Professional Documents

Culture Documents

Chapter 16

Uploaded by

Jomer FernandezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 16

Uploaded by

Jomer FernandezCopyright:

Available Formats

CHAPTER 16:

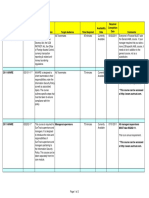

1. List the five primary activities involved in the acquisition and payment cycle.

1. Requisition (request) for goods or services

2. Purchase of goods and services

3. Receipt of, and accounting for, goods and services

4. Approval of items for payment

5. Cash disbursements

2. List at least five common fraud schemes in the acquisition and payment cycle.

1. Recording fictitious cash receipts

2. Failure to record receipt from cash sales

3. Inaccurate recording of a purchase or disbursement

4. Duplicate recording and payment of purchases

5. Unrecorded disbursements

3. Describe the following types of cash accounts; (a) general checking accounts, (b) cash

management accounts, (c) imprest payroll accounts, and (d) petty cash accounts.

a. General Checking Accounts- principal cash account used by the organization for cash

receipts from the revenue process and cash disbursements from the payroll and

purchasing processes

b. Cash Management Accounts- an account held with a financial institution that allows you

to manage your cash transactions through one portal.

c. Imprest payroll Accounts- a separate account held by a corporation that contains funds

strictly for employee payroll use

d. Petty Cash Accounts- established for making small payments that are impractical to pay

by check

4. List at least three common controls for petty cash.

1. Limiting access by keeping funds in a locked box

2. Requiring receipts for petty cash disbursements with:

Date Amount received

Purpose or use for funds

Name of employee receiving funds

3. Reconciling petty cash fund before replenishing it

5. Identify potential fraud schemes related to long-lived assets

Misstatement of acquisitions of property, plant and equipment

Failure to record retirements of property, plant and equipment

Improper reporting of unusual transactions

6. Consider the risks typically associated with tangible long-lived assets and identify the

internal controls over these assets that you would expect a client to have in place.

A subsidiary ledger consisting of a separate record for each unit of property.

A system of authorization requiring advance executive approval of all plant and

equipment acquisitions, whether by purchase, lease or construction.

A reporting procedure assuring prompt disclosure and analysis of variances between

authorized expenditures and actual costs.

An authoritative written statement of company policy distinguishing between capital

expenditures and revenue expenditures.

A policy requiring all purchases of plant and equipment to be handled through the

purchasing department and subjected to a standard routine for receiving, inspection and

payment.

Periodic physical inventories designed to verify the existence, location and condition of

all property listed in the accounts and to disclose the existence of any unrecorded units.

A system of retirement procedures, including serially numbered retirement work orders,

stating reasons for retirement and bearing appropriate approvals.

You might also like

- Cash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleDocument3 pagesCash 1. List The Five Primary Activities Involved in The Acquisition and Payment CycleJomer Fernandez100% (3)

- Chapter 21 Ia2Document15 pagesChapter 21 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Afar 08Document14 pagesAfar 08RENZEL MAGBITANGNo ratings yet

- Module 6Document22 pagesModule 6itsdaloveshot naNANAnanaNo ratings yet

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- Chap 14 Corp Gov Biasura Jhazreel 2 BDocument6 pagesChap 14 Corp Gov Biasura Jhazreel 2 BJhazreel BiasuraNo ratings yet

- The Expenditure Cycle Part I: Purchases and Cash Disbursements ProceduresDocument28 pagesThe Expenditure Cycle Part I: Purchases and Cash Disbursements ProceduresNicah AcojonNo ratings yet

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Consideration of Internal Control in A Financial Statements AuditDocument9 pagesConsideration of Internal Control in A Financial Statements AuditJan Danielle AgaloNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- Chapter 17Document3 pagesChapter 17Michael CarlayNo ratings yet

- Answered Step-By-Step: Problem 1 Data Relating To The Shareholders' Equity of Carlo Co...Document5 pagesAnswered Step-By-Step: Problem 1 Data Relating To The Shareholders' Equity of Carlo Co...Jefferson MañaleNo ratings yet

- Capital Budgeting Lecture UpdatedDocument5 pagesCapital Budgeting Lecture UpdatedMark Gelo WinchesterNo ratings yet

- Top Ten Clothiers Inc. (John Carlo Aquino, 31-BSA-03)Document2 pagesTop Ten Clothiers Inc. (John Carlo Aquino, 31-BSA-03)John Carlo AquinoNo ratings yet

- MS03-03 - Activity-Based-Costing-Reviewees-EncryptedDocument9 pagesMS03-03 - Activity-Based-Costing-Reviewees-EncryptedKaren MagsayoNo ratings yet

- SCM Midterm Exercises Answer KeyDocument30 pagesSCM Midterm Exercises Answer KeyChin FiguraNo ratings yet

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- ACTBC Illustrative Problems - Full Goodwill Approach and Partial Goodwill ApproachDocument46 pagesACTBC Illustrative Problems - Full Goodwill Approach and Partial Goodwill ApproachJoebet DebuyanNo ratings yet

- Factors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationDocument2 pagesFactors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationJin HandsomeNo ratings yet

