Professional Documents

Culture Documents

2020 Scheduleps

Uploaded by

api-248998256Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2020 Scheduleps

Uploaded by

api-248998256Copyright:

Available Formats

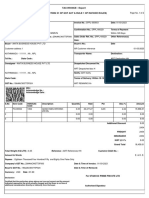

Schedule

PS Private School Tuition

2020

Wisconsin File with Wisconsin Form 1 or 1NPR

Department of Revenue

Name(s) shown on Form 1 or 1NPR Your social security number

Part I School(s) Where Dependents Listed in Part II Were Enrolled

Identifying number

1 Name of School Address of school (FEIN) of school

Part II Subtraction for Tuition Expenses

2 Information about your qualifying dependent

(a) Dependent’s name (b) Dependent’s (c) Grade (d) Tuition

First Last social security number (see instructions) (see instructions)

.00

.00

.00

.00

.00

.00

.00

.00

3 Add the amounts in column (d). This is your subtraction for tuition paid. Fill in here and

on line 9 of Schedule SB (Form 1) or line 43 of Schedule M (Form 1NPR) . . . . . . . . . . . . . . . . . . . . . . . . . . 3 .00

Applicable Laws and Rules

This document provides statements or interpretations of the following laws and regulations in effect as of November 9, 2020: Section

71.05 (6) (b) 49., Wis. Stats.

I-094 (R. 08-20)

2020 Schedule PS Instructions

General Instructions

Purpose of Schedule PS

Use Schedule PS to claim the subtraction for tuition paid in 2020 for your dependent child to attend a private school. Attach Schedule

PS to your Form 1 or 1NPR.

Who is Eligible to Claim the Subtraction

The subtraction may be claimed by a full-year resident, part-year resident, or nonresident of Wisconsin. You must have paid tuition

during the taxable year for your child to attend an eligible institution. The child must have been claimed as a dependent on your

Wisconsin income tax return, and the child must have been an “elementary pupil” or a “secondary pupil” during the taxable year.

Do not take a subtraction for amounts paid for private school tuition which were withdrawn from an Edvest or Tomorrow’s Scholar

college savings account.

Definitions

“Elementary pupil” means an individual who is enrolled in grades kindergarten to 8 at an eligible institution. (Note “Kindergarten” does

not include pre-kindergarten, that is, any 3‑year old or 4‑year old kindergarten.)

“Secondary pupil” means an individual who is enrolled in grades 9 to 12 at an eligible institution.

“Eligible institution” means a private school with an educational program whose primary purpose is to provide private or religious-

based education. The program must be privately controlled; provide at least 875 hours of instruction each school year; provide a

sequentially progressive curriculum of fundamental instruction in reading, language arts, mathematics, social studies, science, and

health; and not be operated or instituted for the purpose of avoiding or circumventing the compulsory school attendance requirements.

The pupils in the institution’s educational program, in the ordinary course of events, return annually to the homes of their parents or

guardians for not less than 2 months of summer vacation, or the institution is licensed as a child welfare agency.

Specific Instructions

Part I

Line 1 Fill in the name, address, and federal employer identification number (FEIN) of the private school(s) where your dependent

child/children were enrolled during 2020.

Part II

Line 2 Columns (a) and (b) – Fill in each of your dependent child’s first and last name and social security number if you paid private

school tuition for that child in 2020.

Grade Column (c) – Enter your child’s grade number as of January 1 of the year for which tuition was paid (grades K-12). If your child

was an elementary pupil for part of the year and a secondary pupil for the rest of the year, fill in “8 and 9” in column (c). If your child

attended a private school for only part of the year, fill in the grade number at the time your child was first enrolled in the private school.

Tuition Column (d) – Enter the amount of tuition paid during the taxable year, but not more than $4,000 for an elementary pupil (grades

K-8) or $10,000 for a secondary pupil (grades 9-12). If your child was both an elementary pupil and a secondary pupil (grades 8 and 9),

fill in the amount you paid for tuition during the taxable year for the period when your child was an elementary pupil (but not more than

$4,000) plus the amount you paid for the period when your child was a secondary pupil. If the total is more than $10,000, fill in $10,000.

