Professional Documents

Culture Documents

Chapter 12 - Capital Expenditure Decisions: Estimating The Initial Cash Payment

Uploaded by

maxwell maingi0 ratings0% found this document useful (0 votes)

18 views3 pagesOriginal Title

63-sample.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views3 pagesChapter 12 - Capital Expenditure Decisions: Estimating The Initial Cash Payment

Uploaded by

maxwell maingiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Chapter

12 – Capital Expenditure Decisions

What is capital expenditure, what are the 4 steps of a capital expenditure decisions?

-‐ capital expenditure decision -‐ long-‐term decision where business determines

whether or not to make an investment at the time in order to obtain future

net cash receipts that’ll exceed the investment (positive ROI)

-‐ 3 categories of investment alternatives: new investments (increase revenue);

new technology (save costs); replacement of old assets as they wear out

-‐ risks of investment: involve large amounts of resources, uncertainty, difficult

to reverse, span over long periods of time

-‐ general rule: capital expenditure proposal is acceptable when return on

investment is greater than cost of providing the cash to make the investment

-‐ Steps in making a capital expenditure decision:

What does a business include in the initial cost of a

capital expenditure proposal?

Estimating the initial cash payment

-‐ initial cost-‐expected cash payment to be made to put proposal into operation

-‐ sometimes, the proposal requires investment of additional working capital

-‐ initial costs may involve the use of estimates (e.g. quotes from contractors)

Estimating future cash flows

-‐ expected future net cash receipts help to provide ROI

-‐ 3 forms of net future cash receipts:

1) future cash receipts only (e.g. no future outflows-‐dividends)

2) future cash receipts exceed future cash payments, positive net cash inflow

3) savings of future cash payments, reduction in future cash outflow (no cash

inflow) (e.g. upgrading to more fuel efficient and saving fuel costs in future)

What are the relevant costs of a capital expenditure proposal and how do operating

income, depreciation and ending cash flows affect these costs?

-‐ relevant cash flows: future cash flows that differ in amount or in timing as a

result of accepting a capital expenditure proposal; relevant as it affects

business’ long-‐term profitability

-‐ relevant cash flows are: the expected additional future cash flows; expected

savings in future payments

-‐ deciding which cash flows are relevant for the decision is similar to deciding

what costs are relevant for a short-‐term decision

-‐ to be relevant to a particular capital expenditure decision, cash flows must:

o occur in the future

o result from activities that are required by the proposal

o cause a change in the business’ existing cash flows

Operating income, depreciation and ending cash flows

-‐ most revenues & expenses result in cash in & outflows approx. at same time

-‐ expected future operating revenues&expenses are frequently used as

estimates for relevant future cash inflows and outflows

-‐ depreciation expenses are not cash flows

-‐ but acquisition cost(of investment) is a cash outflow and the scrap amount (if

any) is a future cash inflow

How does a business determine the rate of return it requires on a capital

expenditure proposal?

Determining the required return on investment

-‐ required return=cost of providing cash for investment (expressed as %)

-‐ business’ financial position improves if accepting capital expenditure

proposal provides a return that’s higher than cost of the investment

-‐ cost of capital-‐rate that measures cost of providing cash for investment

-‐ capital comes from interest, dividends, etc. each source demands ROI

-‐ cost of capital is the weighted-‐average cost it must pay to sources of capital

-‐ cost of capital is the cut-‐off rate used to distinguish between

acceptable&unacceptable capital expenditure proposals; to be acceptable:

return on proposal must be equal/greater than business’ cost of capital

-‐ consistent cost of capital rate must be used for evaluating proposals

Determining acceptable capital expenditure proposals

-‐ business may use different methods to analyse whether a capital expenditure

proposal is acceptable (e.g: NPV method; payback method; accg rate of

return method)

Time value of money and present value (ACST)

-‐ time-‐value of money –$1 in the future is worth less than $1 now

-‐ FV=PV(1+i)n (e.g. FV=100 (1+0.04)1 = $104)

!"#

-‐ To find present value: rearrange future value formula; PV = (!.!")! = $100

-‐ Present value=today’s value of $ amount received in the future

-‐ Use 1st table for compound (single payment)

-‐ Use 2nd table for annuity (multiple payments)

How does a business use the net present value method to evaluate a capital

expenditure proposal?

