Professional Documents

Culture Documents

C. Either A or B.: Discussion Problems

Uploaded by

Glen JavellanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C. Either A or B.: Discussion Problems

Uploaded by

Glen JavellanaCopyright:

Available Formats

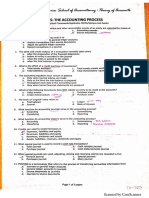

DISCUSSION PROBLEMS

1. Interim financial report means a financial report 5. The terms and conditions of employment with The

containing Pleasing Company include entitlement to share in the

a. A complete set of financial statements for an staff bonus system, under which 5% of the profits for the

interim period. year before charging the bonus are allocated to the bonus

b. A set of condensed financial statements for an pool, provided the annual profits exceed P50 million. The

interim period. profits (before accrual of any bonus) for the first half of

c. Either a or b. 2019 amount to P40 million and the latest estimate of

d. Neither a nor b. the profits (before accrual of any bonus) for the year as a

whole is P60 million.

2. PAS 34 Interim Financial Reporting specifies

a. The content of an interim financial report that is How much should be recognized in profit or loss in

described as conforming to PFRS. respect of the staff bonus for the half year to 30 June

b. The entities required to publish interim financial 2019, according to PAS34 Interim financial reporting?

report a. Nil c. P2.0 million

b. P3.0 million d. P1.5 million

c. The frequency of interim financial reporting.

d. How soon after the end of an interim period should

the entity publish interim financial report. 6 Joseph Corp. had the following transactions during the

3. The Maddy Company is preparing interim financial quarter ended March 31, 2019:

statements for the six months to 30 June 2O16 in Loss from typhoon damage P210,000

accordance with the minimum requirements of PAS34. Payment of fire insurance premium

Its accounting year ends on 31 December each Y•ar. for calendar year 2019 300,000

Which of the following comparative statement is pt

appropriate? What amount should be included in Joseph's income

a. Statement of financial position at 30 June 2015 statement for the quarter ended March 31, 2019?

b. Statement of profit or loss and other Typhoon Loss Insurance Expense

comprehensive income for the half year to 30, a. P210,000 P300,000

June 2015 b. P210,000 P 75,000

c. Statement of changes in equity for the half year c. P 52,500 P 75,000

to 30 June 2015 d. P 0 P300,000

d. Statement of cash flows for the half year to 30

June 2015 7. On January 5, 2019, Red Co. paid P60,O00 for

insurance on its buildings for the calendar year

L ECTURE NOTES: 2016. In the first week of April 2019, the company

made unanticipated major repairs to its equipment

Date and Period Covered - Second Ouarter at a cost of P240,000. These repairs benefited

FS Current year (CY) Prior year (PY) operations for the remainder of 2019. How should

SFP 6.30.CY 12.31.PY these expenses be reflected in Red Co’s quarterly

SCI 3 months ended 6.30.CY 3 months ended 6.30.PY income statements?

6 months ended 6.30.CY 6 months ended 6.30.PY

SCE 6 months ended 6.30.CY 6 months ended 6.30.PY

SCF 6 months ended 6.30.CY 6 months ended 6.30.PY

Mar. 31 Jun. 30 Sep. 30 Dec. 31

a. P15,000 P95,000 P95,000 P95,000

4. An entity operates in the travel industry and incurs cost b. 60,000 240,000

unevenly through the financial year. Advertising costs of c. 75,000 75,000 75,000 75,000

d. 1S,000 255,000 15,o00 s,000

P2 million were incurred on March 1, 2019, and staff

bonuses are paid at year-end based on sales. Staff

bonuses are expected to be around P20 million for 8. Occidental Company’s P10,000,000 net income for the

the year; of that sum, P3 million would relate to the quarter ended September 30, 2019, included the

period ending March 31, 2019. What costs should be following aRer-tax items

included in the entity’s quarterly financial report to

March 31, 2019? • A P1,200,000 gain realized on April 30, 2019 was

a. Advertising costs P2 million; staff bonuses PS allocated equally to the second, third and fourth

million quarters of 2019.

