Professional Documents

Culture Documents

Solved The Miracle Corporation Had The Following Sales During The Past

Uploaded by

M Bilal SaleemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved The Miracle Corporation Had The Following Sales During The Past

Uploaded by

M Bilal SaleemCopyright:

Available Formats

(SOLVED) The Miracle Corporation had the following sales

during the past

The Miracle Corporation had the following sales during the past The Miracle Corporation had

the following sales during the past 10 years (in thousands of dollars): a. Calculate a trend line,

and forecast sales for 2013. How confident are you of this forecast? b. Use exponential

smoothing with a smoothing […]

The sales data for the Lonestar Sports Apparel Company for The sales data for the Lonestar

Sports Apparel Company for the last 12 years are as follows: a. What is the 2001-2012

compound growth rate? b. I sing the result obtained in part a, what is your 2013 projection? c.

[…]

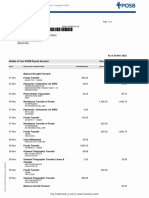

Dudley Bank has the following balance sheet and income statement. For Dudley Bank,

calculate: a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit

margin f. Interest expense ratio g. Provision for loan loss ratio h. Noninterest expense ratio i.

Tax ratio j. Overheadefficiency

Megalopolis Bank has the following balance sheet and income statement. For Megalopolis,

calculate: a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit

margin f. Interest expense ratio g. Provision for loan loss ratio h. Noninterest expense ratio i.

Taxratio

GET ANSWER- https://accanswer.com/downloads/page/2999/

A bank has a balance sheet as shown below. At the beginning of the month, the bank has $

15,141,000 in its loan portfolio and $ 183,000 in the allowance for loan losses. During the

month, management estimates that an additional $ 5,200 of loans will not be paid as […]

The financial statements for BSW National Bank (BSWNB) are shown below: a. What is the

dollar value of earning assets held by BSWNB? b. What is the dollar value of interest-bearing

liabilities held by BSWNB? c. What is BSWNB’s total operating income? d. Calculate

BSWNB’s asset utilization ratio. e. Calculate […]

The financial statements for First National Bank (FNB) are shown below: a. Calculate the dollar

value of FNB’s earning assets. b. Calculate FNB’s ROA.c. Calculate FNB’s asset utilization

ratio. d. Calculate FNB’sspread.

SEE SOLUTION>> https://accanswer.com/downloads/page/2999/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Chapter 4 Measuring Financial PerformanceDocument4 pagesChapter 4 Measuring Financial Performanceabdiqani abdulaahi100% (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- WP Future Consumer 2023 enDocument36 pagesWP Future Consumer 2023 enRaquel Mantovani100% (6)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- FINA 4383 QuizzesDocument10 pagesFINA 4383 QuizzesSamantha Luna100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CMA Examination Sample QuestionsDocument9 pagesCMA Examination Sample QuestionsRamNo ratings yet

- Fin22 Cash Flow and LevarageDocument3 pagesFin22 Cash Flow and LevarageJoeNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- With Correct AnswerDocument8 pagesWith Correct AnswerMervin MartinNo ratings yet

- Chapter 12 QuizDocument4 pagesChapter 12 Quizgottwins05No ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- Summative Test (Fabm2)Document2 pagesSummative Test (Fabm2)Zybel RosalesNo ratings yet

- ACCT 5103 OL Sample Final ExamDocument7 pagesACCT 5103 OL Sample Final ExamEsther MpyisiNo ratings yet

- Business Finance ExamDocument3 pagesBusiness Finance ExamChristian Joy ReyesNo ratings yet

- RevisedACFNModelExam - 2023Document15 pagesRevisedACFNModelExam - 2023Eyuel SintayehuNo ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- QTTCDocument21 pagesQTTCHuong LanNo ratings yet

- Financial Management QualiDocument6 pagesFinancial Management QualiJaime II LustadoNo ratings yet

- Questions On Ratios 1Document2 pagesQuestions On Ratios 1hana osmanNo ratings yet

- FinMan - Special Exam - MidtermDocument4 pagesFinMan - Special Exam - MidtermTimothy JamesNo ratings yet

- Practice Midterm #2Document10 pagesPractice Midterm #2Bree JiangNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Test BankDocument48 pagesFinancial Statement Analysis 11th Edition Subramanyam Test Bankgarrotewrongerzxxo100% (29)

- Finman Final Exam ProblemDocument10 pagesFinman Final Exam ProblemJayaAntolinAyusteNo ratings yet

- Winter 2016 - ACC 1100 Sample FinalDocument16 pagesWinter 2016 - ACC 1100 Sample FinalCourtyNo ratings yet

