Professional Documents

Culture Documents

Zero Rated Sales

Uploaded by

Titania Erza0 ratings0% found this document useful (0 votes)

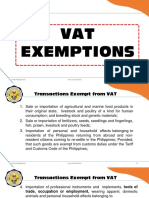

16 views2 pages- Zero-rated sales are exempt from output VAT but allow the seller to claim input VAT as a tax credit or deduction. This includes export sales, sales to economic zones, and sales to certain foreign entities.

- Zero-rated sales of goods include direct exports, sales to international carriers, and sales to economic zones. Zero-rated sales of services include services provided to non-residents, international carriers, and economic zones.

- Zero-rated sales require payment in foreign currency and compliance with rules from the Bureau of Internal Revenue and Bureau of the Treasury. Sales without proper approval or not meeting requirements are considered exempt transactions rather than zero-rated.

Original Description:

Original Title

ZeroRating

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- Zero-rated sales are exempt from output VAT but allow the seller to claim input VAT as a tax credit or deduction. This includes export sales, sales to economic zones, and sales to certain foreign entities.

- Zero-rated sales of goods include direct exports, sales to international carriers, and sales to economic zones. Zero-rated sales of services include services provided to non-residents, international carriers, and economic zones.

- Zero-rated sales require payment in foreign currency and compliance with rules from the Bureau of Internal Revenue and Bureau of the Treasury. Sales without proper approval or not meeting requirements are considered exempt transactions rather than zero-rated.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesZero Rated Sales

Uploaded by

Titania Erza- Zero-rated sales are exempt from output VAT but allow the seller to claim input VAT as a tax credit or deduction. This includes export sales, sales to economic zones, and sales to certain foreign entities.

- Zero-rated sales of goods include direct exports, sales to international carriers, and sales to economic zones. Zero-rated sales of services include services provided to non-residents, international carriers, and economic zones.

- Zero-rated sales require payment in foreign currency and compliance with rules from the Bureau of Internal Revenue and Bureau of the Treasury. Sales without proper approval or not meeting requirements are considered exempt transactions rather than zero-rated.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Zero Rated Sales

- Excess of input VAT can be credited to output VAT

*Exempt Sales – claimable as deduction in the Income Tax Return

I. Zero Rated Sale of Goods

A. Export Sales

1. Direct Export – actual shipment of goods from PH to foreign country, regardless of shipping

arrangements

Requirements:

a. Paid for in acceptable foreign currency or its equivalent in goods or services

b. Accounted for in accordance to the rules and regulations of BSP

**Peso denominated sales = exempt transactions

** Sale to economic Zones – effectively zero-rated sales

By fiction of law, economic/tourism zones are considered foreign territories

Sales are technical exportation

2. Sale of goods or properties, supplies and equipment and fuel to persons engaged in

international shipping/air carriers and transport operations

o Zero-rating is limited to goods, supplies, equipment, and fuel pertaining to the transport

of goods and passengers from a port in the PH directly to a foreign port (vice versa) w/o

docking or stopping at any port in the PH, unless such docking or stopping is for the

purpose of unloading passengers and/or cargoes originating from abroad or to load

passengers and/cargoes bound for abroad

B. Effectively Zero-Rated Sales (Sec 106(a)(2)(b), NIRC)

1. sales to persons or entities where exemption under special laws or international agreements

to which the PH is a signatory

- e.g. sales to ADB, UN, US AID etc. = equal footing with states

Requirement – prior approval from BIR (Audit Info, Tax Exemption and Incentive Division, or BIR

national office – Large taxpayers)

No Approval = considered exempt

2. Embassies and their Personnel

o Zero-rating applies to foreign governments granting PH embassies and diplomats

indirect tax exemptions

o Qualified embassies and their qualified personnel and dependents are issued VAT

Exemption Certificates or VAT Exemption Identification Cards,

II. Zero Rated Sales of Services

1. Sale of Service to non- residents

- Applies to services other than processing, manufacturing, or repacking tendered to a persons

engaged in business conducted outside the PH or to a non-resident person not engaged in

business who is outside the PH when rendered

Requirements:

a. Service must be performed in the PH

b. Must be paid in acceptable foreign currency or its equivalent in goods/services

c. Payment must be accounted for under the RR of the BSP

2. Effectively zero-rated sales of services

3. Services rendered to persons engaged in international shipping/air transport operations

including leases of properties thereof

4. Transport of passengers and cargoes of Domestic Air/Sea Carriers

5. Sale of Power or fuel generated from renewable sources of energy

6. Services rendered to Eco zones

You might also like

- Thread by @WarNuse The Coup D'état. 18 U.S. Code 2384 - Seditious Conspiracy 'TWENTY YEARS.' John Brennan. 18 U.SDocument136 pagesThread by @WarNuse The Coup D'état. 18 U.S. Code 2384 - Seditious Conspiracy 'TWENTY YEARS.' John Brennan. 18 U.Ssfrahm100% (1)

