Professional Documents

Culture Documents

Your Receipt

Your Receipt

Uploaded by

dpfsopfopsfhopOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your Receipt

Your Receipt

Uploaded by

dpfsopfopsfhopCopyright:

Available Formats

PAN No: AAATT 1306L (Eligible for tax relief u/s 80-G)

Donation made to "The Kalgidhar Society, Vill. Baru Sahib, via Rajgarh, Distt. Sirmour (H.P.)" will be eligible for the tax relief u/s 80-G of

the I.T. Act, 1961(43 of 1961) Vide Order no. Pos. - 1/80-G/59/2009-10/3479

: 17.03.2010 of the Commissioner of Income Tax, Shimla. This exemption will be valid from the period 01.04.2010 to 31.03.2013 Vide

CBDT circular No. 5/2010 Dated 3rd June 2010. Related to Finance Act (No. 2) 2009, para 29.7 and para 29.5, the provisio to clause (vi) of

sub section(5) of 80G has been omitted to provide that the approval once granted shall continue to be valid in perpetuity.

This amendment has been made with effect from 1st October, 2009. Accordingly, existing approvals expiring on or after 1st October, 2009

will be deemed to have been extended in perpetuity.

Receipt No: ER-3820

Received with thanks from Mr./Mrs. GURPREET SINGH KHALSA

the sum of Rs. 5000.00/- ( Rupees five thousand point zero zero only )

on 17-12-2020 via transaction no. DNKS1608211093

For The Kalgidhar Society

Authorized Signatory

Disclaimer: This is an electronically generated receipt. No goods or services were provided in exchange for these donations.

The Kalgidhar Society, Baru Sahib

Regd. Office: Baru Sahib, via Rajgarh Distt., Sirmore, Himachal Pradesh - 173101

Delhi Office: F - 3, Rajouri Garden, New Delhi - 110027

www.BaruSahib.org | info@barusahib.org

You might also like

- 80G Receipt PDFDocument1 page80G Receipt PDFdpfsopfopsfhop60% (5)

- 80G ReceiptDocument1 page80G Receiptdpfsopfopsfhop75% (4)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptNeeraj Raushan KanthNo ratings yet

- 80D Medical InsuranceDocument3 pages80D Medical InsuranceRafique ShaikhNo ratings yet

- 090003e88105430f SONIADocument3 pages090003e88105430f SONIAKoushik DuttaNo ratings yet

- Scrip Code: 514043 Symbol: HIMATSEIDE: Himatsingka Seide LimitedDocument14 pagesScrip Code: 514043 Symbol: HIMATSEIDE: Himatsingka Seide LimitedAmitNo ratings yet

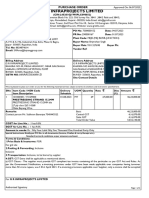

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Umesh 011Document23 pagesUmesh 011Yogesh KumarNo ratings yet

- DonationsDocument1 pageDonationsSamrat MazumderNo ratings yet

- IncomeTaxCertificate 4Document2 pagesIncomeTaxCertificate 4Dushmanta mishraNo ratings yet

- Atul Trimbak Prabhu: Regd. Office: T E W CINDocument19 pagesAtul Trimbak Prabhu: Regd. Office: T E W CINvirupakshudu kodiyalaNo ratings yet

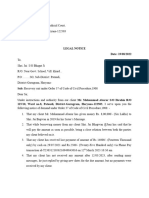

- Legal NoticeDocument2 pagesLegal Noticemanitaprasad96No ratings yet

- Loi Wo Petropath Fluids (I) PVT LTDDocument1 pageLoi Wo Petropath Fluids (I) PVT LTDAlok Singh0% (1)

