Professional Documents

Culture Documents

Basic Accounting3

Uploaded by

Ryoma Echizen0 ratings0% found this document useful (0 votes)

40 views1 pageTeacher's Pet Tutoring Service paid off accounts payable and various expenses in April. They also collected on accounts receivable, purchased supplies and new computers, borrowed from the bank, and billed and collected for tutoring services. Journal entries were made for these transactions and posted to T-accounts to prepare a trial balance as of April 30.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTeacher's Pet Tutoring Service paid off accounts payable and various expenses in April. They also collected on accounts receivable, purchased supplies and new computers, borrowed from the bank, and billed and collected for tutoring services. Journal entries were made for these transactions and posted to T-accounts to prepare a trial balance as of April 30.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views1 pageBasic Accounting3

Uploaded by

Ryoma EchizenTeacher's Pet Tutoring Service paid off accounts payable and various expenses in April. They also collected on accounts receivable, purchased supplies and new computers, borrowed from the bank, and billed and collected for tutoring services. Journal entries were made for these transactions and posted to T-accounts to prepare a trial balance as of April 30.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

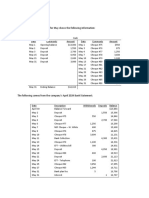

2-3B Journal Entries, T-Accounts, Trial Balance – Existing Company

Teacher’s Pet Tutoring Service provides extra help for students. The company has been operating

successfully for several years and has the following account balances entering April: Cash $8,000;

Accounts Receivable $1,500; Supplies $5,000; Computers (net) $15,000; Accounts Payable $300; Bank

Loan Payable $3,500; Common Shares $50; Retained Earnings $25,650. The following transactions

occurred in April:

April 1 Paid off account payable owing from March.

April 3 Paid $3,000 for advertising for the month of April.

April 4 Purchased supplies on account: $1,000.

April 6 Collected the $1,500 receivable from March.

April 8 Received, but did not pay a $250 electricity bill.

April 12

An employee who was short of money borrowed $500. He signed a note and promised

to repay the company after payday. He is a good employee and the company chose not

to charge him any interest or fees.

April 15 Paid employees’ salaries of $4,000.

April 18 Employee repaid the $500 loan.

April 20 Borrowed $10,000 from the bank with the intention of purchasing new computers.

April 21 Purchased new computers $8,500.

April 24 Received and paid telephone bill $150.

April 26 Paid employees’ salaries of $4,000.

April 29 Paid electricity bill received on April 8.

April 30 Paid interest on the loans for the month of $100.

Billed $18,000 for the month of tutoring service. Collected $16,000 in cash, awaiting

April 30

payment for the remainder.

Required:

a.) Record all necessary journal entries based on the transactions above.

b.) Post the transactions to T-Accounts.

c.) Prepare a trial balance dated April 30.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Principles of Accounting Lecture 4Document5 pagesPrinciples of Accounting Lecture 4Masum HossainNo ratings yet

- Chapter-1 AssignmentDocument3 pagesChapter-1 AssignmentDev ChatterjeeNo ratings yet

- Learning Task 3 and 4Document3 pagesLearning Task 3 and 4Alyana NoraNo ratings yet

- Basic Accounting4Document1 pageBasic Accounting4Ryoma EchizenNo ratings yet

- Chapter 2 Accounting - ContinuationDocument2 pagesChapter 2 Accounting - ContinuationKatrinaNo ratings yet

- Quiz - 1a (Bba 2C)Document2 pagesQuiz - 1a (Bba 2C)mahistudyaccNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- Name: Rafay Naeem Section: BSIT-3B Arid: 2019-Arid-3235 Assignment: 01 Assignment 02Document26 pagesName: Rafay Naeem Section: BSIT-3B Arid: 2019-Arid-3235 Assignment: 01 Assignment 02Rafay Khan RiffiNo ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Fin. Acc. Chapter-2 Tabular AnalysisDocument2 pagesFin. Acc. Chapter-2 Tabular AnalysisFayez AmanNo ratings yet

- 2009-04-17 160040 KellyDocument17 pages2009-04-17 160040 KellyKaran NaikNo ratings yet

- Accounting Final SyllabusDocument8 pagesAccounting Final SyllabusRoufRobin0% (1)

- Group AssignmentDocument2 pagesGroup AssignmentHoang Bich Kha NgoNo ratings yet

- Penn Foster Accounting 06168900 ProjectDocument3 pagesPenn Foster Accounting 06168900 ProjectatifamanNo ratings yet

- Cash Book PracticeDocument2 pagesCash Book Practicenickdrag200No ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- Date Transaction: The Following Table Shows The Journal Entries For The Above EventsDocument2 pagesDate Transaction: The Following Table Shows The Journal Entries For The Above Eventsnishanth_90No ratings yet

- Problems To Be Completed ManuallyDocument2 pagesProblems To Be Completed Manuallysk3 khanNo ratings yet

