Professional Documents

Culture Documents

Bank Reconciliation

Uploaded by

Ryoma EchizenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation

Uploaded by

Ryoma EchizenCopyright:

Available Formats

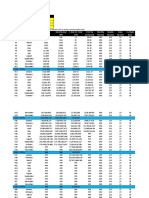

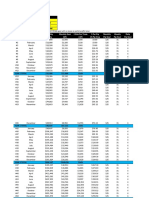

4-1A

ZipFlyer Inc.’s cash T-Account for May shows the following information:

Cash

Date Comments Amount Date Comments Amount

May 1 Opening balance $13,846 May 1 Cheque #75 $550

May 1 Deposit 1,550 May 3 Cheque #76 875

May 3 Deposit 2,700 May 4 Cheque #77 1,256

May 15 Deposit 4,950 May 7 Cheque #78 3,684

May 21 Deposit 2,600 May 10 Cheque #79 1,100

May 31 Deposit 3,000 May 13 Cheque #80 486

May 17 Cheque #81 548

May 21 Cheque #82 3,058

May 25 Cheque #83 1,244

May 28 Cheque #84 983

May 29 Cheque #85 68

May 31 Cheque #86 175

May 31 Ending Balance $14,619

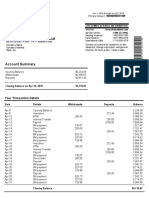

The following comes from the company’s April 2024 Bank Statement:

Date Description Withdrawals Deposits Balance

April 30 Balance Forward $13,846

May 2 Deposit 1,550 15,396

May 3 Cheque #75 550 14,846

May 4 Deposit 2,700 17,546

May 6 Cheque #77 1,256 16,290

May 7 NSF Cheque – W. White 600 15,690

May 8 Cheque #76 875 14,815

May 10 Cheque #78 3,684 11,131

May 11 Bank Collection 4,300 15,431

May 13 Cheque #79 1,100 14,331

May 14 EFT – Utilities bill 300 14,031

May 15 Deposit 4,950 18,981

May 18 Cheque #80 468 18,513

May 21 Deposit 2,600 21,113

May 24 EFT - Telephone 100 21,013

May 25 Cheque #82 3,058 17,955

May 27 Cheque #83 1,244 16,711

May 31 Bank plan fee 5 16,706

May 31 Interest 1 16,707

Additional Information:

A – The correct amount of cheque #80 – a payment of an account payable is $468. ZipFlyer’s

bookkeeper made an error.

B – The bank collection was a note receivable. The note included principal of $4,000 and interest

of $300. No previous interest accruals had been made on the note.

Required

a.) Prepare a bank reconciliation dated May 31, 2024.

b.) Record any required adjustments based on your reconciliation.

You might also like

- Bank Reconciliation1Document2 pagesBank Reconciliation1Ryoma EchizenNo ratings yet

- Latihan Soal Rekonsiliasi BankDocument1 pageLatihan Soal Rekonsiliasi BankIchsan WibowoNo ratings yet

- Bank Reconciliation2Document2 pagesBank Reconciliation2Ryoma EchizenNo ratings yet

- Taller 8 - 03 Julián ConciliaciónDocument14 pagesTaller 8 - 03 Julián ConciliaciónJulian SaezNo ratings yet

- Question 7.1 7.2Document8 pagesQuestion 7.1 7.2AnNo ratings yet

- US Bank Business Statement - Mbcvirtual 4Document4 pagesUS Bank Business Statement - Mbcvirtual 4Aleesha Aleesha100% (2)

- PPEDisposals PM 07 BankStmtsDocument3 pagesPPEDisposals PM 07 BankStmtsJosephine LimNo ratings yet

- A Summary of Deposit Account: Your ATB Financial BranchDocument2 pagesA Summary of Deposit Account: Your ATB Financial BranchMike SandruNo ratings yet

- Exercise On Bank ReconciliationDocument3 pagesExercise On Bank ReconciliationJoshua OtienoNo ratings yet

- Metropolitan Bank LimitedDocument2 pagesMetropolitan Bank LimitedsaifullahNo ratings yet

- Bank StatementDocument4 pagesBank StatementDanielNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Account Summary: Your Transaction DetailsDocument1 pageAccount Summary: Your Transaction Detailsdelfa100% (1)

- Lesson 7.3Document2 pagesLesson 7.3crisjay ramosNo ratings yet

- Bank StatementDocument3 pagesBank StatementSigei LeonardNo ratings yet

- MR MD M Islam Mohibul 8 Eeufees ST Wolseley CBD Wolseley 6830Document2 pagesMR MD M Islam Mohibul 8 Eeufees ST Wolseley CBD Wolseley 6830mdmohibul624No ratings yet

- Account Summary April 30, 2020. Account Number, 00001213456789Document1 pageAccount Summary April 30, 2020. Account Number, 00001213456789Arm CandyNo ratings yet

- SaveMor 1059 - JF Robbertse Augustus 2023Document1 pageSaveMor 1059 - JF Robbertse Augustus 2023Antonet RobbertseNo ratings yet

- Wealth Building Analysis: Targets/InputsDocument6 pagesWealth Building Analysis: Targets/InputsPrashantPatilNo ratings yet

- Waseem Muhammad (Pty) LTD 268 Van Der Walt Street Pretoria 0001Document3 pagesWaseem Muhammad (Pty) LTD 268 Van Der Walt Street Pretoria 0001zeemasnky makuyaNo ratings yet

- Bank Statement Template 09Document1 pageBank Statement Template 09isabelle meyers100% (1)

- Personal Bank Statement Template PDFDocument1 pagePersonal Bank Statement Template PDFAdarsh TadimariNo ratings yet

- Bank StatementDocument14 pagesBank StatementLJ AggabaoNo ratings yet

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDocument1 pageBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNo ratings yet

- TopadsDocument5 pagesTopadsStevenNo ratings yet

- Important Information:: P. Kumar Chief Operating OfficerDocument3 pagesImportant Information:: P. Kumar Chief Operating OfficerpankajNo ratings yet

- CashbookDocument4 pagesCashbookDave ChowtieNo ratings yet

- Account 0001Document2 pagesAccount 0001rajeshdeNo ratings yet

- 01730XXX3885 2019may14 2019jun14Document2 pages01730XXX3885 2019may14 2019jun14saad0% (1)

- Index CardDocument12 pagesIndex CardGermelyn MaranonNo ratings yet

- Assignment - Aduit of CashDocument5 pagesAssignment - Aduit of CashEdemson NavalesNo ratings yet

- Tugas 5 AkuntansiDocument10 pagesTugas 5 AkuntansiHidayat AbisenaNo ratings yet

- 30 Jun StatementDocument2 pages30 Jun StatementOscar Monama0% (1)

- DashboardDocument41 pagesDashboardAriel EnriquezNo ratings yet

- RETO#2 - Dashboard Expert ChallengeDocument48 pagesRETO#2 - Dashboard Expert Challengedavid gomezNo ratings yet

- Dynamic Chart With ScrollerDocument7 pagesDynamic Chart With ScrollerPADMANABHAN33No ratings yet

- 27 Mar 2020 - (Free) ..Chqmwuilbna - Fawfawn - Ehqjeqx - B31yax1ycmcgaadwdnf3ag8jbnjyc3eiaakgcnj1cw8idgf7dxvycqDocument2 pages27 Mar 2020 - (Free) ..Chqmwuilbna - Fawfawn - Ehqjeqx - B31yax1ycmcgaadwdnf3ag8jbnjyc3eiaakgcnj1cw8idgf7dxvycqkhuthadzoNo ratings yet

- Wealth Building Analysis: Targets/InputsDocument6 pagesWealth Building Analysis: Targets/InputsKalebuka mukaoNo ratings yet

- Bank-Statement RGBDocument1 pageBank-Statement RGBAlexNo ratings yet

- Trabajo PrácticoDocument27 pagesTrabajo Prácticocarlos wilsonNo ratings yet

- Team 5 Case Holiday Decorations Excel 1Document27 pagesTeam 5 Case Holiday Decorations Excel 1jack stauberNo ratings yet

- Report of Disbursement: Mamasapano National High SchoolDocument5 pagesReport of Disbursement: Mamasapano National High SchoolBai Alleha MusaNo ratings yet

- Rudolf Lee C. Mangaliag 12 Abm Am2: 1) Presented Below Is The Bank Statement of Gold Bank For The Month of MarchDocument4 pagesRudolf Lee C. Mangaliag 12 Abm Am2: 1) Presented Below Is The Bank Statement of Gold Bank For The Month of MarchKhriza Joy Salvador100% (1)

- Bac 204 - Cat 1Document4 pagesBac 204 - Cat 1duncanmaina204No ratings yet

- 08 04 21sbiDocument4 pages08 04 21sbiDhanaraj ManimaranNo ratings yet

- Date Account Title/Explanation PR Debit CreditDocument6 pagesDate Account Title/Explanation PR Debit CreditMarvin GwapoNo ratings yet

- Wealth Building Analysis: Targets/InputsDocument6 pagesWealth Building Analysis: Targets/InputsRICHARD REY NUNEZNo ratings yet

- MM TRDDocument9 pagesMM TRDNur CahyonoNo ratings yet

- Exercise 31 Excel Practice Book How To Make Bank Passbook Transaction Statement in Ms ExcelDocument2 pagesExercise 31 Excel Practice Book How To Make Bank Passbook Transaction Statement in Ms ExcelRahul KumarNo ratings yet

- Dashboard EjemploDocument48 pagesDashboard EjemploBeatriz SantillanNo ratings yet

- Update BillDocument1 pageUpdate BillDR AbidNo ratings yet

- Transaction Period# of Transactions Total # of Transactions DTFDocument8 pagesTransaction Period# of Transactions Total # of Transactions DTFDaily PhalanxNo ratings yet

- Bank Statement: Insular Building 4123 Paterno Avenue Doljo, Panglao, BoholDocument6 pagesBank Statement: Insular Building 4123 Paterno Avenue Doljo, Panglao, BoholSarah GoNo ratings yet

- Villaluz Repair ShopDocument5 pagesVillaluz Repair ShopJoy SantosNo ratings yet

- Dashboard ExamenDocument42 pagesDashboard ExamenLuis BarahonaNo ratings yet

- FAR1Document1 pageFAR1Ryoma EchizenNo ratings yet

- Basic Cash Flow Statemen2Document2 pagesBasic Cash Flow Statemen2Ryoma EchizenNo ratings yet

- FAR5Document1 pageFAR5Ryoma EchizenNo ratings yet

- Adv Acc 6Document1 pageAdv Acc 6Ryoma EchizenNo ratings yet

- FAR3Document1 pageFAR3Ryoma EchizenNo ratings yet

- 1-3B Basic Financial StatementsDocument1 page1-3B Basic Financial StatementsRyoma EchizenNo ratings yet

- Adv Acc 7Document1 pageAdv Acc 7Ryoma EchizenNo ratings yet

- Basic AccountingDocument1 pageBasic AccountingRyoma EchizenNo ratings yet

- 3A Adjusting EntriesDocument2 pages3A Adjusting EntriesRyoma Echizen0% (1)

- Basic Accounting4Document1 pageBasic Accounting4Ryoma EchizenNo ratings yet

- ELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityDocument1 pageELI Corporation Statement of Financial Position As of January 2, 2013 Assets Liabilities and EquityRyoma EchizenNo ratings yet

- FarDocument1 pageFarRyoma EchizenNo ratings yet

- 2-1A Basic Journal Entries - New Company: June 1Document1 page2-1A Basic Journal Entries - New Company: June 1Ryoma EchizenNo ratings yet

- 2-1B Basic Journal Entries - New Company: March 1Document1 page2-1B Basic Journal Entries - New Company: March 1Ryoma EchizenNo ratings yet

- Basic Accounting2Document1 pageBasic Accounting2Ryoma EchizenNo ratings yet

- A.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesDocument1 pageA.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesRyoma EchizenNo ratings yet

- 2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Document1 page2-4B More Journal Entries, T-Accounts, Trial Balance: February 1 February 3 February 5 February 7 February 8 February 14Ryoma EchizenNo ratings yet

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- AccountingDocument2 pagesAccountingRyoma EchizenNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- 3B Percentage of Sales MethodDocument1 page3B Percentage of Sales MethodRyoma EchizenNo ratings yet

- Basic Accounting3Document1 pageBasic Accounting3Ryoma EchizenNo ratings yet

- 3A Percentage of Sales MethodDocument1 page3A Percentage of Sales MethodRyoma EchizenNo ratings yet

- 3-2A Recording Transactions and Adjusting Entries: RequiredDocument1 page3-2A Recording Transactions and Adjusting Entries: RequiredRyoma EchizenNo ratings yet

