Professional Documents

Culture Documents

Foreign Account Tax Compliance Act ("FATCA") : Account Opening Form Supplement (Use Additional Copies, If Required)

Uploaded by

sharif261Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Account Tax Compliance Act ("FATCA") : Account Opening Form Supplement (Use Additional Copies, If Required)

Uploaded by

sharif261Copyright:

Available Formats

...................................................................

Branch

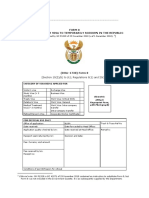

Foreign Account Tax Compliance Act (“FATCA”)

Account Opening Form Supplement (use additional copies, if required)

This form must be completed by any individual/non-individual/entity who wishes to open a Bank Account/have been maintaining one.

Account Number

Name

Country of Residence/Registration

Country of Birth/Incorporation

Please check’’ ” ‘Yes’ or ‘No’ for each of the following questions Yes / No

1. Are you a U.S. Resident?

2. Are you a U.S. Citizen?

3. Do you hold a U.S. Permanent Resident Card (Green Card)?

4. Is your entity a foreign entity where there is substantial “US ownership” ?

i.e.10% or more (for company/non-individuals)

I hereby confirm the information provided above is true, accurate & complete.

Subject to applicable local laws, I hereby consent for Prime Bank Limited, Bangladesh or any of its affiliates (including branches)

(Collectively “the Bank”) to share my information with domestic/U.S. regulators or tax authorities where necessary to establish my tax

liabilities in any jurisdiction.

Where required by domestic or U.S. regulators or tax authorities, I consent and agree that the Bank may withhold from my account(s), such

amounts as may be required according to applicable laws, regulations and directives.

I undertake to notify the Bank within 30 (thirty) calendar days if there is a change in any information which I have provided to the Bank.

Applicant’s Signature ..........................................................................

Applicant’s Name ..........................................................................

Date ..........................................................................

A/C Opening Officer BM/OM

(With Name Seal, Signature & Date) (With Name Seal, Signature & Date)

You might also like

- Thornberry PSC: Registration FormDocument1 pageThornberry PSC: Registration FormVictor MirzaNo ratings yet

- Global Business 4th Edition Mike Peng Test Bank DownloadDocument19 pagesGlobal Business 4th Edition Mike Peng Test Bank DownloadAdam Radloff100% (26)

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- Fusion US Third-Party Tax Filing InterfaceDocument22 pagesFusion US Third-Party Tax Filing InterfaceSubramanianNo ratings yet

- Tax Payment ReceiptDocument1 pageTax Payment ReceiptSushan Gangadhar ShettyNo ratings yet

- Account TerminationDocument2 pagesAccount TerminationQueenie Nil GumandoyNo ratings yet

- SBI - Certificate To Be Submitted by Pensioner - ChandigarhDocument1 pageSBI - Certificate To Be Submitted by Pensioner - ChandigarhMsinghNo ratings yet

- Ey Presentation For UniversitiesDocument13 pagesEy Presentation For UniversitiesRehan FarhatNo ratings yet

- Surrender Discharge Voucher of LIC Form No. 5074Document5 pagesSurrender Discharge Voucher of LIC Form No. 5074Arindam Samanta100% (3)

- Syndicate Bank Application FormDocument9 pagesSyndicate Bank Application FormarsatheeshNo ratings yet

- Business Tax Ans4Document24 pagesBusiness Tax Ans4Lars Frias100% (1)

- Phil Hawk Vs Vivian Tan Lee DigestDocument2 pagesPhil Hawk Vs Vivian Tan Lee Digestfina_ong62590% (1)

- Vantage Loan Application Form: Section A: Particulars of BorrowerDocument9 pagesVantage Loan Application Form: Section A: Particulars of BorrowerOluwaloseyi SekoniNo ratings yet

- 2018 +Generali+Claim+form EN+ (Legal+rev) +-+171017Document2 pages2018 +Generali+Claim+form EN+ (Legal+rev) +-+171017Femi EvalnesNo ratings yet

- BOC AC Opening FormDocument4 pagesBOC AC Opening FormbocbpocityexNo ratings yet

- GSTIN - Loan Application FormDocument14 pagesGSTIN - Loan Application FormPUSHKAR PATIDARNo ratings yet

- Indonesia: Wahyu Senoardhy PamungkasDocument1 pageIndonesia: Wahyu Senoardhy PamungkasWahyu PurnamaNo ratings yet

- Account Opening Form For Non Resident IndiansDocument3 pagesAccount Opening Form For Non Resident IndiansNobleNo ratings yet

- CA IndividualDocument2 pagesCA IndividualSanjeev MiglaniNo ratings yet

- PPF-Account Opening FormDocument3 pagesPPF-Account Opening Formkamal godhaniya1988No ratings yet

- Loan Application Hekima Loan 2022Document2 pagesLoan Application Hekima Loan 2022JAMES MUANGENo ratings yet

- FORM 1 PPF Account OpeningDocument4 pagesFORM 1 PPF Account Openingjanardhanrao1No ratings yet

- 3.BM-TTKH - QLTTKH.01 - Phieu Dang Ky Thong Tin Khach Hang Ca NhanDocument4 pages3.BM-TTKH - QLTTKH.01 - Phieu Dang Ky Thong Tin Khach Hang Ca NhanTrần Thanh TúNo ratings yet

- Settlement Account Opening FormDocument3 pagesSettlement Account Opening FormAkhilesh SinghNo ratings yet

- Form MDocument2 pagesForm Msalmanitrat0% (1)

- Revised PF Withdrawal Form-19Document3 pagesRevised PF Withdrawal Form-19Sukhveer SinghNo ratings yet

- BO Account Open FormDocument2 pagesBO Account Open FormMohammad RumanNo ratings yet

- Punjab National Bank: Application-cum-Appraisal/Sanction Form For Personal Loan Part - I Applicant InformationDocument4 pagesPunjab National Bank: Application-cum-Appraisal/Sanction Form For Personal Loan Part - I Applicant InformationArun BhaleraoNo ratings yet

- Ad Campaign 3Document16 pagesAd Campaign 3Ankit SinghNo ratings yet

- Loan ApplicationDocument4 pagesLoan ApplicationEduciti MumbaiNo ratings yet

- Application for Valuer EmpanelmentDocument3 pagesApplication for Valuer EmpanelmentNishkam GuptaNo ratings yet

- Attonbank Loan Application: Section One - Personal DetailsDocument4 pagesAttonbank Loan Application: Section One - Personal DetailsJosé María Castañeda BautistaNo ratings yet

- Department of Home Affairs DH1738 Form 8Document11 pagesDepartment of Home Affairs DH1738 Form 8Zahidur Ovi RahmanNo ratings yet

- AffidavitDocument2 pagesAffidavitHaridaspulpetta PNo ratings yet

- RLCmembershipformDocument1 pageRLCmembershipformjohnd5108No ratings yet

- SB Form 01Document2 pagesSB Form 01Tony M.TomyNo ratings yet

- Infovalley Mart (Application Form)Document12 pagesInfovalley Mart (Application Form)Ankit SinghNo ratings yet

- Maturity Claim (Form No.3825)Document3 pagesMaturity Claim (Form No.3825)Sarvepalli Uday KiranNo ratings yet

- Maturity Form No 3825Document3 pagesMaturity Form No 3825roshansm1978No ratings yet

- LIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFDocument3 pagesLIC Claim Form 3825 Discharge Voucher For Pollicy Maturity PDFVasudeva AcharyaNo ratings yet

- Maturity Claim (Form No.3825)Document3 pagesMaturity Claim (Form No.3825)PrasanthNo ratings yet

- Maturity Claim (Form No.3825)Document3 pagesMaturity Claim (Form No.3825)PrasanthNo ratings yet

- Form No. 3825 DischargeDocument3 pagesForm No. 3825 DischargePrasanthNo ratings yet

- Maturity Claim (Form No.3825) PDFDocument3 pagesMaturity Claim (Form No.3825) PDFRajeev Ranjan100% (1)

- Form No. 3825 Life Insurance Corporation of India (Established by The Life Insurance Corporation Act, 1956)Document3 pagesForm No. 3825 Life Insurance Corporation of India (Established by The Life Insurance Corporation Act, 1956)RubyNo ratings yet

- Opening PPF & SSA Accounts in CBS-2Document8 pagesOpening PPF & SSA Accounts in CBS-2praveenaNo ratings yet

- Form - 1 Application For Opening An Account: Paste Photograph of Applicant/sDocument9 pagesForm - 1 Application For Opening An Account: Paste Photograph of Applicant/sSundar RajanNo ratings yet

- To The Postmaster : For Use of Post OfficeDocument2 pagesTo The Postmaster : For Use of Post OfficeSuvodip EtcNo ratings yet

- Form 19Document3 pagesForm 1919CS224 Sarathy.RNo ratings yet

- Police Clearance CertificateDocument2 pagesPolice Clearance Certificateapi-19764505No ratings yet

- INDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022Document4 pagesINDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022macklean lionelNo ratings yet

- Proformas of Service BookDocument25 pagesProformas of Service BookToshiba Tv100% (1)

