Professional Documents

Culture Documents

Larsen& Toubro LTD Initiating Coverage 15062020

Larsen& Toubro LTD Initiating Coverage 15062020

Uploaded by

Aparna JROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Larsen& Toubro LTD Initiating Coverage 15062020

Larsen& Toubro LTD Initiating Coverage 15062020

Uploaded by

Aparna JRCopyright:

Available Formats

Initiating Coverage June 15, 2020

RETAIL RESEARCH

Larsen & Toubro Ltd

Industry LTP Base case Fair Value Bull Case Fair Value Buy Range Time Horizon

Construction & Engineering Rs.925.9 Rs. 1045 Rs. 1136 Rs. 820-845 2 quarters

HDFC Scrip Code LARTOUEQNR Our Take:

BSE Code 500510 Larsen & Toubro is the foremost player in Infrastructure and Engineering space in India and company has footprints in technology

and financial services as well. The company addresses critical needs in key sectors such as Hydrocarbon, Infrastructure, Power,

NSE Code LT Process Industries and Defence. The company has a robust order book of Rs 3,03,900 crore out of which Rs 2,28,900 crore is from

Bloomberg LT IN domestic segment while international orders are of Rs 75,000 crore. The company would be beneficiary of Government’s thrust on

infrastructure development and the unveiling of National Infrastructure Pipeline (NIP) augurs well for the company. L&T remains the

CMP June 12 2020 925.9 best proxy of the Indian capex/Infra story. It could further consolidate its market share in the post-COVID-19 times. In a tough macro

Equity Capital (Rscr) 280.72 environment for the construction industry and likely survival challenges for debt-ridden companies. L&T could emerge stronger after

this painful period comes to an end. In the meanwhile the IT subsidiaries could provide some comfort/support. To ensure adequate

Face Value (Rs) 2

margin of safety in these uncertain times, we think investors could buy the stock on dips to Rs.820-845.

Equity Share O/S (cr) 140.3

Valuations &Recommendation:

Market Cap (Rscrs) 129996

L&T reported its Q4FY20 numbers largely in line with expectations with no guidance for FY21 (on expected lines). Amidst the

Book Value (Rs) 451 lockdown, company has won a flurry of orders which will give cushion in turbulent times. The company has a robust order book of Rs

Avg. 52 Wk Volumes 4022844 3,03,900 crore with 25% share of International orders and from remaining 75% of domestic orders. 80% of orders are immune from

any execution risk. Schneider deal is on track and is likely to close by early Q2FY21, deal proceeds may partly get utilized towards

52 Week High 1606.7

rightsizing L&T Hyderabad Metro’s capital structure. We believe L&T is perfectly poised for a cyclical recovery and would also be

52 Week Low 661.05 beneficial of various Government initiatives. We also like management’s conservative business approach with growing focus on

being asset-light/returns-generation. L&T has outperformed benchmark indices in each recovery cycle. We have estimated modest

~3% CAGR in Revenues/EBITDA/PAT over the two years FY20-22E. We have arrived at a base case fair value of Rs.1045 for the next

Share holding Pattern % (Mar 31, 20) two quarters. Post the sharp correction in its stock price these headwinds are priced in to some extent. Its strong Balance Sheet

Institutions 56.48 augurs well from liquidity perspective.

Non Institutions 43.52 Valuation Summary

Business Valuation Methodology Rs (Cr.) Rs/share

Total 100.0 L&T E&C business 16.5x Mar-21 E&C Earnings 98,450 701

L&T Infotech HDFC sec Target Valuation with 25% holdco discount 17,500 125

Fundamental Research Analyst L&T Tech Services HDFC sec Target Valuation with 25% holdco discount 6,600 47

Manthan Jhaveri Mindtree HDFC sec Target Valuation with 25% holdco discount 7,600 54

Manthan.jhaveri@hdfcsec.com L&T Finance Mcap with 25% holdco disc 6,000 43

Other Subs., Associates and Development Portfolio 0.7x P/BV of Invested Equity 10,500 75

Target Price 146650 1045

(Source: HDFC sec Research)

RETAIL RESEARCH Page |1

RETAIL RESEARCH

Multiples Summary Table

Scenario Price (Rs.) Target Multiple (x)

