Professional Documents

Culture Documents

S4Q0000023908 1 PDF

S4Q0000023908 1 PDF

Uploaded by

Ali Azhar KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S4Q0000023908 1 PDF

S4Q0000023908 1 PDF

Uploaded by

Ali Azhar KhanCopyright:

Available Formats

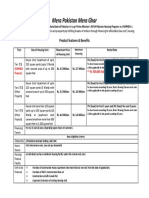

Hyundai Nishat Motor (Pvt.

) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000005 Employee NTN

Employee Name Shuja Ur Rehman Employee CNIC No. 3520227277955

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 216,503.00 21,650.00 238,153.00 4,880.00 0.00 243,033.00 221,383.00 21,650.00

AUG-19 216,503.00 21,650.00 238,153.00 6,409.00 0.00 244,562.00 222,912.00 21,650.00

SEP-19 216,503.00 21,650.00 238,153.00 3,881.00 0.00 242,034.00 220,384.00 21,650.00

OCT-19 216,503.00 21,650.00 238,153.00 14,658.00 0.00 252,811.00 231,161.00 21,650.00

NOV-19 216,503.00 21,650.00 238,153.00 32,372.00 0.00 270,525.00 248,875.00 21,650.00

DEC-19 216,503.00 21,650.00 238,153.00 10,770.40 0.00 248,923.40 227,273.40 21,650.00

JAN-20 228,519.00 22,852.00 251,371.00 10,895.20 0.00 262,266.20 239,414.20 21,650.00

FEB-20 228,519.00 22,852.00 251,371.00 158,207.20 0.00 409,578.20 386,726.20 21,650.00

MAR-20 228,519.00 22,852.00 251,371.00 3,808.80 0.00 255,179.80 232,327.80 21,650.00

APR-20 228,519.00 22,852.00 251,371.00 6,850.00 0.00 258,221.00 235,369.00 21,650.00

MAY-20 228,519.00 22,852.00 251,371.00 6,313.00 0.00 257,684.00 234,832.00 21,650.00

JUN-20 228,519.00 22,852.00 251,371.00 42,146.00 0.00 293,517.00 270,665.00 28,862.00

Total 2,670,132.00 267,012.00 2,937,144.00 301,190.60 0.00 3,238,334.60 2,971,322.60 267,012.00

H Taxable Salary (Annual) 2,971,322.60

I PF Contribution (Employer) in excess of Rs. 150,000 117,012.00

J 5% x Cost of Vehicle provided by Employer 94,643.00

K Total Taxable Income H+I+J 3,182,977.60

L Total Annual Tax 314,520.91

M Average Tax Rate L/K % 9.88

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 52,800.00 5,217.35

Charity 0.00 0.00

Advance Income Tax 3,542.00

Total Tax Credit 8,759.35

Net Tax Withheld & Submitted By the Company 305,761.56

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000006 Employee NTN

Employee Name Muhammad Farhan Saeed Employee CNIC No. 3520269909957

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 82,755.00 8,275.00 91,030.00 8,158.00 4,000.00 103,188.00 94,913.00 8,276.00

AUG-19 82,755.00 8,275.00 91,030.00 8,097.00 4,000.00 103,127.00 94,852.00 8,276.00

SEP-19 82,755.00 8,275.00 91,030.00 14,630.00 4,000.00 109,660.00 101,385.00 8,276.00

OCT-19 82,755.00 8,275.00 91,030.00 20,808.80 4,000.00 115,838.80 107,563.80 8,276.00

NOV-19 82,755.00 8,275.00 91,030.00 13,248.80 4,000.00 108,278.80 100,003.80 8,276.00

DEC-19 82,755.00 8,275.00 91,030.00 10,500.80 4,000.00 105,530.80 97,255.80 8,276.00

JAN-20 90,939.00 9,094.00 100,033.00 7,588.80 4,000.00 111,621.80 102,527.80 8,276.00

FEB-20 90,939.00 9,094.00 100,033.00 68,799.00 4,000.00 172,832.00 163,738.00 8,276.00

MAR-20 90,939.00 9,094.00 100,033.00 12,444.00 4,000.00 116,477.00 107,383.00 8,276.00

APR-20 90,939.00 9,094.00 100,033.00 12,503.20 4,000.00 116,536.20 107,442.20 8,276.00

MAY-20 90,939.00 9,094.00 100,033.00 9,094.40 4,000.00 113,127.40 104,033.40 8,276.00

JUN-20 90,939.00 9,094.00 100,033.00 12,477.00 4,000.00 116,510.00 107,416.00 13,184.00

Total 1,042,164.00 104,214.00 1,146,378.00 198,349.80 48,000.00 1,392,727.80 1,288,513.80 104,220.00

H Taxable Salary (Annual) 1,288,513.80

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 94,643.00

K Total Taxable Income H+I+J 1,383,156.80

L Total Annual Tax 34,051.28

M Average Tax Rate L/K % 2.46

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 34,051.28

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000007 Employee NTN

Employee Name Mehwish Riaz Employee CNIC No. 3520298122404

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 34,115.00 3,411.00 37,526.00 0.00 3,000.00 40,526.00 37,115.00 3,412.00

