Professional Documents

Culture Documents

Apply emergency loan pensioners

Uploaded by

Mark AndrewOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apply emergency loan pensioners

Uploaded by

Mark AndrewCopyright:

Available Formats

EMERGENCY LOAN APPLICATION FORM (PENSIONER)

Form No. 10082019-EL-PEN-REV 0

IMPORTANT: Proceeds of this loan will be credited to the eCard account of the borrower. Prior to the filing of the accomplished application form, the borrower must

read thoroughly the terms and conditions below.

TO BE FILLED OUT BY THE APPLICANT

Name of Applicant Birth Date (mm/dd/yyyy)

Last Name First Name Middle Name

GSIS ID No. (any of the ID No. below may be provided)

BP No. E-Card/UMID Card No. E-Card/UMID Bank Account No.

Mailing/Residential Address

No. Street Brgy/District Municipality/City Zip Code

Mobile No. Email Address

TYPE OF LOAN: New Renewal

TERMS AND CONDITIONS

1. Loanable Amount: Qualified emergency loan borrowers shall be allowed a loan amount of Php20,000.00. The outstanding balance (OBAL) of the previous

emergency loan shall be deducted from the proceeds of the new loan.

2. Qualified Loan Borrowers. Active old-age and disability pensioners shall be qualified to avail of an Emergency Loan (EL) provided the following conditions

are met:

a. Pensioner-borrower is a resident of a declared calamity area, based on latest GSIS records as of the time of declaration of calamity; and

b. Pensioner-borrower has a resulting net monthly pension of at least twenty-five percent (25%) of the basic monthly pension (BMP) after deducting

his/her EL amortization.

3. Repayment Term: The loan repayment shall be made over three (3) years in thirty-six (36) equal monthly installments.

4. Interest Rate and Monthly Amortization: The annual interest rate shall be six percent (6%) computed in advance, with an annual effective rate of 9.88%,

computed as follows:

Particulars

Loan Amount (Loan) P 20,000.00

Interest Rate (Interest) 6%

Term of Loan (Term) 3 years

Amount of Interest (Loan x Interest x Term) P 3,600.00

Total Loan Amount (Loan + Amount of Interest) P 23,600.00

Monthly Amortization (Total Loan Amount / 36 months) P 655.56

5. First Due Date (FDD) of Monthly Amortization: The FDD shall be due on the 10th day of the 3rd calendar month following the granting of the loan, and every

10th day of the succeeding month thereafter until the loan is fully paid.

Illustration:

Date Loan Approved January 15, 2019

First Due Date April 10, 2019

Date of remittance of the 1st Monthly Amortization On or before May 10, 2019

Due Date for the remittance of the remaining 35

Every 10th of the month thereafter until April 10, 2022

Monthly Amortizations

6. Loan Redemption Insurance: The Redemption Insurance (RI) premium shall be deducted monthly from the BMP of the pensioner. The RI premium shall be

derived from the RI rate below and shall depend on the age of the pensioner at the time of availment:

Age RI rate per Age RI rate per Age RI rate per Age RI rate per

P1,000.00 (in Peso) P1,000.00 (in Peso) P1,000.00 (in Peso) P1,000.00 (in Peso)

52 0.53 64 1.54 76 4.73 88 13.17

53 0.58 65 1.69 77 5.16 89 14.16

54 0.63 66 1.85 78 5.62 90 15.20

55 0.69 67 2.02 79 6.11 91 16.32

56 0.76 68 2.20 80 6.65 92 17.59

57 0.82 69 2.41 81 7.26 93 19.16

58 0.90 70 2.64 82 7.96 94 21.36

59 0.98 71 2.90 83 8.72 95 24.79

60 1.06 72 3.21 84 9.54 96 30.67

61 1.16 73 3.55 85 10.41 97 41.31

62 1.28 74 3.92 86 11.30 98 a nd a bove 60.73

63 1.40 75 4.31 87 12.22

For Example, a pensioner availing of emergency loan at age 75 will have a monthly RI premium of Php86.20, derived from (Php20,000.00 / Php1,0000.00) x

Php4.31.