b. Advertising costs P0.5 million; staff bonuses P5 • A P3,000,OOO cumulative loss resulting from a

million change in inventory valuation method was

c. Advertising costs P2 million; staff bonuses P3 recognized on August 2, 2019.

million In addition, Occidental paid P600,000 on February 1,

d. Advertising costs PO.5 million; staff bonuses P3 2019, for 2019 calendar-year property tax. Of this

million amount, P150,000 was allocated to the third quarter of

2019. For the quarter ended September 30, 2019,

Occidental should report net income of

a. P12,600,000 c. P11,800,000

b. P12,750,000 d. P 9,600,000

You might also like

- C. Either A or B.: Discussion ProblemsDocument8 pagesC. Either A or B.: Discussion ProblemsGlen JavellanaNo ratings yet

- Drill: A. P100,000 C. P130,000Document2 pagesDrill: A. P100,000 C. P130,000Glen JavellanaNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- FAR - Interim Financial ReportingDocument3 pagesFAR - Interim Financial ReportingDale JimenoNo ratings yet

- QUIZ 1: Interim Financial ReportingDocument13 pagesQUIZ 1: Interim Financial ReportingJusteen BalcortaNo ratings yet

- FAR.2850 - Interim Financial Reporting.Document4 pagesFAR.2850 - Interim Financial Reporting.Ashley LegaspiNo ratings yet

- Quiz 2 - 4B UpdatesDocument3 pagesQuiz 2 - 4B UpdatesAngelo HilomaNo ratings yet

- INTERIM REPORTING With ANSWERSDocument6 pagesINTERIM REPORTING With ANSWERSRaven Sia100% (3)

- Fat Deferred Income TaxDocument2 pagesFat Deferred Income Taxnicole bancoroNo ratings yet

- Activity 2 - 4B UpdatesDocument3 pagesActivity 2 - 4B UpdatesAngelo HilomaNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFHaidee Flavier SabidoNo ratings yet

- 07 Interim Reporting FinalDocument3 pages07 Interim Reporting FinalMakoy BixenmanNo ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Module 5.2 - Sample ExercisesDocument8 pagesModule 5.2 - Sample ExercisesJaimell LimNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- FAR08.01e-Interim ReportingDocument4 pagesFAR08.01e-Interim ReportingANGELRIEH SUPERTICIOSONo ratings yet

- DocxDocument13 pagesDocxMingNo ratings yet

- Auditing Problem 1 22 22 PDFDocument26 pagesAuditing Problem 1 22 22 PDFKate NuevaNo ratings yet

- PAS34 Questio N& Answer!: Welcome To..Document18 pagesPAS34 Questio N& Answer!: Welcome To..Faker MejiaNo ratings yet

- USJR FAR Quizbowl BlankDocument8 pagesUSJR FAR Quizbowl BlankSarah BalisacanNo ratings yet

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- 2018 Income Tax QDocument4 pages2018 Income Tax QlightNo ratings yet

- The Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.Document6 pagesThe Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.JamesNo ratings yet

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- FAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Document14 pagesFAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Joanna MalubayNo ratings yet

- PDF Intermediate Accounting Volume 3 ValixDocument4 pagesPDF Intermediate Accounting Volume 3 ValixJosh Cruz CosNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- Problem A - Adjusting EntriesDocument4 pagesProblem A - Adjusting EntriesMischa Bianca BesmonteNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Acctg 323 MT ExamDocument10 pagesAcctg 323 MT ExamJoyluxxiNo ratings yet

- ReceivableDocument3 pagesReceivableBellaNo ratings yet

- Intermediate Accounting Volume 3 ValixDocument4 pagesIntermediate Accounting Volume 3 ValixVyonne Ariane EdiongNo ratings yet