- Exercise For Chapter 2Document2 pagesExercise For Chapter 2Bui AnhNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocument3 pagesRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- Catatan: Cross Chek Untuk Jawaban Anda:: (A) Total Assets $20,800 (B) Net Income $5,600 (C) Cash $14,600Document2 pagesCatatan: Cross Chek Untuk Jawaban Anda:: (A) Total Assets $20,800 (B) Net Income $5,600 (C) Cash $14,600Riani AzkiaNo ratings yet

- Journal Entry QuestionsDocument2 pagesJournal Entry QuestionsFarman Afzal100% (1)

- Journal Entry QuestionsDocument5 pagesJournal Entry QuestionsFareeha NazNo ratings yet

- Chapter 3 - Practice ProblemsDocument6 pagesChapter 3 - Practice ProblemsRosa Julia LawrenceNo ratings yet

- Funda Manual Chapter 5 ExercisesDocument8 pagesFunda Manual Chapter 5 ExercisesRimuruNo ratings yet

- Accounting ExampleDocument1 pageAccounting ExampleMeetNo ratings yet

- Excercise Chapter 2Document2 pagesExcercise Chapter 2Loan VũNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna GunioNo ratings yet

- Principles of Accounting Assignment 1Document1 pagePrinciples of Accounting Assignment 1amir azamNo ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Ccounting: Recording Business TransactionsDocument38 pagesCcounting: Recording Business TransactionsGutierrez Ronalyn Y.No ratings yet

- Accounting Equation-Examples and ProblemsDocument3 pagesAccounting Equation-Examples and ProblemsMuhammed Hasan100% (3)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Spring '21 North South University Hhq1 School of Business, BbaDocument4 pagesSpring '21 North South University Hhq1 School of Business, BbaMushfiqur RahmanNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- AccountingexplainedDocument3 pagesAccountingexplainedRamkrishna ChoudhuryNo ratings yet

- Accounting AssDocument2 pagesAccounting Assremou95No ratings yet

- Bank Reconciliation ActivitiesDocument1 pageBank Reconciliation Activitiesmaligaya evelynNo ratings yet

- Double Entry System TestDocument2 pagesDouble Entry System TestHuma EssaNo ratings yet

- New Microsoft Office Word DocumentDocument11 pagesNew Microsoft Office Word DocumentkhandakeralihossainNo ratings yet

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- Assignment For MBA StudentsDocument2 pagesAssignment For MBA Studentsadane bayeNo ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- Fin. Acc - Chapter-2 JournalDocument4 pagesFin. Acc - Chapter-2 JournalFayez AmanNo ratings yet

- Exercises Before Mid-TermDocument6 pagesExercises Before Mid-TermSalmo AbdallaNo ratings yet

- Extra ExerciseDocument1 pageExtra ExerciseVall HallaNo ratings yet

- BT Tự LuyệnDocument4 pagesBT Tự LuyệnNguyen TrangNo ratings yet

- PROBLEMDocument3 pagesPROBLEMVine Vine D (Viney23rd)0% (6)

- Principles of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsDocument3 pagesPrinciples of Accounting Spring 2022 Bba 1-A & B Worksheet No 1: Basic Accounting Equation - Identification of AccountsYumna TauqeerNo ratings yet

- Exercises Chapter 23Document13 pagesExercises Chapter 23Le TrungNo ratings yet

- CH 01Document2 pagesCH 01vivien0% (1)

- Chapter 2 Math For PracticeDocument3 pagesChapter 2 Math For Practiceehratul.bagNo ratings yet

- 442582886-Problem 3Document3 pages442582886-Problem 3gwapoNo ratings yet

- Assignment 1Document8 pagesAssignment 1SaidurRahamanNo ratings yet

- Basic Cash Flow Statemen2Document2 pagesBasic Cash Flow Statemen2Ryoma EchizenNo ratings yet

- Adv Acc 6Document1 pageAdv Acc 6Ryoma EchizenNo ratings yet

- 1-3B Basic Financial StatementsDocument1 page1-3B Basic Financial StatementsRyoma EchizenNo ratings yet

- 2-1B Basic Journal Entries - New Company: March 1Document1 page2-1B Basic Journal Entries - New Company: March 1Ryoma EchizenNo ratings yet

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- 3A Adjusting EntriesDocument2 pages3A Adjusting EntriesRyoma Echizen0% (1)

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- 2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Document1 page2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Ryoma EchizenNo ratings yet

- Receivables Practice Test1Document1 pageReceivables Practice Test1Ryoma EchizenNo ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- Bank Reconciliation1Document2 pagesBank Reconciliation1Ryoma EchizenNo ratings yet

- Bank ReconciliationDocument2 pagesBank ReconciliationRyoma EchizenNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- Bank Reconciliation2Document2 pagesBank Reconciliation2Ryoma EchizenNo ratings yet

- 3 Closing EntriesDocument2 pages3 Closing EntriesRyoma Echizen0% (1)

- Solution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Document1 pageSolution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Ryoma EchizenNo ratings yet