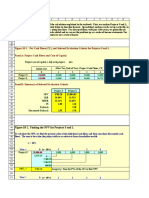

-‐ NPV considers the time value of money and involves a 3-‐steps process:

1) determine initial (present time) cash payment needed to implement proposal

2) determine present value of expected future net cash receipts from proposal

3) determine NPV by subtracting amount in Step 1 from amount in step 2

-‐ note that NPV is net outcome; if NPV is zero/positive, proposal is acceptable

as it’ll earn at least the required rate of return

-‐ adv of NPV: expected cash flows & timing are

considered, decision rule is explicit

-‐ disadv: relies on discount rate, actual return in

terms of % investment outlay isn’t revealed

What is the difference between the payback method and the accg rate of return on

investment method for evaluating a capital expenditure proposal?

-‐ this evaluates a capital expenditure proposal based on the payback period

-‐ payback period-‐length of time required for a return of initial investment

-‐ decision: accept project with shortest payback period

-‐ example: payback period is 3.009 yrs (100/11000=0.009)

-‐ adv of payback method: simple to calculate, easy to understand, incorporates

awareness of risk in decisions

-‐

disadv: ignores time value of money & cash inflow after payback, too simple

to be used as a decision support tool by itself

Accounting rate of return method (ARR)

!"#$!%# !""#!$ !"# !"#! !"#$ !"#$ !""#$!!""#!$ !"#$"%&'(&)* !" !""#$

-‐ ARR= (!"#$%& !"#$%&!" !" !""#$ !"! !"!#!$% !"#$!!"#$%&'( !"#$%)/!

-‐ Average annual net cash flow from asset =

!"# !" !"#! !"#$ !"! !"#! !"#"$%&'!!"#$%&'(

!".!" !"#$ !"#$%&'

!"!#!$% !"#$!!"#$%&'(

-‐ Annual depreciation on asset = !".!" !"#$ !"#$%&'

-‐ Useful in comparing several different projects as ARR can be ranked but it

ignores time value of money

-‐ ARR should be used in support of the NPV method

-‐ Decision: project with highest ARR (which is also higher than required return

and also has positive NPV) is usually chosen

-‐ Adv of ARR: simple to calculate, easy to understand, consistent with return

on assets (ROA) measure

-‐ Disadv: time value of money is ignored, importance of cash is ignored, profits

and costs maybe measured in different ways

How does a business decide which capital expenditure proposal to accept when it

has several proposals that accomplish the same thing, or when it cannot obtain

sufficient cash to make all of its desired investments?

Mutually exclusive capital expenditure proposals

-‐ refers to proposals that accomplish the same thing, so that when 1 proposal

is selected, the others are not (e.g. considering buying aircon)

-‐ Step 1: analyse each proposal to determine whether or not it’s acceptable

-‐ Step 2: select one of the acceptable alternatives by choosing proposal with

highest positive NPV

Capital Rationing

-‐ occurs when business cannot obtain sufficient cash to make all investments

that it would like to make

-‐ business chooses combo of capital expenditure proposals that provides the

highest total NPV for the total investment available

Practical Issues

1) collecting data: costs, revenues and cash flows may not be easy to determine

2) opportunity costs: cost of foregoing benefits of other alternative proposals

3) risk: data may be inaccurate; changes may occur in the future

4) finance: some investments seem good but obtaining loans may be difficult

5) human resources: will there be employees/consultants available with

required skills available required by the project?

6) Social responsibility and care of the natural environ: can affect business

decisions (e.g. pollution), social and environ costs may be hard to estimate

You might also like

- Advanced MGT Accounting Paper 3.2Document242 pagesAdvanced MGT Accounting Paper 3.2Noah Mzyece DhlaminiNo ratings yet

- Engineering EconomicsDocument4 pagesEngineering EconomicstkubvosNo ratings yet

- BEC 3 - Financial ManagementDocument11 pagesBEC 3 - Financial ManagementAudreys PageNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- Project Feasibility & Finance PrinciplesDocument27 pagesProject Feasibility & Finance PrinciplesHimanshu DuttaNo ratings yet

- Capital Budgeting Decisions Under Uncertainity - 1 - 09 - 2019Document55 pagesCapital Budgeting Decisions Under Uncertainity - 1 - 09 - 2019Kaushik meridianNo ratings yet

- Unit 2Document5 pagesUnit 2Aditya GuptaNo ratings yet

- FN1024 Chapter 7 PDF RevDocument34 pagesFN1024 Chapter 7 PDF Revduong duongNo ratings yet

- FIN2004 - 2704 Week 10 SlidesDocument61 pagesFIN2004 - 2704 Week 10 SlidesNguyen DzungNo ratings yet