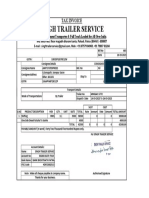

- BILLDocument1 pageBILLLalit BishtNo ratings yet

- Arbitration Notice Prior To The Filing of Execution Petition Card No - XXXXXXXXXXXXXXX1709Document1 pageArbitration Notice Prior To The Filing of Execution Petition Card No - XXXXXXXXXXXXXXX1709Sanjay SandhuNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicecometprinterNo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

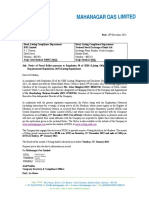

- Renewal Notice-5hshsDocument2 pagesRenewal Notice-5hshsHshshsvd hdhdNo ratings yet

- Renewal Notice 231026 185701Document3 pagesRenewal Notice 231026 185701Mahanth GowdaNo ratings yet

- Income CertificateDocument1 pageIncome Certificatedarjk04No ratings yet

- Inv - 485Document2 pagesInv - 485arnabmukherjee.1212005No ratings yet

- OS Employees ExtensionDocument4 pagesOS Employees ExtensionpraweenNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Donation - June 2023 - 80GDocument1 pageDonation - June 2023 - 80Grohit.kedareNo ratings yet

- PO 7300000152 Bajrang WireDocument6 pagesPO 7300000152 Bajrang WireSM AreaNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptRaghavendra KumarNo ratings yet

- Quotation: Quote To Contact Details Bank DetailsDocument2 pagesQuotation: Quote To Contact Details Bank DetailsDileep ChintalapatiNo ratings yet

- Donation - Nov 2023 - 80GDocument1 pageDonation - Nov 2023 - 80Grohit.kedareNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSai Kiran KodipyakaNo ratings yet

- April BillDocument1 pageApril Billnikunjnick2011No ratings yet

- Noting - BriefcaseDocument66 pagesNoting - BriefcaseSharma AnilNo ratings yet

- Bond Print and Joining Letter31Document3 pagesBond Print and Joining Letter31ppaannddhhhiiNo ratings yet

- 80G OrderDocument2 pages80G OrderTHE R V 0007No ratings yet

- DeepakMedical HealthDocument3 pagesDeepakMedical HealthVipin SinghNo ratings yet

- 1 CertificatesDocument9 pages1 CertificatesBhhasskar BoddupallyyNo ratings yet

- Amit EnterDocument1 pageAmit EnterAditya kumar pandeyNo ratings yet

- Tank 1000Document2 pagesTank 1000sujaraghupsNo ratings yet

- AA5866320 Receipt PDFDocument1 pageAA5866320 Receipt PDFnamanbanthia147No ratings yet

- 02-Sebi V140P7Document2 pages02-Sebi V140P7Varun ShahNo ratings yet

- 0b5ab840-ab43-40ab-b22c-5d452beb1a03Document20 pages0b5ab840-ab43-40ab-b22c-5d452beb1a03virupakshudu kodiyalaNo ratings yet

- Aa00486044 01Document3 pagesAa00486044 01Sachin ShindeNo ratings yet

- Tax InvoiceDocument5 pagesTax Invoicedigitalseva.japanigateNo ratings yet

- JINDALSTEL 23052023200320 NoticePostalBallotDocument44 pagesJINDALSTEL 23052023200320 NoticePostalBallotSANCHAYAN MITRSNo ratings yet

- ForwardInvoice ORD660948335Document4 pagesForwardInvoice ORD660948335Nitin GuptaNo ratings yet

- Dynamometer-3500 KGDocument3 pagesDynamometer-3500 KGssestoreNo ratings yet

- Tax Invoice: Grihasthi Indane Gramin VITRAK (0000282217)Document2 pagesTax Invoice: Grihasthi Indane Gramin VITRAK (0000282217)SHAMBHU KUMARNo ratings yet

- Arihant Enterprise: OriginalDocument2 pagesArihant Enterprise: OriginalManjeet SinghNo ratings yet