CMP 926 13

Buy range 833 (820-845) 11.5

Base Case Fair price 1045 16.5

Bull Case Fair price 1136 18.5

Financial Summary

Particulars (Rs cr) Q4FY20 Q4FY19 YoY-% Q3FY20 QoQ-% FY19 FY20 FY21E FY22E

Net Revenues 44245 43303 2 36243 22 135220 145452 139213 153578

EBITDA 5121 5279 -3 4118 24 15330 16329 13228 17668

Depreciation 711 435 63 660 8 1923 2462 2410 2497

Other Income 661 611 8 475 39 1837 2361 2484 2884

Interest Cost 821 507 62 709 16 1803 2797 2687 2841

Tax 966 1234 -22 711 36 4067 3263 2671 3829

APAT 3197 3418 -6 2352 36 8906 9550 6912 10198

Diluted EPS (Rs) 22.8 24.4 16.8 63.5 68.1 49.3 72.7

(Source: Company, HDFC sec Research)

Recent Developments

In Q4FY20, consolidated revenues increased marginally by 2% YoY at Rs 44,245 crore while EBITDA fell by 3% to Rs 5120

crore. EBIDTA margins narrowed by 60 basis points to 11.6%. Net profit (including discontinued operations) fell by 6.5%

YoY to Rs 3200 crore. Larsen missed booking Rs 1750/400 crore Revenue/PAT due to COVID-19 disruption.

Higher Other Income, lower tax and higher share in JVs/Associates helped L&T in Q4FY20.

The order inflow for the quarter stood at Rs 57,785 crore, registering a 5% YoY growth with significant orders received in

Infrastructure segment. Total order inflows for FY20 stood at Rs 186,356 crore registering a 9% YoY growth, marginally

missing guidance of 10-12%. The consolidated order book as on March 2020 stood at Rs 303,857 crore. International

orders constitute 25% of the total order book.

The company expects that the initial quarters of FY21 are expected to be adversely affected by the current upheaval, and

expects growth revival in the later part of the financial year assuming things get better from here. Amidst the lockdown

company has won a flurry of orders which will give cushion in turbulent times.

The company has removed Rs 29000 crore of order from order book in FY20, not specifically because of COVID-19. All

orders in Andhra Pradesh which has been stayed by green tribunal have been removed. The current order book is net of

slow moving orders.

RETAIL RESEARCH Page |2

RETAIL RESEARCH

The working capital as a portion of sales has risen due to payments to vendors. In FY20, working capital was 23% of sales

compared with 18% in the previous fiscal.

Long term Triggers

L&T operates in various segments including Infrastructure, Power, Heavy Engineering, Defence Engineering, Electrical &

Automation (shown as discontinued operations), Hydrocarbon, Shipbuilding, Material Handling, Mining Equipment, IT and

Financial Services. L&T has a dominant position in most operating verticals, be it oil & gas, factories & building, process

projects, roads, bridges and industrial structures. This gives flexibility to pick projects, which helps optimise overall

business growth. Deep understanding of market dynamics, resources, operational expertise and integration capabilities

enables the Company to compete effectively across these sectors. The cumulative order inflows for FY20 were at Rs

1,86,400 crore. The company has a robust order book of Rs 3,03,900 crore out of which Rs 2,28,900 crore is from

domestic segment while international orders are of Rs 75,000 crore.

Infrastructure is the key driver for the Indian economy and enjoys intense focus of the government for initiating policies

to create world-class infrastructure. The infrastructure segment – especially the EPC sector has witnessed strong order

inflow in recent times. The infrastructure segment make up 55% of the FY20 order inflow composition and about 74% of

FY20 order book. The capex in the economy continues to be driven by public sector mainly in the areas like Power

(Renewables and T&D), Transportation (Roads, Railways and Metro projects) and Defence. With India expected to invest

significantly in infrastructure creation over the next few years with thrust on domestic manufacturing through its ‘Make

in India’ project, the companies with focus on domestic market are in a sweet spot. However, due to COVID-19 outbreak,

we expect delay in Government spending.

The order book of the company is well protected as 80% of domestic order book is from Central/State/PSU clients and of

that 35% is funded by multilateral agencies and 50% is funded by state/central. Hence we don’t expect any significant risk

in execution. The work in Maharashtra has not experienced any hiccups barring 2 projects - metro and coastal road -

because of PIL against these projects but that has been resolved and work has started.

The sale of E&A business (shown as discontinued operations) to Schneider was supposed to be completed by 31st March

2020. But due to COVID-19 crisis, the deal is not yet completed. However, deal is at fairly high point of closing. As

international travels resumes, deal should be completed in next 2-3 months time. There is little risk of deal getting

revalued or cancelled. Inflow from the deal of ~Rs 14000 crore will be partly utilized toward right sizing L&T Hyderabad

Metro’s capital to achieve sustainable debt levels in the project. This will however upset expectations of a buyback or

special dividend out of these sale proceeds and delay the efficient capital allocation process.

L&T has plans to monetize Hyderabad Metro, probably through InvIT structure. It will wait for trains to resume but at the

moment ridership is zero. Going forward, ridership of the metro would be impacted due to WFH policy. L&T will have a

RETAIL RESEARCH Page |3

RETAIL RESEARCH

check on the progress of the situation and as of now InvIT plans have been delayed. Currently, focus is on rightsizing

capital structure of L&T Hyderabad Metro by cutting debt and making it sustainable.

The Government’s humongous Rs 111 lakh crore National Infrastructure Pipeline (NIP) initiative, in accordance with the

Government’s vision to make India a US$5 trillion economy by 2024-25 provides a tremendous opportunity for the

company in coming years.

What could go wrong? -

The unprecedented event of COVID-19 has halted activities across the nation and infrastructure spending might take a

hit. Even in Govt. backed projects we may witness some execution delay due to lack of materials, men or funds.

Deep global recession and slower than expected recovery.

Higher than expected losses from the Hyderabad Metro.

Stressed payment cycles for government projects.

L&T may choose working capital management above revenue growth for some time.

Return ratios (esp. RoCE) of L&T may remain low for some more time even as it grapples with rising working capital

requirements and low OPM in its core E&C business.

Funds requirement from its Real estate/ Housing/LAP business may keep growing till the sector bottoms out.

Company Profile:

Larsen & Toubro (L&T) is the foremost player in Infrastructure and Engineering space in India and company has interests in

technology and financial services as well. L&T has presence globally in over 30 countries around the world. Larsen addresses

critical needs in key sectors such as Hydrocarbon, Infrastructure, Power, Process Industries and Defence.

The Company serves the Government and large corporate customers across multiple sectors, both in India as well as globally.

The Realty and Financial Services businesses provide B2C offerings as well in addition to B2B products/services.

L&T is engaged in core, high impact sectors of the economy and possesses integrated capabilities spanning the entire

spectrum of ‘design to deliver’, with 8 decades of strong, customer focused approach and continuous quest for world-class

quality.

RETAIL RESEARCH Page |4

RETAIL RESEARCH

FY20 Order Inflow Composition FY20 Order Inflow Composition (Region Wise)

(Source: Company, HDFC sec Research)

FY20 Order Book Composition FY20 Order Book Composition (Region Wise)

(Source: Company, HDFC sec Research)

RETAIL RESEARCH Page |5

RETAIL RESEARCH

Financials

Income Statement (Consolidated): Balance Sheet (Consolidated):

(Rs Cr) FY18 FY19 FY20 FY21E FY22E As at March FY18 FY19 FY20 FY21E FY22E

Net Revenue 119683 135220 145452 139213 153578 SOURCE OF FUNDS

Other Income 1535 1837 2361 2484 2884 Share Capital 280.3 280.6 280.6 280.6 280.6

Total Income 121218 137057 147813 141697 156462 Reserves 55377 62094 66441 73576 80182

Growth (%) 9.5 13 7.6 -4.3 10.3 Shareholders' Funds 55657 62375 66723 73858 80464

Operating Expenses 106112 119890 129123 125985 135910 Minority Interest 5625 6826 9520 9228 10423

EBITDA 13571 15330 16329 13228 17668 Long Term Debt 88192 96331 107728 106331 105331

Growth (%) 22.5 13 6.5 -19 33.6 Short Term Debt 19332 29224 35446 36724 35724

EBITDA Margin (%) 11.3 11.3 11.2 9.5 11.5 Net Deferred Taxes 638 311 1453 311 311

Depreciation 1929 1923 2462 2410 2497 Long Term Provisions & Others 946 912 1641 912 912

EBIT 11642 13407 13867 10818 15171 Total Source of Funds 170390 195979 222510 227363 233164

Interest 1539 1803 2797 2687 2841 APPLICATION OF FUNDS

PBT 11638 13441 13431 10615 15214 Net Block 12673 15113 12330 14481 14333

Tax 3199 4067 3263 2671 3829 CWIP 13443 13920 3311 5895 5994

Minority Interest 635 1311 1345 1072 1195 Goodwill 1562 1827 8011 8011 8011

Share of Associate Profits -436 -21 72 40 8 Investments 10193 11215 11062 11658 11775

RPAT 7368 8042 8895 6912 10198 Other Non-Current Assets 90447 102945 125799 125130 127564

EO Items (net of tax) -123 864 655 0 0 Total Non Current Assets 128318 145020 160513 165175 167677