- SDDocument19 pagesSDNitinNo ratings yet

- FIN3701 Tutorial 2 QuestionsDocument4 pagesFIN3701 Tutorial 2 QuestionsYeonjae SoNo ratings yet

- Financial Management: Acca Revision Mock 2Document22 pagesFinancial Management: Acca Revision Mock 2Sidra QamarNo ratings yet

- Microsoft Word - FINA5340 Practice Question 1 Spring 2019Document10 pagesMicrosoft Word - FINA5340 Practice Question 1 Spring 2019Mai PhamNo ratings yet

- DHS Accountancy 2021Document30 pagesDHS Accountancy 2021Kuenga Geltshen100% (2)

- Mba722 Group Assignments September 2023Document4 pagesMba722 Group Assignments September 2023Rudo MukurungeNo ratings yet

- Solved Consider The Following Company S Balance Sheet and Income StatementDocument1 pageSolved Consider The Following Company S Balance Sheet and Income StatementM Bilal SaleemNo ratings yet

- Solved Determine The Effect of The Following Errors On A Company SDocument1 pageSolved Determine The Effect of The Following Errors On A Company SAnbu jaromiaNo ratings yet

- Accountancy and Auditing Paper-IDocument8 pagesAccountancy and Auditing Paper-IHassan TariqNo ratings yet

- Solved Investor W Has The Opportunity To Invest 500 000 in ADocument1 pageSolved Investor W Has The Opportunity To Invest 500 000 in AAnbu jaromiaNo ratings yet

- ACFrOgBx84rfZPyeSLrX1uGbBiJOuh8CxfoOW Sa27wIJ0pJhFscjg97S8GuIUyYNTIKVw0IjgvGpgKvW1ox2he6OUTioCpoBD7L57 uZfMVpsBFYkr9VyEvkrselfIT0UE5vh7U8NtBRqMp7XhODocument5 pagesACFrOgBx84rfZPyeSLrX1uGbBiJOuh8CxfoOW Sa27wIJ0pJhFscjg97S8GuIUyYNTIKVw0IjgvGpgKvW1ox2he6OUTioCpoBD7L57 uZfMVpsBFYkr9VyEvkrselfIT0UE5vh7U8NtBRqMp7XhOPRIYANSHU GOELNo ratings yet

- 5 Question - FinanceDocument19 pages5 Question - FinanceMuhammad IrfanNo ratings yet

- Far 3 MidtermsDocument10 pagesFar 3 MidtermsSarah Del RosarioNo ratings yet

- Accounting Concepts and Business Performance Quiz 1 QuestionsDocument9 pagesAccounting Concepts and Business Performance Quiz 1 QuestionsMohammad Usman TanveerNo ratings yet

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- De La Salle Araneta UniversityDocument7 pagesDe La Salle Araneta UniversityBryent GawNo ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- Solved A Section 20 Subsidiary of A Major U S Bank IsDocument1 pageSolved A Section 20 Subsidiary of A Major U S Bank IsM Bilal SaleemNo ratings yet

- Borders Group Inc Presented This Information in Its 10 K S RDocument1 pageBorders Group Inc Presented This Information in Its 10 K S RM Bilal SaleemNo ratings yet

- QuestionsDocument9 pagesQuestionsGENIUS1507No ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 7Th Edition Whalen Test Bank Full Chapter PDFDocument67 pagesFinancial Reporting Financial Statement Analysis and Valuation 7Th Edition Whalen Test Bank Full Chapter PDFanthelioncingulumgvxq100% (11)

- HO2 - FS and FS Analysis PDFDocument11 pagesHO2 - FS and FS Analysis PDFPATRICIA PEREZNo ratings yet

- MCQ Financial Management B Com Sem 51Document17 pagesMCQ Financial Management B Com Sem 51laxmikushwah7272No ratings yet

- Finance Mid TermDocument4 pagesFinance Mid TermbloodinawineglasNo ratings yet

- Seatwork 01 Financial Statement Analysis PDFDocument5 pagesSeatwork 01 Financial Statement Analysis PDFHannah Mae VestilNo ratings yet

- CMA Exam Support Package 2022 - 2023Document676 pagesCMA Exam Support Package 2022 - 2023Sachin Kumar100% (1)

- The Credit Manager of Montour Fuel Has Gathered The FollowingDocument1 pageThe Credit Manager of Montour Fuel Has Gathered The Followingamit raajNo ratings yet

- AFDM Quiz 1Document8 pagesAFDM Quiz 1Mohsin JalilNo ratings yet

- Finance: Practice QuestionsDocument33 pagesFinance: Practice QuestionsMahtab Chondon100% (1)

