Professional Documents

Culture Documents

TDS Rate Chart For Financial Year 2020 21

Uploaded by

Arun RajaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Rate Chart For Financial Year 2020 21

Uploaded by

Arun RajaCopyright:

Available Formats

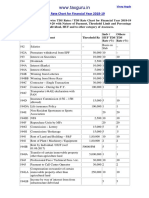

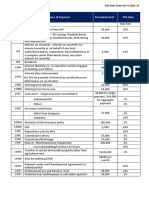

TDS Rate Chart for Financial Year 2020-21

( Applicable from 14th May 2020 )

Vinay Hegde

Others

Section Nature of Payment Indv / HUF TDS

TDS

Threshold

Rs Existing New Rate

Rate (%) rate (% ) (%)

192 Salaries

– Basis on Slab

192A Premature withdrawal from EPF 50,000 10 –

193 Interest on Securities/Debenture’s 10,000 10 7.5 10

194 Dividends (other t han listed Companies) - 10 7.5 10

194A Interest (Banks)/ For Senior Rs 50000 40,000 10 7.5 10

194A Interest (Others) 5,000 10 7.5 10

194B Winning from Lotteries 10,000 30 30 30

194BB Winning from Horse Race 10,000 30 30 30

194C Contractor – Single Transaction 30,000 1 0.75 1.5

194C Contractor – During the F.Y. 1,00,000 1 0.75 1.5

194C Transporter (44AE) declaration with PAN

194D Insurance Commission (15G – 15H allowed) 15,000 5 3.75 3.75

194DA Life insurance Policy 1,00,000 5 3.75 3.75

194E Non-Resident Sportsmen or Sports

20 20

Association

194EE NSS 2,500 10 7.5 7.5

194F Repurchase Units by MFs 20 15 15

194G Commission – Lottery 15,000 5 3.75 5

194H Commission / Brokerage 15,000 5 3.75 5

194I Rent of Land and Building – F&F 2,40,000 10 7.5 7.5

194I Rent of Plant / Machinery / Equipment 2,40,000 2 1.5 1.5

194IB Rent by Individual / HUF 50000/PM 5 3.75 3.75

194IA Transfer of certain immovable property 0.75

50,00,000 1 0.75

other than agriculture land

194J Professional Fees / Technical Fees etc. 30,000 10 7.5 7.5

194J Payment to FTS, Certain Royalties and Call 1.5

30,000 2 1.5

Centre Operator

194IA Compensation on transfer of certain 7.5

immovable property other than agricultural 2,50,000 10 7.5

land

194LB Income by way of interest from

infrastructure debt fund 5 5 5

194LD Interest on Certain bonds. Securities 5 5 5

www.taxguru.in

You might also like

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- Tds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyDocument2 pagesTds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyNarayanakrishnan RNo ratings yet

- TDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Document4 pagesTDS Rate Chart FY 2020-2021 (Covid-19) : Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) (Covid-19)Sahay AlokNo ratings yet

- TDS - and - TCS Rate Chart 2025Document5 pagesTDS - and - TCS Rate Chart 2025jsparakhNo ratings yet

- Tds - and - Tcs Rate Chart Fy 2019 20 TdsmanDocument2 pagesTds - and - Tcs Rate Chart Fy 2019 20 Tdsmankumar45caNo ratings yet

- TDS and TCS Rate Chart 2023Document3 pagesTDS and TCS Rate Chart 2023praveenNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- TDS Rate Chart FY 2024-25Document4 pagesTDS Rate Chart FY 2024-25MOQADDARNo ratings yet

- TDS and TCS Rate Chart 2022Document3 pagesTDS and TCS Rate Chart 2022Ajay ModiNo ratings yet

- Tds Rate Chart AY 21 22Document1 pageTds Rate Chart AY 21 22Keerthana.M MuruganNo ratings yet

- Tax Deduction at SourceDocument13 pagesTax Deduction at SourceSwati SumanNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Document6 pagesReduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)Kranthi Kumar KatamreddyNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocument10 pagesTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Tds Income Tax Rates Fy 2010-11Document13 pagesTds Income Tax Rates Fy 2010-11Surender KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Notes in Hindi PDFDocument8 pagesTDS Notes in Hindi PDFRohit VermaNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Document17 pagesA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- 57 TDS Rate Chart BOARDDocument1 page57 TDS Rate Chart BOARDSatish GoenkaNo ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- Tds Calculator W.E.F. 1.10.09Document1 pageTds Calculator W.E.F. 1.10.09rajesh_vajjasNo ratings yet

- TDS Rate Chart For AY 2009-2010: Prepared By-Himanshu MalikDocument2 pagesTDS Rate Chart For AY 2009-2010: Prepared By-Himanshu Malikysr_cool100% (6)

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document13 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNo ratings yet

- TDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14Document2 pagesTDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14CaCs Piyush SarupriaNo ratings yet

- TDS Rates For The ADocument1 pageTDS Rates For The AsadathnooriNo ratings yet

- TDS - Rates - 07 - 08Document3 pagesTDS - Rates - 07 - 08KRISHNAKUMARNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- Latest Provisions TDS and CSDocument74 pagesLatest Provisions TDS and CShimesh amibrokerNo ratings yet