- To DateDocument5 pagesTo DateAmurtha NetNo ratings yet

- MB ComDocument2 pagesMB Comsatyanand guptaNo ratings yet

- Sundram Fasteners Limited: National Stock Exchange of India Limited (NSE)Document12 pagesSundram Fasteners Limited: National Stock Exchange of India Limited (NSE)Dasari PrabodhNo ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- CTG FormDocument3 pagesCTG FormSamant LeoNo ratings yet

- Acknowledgementslip S1355913418000Document1 pageAcknowledgementslip S1355913418000sajidNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSurinder PahwaNo ratings yet

- Invoice - 2023-02-10T191037.017Document2 pagesInvoice - 2023-02-10T191037.017Amritesh KumarNo ratings yet

- Bangalore Water Supply and Sewerage Board, C, Bangalore-560009Document1 pageBangalore Water Supply and Sewerage Board, C, Bangalore-560009Kamatchi RajeshNo ratings yet

- Intermediary Code Intermediary Contact No Intermediary Name Policybazaar Insurance Web Aggregator PL 80189584 18002585970Document4 pagesIntermediary Code Intermediary Contact No Intermediary Name Policybazaar Insurance Web Aggregator PL 80189584 18002585970Rajan Kumar SinghNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Notice of Postal BallotDocument14 pagesNotice of Postal BallotNitin VermaNo ratings yet

- AAETA0890J - Order Us 80G - 1019180029Document2 pagesAAETA0890J - Order Us 80G - 1019180029Donor CrewNo ratings yet

- PRO 104 2016-17 Nedumchalil Charitable Trust HospitalDocument8 pagesPRO 104 2016-17 Nedumchalil Charitable Trust HospitaldpfsopfopsfhopNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Dream Runners FoundationDocument12 pagesDream Runners FoundationdpfsopfopsfhopNo ratings yet

- Income Tax II B Com Sem 6 MCQDocument23 pagesIncome Tax II B Com Sem 6 MCQdpfsopfopsfhop100% (2)

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopNo ratings yet

- Announcement CMPRF 0 0 PDFDocument1 pageAnnouncement CMPRF 0 0 PDFdpfsopfopsfhopNo ratings yet

- G S I C B: Uide TAR Ndia Ertification RochureDocument4 pagesG S I C B: Uide TAR Ndia Ertification RochuredpfsopfopsfhopNo ratings yet

- Philanthropy Structure - TMM 2020Document32 pagesPhilanthropy Structure - TMM 2020dpfsopfopsfhopNo ratings yet

- Thanking You: Government of KeralaDocument3 pagesThanking You: Government of KeraladpfsopfopsfhopNo ratings yet

- Receipt-Rajashekar (1) Pages 1 - 1 - Flip PDF Download - FlipHTML5Document1 pageReceipt-Rajashekar (1) Pages 1 - 1 - Flip PDF Download - FlipHTML5dpfsopfopsfhopNo ratings yet

- CMDRF Donation Document Ver 7.0 Combined 31102018-CompressedDocument106 pagesCMDRF Donation Document Ver 7.0 Combined 31102018-CompresseddpfsopfopsfhopNo ratings yet

- Substituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019Document5 pagesSubstituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019dpfsopfopsfhopNo ratings yet

- I. Taxation & Tax Rebates For Donors: F & R I P N - P O IDocument19 pagesI. Taxation & Tax Rebates For Donors: F & R I P N - P O IdpfsopfopsfhopNo ratings yet

- A Fatal Case of Disseminated Aspergillosis in An Immunecompetent Patient - An Autopsy Case ReportDocument3 pagesA Fatal Case of Disseminated Aspergillosis in An Immunecompetent Patient - An Autopsy Case ReportdpfsopfopsfhopNo ratings yet

- Binit Bhaskar PDFDocument1 pageBinit Bhaskar PDFdpfsopfopsfhopNo ratings yet

- TaxReceipt 90244Document1 pageTaxReceipt 90244dpfsopfopsfhopNo ratings yet