Professional Documents

Culture Documents

However, Plastic Money Doesn't Mean The End of Evolution of Money. On The Extreme Ends of Evolution of Money

Uploaded by

Aditya Vikram SrivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

However, Plastic Money Doesn't Mean The End of Evolution of Money. On The Extreme Ends of Evolution of Money

Uploaded by

Aditya Vikram SrivastavaCopyright:

Available Formats

Good morning my respected teacher and dear friends. Today im going to talk about the evolution of money.

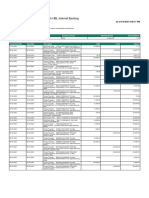

In our world today, money is high-tech. People not only use coins and dollar bills issued by the government as

money, but also increasingly cheques and credit cards. We are now able to move millions of dollars by touching only

one button on our mobile phones and computers. Money has always been important to people and to the economy.

Many economists, like Keynes have dealt with the question of money already and define it as “anything that is

generally accepted in payment for goods and services or in the repayment for debts”..

It serves several functions like-

1. Medium of exchange

2. Unit of account

3. Store of value

There are 5 stages of evolution of money

1. Commodity money- in the past, most societies used a commodity with intrinsic value for money. Any

commodity that was generally demanded and chosen by common consent was used as money.

2. Metallic money- with progress of human civilization, commodity money changed into metallic money.

Metals like gold, silver, copper were used as they could be easily handled and their quantity can be easily

ascertained.

3. Paper money- as commerce and trade expanded and as people made more transactions, the use of precious

metals became very inconvenient. So invention of paper money marked a very important stage in the

evolution of money.

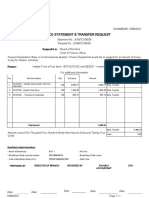

4. Credit money- Paper currency and coins can easily be stolen and can be expensive to transport because of

their size. As a consequence, with the development of modern banking, cheques were invented. The cheque

itself is not money but it performs the same function.

5. Plastic money- Due to the development of the computer and advanced telecommunication technologies,

new advances in the payment system were made. The latest type of money is plastic money in the form of

credit and debit cards. They aim at removing the need for carrying cash to make transactions.

However, plastic money doesn’t mean the end of evolution of money. On the extreme ends of evolution of money

we have barter system on one end and E-money on the other.

Barter system

A barter system is an old method of exchange. Th is system has been used for centuries and long before money

was invented. People exchanged services and goods for other services and goods in return. The invention of

money caused the decline of the system. However, Due to lack of money, bartering became popular in the

1930s during the Great Depression. It was used to obtain food and various other services. It was done through

groups or between people who acted similar to banks.

Digital money

The forms money has taken on over centuries have always been closely connected with the technological

developments in the economy.

electronic money is an electronic store of monetary value on a technical device.

The definition of electronic money is becoming more scientific and specific with

The European Central Bank defining it as “an amount of money value

represented by a claim issued on a prepaid basis, stored in an electronic medium

(card or computer) and accepted as a means of payment by undertakings other

than the issuer”

The greatest differences to earlier forms of money are, that e-money is impersonal and virtual. Contrary to credit or

debit cards, it is always pre-paid. The private issuer of any form of e-money allocates value to a coded digital

message which is stored on a computer system or a smart card chip. The issuer guarantees a fixed reimbursement

value.

Most of these types of digital money still use national currency as a denomination of the value they store and

transfer. In addition to credit cards, which are the most widely spread payments, electronic cheques are used. They

are well suited for minipayments and may be sent through e-mail.

Conclusion

To sum up, money has taken different forms over time. As discussed in the paper, today’s money has evolved over

centuries. Due to many innovations and technological advances in the computer industry, money has become finally

what it is today: high-tech. It acts like a symbol of the commercial structure we operate in

You might also like

- My Content For English ProjectDocument3 pagesMy Content For English ProjectAshutosh RathiNo ratings yet

- I. History of Currency Formation: 2.the Transition From Bartering To CurrencyDocument6 pagesI. History of Currency Formation: 2.the Transition From Bartering To CurrencyQuang SọtNo ratings yet

