Professional Documents

Culture Documents

Since 1977

Uploaded by

Ylor NoniuqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Since 1977

Uploaded by

Ylor NoniuqCopyright:

Available Formats

Since 1977

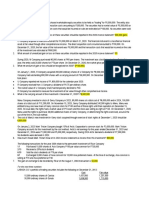

FAR OCAMPO/CABARLES/SOLIMAN/OCAMPO

FAR.2918-Trade and Other Receivables OCTOBER 2020

DISCUSSION PROBLEMS

1. Which statement is incorrect regarding PFRS 15? b. An entity shall consider the terms of the contract

a. The standard outlines a single comprehensive and its customary business practices to determine

model for entities to use in accounting for revenue the transaction price.

arising from contracts with customers. c. The nature, timing and amount of consideration

b. The standard supersedes revenue recognition promised by a customer affect the estimate of the

guidance in PAS 18 Revenue and PAS 11 transaction price.

Construction Contracts and related interpretations. d. The consideration promised in a contract with a

c. The core principle is that an entity recognizes customer may include fixed amounts but not

revenue to depict the transfer of promised goods variable amounts.

or services to customers in an amount that reflects

the consideration to which the entity expects to be 6. When determining the transaction price, an entity shall

entitled in exchange for those goods or services. consider the effects of:

d. None, all the statements are correct. I. Variable consideration

II. Constraining estimates of variable consideration

2. Arrange in proper sequence the five-step approach III. The existence of a significant financing

that entities will follow in recognizing revenue in component in the contract

accordance with PFRS 15: IV. Non-cash consideration

I. Determine the transaction price V. Consideration payable to a customer

II. Identify the contract(s) with the customer

a. I, II, III, IV and V c. III, IV and V only

III. Identify the separate performance obligations in

b. II, III, IV and V only d. III and IV only

the contract

IV. Recognize revenue when (or as) each performance

7. For the purpose of determining the transaction price,

obligation is satisfied

an entity shall assume

V. Allocate the transaction price to separate

a. That the goods or services will be transferred to

performance obligations

the customer as promised in accordance with the

a. I, II, III, IV and V c. III, II, I, V and IV existing contract.

b. II, III, I, V and IV d. II, III, V, I and IV b. That the contract may be cancelled.

c. That the contract may be renewed

3. For PFRS 15 to apply, a contract with a customer d. That the contract may be modified.

should meet which of the following conditions?

I. The contract has been approved by the parties to 8. Where a contract has multiple performance obligations,

the contract. an entity will allocate the transaction price to the

II. Each party’s rights in relation to the goods or performance obligations in the contract by reference to

services to be transferred can be identified. their relative

III. The payment terms for the goods or services to a. Standalone selling prices.

be transferred can be identified. b. Fair values.

IV. The contract has commercial substance. c. Net realizable values.

V. It is probable that the consideration to which the d. Any of the above.

entity is entitled to in exchange for the goods or

services will be collected. 9. Which statement is incorrect regarding recognition of

revenue?

a. I, II, III, IV and V c. I, II, III and V

a. Revenue is recognized as control is passed, either

b. I, III, IV and V d. I, II, III and IV

over time or at a point in time.

b. Control of an asset is defined as the ability to

4. Performance obligation is a promise in a contract with

direct the use of and obtain substantially all of the

a customer to transfer to the customer

remaining benefits from the asset.

a. A good or service (or a bundle of goods or

c. Control includes the ability to prevent others from

services) that is distinct.

directing the use of and obtaining the benefits from

b. A series of distinct goods or services that are

the asset.

substantially the same and that have the same

d. The benefits related to the asset are the potential

pattern of transfer to the customer.

cash flows that may be obtained only directly.

c. Either a or b.

d. Neither a nor b.

10. In accordance with PFRS 15, a receivable is

a. An entity’s right to consideration that is

5. Which statement is incorrect regarding transaction

unconditional (only the passage of time is required

price in accordance with PFRS 15?

before payment of that consideration is due).

a. Transaction price is the amount of consideration to

b. An entity’s right to consideration in exchange for

which an entity expects to be entitled in exchange

goods or services that the entity has transferred to

for transferring promised goods or services to a

a customer when that right is conditioned on

customer, excluding amounts collected on behalf of

something other than the passage of time (for

third parties.

example, the entity’s future performance).