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- 3113 4 Zero Rated TransactionsDocument5 pages3113 4 Zero Rated TransactionsConic DurangparangNo ratings yet

- 04 Vat Exempt TransactionsDocument4 pages04 Vat Exempt TransactionsJaneLayugCabacunganNo ratings yet

- Value Added TaxDocument32 pagesValue Added Taxsei1davidNo ratings yet

- Judicial and Extrajudicial Foreclosure of MortgageDocument4 pagesJudicial and Extrajudicial Foreclosure of MortgageLiza Rosales100% (1)

- Asset Protection PowerPoint PresentationDocument21 pagesAsset Protection PowerPoint PresentationGregg Parrish-EichmanNo ratings yet

- Class Notes On Criminal Law - I (1st Sem - 3 Year LL.B) - Adv GR Rajesh KumarDocument34 pagesClass Notes On Criminal Law - I (1st Sem - 3 Year LL.B) - Adv GR Rajesh KumarShajana Shahul100% (4)

- Sales Proposal TemplateDocument5 pagesSales Proposal TemplatearianaseriNo ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Lecture Notes Individual TaxationDocument16 pagesLecture Notes Individual Taxationבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- TAX-302 (VAT-Exempt Transactions) PDFDocument5 pagesTAX-302 (VAT-Exempt Transactions) PDFclara san miguelNo ratings yet

- VAT On Importation NotesDocument1 pageVAT On Importation NotesSelene DimlaNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- A Digest of David Reyes Vs LimDocument2 pagesA Digest of David Reyes Vs LimJoshua OuanoNo ratings yet

- Affidavit Paniza (Rape)Document10 pagesAffidavit Paniza (Rape)Hadji HrothgarNo ratings yet

- Small Landowners Vs Sec of Dar - DigestDocument3 pagesSmall Landowners Vs Sec of Dar - DigestCayen Cervancia CabiguenNo ratings yet

- Domondon Reviewer - Tax 2Document38 pagesDomondon Reviewer - Tax 2Mar DevelosNo ratings yet

- Output Vat Zero-Rated Sales ch8Document3 pagesOutput Vat Zero-Rated Sales ch8Marionne GNo ratings yet

- Bustax Chapter 8 PDFDocument11 pagesBustax Chapter 8 PDFPineda, Paula MarieNo ratings yet

- Zero - Rated Sales: 0% VAT - Output VATDocument5 pagesZero - Rated Sales: 0% VAT - Output VATNerish PlazaNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- Value Added Tax - : - Output VAT: Zero-Rated SalesDocument23 pagesValue Added Tax - : - Output VAT: Zero-Rated SalesAjey MendiolaNo ratings yet

- Value Added Tax 3Document8 pagesValue Added Tax 3Nerish PlazaNo ratings yet

- Async 2022 VAT UPDATEDocument8 pagesAsync 2022 VAT UPDATEBogs QuitainNo ratings yet

- Zero-Rated and Effectively Zero-Rated Sales of Goods or Properties, and ServicesDocument2 pagesZero-Rated and Effectively Zero-Rated Sales of Goods or Properties, and ServicesBea BangcolaNo ratings yet

- CHAPTER 1 Part 2Document3 pagesCHAPTER 1 Part 2Marinelle DiazNo ratings yet

- May 15 2021 Zero Rated SalesDocument12 pagesMay 15 2021 Zero Rated SalesA cNo ratings yet

- RR 1-95Document9 pagesRR 1-95matinikki0% (1)

- Vat HandoutsDocument7 pagesVat HandoutsjulsNo ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- Value Added TaxDocument14 pagesValue Added TaxWyndell AlajenoNo ratings yet

- Chapter 8 Output Vat Zero Rated SalesDocument29 pagesChapter 8 Output Vat Zero Rated SalesChristian PelimcoNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- VAT Zero-Rated and VAT ExemptDocument28 pagesVAT Zero-Rated and VAT ExemptJeser JavierNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- BUSTAXADocument9 pagesBUSTAXATitania ErzaNo ratings yet

- Philippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDocument6 pagesPhilippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDaryl Noel TejanoNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- Simlplified Cao 2 2021Document5 pagesSimlplified Cao 2 2021Levi AckermanNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesSunny DaeNo ratings yet

- TAX 302 VAT Exempt Transactions 1Document6 pagesTAX 302 VAT Exempt Transactions 1Jeen JeenNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Republic of The Philippines Department of Finance Manila: (. I. E, ForDocument7 pagesRepublic of The Philippines Department of Finance Manila: (. I. E, ForPaulo LagdaminNo ratings yet

- Zero - Rated / Effectively Zero-Rated Transactions ExplanationDocument2 pagesZero - Rated / Effectively Zero-Rated Transactions ExplanationValerie Kaye BinayasNo ratings yet

- SUMMARY OF TAX TABLES AND RATES Train LawDocument5 pagesSUMMARY OF TAX TABLES AND RATES Train LawErnest Christopher Viray GonzaludoNo ratings yet

- Value Added Tax On ImportationDocument3 pagesValue Added Tax On ImportationAnna CynNo ratings yet

- Tax 2 Final Exam Summer Ay2018-19 (Sam)Document12 pagesTax 2 Final Exam Summer Ay2018-19 (Sam)Uy SamuelNo ratings yet

- PH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDFDocument6 pagesPH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDFWilmar AbriolNo ratings yet

- Income TaxationDocument19 pagesIncome TaxationDaphnie BoloNo ratings yet

- Zero-Rated Sales PDFDocument24 pagesZero-Rated Sales PDFNEstandaNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- PT, Excise and DST NotesDocument10 pagesPT, Excise and DST NotesFayie De LunaNo ratings yet

- Intro To Business Taxation: Group 2Document32 pagesIntro To Business Taxation: Group 2Hardly Dare GonzalesNo ratings yet

- Output Vat - Zero-Rated SalesDocument36 pagesOutput Vat - Zero-Rated SalesCoreen Samaniego0% (2)

- What Is Zero (0%) Rated Transactions? A. Sale of GoodsDocument1 pageWhat Is Zero (0%) Rated Transactions? A. Sale of GoodsKathrine CruzNo ratings yet

- 4 VAT ExemptionsDocument28 pages4 VAT ExemptionsMobile LegendsNo ratings yet

- VAT On ImportationDocument24 pagesVAT On ImportationShamae Duma-anNo ratings yet

- Vat On ImportationDocument3 pagesVat On ImportationKorrine Angeli CaliguiranNo ratings yet

- Pink Pastel Cute Abstract Watercolor Weekly Lesson Plan A4Document1 pagePink Pastel Cute Abstract Watercolor Weekly Lesson Plan A4Titania ErzaNo ratings yet

- Time Period Monthly Construction Monthly Carpet Permits Sales (1,000 Yards) X y Xy x2 Y2Document2 pagesTime Period Monthly Construction Monthly Carpet Permits Sales (1,000 Yards) X y Xy x2 Y2Titania ErzaNo ratings yet

- As An Accountancy StudentDocument1 pageAs An Accountancy StudentTitania ErzaNo ratings yet

- Maslow's Hierarchy of NeedsDocument1 pageMaslow's Hierarchy of NeedsTitania ErzaNo ratings yet

- Load-Distance Method Present Layout From/To Workflow, Number of Checks Distance, FeetDocument2 pagesLoad-Distance Method Present Layout From/To Workflow, Number of Checks Distance, FeetTitania ErzaNo ratings yet

- Explore Table 1. Clues On The Location of The First Catholic Mass in Thephilippines From The Pigafetta and Albo AccountsDocument1 pageExplore Table 1. Clues On The Location of The First Catholic Mass in Thephilippines From The Pigafetta and Albo AccountsTitania ErzaNo ratings yet

- Historical Sources Come From Either Primary or Secondary. Primary Sources Are First Hand or DirectDocument1 pageHistorical Sources Come From Either Primary or Secondary. Primary Sources Are First Hand or DirectTitania ErzaNo ratings yet

- Book 3Document6 pagesBook 3Titania ErzaNo ratings yet

- Evaluate Unit Quiz (2 Parts)Document1 pageEvaluate Unit Quiz (2 Parts)Titania ErzaNo ratings yet

- Elaborate Table 2. Arguments in Favor of Butuan As The Site of The First Philippine MassDocument1 pageElaborate Table 2. Arguments in Favor of Butuan As The Site of The First Philippine MassTitania ErzaNo ratings yet

- The Common Assumption in Capital Budgeting AnalysiDocument5 pagesThe Common Assumption in Capital Budgeting AnalysiTitania ErzaNo ratings yet

- REFLECTIONDocument1 pageREFLECTIONTitania ErzaNo ratings yet

- CASTILLO AE313 FinalsDocument2 pagesCASTILLO AE313 FinalsTitania ErzaNo ratings yet

- Gross Estate: Chapter 13-A: Gross Esate - Common RulesDocument3 pagesGross Estate: Chapter 13-A: Gross Esate - Common RulesTitania ErzaNo ratings yet

- IDENTIFICATIONDocument3 pagesIDENTIFICATIONTitania ErzaNo ratings yet

- BUSTAXADocument9 pagesBUSTAXATitania ErzaNo ratings yet

- My First Presentation SGYLTDocument7 pagesMy First Presentation SGYLTTitania ErzaNo ratings yet

- Certificate of Appearance: Office of The Sangguniang BayanDocument1 pageCertificate of Appearance: Office of The Sangguniang BayanJeffrey Constantino PatacsilNo ratings yet

- Rules & Regulations and Application FormatDocument9 pagesRules & Regulations and Application FormatheartslayerNo ratings yet

- Alfaro Vs Dumalagan - UnknownDocument12 pagesAlfaro Vs Dumalagan - Unknownανατολή και πετύχετεNo ratings yet

- Laquan McDonald Police Reports, Part 1Document52 pagesLaquan McDonald Police Reports, Part 1jroneillNo ratings yet

- Chapter Fifteen Intellectual Property RightsDocument33 pagesChapter Fifteen Intellectual Property RightsEstudiantes por DerechoNo ratings yet

- Freeletics Garmin Hyperice AG1 T&Cs May 2023Document4 pagesFreeletics Garmin Hyperice AG1 T&Cs May 2023egirl9No ratings yet

- CausationDocument8 pagesCausationapi-234400353No ratings yet

- The Bankers Books Evidence Act, 1891, Definitions, Applicability, Conditions in The PrintoutDocument6 pagesThe Bankers Books Evidence Act, 1891, Definitions, Applicability, Conditions in The Printoutvijayadarshini vNo ratings yet

- Aktas V Adepta (A Registered Charity) Dixie V British Polythene Industries PLCDocument38 pagesAktas V Adepta (A Registered Charity) Dixie V British Polythene Industries PLCRon MotilallNo ratings yet

- Foreign Military Sales Program General InformationDocument26 pagesForeign Military Sales Program General InformationSanjeev ChowdhryNo ratings yet

- 2 3 03 UNLV Report To CBX California Bar Character Application Coughlin His Father Calls UNLV Dean Declares Him A Drug Addict, Twelve Step CultDocument3 pages2 3 03 UNLV Report To CBX California Bar Character Application Coughlin His Father Calls UNLV Dean Declares Him A Drug Addict, Twelve Step CultDoTheMacaRenoNo ratings yet

- AP HC Order Display PDF 3Document26 pagesAP HC Order Display PDF 3Moneylife FoundationNo ratings yet

- Munandu V Public Prosecutor - (1984) 2 MLJ 8Document2 pagesMunandu V Public Prosecutor - (1984) 2 MLJ 8mykoda-1No ratings yet

- The Executive BranchDocument18 pagesThe Executive Branchdhrubo_tara25No ratings yet

- Prakas On The Accreditation To The Cash Settlement Agent EnglishDocument12 pagesPrakas On The Accreditation To The Cash Settlement Agent EnglishLona CheeNo ratings yet

- B22 Neth BambiDocument3 pagesB22 Neth BambiNeth MarquezNo ratings yet

- Docshare - Tips Evid HearsayDocument45 pagesDocshare - Tips Evid HearsayKevin AmanteNo ratings yet

- Judge David Reader Motion COADocument55 pagesJudge David Reader Motion COALansingStateJournal50% (2)

- INVESTIGATION SyllabusDocument9 pagesINVESTIGATION SyllabusGomez Agustin LeslieNo ratings yet

- World Health OrganizationDocument13 pagesWorld Health OrganizationDaniel LaurenteNo ratings yet

- McCaul Letter To Secretary Blinken - Daily Caller News FoundationDocument2 pagesMcCaul Letter To Secretary Blinken - Daily Caller News FoundationDaily Caller News FoundationNo ratings yet

- P) Special Branch (C.I.D) : Andaman and NicobarDocument9 pagesP) Special Branch (C.I.D) : Andaman and Nicobarlalith kumar mallavelliNo ratings yet