- Evolution of MoneyDocument21 pagesEvolution of MoneyKunal100% (1)

- Evolution of MoneyDocument2 pagesEvolution of Moneypriscilamumbi4No ratings yet

- Evolution of Money/ Payments System Payment System: The Method of Conducting Transactions in The Economy. The Payments System Has BeenDocument5 pagesEvolution of Money/ Payments System Payment System: The Method of Conducting Transactions in The Economy. The Payments System Has Beenrabia liaqatNo ratings yet

- Cash Matters: The Power and Persistence of Physical CurrencyFrom EverandCash Matters: The Power and Persistence of Physical CurrencyRating: 5 out of 5 stars5/5 (1)

- Modern MoneyDocument7 pagesModern Moneyjulia1212marshmellowNo ratings yet

- Money and Its EvolutionDocument7 pagesMoney and Its EvolutionCANDA Jennyrose A.No ratings yet

- EmoneyDocument87 pagesEmoneyFlash FlashNo ratings yet

- Report On E-Money and Its Usage (Business Communication)Document10 pagesReport On E-Money and Its Usage (Business Communication)Piyush PorwalNo ratings yet

- In The Early Days of CommerceDocument2 pagesIn The Early Days of Commercepitad21.marquezgeraldineNo ratings yet

- Group Name Id: A Resarch Proposal Sumitted To Accounting and Finance DepartmentDocument12 pagesGroup Name Id: A Resarch Proposal Sumitted To Accounting and Finance DepartmentMIKIYAS BERHENo ratings yet

- Digital CurrenciesDocument5 pagesDigital CurrenciesAnkit MittalNo ratings yet

- The Digital Revolution: Central Bank Digital Currencies (CBDC) UnveiledFrom EverandThe Digital Revolution: Central Bank Digital Currencies (CBDC) UnveiledNo ratings yet

- MoneyDocument6 pagesMoneyMD. IBRAHIM KHOLILULLAHNo ratings yet

- Evolution of MoneyDocument14 pagesEvolution of MoneyRiyaz KhanNo ratings yet

- How Would You Like To Pay? How Technology Is Changing The Future of Money by Bill MaurerDocument17 pagesHow Would You Like To Pay? How Technology Is Changing The Future of Money by Bill MaurerDuke University Press0% (1)

- Crypto Currensi Dan Pandangan Legalitas Menurut Islam: Sebuah Literature ReviewDocument13 pagesCrypto Currensi Dan Pandangan Legalitas Menurut Islam: Sebuah Literature ReviewEldani Ibnu RahmanNo ratings yet

- The Overview of Money The History of Money: From Barter To BanknotesDocument9 pagesThe Overview of Money The History of Money: From Barter To BanknotesfarahNo ratings yet

- Bitcoin: UNVEILING THE REVOLUTIONARY POWER OF DIGITAL CURRENCY: A COMPREHENSIVE GUIDE TO BITCOINFrom EverandBitcoin: UNVEILING THE REVOLUTIONARY POWER OF DIGITAL CURRENCY: A COMPREHENSIVE GUIDE TO BITCOINNo ratings yet

- Project WorkDocument51 pagesProject Workvishal galaNo ratings yet

- As Money Has Been Invented, Fraud and Volume Payment Became An IssueDocument1 pageAs Money Has Been Invented, Fraud and Volume Payment Became An IssueRina DutonNo ratings yet

- Evolution of Currency: Isha Suhail - 2015-ARCH-05 Amna Kazmi - 2015-ARCH-12 Aqsa Shafique - 2015-ARCH-21Document27 pagesEvolution of Currency: Isha Suhail - 2015-ARCH-05 Amna Kazmi - 2015-ARCH-12 Aqsa Shafique - 2015-ARCH-21Isha ChaudhryNo ratings yet

- E-Banking and Legal IssuesDocument20 pagesE-Banking and Legal IssuesAnmani KanmaniNo ratings yet

- Cashless SocietyDocument65 pagesCashless SocietyAnonymous 4RApes100% (5)

- Currency: Barter DeterminedDocument2 pagesCurrency: Barter DeterminedFiantiayu efandiNo ratings yet

- Digital Currencies Vis-A-Vis The Future of BankingDocument1 pageDigital Currencies Vis-A-Vis The Future of BankingSuhotraNo ratings yet

- Introduction To Money: Inconveniences (Problems) of Barter ExchangeDocument30 pagesIntroduction To Money: Inconveniences (Problems) of Barter ExchangeMahendra Kumar B RNo ratings yet

- Beyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3From EverandBeyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3No ratings yet

- MoneyDocument54 pagesMoneyTwinkle MehtaNo ratings yet

- Eco PDFDocument4 pagesEco PDFyksamy23No ratings yet

- Unit 8Document16 pagesUnit 8mohamed ahmed HamadaNo ratings yet

- Bill Maurer-How Would You Like To Pay - How Technology Is Changing The Future of Money-Duke University Press Books (2015)Document172 pagesBill Maurer-How Would You Like To Pay - How Technology Is Changing The Future of Money-Duke University Press Books (2015)mohdjavedalamNo ratings yet

- Cryptocurrencies, Money of The Future or The Future of MoneyDocument5 pagesCryptocurrencies, Money of The Future or The Future of MoneyNassyiwa Dwi KesyaNo ratings yet

- What Is Cash?: Legal TenderDocument2 pagesWhat Is Cash?: Legal TenderJonhmark AniñonNo ratings yet

- The Evolution of MoneyDocument7 pagesThe Evolution of MoneyHà Nhi LêNo ratings yet

- Payment SystemsDocument32 pagesPayment SystemsNamyenya MaryNo ratings yet

- MA P.PointDocument40 pagesMA P.PointEndris ZeyinuNo ratings yet

- F19BB023 ECON231 Assignment 2Document4 pagesF19BB023 ECON231 Assignment 2Mehreen M AhmadNo ratings yet

- Study On Cash Vs Cashless Indian EconomyDocument91 pagesStudy On Cash Vs Cashless Indian EconomyBhagyashri AhireNo ratings yet

- Reading Lesson 10Document25 pagesReading Lesson 10AnshumanNo ratings yet

- AlumDocument4 pagesAlumNadine Alyssa MagpantayNo ratings yet

- REVIEWERDocument15 pagesREVIEWERRenz Jerome BregabrielNo ratings yet

- MPCB Lesson #1 (Jan 30, 2022)Document16 pagesMPCB Lesson #1 (Jan 30, 2022)SonnyNo ratings yet

- Chapter 3 - The Payment SystemDocument10 pagesChapter 3 - The Payment SystemJohn Mark LopezNo ratings yet

- Dps 0116Document30 pagesDps 0116Flaviub23No ratings yet

- The Concept and Development of MoneyDocument9 pagesThe Concept and Development of MoneyDorhea Kristha Guian SantosNo ratings yet

- Money PadDocument12 pagesMoney PadAppu KrNo ratings yet

- Plastic MoneyDocument60 pagesPlastic Moneyahmad7920005675100% (1)

- 09 Chapter 1Document30 pages09 Chapter 1Hari SridharanNo ratings yet

- Electronic CashDocument14 pagesElectronic CashNizou ChemNo ratings yet

- Electronic Payment SystemDocument14 pagesElectronic Payment SystemToppers of WorldsNo ratings yet

- Evolution of MoneyDocument3 pagesEvolution of MoneyLalith PothuriNo ratings yet

- Innovation ISU Brochure WebDocument6 pagesInnovation ISU Brochure WebAditya Vikram SrivastavaNo ratings yet

- Unified Iot Ontology To Enable Interoperability and Federation of TestbedsDocument6 pagesUnified Iot Ontology To Enable Interoperability and Federation of TestbedsAditya Vikram SrivastavaNo ratings yet

- Business Technology Solutions AssociateDocument3 pagesBusiness Technology Solutions AssociateAditya Vikram SrivastavaNo ratings yet

- Microsoft Infographics On ML AlgorithmsexamplesDocument1 pageMicrosoft Infographics On ML AlgorithmsexamplesAditya Vikram SrivastavaNo ratings yet

- Software Developer (Campus)Document1 pageSoftware Developer (Campus)Aditya Vikram SrivastavaNo ratings yet

