Professional Documents

Culture Documents

7.29.22 Am Trade-And-Other-Receivables

Uploaded by

Aether SkywardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7.29.22 Am Trade-And-Other-Receivables

Uploaded by

Aether SkywardCopyright:

Available Formats

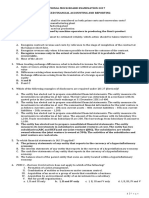

Manila * Cavite * Laguna * Cebu * Cagayan De Oro * Davao

Since 1977

FAR OCAMPO/OCAMPO

FAR.3317-Trade and Other Receivables OCTOBER 2022

DISCUSSION PROBLEMS

1. Receivables are financial assets because they are 6. Which statement is incorrect regarding transaction

a. Cash equivalents. price in accordance with PFRS 15?

b. Equity instruments of another entity. a. Transaction price is the amount of consideration to

c. Contractual rights to receive cash or another which an entity expects to be entitled in exchange

financial asset from another entity. for transferring promised goods or services to a

d. Contractual rights to exchange financial assets or customer, excluding amounts collected on behalf of

financial liabilities with another entity under third parties.

conditions that are potentially favorable to the b. An entity shall consider the terms of the contract

entity. and its customary business practices to determine

the transaction price.

2. Which statement is incorrect regarding PFRS 15? c. The nature, timing and amount of consideration

a. The standard outlines a single comprehensive promised by a customer affect the estimate of the

model for entities to use in accounting for revenue transaction price.

arising from contracts with customers. d. The consideration promised in a contract with a

b. The standard supersedes revenue recognition customer may include fixed amounts but not

guidance in PAS 18 Revenue and PAS 11 variable amounts.

Construction Contracts and related interpretations.

c. The core principle is that an entity recognizes 7. When determining the transaction price, an entity shall

revenue to depict the transfer of promised goods consider the effects of:

or services to customers in an amount that reflects I. Variable consideration

the consideration to which the entity expects to be II. Constraining estimates of variable consideration

entitled in exchange for those goods or services. III. The existence of a significant financing

d. None, all the statements are correct. component in the contract

IV. Non-cash consideration

3. Arrange in proper sequence the five-step approach V. Consideration payable to a customer

that entities will follow in recognizing revenue in

a. I, II, III, IV and V c. III, IV and V only

accordance with PFRS 15:

b. II, III, IV and V only d. III and IV only

I. Determine the transaction price

II. Identify the contract(s) with the customer

8. For the purpose of determining the transaction price,

III. Identify the separate performance obligations in

an entity shall assume

the contract

a. That the goods or services will be transferred to

IV. Recognize revenue when (or as) each performance

the customer as promised in accordance with the

obligation is satisfied

existing contract.

V. Allocate the transaction price to separate

b. That the contract may be cancelled.

performance obligations

c. That the contract may be renewed

a. I, II, III, IV and V c. III, II, I, V and IV d. That the contract may be modified.

b. II, III, I, V and IV d. II, III, V, I and IV

9. Where a contract has multiple performance obligations,

4. For PFRS 15 to apply, a contract with a customer an entity will allocate the transaction price to the

should meet which of the following conditions? performance obligations in the contract by reference to

I. The contract has been approved by the parties to their relative

the contract and are committed to perform their a. Standalone selling prices.

respective obligations. b. Fair values.

II. Each party’s rights in relation to the goods or c. Net realizable values.

services to be transferred can be identified. d. Any of the above.

III. The payment terms for the goods or services to

be transferred can be identified. 10. Which statement is incorrect regarding recognition of

IV. The contract has commercial substance. revenue?

V. It is probable that the consideration to which the a. Revenue is recognized as control is passed, either

entity is entitled to in exchange for the goods or over time or at a point in time.

services will be collected. b. Control of an asset is defined as the ability to

direct the use of and obtain substantially all of the

a. I, II, III, IV and V c. I, II, III and V

remaining benefits from the asset.

b. I, III, IV and V d. I, II, III and IV

c. Control includes the ability to prevent others from

directing the use of and obtaining the benefits from

5. Performance obligation is a promise in a contract with

the asset.

a customer to transfer to the customer

d. The benefits related to the asset are the potential

a. A good or service (or a bundle of goods or

cash flows that may be obtained only directly.

services) that is distinct.

b. A series of distinct goods or services that are

substantially the same and that have the same

pattern of transfer to the customer.

c. Either a or b.

d. Neither a nor b.

Page 1 of 5 www.teamprtc.com.ph FAR.3317

EXCEL PROFESSIONAL SERVICES, INC.

11. At initial recognition, an entity shall measure trade Promissory notes received in payment

receivables at their transaction price (as defined in of accounts receivable 2,000,000

PFRS 15) if the trade receivables Accounts receivable written off as

a. Do not contain a significant financing component in uncollectible 160,000

accordance with PFRS 15. Collections on accounts previously

b. When the entity applies the practical expedient in written off 60,000

accordance with paragraph 63 of PFRS 15. Accounts receivable used as collateral 1,000,000

c. Either a or b.

The entity’s accounts receivable balance at the end of

d. Neither a nor b.

the period is

a. P6,060,000 c. P3,060,000

12. Receivables not measured initially at their transaction

b. P4,060,000 d. P3,000,000

price are measured initially at

a. Fair value

18. On June 9, Seller Corp. sold merchandise with a list

b. Fair value less costs to sell

price of P5,000 to Buyer on account. Seller allowed

c. Fair value minus transaction costs that are directly

trade discounts of 30% and 20%. Credit terms were

attributable to the acquisition of the financial

2/15, n/40 and the sale was made FOB shipping point.

asset.

Seller prepaid P200 of delivery costs for Buyer as an

d. Fair value plus transaction costs that are directly

accommodation. On June 25, Seller received from

attributable to the acquisition of the financial

Buyer a remittance in full payment amounting to

asset.

a. P2,744 c. P2,944

b. P2,940 d. P3,000

13. In accordance with PFRS 9, receivables shall be

measured at amortized cost if

a. The receivables are held within a business model

LECTURE NOTES:

whose objective is to hold assets in order to collect

contractual cash flows. Accounting for Freight

b. The contractual terms of the receivables give rise

on specified dates to cash flows that are solely Who should pay? Who actually paid?

payments of principal and interest on the principal

amount outstanding. Buyer FOB shipping point Freight collect

c. Both a and b.

Seller FOB destination Freight prepaid

d. Either a or b.

Deduct FOB destination Freight collect

14. The ideal measure of short-term receivables in the from AR

statement of financial position is the discounted value

of the cash to be received in the future, failure to Add to AR FOB shipping point Freight prepaid

follow this practice usually does not make the

statement of financial position misleading because Gross and Net method of recording Sales

a. The amount of the discount is not material.

b. Most short-term receivables are not interest Gross Net

bearing.

c. The allowance for uncollectible accounts includes a Cash Deducted from Deducted from

discount element. discounts sales when granted sales whether

d. Most receivables can be sold to a bank or factor. granted or not

15. Accounts receivable are normally reported at the: Cash Deducted from Not accounted for

discounts sales (sales separately since

a. Present value of future cash receipts.

granted discounts) already deducted

b. Current value plus accrued interest.

from sales

c. Expected amount to be received.

d. Current value less expected collection costs. Cash Included in sales Reported as other

discounts income

16. New Corp has the following data relating to accounts not (Forfeited sales

receivable at the end of the current year: granted discounts)

Accounts receivable P1,880,000

Allowance for doubtful accounts 94,000

Allowance for sales discounts 10,000 19. The Pacifier Company uses the net price method of

Allowance for sales returns 15,000 accounting for cash discounts. In one of its

Allowance for freight 3,000 transactions on December 15, Pacifier sold

What is the net realizable value of New Corp.’s merchandise with a list price of P500,000 to a client

accounts receivable? who was given a trade discount of 20% and 15%.

a. P2,708,000 c. P1,758,000 Credit terms were 2/10, n/30. The goods were

b. P1,880,000 d. P1,752,000 shipped FOB destination, freight collect. On December

20, the client returned damaged goods originally billed

17. The following information pertains to an entity’s at P60,000. Total freight charges paid by the buyer

accounts receivable: amounted to P7,500. What is the net realizable value

of this receivable on December 31?