Tuition includes any amount paid by the claimant for a pupil’s tuition to attend an eligible institution and mandatory book fees paid to the

institution. Tuition does not include amounts paid with a voucher or any amounts paid as a separate charge for other items, such as:

• Room and board • Registration fees • Social and extracurricular activities,

• Supplies • Building fees including musical or athletic activity fees

• Cap and gown fees • Personal use items (e.g., uniforms, • High school classes not required for

• Rentals of equipment gym clothes, towels) graduation and for which no credits toward

• Meals • Before-school and after-school graduation are given

• Transportation child care

Line 3 Add the amounts in column (d). This is your subtraction for private school tuition. Fill in the amount from line 3 of Schedule PS

on line 9 of Schedule SB (Form 1) or line 43 of Schedule M (Form 1NPR).

-2-

You might also like

- College Planning WorkbookDocument94 pagesCollege Planning WorkbookDuluth News TribuneNo ratings yet

- Updated Annual Implementation PlanDocument5 pagesUpdated Annual Implementation PlanPaul Bryan Bron100% (4)

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- GeneralPrinciples Incometax Tabag 51 224Document28 pagesGeneralPrinciples Incometax Tabag 51 224John Carlo Dela CruzNo ratings yet

- Artifact 5 PF Withdrawal Form PDFDocument1 pageArtifact 5 PF Withdrawal Form PDFSuraj BaugNo ratings yet

- Quizzer - PREFINALDocument19 pagesQuizzer - PREFINALrav dano0% (1)

- Philippine Women'S University: College DepartmentDocument3 pagesPhilippine Women'S University: College DepartmentJui Provido100% (2)

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- D114003jul2020 PDFDocument1 pageD114003jul2020 PDFRajarshiRoyNo ratings yet

- UAE VAT LawDocument307 pagesUAE VAT LawRajendran Suresh100% (1)

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Work and Financial Plan School-Based Feeding Program (SBFP)Document9 pagesWork and Financial Plan School-Based Feeding Program (SBFP)Joan Del Castillo Naing0% (1)

- Air Canada v. CIR - Taxation Law - DebtDocument3 pagesAir Canada v. CIR - Taxation Law - DebtMichael Villalon100% (1)

- Tax 1 Summative 1 Multiple ChoiceDocument3 pagesTax 1 Summative 1 Multiple ChoiceVon Andrei MedinaNo ratings yet

- Uw-Green Bay Bursar's Office, SS1300 2420 Nicolet Drive Green Bay, WI 54311-7001Document2 pagesUw-Green Bay Bursar's Office, SS1300 2420 Nicolet Drive Green Bay, WI 54311-7001Lance KramerNo ratings yet

- 1 0 2 0 3 0 4 0 5 0 6 Indicate:: Quarter 1Document3 pages1 0 2 0 3 0 4 0 5 0 6 Indicate:: Quarter 1Ralph Røilan LasdøceNo ratings yet

- For Validation: Not Valid As An Official ReceiptDocument1 pageFor Validation: Not Valid As An Official ReceiptElvira Sta. MariaNo ratings yet

- 11th Udgam Pre Boards 22-23Document15 pages11th Udgam Pre Boards 22-23Priyansh BaggaNo ratings yet

- Assessment FormDocument1 pageAssessment FormKenneth DelorinoNo ratings yet

- Retail SylabusDocument49 pagesRetail Sylabusfiem.registrarNo ratings yet

- Communication Allowance Payroll Format and Instructions 1Document9 pagesCommunication Allowance Payroll Format and Instructions 1Lea LabindaoNo ratings yet

- Syllabus B.voc. Degree Programme in Retail Management - 26Document48 pagesSyllabus B.voc. Degree Programme in Retail Management - 26Dinesh SharmaNo ratings yet

- Editable TD1 Form 2020.Document3 pagesEditable TD1 Form 2020.jeremy1976No ratings yet

- Description: Tags: 0304CODVol3Sec1PellIGvSept03Document22 pagesDescription: Tags: 0304CODVol3Sec1PellIGvSept03anon-599824No ratings yet

- Tl11a Fill 21eDocument1 pageTl11a Fill 21eKimique ChinNo ratings yet

- SBFP Revised App FormDocument9 pagesSBFP Revised App FormJoan Del Castillo NaingNo ratings yet

- Work and Financial Plan School-Based Feeding Program (SBFP)Document9 pagesWork and Financial Plan School-Based Feeding Program (SBFP)Joan Del Castillo NaingNo ratings yet

- M.comDocument7 pagesM.comshraddha shuklaNo ratings yet

- Trial All0Tment: Directorate of Higher Secondary Education Plus One Admission-2019 (Single Window)Document3 pagesTrial All0Tment: Directorate of Higher Secondary Education Plus One Admission-2019 (Single Window)Adnan AmbalavanNo ratings yet