- Business Technology Solutions AssociateDocument3 pagesBusiness Technology Solutions AssociateAditya Vikram SrivastavaNo ratings yet

- Software Developer (Campus)Document1 pageSoftware Developer (Campus)Aditya Vikram SrivastavaNo ratings yet

- About Us - Campus HiringDocument19 pagesAbout Us - Campus HiringAditya Vikram SrivastavaNo ratings yet

- Project Proposal Mechanical HandDocument2 pagesProject Proposal Mechanical HandAditya Vikram SrivastavaNo ratings yet

- Superset Introduction PDFDocument14 pagesSuperset Introduction PDFAditya Vikram SrivastavaNo ratings yet

- FacturaDocument1 pageFacturaYvonne IoanaNo ratings yet

- Starter Form TemplateDocument6 pagesStarter Form TemplatelucyjohufferNo ratings yet

- Bos 50847 MCQP 7Document150 pagesBos 50847 MCQP 7keshav bajajNo ratings yet

- June BillDocument2 pagesJune BillSafwan SadiqNo ratings yet

- AugDocument3 pagesAugArjun Mishra0% (1)

- Onex I 230956Document2 pagesOnex I 230956chunduharikrishnaNo ratings yet

- Premium Paid Certificate For The Year 2020-2021Document1 pagePremium Paid Certificate For The Year 2020-2021Prince GoelNo ratings yet

- ATD and LOA To Debit PremiumDocument2 pagesATD and LOA To Debit PremiumWalyn NagaNo ratings yet

- Junst2106036-Statement Huc0102 ContruccionDocument8 pagesJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNo ratings yet

- Tax Remedies QuizzerDocument3 pagesTax Remedies QuizzerCharrie Grace Pablo29% (7)

- Select Product GuideDocument10 pagesSelect Product GuideRaghav SharmaNo ratings yet

- BIR Form 2316 and 1700 TemplateDocument16 pagesBIR Form 2316 and 1700 Templatepogiman_0167% (3)

- Tan vs. Del Rosario Et Al G.R. No. 109289Document4 pagesTan vs. Del Rosario Et Al G.R. No. 109289ZeusKimNo ratings yet

- E StatementDocument2 pagesE Statementsheikh abdullah aleemNo ratings yet

- PH PT Green Planet IndonesiaDocument2 pagesPH PT Green Planet IndonesiaLukas GPINo ratings yet

- 81601CP575Notice 1692149599160Document3 pages81601CP575Notice 1692149599160FGHJJ FDJFHDNo ratings yet

- Account Activity Generated Through HBL Internet BankingDocument1 pageAccount Activity Generated Through HBL Internet BankingJafar HussainNo ratings yet

- Adjusted Retained Earnings StatementDocument2 pagesAdjusted Retained Earnings StatementSerazul Arafin MrinmoyNo ratings yet

- Annual Financial Report: Your Company NameDocument3 pagesAnnual Financial Report: Your Company NamezulfiNo ratings yet

- Cost of Goods Manufactured Income Statement Norton IndustriesDocument2 pagesCost of Goods Manufactured Income Statement Norton IndustriesAmit PandeyNo ratings yet

- Ssa 7163Document3 pagesSsa 7163GabrielNo ratings yet

- Gpi ModelDocument1 pageGpi ModelEllerNo ratings yet

- Fishwealth Canning v. CIRDocument1 pageFishwealth Canning v. CIRRia Kriselle Francia PabaleNo ratings yet

- 3RD SemDocument34 pages3RD SemMohan kumar K.SNo ratings yet

- Acknowledgement of Indebtedness (Pengakuan Hutang)Document6 pagesAcknowledgement of Indebtedness (Pengakuan Hutang)Savara MarhabanNo ratings yet

- The Wall Street Journal LetterDocument1 pageThe Wall Street Journal LetterVovan VovanNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- Mobile Financial ServicesDocument16 pagesMobile Financial ServicesgamesstateNo ratings yet

- Format of CRJ and CPJDocument2 pagesFormat of CRJ and CPJMERLYNJ199850% (2)