- BANK RECON and PROOF OF CASHDocument2 pagesBANK RECON and PROOF OF CASHJay-an AntipoloNo ratings yet

- Agamata Relevant Costing Chap 9 Short Term DecisionpdfDocument66 pagesAgamata Relevant Costing Chap 9 Short Term DecisionpdfJerome Eziekel Posada PanaliganNo ratings yet

- Cash Basis, Accrual Basis and Single Entry Method: General ConceptsDocument7 pagesCash Basis, Accrual Basis and Single Entry Method: General ConceptsNhel AlvaroNo ratings yet

- Almendraejo Strategic3Document5 pagesAlmendraejo Strategic3Miafe B. AlmendralejoNo ratings yet

- Arabian Company Reported The Following at YearDocument1 pageArabian Company Reported The Following at YearKatrina Dela CruzNo ratings yet

- Auditing (Problems) Book Value Per ShareDocument12 pagesAuditing (Problems) Book Value Per ShareJasper Bryan BlagoNo ratings yet

- Add: Desired Ending Raw Materials Inventory (130% From Following Month's Production and 2000Document4 pagesAdd: Desired Ending Raw Materials Inventory (130% From Following Month's Production and 2000Kyla Kim AriasNo ratings yet

- Intercompany Sale of PropertyDocument6 pagesIntercompany Sale of PropertyClauie BarsNo ratings yet

- Seatwork No. 1 - GicaleDocument3 pagesSeatwork No. 1 - GicaleDeanna GicaleNo ratings yet

- JIT SystemDocument2 pagesJIT SystemJona FranciscoNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- Decasa, Erica J. CBET 01 401E The Philippine Finacial SystemDocument4 pagesDecasa, Erica J. CBET 01 401E The Philippine Finacial SystemErica DecasaNo ratings yet

- Answer Key - Chapter 5 - 2020 EditionDocument37 pagesAnswer Key - Chapter 5 - 2020 EditionDaniel DialinoNo ratings yet

- Prelim Exam - Intermediate Accounting Part 1Document13 pagesPrelim Exam - Intermediate Accounting Part 1Vincent AbellaNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Chapter 1-4 Review QuestionsDocument24 pagesChapter 1-4 Review QuestionsSophia JunelleNo ratings yet

- DT 2Document8 pagesDT 2Janesene SolNo ratings yet

- Unit 1 Audit of Property PLant and EquipmentDocument5 pagesUnit 1 Audit of Property PLant and EquipmentJustin SolanoNo ratings yet

- Profe03 - Chapter 1 Business Combinations Recognition and MeasurementDocument19 pagesProfe03 - Chapter 1 Business Combinations Recognition and MeasurementSteffany Roque100% (1)

- Financial Market Quiz 2 FABRIADocument5 pagesFinancial Market Quiz 2 FABRIAClaire Magbunag AntidoNo ratings yet

- Chapter 1-Introduction To Cost Accounting: True/FalseDocument13 pagesChapter 1-Introduction To Cost Accounting: True/FalseJasmine AraniegoNo ratings yet

- AlagangWency - Partnersip Dissolution Short QuizDocument1 pageAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaNo ratings yet

- Chapter 14: Cash and Accrual BasisDocument60 pagesChapter 14: Cash and Accrual BasissofiaNo ratings yet

- .Arch94-03 - Corporate Income TaxationDocument18 pages.Arch94-03 - Corporate Income TaxationShintaro KisaragiNo ratings yet

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietNo ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Document4 pagesSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONo ratings yet

- Sales Chapter 13 Part II REPORTDocument50 pagesSales Chapter 13 Part II REPORTJeane Mae BooNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- Problem 1Document8 pagesProblem 1KyleRhayneDiazCaliwagNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Activity 1 - Demetillo, Emnace, NepomucenoDocument3 pagesActivity 1 - Demetillo, Emnace, NepomucenoCheveem Grace EmnaceNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Internal Control Affecting AssetsDocument27 pagesInternal Control Affecting AssetsJannefah Saglayan50% (2)

- Audit CHAPTER TWODocument23 pagesAudit CHAPTER TWOTesfaye Megiso BegajoNo ratings yet

- Internal Control Over Cash TransactionsDocument18 pagesInternal Control Over Cash TransactionsEYOB AHMEDNo ratings yet

- Chapter 3: Cash and ReceivablesDocument7 pagesChapter 3: Cash and ReceivablesZuber ZinabuNo ratings yet

- Describe The Operation of A Petty Cash Fund. Companies Operate A Petty CashDocument3 pagesDescribe The Operation of A Petty Cash Fund. Companies Operate A Petty CashLê Lý Nhân HậuNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Chapter 15Document1 pageChapter 15Jomer FernandezNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Chapter 16Document2 pagesChapter 16Jomer FernandezNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument60 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJomer FernandezNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument55 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionJanex TolineroNo ratings yet

- Pdic 1Document3 pagesPdic 1Jomer FernandezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Explain The Difference in Attitude To Risk Between European and US CompaniesDocument3 pagesExplain The Difference in Attitude To Risk Between European and US CompaniesJomer FernandezNo ratings yet