Page 1 of 5 www.facebook.com/excel.prtc FAR.2918

EXCEL PROFESSIONAL SERVICES, INC.

c. An entity’s obligation to transfer goods or services 17. The following information pertains to an entity’s

to a customer for which the entity has received accounts receivable:

consideration (or the amount is due) from the Accounts receivable, beginning P 3,800,000

customer. Credit sales 18,000,000

d. A party that has contracted with an entity to obtain Sales returns 280,000

goods or services that are an output of the entity’s Collections 15,300,000

ordinary activities in exchange for consideration. Promissory notes received in payment

of accounts receivable 2,000,000

11. At initial recognition, an entity shall measure trade Accounts receivable written off as

receivables at their transaction price (as defined in uncollectible 160,000

PFRS 15) if the trade receivables Collections on accounts previously

a. Do not contain a significant financing component in written off 60,000

accordance with PFRS 15. Accounts receivable used as collateral 1,000,000

b. When the entity applies the practical expedient in

accordance with paragraph 63 of PFRS 15. The entity’s accounts receivable balance at the end of

c. Either a or b. the period is

d. Neither a nor b. a. P6,060,000 c. P3,060,000

b. P4,060,000 d. P3,000,000

12. Receivables not measured initially at their transaction

price are measured initially at 18. On June 9, Seller Corp. sold merchandise with a list

a. Fair value price of P5,000 to Buyer on account. Seller allowed

b. Fair value less costs to sell trade discounts of 30% and 20%. Credit terms were

c. Fair value minus transaction costs that are directly 2/15, n/40 and the sale was made FOB shipping point.

attributable to the acquisition of the financial Seller prepaid P200 of delivery costs for Buyer as an

asset. accommodation. On June 25, Seller received from

d. Fair value plus transaction costs that are directly Buyer a remittance in full payment amounting to

attributable to the acquisition of the financial a. P2,744 c. P2,944

asset. b. P2,940 d. P3,000

13. In accordance with PFRS 9, receivables shall be LECTURE NOTES:

measured at amortized cost if

Accounting for Freight

a. The receivables are held within a business model

whose objective is to hold assets in order to collect Who should pay? Who actually paid?

contractual cash flows.

b. The contractual terms of the receivables give rise Buyer FOB shipping point Freight collect

on specified dates to cash flows that are solely

payments of principal and interest on the principal Seller FOB destination Freight prepaid

amount outstanding.

Deduct FOB destination Freight collect

c. Both a and b.

from AR

d. Either a or b.

Add to AR FOB shipping point Freight prepaid

14. The ideal measure of short-term receivables in the

statement of financial position is the discounted value

Gross and Net method of recording Sales

of the cash to be received in the future, failure to

follow this practice usually does not make the

Gross Net

statement of financial position misleading because

a. The amount of the discount is not material. Cash Deducted from Deducted from

b. Most short-term receivables are not interest discounts sales when granted sales whether

bearing. granted or not

c. The allowance for uncollectible accounts includes a

discount element. Cash Deducted from Not accounted for

d. Most receivables can be sold to a bank or factor. discounts sales (sales separately since

granted discounts) already deducted

15. Accounts receivable are normally reported at the: from sales

a. Present value of future cash receipts.

b. Current value plus accrued interest. Cash Included in sales Reported as other

c. Expected amount to be received. discounts income

d. Current value less expected collection costs. not (Forfeited sales

granted discounts)

16. New Corp has the following data relating to accounts

receivable at the end of the current year: 19. The Pacifier Company uses the net price method of

Accounts receivable P1,880,000 accounting for cash discounts. In one of its

Allowance for doubtful accounts 94,000 transactions on December 15, Pacifier sold

Allowance for sales discounts 10,000 merchandise with a list price of P500,000 to a client

Allowance for sales returns 15,000 who was given a trade discount of 20% and 15%.

Allowance for freight 3,000 Credit terms were 2/10, n/30. The goods were

shipped FOB destination, freight collect. On December

What is the net realizable value of New Corp.’s 20, the client returned damaged goods originally billed

accounts receivable? at P60,000. Total freight charges paid by the buyer

a. P2,708,000 c. P1,758,000 amounted to P7,500. What is the net realizable value

b. P1,880,000 d. P1,752,000 of this receivable on December 31?

a. P272,500 c. P280,000

b. P274,400 d. P333,200

Page 2 of 5 www.facebook.com/excel.prtc FAR.2918

EXCEL PROFESSIONAL SERVICES, INC.