- Theory of Accounts - Multiple Choices: Cash Flows?Document20 pagesTheory of Accounts - Multiple Choices: Cash Flows?Babylyn Navarro0% (1)

- CH 15Document17 pagesCH 15Linda YuNo ratings yet

- Unit 15 Final ExamDocument5 pagesUnit 15 Final ExamTakuriNo ratings yet

- A. All of The AboveDocument11 pagesA. All of The AbovetikaNo ratings yet

- MAS 1 PrelimDocument10 pagesMAS 1 PrelimRose Ann Moraga FrancoNo ratings yet

- Objective Questions On Advance Financial ManagementDocument14 pagesObjective Questions On Advance Financial ManagementJyoti SinghalNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Comparative Vs Absolute AdvantageDocument9 pagesComparative Vs Absolute AdvantageJayesh Kumar YadavNo ratings yet

- Simple Tax Invoice With Billing and ShippingDocument1 pageSimple Tax Invoice With Billing and ShippingerjasdNo ratings yet

- BOB Revised Service ChargesDocument36 pagesBOB Revised Service ChargesKulbhushan SinghNo ratings yet

- Soa 0457Document4 pagesSoa 0457Sunil SDNo ratings yet

- DETAILS ON GROUP and INDIVIDUAL ASSIGNMENTDocument1 pageDETAILS ON GROUP and INDIVIDUAL ASSIGNMENTANIS SURAYA NOOR AZIZANNo ratings yet

- The Directors ReportDocument1 pageThe Directors ReportTENDEKAI MASOKANo ratings yet

- Unit 1 MCQDocument7 pagesUnit 1 MCQHan Nwe OoNo ratings yet

- Chat GPT Banking SystemDocument7 pagesChat GPT Banking SystemSebas GarciaNo ratings yet

- Vat 220-223-224Document2 pagesVat 220-223-224timotheoigogo100% (1)

- Consumer Information:: Name: Date of Birth: GenderDocument3 pagesConsumer Information:: Name: Date of Birth: GendermohitNo ratings yet

- Real Estate Pro FormaDocument4 pagesReal Estate Pro FormaJohn BanaskiNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- Cottage and Small Scale Industry PresentationDocument3 pagesCottage and Small Scale Industry PresentationThe BeatableNo ratings yet

- Peopleware Chapter 20Document14 pagesPeopleware Chapter 20Umar AshrafNo ratings yet

- Questionnaire On "Study On Consumer Perception of E-Commerce Shopping."Document3 pagesQuestionnaire On "Study On Consumer Perception of E-Commerce Shopping."anand shindeNo ratings yet

- Valency Agro Nigeria Limited - Programme Memorandum - Executed - 080121 1Document44 pagesValency Agro Nigeria Limited - Programme Memorandum - Executed - 080121 1Amit MathurNo ratings yet

- 6 Unit 8 Corporate RestructureDocument19 pages6 Unit 8 Corporate RestructureAnuska JayswalNo ratings yet

- November 2022Document4 pagesNovember 2022NURSAJIDANo ratings yet

- ISCDL - Problem Statements For State Level HackthonDocument6 pagesISCDL - Problem Statements For State Level HackthonSarvesh DubeyNo ratings yet

- Discuss How Any Company Can Become A Multinational Company What Are Some TheDocument2 pagesDiscuss How Any Company Can Become A Multinational Company What Are Some TheAmara jrrNo ratings yet

- Dealers Perception About Sanghi CementnewDocument10 pagesDealers Perception About Sanghi CementnewpujanswetalNo ratings yet

- Chapter Four: Micro-Financing InstitutionsDocument16 pagesChapter Four: Micro-Financing InstitutionsBekele DemissieNo ratings yet

- DEPSDocument2 pagesDEPSvietdung25112003No ratings yet

- Xiaomi Case StudyDocument4 pagesXiaomi Case StudyAyushi KumawatNo ratings yet

- Borrower (S) Commitment Letter: Revised March 2016Document4 pagesBorrower (S) Commitment Letter: Revised March 2016Noor Azah AdamNo ratings yet

- Report - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaDocument101 pagesReport - Comparative Baseline Study On Establishing The Startup Policy in TanzaniaBongani SaidiNo ratings yet

- Status of Primary Market Response in Nepal: Jas Bahadur GurungDocument13 pagesStatus of Primary Market Response in Nepal: Jas Bahadur GurungSonam ShahNo ratings yet

- Elements of Financial StatementsDocument6 pagesElements of Financial StatementsAngelAnneDeJesus86% (7)

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet