Professional Documents

Culture Documents

3-1A 5 Types of Adjustments: Required

Uploaded by

Ryoma EchizenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3-1A 5 Types of Adjustments: Required

Uploaded by

Ryoma EchizenCopyright:

Available Formats

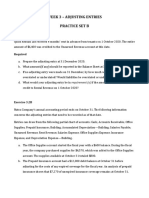

3-1A 5 types of Adjustments

This problem explores 5 common types of adjusting journal entries. All problems relate to ABC

Company, which has a fiscal year-end of December 31.

a.) Prepaid expenses - Insurance

ABC Company purchases a one-year insurance policy on June 1, 2024 for $1,800 cash.

Required

Record the entry for the purchase of insurance and for the year-end adjustment. b.)

Depreciation

ABC Company purchases a vehicle on August 31, 2024 for $12,000 cash. The vehicle is expected to

be useful for 10-years, after which time it will have no residual value. The company wishes to use

straight-line depreciation.

Required

Record the journal entry for the purchase of the vehicle and for the year-end adjustment.

c.) Accrued expenses - Interest

On May 1, 2024, ABC Company borrows $10,000 from the bank and signs a note payable. The debt

carries annual interest of 6% and is repaid in full (with interest) on July 1, 2025.

Required

Record the journal entry for the initial borrowing, the year-end adjustment and the repayment of the

debt.

d.) Accrued revenues

As at December 31, 2024, ABC Company had provided 3 months of consulting service to a client at a

rate of $1,000 per month, but had not yet billed the client or collected any money. On January 31, 2025

the client was billed for four months of service and paid one week later on February 8, 2025.

Required

Record the journal entry for the year-end adjustment, and any other entries required.

e.) Unearned revenues

A client pre-pays ABC Company on November 1, 2024 for five months of consulting service (from

November through the end of March). The company pays $15,000. ABC Company earns the money

evenly over the life of the project, and has fulfilled its obligations up to December 31.

Required

Record the journal entry November 1 and for the year-end adjustment.

You might also like

- AccountingDocument2 pagesAccountingRyoma EchizenNo ratings yet

- A.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesDocument1 pageA.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesRyoma EchizenNo ratings yet

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizNo ratings yet

- Activity: Notes PayableDocument3 pagesActivity: Notes PayablePiaNo ratings yet

- 3-2A Recording Transactions and Adjusting Entries: RequiredDocument1 page3-2A Recording Transactions and Adjusting Entries: RequiredRyoma EchizenNo ratings yet

- Tutorial 8Document6 pagesTutorial 8Waruna PrabhaswaraNo ratings yet

- 19 Questions Financial Asset at Amortized Cost 2Document1 page19 Questions Financial Asset at Amortized Cost 2bernadeth.lorzanoNo ratings yet

- Adjusting Entry Part 2Document4 pagesAdjusting Entry Part 2Ken DiNo ratings yet

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- ACC101 - Chap 3 - SPR2020Document1 pageACC101 - Chap 3 - SPR2020Hà TrangNo ratings yet

- Illustrative Examples - Bonds PayableDocument2 pagesIllustrative Examples - Bonds PayableChuchi SubardiagaNo ratings yet

- Ch3 - Practice Set BDocument2 pagesCh3 - Practice Set BHan Hung GiaNo ratings yet

- Adjsuting EntriesDocument3 pagesAdjsuting Entrieshs927071No ratings yet

- (INTACC2) Sample ProblemsDocument8 pages(INTACC2) Sample ProblemsAngelyn AmadorNo ratings yet

- Saminar 10Document1 pageSaminar 10Nam Phạm Lê NhậtNo ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Module 8 - THEORIESDocument5 pagesModule 8 - THEORIESFiona MiralpesNo ratings yet

- Adjusting Entries PracticeDocument11 pagesAdjusting Entries Practiceback4peaceNo ratings yet

- 2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)Document2 pages2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)max pNo ratings yet

- Acc 112 MockDocument10 pagesAcc 112 Mockالسيد علي علوي السيد خليل إبراهيمNo ratings yet

- Quiz 12 (Bonds)Document1 pageQuiz 12 (Bonds)Panda ErarNo ratings yet

- Aqil Zizov MUhasibat U Otu Imtahan SuallarDocument23 pagesAqil Zizov MUhasibat U Otu Imtahan SuallarKamran AslanNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- ReviewerDocument19 pagesReviewerLyca Jane OlamitNo ratings yet

- Chapter 3 Practice QuestionsDocument6 pagesChapter 3 Practice QuestionsRishi KamalNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- PDF DocumentDocument4 pagesPDF DocumentYarka Buuqa Neceb MuuseNo ratings yet

- Fin 300 Exam PracticeDocument6 pagesFin 300 Exam PracticePhillip Lee0% (1)

- Notes Payable ActivityDocument2 pagesNotes Payable ActivityAl-Ameen P. MacabaningNo ratings yet

- Cfas Quiz Pas 19Document5 pagesCfas Quiz Pas 19Michaella NudoNo ratings yet

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- AC3202 - 20202021B - Exam PaperDocument9 pagesAC3202 - 20202021B - Exam PaperlawlokyiNo ratings yet

- Test Bank Notes ReceivableDocument5 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Financial Reporting Exam BAFEDocument3 pagesFinancial Reporting Exam BAFEUsman BalochNo ratings yet

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- Assignment #1 QuestionsDocument3 pagesAssignment #1 QuestionsSmelly DonkeyNo ratings yet

- E3 Adjusting Entries - QuestionsDocument3 pagesE3 Adjusting Entries - QuestionsHuzaifanadeemNo ratings yet

- S - Adjusting Entry ProblemsDocument4 pagesS - Adjusting Entry ProblemsYusra PangandamanNo ratings yet

- U 6200 - Accounting For International and Public Affairs Session 4: Pre-Class Assignment Accrual AccountingDocument3 pagesU 6200 - Accounting For International and Public Affairs Session 4: Pre-Class Assignment Accrual Accountingsachin_sacNo ratings yet

- Financial Accounting Part 1Document5 pagesFinancial Accounting Part 1Christopher Price100% (1)

- Midterm Spring 2020: Principles of Accounting (Principles of Accounting-ACCS2003-Section 1)Document7 pagesMidterm Spring 2020: Principles of Accounting (Principles of Accounting-ACCS2003-Section 1)IrfanNo ratings yet

- Exam For Accounting 4Document7 pagesExam For Accounting 4HamieWave TVNo ratings yet

- RISE ITA Model Paper SolutionDocument15 pagesRISE ITA Model Paper Solutionzaffiii.293No ratings yet

- Midterms Part 1Document3 pagesMidterms Part 1Chris CastleNo ratings yet

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- FR L9.1-9.2 Financial InstrumentsDocument9 pagesFR L9.1-9.2 Financial InstrumentsPrachanda BhandariNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- đề kiểm tra nguyên lý kế toán 1 2Document5 pagesđề kiểm tra nguyên lý kế toán 1 2Lê Thanh HuyềnNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNo ratings yet

- Quiz 5 ReceivablesDocument1 pageQuiz 5 ReceivablesPanda ErarNo ratings yet

- FA Adjusting Entries ReviewDocument11 pagesFA Adjusting Entries ReviewNicka MinasNo ratings yet

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- AccountDocument3 pagesAccountSk SinghNo ratings yet

- Acc423 in 2015 Better City Received 5000000 of BondDocument8 pagesAcc423 in 2015 Better City Received 5000000 of BondDoreenNo ratings yet

- Illustrative Examples - Notes and Loans ReceivableDocument4 pagesIllustrative Examples - Notes and Loans ReceivableMelrose Eugenio ErasgaNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Basic Cash Flow Statemen2Document2 pagesBasic Cash Flow Statemen2Ryoma EchizenNo ratings yet

- 1-3B Basic Financial StatementsDocument1 page1-3B Basic Financial StatementsRyoma EchizenNo ratings yet

- Adv Acc 6Document1 pageAdv Acc 6Ryoma EchizenNo ratings yet

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- Basic Accounting4Document1 pageBasic Accounting4Ryoma EchizenNo ratings yet

- 2-1B Basic Journal Entries - New Company: March 1Document1 page2-1B Basic Journal Entries - New Company: March 1Ryoma EchizenNo ratings yet

- Basic Accounting3Document1 pageBasic Accounting3Ryoma EchizenNo ratings yet

- 2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Document1 page2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Ryoma EchizenNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- Bank Reconciliation1Document2 pagesBank Reconciliation1Ryoma EchizenNo ratings yet

- 3A Adjusting EntriesDocument2 pages3A Adjusting EntriesRyoma Echizen0% (1)

- 3 Closing EntriesDocument2 pages3 Closing EntriesRyoma Echizen0% (1)

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- Bank ReconciliationDocument2 pagesBank ReconciliationRyoma EchizenNo ratings yet

- Receivables Practice Test1Document1 pageReceivables Practice Test1Ryoma EchizenNo ratings yet

- Bank Reconciliation2Document2 pagesBank Reconciliation2Ryoma EchizenNo ratings yet

- Solution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Document1 pageSolution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Ryoma EchizenNo ratings yet