Professional Documents

Culture Documents

Marston Corporation Manufactures Pharmaceutical Products Sold TH

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marston Corporation Manufactures Pharmaceutical Products Sold TH

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Marston Corporation manufactures pharmaceutical

products sold th

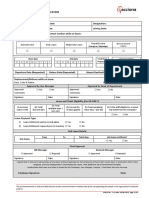

Marston Corporation manufactures pharmaceutical products sold through a network of sales

agents in the United States and Canada. The agents are currently paid an 18 percent

commission on sales; that percentage was used when Marston prepared the following budgeted

income statement for the fiscal year ending June 30, 2010.

Since the completion of the income statement, Marston has learned that its sales agents are

requiring a 5 percent increase in their commission rate (to 23 percent) for the upcoming year. As

a result, Marston's president has decided to investigate the possibility of hiring its own sales

staff in place of the network of sales agents and has asked Tom Markowitz, Marston's

controller, to gather information on the costs associated with this change. Tom estimates that

Marston must hire eight salespeople to cover the current market area, at an average annual

payroll cost for each employee of $80,000, including fringe benefits expense. Travel and

entertainment expense is expected to total $600,000 for the year, and the annual cost of hiring

a sales manager and sales secretary will be $150,000. In addition to their salaries, the eight

salespeople will each earn commissions at the rate of 10 percent. The president believes that

Marston also should increase its advertising budget by $500,000 if the eight salespeople are

hired.

Required

1. Determine Marston Corporation's breakeven point in sales dollars for the fiscal year ending

June 30, 2010, if the company hires its own sales force and increases its advertising costs.

2. If Marston continues to sell through its network of sales agents and pays the higher

commission rate, determine the estimated volume in sales dollars that would be required to

generate the same operating profit as projected in the budgeted income statement.

3. Describe the general assumptions underlying breakeven analysis that limit its usefulness.

4. What is the indifference point in sales for the firm to either accept the agents' demand or

adopt the proposed change? Which plan is better for the firm?

5. What are the ethical issues, if any, that Tom should consider?

(CMAAdapted)

ANSWER

https://solvedquest.com/marston-corporation-manufactures-pharmaceutical-products-sold-th/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Outreach Networks Case StudyDocument9 pagesOutreach Networks Case Studymothermonk100% (3)

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Completed Chapter 2 Mini Case Excel Working Papers FA14Document4 pagesCompleted Chapter 2 Mini Case Excel Working Papers FA14ZachLovingNo ratings yet

- Accounting Microsoft CaseDocument6 pagesAccounting Microsoft CaseChi100% (1)

- Ortho 500 Sales StrategyDocument4 pagesOrtho 500 Sales Strategyavi201567% (6)

- Chapter 1 SolutionsDocument25 pagesChapter 1 SolutionsKenny RunyanNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Chloe BuiDocument2 pagesChloe BuiTuệ VănNo ratings yet

- Business Environment Report of MorrisonsDocument3 pagesBusiness Environment Report of MorrisonsAmar narayanNo ratings yet

- FWD - HUDA RIHAN - STRATEGIC MARKETING ASSIGNMENT - EditedDocument20 pagesFWD - HUDA RIHAN - STRATEGIC MARKETING ASSIGNMENT - EditedSundar Ranju100% (1)

- Millward Brown Optimor Case StudyDocument2 pagesMillward Brown Optimor Case StudySumit RanjanNo ratings yet

- Assess Boston Chicken's Business Strategy by Identifying Its Critical Success FactorsDocument4 pagesAssess Boston Chicken's Business Strategy by Identifying Its Critical Success FactorsArindam PalNo ratings yet

- Ortho 500 Sales StrategyDocument3 pagesOrtho 500 Sales StrategyAnas MujaddidiNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Two Products Are Manufactured by The Burlington Northern Corporation WidgetDocument2 pagesTwo Products Are Manufactured by The Burlington Northern Corporation WidgetAmit PandeyNo ratings yet

- Teacher A Catalyst of ChangeDocument2 pagesTeacher A Catalyst of ChangeYeshua Yesha100% (6)

- LevisDocument6 pagesLevisRichelle Copon-ToledoNo ratings yet

- Practical Guide For Professional Conference Interpreters LinksDocument22 pagesPractical Guide For Professional Conference Interpreters Linksrebe_piccolinaNo ratings yet

- Profit Split Method Transfer Pricing ExamplesDocument1 pageProfit Split Method Transfer Pricing ExamplesLJBernardoNo ratings yet

- 2010 Trends in MarketingDocument8 pages2010 Trends in Marketingsaleem_a_jNo ratings yet

- Student Name: Institution: Fitchburg State University Course: MGMT - 9170 Professor: Dr. Louis Pereira Date: 07/25/2021Document4 pagesStudent Name: Institution: Fitchburg State University Course: MGMT - 9170 Professor: Dr. Louis Pereira Date: 07/25/2021Sana FarhanNo ratings yet

- TUTORIAL 6 & 7 QuestionsDocument1 pageTUTORIAL 6 & 7 QuestionsgasdadsNo ratings yet

- Simfoni Raises $3M To Accelerate US Expansion of Its Spend Analytics and Spend Automation PlatformDocument3 pagesSimfoni Raises $3M To Accelerate US Expansion of Its Spend Analytics and Spend Automation PlatformPR.comNo ratings yet

- Assignment 1Document7 pagesAssignment 1rohit77123No ratings yet

- Marketing 301 Exam 3 Marketing MathDocument2 pagesMarketing 301 Exam 3 Marketing MathEarth's SpiritNo ratings yet

- Analysis Birch PaperDocument9 pagesAnalysis Birch PapervaruntyagiNo ratings yet

- Marketing PlanDocument8 pagesMarketing PlanRoxieNo ratings yet

- Competitive Landscape Revenu 209271Document43 pagesCompetitive Landscape Revenu 209271alvaro_a_ribeiroNo ratings yet

- Advanced Financial Management 3.3 IcagDocument23 pagesAdvanced Financial Management 3.3 IcagmohedNo ratings yet

- BritishAmericanTobacco-customer Relationship ManagementDocument45 pagesBritishAmericanTobacco-customer Relationship ManagementLim KeakruyNo ratings yet

- Case Study 3B-Financial Statement Analysis-Risk-Return On InvestmentDocument3 pagesCase Study 3B-Financial Statement Analysis-Risk-Return On InvestmentmaksiuiclubNo ratings yet

- BSBFIM601 Appendices1 V1.0Document10 pagesBSBFIM601 Appendices1 V1.0xovaba7514No ratings yet

- Budget Report For X-Max SystemsDocument6 pagesBudget Report For X-Max Systemsbts armyNo ratings yet

- FCF - Firm - Valuation - GAP - AnushaPrasadam FIN 517 Sum 2020Document6 pagesFCF - Firm - Valuation - GAP - AnushaPrasadam FIN 517 Sum 2020अनुशा प्रसादम्No ratings yet

- Practice Case On ValuationDocument4 pagesPractice Case On ValuationSiwalik MishraNo ratings yet

- ACC7800 Walmart & Amazon Cash Cycle (Fall 2021)Document1 pageACC7800 Walmart & Amazon Cash Cycle (Fall 2021)KumarNo ratings yet

- Eastboro Machine Tools CorporationDocument32 pagesEastboro Machine Tools Corporationrifki100% (2)

- Metro Inc.: Resilient Business ModelDocument4 pagesMetro Inc.: Resilient Business ModelSudhir PowerNo ratings yet

- Generic Competitive Strategies Corporate-Level Strategy Types of DiversificationDocument4 pagesGeneric Competitive Strategies Corporate-Level Strategy Types of DiversificationFoysal Bin TaherNo ratings yet

- 1.3 M1 - Dividends Question SetDocument3 pages1.3 M1 - Dividends Question Setshyla negiNo ratings yet

- Virgin Mobile Pricing and Launch in UsaDocument5 pagesVirgin Mobile Pricing and Launch in UsaHiamanshu SinghNo ratings yet

- Finance Assignment HelpDocument4 pagesFinance Assignment HelpJane AustinNo ratings yet

- Grand Jeans Case (Assign 2)Document5 pagesGrand Jeans Case (Assign 2)arn01dNo ratings yet

- Introduction To BusinessDocument17 pagesIntroduction To BusinessRamona AmorasNo ratings yet

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- (K54CLC5) Business Serivce - Group Enough - 9Document11 pages(K54CLC5) Business Serivce - Group Enough - 9Hoang TrangNo ratings yet

- Marriot InternationalDocument7 pagesMarriot InternationalIrish ButtNo ratings yet

- Establishing Strategic Business Units: Prepared By: Dr. Shamsad AhmedDocument8 pagesEstablishing Strategic Business Units: Prepared By: Dr. Shamsad AhmedDas ApurboNo ratings yet

- Smart Mart Strategic Analysis Student's Name: InstitutionDocument9 pagesSmart Mart Strategic Analysis Student's Name: InstitutionAnurag AgrawalNo ratings yet

- Principles of MarketingDocument14 pagesPrinciples of MarketingSundar RanjuNo ratings yet

- By: Ramarao Kandregula Pavan Putra Gosangi Karthikeya Voora Pavan Kumar VegiDocument18 pagesBy: Ramarao Kandregula Pavan Putra Gosangi Karthikeya Voora Pavan Kumar VegiSrikanth GaaliNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument5 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- MNC's Bane or BoonDocument5 pagesMNC's Bane or Boonryan_dsouza501246No ratings yet

- Executive Boardroom MeetingDocument6 pagesExecutive Boardroom MeetingAngel29JNo ratings yet

- Business Plan AdGroveDocument21 pagesBusiness Plan AdGrovefms162No ratings yet

- Why Mergers Go Wrong PDFDocument7 pagesWhy Mergers Go Wrong PDFADITYAJDNo ratings yet

- Seed Co Business PlanDocument3 pagesSeed Co Business PlanFrancis Mtambo100% (1)