AUG-19 34,115.00 3,411.00 37,526.00 0.00 3,000.00 40,526.00 37,115.00 3,412.00

SEP-19 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

OCT-19 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

NOV-19 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

DEC-19 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

JAN-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

FEB-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

MAR-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

APR-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

MAY-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

JUN-20 34,115.00 3,411.00 37,526.00 0.00 0.00 37,526.00 34,115.00 0.00

Total 409,380.00 40,932.00 450,312.00 0.00 54,000.00 456,312.00 415,380.00 6,824.00

H Taxable Salary (Annual) 415,380.00

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 94,643.00

K Total Taxable Income H+I+J 510,023.00

L Total Annual Tax 0.00

M Average Tax Rate L/K % 0.00

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 0.00

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000008 Employee NTN

Employee Name Faisal Arshad Employee CNIC No. 3520226157829

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 191,664.00 19,166.00 210,830.00 5,056.00 0.00 215,886.00 196,720.00 19,166.00

AUG-19 191,664.00 19,166.00 210,830.00 6,843.00 0.00 217,673.00 198,507.00 19,166.00

SEP-19 191,664.00 19,166.00 210,830.00 4,760.00 0.00 215,590.00 196,424.00 19,166.00

OCT-19 191,664.00 19,166.00 210,830.00 10,068.00 0.00 220,898.00 201,732.00 19,166.00

NOV-19 191,664.00 19,166.00 210,830.00 4,872.00 0.00 215,702.00 196,536.00 19,166.00

DEC-19 191,664.00 19,166.00 210,830.00 8,453.60 0.00 219,283.60 200,117.60 19,166.00

JAN-20 203,259.00 20,326.00 223,585.00 5,852.00 0.00 229,437.00 209,111.00 19,166.00

FEB-20 203,259.00 20,326.00 223,585.00 151,389.80 0.00 374,974.80 354,648.80 19,166.00

MAR-20 203,259.00 20,326.00 223,585.00 6,556.00 0.00 230,141.00 209,815.00 19,166.00

APR-20 203,259.00 20,326.00 223,585.00 0.00 0.00 223,585.00 203,259.00 19,166.00

MAY-20 203,259.00 20,326.00 223,585.00 12,436.80 0.00 236,021.80 215,695.80 19,166.00

JUN-20 203,259.00 20,326.00 223,585.00 0.00 0.00 223,585.00 203,259.00 26,126.00

Total 2,369,538.00 236,952.00 2,606,490.00 216,287.20 54,000.00 2,822,777.20 2,585,825.20 236,952.00

H Taxable Salary (Annual) 2,585,825.20

I PF Contribution (Employer) in excess of Rs. 150,000 86,952.00

J 5% x Cost of Vehicle provided by Employer 95,866.00

K Total Taxable Income H+I+J 2,768,643.20

L Total Annual Tax 242,012.39

M Average Tax Rate L/K % 8.74

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 242,012.39

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000009 Employee NTN

Employee Name Farooq Latif Nasir Employee CNIC No. 3430117340781

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 58,075.00 5,808.00 63,883.00 28,506.00 4,000.00 96,389.00 90,581.00 5,808.00

AUG-19 58,075.00 5,808.00 63,883.00 27,313.00 4,000.00 95,196.00 89,388.00 5,808.00

SEP-19 58,075.00 5,808.00 63,883.00 15,911.00 4,000.00 83,794.00 77,986.00 5,808.00

OCT-19 58,075.00 5,808.00 63,883.00 13,352.80 4,000.00 81,235.80 75,427.80 5,808.00

NOV-19 58,075.00 5,808.00 63,883.00 29,876.00 4,000.00 97,759.00 91,951.00 5,808.00

DEC-19 58,075.00 5,808.00 63,883.00 10,337.60 4,000.00 78,220.60 72,412.60 5,808.00

JAN-20 64,110.00 6,411.00 70,521.00 11,379.00 4,000.00 85,900.00 79,489.00 5,808.00

FEB-20 64,110.00 6,411.00 70,521.00 38,547.80 4,000.00 113,068.80 106,657.80 5,808.00

MAR-20 64,110.00 6,411.00 70,521.00 10,040.00 4,000.00 84,561.00 78,150.00 5,808.00

APR-20 64,110.00 6,411.00 70,521.00 0.00 4,000.00 74,521.00 68,110.00 5,808.00

MAY-20 64,110.00 6,411.00 70,521.00 12,196.00 4,000.00 86,717.00 80,306.00 5,808.00

JUN-20 64,110.00 6,411.00 70,521.00 1,404.00 4,000.00 75,925.00 69,514.00 9,426.00

Total 733,110.00 73,314.00 806,424.00 198,863.20 102,000.00 1,053,287.20 979,973.20 73,314.00

H Taxable Salary (Annual) 979,973.20

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 95,866.00

K Total Taxable Income H+I+J 1,075,839.20

L Total Annual Tax 16,598.61

M Average Tax Rate L/K % 1.54

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 16,598.61

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000010 Employee NTN

Employee Name Hina Aslam Employee CNIC No. 3520113639404

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 191,309.00 19,131.00 210,440.00 3,508.00 0.00 213,948.00 194,817.00 19,131.00

AUG-19 191,309.00 19,131.00 210,440.00 0.00 0.00 210,440.00 191,309.00 19,131.00

SEP-19 191,309.00 19,131.00 210,440.00 4,624.00 0.00 215,064.00 195,933.00 19,131.00

OCT-19 191,309.00 19,131.00 210,440.00 0.00 0.00 210,440.00 191,309.00 19,131.00

NOV-19 191,309.00 19,131.00 210,440.00 0.00 0.00 210,440.00 191,309.00 19,131.00

DEC-19 191,309.00 19,131.00 210,440.00 3,521.60 0.00 213,961.60 194,830.60 19,131.00

JAN-20 201,927.00 20,193.00 222,120.00 0.00 0.00 222,120.00 201,927.00 19,131.00

FEB-20 201,927.00 20,193.00 222,120.00 138,371.00 0.00 360,491.00 340,298.00 19,131.00

MAR-20 201,927.00 20,193.00 222,120.00 14,647.20 0.00 236,767.20 216,574.20 19,131.00

APR-20 201,927.00 20,193.00 222,120.00 0.00 0.00 222,120.00 201,927.00 19,131.00

MAY-20 201,927.00 20,193.00 222,120.00 0.00 0.00 222,120.00 201,927.00 19,131.00

JUN-20 201,927.00 20,193.00 222,120.00 22,516.00 0.00 244,636.00 224,443.00 25,503.00

Total 2,359,416.00 235,944.00 2,595,360.00 187,187.80 102,000.00 2,782,547.80 2,546,603.80 235,944.00

H Taxable Salary (Annual) 2,546,603.80

I PF Contribution (Employer) in excess of Rs. 150,000 85,944.00

J 5% x Cost of Vehicle provided by Employer 95,868.00

K Total Taxable Income H+I+J 2,728,415.80

L Total Annual Tax 234,972.59

M Average Tax Rate L/K % 8.61

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 545,683.16 46,994.52

Charity 0.00 0.00

Advance Income Tax 10,089.00

Total Tax Credit 57,083.52

Net Tax Withheld & Submitted By the Company 177,889.07

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000011 Employee NTN

Employee Name Raza Zahid Employee CNIC No. 3410174164423

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 120,890.00 12,089.00 132,979.00 0.00 0.00 132,979.00 120,890.00 12,089.00

AUG-19 120,890.00 12,089.00 132,979.00 12,000.00 0.00 144,979.00 132,890.00 12,089.00

SEP-19 120,890.00 12,089.00 132,979.00 0.00 0.00 132,979.00 120,890.00 12,089.00

OCT-19 120,890.00 12,089.00 132,979.00 0.00 0.00 132,979.00 120,890.00 12,089.00

NOV-19 120,890.00 12,089.00 132,979.00 0.00 0.00 132,979.00 120,890.00 12,089.00

DEC-19 120,890.00 12,089.00 132,979.00 0.00 0.00 132,979.00 120,890.00 12,089.00

JAN-20 133,451.00 13,345.00 146,796.00 0.00 0.00 146,796.00 133,451.00 13,345.00

FEB-20 133,451.00 13,345.00 146,796.00 95,387.00 0.00 242,183.00 228,838.00 13,345.00

MAR-20 133,451.00 13,345.00 146,796.00 0.00 0.00 146,796.00 133,451.00 13,345.00

APR-20 133,451.00 13,345.00 146,796.00 0.00 0.00 146,796.00 133,451.00 13,345.00

MAY-20 133,451.00 13,345.00 146,796.00 0.00 0.00 146,796.00 133,451.00 13,345.00

JUN-20 133,451.00 13,345.00 146,796.00 4,312.00 0.00 151,108.00 137,763.00 13,345.00

Total 1,526,046.00 152,604.00 1,678,650.00 111,699.00 102,000.00 1,790,349.00 1,637,745.00 152,604.00

H Taxable Salary (Annual) 1,637,745.00

I PF Contribution (Employer) in excess of Rs. 150,000 2,604.00

J 5% x Cost of Vehicle provided by Employer 45,846.00

K Total Taxable Income H+I+J 1,686,195.00

L Total Annual Tax 78,619.40

M Average Tax Rate L/K % 4.66

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 78,619.40

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000012 Employee NTN

Employee Name Saad Masood Employee CNIC No. 4200073034313

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 177,713.00 17,771.00 195,484.00 2,400.00 46,000.00 243,884.00 226,113.00 17,771.00

AUG-19 177,713.00 17,771.00 195,484.00 4,820.00 46,000.00 246,304.00 228,533.00 17,771.00

SEP-19 177,713.00 17,771.00 195,484.00 8,656.80 46,000.00 250,140.80 232,369.80 17,771.00

OCT-19 177,713.00 17,771.00 195,484.00 2,291.20 46,000.00 243,775.20 226,004.20 17,771.00

NOV-19 177,713.00 17,771.00 195,484.00 7,883.20 46,000.00 249,367.20 231,596.20 17,771.00

DEC-19 177,713.00 17,771.00 195,484.00 127,383.00 46,000.00 368,867.00 351,096.00 17,771.00

JAN-20 190,909.00 19,091.00 210,000.00 6,800.00 43,311.00 260,111.00 241,020.00 19,091.00

FEB-20 190,909.00 19,091.00 210,000.00 80,719.60 43,311.00 334,030.60 314,939.60 19,091.00

MAR-20 190,909.00 19,091.00 210,000.00 0.00 43,311.00 253,311.00 234,220.00 19,091.00

APR-20 190,909.00 19,091.00 210,000.00 0.00 43,311.00 253,311.00 234,220.00 19,091.00

MAY-20 190,909.00 19,091.00 210,000.00 0.00 43,311.00 253,311.00 234,220.00 19,091.00

JUN-20 190,909.00 19,091.00 210,000.00 1,560.00 43,311.00 254,871.00 235,780.00 19,091.00

Total 2,211,732.00 221,172.00 2,432,904.00 242,513.80 637,866.00 3,211,283.80 2,990,111.80 221,172.00

H Taxable Salary (Annual) 2,990,111.80

I PF Contribution (Employer) in excess of Rs. 150,000 71,172.00

J 5% x Cost of Vehicle provided by Employer 45,846.00

K Total Taxable Income H+I+J 3,107,129.80

L Total Annual Tax 301,247.54

M Average Tax Rate L/K % 9.70

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 431,294.00 41,815.52

Charity 0.00 0.00

Advance Income Tax 6,691.00

Total Tax Credit 48,506.52

Net Tax Withheld & Submitted By the Company 252,741.02

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000013 Employee NTN

Employee Name Norez Abdullah Employee CNIC No. 3520114472807

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 707,295.00 70,729.00 778,024.00 0.00 0.00 778,024.00 707,295.00 70,730.00

AUG-19 707,295.00 70,729.00 778,024.00 24,521.00 0.00 802,545.00 731,816.00 70,730.00

SEP-19 707,295.00 70,729.00 778,024.00 0.00 0.00 778,024.00 707,295.00 70,730.00

OCT-19 707,295.00 70,729.00 778,024.00 0.00 0.00 778,024.00 707,295.00 70,730.00

NOV-19 707,295.00 70,729.00 778,024.00 12,876.00 0.00 790,900.00 720,171.00 70,730.00

DEC-19 707,295.00 70,729.00 778,024.00 0.00 0.00 778,024.00 707,295.00 70,730.00

JAN-20 720,927.00 72,093.00 793,020.00 29,068.00 0.00 822,088.00 749,995.00 72,093.00

FEB-20 720,927.00 72,093.00 793,020.00 558,085.00 0.00 1,351,105.00 1,279,012.00 72,093.00

MAR-20 720,927.00 72,093.00 793,020.00 0.00 0.00 793,020.00 720,927.00 72,093.00

APR-20 720,927.00 72,093.00 793,020.00 0.00 0.00 793,020.00 720,927.00 72,093.00

MAY-20 720,927.00 72,093.00 793,020.00 91,470.40 0.00 884,490.40 812,397.40 72,093.00

JUN-20 720,927.00 72,093.00 793,020.00 8,468.00 0.00 801,488.00 729,395.00 72,093.00

Total 8,569,332.00 856,932.00 9,426,264.00 724,488.40 637,866.00 10,150,752.40 9,293,820.40 856,938.00

H Taxable Salary (Annual) 9,293,820.40

I PF Contribution (Employer) in excess of Rs. 150,000 706,938.00

J 5% x Cost of Vehicle provided by Employer 0.00

K Total Taxable Income H+I+J 10,000,758.40

L Total Annual Tax 1,845,189.35

M Average Tax Rate L/K % 18.45

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 3,000,000.00 553,514.82

Charity 0.00 0.00

Advance Income Tax 35,350.00

Total Tax Credit 588,864.82

Net Tax Withheld & Submitted By the Company 1,256,324.53

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000015 Employee NTN

Employee Name Muhammad Usman Ashraf Employee CNIC No. 33100-0212819-3

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 63,636.00 6,364.00 70,000.00 0.00 0.00 70,000.00 63,636.00 6,364.00

AUG-19 63,636.00 6,364.00 70,000.00 0.00 0.00 70,000.00 63,636.00 6,364.00

SEP-19 63,636.00 6,364.00 70,000.00 8,452.00 0.00 78,452.00 72,088.00 6,364.00

OCT-19 63,636.00 6,364.00 70,000.00 0.00 0.00 70,000.00 63,636.00 6,364.00

NOV-19 63,636.00 6,364.00 70,000.00 0.00 0.00 70,000.00 63,636.00 6,364.00

DEC-19 63,636.00 6,364.00 70,000.00 8,421.00 3,000.00 81,421.00 75,057.00 6,364.00

JAN-20 72,965.00 7,297.00 80,262.00 27,737.00 4,000.00 111,999.00 104,702.00 7,297.00

FEB-20 72,965.00 7,297.00 80,262.00 38,321.00 4,000.00 122,583.00 115,286.00 7,297.00

MAR-20 72,965.00 7,297.00 80,262.00 0.00 4,000.00 84,262.00 76,965.00 7,297.00

APR-20 72,965.00 7,297.00 80,262.00 0.00 4,000.00 84,262.00 76,965.00 7,297.00

MAY-20 72,965.00 7,297.00 80,262.00 27,270.40 4,000.00 111,532.40 104,235.40 7,297.00

JUN-20 72,965.00 7,297.00 80,262.00 1,404.00 4,000.00 85,666.00 78,369.00 7,297.00

Total 819,606.00 81,966.00 901,572.00 111,605.40 664,866.00 1,040,177.40 958,211.40 81,966.00