- Bca Semester-II 2023-24 (1) 2Document49 pagesBca Semester-II 2023-24 (1) 2kimberlyeric009No ratings yet

- WFP Sugod PlanDocument40 pagesWFP Sugod PlanJoseph Joshua A. PaLaparNo ratings yet

- JHS BUENO IS 2ND QTR Classifying Learners Grade For Learning Area Grade 1 10 2Document4 pagesJHS BUENO IS 2ND QTR Classifying Learners Grade For Learning Area Grade 1 10 2Niccolo RamosNo ratings yet

- Registration FormDocument1 pageRegistration Formmfreedman661300No ratings yet

- PUP Enrollment Payment Voucher PDFDocument3 pagesPUP Enrollment Payment Voucher PDFGiulia Tabara100% (1)

- Republic of The Philippines Department of Education Region VIII Division of Samar District of San Jose de Buan San Jose de Buan, SamarDocument3 pagesRepublic of The Philippines Department of Education Region VIII Division of Samar District of San Jose de Buan San Jose de Buan, SamarNica SalentesNo ratings yet

- Secondary School Report On Resources Generated B.E. Forms 1 1.2Document9 pagesSecondary School Report On Resources Generated B.E. Forms 1 1.2Baby BabeNo ratings yet

- 2022 School Fees Bandar Seri Coalfields PDocument1 page2022 School Fees Bandar Seri Coalfields PPearlNo ratings yet

- Form E81Document1 pageForm E81jearieldonNo ratings yet

- DDDDocument2 pagesDDDFAZAL T SNo ratings yet

- WFP BlankDocument18 pagesWFP BlankJRNo ratings yet

- Instruction 2022 23Document7 pagesInstruction 2022 23Vinay SharmaNo ratings yet

- Form-C-LUCIANO A. CONDE-ESDocument11 pagesForm-C-LUCIANO A. CONDE-ESMichelle Fuentes VillosoNo ratings yet

- Online Fee Approval Proposal For Academic Year 2021 22fDocument21 pagesOnline Fee Approval Proposal For Academic Year 2021 22ftahailicNo ratings yet

- General Information: SBM Progress Monitoring ToolDocument13 pagesGeneral Information: SBM Progress Monitoring ToolShairuz Caesar Briones DugayNo ratings yet

- Cor dhvtsuUBsjEP2XqiDocument1 pageCor dhvtsuUBsjEP2XqiCasper VillanuevaNo ratings yet

- Sy Admission Circular For A.Y. 2023-2024Document2 pagesSy Admission Circular For A.Y. 2023-2024Akash RanaNo ratings yet

- Psew 1Document1 pagePsew 1gail.plushNo ratings yet

- Classifying Learners' Grades Per Subject in Grades 11-12 FIRST QUARTER (S.Y. 2020-2021) Number of Learners Who Passed OutstandingDocument2 pagesClassifying Learners' Grades Per Subject in Grades 11-12 FIRST QUARTER (S.Y. 2020-2021) Number of Learners Who Passed OutstandingAbiey Cruz LacapNo ratings yet

- BBA Degree Analysis Form (Curriculum-143), Both Single & Dual MajorDocument8 pagesBBA Degree Analysis Form (Curriculum-143), Both Single & Dual MajorKurosa RozaleanNo ratings yet

- PUP Enrollment Payment Voucher PDFDocument4 pagesPUP Enrollment Payment Voucher PDFJessNo ratings yet

- REV BandoContribuzioneEsoneri 2021 22 ENG OkDocument19 pagesREV BandoContribuzioneEsoneri 2021 22 ENG Oklavinia tiara malikaNo ratings yet

- Grade For School 2020-2021, 2022 2022Document9 pagesGrade For School 2020-2021, 2022 2022Abigail D'YbañezNo ratings yet

- 2024 - REGION VI - BP 204 - Casual Budget RequestDocument169 pages2024 - REGION VI - BP 204 - Casual Budget RequestJona Mae VillaeraNo ratings yet

- Data On Learners' Grades For The First Quarter SY 2020-2021Document7 pagesData On Learners' Grades For The First Quarter SY 2020-2021Ma RhizNo ratings yet

- CONVERTED BEIS Uploading of School Profile Facility As of Oct 2020v3 1Document29 pagesCONVERTED BEIS Uploading of School Profile Facility As of Oct 2020v3 1Shaniya Kai MadriagaNo ratings yet

- 2024-02-15T091823.833Document1 page2024-02-15T091823.833adityak6036No ratings yet