Accounts receivable, beginning P 3,800,000

a. P272,500 c. P280,000

Credit sales 18,000,000 b. P274,400 d. P333,200

Sales returns 280,000

Collections 15,300,000

Page 2 of 5 www.teamprtc.com.ph FAR.3317

EXCEL PROFESSIONAL SERVICES, INC.

20. An advantage of using the net price method of b. At the end of each reporting period, an entity shall

recording cash discounts on credit sales is update the measurement of the asset arising from

a. It simplifies recording of sales returns and changes in expectations about products to be

allowances. returned.

b. It eases communication with customers about their c. An entity shall offset the asset and the refund

balances. liability.

c. It requires less record-keeping efforts than the d. None, all the statements are correct.

gross method.

d. It properly reflects current period sales revenue. 26. Ely Corp. sold merchandise to various customers with

a list price of P1,000,000. The customers were given

21. In accordance with PFRS 15, how should volume trade discounts of 20% and 15%. Credit terms were

rebates and/or discounts on goods or services applied 2/10, n/30. Based on experience, Ely expects that

retrospectively be accounted for? 50% will avail of the cash discounts and 10% will

a. As variable consideration. return the products. In accordance with PFRS 15, Ely

b. As customer options to acquire additional goods or should recognize revenue of

services at a discount. a. P680,000 c. P605,200

c. Either a or b. b. P673,200 d. P598,400

d. Neither a nor b.

27. Seller Corporation sold P21,000 of merchandise during

22. In accordance with PFRS 15, how are variable the month of December, which was charged to a

considerations accounted for? national credit card. On December 15, Seller bills the

a. Included in transaction price. independent national credit card company for these

b. Included in the transaction price only to the extent sales and is assessed a 5% service charge. On

that it is highly probable that a significant reversal December 21, a customer returned merchandise

in the amount of cumulative revenue recognized originally sold for P2,000 and Seller notifies the credit

will occur when the uncertainty associated with the card company of the return. On December 29, the

variable consideration is subsequently resolved. credit card company remitted amount owed to Seller.

c. Included in the transaction price only to the extent

Which statement is incorrect?

that it is highly probable that a significant reversal

a. In recording this sale, Seller should record an

in the amount of cumulative revenue recognized

account receivable from the credit card company.

will not occur when the uncertainty associated with

b. Seller received P18,050 from the credit card

the variable consideration is subsequently

company.

resolved.

c. Seller should recognize P18,050 as net revenue.

d. Excluded from transaction price.

d. None, all the statements are correct.

23. To account for the transfer of products with a right of

28. Bangui Company provides for doubtful accounts

return (and for some services that are provided

expense at the rate of 3 percent of credit sales. The

subject to a refund), an entity shall recognize

following data are available for the current year:

a. Revenue for the transferred products in the

amount of consideration to which the entity Allow. for Doubtful Accounts, Jan. 1 P 54,000

expects to be entitled (therefore, revenue would Accounts written off as uncollectible 60,000

not be recognized for the products expected to be Collection of accounts written off 15,000

returned). Credit sales, year-ended December 31 3,000,000

b. A refund liability.

The allowance for doubtful accounts balance at

c. An asset (and corresponding adjustment to cost of

December 31, after adjusting entries, should be

sales) for its right to recover products from

a. P45,000 c. P90,000

customers on settling the refund liability.

b. P84,000 d. P99,000

d. All of these.

LECTURE NOTES:

24. Which statement is incorrect regarding a refund

liability? Direct write-off vs Allowance method

a. An entity shall recognize a refund liability if the

entity receives consideration from a customer and

expects to refund some or all of that consideration

to the customer.

b. A refund liability is measured at the amount of

consideration received (or receivable) for which the

entity does not expect to be entitled.

c. The refund liability shall be updated at the end of

each reporting period for changes in

circumstances.

d. Changes in refund liability shall be recognized as

Accounting for doubtful accounts – Allowance method

other income or expense.

Profit or loss approach

25. Which statement is incorrect regarding an asset • % of sales

recognized for an entity’s right to recover products FOCUS: Doubtful accounts expense (Matching)

from a customer on settling a refund liability?

a. It shall initially be measured by reference to the SFP approach

former carrying amount of the product (for • % of accounts receivable

example, inventory) less any expected costs to • Aging

recover those products (including potential

decreases in the value to the entity of returned FOCUS: Allowance for doubtful accounts (NRV of AR)

products).

