Professional Documents

Culture Documents

On January 1 2012 Pierson Corporation Exchanged 1 710 000 Cash For

On January 1 2012 Pierson Corporation Exchanged 1 710 000 Cash For

Uploaded by

Miroslav Gegoski0 ratings0% found this document useful (0 votes)

8 views1 pageOn January 1, 2012, Pierson Corporation acquired 90% of Steele Company for $1,710,000 cash. Pierson determined Steele's fair value was $1,900,000, higher than Steele's book value of $725,000. The $1,175,000 excess fair value was allocated to a customer base valued at $800,000 and goodwill of $375,000. At December 31, 2013, Pierson and Steele reported consolidated balances reflecting the business combination.

Original Description:

On January 1 2012 Pierson Corporation Exchanged 1 710 000 Cash For

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOn January 1, 2012, Pierson Corporation acquired 90% of Steele Company for $1,710,000 cash. Pierson determined Steele's fair value was $1,900,000, higher than Steele's book value of $725,000. The $1,175,000 excess fair value was allocated to a customer base valued at $800,000 and goodwill of $375,000. At December 31, 2013, Pierson and Steele reported consolidated balances reflecting the business combination.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageOn January 1 2012 Pierson Corporation Exchanged 1 710 000 Cash For

On January 1 2012 Pierson Corporation Exchanged 1 710 000 Cash For

Uploaded by

Miroslav GegoskiOn January 1, 2012, Pierson Corporation acquired 90% of Steele Company for $1,710,000 cash. Pierson determined Steele's fair value was $1,900,000, higher than Steele's book value of $725,000. The $1,175,000 excess fair value was allocated to a customer base valued at $800,000 and goodwill of $375,000. At December 31, 2013, Pierson and Steele reported consolidated balances reflecting the business combination.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

On January 1 2012 Pierson Corporation exchanged 1 710

000 cash for #8086

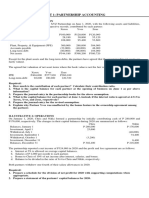

On January 1, 2012, Pierson Corporation exchanged $1,710,000 cash for 90 percent of the

outstanding voting stock of Steele Company. The consideration transferred by Pierson provided

a reasonable basis for assessing the total January 1, 2012, fair value of Steele Company.At the

acquisition date, Steele reported the following owners' equity amounts in its balance

sheet:Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $400,000Additional paid-in

capital . . . . . . . . . . . . . . . . . . . . . . . . . . .60,000Retained earnings . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . .265,000In determining its acquisition offer, Pierson noted that the values for Steele's

recorded assets and liabilities approximated their fair values. Pierson also observed that Steele

had developed internally a customer base with an assessed fair value of $800,000 that was not

reflected on Steele's books. Pierson expected both cost and revenue synergies from the

combination. At the acquisition date, Pierson prepared the following fair-value allocation

schedule:Fair value of Steele Company . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,900,000Book

value of Steele Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 725,000Excess fair value . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,175,000 to customer base (10-year remaining life) . .

. . . . . . . . . . . . . . . . . . 800,000 to goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 375,000At December 31, 2013, the two companies report the following balances:a. Determine

the consolidated balances for this business combination as of December 31, 2013.b. If instead

the noncontrolling interest's acquisition-date fair value is assessed at $152,500, what changes

would be evident in the consolidated statements?View Solution:

On January 1 2012 Pierson Corporation exchanged 1 710 000 cash for

ANSWER

http://paperinstant.com/downloads/on-january-1-2012-pierson-corporation-

exchanged-1-710-000-cash-for/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Internal Controls ChecklistDocument16 pagesInternal Controls ChecklistZubair ShafeeqNo ratings yet

- MidTerm ExamDocument15 pagesMidTerm ExamYonatan Wadler100% (2)

- Partnership - Key Notes and Sample ProblemsDocument6 pagesPartnership - Key Notes and Sample ProblemsCrestinaNo ratings yet

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- Business Combination Final ExamDocument9 pagesBusiness Combination Final Examcharlene lizardoNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument79 pagesPartnerships - Formation, Operations, and Changes in Ownership Interestsrenna magdalenaNo ratings yet

- Reviewer On InvestmentDocument16 pagesReviewer On Investmentcriszel4sobejanaNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Chapter 3 Business CombinationDocument9 pagesChapter 3 Business CombinationAnonymous XOv12G100% (1)

- Advance Accounting Beams 10th eDocument15 pagesAdvance Accounting Beams 10th eHecel OlitaNo ratings yet

- AFAR Summary Lecture (10 May 2021)Document30 pagesAFAR Summary Lecture (10 May 2021)Joanna MalubayNo ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Afar 2Document24 pagesAfar 2KriztleKateMontealtoGelogo100% (1)

- May 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyROMAR A. PIGANo ratings yet

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1rendy adiwigunaNo ratings yet

- Business Combinations: Answers To Questions 1Document7 pagesBusiness Combinations: Answers To Questions 1ohbNo ratings yet

- Assets Liabilities and EquityDocument16 pagesAssets Liabilities and EquityYahlianah LeeNo ratings yet

- Solution To Chap 1 Accounting 26e WarrenDocument55 pagesSolution To Chap 1 Accounting 26e WarrenKhánh Linh Nguyễn NgọcNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Practice Set 1 ABC-3Document3 pagesPractice Set 1 ABC-3reiNo ratings yet

- 2011 Jun 10 Steven Hodgson and Sarah Asham Have AgreedDocument1 page2011 Jun 10 Steven Hodgson and Sarah Asham Have AgreedMiroslav GegoskiNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1MUFC SupporterNo ratings yet

- 1 - Week Partnership FormationDocument24 pages1 - Week Partnership FormationAlrac Garcia100% (1)

- Warren SM - Ch.01 - Final PDFDocument54 pagesWarren SM - Ch.01 - Final PDFyoshe lauraNo ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- On January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedDocument1 pageOn January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedMiroslav GegoskiNo ratings yet

- Audit Qualifying Exam 1 1Document12 pagesAudit Qualifying Exam 1 1Fery AnnNo ratings yet

- 1.1. Partnership FormationDocument7 pages1.1. Partnership FormationKPoPNyx EditsNo ratings yet

- Accounting For Partnership FARDocument31 pagesAccounting For Partnership FARlousevero10No ratings yet

- ProblemsDocument12 pagesProblemsJoy MarieNo ratings yet

- Group Accounts 2 - Module AssessmentDocument25 pagesGroup Accounts 2 - Module AssessmentArn KylaNo ratings yet

- Advanced Financial Accounting Work SheetDocument7 pagesAdvanced Financial Accounting Work SheetAshenafi ZelekeNo ratings yet

- Acc 4100 Chapter 2 QuestionsDocument13 pagesAcc 4100 Chapter 2 Questionssam luiNo ratings yet

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- 401 Practice FinalDocument93 pages401 Practice FinalAsmir Ermina BegicNo ratings yet

- Chapter+13 +problems +accounting+230Document26 pagesChapter+13 +problems +accounting+230amsr khNo ratings yet

- Business Combination Prelim Reviewer 2Document18 pagesBusiness Combination Prelim Reviewer 2Millicent AlmueteNo ratings yet

- Acc 7Document39 pagesAcc 7Kurt PlatonNo ratings yet

- Acc401advancedaccountingweek11quizfinalexam 170306122641Document103 pagesAcc401advancedaccountingweek11quizfinalexam 170306122641Izzy BNo ratings yet

- Beams9esm Ch01Document13 pagesBeams9esm Ch01zandra SumbarNo ratings yet

- Business Combinations: Answers To Questions 1Document12 pagesBusiness Combinations: Answers To Questions 1Sin TungNo ratings yet

- Accounting For Business Combination - AssessmentsDocument114 pagesAccounting For Business Combination - AssessmentsArn KylaNo ratings yet

- Fin440 AssignmentDocument1 pageFin440 Assignmentদিপ্ত বসুNo ratings yet

- Accounting 12Document4 pagesAccounting 12Breathe ArielleNo ratings yet

- ACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsDocument9 pagesACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsBaby BabeNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- 2.2 - Lecture Notes - Partnership FormationDocument13 pages2.2 - Lecture Notes - Partnership FormationKatrina Regina BatacNo ratings yet

- Acquisition MethodDocument38 pagesAcquisition MethodArn KylaNo ratings yet

- Instruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inDocument2 pagesInstruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inJeane Mae BooNo ratings yet

- On January 1 2017 Allan Company Bought A 15 PercentDocument2 pagesOn January 1 2017 Allan Company Bought A 15 PercentAmit PandeyNo ratings yet

- 1Document4 pages1Janea Lorraine TanNo ratings yet

- Afar Review HandoutsDocument19 pagesAfar Review HandoutsAlisonNo ratings yet

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse Sioco100% (1)

- Suppose That People Consume Only Three Goods As Shown inDocument1 pageSuppose That People Consume Only Three Goods As Shown inMiroslav Gegoski0% (1)