APAT 7245 8906 9550 6912 10198 Inventories 4848 6414 5747 5857 6007

APAT Growth (%) 22.4 22.9 7.2 -27.6 47.5 Trade Receivables 34654 36845 40731 39585 41628

EPS 51.6 63.5 68.1 49.3 72.7 Short term Loans & Advances 2354 3177 3644 3262 3914

Cash & Equivalents 17497 25672 27817 28572 29805

Other Current Assets 55922 61218 69686 66203 66865

Total Current Assets 115275 133326 147625 143479 148219

Trade Payables 31571 42994 43644 42020 43692

Other Current Liab & Provisions 41631 39373 41984 40246 40015

Total Current Liabilities 73202 82367 85628 82266 83707

Net Current Assets 42073 50959 61997 61213 64512

Misc Expenses & Others 975 975

Total Application of Funds 170390 195979 222510 227363 233164

(Source: Company, HDFC sec Research)

RETAIL RESEARCH Page |6

RETAIL RESEARCH

Cash Flow Statement (Consolidated): Key Ratios (Consolidated):

(Rs Cr) FY18 FY19 FY20 FY21E FY22E FY18 FY19 FY20 FY21E FY22E

Reported PBT 11,516 14,286 14,314 10,655 15,222 Profitability (%)

Non-operating & EO items -1,070 -1,938 -1,041 -2,484 -2,884 EBITDA Margin 11.3 11.3 11.2 9.5 11.5

Interest Expenses 873 1,802 2,796 2,687 2,841 EBIT Margin 9.7 9.9 9.5 7.8 9.9

Depreciation 1,929 1,923 2,462 2,409 2,497 APAT Margin 6.1 6.6 6.6 5 6.6

Working Capital Change -19,876 -15,946 -7,791 -15,066 -4,499 RoE 13.7 15.1 14.8 9.8 13.2

Tax Paid -3,403 -4,882 -4,046 -2,672 -3,829 RoCE 5.3 5.6 5.6 4 5.4

OPERATING CASH FLOW ( a ) -10,031 -4,755 6,694 -4,471 9,348 Solvency Ratio

Capex -2,015 -3,499 -3,299 -2,150 -2,450 Debt/EBITDA (x) 7.9 8.2 8.8 10.8 8

Free Cash Flow -12,046 -8,254 3,395 -6,621 6,898 Net D/E 1.6 1.6 1.7 1.6 1.4

Investments 1,903 -8,606 -6,148 -115 -117 Interest Coverage 7.6 7.4 5 4 5.3

Non-operating income 4,027 1,083 1,191 2,484 2,884 PER SHARE DATA

INVESTING CASH FLOW ( b ) 3,915 -11,022 -8,256 219 317 EPS 51.6 63.5 68.1 49.3 72.7

Debt Issuance / (Repaid) 12,619 18,174 14,126 10,500 -2,000 CEPS 65.4 77.2 85.6 66.4 90.5

Interest Expenses -2,470 -2,983 -2,739 -2,687 -2,841 BV 397 445 476 527 574

Share Capital Issuance 50 11 18 0 0 Dividend 17 19 32 20 26

Dividend -2,389 -2,647 -4,551 -2,805 -3,591 Turnover Ratios (days)

Others 1,562 2,885 -481 Debtor days 106 99 102 104 99

FINANCING CASH FLOW ( c ) 9,372 15,440 6,373 5,008 -8,432 Inventory days 15 17 14 15 14

NET CASH FLOW (a+b+c) 3,256 -337 4,811 756 1,233 Creditors days 96 116 110 110 104

Other Current Asstets days 178 174 184 182 168

Other Current Liabilities days 127 106 105 106 95

Working Capital Days 75 68 85 85 82

VALUATION

P/E 18 14.7 13.7 18.9 12.8

P/BV 2.3 2.1 2 1.8 1.6

EV/EBITDA 16.5 15.3 15.3 18.8 13.9

Dividend Yield (%) 1.8 2 3.4 2.1 2.7

Price Chart (Source: Company, HDFC sec Research)

RETAIL RESEARCH Page |7

RETAIL RESEARCH

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 3075 3450

Compliance Officer: Binkle R. Oza Email: complianceofficer@hdfcsec.com Phone: (022) 3045 3600

SEBI Registration No.: INZ000186937 (NSE, BSE, MSEI, MCX) |NSE Trading Member Code: 11094 | BSE Clearing Number: 393 | MSEI Trading Member Code: 30000 | MCX Member Code: 56015 | AMFI Reg No. ARN -13549, PFRDA Reg.

No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657 , Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193.