- TDS 2011-12Document3 pagesTDS 2011-12Aditya SoniNo ratings yet

- Particulars TDS Rates (In %) : Section 192 Section 192A Section 193Document7 pagesParticulars TDS Rates (In %) : Section 192 Section 192A Section 193ABHISHEKNo ratings yet

- Notification TDS Rates - FV AMC BillDocument8 pagesNotification TDS Rates - FV AMC Billamit chavariaNo ratings yet

- TDS Rate Chart For FY 2022-2023Document15 pagesTDS Rate Chart For FY 2022-2023leelathecaNo ratings yet

- TDS Rate Chart 1Document1 pageTDS Rate Chart 1bulu1987No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Declaration: Dated: (Signature)Document1 pageDeclaration: Dated: (Signature)AbhishekNo ratings yet

- GST Chapter Wise RateDocument213 pagesGST Chapter Wise RateMoneycontrol News92% (280)

- License ConditionDocument3 pagesLicense ConditionShabir TrambooNo ratings yet

- Accounting Standards As5newDocument9 pagesAccounting Standards As5newapi-3705877No ratings yet

- As 4 Contingencies and Events Occuring After The Balance Sheet DateDocument9 pagesAs 4 Contingencies and Events Occuring After The Balance Sheet Dateanon_672065362No ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- As 2 - Valuation of InventoriesDocument9 pagesAs 2 - Valuation of InventoriesRohit KumbharNo ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- LiabilitiesDocument51 pagesLiabilitiesLuisa Janelle BoquirenNo ratings yet

- FAC1601 Assignment 5Document73 pagesFAC1601 Assignment 5Kgomotso RamodikeNo ratings yet

- Pay Particulars: Pay and Pension Directorate - Sri Lanka NavyDocument1 pagePay Particulars: Pay and Pension Directorate - Sri Lanka NavySLNS RUHUNA100% (1)

- Types of Bank Accounts in India (Deposit Accounts)Document5 pagesTypes of Bank Accounts in India (Deposit Accounts)Sumanta PanNo ratings yet

- Acclaw QuizDocument4 pagesAcclaw QuizJasmine PeraltaNo ratings yet

- Bank Pertanian Malaysia Berhad (811810-U) Hartani-IDocument4 pagesBank Pertanian Malaysia Berhad (811810-U) Hartani-IDANARAJ A/L MUTHUSAMY MoeNo ratings yet

- Décimo Aplicaciones: Quiz No. 2 Tipo 2 Aplicaciones Financieras (44 Marks)Document6 pagesDécimo Aplicaciones: Quiz No. 2 Tipo 2 Aplicaciones Financieras (44 Marks)MARIANA BERDUGONo ratings yet

- Act 2 Engineering Economics - MercadoDocument4 pagesAct 2 Engineering Economics - MercadoCharlie Ercole Mercado0% (1)

- Acquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1Document58 pagesAcquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1amjad asfourNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- First Preboard FAR ReviewDocument26 pagesFirst Preboard FAR Reviewlois martinNo ratings yet

- DEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxDocument3 pagesDEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxWilliam AzucenaNo ratings yet

- Master Budgeting ProblemsDocument4 pagesMaster Budgeting ProblemsKRook NitsNo ratings yet

- 4th Periodical Exam WorksheetDocument12 pages4th Periodical Exam WorksheetMc Clent CervantesNo ratings yet

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Basic Accounting Terms & RulesDocument6 pagesBasic Accounting Terms & Rulesniraj jainNo ratings yet

- BOND VALUATION - Kelompok 5 UpdateDocument67 pagesBOND VALUATION - Kelompok 5 UpdateRemano GitzkyNo ratings yet

- Principles of Accounts For CSEC®: 2nd EditionDocument20 pagesPrinciples of Accounts For CSEC®: 2nd EditionVeronica BaileyNo ratings yet

- Swarnjayanti Gram Swarozgar Yojana ZaidDocument10 pagesSwarnjayanti Gram Swarozgar Yojana ZaidIqra ShaikhNo ratings yet

- For 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableDocument3 pagesFor 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableExzyl Vixien Iexsha LoxinthNo ratings yet

- PARCOR 1 and 2Document7 pagesPARCOR 1 and 2Kim Audrey Jalalain100% (1)

- Final Mock Spring 2023Document6 pagesFinal Mock Spring 2023broken GMDNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2005 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2005 1 HourzeelNo ratings yet

- Sol. Man. - Chapter 1 Current LiabilitiesDocument10 pagesSol. Man. - Chapter 1 Current LiabilitiesChristine Mae Fernandez Mata100% (4)

- Module 2.3 - Loan ReceivableDocument1 pageModule 2.3 - Loan ReceivableEilana CandelariaNo ratings yet

- Financial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyDocument151 pagesFinancial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyAksh KhandelwalNo ratings yet

- Accounting Conventions and EquationDocument33 pagesAccounting Conventions and EquationanuragNo ratings yet

- Ap Cash Cash Equivalents QuizDocument8 pagesAp Cash Cash Equivalents QuizJenny BernardinoNo ratings yet

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Documents PDFDocument6 pagesDocuments PDFAngela NortonNo ratings yet