- Amazon Case StudyDocument15 pagesAmazon Case Studyade firmansyah71% (7)

- McDonalds RoyaltyfeesDocument2 pagesMcDonalds RoyaltyfeesNidhi BengaliNo ratings yet

- Marriot CorpDocument7 pagesMarriot Corpamith88100% (1)

- Your Strategy Needs A Strategy - Reflection EssayDocument4 pagesYour Strategy Needs A Strategy - Reflection EssaySam100% (1)

- Manhattan Strategies - AnalysisDocument32 pagesManhattan Strategies - Analysisalok26sinhaNo ratings yet

- Marketing CasesDocument11 pagesMarketing CasesMakarand TakaleNo ratings yet

- An Appraisal of Dividend Policy of Meghna Cement Mills LimitedDocument21 pagesAn Appraisal of Dividend Policy of Meghna Cement Mills LimitedMd. Mesbah Uddin100% (6)

- ManaccccDocument24 pagesManaccccJaynalyn MonasterialNo ratings yet

- MB0036 - Strategic Management & Business Policy Assignment Set-1Document51 pagesMB0036 - Strategic Management & Business Policy Assignment Set-1Tushar PatilNo ratings yet

- Sales Growth (Review and Analysis of Baumgartner, Hatami and Vander Ark's Book)From EverandSales Growth (Review and Analysis of Baumgartner, Hatami and Vander Ark's Book)No ratings yet

- Distribution Strategy: The BESTX® Method for Sustainably Managing Networks and ChannelsFrom EverandDistribution Strategy: The BESTX® Method for Sustainably Managing Networks and ChannelsNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Job AnalysisDocument20 pagesJob AnalysisRisha RehanNo ratings yet

- Personnel RisksDocument2 pagesPersonnel RisksAnushka SeebaluckNo ratings yet

- FSQ14 Leave Application (03 August 2022) Rev 3.0Document1 pageFSQ14 Leave Application (03 August 2022) Rev 3.0Rejo AbrahamNo ratings yet

- Petitioners Respondent: Bluer Than Blue Joint Ventures Company/Mary Ann Dela Vega, - Glyza EstebanDocument9 pagesPetitioners Respondent: Bluer Than Blue Joint Ventures Company/Mary Ann Dela Vega, - Glyza EstebanIsabel HigginsNo ratings yet

- Al-Madietal 2017 PDFDocument13 pagesAl-Madietal 2017 PDFSatish Chowdary KothaNo ratings yet

- SPMDocument41 pagesSPMcharlesbabuNo ratings yet

- Lec. 2 HRM IntroductionDocument26 pagesLec. 2 HRM Introductionlabiba yashnaNo ratings yet

- Sullivans Auto World 1Document11 pagesSullivans Auto World 1fhipolitoNo ratings yet

- Caleb Culberson Current ResumeDocument1 pageCaleb Culberson Current Resumeapi-339695920No ratings yet

- Regular Employee Details FormDocument4 pagesRegular Employee Details FormRajesh BabuNo ratings yet

- DOLE Labor Advisory No. 11, Series of 2014 PDFDocument2 pagesDOLE Labor Advisory No. 11, Series of 2014 PDFWilliam Azucena100% (1)

- Career Exploration Worksheet 1Document4 pagesCareer Exploration Worksheet 1api-226102828No ratings yet

- Makers by Cory DoctorowDocument286 pagesMakers by Cory DoctorowPaolo BartoliNo ratings yet

- Child Labour: ResearchDocument10 pagesChild Labour: ResearchUneeb AliNo ratings yet

- Forma 8Document48 pagesForma 8HITONo ratings yet

- Scannerindustriallabourchapter1 PDFDocument4 pagesScannerindustriallabourchapter1 PDFVijay VikasNo ratings yet

- Grounds For Termination of A Probationary EmployeeDocument2 pagesGrounds For Termination of A Probationary Employeeyurets929No ratings yet

- Yes I Know Sab ChoirDocument6 pagesYes I Know Sab ChoirlevonNo ratings yet

- A Study On Stress Management in Banking IndustryDocument45 pagesA Study On Stress Management in Banking IndustryShop987 ssNo ratings yet

- Banyu Urip: From Indonesia, For IndonesiaDocument24 pagesBanyu Urip: From Indonesia, For IndonesiaenerNo ratings yet

- Job Description Position Title: Reports To: Location: DateDocument2 pagesJob Description Position Title: Reports To: Location: DateAspire SuccessNo ratings yet

- Chapter 14 (Ans)Document11 pagesChapter 14 (Ans)Thanh Lam LamNo ratings yet

- Report of The Baseline Study On CambodiaDocument11 pagesReport of The Baseline Study On CambodiaTheng TingNo ratings yet

- CBYDP Workshop MatrixDocument22 pagesCBYDP Workshop MatrixJames BombitaNo ratings yet

- Individual PaperDocument9 pagesIndividual PaperApple SangreNo ratings yet

- TOPIC-A Study On HR Strategies of "Havelles India"Document12 pagesTOPIC-A Study On HR Strategies of "Havelles India"Prachi PatilNo ratings yet