- Suppose That Fixed Costs For A Firm in The AutomobileDocument1 pageSuppose That Fixed Costs For A Firm in The AutomobileMiroslav GegoskiNo ratings yet

- Suppose That Congress Imposes A Tariff On Imported Autos ToDocument1 pageSuppose That Congress Imposes A Tariff On Imported Autos ToMiroslav GegoskiNo ratings yet

- Suppose That A Market Is Described by The Following SupplyDocument1 pageSuppose That A Market Is Described by The Following SupplyMiroslav GegoskiNo ratings yet

- Suppose That in A Year An American Worker Can ProduceDocument1 pageSuppose That in A Year An American Worker Can ProduceMiroslav GegoskiNo ratings yet

- Suppose That Every Driver Faces A 1 Probability of AnDocument1 pageSuppose That Every Driver Faces A 1 Probability of AnMiroslav GegoskiNo ratings yet

- Suppose That A Paper Mill Feeds A Downstream Box MillDocument1 pageSuppose That A Paper Mill Feeds A Downstream Box MillMiroslav GegoskiNo ratings yet

- Suppose That Congress Passes A Law Requiring Employers To ProvidDocument1 pageSuppose That Congress Passes A Law Requiring Employers To ProvidMiroslav GegoskiNo ratings yet

- Suppose That The Owner of Boyer Construction Is Feeling TheDocument1 pageSuppose That The Owner of Boyer Construction Is Feeling TheMiroslav GegoskiNo ratings yet

- Suppose That Prior To The Passage of The Truth inDocument1 pageSuppose That Prior To The Passage of The Truth inMiroslav GegoskiNo ratings yet

- Suppose Douglas and Ziffel Have Properties That Adjoin The FarmDocument1 pageSuppose Douglas and Ziffel Have Properties That Adjoin The FarmMiroslav GegoskiNo ratings yet

- Suppose That A Perfectly Competitive Firm Has The Following TotaDocument1 pageSuppose That A Perfectly Competitive Firm Has The Following TotaMiroslav GegoskiNo ratings yet

- Suppose That There Are 10 Million Workers in Canada andDocument1 pageSuppose That There Are 10 Million Workers in Canada andMiroslav GegoskiNo ratings yet

- Suppose That The Marshall Islands Does Not Trade With TheDocument1 pageSuppose That The Marshall Islands Does Not Trade With TheMiroslav GegoskiNo ratings yet

- Suppose That A Firm S Production Function Is Given by TheDocument1 pageSuppose That A Firm S Production Function Is Given by TheMiroslav GegoskiNo ratings yet

- Suppose An Economy Is in Long Run Equilibrium A Use TheDocument1 pageSuppose An Economy Is in Long Run Equilibrium A Use TheMiroslav GegoskiNo ratings yet

- Structural Unemployment Is Sometimes Said To Result From A MismaDocument1 pageStructural Unemployment Is Sometimes Said To Result From A MismaMiroslav GegoskiNo ratings yet

- Suppose A Computer Virus Disables The Nation S Automatic TellerDocument1 pageSuppose A Computer Virus Disables The Nation S Automatic TellerMiroslav GegoskiNo ratings yet

- Sung Sam Inc Is Currently DesigningDocument1 pageSung Sam Inc Is Currently DesigningMiroslav GegoskiNo ratings yet

- Suppose A Technological Advance Reduces The Cost of Making CompuDocument1 pageSuppose A Technological Advance Reduces The Cost of Making CompuMiroslav GegoskiNo ratings yet

- Suppose One of Your Clients Is Four Years Away FromDocument1 pageSuppose One of Your Clients Is Four Years Away FromMiroslav GegoskiNo ratings yet

- Stowe Automotive Is Considering An Offer From Indula To BuildDocument1 pageStowe Automotive Is Considering An Offer From Indula To BuildMiroslav GegoskiNo ratings yet

- Suppose That A Fall in Consumer Spending Causes A RecessionDocument1 pageSuppose That A Fall in Consumer Spending Causes A RecessionMiroslav GegoskiNo ratings yet

- Suppose An Appliance Manufacturer Is Doing A Regression AnalysisDocument1 pageSuppose An Appliance Manufacturer Is Doing A Regression AnalysisMiroslav GegoskiNo ratings yet

- Suppose Firms Become Very Optimistic About Future Business CondiDocument1 pageSuppose Firms Become Very Optimistic About Future Business CondiMiroslav GegoskiNo ratings yet

- Suppose An Enhanced Effectiveness of Cooperative Advertising OccDocument1 pageSuppose An Enhanced Effectiveness of Cooperative Advertising OccMiroslav GegoskiNo ratings yet

- Stamp Collecting Has Become An IncreasinglyDocument1 pageStamp Collecting Has Become An IncreasinglyMiroslav GegoskiNo ratings yet

- Suppose That A Ceo S Goal Is To Increase Profitability andDocument1 pageSuppose That A Ceo S Goal Is To Increase Profitability andMiroslav GegoskiNo ratings yet

- Royersford Knitting Mills LTD Sells A Line of Women S KnitDocument1 pageRoyersford Knitting Mills LTD Sells A Line of Women S KnitMiroslav GegoskiNo ratings yet

- Refer To Table in This Chapter and Answer The FollowingDocument1 pageRefer To Table in This Chapter and Answer The FollowingMiroslav GegoskiNo ratings yet

- Setup Task Lists FinancialsDocument23 pagesSetup Task Lists FinancialsWaseem TanauliNo ratings yet

- DMATHDocument2 pagesDMATHrichelleartgalleryNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Chapter 4: Analysis of Financial StatementsDocument8 pagesChapter 4: Analysis of Financial StatementsSafuan HalimNo ratings yet

- Group Members Name:: Iqra Hashim Jahnzaib Ali Bhatti Ammar Malik Mayra Sundas Amina MushtaqDocument62 pagesGroup Members Name:: Iqra Hashim Jahnzaib Ali Bhatti Ammar Malik Mayra Sundas Amina MushtaqIQRA HASHIMNo ratings yet

- Financial Ratio Analysis ExplainationDocument5 pagesFinancial Ratio Analysis ExplainationSyaiful RokhmanNo ratings yet

- Chapter 5 ReceivablesDocument27 pagesChapter 5 ReceivablesCabdiraxmaan GeeldoonNo ratings yet

- Investment Banking Scorecard 07 28 22Document5 pagesInvestment Banking Scorecard 07 28 22AlfredNo ratings yet

- p8 Cfas Final ExamDocument3 pagesp8 Cfas Final ExamJames DetallaNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- 4Document4 pages4Lazy LeathNo ratings yet

- Derivatives and Risk ManagementDocument4 pagesDerivatives and Risk ManagementXxx vidios Hot videos Xnxx videos Sexy videosNo ratings yet

- Summary Session 1 - The Nature of Accounting and The Chief Ethical DifficultyDocument6 pagesSummary Session 1 - The Nature of Accounting and The Chief Ethical Difficultyrifqi salmanNo ratings yet

- Final Accounts of A CompanyDocument10 pagesFinal Accounts of A Companymanoraman50% (2)

- Chap 020Document58 pagesChap 020mad2kNo ratings yet

- Cash Flow InfographicDocument1 pageCash Flow InfographicDiego PeñaNo ratings yet

- Reliance Financial Model (Done)Document5 pagesReliance Financial Model (Done)achal jainNo ratings yet

- MGMT - Topic 7 - ControlDocument13 pagesMGMT - Topic 7 - Controlnorliza albutraNo ratings yet

- Retained Earnings Account in SapDocument3 pagesRetained Earnings Account in SapAnanthakumar ANo ratings yet

- Dissertation For M Mashava R14940G 24.10.19Document67 pagesDissertation For M Mashava R14940G 24.10.19moreblessing mashavaNo ratings yet

- p3 Advanced Auditing & Financial Management Suggested Answers May 2017Document31 pagesp3 Advanced Auditing & Financial Management Suggested Answers May 2017Apeksha ChilwalNo ratings yet

- P1 Exams Set ADocument10 pagesP1 Exams Set Aerica lamsenNo ratings yet

- Q Finman2 Capbudgtng 1920Document5 pagesQ Finman2 Capbudgtng 1920Deniece RonquilloNo ratings yet

- C. Either A or B.: Discussion ProblemsDocument1 pageC. Either A or B.: Discussion ProblemsGlen JavellanaNo ratings yet

- Unit Trust Funds: Frequently Asked QuestionsDocument2 pagesUnit Trust Funds: Frequently Asked QuestionsJoseph OsakoNo ratings yet

- Analysis and Interpretation - BalladaDocument4 pagesAnalysis and Interpretation - BalladaClaire Evann Villena EboraNo ratings yet

- HDFC ProjectDocument122 pagesHDFC Projectmanbesh50% (2)

- ACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentDocument57 pagesACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentKevinNo ratings yet

- Alya Ghaitsa Putri - D42192456 - D - Praktikum 3 - Applied EnglishDocument6 pagesAlya Ghaitsa Putri - D42192456 - D - Praktikum 3 - Applied EnglishAlya Ghaitsa putriNo ratings yet