Professional Documents

Culture Documents

3A Adjusting Entries

Uploaded by

Ryoma Echizen0%(1)0% found this document useful (1 vote)

40 views2 pagesNetlock Security provided an unadjusted trial balance and adjustments needing to be made at fiscal year-end June 30, 2024. Adjusting entries were required for supplies, prepaid insurance, depreciation of computers, interest on a note payable, unearned revenue, accrued salaries, and unbilled services. An adjusted trial balance was prepared using the adjusting entries. From the adjusted trial balance, financial statements including an income statement, statement of changes in equity, and balance sheet were prepared. Closing entries were also required to close revenue and expense accounts to retained earnings at fiscal year-end.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNetlock Security provided an unadjusted trial balance and adjustments needing to be made at fiscal year-end June 30, 2024. Adjusting entries were required for supplies, prepaid insurance, depreciation of computers, interest on a note payable, unearned revenue, accrued salaries, and unbilled services. An adjusted trial balance was prepared using the adjusting entries. From the adjusted trial balance, financial statements including an income statement, statement of changes in equity, and balance sheet were prepared. Closing entries were also required to close revenue and expense accounts to retained earnings at fiscal year-end.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

40 views2 pages3A Adjusting Entries

Uploaded by

Ryoma EchizenNetlock Security provided an unadjusted trial balance and adjustments needing to be made at fiscal year-end June 30, 2024. Adjusting entries were required for supplies, prepaid insurance, depreciation of computers, interest on a note payable, unearned revenue, accrued salaries, and unbilled services. An adjusted trial balance was prepared using the adjusting entries. From the adjusted trial balance, financial statements including an income statement, statement of changes in equity, and balance sheet were prepared. Closing entries were also required to close revenue and expense accounts to retained earnings at fiscal year-end.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

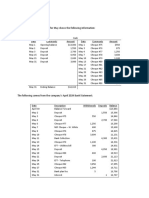

3A Adjusting Entries, the Adjusted Trial Balance Worksheet, Financial Statements and

Closing Entries (and the kitchen sink.)

Below is the June 30, 2024 unadjusted trial balance of Netlock Security, a firm that offers hacking prevention

services to large companies.

Unadjusted TB Adjustments Adjusted TB

DR CR DR CR DR CR

Cash $38,000

Accounts receivable 12,000

Supplies 5,000

Prepaid insurance 28,000

Computers 214,000

A.D. – Computers $46,000

Accounts payable 8,000

Salaries payable

Interest payable

Unearned security revenue 15,000

Note payable 30,000

Common shares 40,000

Retained earnings 87,000

Dividends 10,000

Security revenue 485,000

Salaries expense 320,000

Interest expense

Depreciation expense

Supplies expense

Repairs expense 17,000

Insurance expense

Rent expense 60,000

Income tax expense 7,000

Total $711,000 $711,000

The company’s fiscal year end is June 30, and the following items require adjustment:

a.) A count of supplies reveals $300 were on hand on June 30.

b.) The $28,000 insurance policy was purchased on March 1, 2024.

c.) The computers were purchased years ago for 214,000. At the time of purchase, the estimated life of the

computers was 10 years with no estimated residual value.

d.) The $30,000 note payable was issued on February 1, 2024 and accrues interest at a 10% annual rate. The

note is expected to be repaid in late-2024.

e.) On May 1, 2024 the company entered into a 3-month contract to provide security for a major corporation,

the corporation paid $15,000 for their 3-month contract on May 1, and that amount was correctly

recorded as unearned revenue. On June 30, Netlock had fulfilled the first 2 months of the contract.

f.) The company had three employees who were owed for two days of salaries at year end. Each employee

earns $250 per day.

g.) On June 1, 2024, the company entered into an agreement to provide service for a new client at a rate of

$4,000 per month. At the end of June, the client had received their first month of service but had not yet

been billed.

Required:

a.) As necessary, record adjusting journal entries based on items a.) through g.) above.

b.) Using your adjusting journal entries, complete the adjusted trial balance.

c.) Based on the adjusted trial balance, prepare an income statement, statement of changes in equity and a

balance sheet. Assume no common shares were issued during the year.

Prepare closing entries for the company.

You might also like

- ACC 2101 CA1 With TemplateDocument8 pagesACC 2101 CA1 With TemplatedeboevaniaNo ratings yet

- ACC1101-MT Exam Q-Sem2-22-23Document5 pagesACC1101-MT Exam Q-Sem2-22-23aainaazam04No ratings yet

- Faisal WorksheetDocument5 pagesFaisal WorksheetAbdul MateenNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Fca Tax Ican November 2023 Mock QuestionsDocument8 pagesFca Tax Ican November 2023 Mock QuestionsArogundade kamaldeenNo ratings yet

- ExtAud 3 Quiz 4 Wo AnswersDocument5 pagesExtAud 3 Quiz 4 Wo AnswersJANET ILLESESNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Accounting CycleDocument5 pagesAccounting Cycleruth san jose100% (1)

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- F3 Progress 2 QuestionDocument10 pagesF3 Progress 2 QuestiontommydunkNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- 2 Financial Accounting ReportingDocument5 pages2 Financial Accounting ReportingBizness Zenius HantNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsDe CemNo ratings yet

- Local Media9025184987896819828Document2 pagesLocal Media9025184987896819828Nuriyam ToledoNo ratings yet

- Mauritian Taxation - Ba Acctg and FinanceDocument8 pagesMauritian Taxation - Ba Acctg and Financemissyemylia27novNo ratings yet

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- The Complete Accounting CycleDocument2 pagesThe Complete Accounting CycleAiman KhanNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Week 11 Tutorial SolutionsDocument6 pagesWeek 11 Tutorial SolutionsFarah PatelNo ratings yet

- Work Sheet On Financial AccountingDocument3 pagesWork Sheet On Financial AccountingFantayNo ratings yet

- Fundamentals of Accounting QE (Suggested)Document7 pagesFundamentals of Accounting QE (Suggested)JamesNo ratings yet

- ACY 53 Summative Exam 2 CH 26 28 Answer KeyDocument3 pagesACY 53 Summative Exam 2 CH 26 28 Answer KeyAMIKO OHYANo ratings yet

- Final Exam Review QuestionsDocument16 pagesFinal Exam Review QuestionsAj201819No ratings yet

- Accounting - UEB - Mock Test 2 - STDDocument14 pagesAccounting - UEB - Mock Test 2 - STDTiến NguyễnNo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Current Liabilities and WarrantiesDocument5 pagesCurrent Liabilities and WarrantiesJames AngklaNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Liabilities Part 2Document4 pagesLiabilities Part 2Jay LloydNo ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- Audit of Liabilities Quiz 3Document3 pagesAudit of Liabilities Quiz 3Cattleya50% (2)

- CARAGA Finals-FABM1 SHSABM11-6Document22 pagesCARAGA Finals-FABM1 SHSABM11-6eshanecaragaNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Financial Problems Jan 19Document17 pagesFinancial Problems Jan 19ledmabaya23No ratings yet

- Revenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Document5 pagesRevenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Kristen0% (1)

- Activity 4 Ch293031 Drill With Answer KeyDocument2 pagesActivity 4 Ch293031 Drill With Answer KeyMABI ESPENIDONo ratings yet

- FAR Problem Quiz 2 !Document6 pagesFAR Problem Quiz 2 !Ednalyn CruzNo ratings yet

- Liabilities QuizDocument5 pagesLiabilities QuizVanshee 11No ratings yet

- Uia Cap 1 Acco 1161 FOR StudentsDocument3 pagesUia Cap 1 Acco 1161 FOR StudentsPatricia TorresNo ratings yet

- HaloCrypto Cumulative Case Tutorial QuestionsDocument6 pagesHaloCrypto Cumulative Case Tutorial QuestionsLim ShawnNo ratings yet

- Liabilities With SolutionsDocument17 pagesLiabilities With SolutionsJr TanNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- Barrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Document4 pagesBarrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Alishba KhanNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- ACC 1100 Day 06&07 Columbia ExampleDocument2 pagesACC 1100 Day 06&07 Columbia ExampleMai Anh ĐàoNo ratings yet

- Bbfa1103 Assigment Question 2023Document13 pagesBbfa1103 Assigment Question 2023Bdq ArrogantNo ratings yet

- Teamwork For Ibl1201Document16 pagesTeamwork For Ibl1201Thanh Phat Nguyen MyNo ratings yet

- IAS 12 - Promotianal Assesment 2024Document2 pagesIAS 12 - Promotianal Assesment 2024abraham johannesNo ratings yet

- Accounting MathDocument4 pagesAccounting Mathhabib50% (2)

- Adam Lee Trial Balance As at 31 May 2023: RequiredDocument48 pagesAdam Lee Trial Balance As at 31 May 2023: Requirednguyenphamnhungoc51No ratings yet

- Intermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreDocument20 pagesIntermediate Accounting 1 First Grading Examination: Name: Date: Professor: Section: ScoreJulia Andrea Yting100% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Basic Cash Flow Statemen2Document2 pagesBasic Cash Flow Statemen2Ryoma EchizenNo ratings yet

- 1-3B Basic Financial StatementsDocument1 page1-3B Basic Financial StatementsRyoma EchizenNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- 2-1B Basic Journal Entries - New Company: March 1Document1 page2-1B Basic Journal Entries - New Company: March 1Ryoma EchizenNo ratings yet

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- Adv Acc 6Document1 pageAdv Acc 6Ryoma EchizenNo ratings yet

- Basic Accounting4Document1 pageBasic Accounting4Ryoma EchizenNo ratings yet

- 2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Document1 page2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Ryoma EchizenNo ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- Basic Accounting3Document1 pageBasic Accounting3Ryoma EchizenNo ratings yet

- Bank Reconciliation1Document2 pagesBank Reconciliation1Ryoma EchizenNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- 3 Closing EntriesDocument2 pages3 Closing EntriesRyoma Echizen0% (1)

- Bank ReconciliationDocument2 pagesBank ReconciliationRyoma EchizenNo ratings yet

- Bank Reconciliation2Document2 pagesBank Reconciliation2Ryoma EchizenNo ratings yet

- Solution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Document1 pageSolution:: J's Capital Cash Machinery and Equipment Building Mortgage J's Capital Balance 2,900,000Ryoma EchizenNo ratings yet

- Receivables Practice Test1Document1 pageReceivables Practice Test1Ryoma EchizenNo ratings yet

- Marcus CompanyDocument1 pageMarcus CompanyRyoma EchizenNo ratings yet

- Uk PayslipDocument2 pagesUk PayslipraoNo ratings yet

- W-8Ben: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document2 pagesW-8Ben: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Rebecca AntoniosNo ratings yet

- Course Outline Taxation PakistanDocument4 pagesCourse Outline Taxation PakistanrehanshervaniNo ratings yet

- CIR Vs SM Prime HoldingsDocument5 pagesCIR Vs SM Prime Holdingsamareia yapNo ratings yet

- ACC 307 Homework CH 3Document2 pagesACC 307 Homework CH 3leelee0302No ratings yet

- Refund of TaxDocument3 pagesRefund of TaxrichaNo ratings yet

- Carlos Superdrug Corp Vs DSWDDocument3 pagesCarlos Superdrug Corp Vs DSWDSoah JungNo ratings yet

- TB16 Income Taxes - TAX 2Document21 pagesTB16 Income Taxes - TAX 2scrapped princeNo ratings yet

- Session 4 - Solution To ExercisesDocument8 pagesSession 4 - Solution To ExercisesChristine PayopayNo ratings yet

- BataClub Receipt 123451364401Document4 pagesBataClub Receipt 123451364401Nikhil KatariaNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Contex vs. CIR, GR No. 151135, 2 July 2004Document8 pagesContex vs. CIR, GR No. 151135, 2 July 2004Christopher ArellanoNo ratings yet

- "Commissioner of Internal Revenue v. San Roque Power Corporation, G.R. No. 187485, 8 October 2013Document1 page"Commissioner of Internal Revenue v. San Roque Power Corporation, G.R. No. 187485, 8 October 2013chescasantosNo ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- FAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIDocument6 pagesFAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIifpauditNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Akash - Salary SlipDocument2 pagesAkash - Salary Slipzingo bingoNo ratings yet

- Solved Watkins Inc Acquires All of The Outstanding Stock of GlenDocument1 pageSolved Watkins Inc Acquires All of The Outstanding Stock of GlenAnbu jaromiaNo ratings yet

- Chapter 13 SummaryDocument4 pagesChapter 13 SummaryAbhishek GoswamiNo ratings yet

- Midterm Test - Second Chance!Document2 pagesMidterm Test - Second Chance!Lê Thái Thiên HươngNo ratings yet

- Chapter 5 Final Income Taxation Summary BanggawanDocument8 pagesChapter 5 Final Income Taxation Summary Banggawanyours truly,100% (3)

- 1 Le Parrain The Godfather SongbookDocument2 pages1 Le Parrain The Godfather SongbookyuNo ratings yet

- Tax Quiz 2Document2 pagesTax Quiz 2Peng GuinNo ratings yet

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDocument1 pageSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNo ratings yet

- Solved On January 1 of The Current Year Scott Borrows 80 000Document1 pageSolved On January 1 of The Current Year Scott Borrows 80 000Anbu jaromiaNo ratings yet

- Ghulam PDFDocument1 pageGhulam PDFNazir Ahmad GanieNo ratings yet

- Assignment 1 - f22Document2 pagesAssignment 1 - f22Alaa ShaathNo ratings yet

- Asian Transmission Corp. vs. CIRDocument2 pagesAsian Transmission Corp. vs. CIRRhea Caguete50% (2)

- Contribution Margin RatioDocument4 pagesContribution Margin RatioResty VillaroelNo ratings yet