7. Payment Mechanism for Active Pensioners:

a. The monthly amortization shall be paid through automatic deduction from the basic monthly pension. It is understood that the deduction shall not be

stopped by GSIS until the loan is fully paid.

b. In case a pensioner is suspended due to non-compliance with the Annual Pensioner Information Revalidation (APIR), deduction of monthly

amortization shall be withheld due to the suspension of the monthly pension.

c. The unpaid monthly amortization/s shall be deducted from the pension accrual that will be processed after the pensioner has complied with APIR.

d. The EL account shall not be imposed with penalty, and shall not graduate into a due and demandable account during the period that the pensioner

is under suspended status.

8. Loan Pre-Termination: The pensioner-borrower may pre-pay the loan anytime during its term without penalty by paying off the remaining outstanding

principal and any unpaid interest up to the time of termination.

9. Maturity of the Loan: The loan shall mature at the end of the payment term of thirty-six (36) months, disqualification as pensioner, or death of the borrower,

whichever comes first. In which case, the entire principal amount of the loan including all interest and other charges payable, shall be due and payable without

need of demand or further notice.

In the event of death of the pensioner-borrower during the term of the loan and the account is not in default, the insurance proceeds from the member’s ELRI

benefits shall be applied as payment to the current outstanding balance of the loan. The loan shall be deemed paid by virtue of the ELRI if the pensioner-

borrower dies and the loan is up-to-date.

10. Deduction from the Loan Proceeds: The following shall be deducted from the loan proceeds:

a. Outstanding balance of the previous EL; and

b. ELRI premium based on the computation under No. 6 of this Terms and Conditions.

11. Condition for Renewal: Renewal before the full payment of a previous emergency loan shall be allowed only if the current emergency loan account is up-to

date. Upon renewal of the loan, the outstanding balance of the previous loan together with the penalties, if any, shall be deducted from the proceeds of the

new loan.

12. Loan Cancellation: Borrowers shall be allowed to cancel the loan agreement within a period of thirty (30) calendar days from the date of loan granting. In

cases of cancellation of the loan upon the behest of the borrower, the principal amount (or the face value in the loan contract), plus the pro-rata interest and

ELRI covering the days from loan granting up to the actual cancellation of the loan, shall be paid in full.

13. Policy on Default: An account is considered in default when the total unpaid obligation is equivalent to more than six (6) monthly amortizations. In the event

of default, the outstanding balance of the loan becomes due and demandable without need of demand. In case of failure to pay the outstanding balance

declared in default, the outstanding balance shall be charged with an interest equivalent to 12% per annum compounded monthly (p.a.c.m.) and a penalty of

6% p.a.c.m., from the date of default until the date of full payment.

Any payment received after a loan has been declared in default shall be applied in the order of priority below:

a. Penalty

b. Interest

c. Principal

14. Availment of Loan: The loan may be availed in accordance with the prescribed policies and guidelines of the GSIS.

15. Authority to Apply Payment: In case of maturity of this loan and it remains outstanding either in whole or in part, both for principal and interest, the GSIS is

authorized to collect, deduct or withhold from whatever benefits that may be due the Borrower, his/her heirs, beneficiaries, assignees or successors-in-interest,

the amount equivalent to the outstanding balance of this loan, inclusive of interest, penalties and surcharges. Such authorization shall remain effective until full

payment of the loan or any other outstanding obligation of the Borrower to the GSIS. It is expressly understood that any unpaid balance or outstanding

obligation of the Borrower to the GSIS, by virtue of this loan and/or other obligation, shall constitute a lien over any benefits/claims that may be due the

Borrower. Should such benefits/claims from the GSIS be insufficient to cover the remaining balance, GSIS shall not be prevented from filing the necessary civil

and administrative action(s) for recovery either against the borrower or his estate.

16. Recovery of amount/s credited in the eCard: GSIS shall have the right to recover by any legal means, any amount in the eCard account credited thereon by

the GSIS due to fraud, misrepresentation or error on account of any transaction which the Pensioner-Borrower may have with the GSIS.

17. Attorney’s Fees: Should the GSIS be compelled to refer the Loan or any portion thereof to an Attorney-at-Law for collection or to enforce any right hereunder

against the Borrower or avail of any remedy under the law or this Agreement, the Pensioner-Borrower shall pay an amount equivalent to twenty five (25%) per

cent of all amounts outstanding and unpaid as and for attorney’s fees and litigation expenses.

18. Venue: Any legal action, suit, or proceeding arising out or relating to this Agreement, shall be brought or instituted in the appropriate courts in the City of

Pasay or such other venue at the exclusive option of GSIS. In the event the borrower initiates any legal action arising from or under this agreement, for

whatever causes, the borrower agrees to initiate such action only in the City where the principal office of GSIS is located.

19. Notices: All notices required under this Agreement or for its enforcement shall be sent to the mailing address indicated in the Personal Data portion of this

loan application. The notices sent to the said mailing address shall be valid and shall serve as sufficient notice to the Borrower for all legal intents and

purposes.

I confirm that I have read and fully understood the EMERGENCY LOAN Terms and Conditions and undertake to comply with them.

I confirm my understanding of the Privacy Policy of the GSIS pursuant to the requirements of Republic Act (R.A.) No. 10173, otherwise known as the Data Privacy

Act, and consent to the manner of collection, use, access, disclosure and processing of my personal and sensitive personal data by the GSIS.

Finally, pursuant to R.A. No. 9510, otherwise known as the “Credit Information System Act”, and its Implementing Rules and Regulations IRR, I hereby

acknowledge and consent to: 1) the regular submission and disclosure of my basic credit data and updates thereon to the Credit Information Corporation (CIC); and

2) the sharing of my basic credit data with lenders authorized by the CIC, and credit reporting agencies and outsourced entities duly accredited by the CIC, subject

to the provisions of R.A. No. 9510, its IRR and other relevant laws and regulations.

SIGNATURE OF MEMBER/BORROWER TIN DATE SIGNED

You might also like

- Working Capital Finance AdvisoryDocument18 pagesWorking Capital Finance AdvisoryAnnaNo ratings yet

- Nationalisation of Banks in IndiaDocument5 pagesNationalisation of Banks in IndiaPravish Lionel DcostaNo ratings yet

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument79 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month Yyyyjohny BraveNo ratings yet

- Fund Flow and Cash Flow AnalysisDocument20 pagesFund Flow and Cash Flow AnalysisThirumanas Kottarathil K RNo ratings yet

- Interview With J Welles WilderDocument7 pagesInterview With J Welles WilderScribd-downloadNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormFermarc Lestajo100% (1)

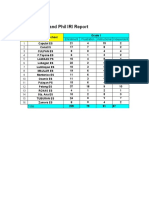

- EGRA and Phil IRI Report 2020-2021Document10 pagesEGRA and Phil IRI Report 2020-2021Mark AndrewNo ratings yet

- COT 2 EdithDocument4 pagesCOT 2 EdithMark AndrewNo ratings yet

- Assess credit worthinessDocument14 pagesAssess credit worthinessAsim MahatoNo ratings yet

- PERSONAL LOAN AGREEMENT - OlanDocument4 pagesPERSONAL LOAN AGREEMENT - OlanJerson ArinqueNo ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollRogie Apolo67% (3)

- Case Digests Atty CabochanDocument38 pagesCase Digests Atty CabochanAthena Lajom100% (1)

- Developing Reading Skills and Assessing Pupil ProgressDocument42 pagesDeveloping Reading Skills and Assessing Pupil ProgressMark Andrew93% (30)

- Developing Reading Skills and Assessing Pupil ProgressDocument42 pagesDeveloping Reading Skills and Assessing Pupil ProgressMark Andrew93% (30)

- Developing Reading Power 5Document2 pagesDeveloping Reading Power 5Mark Andrew100% (1)

- Apply for Emergency Loan (PensionerDocument2 pagesApply for Emergency Loan (PensionerRizal Municipal Accountant's OfficeNo ratings yet

- Emergency Loan (Pensioner) Application Form: 05042020-EL-PEN-REV 1Document2 pagesEmergency Loan (Pensioner) Application Form: 05042020-EL-PEN-REV 1Joel Terrence Gumapon TigoyNo ratings yet

- 20210128-Forms-Enhanced Pension Loan ApplicationDocument2 pages20210128-Forms-Enhanced Pension Loan ApplicationReverencio B. GaborNo ratings yet

- Emergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantChristian de LunaNo ratings yet

- EL Application Form Active MembersDocument2 pagesEL Application Form Active MembersCharles De Saint AmantNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameKarena WahimanNo ratings yet

- 20200403-Forms-EML Active FillableDocument2 pages20200403-Forms-EML Active FillableChesca Angel ReyesNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameDeese Marie ZabalaNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFKarena WahimanNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameGian Paula MonghitNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFBusyMae CabadonNo ratings yet

- Emergency Loan Application Form for Active GSIS MembersDocument2 pagesEmergency Loan Application Form for Active GSIS MembersJ Espelita CaballedaNo ratings yet

- Emergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantRichelle PascorNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NamePhebe Zhie Zhia CampeñaNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormenzoNo ratings yet

- GCL-REV 1: RD TH RD THDocument2 pagesGCL-REV 1: RD TH RD THhenryNo ratings yet

- IQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Document6 pagesIQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Cathlyn PalceNo ratings yet

- Codified - Gsis Computer Loan Application Form 09222020 - v1Document2 pagesCodified - Gsis Computer Loan Application Form 09222020 - v1Cloud StrifeNo ratings yet

- Promissory Note Promissory Note Number: PN761443 - 347310Document4 pagesPromissory Note Promissory Note Number: PN761443 - 347310Joseph TolentinoNo ratings yet

- Sisodiya Bhamarsingh BabusinghDocument3 pagesSisodiya Bhamarsingh BabusinghRajib KumarNo ratings yet

- IDFC FIRST Bank - Credit Card - Statement - 22062023Document5 pagesIDFC FIRST Bank - Credit Card - Statement - 22062023Udaya KumarNo ratings yet

- Private Education Loan DetailsDocument2 pagesPrivate Education Loan DetailsLalo CavaliNo ratings yet

- CASHe Soa 568304-1Document2 pagesCASHe Soa 568304-1sathyaNo ratings yet

- Borrower Must Read Thoroughly The Terms and Conditions BelowDocument3 pagesBorrower Must Read Thoroughly The Terms and Conditions BelowNgirp Alliv TreborNo ratings yet

- Joemer Gasparillo MationgDocument5 pagesJoemer Gasparillo MationggasparillojoemerNo ratings yet

- PNB Fixed Deposit FormDocument6 pagesPNB Fixed Deposit FormKaushal DidwaniaNo ratings yet

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDocument6 pagesLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNo ratings yet

- CFA TemplateDocument15 pagesCFA TemplateGaurav SinghNo ratings yet

- Gsis Computer Loan Application Form: To Be Filled Up by The ApplicantDocument2 pagesGsis Computer Loan Application Form: To Be Filled Up by The ApplicantMr. Bates100% (1)

- eStatement1481IN - 2024 02 23Document3 pageseStatement1481IN - 2024 02 23sanjitsha2708No ratings yet

- LCF Mum 0007001053Document4 pagesLCF Mum 0007001053The Shah'sNo ratings yet

- Sanction Letter FAST7186877785851539 775883241168816Document4 pagesSanction Letter FAST7186877785851539 775883241168816yogeshmepindiaNo ratings yet

- Promissory Note - Katherine Rose Frias - April 20, 2021Document5 pagesPromissory Note - Katherine Rose Frias - April 20, 2021khate friasNo ratings yet

- Loan Agreement LAI1005782312Document3 pagesLoan Agreement LAI1005782312orugalluNo ratings yet

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDocument7 pagesNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinNo ratings yet

- Life Insurance Premium CalculationDocument15 pagesLife Insurance Premium CalculationDawit MNo ratings yet

- Loan statement summaryDocument3 pagesLoan statement summaryGirish LunaviyaNo ratings yet

- Day 13 and 14 Liabilitiessec1 2024Document35 pagesDay 13 and 14 Liabilitiessec1 2024Kit KatNo ratings yet

- Motorcycle LoanDocument10 pagesMotorcycle Loanrowilson reyNo ratings yet

- Project 1Document43 pagesProject 1gowtham114411No ratings yet

- UAB PERSONAL LOAN KFSDocument3 pagesUAB PERSONAL LOAN KFSTwimukye MarkNo ratings yet

- Bank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaDocument2 pagesBank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaPonnam VenkateshamNo ratings yet

- Loan Calculator WorksheetDocument1 pageLoan Calculator WorksheetRavindrsNo ratings yet

- Sanction DlaDocument17 pagesSanction DlaVada SeamNo ratings yet

- 313 PCDRDocument3 pages313 PCDRkahwai ngNo ratings yet

- 83453460-2Document6 pages83453460-2utkarshlegal96No ratings yet

- Kim Ann Villarosa Loan DetailsDocument1 pageKim Ann Villarosa Loan DetailsKim OpeñaNo ratings yet

- FORMS Emergency - Loan PDFDocument3 pagesFORMS Emergency - Loan PDFUsep ObreroNo ratings yet

- The Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDocument3 pagesThe Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDeny KosasihNo ratings yet

- Mgac 1Document7 pagesMgac 1Yah yah yahhhhhNo ratings yet

- UntitledDocument1 pageUntitledBembem CaniedoNo ratings yet

- Test II - SDocument5 pagesTest II - Siczech1506No ratings yet

- Loan AmortizationDocument28 pagesLoan AmortizationMarilyn Perez OlañoNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Chap 008Document5 pagesChap 008hasnat sakibNo ratings yet

- LOLC Life Insurance QuotationDocument3 pagesLOLC Life Insurance QuotationYasiru rasanjanaNo ratings yet

- PNB Housing: Harvest Great Returns, Assured and SafeDocument6 pagesPNB Housing: Harvest Great Returns, Assured and Safeshahid2opuNo ratings yet

- Grade Level Report on SREA, EGRA and Phil IRI AssessmentsDocument10 pagesGrade Level Report on SREA, EGRA and Phil IRI AssessmentsMark AndrewNo ratings yet

- DepEd Online Workweek ReportDocument2 pagesDepEd Online Workweek ReportMark AndrewNo ratings yet

- District Update 6-21-25Document1 pageDistrict Update 6-21-25Mark AndrewNo ratings yet

- SF 9 - ES ( (Learner's Progress Report Card)Document2 pagesSF 9 - ES ( (Learner's Progress Report Card)Mark AndrewNo ratings yet

- DepEd 2020 Standard ScreenDocument1 pageDepEd 2020 Standard ScreenMark AndrewNo ratings yet

- Submission On SALN DM.-018-S.-2020-1Document1 pageSubmission On SALN DM.-018-S.-2020-1Mark AndrewNo ratings yet

- CS Form No. 212 Revised Personal Data Sheet 2Document13 pagesCS Form No. 212 Revised Personal Data Sheet 2ferosiacNo ratings yet

- Deped Mobile Monitoring App User Guide: How To Use The Facilities Tracker - (Ecq)Document3 pagesDeped Mobile Monitoring App User Guide: How To Use The Facilities Tracker - (Ecq)Mark AndrewNo ratings yet

- Filipino English Math Science Aral Pan ESP EPP Mapeh 90-100 85-89 80-84 75-79 60-74Document1 pageFilipino English Math Science Aral Pan ESP EPP Mapeh 90-100 85-89 80-84 75-79 60-74Mark AndrewNo ratings yet

- Gad BudgetaryDocument1 pageGad BudgetaryMark AndrewNo ratings yet

- Mohon Es Health Report 2020Document1 pageMohon Es Health Report 2020Mark AndrewNo ratings yet

- Epson L3110 Resetter PasswordDocument1 pageEpson L3110 Resetter PasswordMark AndrewNo ratings yet

- Verb AgreementDocument5 pagesVerb AgreementMark AndrewNo ratings yet

- Budget Preparation Forms-FinalDocument124 pagesBudget Preparation Forms-FinalMark AndrewNo ratings yet

- Action Plan Mapeh Part IDocument1 pageAction Plan Mapeh Part IMark AndrewNo ratings yet

- 7 StandardReport AprilDocument9 pages7 StandardReport AprilMark AndrewNo ratings yet

- ICT DesignationDocument1 pageICT DesignationMark AndrewNo ratings yet

- FDS First Day of ServiceDocument2 pagesFDS First Day of ServiceGerry Areola AquinoNo ratings yet

- Agents of Soil Erosion Report by Wilfred BaculaoDocument1 pageAgents of Soil Erosion Report by Wilfred BaculaoMark AndrewNo ratings yet

- Anthem Words AustraliaDocument1 pageAnthem Words AustralialamtamnhuNo ratings yet

- Activity Sheet Quarter 1 Consolidated PDFDocument69 pagesActivity Sheet Quarter 1 Consolidated PDFGeoffrey Tolentino-Unida100% (3)

- Brigada Eskwela Jingle Contest Entry FormDocument1 pageBrigada Eskwela Jingle Contest Entry FormMark AndrewNo ratings yet

- Ebeis Data For NutritionDocument1 pageEbeis Data For NutritionMark AndrewNo ratings yet

- National Shelter ProgramDocument43 pagesNational Shelter ProgramLara CayagoNo ratings yet

- Internship Report OnDocument52 pagesInternship Report OnFarjana RahmanNo ratings yet

- Government Incentives For EntrepreneurshipDocument3 pagesGovernment Incentives For EntrepreneurshipCato InstituteNo ratings yet

- Neelkanth Palace Shop ValuationDocument3 pagesNeelkanth Palace Shop ValuationRaj GohilNo ratings yet

- Mortgage Loan Case StudiesDocument8 pagesMortgage Loan Case StudiesFurkhan SyedNo ratings yet

- Contact No. Client Name Product Sl. NoDocument12 pagesContact No. Client Name Product Sl. NoSameeur Rahman MehdiNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Invoice Template Construction 1Document1 pageInvoice Template Construction 1GyanaRaghavan-chamuNo ratings yet

- Comprehensive Accounting Case StudyDocument11 pagesComprehensive Accounting Case StudyMike StevenNo ratings yet

- Questions On Mariott Case StudyDocument1 pageQuestions On Mariott Case StudyKaran BaruaNo ratings yet

- Master Budget Case: Toyworks Ltd. (A)Document4 pagesMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- Original IMPORT INVOICE Number: 5589642625: Total Amount Due Condition Rate Base Value Total (USD)Document2 pagesOriginal IMPORT INVOICE Number: 5589642625: Total Amount Due Condition Rate Base Value Total (USD)AllyNo ratings yet

- Household Budget Tracker Shows Income Over ExpensesDocument6 pagesHousehold Budget Tracker Shows Income Over ExpensesDavin AgustaNo ratings yet

- CAFIB (RWA) PD 02032017 - NDocument528 pagesCAFIB (RWA) PD 02032017 - NHamdan Hassin100% (1)

- Financial Accounting Theory (Sem V) PDFDocument4 pagesFinancial Accounting Theory (Sem V) PDFHarshal JainNo ratings yet

- Reconcile Nostro Februari 2023Document56 pagesReconcile Nostro Februari 2023Riko RudyantoNo ratings yet

- Undisclosed Insider Activities at 21 Vianet GroupDocument37 pagesUndisclosed Insider Activities at 21 Vianet GroupTrinity Research Group0% (1)

- Mcom Research PaperDocument63 pagesMcom Research PaperKhushbu MishraNo ratings yet

- Deposit Slip For Faculty and Staff - BankDocument1 pageDeposit Slip For Faculty and Staff - BankSaurabh ShubhamNo ratings yet

- Fdi & FiiDocument38 pagesFdi & FiiJitendra KalwaniNo ratings yet

- Engineering Midterm Review: Gradient Series FormulasDocument7 pagesEngineering Midterm Review: Gradient Series FormulasHikaruNo ratings yet

- 2a2e27161d 280438c15aDocument205 pages2a2e27161d 280438c15aDewi LestariNo ratings yet