- Fee Structure 2021Document1 pageFee Structure 2021KishornawdeepNo ratings yet

- EDF2011Document2 pagesEDF2011zabeelrNo ratings yet

- Cuhas Fee Financial Information 20-21Document12 pagesCuhas Fee Financial Information 20-21W. MbiseNo ratings yet

- Offer Letter 2024SNU0048812Document4 pagesOffer Letter 2024SNU0048812kishan sanaNo ratings yet

- Non PO Voucher Expense Report InstructionsDocument3 pagesNon PO Voucher Expense Report InstructionsMthunzi MthunziNo ratings yet

- New Sip TemplateDocument84 pagesNew Sip TemplateOscar MatelaNo ratings yet

- SHS VP Certification of School FeesDocument4 pagesSHS VP Certification of School FeesAbdulwahid S. UlangkayaNo ratings yet

- PRIWorksheetDocument1 pagePRIWorksheetsnaregistrar1960No ratings yet

- ST TH ST TH ND TH ST TH ND TH RD TH TH THDocument2 pagesST TH ST TH ND TH ST TH ND TH RD TH TH THGundeti TejaNo ratings yet

- Student Financial Statement: Enrolment and Financial Details For The SemesterDocument3 pagesStudent Financial Statement: Enrolment and Financial Details For The Semesterziyu haoNo ratings yet

- Composit Grant Utilization FormatDocument2 pagesComposit Grant Utilization Formatkrishna kantNo ratings yet

- Revised Fee Structure For The Academic Year 2019-2021 OnwardsDocument1 pageRevised Fee Structure For The Academic Year 2019-2021 OnwardsRajanSharmaNo ratings yet

- Template ReviewDocument13 pagesTemplate ReviewMalcolm Du BruynNo ratings yet

- Lent CalendarDocument8 pagesLent Calendarapi-248998256No ratings yet

- Income Chart 2024-25Document1 pageIncome Chart 2024-25api-248998256No ratings yet

- Fall Festival Flyer 2023Document1 pageFall Festival Flyer 2023api-248998256No ratings yet

- Schoolchoicewi WebDocument4 pagesSchoolchoicewi Webapi-248998256No ratings yet

- Invoice AmazonDocument1 pageInvoice AmazonASHIN ANTONYNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentSreedhar RaoNo ratings yet

- Taxation of Income of Individual TaxpayerDocument24 pagesTaxation of Income of Individual TaxpayerEleasar Banasen PidoNo ratings yet

- Tax Invoice ExportDocument2 pagesTax Invoice ExportPrabhatNo ratings yet

- PICPA Tax Incentive Report (CDA)Document29 pagesPICPA Tax Incentive Report (CDA)francklineNo ratings yet

- ReportDocument4 pagesReportryan angelica allanicNo ratings yet

- M&a - Types of AcquisitionsDocument2 pagesM&a - Types of AcquisitionsArijit SahaNo ratings yet

- SPC#01 - Advanced AutomationDocument3 pagesSPC#01 - Advanced Automationyallasports23No ratings yet

- AsdfaDocument2 pagesAsdfaKevin T. OnaroNo ratings yet

- Treasury December 2021 Budget ReportDocument40 pagesTreasury December 2021 Budget ReportAustin DeneanNo ratings yet

- Rohit Saini Form-16Document2 pagesRohit Saini Form-16Sanjay DuaNo ratings yet

- Chapter 13-BDocument4 pagesChapter 13-BCARINO, GILLE ANNE MAE P.No ratings yet

- A The 2016 Sales of Cumberland Industries Were 455 000 000 OperatingDocument2 pagesA The 2016 Sales of Cumberland Industries Were 455 000 000 OperatingAmit PandeyNo ratings yet

- Total 244.53: Thanks For Riding, NagendraDocument4 pagesTotal 244.53: Thanks For Riding, NagendraNagendra KommuriNo ratings yet

- Argentina Tax Interview QuestionaireDocument10 pagesArgentina Tax Interview QuestionaireSudhakar PatnamNo ratings yet

- Your Canadian Arrival GuideDocument24 pagesYour Canadian Arrival GuidesadNo ratings yet

- Neuop DevelopmentDocument1 pageNeuop Developmentniraj9janiNo ratings yet

- Input Vat On Capital Goods, Transitional Vat, and Presumptive TaxDocument4 pagesInput Vat On Capital Goods, Transitional Vat, and Presumptive Taxyes it's kaiNo ratings yet