Professional Documents

Culture Documents

Swindall Industries Uses Straight Line Depreciation On All of Its Depreciable

Swindall Industries Uses Straight Line Depreciation On All of Its Depreciable

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swindall Industries Uses Straight Line Depreciation On All of Its Depreciable

Swindall Industries Uses Straight Line Depreciation On All of Its Depreciable

Uploaded by

Amit PandeyCopyright:

Available Formats

Swindall Industries uses straight line depreciation on all of

its depreciable

Swindall Industries uses straight-line depreciation on all of its depreciable assets. The company

records annual depreciation expense at the end of each calendar year. On January 11, 2014,

the company purchased a machine costing $90,000. The machine's useful life was estimated to

be 12 years with an estimated residual value of $18,000. Depreciation for partial years is

recorded to the nearest full month.

In 2018, after almost five years of experience with the machine, management decided to revise

its estimated life from 12 years to 20 years. No change was made in the estimated residual

value. The revised estimate of the useful life was decided prior to recording annual depreciation

expense for the year ended December 31, 2018.

a. Prepare journal entries in chronological order for the given events, beginning with the

purchase of the machinery on January 11, 2014. Show separately the recording of depreciation

expense in 2014 through 2018.

b. What factors may have caused the company to revise its estimate of the machine's useful

life?

Swindall Industries uses straight line depreciation on all of its depreciable

SOLUTION-- http://solutiondone.online/downloads/swindall-industries-uses-straight-line-

depreciation-on-all-of-its-depreciable/

Unlock answers here solutiondone.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Solved Tred America Inc Manufactures Tires For Large Auto Companies It UsesDocument1 pageSolved Tred America Inc Manufactures Tires For Large Auto Companies It UsesAnbu jaromiaNo ratings yet

- Tutorial 6 Non Current Assets (Q)Document3 pagesTutorial 6 Non Current Assets (Q)lious liiNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- IAS 8 Tutorial Question (Q)Document2 pagesIAS 8 Tutorial Question (Q)Given RefilweNo ratings yet

- Consider The Following Independent Situations Situation 1 Ducharme Corporation Purchased ElectricDocument2 pagesConsider The Following Independent Situations Situation 1 Ducharme Corporation Purchased ElectricTaimur TechnologistNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- Sunlplast Brochure 2021Document12 pagesSunlplast Brochure 2021rnd.akchemtecNo ratings yet

- 2014 Dse Bafs 2aDocument9 pages2014 Dse Bafs 2aRay WongNo ratings yet

- CMA - 1-Introduction To CMADocument35 pagesCMA - 1-Introduction To CMAIrtaza AhsanNo ratings yet

- T9 - ABFA1153 FA I (Tutor)Document6 pagesT9 - ABFA1153 FA I (Tutor)Wu kai AngNo ratings yet

- FAR - PPE (Depreciation and Derecognition) - StudentDocument3 pagesFAR - PPE (Depreciation and Derecognition) - StudentPamelaNo ratings yet

- CE22 - 13 - DepreciationDocument61 pagesCE22 - 13 - DepreciationNathan TanNo ratings yet

- Solved in Regression Analysis The Coefficient of Determination A Is Used ToDocument1 pageSolved in Regression Analysis The Coefficient of Determination A Is Used ToAnbu jaromiaNo ratings yet

- Chapter 9 - Lecture Notes - DungDocument56 pagesChapter 9 - Lecture Notes - DungThanh UyênNo ratings yet

- Tariff of Hydroelectric Schemes and A Case Study: Anil KumarDocument40 pagesTariff of Hydroelectric Schemes and A Case Study: Anil KumarSovan NandyNo ratings yet

- Problem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase MethodDocument1 pageProblem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase Methodleshz zynNo ratings yet

- Cost Audit Report 2014 FinalDocument52 pagesCost Audit Report 2014 FinalBHUSHAN DahaleNo ratings yet

- Statement of Significant Accounting PoliciesDocument6 pagesStatement of Significant Accounting PoliciesthomasNo ratings yet

- @cahelp23 - Inter Costing Must Do List Nov2021Document120 pages@cahelp23 - Inter Costing Must Do List Nov2021bnanduriNo ratings yet

- Garden Wizards Provides Gardening Services To Both Commercial and ResidentialDocument1 pageGarden Wizards Provides Gardening Services To Both Commercial and Residentialtrilocksp Singh0% (1)

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- The Annual Report of Prodimax LTD For Fiscal Year 2014 PDFDocument1 pageThe Annual Report of Prodimax LTD For Fiscal Year 2014 PDFFreelance WorkerNo ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- Director ReportDocument5 pagesDirector ReportkcpNo ratings yet

- Gibbs Inc Purchased A Machine On January 1 2014 atDocument1 pageGibbs Inc Purchased A Machine On January 1 2014 atFreelance WorkerNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAsjad RehmanNo ratings yet

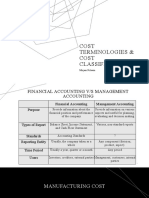

- Cost Terminologies & Cost Classification: Mirjam NilssonDocument13 pagesCost Terminologies & Cost Classification: Mirjam NilssonHitesh JainNo ratings yet

- During 2016 Ryel Company S Controller Asked You To Prepare CorrectingDocument1 pageDuring 2016 Ryel Company S Controller Asked You To Prepare CorrectingFreelance WorkerNo ratings yet

- Principles of Accounting (503) : Dr. Md. Mahabbat Hossain Faculty Member BibmDocument36 pagesPrinciples of Accounting (503) : Dr. Md. Mahabbat Hossain Faculty Member BibmZakaria SakibNo ratings yet

- Problems - PPE & DepnDocument5 pagesProblems - PPE & DepnSaurabh SinghNo ratings yet

- Tutorial Solution Week 06Document4 pagesTutorial Solution Week 06itmansaigonNo ratings yet

- Set Dc9bf9e2Document9 pagesSet Dc9bf9e2Jason SNo ratings yet

- On January 1 2015 Bourgeois Company Purchased The Following TwoDocument1 pageOn January 1 2015 Bourgeois Company Purchased The Following TwoAmit PandeyNo ratings yet

- FAMA OldDocument4 pagesFAMA OldVarun RNo ratings yet

- An Introduction To Cost Terms and PurposesDocument26 pagesAn Introduction To Cost Terms and PurposesAmit DeyNo ratings yet

- NAYYERDocument27 pagesNAYYERByan SaghirNo ratings yet

- CH 7Document50 pagesCH 7notnada2002No ratings yet

- Group 3 Reort MachineryDocument18 pagesGroup 3 Reort MachineryMegan Rose LadaoNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- Individual Assignment (Financial Accounting Module)Document4 pagesIndividual Assignment (Financial Accounting Module)Heisenberg008No ratings yet

- Poa T - 6Document2 pagesPoa T - 6SHEVENA A/P VIJIANNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- EXERCISE 3.4 (1) Ass1Document1 pageEXERCISE 3.4 (1) Ass1Sonwabiso MatomelaNo ratings yet

- 2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementDocument41 pages2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementNaveen R HegadeNo ratings yet

- Cost Concepts HandoutsDocument13 pagesCost Concepts HandoutsTushar DuaNo ratings yet

- Far510 - PPE 1Document19 pagesFar510 - PPE 1intanNo ratings yet

- Consider The Following Transactions For Liner Company A CollectedDocument1 pageConsider The Following Transactions For Liner Company A Collectedhassan taimourNo ratings yet

- A192-Mc1 PpeDocument4 pagesA192-Mc1 PpeTeo ShengNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- ACC 1100 Days 14&15 Long-Lived Assets PDFDocument25 pagesACC 1100 Days 14&15 Long-Lived Assets PDFYevhenii VdovenkoNo ratings yet

- FAMA IndividualAssignmentDocument5 pagesFAMA IndividualAssignmentSRINIVAS BALIGANo ratings yet

- Cost Must DoDocument198 pagesCost Must DoVanshika BhedaNo ratings yet

- A Recent Annual Report For Swifty Air Cargo Company States PDFDocument1 pageA Recent Annual Report For Swifty Air Cargo Company States PDFLet's Talk With HassanNo ratings yet

- IASb 16 Property, Plant EquipmentDocument32 pagesIASb 16 Property, Plant EquipmentIan chisema100% (1)

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet