only) PDFnummoNo ratings yet

- Slides FM s4s5Document31 pagesSlides FM s4s5Amartya KumarNo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Bonds PayableDocument14 pagesBonds PayableCarl Yry BitengNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Pdic 1Document3 pagesPdic 1Jomer FernandezNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument60 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJomer FernandezNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Explain The Difference in Attitude To Risk Between European and US CompaniesDocument3 pagesExplain The Difference in Attitude To Risk Between European and US CompaniesJomer FernandezNo ratings yet

- Chapter 15Document1 pageChapter 15Jomer FernandezNo ratings yet

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Cash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleDocument3 pagesCash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleJomer Fernandez100% (3)

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Chapter 17Document2 pagesChapter 17Jomer Fernandez0% (1)

- Chapter 17Document2 pagesChapter 17Jomer Fernandez0% (1)

- Further Learning Exercises On HumeDocument3 pagesFurther Learning Exercises On HumeJomer FernandezNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Cash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleDocument3 pagesCash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleJomer Fernandez100% (3)

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Chapter 15Document1 pageChapter 15Jomer FernandezNo ratings yet

- Explain The Difference in Attitude To Risk Between European and US CompaniesDocument3 pagesExplain The Difference in Attitude To Risk Between European and US CompaniesJomer FernandezNo ratings yet

- Further Learning Exercises On KantDocument4 pagesFurther Learning Exercises On KantJomer FernandezNo ratings yet

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- Acot103 - AssignmentDocument4 pagesAcot103 - AssignmentJomer FernandezNo ratings yet

- Further Learning Exercises On HumeDocument3 pagesFurther Learning Exercises On HumeJomer FernandezNo ratings yet

- Philippines Under ColonizersDocument11 pagesPhilippines Under ColonizersJomer FernandezNo ratings yet

- Acot103 Assignment 1Document3 pagesAcot103 Assignment 1Jomer FernandezNo ratings yet

- Post Edsa PhilippinesDocument25 pagesPost Edsa PhilippinesJomer FernandezNo ratings yet

- Harvard Referencing GuideDocument6 pagesHarvard Referencing GuideKhánh Nguyên VõNo ratings yet

- CASE 1. Non-Cash Assets Are Sold For P 580,000Document3 pagesCASE 1. Non-Cash Assets Are Sold For P 580,000Riza Mae AlceNo ratings yet

- So 2nd Ed Adv Read Extra U4Document2 pagesSo 2nd Ed Adv Read Extra U4hector1817No ratings yet

- The Mystique of The Dominant WomanDocument8 pagesThe Mystique of The Dominant WomanDorothy HaydenNo ratings yet

- LTHE Comments On APG's Proposal No. 9090/3181-L&T-Detailed Engineering Services For EPCC-1-AVU Unit, Barauni RefineryDocument9 pagesLTHE Comments On APG's Proposal No. 9090/3181-L&T-Detailed Engineering Services For EPCC-1-AVU Unit, Barauni RefineryajayNo ratings yet

- Gambaran Professional Quality of Life Proqol GuruDocument7 pagesGambaran Professional Quality of Life Proqol Gurufebrian rahmatNo ratings yet

- Expressions of QuantityDocument5 pagesExpressions of Quantitybenilde bastidaNo ratings yet

- Allison Burke Adime 4Document8 pagesAllison Burke Adime 4api-317577095No ratings yet

- Public Speaking ScriptDocument2 pagesPublic Speaking ScriptDhia MizaNo ratings yet

- Copy of HW UMTS KPIsDocument18 pagesCopy of HW UMTS KPIsMohamed MoujtabaNo ratings yet

- Agriculture and FisheryDocument5 pagesAgriculture and FisheryJolliven JamiloNo ratings yet

- Guarantor Indemnity For Illness or DeathDocument2 pagesGuarantor Indemnity For Illness or Deathlajaun hindsNo ratings yet

- Consolidation of ClayDocument17 pagesConsolidation of ClayMD Anan MorshedNo ratings yet

- T103 InstructionsDocument1 pageT103 Instructionsjtcool74No ratings yet

- SPKT Thiet Ke Co Khi 1Document33 pagesSPKT Thiet Ke Co Khi 1Chiến PhanNo ratings yet

- Factors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaDocument12 pagesFactors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Transdermal Nano BookDocument44 pagesTransdermal Nano BookMuhammad Azam TahirNo ratings yet

- Prestress 3.0Document10 pagesPrestress 3.0Jonel CorbiNo ratings yet

- Air Compressor CP9149-05Document5 pagesAir Compressor CP9149-05Andrés RuizNo ratings yet

- Z0109MN Z9M TriacDocument6 pagesZ0109MN Z9M TriaciammiaNo ratings yet

- 2nd Term Biology Ss3Document20 pages2nd Term Biology Ss3Wisdom Lawal (Wizywise)No ratings yet

- Chapter 3.2 Futures HedgingDocument19 pagesChapter 3.2 Futures HedginglelouchNo ratings yet

- Culturally Safe Classroom Context PDFDocument2 pagesCulturally Safe Classroom Context PDFdcleveland1706No ratings yet

- Tropical Fruit CHAPTER-3Document32 pagesTropical Fruit CHAPTER-3Jeylan FekiNo ratings yet

- Mediclinic Weekly Progress Report No 29Document27 pagesMediclinic Weekly Progress Report No 29Julius Ceasar SanorjoNo ratings yet

- Sewage and Effluent Water Treatment Plant Services in PuneDocument11 pagesSewage and Effluent Water Treatment Plant Services in PunedipakNo ratings yet

- Ems em FW Paneel Firetec enDocument2 pagesEms em FW Paneel Firetec enzlatkokrsicNo ratings yet

- Invertec 200 260 400tDocument16 pagesInvertec 200 260 400tJxyz QwNo ratings yet

- Automotive Voltage DropDocument5 pagesAutomotive Voltage Dropashraf.rahim139No ratings yet

- Death Obituary Cause of Death Ookht PDFDocument4 pagesDeath Obituary Cause of Death Ookht PDFMayerRhodes8No ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)