Disclosure:

I, Manthan Jhaveri, CA, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. HSL has no material

adverse disciplinary history as on the date of publication of this report. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate does not have beneficial ownership

of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any

material conflict of interest.

Any holding in stock –No

HDFC Securities Limited (HSL) is a SEBI Registered Research Analyst having registration no. INH000002475.

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation.The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended

to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction

where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HSL or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published

for any purposes without prior written approval of HSL.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HSL may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail and/or its

attachments.

HSL and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other

transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies)

or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HSL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not

restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HSL and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other deals in these

securities from time to time or may deal in other securities of the companies / organizations described in this report.

HSL or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

HSL or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from t date of this report for services in respect of managing or co-managing

public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HSL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HSL nor Research Analysts

have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HSL may

have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits

from the subject company or third party in connection with the Research Report.

This report is intended for non-Institutional Clients only. The views and opinions expressed in this report may at times be contrary to or not in consonance with those of Institutional Research or PCG Research teams of HDFC

Securities Ltd. and/or may have different time horizons.

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic

distribution partnerships. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Customers need to check products &features before investing since the contours of the

product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures& Options are subject to market

risk. Clients should read the Risk Disclosure Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not

be dealt at Exchange platform.

RETAIL RESEARCH Page |8

You might also like

- Roark Capital - Buyout of Buffalo Wild Wings JaiminDocument30 pagesRoark Capital - Buyout of Buffalo Wild Wings JaiminjaiminNo ratings yet

- Bandhan BankDocument37 pagesBandhan BankBandaru NarendrababuNo ratings yet

- 02 Oct 2013 Fact SheetDocument1 page02 Oct 2013 Fact SheetfaisaladeemNo ratings yet

- Equity ResearchDocument3 pagesEquity Researchanil100% (2)

- Financial Management Sanjay DhamijaDocument3 pagesFinancial Management Sanjay DhamijaSaurabh KhuranaNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- Chapter 4 - Consolidated Financial Statements and Outside OwnershipDocument23 pagesChapter 4 - Consolidated Financial Statements and Outside Ownershipjesicamurano100% (1)

- Valuation Report of BPCLDocument24 pagesValuation Report of BPCLJobin JohnNo ratings yet

- 5 Important Elements in Fundamental AnalysisDocument5 pages5 Important Elements in Fundamental AnalysisSaverio NataleNo ratings yet

- Shriram Transport Finance Company Ltd. - Initiating Coverage - 30032021Document12 pagesShriram Transport Finance Company Ltd. - Initiating Coverage - 30032021Devarsh VakilNo ratings yet

- Arrow Greentech - Initiating Coverage - CentrumDocument53 pagesArrow Greentech - Initiating Coverage - CentrumanantNo ratings yet

- 22 SMCFinalOfferSupplement PDFDocument498 pages22 SMCFinalOfferSupplement PDFJeanneNo ratings yet

- Admin Law CasesDocument15 pagesAdmin Law CasesBfp Siniloan FS LagunaNo ratings yet

- FDsetia 20150923pj8xfnDocument41 pagesFDsetia 20150923pj8xfnJames WarrenNo ratings yet

- Nubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserDocument5 pagesNubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserFelipe AreiaNo ratings yet

- Marico Equity Research ReportDocument47 pagesMarico Equity Research ReportamitNo ratings yet

- 5.2 Excise Tax Part 2 - Excise Tax On Alcohols, Tobacco, Petroleum, Mineral Products and Miscellaneous ArticlesDocument37 pages5.2 Excise Tax Part 2 - Excise Tax On Alcohols, Tobacco, Petroleum, Mineral Products and Miscellaneous ArticlesDeo CoronaNo ratings yet

- J. P Morgan - NMDCDocument12 pagesJ. P Morgan - NMDCvicky168No ratings yet

- Pakistan Strategy - CPEC A Big Impetus For Growth and InvestmentDocument9 pagesPakistan Strategy - CPEC A Big Impetus For Growth and InvestmentAyeshaJangdaNo ratings yet

- Bakrie Sumatra Plantation: Perplexing End To A Confusing YearDocument5 pagesBakrie Sumatra Plantation: Perplexing End To A Confusing YearerlanggaherpNo ratings yet

- Pizza Asm 2020 ReportDocument130 pagesPizza Asm 2020 ReportJohn Robert ColladoNo ratings yet

- Tradewinds (M) : Board: Sector: Gics: Market Value - Total: SummaryDocument4 pagesTradewinds (M) : Board: Sector: Gics: Market Value - Total: Summarylimml63No ratings yet