20. An advantage of using the net price method of b. At the end of each reporting period, an entity shall

recording cash discounts on credit sales is update the measurement of the asset arising from

a. It simplifies recording of sales returns and changes in expectations about products to be

allowances. returned.

b. It eases communication with customers about their c. An entity shall offset the asset and the refund

balances. liability.

c. It requires less record-keeping efforts than the d. None, all the statements are correct.

gross method.

d. It properly reflects current period sales revenue. 26. Ely Corp. sold merchandise to various customers with

a list price of P1,000,000. The customers were given

21. In accordance with PFRS 15, how should volume trade discounts of 20% and 15%. Credit terms were

rebates and/or discounts on goods or services applied 2/10, n/30. Based on experience, Ely expects that

retrospectively be accounted for? 50% will avail of the cash discounts and 10% will

a. As variable consideration. return the products. In accordance with PFRS 15, Ely

b. As customer options to acquire additional goods or should recognize revenue of

services at a discount. a. P680,000 c. P605,200

c. Either a or b. b. P673,200 d. P598,400

d. Neither a nor b.

27. Seller Corporation sold P21,000 of merchandise during

22. In accordance with PFRS 15, how are variable the month of December, which was charged to a

considerations accounted for? national credit card. On December 15, Seller bills the

a. Included in transaction price. independent national credit card company for these

b. Included in the transaction price only to the extent sales and is assessed a 5% service charge. On

that it is highly probable that a significant reversal December 21, a customer returned merchandise

in the amount of cumulative revenue recognized originally sold for P2,000 and Seller notifies the credit

will occur when the uncertainty associated with the card company of the return. On December 29, the

variable consideration is subsequently resolved. credit card company remitted amount owed to Seller.

c. Included in the transaction price only to the extent

Which statement is incorrect?

that it is highly probable that a significant reversal

a. In recording this sale, Seller should record an

in the amount of cumulative revenue recognized

account receivable from the credit card company.

will not occur when the uncertainty associated with

b. Seller received P18,050 from the credit card

the variable consideration is subsequently

company.

resolved.

c. Seller should recognize P18,050 as net revenue.

d. Excluded from transaction price.

d. None, all the statements are correct.

23. To account for the transfer of products with a right of

28. Bangui Company provides for doubtful accounts

return (and for some services that are provided

expense at the rate of 3 percent of credit sales. The

subject to a refund), an entity shall recognize

following data are available for last year:

a. Revenue for the transferred products in the

amount of consideration to which the entity Allow. for Doubtful Accounts, Jan. 1 P 54,000

expects to be entitled (therefore, revenue would Accounts written off as uncollectible 60,000

not be recognized for the products expected to be Collection of accounts written off 15,000

returned). Credit sales, year-ended December 31 3,000,000

b. A refund liability.

The allowance for doubtful accounts balance at

c. An asset (and corresponding adjustment to cost of

December 31, after adjusting entries, should be

sales) for its right to recover products from

a. P45,000 c. P90,000

customers on settling the refund liability.

b. P84,000 d. P99,000

d. All of these.

LECTURE NOTES:

24. Which statement is incorrect regarding a refund

liability? Direct write-off vs Allowance method

a. An entity shall recognize a refund liability if the

entity receives consideration from a customer and

expects to refund some or all of that consideration

to the customer.

b. A refund liability is measured at the amount of

consideration received (or receivable) for which the

entity does not expect to be entitled.

c. The refund liability shall be updated at the end of

each reporting period for changes in

circumstances.

d. Changes in refund liability shall be recognized as

Accounting for doubtful accounts – Allowance method

other income or expense.

Profit or loss approach

25. Which statement is incorrect regarding an asset • % of sales

recognized for an entity’s right to recover products FOCUS: Doubtful accounts expense (Matching)

from a customer on settling a refund liability?

a. It shall initially be measured by reference to the SFP approach

former carrying amount of the product (for • % of accounts receivable

example, inventory) less any expected costs to • Aging

recover those products (including potential

decreases in the value to the entity of returned FOCUS: Allowance for doubtful accounts (NRV of AR)

products).

Page 3 of 5 www.facebook.com/excel.prtc FAR.2918

EXCEL PROFESSIONAL SERVICES, INC.

29. What is the effect on net income at the time of the The estimated bad debt rates below are based on the

collection of an account previously written off under Corporation’s receivable collection experience.

each of the following methods? Age of accounts Rate

Direct write-off Allowance method 0 – 30 days 1%

a. No effect Increase 31 – 60 days 1.5%

b. Increase Increase 61 – 90 days 3%

c. Increase No effect 91 – 120 days 10%

d. No effect No effect Over 120 days 50%

The Allowance for Doubtful Accounts had a credit

30. On January 1, 2020, the balance of accounts

balance of P14,000 on December 31, 2020, before

receivable of Burgos Company was P5,000,000 and the

adjustment.

allowance for doubtful accounts on same date was

P800,000. The following data were gathered: The adjusting journal entry to adjust the allowance for

Credit sales Writeoffs Recoveries doubtful accounts as of December 31, 2020 will include

2017 P10,000,000 P250,000 P20,000 a debit to doubtful accounts expense of

2018 14,000,000 400,000 30,000 a. P52,795 c. P24,795

2019 16,000,000 650,000 50,000 b. P38,795 d. P14,000

2020 25,000,000 1,100,000 145,000

SOLUTION GUIDE:

Doubtful accounts are provided for as percentage of

Category Balance Rate Allow.

credit sales. The accountant calculates the percentage

annually by using the experience of the three years 0 - 30 days P262,400 1% P2,624

prior to the current year. How much should be

reported as 2020 doubtful accounts expense? 31 - 60 days 177,280 1.5% 2,659

a. P750,000 c. P330,000

b. P812,500 d. P875,000 61 - 90 days 130,400 3% 3,912

91 - 120 days 117,600 10% 11,760

31. John Corp. has the following data relating to accounts

receivable for the year ended December 31, 2020: Over 120 days 35,680 50% 17,840

Accounts receivable, January 1, 2020 P480,000

Allowance for doubtful accounts, P723,360 P38,795

January 1, 2020 19,200

Sales during the year, all on account,

terms 2/10, 1/15, n/60 2,400,000 33. Which statement is incorrect regarding presentation of

Cash received from customers during receivables in the statement of financial position?

the year 2,560,000 a. Trade receivables are reported under current

Accounts written off during the year 17,600 assets.

b. Non-trade receivables are included in the line item

An analysis of cash received from customers during the

‘trade and other receivables’ if they are expected

year revealed that P1,411,200 was received from

to be realized within twelve months after the

customers availing the 10-day discount period,

reporting period.

P792,000 from customers availing the 15-day discount

c. Non-trade receivables are reported as non-current

period, P4,800 represented recovery of accounts

if they are not expected to be realized within

written-off, and the balance was received from

twelve months after the reporting period

customers paying beyond the discount period.

d. None of these.

The allowance for doubtful accounts is adjusted so that

it represents certain percentage of the outstanding

accounts receivable at year end. The required 34. The following are normally included in the line item

percentage at December 31, 2020 is 125% of the rate trade and other receivables, except

used on December 31, 2019. a. Advances to officers and employees

b. Advances to subsidiaries and affiliates

The doubtful accounts expense for 2020 is

c. Receivables from sale of securities or property

a. P6,880 c. P8,720

other than inventory.

b. P7,120 d. P8,960

d. Dividends and interest receivable.

32. The accounts receivable subsidiary ledger of Besao

Corporation shows the following information:

35. In relation to receivables, an entity is required by

12/31 Invoice PFRSs to

Account a. Classify receivables as current and non-current in

Customer balance Date Amount the statement of financial position.

Maybe, Inc. P140,720 12/06 P56,000 b. Disclose any receivables pledged as collateral.

11/29 84,720 c. Disclose all significant concentrations of credit risk

Perhaps Co. 83,680 09/02 48,000 arising from receivables.

08/20 35,680 d. All of these.

Pwede Corp. 122,400 12/08 80,000

10/25 42,400

Perchance Co. 180,560 11/17 92,560

10/09 88,000

Possibly Co. 126,400 12/12 76,800

12/02 49,600

Luck, Inc. 69,600 09/12 69,600

Total P723,360 P723,360 - now do the DIY drill -

Page 4 of 5 www.facebook.com/excel.prtc FAR.2918

EXCEL PROFESSIONAL SERVICES, INC.

DO-IT-YOURSELF (DIY) DRILL

1. On the December 31, 2020 statement of financial 4. Cabugao Company began operations on January 1,

position of Mann Company, the receivables consisted 2019. On December 31, 2019, Cabugao provided

of the following: for uncollectible accounts based on 5% of annual

Trade accounts receivable P 93,000 credit sales. On January 1, 2020, Cabugao changed

Allowance for uncollectible accounts ( 2,000) its method of determining its allowance for

Claim against shipper for goods lost in uncollectible accounts to the percentage of accounts

transit last November 2020 3,000 receivable. The rate of uncollectible accounts was

Selling price of unsold goods sent by determined to be 15% of the ending accounts

Mann on consignment at 30% of receivable balance. In addition, Cabugao wrote off

cost (not included in Mann's ending all accounts receivable that were over 1 year old.

inventory) 26,000 The following additional information relates to the

Security deposit on the lease of a years ended December 31, 2019 and 2020.

warehouse 30,000 2020 2019

Total P150,000 Credit sales P8,000,000 P6,000,000

Collections (including

How much should be reported as trade and other collections on

receivables in Mann's December 31, 2020 statement recovery) 6,950,000 4,500,000

of financial position? Accounts written off 70,000 None

a. P94,000 c. P120,000 Recovery in accounts

b. P68,000 d. P150,000 previously written off 20,000 None

2. When examining the accounts of Medved Company, How much is the provision for uncollectible accounts

you ascertain that balances relating to both for the year ended December 31, 2020?