- Maturity Discharge Form No.3825Document2 pagesMaturity Discharge Form No.3825ranju ramachandranNo ratings yet

- KGB SB - CA - Opening - FormDocument3 pagesKGB SB - CA - Opening - FormbagfrstyNo ratings yet

- Panvel Indiabulls Greens Mega Mall Application FormDocument24 pagesPanvel Indiabulls Greens Mega Mall Application FormsharmaabhayNo ratings yet

- SECI000128-4710908-Annexure2toAmdt02.docxDocument6 pagesSECI000128-4710908-Annexure2toAmdt02.docxMuskmelon gamerNo ratings yet

- Contractors FormDocument5 pagesContractors FormALMARZOOL TVNo ratings yet

- Ssy All Forms 09 08Document9 pagesSsy All Forms 09 08raja.alifnoorNo ratings yet

- Tick The One That Is Applicable To You Below.: Form KPF 3. VDocument1 pageTick The One That Is Applicable To You Below.: Form KPF 3. VTimoara NatanNo ratings yet

- Notice and Proof of Claim For Disability BenefitsDocument4 pagesNotice and Proof of Claim For Disability BenefitsabramovrNo ratings yet

- CASTE CERTIFICATEDocument3 pagesCASTE CERTIFICATEdhehi332No ratings yet

- Loan Application and Agreement FormDocument4 pagesLoan Application and Agreement Formedward biwottNo ratings yet

- 1 Account Opening Form PDFDocument3 pages1 Account Opening Form PDFRavi AgarwalNo ratings yet

- Nzcs 224 Trade Single Window Client Registration Application BG PatchettDocument16 pagesNzcs 224 Trade Single Window Client Registration Application BG PatchettBrett PatchettNo ratings yet

- IPOapplicationfor RBDocument1 pageIPOapplicationfor RBriadhridoyNo ratings yet

- Thank You For Your Interest in Opening A Chase AccountDocument2 pagesThank You For Your Interest in Opening A Chase AccountVeronica BowmanNo ratings yet

- Applicants Guardian Personal Information FormDocument1 pageApplicants Guardian Personal Information Formsharif261No ratings yet

- Mid-Term Examination Batch: 10, Semester: 2 Course Name: Financial Accounting Course Code: MKT 108Document2 pagesMid-Term Examination Batch: 10, Semester: 2 Course Name: Financial Accounting Course Code: MKT 108sharif261No ratings yet

- Copper Industry OverviewDocument1 pageCopper Industry Overviewsharif261No ratings yet

- Mid-Term Examination Batch: 10, Semester: 2 Course Name: Financial Accounting Course Code: MKT 108Document2 pagesMid-Term Examination Batch: 10, Semester: 2 Course Name: Financial Accounting Course Code: MKT 108sharif261No ratings yet

- NEW TopicDocument1 pageNEW Topicsharif261No ratings yet

- Internet Banking Application Form Hasana01Document2 pagesInternet Banking Application Form Hasana01sharif261No ratings yet

- E VSK MGŠ Q Weeiyxi Bgybv QKDocument1 pageE VSK MGŠ Q Weeiyxi Bgybv QKsharif261No ratings yet

- Concern For PeopleDocument1 pageConcern For Peoplesharif261No ratings yet

- Bank Management Course 3503Document1 pageBank Management Course 3503sharif261No ratings yet

- TopicDocument1 pageTopicsharif261No ratings yet

- E VSK MGŠ Q Weeiyxi Bgybv QKDocument1 pageE VSK MGŠ Q Weeiyxi Bgybv QKsharif261No ratings yet

- ApplicationDocument1 pageApplicationsharif261No ratings yet

- Mahatma Gandhi's principles of business ethicsDocument17 pagesMahatma Gandhi's principles of business ethicsghsjgjNo ratings yet

- Wnmveweáv Bi Cöv - WGK Av JVPBV: (Introductory Discussion On Accounting)Document84 pagesWnmveweáv Bi Cöv - WGK Av JVPBV: (Introductory Discussion On Accounting)sharif261No ratings yet

- Assignment 8th BatchDocument1 pageAssignment 8th Batchsharif261No ratings yet

- Mubarok Hossain CVDocument3 pagesMubarok Hossain CVsharif261No ratings yet

- Department of Marketing: Jahangirnagar University Quiz TestDocument1 pageDepartment of Marketing: Jahangirnagar University Quiz TestShariful IslamNo ratings yet

- CSR Strategy ImplementationDocument31 pagesCSR Strategy Implementationsharif261No ratings yet

- Mahatma Gandhi's principles of business ethicsDocument17 pagesMahatma Gandhi's principles of business ethicsghsjgjNo ratings yet

- Welq: Cövc Uvkv Av'V Q MN HVWMZV CömDocument3 pagesWelq: Cövc Uvkv Av'V Q MN HVWMZV Cömsharif261No ratings yet

- Two Theories of Business EthicsDocument4 pagesTwo Theories of Business Ethicssharif261No ratings yet

- 10 Ways To Protect Your Intellectual PropertyDocument10 pages10 Ways To Protect Your Intellectual Propertysharif261No ratings yet

- Welq: Cövc Uvkv Av'V Q MN HVWMZV CömDocument3 pagesWelq: Cövc Uvkv Av'V Q MN HVWMZV Cömsharif261No ratings yet

- Department of Marketing: Jahangirnagar University Quiz TestDocument1 pageDepartment of Marketing: Jahangirnagar University Quiz TestShariful IslamNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- MIDTERM EXAM - Mahardika Ayunda C1I019034 AKMDocument12 pagesMIDTERM EXAM - Mahardika Ayunda C1I019034 AKMMahardika AyundaNo ratings yet

- Basava Sir - Rau's Economics ClassDocument32 pagesBasava Sir - Rau's Economics ClassDivyajeet Singh Champawat100% (1)

- Morpheus Proposal PoLL 2Document12 pagesMorpheus Proposal PoLL 2Papers of the Libertarian LeftNo ratings yet

- Nicanor Perlas PlatformDocument20 pagesNicanor Perlas PlatformManuel L. Quezon IIINo ratings yet

- Bilt Annual ReportDocument94 pagesBilt Annual Reportbobbilia3100% (1)

- Frederick C. Fisher V. Wenceslao Trinidad, GR No. 17518, 1922-10-30Document84 pagesFrederick C. Fisher V. Wenceslao Trinidad, GR No. 17518, 1922-10-30Reia RuecoNo ratings yet

- Njord - Mislov, Mauro - Za Slanje PDFDocument9 pagesNjord - Mislov, Mauro - Za Slanje PDFMauroNo ratings yet

- American Home Assurance Company vs Antonio Chua - Insurance Policy Binding Despite Premium Payment DisputeDocument10 pagesAmerican Home Assurance Company vs Antonio Chua - Insurance Policy Binding Despite Premium Payment DisputeApay GrajoNo ratings yet

- Workshop E-Filing of TaxDocument2 pagesWorkshop E-Filing of TaxFaisal MemonNo ratings yet

- Computing The NET PAYDocument21 pagesComputing The NET PAYRoss Christian Corpuz ManuelNo ratings yet

- Universal Basic Income and The Burkhard WehnerDocument83 pagesUniversal Basic Income and The Burkhard WehnerMarian KaliszNo ratings yet

- Cca 1990-91Document314 pagesCca 1990-91Samples Ames PLLCNo ratings yet

- PWC Tax Function of The FutureDocument24 pagesPWC Tax Function of The FutureDemewez AsfawNo ratings yet

- LTA OracleDocument1 pageLTA OracleVishwanath Gaur100% (1)

- Jashu Negi Summer Training Report On IDBIDocument63 pagesJashu Negi Summer Training Report On IDBIjashu negiNo ratings yet

- Swanzy RidgeDocument21 pagesSwanzy RidgeRyan SloanNo ratings yet

- Taxation Pepsi-Cola Bottling Comp Vs City of Butuan (1968)Document9 pagesTaxation Pepsi-Cola Bottling Comp Vs City of Butuan (1968)ms_lawyerNo ratings yet

- Big Bang Edge Test: Your Offer LetterDocument4 pagesBig Bang Edge Test: Your Offer LetterShubham AwasthiNo ratings yet

- GST White Paper in PDFDocument14 pagesGST White Paper in PDFReggeloNo ratings yet

- Intercompany Inventory and Land Profits: Solutions Manual, Chapter 6Document40 pagesIntercompany Inventory and Land Profits: Solutions Manual, Chapter 6HelloWorldNowNo ratings yet

- Pre-Investment Study District Dera Ghazi Khan: Directorate of Industries, Punjab, Poonch House, Multan Road, LahoreDocument37 pagesPre-Investment Study District Dera Ghazi Khan: Directorate of Industries, Punjab, Poonch House, Multan Road, LahoreJinnNo ratings yet

- Alveo Land Accreditation Contract 2012Document7 pagesAlveo Land Accreditation Contract 2012Zulueta Jing MjNo ratings yet

- Revenue Regulation No. 16-05Document62 pagesRevenue Regulation No. 16-05Raymond Atanacio100% (1)