H Taxable Salary (Annual) 958,211.40

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 0.00

K Total Taxable Income H+I+J 958,211.40

L Total Annual Tax 16,560.52

M Average Tax Rate L/K % 1.73

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 16,560.52

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000017 Employee NTN

Employee Name Mujtaba Yaqoob Employee CNIC No. 42201-2840555-3

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 181,818.00 18,182.00 200,000.00 2,584.00 0.00 202,584.00 184,402.00 18,182.00

AUG-19 181,818.00 18,182.00 200,000.00 7,341.00 0.00 207,341.00 189,159.00 18,182.00

SEP-19 181,818.00 18,182.00 200,000.00 8,360.80 0.00 208,360.80 190,178.80 18,182.00

OCT-19 181,818.00 18,182.00 200,000.00 22,015.20 0.00 222,015.20 203,833.20 18,182.00

NOV-19 181,818.00 18,182.00 200,000.00 0.00 0.00 200,000.00 181,818.00 18,182.00

DEC-19 181,818.00 18,182.00 200,000.00 4,312.00 0.00 204,312.00 186,130.00 18,182.00

JAN-20 197,912.00 19,791.00 217,703.00 2,016.00 0.00 219,719.00 199,928.00 19,791.00

FEB-20 197,912.00 19,791.00 217,703.00 125,529.00 0.00 343,232.00 323,441.00 19,791.00

MAR-20 197,912.00 19,791.00 217,703.00 14,903.20 0.00 232,606.20 212,815.20 19,791.00

APR-20 197,912.00 19,791.00 217,703.00 10,653.60 0.00 228,356.60 208,565.60 19,791.00

MAY-20 197,912.00 19,791.00 217,703.00 0.00 0.00 217,703.00 197,912.00 19,791.00

JUN-20 197,912.00 19,791.00 217,703.00 11,528.00 0.00 229,231.00 209,440.00 19,791.00

Total 2,278,380.00 227,838.00 2,506,218.00 209,242.80 664,866.00 2,715,460.80 2,487,622.80 227,838.00

H Taxable Salary (Annual) 2,487,622.80

I PF Contribution (Employer) in excess of Rs. 150,000 77,838.00

J 5% x Cost of Vehicle provided by Employer 95,843.00

K Total Taxable Income H+I+J 2,661,303.80

L Total Annual Tax 223,227.99

M Average Tax Rate L/K % 8.39

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 223,227.99

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000018 Employee NTN

Employee Name Sana Mozzam Gillani Employee CNIC No. 3520142029574

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 27,273.00 2,727.00 30,000.00 0.00 3,000.00 33,000.00 30,273.00 2,727.00

AUG-19 27,273.00 2,727.00 30,000.00 32,562.00 3,000.00 65,562.00 62,835.00 2,727.00

SEP-19 27,273.00 2,727.00 30,000.00 15,856.00 3,000.00 48,856.00 46,129.00 2,727.00

OCT-19 27,273.00 2,727.00 30,000.00 17,226.00 3,000.00 50,226.00 47,499.00 2,727.00

NOV-19 27,273.00 2,727.00 30,000.00 15,856.00 3,000.00 48,856.00 46,129.00 2,727.00

DEC-19 27,273.00 2,727.00 30,000.00 20,551.20 3,000.00 53,551.20 50,824.20 2,727.00

JAN-20 30,774.00 3,077.00 33,851.00 19,320.00 3,000.00 56,171.00 53,094.00 3,077.00

FEB-20 30,774.00 3,077.00 33,851.00 40,990.80 3,000.00 77,841.80 74,764.80 3,077.00

MAR-20 30,774.00 3,077.00 33,851.00 0.00 3,000.00 36,851.00 33,774.00 3,077.00

APR-20 30,774.00 3,077.00 33,851.00 20,706.00 3,000.00 57,557.00 54,480.00 3,077.00

MAY-20 30,774.00 3,077.00 33,851.00 0.00 3,000.00 36,851.00 33,774.00 3,077.00

JUN-20 30,774.00 3,077.00 33,851.00 1,560.00 3,000.00 38,411.00 35,334.00 3,077.00

Total 348,282.00 34,824.00 383,106.00 184,628.00 700,866.00 603,734.00 568,910.00 34,824.00

H Taxable Salary (Annual) 568,910.00

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 95,843.00

K Total Taxable Income H+I+J 664,753.00

L Total Annual Tax 0.00

M Average Tax Rate L/K % 0.00

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 0.00

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000019 Employee NTN

Employee Name Ibad Jamal Employee CNIC No. 4220196739983

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 375,683.00 37,568.00 413,251.00 0.00 25,000.00 438,251.00 400,683.00 37,568.00