receivables and payables are included in a single a. P125,000 c. P400,000

controlling account called receivables control that b. P122,000 d. P 72,000

has a debit balance of P4,850,000. An analysis of

the composition of this account revealed the 5. Don’t Let Me Down, Inc. estimates its doubtful

following: accounts by aging its accounts receivable. The

aging schedule of accounts receivable at December

Debit Credit 31, 2020 is presented below:

Account receivable –

Age of accounts Amount

customers P7,800,000

0 – 30 days P1,264,800

Accounts receivable –

31 – 60 days 691,500

officers 500,000

61 – 90 days 288,600

Debit balances –

91 – 120 days 114,975

creditors 300,000

over 120 days 59,100

Postdated checks from

P2,418,975

customers 400,000

Subscriptions 800,000 Don’t Let Me Down, Inc.’s uncollectible accounts

receivable experience for the past 5 years are summarized in

Accounts payable for the following schedule:

merchandise P4,500,000

0– 31 - 61 – 91 – Over

Credit balances in A/R Balance 30 60 90 120 120

customers’ accounts 200,000 Year Dec. 31 Days Days Days Days Days

Cash received in 2019 P1,968,750 0.3% 1.8% 12% 38% 65%

advance from 2018 1,500,000 0.5% 1.6% 11% 41% 70%

customers for goods 100,000 2017 697,500 0.2% 1.5% 9% 50% 69%

not yet shipped 2016 1,224,000 0.4% 1.7% 10.2% 47% 81%

Expected bad debts 150,000 2015 1,865,500 0.9% 2.0% 9.7% 33% 95%

After further analysis of the aged accounts The balance of the allowance for doubtful accounts

receivable, you determined that the allowance for at December 31, 2020 (before adjustment) is

doubtful accounts should be P200,000. What is the P126,751.

correct total of current net receivables?

The necessary adjusting journal entry to adjust the

a. P8,950,000 c. P8,600,000

allowance for doubtful accounts as of December 31,

b. P8,800,000 d. P8,850,000

2020 would include:

a. No adjusting journal entry is necessary.

b. A debit to retained earnings of P13,894.

3. Tyson, Inc. reported the following balances (after

c. A debit to doubtful accounts expense P140,644.

adjustment) at the end of 2020 and 2019.

d. A credit to allow. for doubtful accounts of

12/31/20 12/31/19 P13,894.

Total accounts receivable P105,000 P96,000

Net accounts receivable 102,000 94,500 6. A company, which has an adequate amount in its

During 2020, Tyson wrote off customer accounts Allowance for Doubtful Accounts, writes off as

totaling P3,200 and collected P800 on accounts uncollectible an accounts receivable from a bankrupt

written off in previous years. Tyson's doubtful customer. This action will

accounts expense for the year ending December 31, a. Reduce net income for the period.

2020 is b. Reduce the amount of equity.

a. P1,500 c. P3,000 c. Reduce total current assets.

b. P2,400 d. P3,900 d. Have no effect on total current assets.

J - end of FAR.2918 - J

Page 5 of 5 www.facebook.com/excel.prtc FAR.2918

You might also like

- Bank Reconciliation EditedDocument1 pageBank Reconciliation EditedNors PataytayNo ratings yet

- Receivable - Q2Document3 pagesReceivable - Q2Dymphna Ann CalumpianoNo ratings yet

- Intermacc Receivables Postlec WaDocument3 pagesIntermacc Receivables Postlec WaClarice Awa-aoNo ratings yet

- Since 1977FAR.2914 - Borrowing Costs CapitalizationDocument4 pagesSince 1977FAR.2914 - Borrowing Costs CapitalizationNoella Marie BaronNo ratings yet

- Intermediate Accounting - Final Output ReceivablesDocument56 pagesIntermediate Accounting - Final Output ReceivablesAnitas LimmaumNo ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Book QuestionairesDocument1 pageBook QuestionairesKwenzie FortalezaNo ratings yet

- Week 2 Theory of Accounts Part 2 QuizDocument6 pagesWeek 2 Theory of Accounts Part 2 QuizMarilou Arcillas PanisalesNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Mid-Term Exam Review for Intermediate Accounting IDocument9 pagesMid-Term Exam Review for Intermediate Accounting Ijestoni alvezNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Cq1 Topics Far2901 To 2926 PDF FreeDocument9 pagesCq1 Topics Far2901 To 2926 PDF FreeKlomoNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- CASH AND CASH EQUIVALENTS AUDITDocument5 pagesCASH AND CASH EQUIVALENTS AUDITyna kyleneNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- FarDocument19 pagesFarsarahbeeNo ratings yet

- Reviewer Controlling Cash Part 1Document6 pagesReviewer Controlling Cash Part 1Mikey Irwin0% (2)

- Ch08 Property, Plant & EquipmentDocument6 pagesCh08 Property, Plant & EquipmentralphalonzoNo ratings yet

- Chapter 23 PPEDocument5 pagesChapter 23 PPERose AysonNo ratings yet

- 9.2 Investment in AssociateDocument6 pages9.2 Investment in AssociateJorufel PapasinNo ratings yet

- 2 3 2017 ReceivablesDocument4 pages2 3 2017 ReceivablesMr. CopernicusNo ratings yet

- ACCO 3016 - FINANCIAL ACCOUNTING AND REPORTING EXAMDocument14 pagesACCO 3016 - FINANCIAL ACCOUNTING AND REPORTING EXAMPatrick ArazoNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- Government Grant AccountingDocument2 pagesGovernment Grant AccountingRNo ratings yet

- MANSCI Final Exam QuestionnaireDocument10 pagesMANSCI Final Exam QuestionnaireChristine NionesNo ratings yet

- Aud Application 2 - Handout 3 Depreciation (UST)Document3 pagesAud Application 2 - Handout 3 Depreciation (UST)RNo ratings yet

- Revaluation surplus changes for Bloxden CorpDocument6 pagesRevaluation surplus changes for Bloxden CorpCarl Yry Bitz100% (1)

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Far 21Document1 pageFar 21memejaneNo ratings yet

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- This Study Resource Was: Problem 1Document2 pagesThis Study Resource Was: Problem 1Michelle J UrbodaNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource WasMarjorie PalmaNo ratings yet

- FAR.104 PPE Acquisition and Subsequent ExpendituresDocument7 pagesFAR.104 PPE Acquisition and Subsequent ExpendituresMarlon Jeff Concepcion Cariaga100% (2)

- Aud Application 2 - Handout 8 Intangible (UST)Document4 pagesAud Application 2 - Handout 8 Intangible (UST)RNo ratings yet

- Cash and Cash EquivalentDocument8 pagesCash and Cash EquivalentApril ManaloNo ratings yet

- Bank Deposits and Cash EquivalentsDocument6 pagesBank Deposits and Cash EquivalentsPamela Mae PlatonNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- PPE Government Grant Borrowing Cost Intangible AssetsDocument7 pagesPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- Financial Accounting I Test BankDocument5 pagesFinancial Accounting I Test BankKim Cristian MaañoNo ratings yet

- Problem Set 2Document4 pagesProblem Set 2Michael Jay LingerasNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Account Receivables ModuleDocument36 pagesAccount Receivables Modulelord kwantoniumNo ratings yet

- AFAR06-01 Partnership AccountingDocument8 pagesAFAR06-01 Partnership AccountingEd MendozaNo ratings yet

- 2 Impairment LossDocument2 pages2 Impairment LossNeighvestNo ratings yet

- Summary Note. Land - Building.machineryDocument3 pagesSummary Note. Land - Building.machineryRazel TercinoNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsJohn Michael SorianoNo ratings yet

- Integrated Accounting Midterm ExamDocument3 pagesIntegrated Accounting Midterm ExamAuroraNo ratings yet

- Test Bank Auditng ProbDocument11 pagesTest Bank Auditng ProbTinne PaculabaNo ratings yet

- Acquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Document3 pagesAcquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Gray JavierNo ratings yet

- WQ2 - Topics 2902 To 2904 PDFDocument4 pagesWQ2 - Topics 2902 To 2904 PDFRizal Haines IV100% (1)

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Equity YyyDocument33 pagesEquity YyyJude SantosNo ratings yet

- PAS-10 Valix Reviewer For CPADocument3 pagesPAS-10 Valix Reviewer For CPAZatsumono Yamamoto100% (1)

- 7.29.22 Am Trade-And-Other-ReceivablesDocument5 pages7.29.22 Am Trade-And-Other-ReceivablesAether SkywardNo ratings yet

- Pfrs 15 Revenue From Contracts With CustomersDocument3 pagesPfrs 15 Revenue From Contracts With CustomersR.A.No ratings yet

- Blogging Marketing Course Emarketing Institute Ebook 2018 Edition PDFDocument161 pagesBlogging Marketing Course Emarketing Institute Ebook 2018 Edition PDFTiwari Pranjal100% (1)

- Audit of InventoryDocument32 pagesAudit of Inventoryxxxxxxxxx92% (48)

- Answer Key On Review Session On Cash and Cash Equivalent, Bank Reconciliation and Biological AssetsDocument1 pageAnswer Key On Review Session On Cash and Cash Equivalent, Bank Reconciliation and Biological AssetsYlor NoniuqNo ratings yet

- Ch07 Cash and ReceivablesDocument30 pagesCh07 Cash and ReceivablesKimberly Ann Lumanog AmarNo ratings yet

- WEEKLY COMPUTER EXERCISESDocument3 pagesWEEKLY COMPUTER EXERCISESYlor NoniuqNo ratings yet

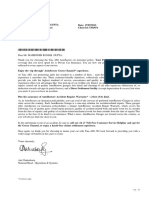

- 2020notice - TPS Re Info For Clients PDFDocument1 page2020notice - TPS Re Info For Clients PDFYlor NoniuqNo ratings yet

- COMP1 - RECOTE-COURSE OUTLINE (Ivisan)Document2 pagesCOMP1 - RECOTE-COURSE OUTLINE (Ivisan)Ylor NoniuqNo ratings yet

- 1-MAS Bobadilla ReviewerDocument55 pages1-MAS Bobadilla ReviewerRey Jr AlipisNo ratings yet

- 2019PressRelease SEC Approves Rules On CrowdfundingDocument4 pages2019PressRelease SEC Approves Rules On CrowdfundingpierremartinreyesNo ratings yet

- St. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesDocument3 pagesSt. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesYlor NoniuqNo ratings yet

- 2020CDO - Fast Track PDFDocument12 pages2020CDO - Fast Track PDFYlor NoniuqNo ratings yet

- 2020notice - TPS Re Info For Clients PDFDocument1 page2020notice - TPS Re Info For Clients PDFYlor NoniuqNo ratings yet

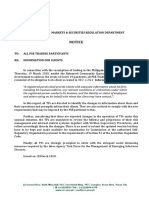

- Notice: To: All Sec Registered Corporations Required To Submit The GisDocument1 pageNotice: To: All Sec Registered Corporations Required To Submit The GisYlor NoniuqNo ratings yet

- Operations Management 18769Document278 pagesOperations Management 18769IbrahimElKelany100% (2)

- Relevant Costing by A BobadillaDocument43 pagesRelevant Costing by A BobadillaAngelu Amper56% (18)

- MAS Bobadilla-Transfer PricingDocument8 pagesMAS Bobadilla-Transfer Pricingrandy100% (1)

- SHS Core - Oral Communication CGDocument7 pagesSHS Core - Oral Communication CGEstela Benegildo67% (3)

- SRC Supplement 1-Registered Debt CompaniesDocument2 pagesSRC Supplement 1-Registered Debt CompaniesMae Richelle Dizon DacaraNo ratings yet

- COMP1 - RECOTE-COURSE OUTLINE (Ivisan)Document2 pagesCOMP1 - RECOTE-COURSE OUTLINE (Ivisan)Ylor NoniuqNo ratings yet

- SMU Research Highlights Challenges and Opportunities in Brand ManagementDocument11 pagesSMU Research Highlights Challenges and Opportunities in Brand ManagementYlor Noniuq100% (1)

- SEC Issues Cease and Desist Order Against Crowd1 Asia Pacific for Unregistered SecuritiesDocument14 pagesSEC Issues Cease and Desist Order Against Crowd1 Asia Pacific for Unregistered SecuritiesDaniel CorralNo ratings yet

- Smart Contracts: Legal Considerations: Jack Gilcrest Arthur CarvalhoDocument5 pagesSmart Contracts: Legal Considerations: Jack Gilcrest Arthur CarvalhoYlor NoniuqNo ratings yet

- 2020notice - TPS Re Info For Clients PDFDocument1 page2020notice - TPS Re Info For Clients PDFYlor NoniuqNo ratings yet

- 2019PressRelease SEC Approves Rules On CrowdfundingDocument4 pages2019PressRelease SEC Approves Rules On CrowdfundingpierremartinreyesNo ratings yet

- Sec Advisory: Enforcement and Investor Protection DepartmentDocument4 pagesSec Advisory: Enforcement and Investor Protection DepartmentYlor NoniuqNo ratings yet

- 2020CDO - Fast Track PDFDocument12 pages2020CDO - Fast Track PDFYlor NoniuqNo ratings yet

- 1-MAS Bobadilla ReviewerDocument55 pages1-MAS Bobadilla ReviewerRey Jr AlipisNo ratings yet

- Flores, M.O., 2016, Integrated Cost Accounting (Principles and Application)Document34 pagesFlores, M.O., 2016, Integrated Cost Accounting (Principles and Application)Girly Lumsod100% (1)

- COMP 1-RECOTE-MODULE 1 - (Ivisan)Document62 pagesCOMP 1-RECOTE-MODULE 1 - (Ivisan)Ylor NoniuqNo ratings yet

- Ayala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Document932 pagesAyala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Captain ObviousNo ratings yet

- Ca 2016 PDFDocument33 pagesCa 2016 PDFMelvin OngNo ratings yet

- Factfulness ExcerptDocument13 pagesFactfulness Excerptfreddlutz765No ratings yet

- Accounting 11 FS AnalysisDocument2 pagesAccounting 11 FS AnalysisMarvin AquinoNo ratings yet

- Bank of America Vs CA - G.R. No. 105395. December 10, 1993Document8 pagesBank of America Vs CA - G.R. No. 105395. December 10, 1993Ebbe DyNo ratings yet

- MIFOS TRAINING SLIDES ON BULK JLG LOAN PROCESSINGDocument24 pagesMIFOS TRAINING SLIDES ON BULK JLG LOAN PROCESSINGAllanNo ratings yet

- Annexure 1account Closure Request Form PDFDocument3 pagesAnnexure 1account Closure Request Form PDFShriram JoshiNo ratings yet

- IIBMDocument24 pagesIIBMAshok SaiNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Chap002 Consolidation of Wholly Owned Subsidiaries With No DifferentialDocument73 pagesChap002 Consolidation of Wholly Owned Subsidiaries With No DifferentialMd. Rejaul Ahsan ChowdhuryNo ratings yet

- Banks Valuation Fees UniformityDocument12 pagesBanks Valuation Fees UniformityS.SadiqNo ratings yet

- Crude Oil Methodology PDFDocument50 pagesCrude Oil Methodology PDFsolarstuffNo ratings yet

- Icaew CR Part 02 6e Corporate Reporting Part 2Document807 pagesIcaew CR Part 02 6e Corporate Reporting Part 2Taskin Reza Khalid100% (3)

- IC Generic Purchase Order Template 9181Document3 pagesIC Generic Purchase Order Template 9181DipeshNo ratings yet

- Aileron Market Balance: Issue 19Document6 pagesAileron Market Balance: Issue 19Dan ShyNo ratings yet

- Taking Sides - Clashing Views On Economic Issues - Issue 2.4Document4 pagesTaking Sides - Clashing Views On Economic Issues - Issue 2.4Shawn Rutherford0% (1)

- Tata AigDocument4 pagesTata AigHarpal Singh MassanNo ratings yet

- PR 21 - Sarakreek FINALDocument8 pagesPR 21 - Sarakreek FINALGiovanni Karsopawiro100% (1)

- Inventory of Seized Tillman PropertiesDocument76 pagesInventory of Seized Tillman Propertiescitypaper100% (1)

- Contract Growing: I. Application ProcessDocument5 pagesContract Growing: I. Application ProcessbetterthandrugsNo ratings yet

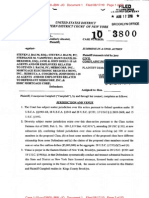

- Connie Campbell Against Steven Baum, MERSCORP, Inc, Et Al., Case #10CV3800Document53 pagesConnie Campbell Against Steven Baum, MERSCORP, Inc, Et Al., Case #10CV3800Foreclosure FraudNo ratings yet

- Disbursement Voucher FidelityDocument1 pageDisbursement Voucher FidelityGigi Quinsay VisperasNo ratings yet

- Republic vs. Del Monte Motors, Inc., 504 SCRA 53 (2006)Document13 pagesRepublic vs. Del Monte Motors, Inc., 504 SCRA 53 (2006)Courtney TirolNo ratings yet

- Financial Asset at Amortized CostDocument14 pagesFinancial Asset at Amortized CostLorenzo Diaz DipadNo ratings yet

- VolumeProfile Course WhalestraderDocument105 pagesVolumeProfile Course WhalestraderYazan Barjawi100% (2)

- Compensation Analyst or Financial Analyst or Data Analyst or OpeDocument2 pagesCompensation Analyst or Financial Analyst or Data Analyst or Opeapi-77649810No ratings yet

- Personal Financial StatementDocument1 pagePersonal Financial StatementCenon Alipante Turiano Jr.No ratings yet

- Bank Exam Quantitative Solved Paper - 1Document9 pagesBank Exam Quantitative Solved Paper - 1VivekNo ratings yet

- Samsung C&T 2014 Financial StatementsDocument126 pagesSamsung C&T 2014 Financial StatementsJinay ShahNo ratings yet

- Drugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsDocument16 pagesDrugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsJayson Lloyd P. MaquilanNo ratings yet