- Quiz 6 - Error Correction Interim Financial Reporting 1Document5 pagesQuiz 6 - Error Correction Interim Financial Reporting 1Caballero, Charlotte MichaellaNo ratings yet

- Ap 9201-2 SheDocument5 pagesAp 9201-2 SheShefannie PaynanteNo ratings yet

- AP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryDocument4 pagesAP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryAngela AlejandroNo ratings yet

- BFJPIA Cup Level 3 P1Document9 pagesBFJPIA Cup Level 3 P1Blessy Zedlav LacbainNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Review On AfarDocument4 pagesReview On AfarKenneth Christian WilburNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Chapter 3Document6 pagesChapter 3You Knock On My DoorNo ratings yet

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- FinaccDocument3 pagesFinaccpatrise siosonNo ratings yet

- Rmyc SGV Cup Final Round QM Copy v1Document15 pagesRmyc SGV Cup Final Round QM Copy v1Darelle Hannah MarquezNo ratings yet

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- Final Examination AK (60 COPIES)Document9 pagesFinal Examination AK (60 COPIES)Sittie Ainna A. UnteNo ratings yet

- 02 MAS Final Preboard 2018 2019 WITH ANSWER 2Document13 pages02 MAS Final Preboard 2018 2019 WITH ANSWER 2Jims Leñar CezarNo ratings yet

- 02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFDocument13 pages02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFAshNor RandyNo ratings yet

- Far 103 - Accounting For Receivables and Notes ReceivableDocument4 pagesFar 103 - Accounting For Receivables and Notes ReceivablePatrishaNo ratings yet

- Chapter 3Document7 pagesChapter 3Coursehero PremiumNo ratings yet

- Interim ReportingDocument5 pagesInterim ReportingPat QuiaoitNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Books of Accounts - ManualDocument4 pagesBooks of Accounts - ManualGlen JavellanaNo ratings yet

- Sworn DeclarationDocument1 pageSworn DeclarationGlen Javellana100% (1)

- Statement of Management Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management Responsibility For Annual Income Tax ReturnGlen JavellanaNo ratings yet

- Irr On Employees Credit LineDocument2 pagesIrr On Employees Credit LineGlen JavellanaNo ratings yet

- Receipt TemplateDocument1 pageReceipt TemplateGlen JavellanaNo ratings yet

- Format of Implementing Rules and RegulationsDocument6 pagesFormat of Implementing Rules and RegulationsGlen JavellanaNo ratings yet

- Chart of Accounts List: AssetsDocument18 pagesChart of Accounts List: AssetsGlen JavellanaNo ratings yet

- Operations Operations Operations Operations Manual Manual Manual ManualDocument2 pagesOperations Operations Operations Operations Manual Manual Manual ManualGlen JavellanaNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- SMEs - TOA - VALIX 2018 PDFDocument17 pagesSMEs - TOA - VALIX 2018 PDFHarvey Dienne Quiambao100% (1)

- 1365464987statement of Financial Positio 3Document1 page1365464987statement of Financial Positio 3Glen JavellanaNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument2 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- 5134649879operating Segment FinalDocument8 pages5134649879operating Segment FinalGlen JavellanaNo ratings yet

- 211toa PDFDocument3 pages211toa PDFGlen JavellanaNo ratings yet

- Topic 26 Internal Control Sales Cycle PDFDocument6 pagesTopic 26 Internal Control Sales Cycle PDFGlen JavellanaNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- 13213213operating SegmentDocument2 pages13213213operating SegmentGlen JavellanaNo ratings yet

- 3214649879operating SegmentDocument1 page3214649879operating SegmentGlen JavellanaNo ratings yet

- Insurer Oil and Gas Engineering Company Contract Appointment LetterDocument5 pagesInsurer Oil and Gas Engineering Company Contract Appointment LetterJunior Martinez100% (1)

- Solution Manual For Steps To Writing Well 11th EditionDocument38 pagesSolution Manual For Steps To Writing Well 11th Editionfootfleececyud5100% (15)