Page 3 of 5 www.teamprtc.com.ph FAR.3317

EXCEL PROFESSIONAL SERVICES, INC.

29. What is the effect on net income at the time of the The estimated bad debt rates below are based on the

collection of an account previously written off under Corporation’s receivable collection experience.

each of the following methods? Age of accounts Rate

Direct write-off Allowance method 0 – 30 days 1%

a. No effect Increase 31 – 60 days 1.5%

b. Increase Increase 61 – 90 days 3%

c. Increase No effect 91 – 120 days 10%

d. No effect No effect Over 120 days 50%

The Allowance for Doubtful Accounts had a credit

30. On Jan. 1, 2022, the balance of accounts receivable of

balance of P14,000 on Dec. 31, 2022, before

Burgos Corp. was P5,000,000 and the allowance for

adjustment.

doubtful accounts on same date was P800,000. The

following data were gathered: The adjusting journal entry to adjust the allowance for

Credit sales Write-offs Recoveries doubtful accounts as of Dec. 31, 2022 will include a

2019 P10,000,000 P250,000 P20,000 debit to doubtful accounts expense of

2020 14,000,000 400,000 30,000 a. P52,795 c. P24,795

2021 16,000,000 650,000 50,000 b. P38,795 d. P14,000

2022 25,000,000 1,100,000 145,000

SOLUTION GUIDE:

Doubtful accounts are provided for as percentage of

Category Balance Rate Allow.

credit sales. The accountant calculates the percentage

annually by using the experience of the three years 0 - 30 days P262,400 1% P2,624

prior to the current year. How much should be

reported as 2022 doubtful accounts expense? 31 - 60 days 177,280 1.5% 2,659

a. P750,000 c. P330,000

b. P812,500 d. P875,000 61 - 90 days 130,400 3% 3,912

91 - 120 days 117,600 10% 11,760

31. John Corp. has the following data relating to accounts

receivable for the year ended Dec. 31, 2022: Over 120 days 35,680 50% 17,840

Accounts receivable, Jan. 1, 2022 P480,000

Allowance for doubtful accounts, P723,360 P38,795

Jan. 1, 2022 19,200

Sales during the year, all on account, 33. Which statement is incorrect regarding presentation of

terms 2/10, 1/15, n/60 2,400,000 receivables in the statement of financial position?

Cash received from customers during a. Trade receivables are reported under current

the year 2,560,000 assets.

Accounts written off during the year 17,600 b. Non-trade receivables are included in the line item

An analysis of cash received from customers during the ‘trade and other receivables’ if they are expected

to be realized within twelve months after the

year revealed that P1,411,200 was received from

reporting period.

customers availing the 10-day discount period,

P792,000 from customers availing the 15-day discount c. Non-trade receivables are reported as non-current

if they are not expected to be realized within

period, P4,800 represented recovery of accounts

written-off, and the balance was received from twelve months after the reporting period

d. None of these.

customers paying beyond the discount period.

The allowance for doubtful accounts is adjusted so that 34. The following are normally included in the line item

it represents certain percentage of the outstanding trade and other receivables, except

accounts receivable at year end. The required a. Advances to subsidiaries and affiliates

percentage at Dec. 31, 2022 is 125% of the rate used b. Advances to officers and employees

on Dec. 31, 2021. c. Receivables from sale of securities or property

other than inventory.

The doubtful accounts expense for 2022 is

d. Dividends and interest receivable.

a. P6,880 c. P8,720

b. P7,120 d. P8,960

35. In accordance with PFRS 15, a receivable is

a. An entity’s right to consideration that is

32. The accounts receivable subsidiary ledger of Besao

unconditional (only the passage of time is required

Corporation shows the following information:

before payment of that consideration is due).

12/31 Invoice b. An entity’s right to consideration in exchange for

Account goods or services that the entity has transferred to

Customer balance Date Amount a customer when that right is conditioned on

Maybe, Inc. P140,720 12/06 P56,000 something other than the passage of time (for

11/29 84,720 example, the entity’s future performance).

Perhaps Co. 83,680 09/02 48,000 c. An entity’s obligation to transfer goods or services

08/20 35,680 to a customer for which the entity has received

Pwede Corp. 122,400 12/08 80,000 consideration (or the amount is due) from the

10/25 42,400 customer.

Perchance Co. 180,560 11/17 92,560 d. A party that has contracted with an entity to obtain

10/09 88,000 goods or services that are an output of the entity’s

Possibly Co. 126,400 12/12 76,800 ordinary activities in exchange for consideration.

12/02 49,600

Luck, Inc. 69,600 09/12 69,600

Total P723,360 P723,360

Page 4 of 5 www.teamprtc.com.ph FAR.3317

EXCEL PROFESSIONAL SERVICES, INC.

36. If an entity reported a contract liability in its statement

of financial position, it means that

a. The entity has no receivables.

b. Neither the entity nor the customer has performed.

c. The entity’s performance is more than the

customer’s payment.

d. The entity’s performance is less than the

customer’s payment.

37. The objective of the disclosure requirements in PFRS

15 is for an entity to disclose sufficient information to

enable users of financial statements to understand the

nature, amount, timing and uncertainty of revenue and

cash flows arising from contracts with customers. To

achieve that objective, an entity shall disclose

qualitative and quantitative information about

a. Its contracts with customers.

b. The significant judgements, and changes in the

judgements, made in applying PFRS 15 its

contracts with customers.

c. Any assets recognized from the costs to obtain or

fulfill a contract with a customer.

d. All of these.

38. PFRS 7 requires disclosures about qualitative and

quantitative information about exposure to risks

arising from financial instruments. These risks include

a. The risk that one party to a financial instrument

will cause a financial loss for the other party by

failing to discharge an obligation.

b. The risk that an entity will encounter difficulty in

meeting obligations associated with financial

liabilities that are settled by delivering cash or

another financial asset.

c. The risk that the fair value or future cash flows of a

financial instrument will fluctuate because of

changes in market prices.

d. All of these.

39. For each type of risk arising from financial instruments,

an entity shall disclose:

a. The exposures to risk and how they arise.

b. Its objectives, policies and processes for managing

the risk and the methods used to measure the risk.

c. Any changes in (a) or (b) from the previous period.

d. All of these.

40. In relation to receivables, PFRS 7 does not require an

entity to disclose

a. Receivables pledged as collateral.

b. Information about credit risk that enable users of

financial statements to understand the effect of

credit risk on the amount, timing and uncertainty

of future cash flows.

c. Significant concentrations of credit risk arising

from receivables.

d. Fair value of short-term trade receivables.

J - end of FAR.3317 - J

Page 5 of 5 www.teamprtc.com.ph FAR.3317

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Revenue RecognitionDocument9 pagesRevenue Recognitionadmiral spongebobNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- AA Lending Advanced Part 4 GuideDocument102 pagesAA Lending Advanced Part 4 Guidelolitaferoz100% (2)

- Far2921investments in Debt Instruments PDF FreeDocument6 pagesFar2921investments in Debt Instruments PDF FreeMarcus MonocayNo ratings yet

- Credit risk assessment for new hardware businessDocument1 pageCredit risk assessment for new hardware businessJarelyn Doctor0% (1)

- Revenue From Contracts With CustomersDocument4 pagesRevenue From Contracts With Customersmy miNo ratings yet

- Share Based CompensationDocument3 pagesShare Based CompensationYeshua DeluxiusNo ratings yet

- Chapt 2 AssDocument2 pagesChapt 2 AssMary Jescho Vidal Ampil79% (14)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Nfjpia Mock Board 2016 - AfarDocument8 pagesNfjpia Mock Board 2016 - AfarLeisleiRago50% (2)

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- Mock Cpa Board Exams Rfjpia R 12 WDocument17 pagesMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- Toa 38 40Document17 pagesToa 38 40Mary Joy AlbandiaNo ratings yet

- FAR.3015 Cash and Cash EquivalentsDocument3 pagesFAR.3015 Cash and Cash EquivalentsJoana Tatac100% (1)

- Since 1977PFRS 9 Financial AssetsDocument11 pagesSince 1977PFRS 9 Financial AssetsNah HamzaNo ratings yet

- Since 1977Document5 pagesSince 1977Ylor NoniuqNo ratings yet

- FAFVPL-FAFVOCI IARev RLPDocument2 pagesFAFVPL-FAFVOCI IARev RLPBrian Daniel BayotNo ratings yet

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Yield Farming Vs Staking How Are They DifferentjdhieDocument5 pagesYield Farming Vs Staking How Are They Differentjdhiecrayonvalley4No ratings yet

- Fredmark Evangelista Graduation Statement Financial PositionDocument4 pagesFredmark Evangelista Graduation Statement Financial PositionFredmark EvangelistaNo ratings yet

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- TOA Quizzer 18 PFRS 15 Revenue From Contracts With Customers RevisedDocument7 pagesTOA Quizzer 18 PFRS 15 Revenue From Contracts With Customers RevisedSheena Oro100% (1)

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- Afar PBDocument7 pagesAfar PBJosephine MercadoNo ratings yet

- Partial Topics AccountingDocument51 pagesPartial Topics AccountingDzulija Talipan100% (1)

- 7.30.22 Am Investments-In-Debt-InstrumentsDocument6 pages7.30.22 Am Investments-In-Debt-InstrumentsAether SkywardNo ratings yet

- IFRS 3 Business Combination EssentialsDocument1 pageIFRS 3 Business Combination EssentialsSweet EmmeNo ratings yet

- Accountancy Review: Part ADocument10 pagesAccountancy Review: Part AJesa SinghbalNo ratings yet

- FAR.2936 - Non-Financial Liabilities Summary (DIY) .Document5 pagesFAR.2936 - Non-Financial Liabilities Summary (DIY) .Edmark LuspeNo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.205 - Group3Document4 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.205 - Group3Mary VenturaNo ratings yet

- PFRS 15 AssesmnetDocument2 pagesPFRS 15 AssesmnetbadelacuadraNo ratings yet

- Chapter 18 - : Revenue Recognition Study GuideDocument10 pagesChapter 18 - : Revenue Recognition Study GuideRyzel BorjaNo ratings yet

- Pfrs 15 Revenue From Contracts With CustomersDocument3 pagesPfrs 15 Revenue From Contracts With CustomersR.A.No ratings yet

- Chapter 34 PFRS 15 Revenue From Contracts With CustomersDocument3 pagesChapter 34 PFRS 15 Revenue From Contracts With Customersjeanette lampitocNo ratings yet

- IFRS 15 Revenue RecognitionDocument11 pagesIFRS 15 Revenue RecognitionYukiNo ratings yet

- Discussion Problems: FAR.2831-Leases MAY 2020Document13 pagesDiscussion Problems: FAR.2831-Leases MAY 2020Eira ShaneNo ratings yet

- Since 1977Document7 pagesSince 1977Lynssej BarbonNo ratings yet

- FAR.2921 Investments in Debt InstrumentsDocument6 pagesFAR.2921 Investments in Debt Instrumentsbrmo.amatorio.uiNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- FAR.2916 - Cash and Cash EquivalentsDocument4 pagesFAR.2916 - Cash and Cash EquivalentsCathlyn PatalitaNo ratings yet

- Module 10 - Revenue RecognitionDocument9 pagesModule 10 - Revenue RecognitionAva RodriguesNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Trade and Other Receivables Discussion ProblemsDocument3 pagesTrade and Other Receivables Discussion ProblemsJim IsmaelNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- 9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsDocument8 pages9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsandreamrieNo ratings yet

- Far Acctg Notes - CompressDocument3 pagesFar Acctg Notes - CompressMARK JHEN SALANGNo ratings yet

- Reviewing key accounting conceptsDocument13 pagesReviewing key accounting conceptschristine anglaNo ratings yet

- D4Document13 pagesD4neo14No ratings yet

- Scope: The Five-Step Model FrameworkDocument3 pagesScope: The Five-Step Model FrameworkPeejay Adame MasongsongNo ratings yet

- Which of The Following Is Not An Essential Characteristic of A LiabilityDocument31 pagesWhich of The Following Is Not An Essential Characteristic of A LiabilityJam PotutanNo ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- Part - 1 - Dashboard - Revenue RecognitionDocument5 pagesPart - 1 - Dashboard - Revenue RecognitionbagayaobNo ratings yet

- Financial Instruments QuizDocument2 pagesFinancial Instruments QuizPHI NGUYEN HOANGNo ratings yet

- Non-financial Liabilities SummaryDocument5 pagesNon-financial Liabilities SummaryNah HamzaNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- Financial Accounting Theory - Test Bank 80102016 - 2Document7 pagesFinancial Accounting Theory - Test Bank 80102016 - 2Allie LinNo ratings yet

- This Study Resource Was: Advanced Accounting Ifrs 15Document6 pagesThis Study Resource Was: Advanced Accounting Ifrs 15YukiNo ratings yet

- This Study Resource Was: Advanced Accounting Ifrs 15Document6 pagesThis Study Resource Was: Advanced Accounting Ifrs 15YukiNo ratings yet

- Tax.3301-3 Accounting Methods and PeriodsDocument2 pagesTax.3301-3 Accounting Methods and PeriodsDena Heart OrenioNo ratings yet

- Tax.3301-2 Classification of TaxesDocument3 pagesTax.3301-2 Classification of TaxesDena Heart OrenioNo ratings yet

- Nurturing Filipino ValuesDocument10 pagesNurturing Filipino ValuesAether SkywardNo ratings yet

- CWTS REVIEWER Module 5 7Document9 pagesCWTS REVIEWER Module 5 7Aether SkywardNo ratings yet

- Understanding the National Service Training ProgramDocument7 pagesUnderstanding the National Service Training ProgramAether SkywardNo ratings yet

- Learn Hiragana Characters and SoundsDocument21 pagesLearn Hiragana Characters and SoundsAether SkywardNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfsgauravpooja808No ratings yet

- Acctg7 - CH 8Document22 pagesAcctg7 - CH 8Jao FloresNo ratings yet

- FAB PayOff Letter - Smith, Oct. 18, 2018 PDFDocument4 pagesFAB PayOff Letter - Smith, Oct. 18, 2018 PDFlarry-612445No ratings yet

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420No ratings yet

- Chapter 05 Consolidation of Less Than WHDocument93 pagesChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhNo ratings yet

- IAS 32 and IFRS 9 Financial Instruments Hanoi FINAL - EDocument107 pagesIAS 32 and IFRS 9 Financial Instruments Hanoi FINAL - ECam viNo ratings yet

- BKAR 3033 Deferred Tax CalculationDocument2 pagesBKAR 3033 Deferred Tax Calculationdini sofiaNo ratings yet

- PSBA-QC 2nd Quiz ReviewDocument2 pagesPSBA-QC 2nd Quiz ReviewIvan ArcinalNo ratings yet

- Accounting 3Document6 pagesAccounting 3Princess Frean VillegasNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Assignment Auditing Problemmichelle PagulayanDocument7 pagesAssignment Auditing Problemmichelle PagulayanEsse ValdezNo ratings yet

- Chart of Accounts GuideDocument3 pagesChart of Accounts GuideThea LicupNo ratings yet

- Ultimate Reward Current Account GuideDocument96 pagesUltimate Reward Current Account GuideAnthony BoocockNo ratings yet

- Income From House PropertyDocument13 pagesIncome From House PropertyVicky DNo ratings yet

- Acct 101 CH 2Document15 pagesAcct 101 CH 2Nigussie BerhanuNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- WLT Proof Form - 2022Document2 pagesWLT Proof Form - 2022Jebis DosNo ratings yet

- Ruck ManDocument180 pagesRuck ManShayanNo ratings yet

- Kinds of ObligationDocument21 pagesKinds of Obligationjeraldtomas12No ratings yet

- Solved Lia Chen and Martin Monroe Formed A Partnership Dividing IncomeDocument1 pageSolved Lia Chen and Martin Monroe Formed A Partnership Dividing IncomeAnbu jaromiaNo ratings yet

- Uco Bank - Tulshiram Mujumale - List of Documents - Plaint To Submitted in The CourtDocument2 pagesUco Bank - Tulshiram Mujumale - List of Documents - Plaint To Submitted in The CourtAbdul Jabbar ShaikhNo ratings yet

- Capital GainsDocument22 pagesCapital GainsrachitNo ratings yet

- 2023 Audit Final Exam - Version1Document20 pages2023 Audit Final Exam - Version1rakutenmeeshoNo ratings yet