- Investment AppraisalDocument1 pageInvestment Appraisalaryananvekar646No ratings yet

- Profitability Analysis Method PresentationDocument16 pagesProfitability Analysis Method PresentationArnab DasNo ratings yet

- Capital Requirement, Raising Cost of Capital: Lecture FiveDocument32 pagesCapital Requirement, Raising Cost of Capital: Lecture FiveAbraham Temitope AkinnurojuNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalShaza NaNo ratings yet

- Capital Budgeting 2Document102 pagesCapital Budgeting 2atharpimt100% (1)

- Epeng 308-2Document46 pagesEpeng 308-2gwemeowenNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Cost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Document27 pagesCost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Nirjon BhowmicNo ratings yet

- BUSINESS ENVIRONMENT AND CONCEPTS: CAPITAL BUDGETINGDocument2 pagesBUSINESS ENVIRONMENT AND CONCEPTS: CAPITAL BUDGETINGHazem El SayedNo ratings yet

- Capital Budgeting AnalysisDocument37 pagesCapital Budgeting AnalysisEsha ThawalNo ratings yet

- Fin Mar ReviewerDocument2 pagesFin Mar ReviewerPixie CanaveralNo ratings yet

- Capital BudgetingDocument35 pagesCapital BudgetingShivam Goel100% (1)

- Project Management: The Financial Perspective: Muhammad UmerDocument37 pagesProject Management: The Financial Perspective: Muhammad Umermumer1No ratings yet

- Unit VDocument8 pagesUnit VJohn LastonNo ratings yet

- 5 Evaluating A Single ProjectDocument32 pages5 Evaluating A Single ProjectImie CamachoNo ratings yet

- Chapter 5_ ManEcoDocument2 pagesChapter 5_ ManEcoMharc PerezNo ratings yet

- Financial aspects of utility regulationDocument9 pagesFinancial aspects of utility regulationmohd_rosman_3No ratings yet

- Chapter 02 - The Future Asset Structure and Capital Project Appraisal (Wilson 2008)Document4 pagesChapter 02 - The Future Asset Structure and Capital Project Appraisal (Wilson 2008)Neil WilsonNo ratings yet

- BEC Notes Chapter 3Document6 pagesBEC Notes Chapter 3cpacfa90% (10)

- NotesFMF FinalDocument52 pagesNotesFMF FinalKyrelle Mae LozadaNo ratings yet

- 4853 - CID-sessions 3-4-5Document35 pages4853 - CID-sessions 3-4-5Sidharth Ray100% (1)

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranAsif IqbalNo ratings yet

- Capital BudgetingDocument31 pagesCapital BudgetingJanu JinniNo ratings yet

- EVALUATION OF INVESTMENT PROPOSALS LectDocument6 pagesEVALUATION OF INVESTMENT PROPOSALS LectSimranjeet SinghNo ratings yet

- Capital Inv Appraisal Questions Notes PDFDocument6 pagesCapital Inv Appraisal Questions Notes PDFtaridanNo ratings yet

- Net Present Value MethodDocument9 pagesNet Present Value MethodRain Roslan100% (2)

- Cost of Capital 4Document5 pagesCost of Capital 4sudarshan1985No ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingVarsha KastureNo ratings yet

- FM Mod II-2Document10 pagesFM Mod II-2Irfanu NisaNo ratings yet

- Management of Working CapitalDocument12 pagesManagement of Working CapitalViraj DhamdhereNo ratings yet

- CHAPTER 5 Engineering EconomicDocument44 pagesCHAPTER 5 Engineering EconomicLaila AzreenNo ratings yet

- International Capital Budgeting ExplainedDocument18 pagesInternational Capital Budgeting ExplainedHitesh Kumar100% (1)

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- Account FinanceDocument28 pagesAccount FinanceOblivionOmbreNo ratings yet

- Corporate Finance Basics ExplainedDocument15 pagesCorporate Finance Basics Explainedakirocks71No ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingRani JaiswalNo ratings yet

- Acctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1Document8 pagesAcctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1masan01No ratings yet

- Fidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Document17 pagesFidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Fidelia AgathaNo ratings yet

- Capital Budgeting: Time-Value of MoneyDocument39 pagesCapital Budgeting: Time-Value of MoneydanielNo ratings yet

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocument39 pagesCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeNAGESH GUTTEDARNo ratings yet

- CAPITAL BUDGETING PROCESSDocument15 pagesCAPITAL BUDGETING PROCESSJoshua Cabinas100% (1)

- Finance and Management Accounting 2 Week 2Document29 pagesFinance and Management Accounting 2 Week 2565961628No ratings yet

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Roles of Finance - SlidesDocument77 pagesRoles of Finance - SlidesCrizziaNo ratings yet

- Fundamentals of Corporate Finance Chapter 13: Calculating a Firm's Weighted Average Cost of Capital (WACCDocument55 pagesFundamentals of Corporate Finance Chapter 13: Calculating a Firm's Weighted Average Cost of Capital (WACCKhadija AlkebsiNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Fundamentals of Corporate Finance Canadian 6Th Edition Brealey Test Bank Full Chapter PDFDocument45 pagesFundamentals of Corporate Finance Canadian 6Th Edition Brealey Test Bank Full Chapter PDFousleyrva9100% (9)

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarNo ratings yet

- Global Market Entry StrategiesDocument64 pagesGlobal Market Entry StrategiesVinathy PalleNo ratings yet

- BBA 407 GUIDE BOOK Smu 4rth SemDocument81 pagesBBA 407 GUIDE BOOK Smu 4rth SemlalsinghNo ratings yet

- PMG506 - Lecture No.2Document22 pagesPMG506 - Lecture No.2bedoor alotaibiNo ratings yet

- Business Environment and Concepts - Version 1 NotesDocument27 pagesBusiness Environment and Concepts - Version 1 Notesaffy714No ratings yet

- ch12 2Document3 pagesch12 2ghsoub777100% (1)

- Viva Term Finance & BankingDocument26 pagesViva Term Finance & BankingMinhaz Hossain Onik100% (2)

- ch13Document60 pagesch13Ains M. BantuasNo ratings yet

- Ch10 Tool KitDocument18 pagesCh10 Tool KitElias DEBSNo ratings yet

- Chapter10 Test Bank in Manegerial FinanceDocument37 pagesChapter10 Test Bank in Manegerial FinanceShealalyn1100% (8)

- ZERO-WASTE PROJECT - Group 2 FINALDocument26 pagesZERO-WASTE PROJECT - Group 2 FINALARLENE GARCIANo ratings yet

- Decision Analysis Process and TechniquesDocument102 pagesDecision Analysis Process and TechniquesRuth SmallmarkNo ratings yet

- ME 291 Engineering Economy: Comparison On The Basis of CC and Payback Period AnalysisDocument11 pagesME 291 Engineering Economy: Comparison On The Basis of CC and Payback Period AnalysisEhsan Ur RehmanNo ratings yet

- Chapter16.Capital Expenditure DecisionsDocument44 pagesChapter16.Capital Expenditure DecisionsErdjol Yzeiri63% (8)

- Corporate Finance Solution Chapter 5Document8 pagesCorporate Finance Solution Chapter 5Kunal KumarNo ratings yet

- Chapter 3 Bond Duration and Bond PricingDocument28 pagesChapter 3 Bond Duration and Bond PricingClaire VensueloNo ratings yet

- Corporate Finance Outline, Spring 2013Document60 pagesCorporate Finance Outline, Spring 2013Kasem Ahmed100% (1)

- Capital Budgeting Part 3Document4 pagesCapital Budgeting Part 3Chirag khanchabdaniNo ratings yet

- CHAPTER 6 Case SolutionDocument3 pagesCHAPTER 6 Case SolutionJeffy Jan100% (2)

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDocument10 pagesAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Estimation ModelsDocument46 pagesEstimation ModelsQuizMM MujNo ratings yet

- Cash Flow Estimation Problem SetDocument25 pagesCash Flow Estimation Problem SetCucumber IsHealthy96No ratings yet

- ME482 M6 Ktunotes - inDocument20 pagesME482 M6 Ktunotes - injas nazarNo ratings yet

- CH 7 - Net Present ValueDocument54 pagesCH 7 - Net Present ValueDeepak Jatain100% (1)

- Accounting Devoir Part BDocument2 pagesAccounting Devoir Part BAbdul HadiNo ratings yet

- Introducing Suncharge Pro: A Guide: by Sheikh TayyabDocument12 pagesIntroducing Suncharge Pro: A Guide: by Sheikh TayyabTayyab AliNo ratings yet

- Proposal A Proposal B Proposal CDocument6 pagesProposal A Proposal B Proposal CMaha HamdyNo ratings yet

- Review Questions for Unit 1 Project ManagementDocument17 pagesReview Questions for Unit 1 Project ManagementPriya Guna100% (1)

- 3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseDocument11 pages3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseRaghavendra NaduvinamaniNo ratings yet