AUG-19 375,683.00 37,568.00 413,251.00 0.00 25,000.00 438,251.00 400,683.00 37,568.00

SEP-19 375,683.00 37,568.00 413,251.00 3,306.40 25,000.00 441,557.40 403,989.40 37,568.00

OCT-19 375,683.00 37,568.00 413,251.00 13,329.00 25,000.00 451,580.00 414,012.00 37,568.00

NOV-19 375,683.00 37,568.00 413,251.00 58,783.20 25,000.00 497,034.20 459,466.20 37,568.00

DEC-19 375,683.00 37,568.00 413,251.00 0.00 25,000.00 438,251.00 400,683.00 37,568.00

JAN-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

FEB-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

MAR-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

APR-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

MAY-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

JUN-20 375,683.00 37,568.00 413,251.00 0.00 0.00 413,251.00 375,683.00 0.00

Total 4,508,196.00 450,816.00 4,959,012.00 75,418.60 850,866.00 5,184,430.60 4,733,614.60 225,408.00

H Taxable Salary (Annual) 4,733,614.60

I PF Contribution (Employer) in excess of Rs. 150,000 75,408.00

J 5% x Cost of Vehicle provided by Employer 124,305.50

K Total Taxable Income H+I+J 4,933,328.10

L Total Annual Tax 739,465.40

M Average Tax Rate L/K % 14.99

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 739,465.40

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000020 Employee NTN

Employee Name Mumtaz Ahmad Employee CNIC No. 3520161662703

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 8,000.00 800.00 8,800.00 0.00 5,520.00 14,320.00 13,520.00 800.00

AUG-19 8,000.00 800.00 8,800.00 0.00 4,968.00 13,768.00 12,968.00 800.00

SEP-19 8,000.00 800.00 8,800.00 0.00 6,237.00 15,037.00 14,237.00 800.00

OCT-19 8,000.00 800.00 8,800.00 0.00 5,253.00 14,053.00 13,253.00 800.00

NOV-19 8,000.00 800.00 8,800.00 0.00 7,947.00 16,747.00 15,947.00 800.00

DEC-19 8,000.00 800.00 8,800.00 0.00 5,965.00 14,765.00 13,965.00 800.00

JAN-20 9,177.00 918.00 10,095.00 0.00 6,234.00 16,329.00 15,411.00 918.00

FEB-20 9,177.00 918.00 10,095.00 11,836.00 5,975.00 27,906.00 26,988.00 918.00

MAR-20 9,177.00 918.00 10,095.00 0.00 5,084.00 15,179.00 14,261.00 918.00

APR-20 9,177.00 918.00 10,095.00 0.00 0.00 10,095.00 9,177.00 918.00

MAY-20 9,177.00 918.00 10,095.00 3,264.00 0.00 13,359.00 12,441.00 918.00

JUN-20 9,177.00 918.00 10,095.00 14,336.00 0.00 24,431.00 23,513.00 918.00

Total 103,062.00 10,308.00 113,370.00 29,436.00 904,049.00 195,989.00 185,681.00 10,308.00

H Taxable Salary (Annual) 185,681.00

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 124,305.50

K Total Taxable Income H+I+J 309,986.50

L Total Annual Tax 0.00

M Average Tax Rate L/K % 0.00

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 0.00

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000021 Employee NTN

Employee Name Muhammad Asim Employee CNIC No. 3740536941131

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 272,727.00 27,273.00 300,000.00 0.00 0.00 300,000.00 272,727.00 27,273.00

AUG-19 272,727.00 27,273.00 300,000.00 0.00 0.00 300,000.00 272,727.00 27,273.00

SEP-19 272,727.00 27,273.00 300,000.00 0.00 0.00 300,000.00 272,727.00 27,273.00

OCT-19 272,727.00 27,273.00 300,000.00 20,143.00 0.00 320,143.00 292,870.00 27,273.00

NOV-19 272,727.00 27,273.00 300,000.00 0.00 0.00 300,000.00 272,727.00 27,273.00

DEC-19 272,727.00 27,273.00 300,000.00 0.00 0.00 300,000.00 272,727.00 27,273.00

JAN-20 295,918.00 29,592.00 325,510.00 6,396.00 0.00 331,906.00 302,314.00 29,592.00

FEB-20 295,918.00 29,592.00 325,510.00 188,294.00 0.00 513,804.00 484,212.00 29,592.00

MAR-20 295,918.00 29,592.00 325,510.00 0.00 0.00 325,510.00 295,918.00 29,592.00

APR-20 295,918.00 29,592.00 325,510.00 0.00 0.00 325,510.00 295,918.00 29,592.00

MAY-20 295,918.00 29,592.00 325,510.00 0.00 0.00 325,510.00 295,918.00 29,592.00

JUN-20 295,918.00 29,592.00 325,510.00 0.00 0.00 325,510.00 295,918.00 29,592.00

Total 3,411,870.00 341,190.00 3,753,060.00 214,833.00 904,049.00 3,967,893.00 3,626,703.00 341,190.00

H Taxable Salary (Annual) 3,626,703.00

I PF Contribution (Employer) in excess of Rs. 150,000 191,190.00

J 5% x Cost of Vehicle provided by Employer 104,764.00

K Total Taxable Income H+I+J 3,922,657.00

L Total Annual Tax 454,531.20

M Average Tax Rate L/K % 11.59

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 454,531.20

Hyundai Nishat Motor (Pvt.) Ltd

1.B Aziz Avenue Canal Bank Gulberg V, Lahore

Income Tax Calculation - TY 2020

Employee ID 10000022 Employee NTN 5192769-3

Employee Name Hideo Takenaka Employee CNIC No. TS0682979

Month Basic Salary Medical Allowance Gross Salary OPD, Bonus & Other Taxable Total Salary Taxable Salary PF Employer

(Tax-Exempt) Annual Leave Allowances

Encashment

TY 2020 A B C=A+B D E F=C+D+E G=F-B

JUL-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

AUG-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

SEP-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

OCT-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

NOV-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

DEC-19 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

JAN-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

FEB-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

MAR-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

APR-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

MAY-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

JUN-20 82,421.00 8,242.00 90,663.00 0.00 0.00 90,663.00 82,421.00 0.00

Total 989,052.00 98,904.00 1,087,956.00 0.00 904,049.00 1,087,956.00 989,052.00 0.00

H Taxable Salary (Annual) 989,052.00

I PF Contribution (Employer) in excess of Rs. 150,000 0.00

J 5% x Cost of Vehicle provided by Employer 104,764.00

K Total Taxable Income H+I+J 1,093,816.00

L Total Annual Tax 19,452.55

M Average Tax Rate L/K % 1.78

Tax Credits Amount for Credit Tax Credit

Zakat 0.00 0.00

Investments 0.00 0.00

Charity 0.00 0.00

Advance Income Tax 0.00

Total Tax Credit 0.00

Net Tax Withheld & Submitted By the Company 19,452.55

You might also like

- SSAT Prep Guide: Tips and Strategies For Every Section of The TestDocument64 pagesSSAT Prep Guide: Tips and Strategies For Every Section of The Testthomson100% (1)

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Full and Final Payslip P1305Document1 pageFull and Final Payslip P1305ArmaanNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Hemostasis and Transfusion MedicineDocument83 pagesHemostasis and Transfusion MedicineJesserene Mangulad SorianoNo ratings yet

- ISO 27005 Risk Manager - Four Page BrochureDocument4 pagesISO 27005 Risk Manager - Four Page BrochurePECBCERTIFICATIONNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- Nichorus Muthomi P9Document1 pageNichorus Muthomi P9TERRYNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsNilesh GopnarayanNo ratings yet

- Conneqt Business Solutions Limited: 318667 Bhushan JadhavDocument1 pageConneqt Business Solutions Limited: 318667 Bhushan JadhavBhushan JadhavNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- Profit Loss - 12month ComparisonDocument2 pagesProfit Loss - 12month ComparisonIbrahim SyedNo ratings yet

- Raufmasood@live - Com TemppayslipDocument1 pageRaufmasood@live - Com TemppayslipraufmasoodNo ratings yet

- Value Forecasting 13 04 23Document10 pagesValue Forecasting 13 04 23Dani MagarzoNo ratings yet

- Payslip 202403Document1 pagePayslip 202403rashidah hajariNo ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- Ranjan KumarDocument2 pagesRanjan KumarRanjan KumarNo ratings yet

- Kirandeep August SalaryDocument1 pageKirandeep August Salaryprince.gill07No ratings yet

- 9S-2B Corporation Forecasted Income StatementDocument5 pages9S-2B Corporation Forecasted Income StatementFlora Fil GutierrezNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Conneqt Business Solutions Limited: 304994 Ashitosh MoreDocument1 pageConneqt Business Solutions Limited: 304994 Ashitosh MoreBhushan JadhavNo ratings yet

- Payslip For The Month of Mar 2021Document1 pagePayslip For The Month of Mar 2021Loan LoanNo ratings yet

- Payslip Feb 2024Document2 pagesPayslip Feb 2024sweta.work24No ratings yet

- Sre San Fabian 2022Document6 pagesSre San Fabian 2022San Fabian DILGNo ratings yet

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- Payslip For: JAN-2022: Louis Berger SASDocument1 pagePayslip For: JAN-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Income Statement: Managed Rite ConstructionDocument4 pagesIncome Statement: Managed Rite ConstructionJim SchuettNo ratings yet

- BBG Adj HighlightsDocument1 pageBBG Adj HighlightsMaria Pia Rivas LozadaNo ratings yet

- Sre Malinao Q1 2023Document6 pagesSre Malinao Q1 2023Paolo IcangNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- Teleperformance Global Business Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Business Private Limited: Full and Final Settlement - December 2023touheedahmed8269No ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- Activity Data DashboardDocument9 pagesActivity Data DashboardAngel Yohaiña Ramos SantiagoNo ratings yet

- Akhtar Finishing + CMT Contractor (2021)Document3 pagesAkhtar Finishing + CMT Contractor (2021)Waris KhanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- FAQs - Markup Subsidy Scheme-Housing FinanceDocument2 pagesFAQs - Markup Subsidy Scheme-Housing FinanceAli Azhar KhanNo ratings yet

- The Bank of Punjab: Product Key Fact Statement Low Cost Housing FinanceDocument2 pagesThe Bank of Punjab: Product Key Fact Statement Low Cost Housing FinanceAli Azhar KhanNo ratings yet

- Mera Pakistan Mera Ghar: Product Features & BenefitsDocument1 pageMera Pakistan Mera Ghar: Product Features & BenefitsAli Azhar KhanNo ratings yet

- Help Desk PDFDocument1 pageHelp Desk PDFAli Azhar KhanNo ratings yet

- Documentation Requirement - Salaried Segment OriginalDocument3 pagesDocumentation Requirement - Salaried Segment OriginalAli Azhar KhanNo ratings yet

- BOP Application Form A5 Flyer (16th October) Final PagesDocument10 pagesBOP Application Form A5 Flyer (16th October) Final PagesAli Azhar KhanNo ratings yet

- Low Cost Housing Finance Application Form: 2 LakhDocument10 pagesLow Cost Housing Finance Application Form: 2 LakhAli Azhar KhanNo ratings yet

- S4Q0000023905 1 PDFDocument16 pagesS4Q0000023905 1 PDFAli Azhar KhanNo ratings yet

- Top 60 Buddhist Blogs and Websites To Follow in 2022Document32 pagesTop 60 Buddhist Blogs and Websites To Follow in 2022sumangalaNo ratings yet

- CookinglabevaluationsheetDocument2 pagesCookinglabevaluationsheetapi-351766281No ratings yet

- Practice Test 4 - Mid Term 2 - English 7Document3 pagesPractice Test 4 - Mid Term 2 - English 7Duy AnhNo ratings yet

- Kerke Customer List 2020 VersionDocument4 pagesKerke Customer List 2020 VersionLam NgoNo ratings yet

- List Items: "Apple" "Banana" "Cherry"Document9 pagesList Items: "Apple" "Banana" "Cherry"Dheeraj ChalasaniNo ratings yet

- Ong vs. Ca: DownloadDocument1 pageOng vs. Ca: DownloadMackie SaidNo ratings yet

- Small and Medium Enterprises Access To Finance in Ethiopia: Synthesis of Demand and SupplyDocument48 pagesSmall and Medium Enterprises Access To Finance in Ethiopia: Synthesis of Demand and SupplyGedionNo ratings yet

- Ag PDFDocument3 pagesAg PDFAmar GuptaNo ratings yet

- Warm UpDocument11 pagesWarm UpFritz David SevaNo ratings yet

- Quiz 1 Organization Structure and StrategyDocument1 pageQuiz 1 Organization Structure and StrategyShabana NaveedNo ratings yet

- Security2 1Document42 pagesSecurity2 1Broot KalNo ratings yet

- Arcelor Mittal HistarDocument32 pagesArcelor Mittal HistarAnonymous uNhWGqNzNo ratings yet

- L3 Energy Balance Reactive SystemDocument16 pagesL3 Energy Balance Reactive Systemchiang95No ratings yet

- KLM8G1GETF B041 SamsungDocument28 pagesKLM8G1GETF B041 Samsungcess2406No ratings yet

- Tidsdiskret Pid RegDocument5 pagesTidsdiskret Pid RegLucian GomoescuNo ratings yet

- Aw y Gin 2011 - Prevalence and Genetic Diversity of Waterborne Pathogenic Viruses in Surface Waters of Tropical Urban CatchmentsDocument13 pagesAw y Gin 2011 - Prevalence and Genetic Diversity of Waterborne Pathogenic Viruses in Surface Waters of Tropical Urban CatchmentsYoNo ratings yet

- Low Cost House ProjectDocument6 pagesLow Cost House ProjectAkum obenNo ratings yet

- ST Gate2023Document48 pagesST Gate2023anoopNo ratings yet

- ECT018 - Analisis de Sist 3F Con Componentes SimetricosDocument33 pagesECT018 - Analisis de Sist 3F Con Componentes SimetricosfsalviniNo ratings yet

- Rose Mount Analytical 1056 ManualDocument12 pagesRose Mount Analytical 1056 ManualFrancisco RomoNo ratings yet

- Uwi Thesis AbstractDocument5 pagesUwi Thesis Abstractgbrgvvfr100% (1)

- Building Fires: (With Emphasis On House Fires)Document6 pagesBuilding Fires: (With Emphasis On House Fires)dwenNo ratings yet

- Introduction To Database Chap - 1Document34 pagesIntroduction To Database Chap - 1saleemNo ratings yet

- RobotsDocument3 pagesRobotselinildoNo ratings yet

- 1990 Heritage Golden EagleDocument6 pages1990 Heritage Golden EagleBetoguitar777No ratings yet

- Logistic Strategy and PlanningDocument8 pagesLogistic Strategy and PlanningDawud MuhammadNo ratings yet

- Dynamic Matrix Control - A Computer Control AlgorithmDocument7 pagesDynamic Matrix Control - A Computer Control Algorithmquinteroudina50% (2)