- Ac 1&2 Module 1Document11 pagesAc 1&2 Module 1ABM-5 Lance Angelo SuganobNo ratings yet

- Lisson v. Mohsenin - 1:15-cv-1148-SSDocument60 pagesLisson v. Mohsenin - 1:15-cv-1148-SSLisson v. MohseninNo ratings yet

- Yogesh Naik (Project)Document68 pagesYogesh Naik (Project)yogeshnaik06100% (1)

- Starting A BusinessDocument9 pagesStarting A BusinessPaulNo ratings yet

- Financial Statement of Sole Proprietorship (Final Ac)Document16 pagesFinancial Statement of Sole Proprietorship (Final Ac)centmusic8No ratings yet

- Intermediate Accounting Vol 1 Canadian 2nd Edition Lo Test BankDocument24 pagesIntermediate Accounting Vol 1 Canadian 2nd Edition Lo Test BankDarrylWoodsormni100% (17)

- Buckwold12e Solutions Ch07Document41 pagesBuckwold12e Solutions Ch07awerweasd100% (1)

- Cadbury India: Previous YearsDocument6 pagesCadbury India: Previous YearsAnuj SinhaNo ratings yet

- Bank Performance Analysis - Anushka Gupta (Kotak Mahindra Bank)Document13 pagesBank Performance Analysis - Anushka Gupta (Kotak Mahindra Bank)Surbhî GuptaNo ratings yet

- Specific Intangible AssetDocument30 pagesSpecific Intangible Assetlana del reyNo ratings yet

- Financial Management MDocument3 pagesFinancial Management MYaj CruzadaNo ratings yet

- GPF All FormsDocument66 pagesGPF All Formsnkj9512No ratings yet

- Infosys Annual Report 2016 Available Online For ADS Holders (Company Update)Document200 pagesInfosys Annual Report 2016 Available Online For ADS Holders (Company Update)Shyam SunderNo ratings yet

- Modern Approach of AccountingDocument24 pagesModern Approach of AccountingParesh ShahNo ratings yet

- MasDocument14 pagesMasgnim1520100% (1)

- Accounting For Special TransactionsDocument43 pagesAccounting For Special TransactionsNezer VergaraNo ratings yet

- Basic Concepts Bank Reports: Big Picture B. Ulo BDocument26 pagesBasic Concepts Bank Reports: Big Picture B. Ulo BEDLYN MABUTINo ratings yet

- Aircraft Cost Calculator BBJ Vs B737-700Document13 pagesAircraft Cost Calculator BBJ Vs B737-700Harry NuryantoNo ratings yet

- Below Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Document3 pagesBelow Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Ayushi SinghalNo ratings yet

- Project Report Mandap DecorationDocument17 pagesProject Report Mandap Decorationkushal chopda100% (1)

- Definition of 'Shares'Document8 pagesDefinition of 'Shares'c_vijaykumaryadavNo ratings yet

- Midterm Financial Management Chapter IIDocument119 pagesMidterm Financial Management Chapter IIm_chan029No ratings yet

- Final Exammm 3Document10 pagesFinal Exammm 3Marianne Adalid MadrigalNo ratings yet

- F5 & F6 NotesDocument125 pagesF5 & F6 Notesmunashe shawnNo ratings yet

- CDP Mandav EnglishDocument332 pagesCDP Mandav EnglishCity Development Plan Madhya Pradesh75% (4)

- 24-Sheep Fattening Feasibility Revised 17 FebDocument12 pages24-Sheep Fattening Feasibility Revised 17 FebDr. Huzaifa RizwanNo ratings yet

- Reyes Solution Adjusting EntryDocument4 pagesReyes Solution Adjusting EntryJustine ReyesNo ratings yet

- Income Statement: Clymel Cebu Music SchoolDocument3 pagesIncome Statement: Clymel Cebu Music SchoolLorn RobNo ratings yet