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Chapter 15Document1 pageChapter 15Jomer FernandezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Chapter 17Document2 pagesChapter 17Jomer Fernandez0% (1)

- Chapter 17Document2 pagesChapter 17Jomer Fernandez0% (1)

- Explain The Difference in Attitude To Risk Between European and US CompaniesDocument3 pagesExplain The Difference in Attitude To Risk Between European and US CompaniesJomer FernandezNo ratings yet

- Further Learning Exercises On HumeDocument3 pagesFurther Learning Exercises On HumeJomer FernandezNo ratings yet

- Further Learning Exercises On KantDocument4 pagesFurther Learning Exercises On KantJomer FernandezNo ratings yet

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- A5 - Fringe Benefit TaxationDocument3 pagesA5 - Fringe Benefit TaxationJomer FernandezNo ratings yet

- Post Edsa PhilippinesDocument25 pagesPost Edsa PhilippinesJomer FernandezNo ratings yet

- Acot103 Assignment 1Document3 pagesAcot103 Assignment 1Jomer FernandezNo ratings yet

- Further Learning Exercises On HumeDocument3 pagesFurther Learning Exercises On HumeJomer FernandezNo ratings yet

- Acot103 - AssignmentDocument4 pagesAcot103 - AssignmentJomer FernandezNo ratings yet

- Philippines Under ColonizersDocument11 pagesPhilippines Under ColonizersJomer FernandezNo ratings yet

- Cheque Truncation ProjectDocument26 pagesCheque Truncation ProjectReema Dawra0% (1)

- How To Approach BanksDocument9 pagesHow To Approach BankssohailNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeMarie FeNo ratings yet

- Benefits: Quick Application ProcessDocument8 pagesBenefits: Quick Application ProcessAisyah Rizki Al LathifahNo ratings yet

- HDFC BankDocument18 pagesHDFC BankManthan Ashutosh MehtaNo ratings yet

- Senior Risk Manager in Cincinnati OH Resume David RussellDocument2 pagesSenior Risk Manager in Cincinnati OH Resume David RussellDavidRussell1100% (1)

- Financial & Managerial Accounting MbasDocument40 pagesFinancial & Managerial Accounting MbasHồng Long100% (1)

- Lecture 9 Monetary Policy Decision Making 2022Document40 pagesLecture 9 Monetary Policy Decision Making 2022Onyee FongNo ratings yet

- VP Institutional Asset Management in Washington DC Resume Lisa DrazinDocument3 pagesVP Institutional Asset Management in Washington DC Resume Lisa DrazinLisaDrazinNo ratings yet

- Capstone Project: On Daily Cash Flow ManagementDocument11 pagesCapstone Project: On Daily Cash Flow Managementloneheart007No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Aimen AhmedNo ratings yet

- Detail - 18 Jul 2019 01 02 33 PMDocument24 pagesDetail - 18 Jul 2019 01 02 33 PMparas creationNo ratings yet

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- Risk AssignmentDocument4 pagesRisk AssignmentMd. Asifujjaman JoyNo ratings yet

- CFE Sample QuestionsDocument4 pagesCFE Sample Questionsraajmithun3568No ratings yet

- Accounting Activities - MerchandisingDocument6 pagesAccounting Activities - MerchandisingJoyNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoMohammad AzharuddinNo ratings yet

- Unit-5 Chapter-3: Insurance-Contract and ImportanceDocument34 pagesUnit-5 Chapter-3: Insurance-Contract and ImportanceRammohanreddy RajidiNo ratings yet

- Auditing PDFDocument134 pagesAuditing PDFJAGRITI SINGH JU100% (1)

- SOC Islamic July Dec 2022 1Document60 pagesSOC Islamic July Dec 2022 1Syed Rafay HashmiNo ratings yet

- FY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Document26 pagesFY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Nyasha MakoreNo ratings yet

- Financial Statements of Insurance Companies (PDFDrive)Document106 pagesFinancial Statements of Insurance Companies (PDFDrive)Putin PhyNo ratings yet

- Twice A Week - Online Japanese Course (English Guidance)Document5 pagesTwice A Week - Online Japanese Course (English Guidance)Anonymous G4rRYDONo ratings yet

- Research Questionnaire On Indian Overseas Bank Credit Flow ToDocument5 pagesResearch Questionnaire On Indian Overseas Bank Credit Flow ToKrishna Kant PariharNo ratings yet

- Interest Free Banking in Ethiopia: Prospects and ChallengesDocument20 pagesInterest Free Banking in Ethiopia: Prospects and Challengessi labNo ratings yet

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Eric LeguardaNo ratings yet

- A Study On Customer Awareness Towards HDFC Bank Money Transfer App-PayZapp in Lucknow CityDocument112 pagesA Study On Customer Awareness Towards HDFC Bank Money Transfer App-PayZapp in Lucknow CityChandan Srivastava100% (1)

- Summary of Accounts: Contacting UsDocument3 pagesSummary of Accounts: Contacting Ussiva AwaraNo ratings yet

- Stor & Shop Bir ReportsDocument78 pagesStor & Shop Bir ReportsHanz RealNo ratings yet