- Gland Pharma LTD - Initiating CoverageDocument14 pagesGland Pharma LTD - Initiating CoverageBorn StarNo ratings yet

- Globetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Document7 pagesGlobetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Rhb InvestNo ratings yet

- Upl PDFDocument44 pagesUpl PDFbharat005No ratings yet

- Toshiba 30 Year Balance SheetDocument24 pagesToshiba 30 Year Balance SheetBronteCapitalNo ratings yet

- IFR - Asia 19.march.2022Document58 pagesIFR - Asia 19.march.2022Belu IonNo ratings yet

- Karnataka Bank - Initiating Coverage - 161020Document14 pagesKarnataka Bank - Initiating Coverage - 161020Nihit SandNo ratings yet

- Plan:Target Exhibitors From CES 09 SL No. Action Items Closure DateDocument51 pagesPlan:Target Exhibitors From CES 09 SL No. Action Items Closure DateApurv ModiNo ratings yet

- Clsa RussiaDocument97 pagesClsa RussiaAnonymous pKw7NB4jNo ratings yet

- Birla Sunlife Asset Management Company Limited: Current Ratio Current Assets/current LiabilitiesDocument9 pagesBirla Sunlife Asset Management Company Limited: Current Ratio Current Assets/current LiabilitiesAkanksha08051990No ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- AltaCorp PDFDocument4 pagesAltaCorp PDFzNo ratings yet

- Credit Suisse Investment Outlook 2018Document64 pagesCredit Suisse Investment Outlook 2018dpbasic100% (1)

- Offshore DrillingDocument28 pagesOffshore DrillingBull WinkleNo ratings yet

- Initiation - Comment Seadrill Limited: Initiating Coverage of SeadrillDocument25 pagesInitiation - Comment Seadrill Limited: Initiating Coverage of SeadrillocrandallNo ratings yet

- Quintis Limited (ASX:QIN) - Formerly TFS Corporation Limited - Money Doesn't Grow On TreesDocument49 pagesQuintis Limited (ASX:QIN) - Formerly TFS Corporation Limited - Money Doesn't Grow On TreesViceroy100% (2)

- CLSA Power Report (Jun 11)Document300 pagesCLSA Power Report (Jun 11)Deepak Saheb Gupta100% (1)

- Aegis Logistics-Initiating Coverage - 10.07.2020 - EquirisDocument49 pagesAegis Logistics-Initiating Coverage - 10.07.2020 - EquirisP VinayakamNo ratings yet

- Emperador Inc. Annual Report 2016Document167 pagesEmperador Inc. Annual Report 2016grail.donaelNo ratings yet

- Cannacord - RKHDocument17 pagesCannacord - RKHShane ChambersNo ratings yet

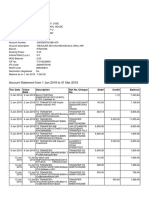

- Account Statement From 1 Jan 2019 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Jan 2019 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMathews JoseNo ratings yet

- PT. Mirae Asset Sekuritas Indonesia - Initiation Report PDFDocument75 pagesPT. Mirae Asset Sekuritas Indonesia - Initiation Report PDFLia HafizaNo ratings yet

- Is BSE-SENSEX Over/undervalued As of Sep 30, 2009?: To Download Word DocumentDocument8 pagesIs BSE-SENSEX Over/undervalued As of Sep 30, 2009?: To Download Word Documentpuneet-malikNo ratings yet

- Global Oil & Gas - 130813 - BarclaysDocument56 pagesGlobal Oil & Gas - 130813 - Barclaysalokgupta87No ratings yet

- 2021-02-01 - Asia Partners 2021 Southeast Asia Internet ReportDocument129 pages2021-02-01 - Asia Partners 2021 Southeast Asia Internet ReportaNo ratings yet

- Equity Research Report - CIMB 27 Sept 2016Document14 pagesEquity Research Report - CIMB 27 Sept 2016Endi SingarimbunNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- AECOM URS Presentation Final PDFDocument20 pagesAECOM URS Presentation Final PDFM. Murat ErginNo ratings yet

- ITC by EdelweissDocument9 pagesITC by EdelweissdarshanmadeNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialRaman BajpaiNo ratings yet

- Sessions 2 and 3 - Equity Valuation - in Session - Section EDocument88 pagesSessions 2 and 3 - Equity Valuation - in Session - Section EAnurag JainNo ratings yet

- Urgent Legal Notice To Kotak - 30102021 - 211030 - 182306Document4 pagesUrgent Legal Notice To Kotak - 30102021 - 211030 - 182306spahujNo ratings yet

- Oil & Gas Valuation Case Study: Ultra Petroleum (UPL) and Its Acquisition of The Uinta Basin Acreage - SHORT Recommendation Notes and DisclaimersDocument21 pagesOil & Gas Valuation Case Study: Ultra Petroleum (UPL) and Its Acquisition of The Uinta Basin Acreage - SHORT Recommendation Notes and DisclaimersihopethisworksNo ratings yet

- Equity Securities:Article IIIDocument37 pagesEquity Securities:Article IIIsherwin pulidoNo ratings yet

- Orchid+Pharma+ Initiating+Coverage Dec 23 NUVAMADocument44 pagesOrchid+Pharma+ Initiating+Coverage Dec 23 NUVAMAalfaresearch1No ratings yet

- Odfjell Drilling - Prospectus (International)Document442 pagesOdfjell Drilling - Prospectus (International)dhoomketuNo ratings yet

- HSBC Hedge Weekly (2006 - 2007 - 2008)Document46 pagesHSBC Hedge Weekly (2006 - 2007 - 2008)GeorgeNo ratings yet

- SAI I-Pru MFDocument429 pagesSAI I-Pru MFDirgha ShertukdeNo ratings yet

- Retailer Model - No TransactionDocument9 pagesRetailer Model - No TransactionAryan GNo ratings yet

- NFLXDocument7 pagesNFLXe39dinanNo ratings yet

- Northern Lights: in This IssueDocument18 pagesNorthern Lights: in This IssuejainantoNo ratings yet

- AngelBrokingResearch L&TTechnologyServices IPONote 090916Document18 pagesAngelBrokingResearch L&TTechnologyServices IPONote 090916durgasainathNo ratings yet

- PETRONAS IR20 Integrated Report 2020Document120 pagesPETRONAS IR20 Integrated Report 2020Aparna JRNo ratings yet

- Business Econometrics: Session VII-VIII DR Tutan Ahmed IIT Kharagpur February 2020Document21 pagesBusiness Econometrics: Session VII-VIII DR Tutan Ahmed IIT Kharagpur February 2020Aparna JRNo ratings yet

- Simulation of Newsvendor Model: Order Size (Units)Document8 pagesSimulation of Newsvendor Model: Order Size (Units)Aparna JRNo ratings yet

- Session IX X FinalDocument38 pagesSession IX X FinalAparna JRNo ratings yet

- Implicit Egotism: Current Directions in Psychological Science April 2005Document7 pagesImplicit Egotism: Current Directions in Psychological Science April 2005Aparna JRNo ratings yet

- Group - 4: The Psychology of Pricing: Some Useful TacticsDocument11 pagesGroup - 4: The Psychology of Pricing: Some Useful TacticsAparna JRNo ratings yet

- General Investment Authority: August 2018Document46 pagesGeneral Investment Authority: August 2018Aparna JRNo ratings yet

- Name-Letters and Birthday-Numbers: Implicit Egotism Effects in PricingDocument53 pagesName-Letters and Birthday-Numbers: Implicit Egotism Effects in PricingAparna JRNo ratings yet

- LorealDocument1 pageLorealAparna JRNo ratings yet

- Bicycling WorldDocument1 pageBicycling WorldAparna JRNo ratings yet

- Correlation RegressionDocument16 pagesCorrelation RegressionAparna JRNo ratings yet

- Buol 643 1 Running Head: BUOL643 WEEK # 8Document6 pagesBuol 643 1 Running Head: BUOL643 WEEK # 8Aparna JRNo ratings yet

- Product Advertisement in MediaDocument4 pagesProduct Advertisement in MediaAparna JRNo ratings yet

- Lec 26Document64 pagesLec 26Aparna JRNo ratings yet

- WEEK Eight - FINAL EXAM PAPER - Grading RubricDocument2 pagesWEEK Eight - FINAL EXAM PAPER - Grading RubricAparna JRNo ratings yet

- Lec 24Document54 pagesLec 24Aparna JRNo ratings yet

- Siemens Business Fact SheetsDocument9 pagesSiemens Business Fact Sheetszain shafiqNo ratings yet

- Paper 3Document14 pagesPaper 3Aparna JRNo ratings yet

- Law of Contract Sa 9 1 21Document40 pagesLaw of Contract Sa 9 1 21Aparna JRNo ratings yet

- Constituents and Consequences of Online-Shopping in Sustainable E-Business: An Experimental Study of Online-Shopping MallsDocument24 pagesConstituents and Consequences of Online-Shopping in Sustainable E-Business: An Experimental Study of Online-Shopping MallsAparna JRNo ratings yet

- Law of Insurance VGSOM 16 1 2021Document31 pagesLaw of Insurance VGSOM 16 1 2021Aparna JRNo ratings yet

- Allocating Cash Dividends Between Preferred and Co PDFDocument3 pagesAllocating Cash Dividends Between Preferred and Co PDFrockerNo ratings yet

- Lecture 2: Transaction Analysis & Financial Statements: ACCT10001 Accounting Reports and AnalysisDocument21 pagesLecture 2: Transaction Analysis & Financial Statements: ACCT10001 Accounting Reports and AnalysisBáchHợpNo ratings yet

- BA 2802 - Principles of Finance Problems For Recitation #1Document3 pagesBA 2802 - Principles of Finance Problems For Recitation #1Eda Nur EvginNo ratings yet

- ABM ReviewerDocument5 pagesABM ReviewerKRISTELLE ROSARIONo ratings yet

- Gamboa V Teves G.R. 176579Document2 pagesGamboa V Teves G.R. 176579Dino Bernard LapitanNo ratings yet

- Assignment 1: Chapter 12 LiabilitiesDocument5 pagesAssignment 1: Chapter 12 LiabilitiesKarylle Ynah MalanaNo ratings yet

- Bank StatementDocument440 pagesBank StatementsushilNo ratings yet

- Introduction To Banking - Handwritten NotesDocument10 pagesIntroduction To Banking - Handwritten NotesHarsh Raj SinghNo ratings yet

- What Are Management Assertions?: Audit Financial Statements Auditors Assertions Audit TestsDocument3 pagesWhat Are Management Assertions?: Audit Financial Statements Auditors Assertions Audit TestsAdeline DelveyNo ratings yet

- Acca P2 Corporate Reporting (INT) June 2015: Sample NoteDocument64 pagesAcca P2 Corporate Reporting (INT) June 2015: Sample NoteSovanna HangNo ratings yet

- CCA - Explanation Doc - DescriptionDocument2 pagesCCA - Explanation Doc - DescriptionNadja Josefine GavrilukNo ratings yet

- BA 99.1 Rodriguez LE 1 SamplexDocument6 pagesBA 99.1 Rodriguez LE 1 SamplexYsabella Beatriz SamsonNo ratings yet

- Syngene Q3FY20 - RU - 23 Jan 2020Document9 pagesSyngene Q3FY20 - RU - 23 Jan 2020Doshi VaibhavNo ratings yet

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- Crisil Amfi Mutual Fund Report Digital Evolution PDFDocument56 pagesCrisil Amfi Mutual Fund Report Digital Evolution PDFShubham SinghNo ratings yet

- Thirumalai Chemicals LTD - 2018 PDFDocument132 pagesThirumalai Chemicals LTD - 2018 PDFRavi PanaraNo ratings yet

- Accounting ProblemsDocument41 pagesAccounting ProblemsAnnisa Nurbaity100% (1)

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- Review Questions For FinalsDocument7 pagesReview Questions For Finalsairishmae.macam.acctNo ratings yet

- Corporate Finance - Ahuja - Chauhan PDFDocument177 pagesCorporate Finance - Ahuja - Chauhan PDFSiddharth BirjeNo ratings yet

- En Principal DALI Equity Growth Fund IRDocument46 pagesEn Principal DALI Equity Growth Fund IREjang GutNo ratings yet

- Sales Budget in Millions $Document13 pagesSales Budget in Millions $IkramNo ratings yet

- In-Depth Analysis of The Insolvency and Bankruptcy Code, 2016 and The Frdi Bill, 2017Document276 pagesIn-Depth Analysis of The Insolvency and Bankruptcy Code, 2016 and The Frdi Bill, 2017Venkat Deepak SarmaNo ratings yet

- SECP Drafts New Provident Fund RulesDocument4 pagesSECP Drafts New Provident Fund Rulesachievingsquad4lifeNo ratings yet

- Microsoft Dynamics 365 Finance and Operation: ConsolidationDocument9 pagesMicrosoft Dynamics 365 Finance and Operation: ConsolidationSherif KeshtaNo ratings yet

- Document Incorporated by Reference Financial Information Annual Report - 2021 12 31Document55 pagesDocument Incorporated by Reference Financial Information Annual Report - 2021 12 31Thy Hoang GiaNo ratings yet

- 3rd QUARTER EXAMS WEEK 10 FABMDocument6 pages3rd QUARTER EXAMS WEEK 10 FABMLenlyn Fallarcuna Falamig100% (5)