- 3-1A 5 Types of Adjustments: RequiredDocument2 pages3-1A 5 Types of Adjustments: RequiredRyoma EchizenNo ratings yet

- 3 Closing EntriesDocument2 pages3 Closing EntriesRyoma Echizen0% (1)

- Receivables Practice Test1Document1 pageReceivables Practice Test1Ryoma EchizenNo ratings yet

- Ratio Analysis of L&T InfotechDocument36 pagesRatio Analysis of L&T Infotechrajwindernijjar1100% (1)

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Lebanese International University: School of Business Masters of Business AdministrationDocument8 pagesLebanese International University: School of Business Masters of Business AdministrationTaghrid A. HNo ratings yet

- Doctrine of Separate Legal PersonalityDocument23 pagesDoctrine of Separate Legal Personalityshubham kumar100% (1)

- Assignment 4Document30 pagesAssignment 4azimlitamellaNo ratings yet

- STM Assignment Workbook - v1.0Document20 pagesSTM Assignment Workbook - v1.0Neha SmritiNo ratings yet

- Haranahalli Ramaswamy Institute of Higher EducationDocument15 pagesHaranahalli Ramaswamy Institute of Higher EducationAnkitha KavyaNo ratings yet

- SSM OriginalDocument6 pagesSSM OriginalAlyafa LegacyNo ratings yet

- zMSQ-02 - Variable & Absorption CostingDocument11 pageszMSQ-02 - Variable & Absorption CostingKekenn EscabasNo ratings yet

- Corporate Income TaxDocument12 pagesCorporate Income Taxrevilo ordinarioNo ratings yet

- Cara Menghitung BALANCE SHEETDocument1 pageCara Menghitung BALANCE SHEETIncesNo ratings yet

- Project Report - M&A - Krishna PatelDocument69 pagesProject Report - M&A - Krishna PatelKrishnaNo ratings yet

- Comparative Balance Sheet of BSNL LTDDocument19 pagesComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- Project On Merger and AcquisitionDocument51 pagesProject On Merger and AcquisitionRaghavNo ratings yet

- Business Studies Class 12 Study Material Chapter 9Document17 pagesBusiness Studies Class 12 Study Material Chapter 9YashNo ratings yet

- Sections of IBC CA Final Law by CA Swapnil PatniDocument5 pagesSections of IBC CA Final Law by CA Swapnil PatniPrice JainNo ratings yet

- Cus Cir-7Document7 pagesCus Cir-7satya narayan kumarNo ratings yet

- FDI FII & International Finance ExamplesDocument21 pagesFDI FII & International Finance ExamplesgauravNo ratings yet

- Chapter 4 - 5 ActivitiesDocument3 pagesChapter 4 - 5 ActivitiesJane Carla BorromeoNo ratings yet

- Gross Profit Method CVDocument18 pagesGross Profit Method CVRigine Pobe MorgadezNo ratings yet

- Business Combination PDFDocument39 pagesBusiness Combination PDFEmmanuelNo ratings yet

- Thesis Version 1Document80 pagesThesis Version 1deosa villamonteNo ratings yet

- Accounting Theory and Analysis Chart 16 Test BankDocument14 pagesAccounting Theory and Analysis Chart 16 Test BankSonny MaciasNo ratings yet

- Acctg5-Summary C13 Cash and Accrual BasisDocument2 pagesAcctg5-Summary C13 Cash and Accrual BasisVenz Karylle CapitanNo ratings yet

- Assignment 01 Financial AccountingDocument3 pagesAssignment 01 Financial Accountingsehrish kayaniNo ratings yet

- M. GordonDocument27 pagesM. GordonRosevie ZantuaNo ratings yet

- Choose One Answer To Each QuestionDocument5 pagesChoose One Answer To Each QuestionNguyễn Vũ Phương AnhNo ratings yet

- Final MCB Ar2017 5x35 enDocument1 pageFinal MCB Ar2017 5x35 enRida FatimaNo ratings yet

- 4 Retiremnet and Death of A Partner QNDocument4 pages4 Retiremnet and Death of A Partner QNHridya SNo ratings yet

- Intermediate Bookkeeping FA2 Course MapDocument7 pagesIntermediate Bookkeeping FA2 Course MapBondhu GuptoNo ratings yet