Professional Documents

Culture Documents

Tds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-Penalty

Uploaded by

Narayanakrishnan ROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-Penalty

Uploaded by

Narayanakrishnan RCopyright:

Available Formats

SIMPLE TAX INDIA

SPONSORED SEARCHES

tds rate chart for fy 18 19 salary calculator income tax calculator

rental properties 2018 tax return flats to rent

Home TDS RATES latest tds rate chart

TDS RATE CHART FY 2018-19 AY 2019-20 TDS DEPOSIT-RETURN DUE DATES-INTEREST-

PENALTY

4 Raj Kumari Monday, May 14, 2018

Tax Deducted at Source (TDS) is a system introduced by Income Tax Department, where person responsible for making specified

payments such as salary, commission, professional fees, interest, rent, etc. is liable to deduct a certain percentage of tax before

making payment in full to the receiver of the payment. As the name suggests, the concept of TDS is to deduct tax at its source.

A significant part of Income tax collection comes through TDS ,so Tax machinery is monitoring the TDS collection minutely.

In view of above ,Deduction of Tax at correct rate is very important for deductor and minor mistake in deduction leads to penalty in

shape of Interest on late deposit and disallowance of Expenses. We have Compiled Tax deduction rates chart (TDS rate chart) for

Financial year 2018-19 Assessment year 2019-20 which may be useful for all the readers.

Kindly give suggestion/queries/errors/amendments in comment section or raniraj1950 at gmail.com , suitable prizes will

be given to persons who will point out error(s) or sent good suggestions about this post.Copy paste has been disabled .

REPORT ERROR: RANIRAJ1950 at GMAIL.COM

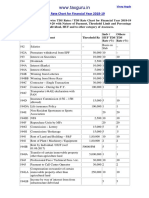

1. TDS RATE CHART FY 2018-19 AY 2019-20

TDS RATE CHART FY 2018-19 AY 2019-20

Section Nature of Payment Cut off (Rs.) Indi/HUF Others

192 Salaries - Avg NA

rates

192A Premature withdrawal from 50000 10

EPF NA

193 Interest on securities 10000 10

194 Dividends 2500 10

Interest Banks/Other 10000/5000

194A 10

For Senior citizen(01.04.18) 50000

194B Winning from Lotteries 10000 30

194BB Winnings from Horse Race 10000 30

194C Contractor-Single/Yearly 30K/1LAKh 1 2

Transporter(44AE) As above - -

194C

Declaration with PAN

194D Insurance Comm(15G-15H 15000 5%

allowed)

194DA Life insurance policy 100000 1%

194EE NSS 2500 10 NA

194G Commission /Lottery 15000 5

194H Commission / Brokerage 15000 5

194I Rent Land and Building 180000 10

F&F

194IB Rent (by Indvl/HUF) 50000/Month 5% NA

(01.06.17)

194I Rent- 180000 2

Plant/Machinery/equipment

194IA Immovable property 50 Lakh 1

194J Professional/technical Fees 30000 10

194J Payment to Call 30000 2

Center(01.06.17)

194LA Immovable 2.5 LAKH 10

Property(compenation)

194LA Immovable Property-TDS exempted under RFCTLARR

Act'(01.04.17)

TDS RATE CHART FY 2018-19 AY 2019-20

Sec Nature of Payment Cut off (Rs.) Indi/HUF Others

192 Salaries - Avg NA

rates

192A Premature withdrawal from 50000 10

EPF NA

193 Interest on securities 10000 10

194 Dividends 2500 10

Interest Banks/Other 10000/5000

194A For Senior 50000 10

citizen(01.04.18)

194B Winning from Lotteries 10000 30

194BB Winnings from Horse Race 10000 30

Contractor-Single/Yearly 30K/1LAKh 1 2

194C Transporter(44AE) Declaration with As above - -

PAN

194D Insurance Comm (15G-15H 15000 5%

allowed)

194DA Life insurance policy 100000 1%

194EE NSS 2500 10 NA

194G Commission /Lottery 15000 5

194H Commission / Brokerage 15000 5

194I Rent Land and Building F&F 180000 10

194IB Rent (by Indvl/HUF) 50000/Month 5% NA

(01.06.17)

194I Rent- 180000 2

Plant/Machinery/equipment

194IA Immovable property 50 Lakh 1

194J Professional/technical Fees 30000 10

194J Payment to Call 30000 2

Center(01.06.17)

194LA Immovable 2.5 LAKH 10

You might also like

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Document1 pageWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- TDS & TCS Rates Made EasyDocument2 pagesTDS & TCS Rates Made Easykumar45caNo ratings yet

- TDS and TCS-rate-chart-2023 RemovedDocument4 pagesTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65No ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- TDS and TCS Rate Chart 2022Document3 pagesTDS and TCS Rate Chart 2022Ajay ModiNo ratings yet

- TDS and TCS Rate Chart 2023Document3 pagesTDS and TCS Rate Chart 2023praveenNo ratings yet

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDocument1 pageTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINo ratings yet

- TDS_and_TCS-rate-chart-2025Document5 pagesTDS_and_TCS-rate-chart-2025jsparakhNo ratings yet

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- Tds Rate Chart For Fy 21016Document2 pagesTds Rate Chart For Fy 21016VedpalNo ratings yet

- TDS Rate Chart For Financial Year 2020 21Document1 pageTDS Rate Chart For Financial Year 2020 21Arun RajaNo ratings yet

- Tds Income Tax Rates Fy 2010-11Document13 pagesTds Income Tax Rates Fy 2010-11Surender KumarNo ratings yet

- TDS Rate Chart for FY 2010-11Document2 pagesTDS Rate Chart for FY 2010-11Ashish JainNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document13 pagesTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNo ratings yet

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Document3 pagesTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNo ratings yet

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- TDS 2011-12Document3 pagesTDS 2011-12Aditya SoniNo ratings yet

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocument10 pagesTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNo ratings yet

- TDS Summary SRDocument2 pagesTDS Summary SRdokkalaspiNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- Commonly used TDS Provisions for payments in IndiaDocument17 pagesCommonly used TDS Provisions for payments in IndiaSonika GuptaNo ratings yet

- Tds Calculator W.E.F. 1.10.09Document1 pageTds Calculator W.E.F. 1.10.09rajesh_vajjasNo ratings yet

- TDS Rates ChartDocument11 pagesTDS Rates ChartSarat KumarNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument5 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- TDS Rate Chart 1Document1 pageTDS Rate Chart 1bulu1987No ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions AreDocument1 pageTDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions ArekajalNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2veena_hewalekarNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- TDS Rate Chart 2011 - 12Document1 pageTDS Rate Chart 2011 - 12m_y_chavanNo ratings yet

- TDS Rate Chart: Assessment Year 2011-12Document1 pageTDS Rate Chart: Assessment Year 2011-12Saravanan ElumalaiNo ratings yet

- Ssra Tds Rates 2021-2022Document10 pagesSsra Tds Rates 2021-2022deepu kNo ratings yet

- Karvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not ProvidedDocument1 pageKarvy Group TDS Rates W.E.F. 01.04.2010 Rate of TDS Rate of TDS If PAN Providedif PAN Not Providedarjun_cwaNo ratings yet

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Document1 pageTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Shwetta GogawaleNo ratings yet

- TDS Rates For The ADocument1 pageTDS Rates For The AsadathnooriNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument13 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- TDS Rates Chart Fy 2020 21 Ay 2021 22Document6 pagesTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNo ratings yet

- Instapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355Document7 pagesInstapdf - in Tds Rate Chart Fy 2023 24 Ay 2024 25 355skassociatetaxconsultantNo ratings yet

- TDS Rates Applicable from 01.10.2009Document2 pagesTDS Rates Applicable from 01.10.2009Gaurav MalhotraNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Document9 pagesTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNo ratings yet

- TDS Chart FY 23-24Document6 pagesTDS Chart FY 23-24kuldeep singhNo ratings yet

- MCQ Law Ca InterDocument71 pagesMCQ Law Ca InterGaurav PatelNo ratings yet

- Konstruksi Indonesia 2010 - Exhibition Contract FormDocument2 pagesKonstruksi Indonesia 2010 - Exhibition Contract FormYudith Bdoel AbdullahNo ratings yet

- Factory Destuff LOI - 2019 PDFDocument5 pagesFactory Destuff LOI - 2019 PDFDron BatraNo ratings yet

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Quiz On Journalizing, Posting & Preparation of Trial BalanceDocument28 pagesQuiz On Journalizing, Posting & Preparation of Trial BalanceBpNo ratings yet

- HR Practices in Insurance Companies PDFDocument14 pagesHR Practices in Insurance Companies PDFTasin NasirNo ratings yet

- TATA AIG General InsuranceDocument8 pagesTATA AIG General InsuranceSaikrishna PendyalaNo ratings yet

- Bank Loan DocumentsDocument10 pagesBank Loan DocumentsSatish KanojiyaNo ratings yet

- Phil. Charter Insurance Corp. VS. Phil. National Construction Corp. CaseDocument2 pagesPhil. Charter Insurance Corp. VS. Phil. National Construction Corp. CasePaolo MendioroNo ratings yet

- Filipinos' Love for Buffet: The Rise of All-You-Can-Eat RestaurantsDocument81 pagesFilipinos' Love for Buffet: The Rise of All-You-Can-Eat RestaurantsCharlene Subong100% (1)

- MC2018 01 Social Audit Working Docs Report PDFDocument5 pagesMC2018 01 Social Audit Working Docs Report PDFMark John OrtencioNo ratings yet

- A Concise Guide To The Employees' Compensation Ordinance (With Frequently Asked Questions On Common Employees' Compensation Issues)Document60 pagesA Concise Guide To The Employees' Compensation Ordinance (With Frequently Asked Questions On Common Employees' Compensation Issues)Grace Angelie C. Asio-SalihNo ratings yet

- SC Rules Pipeline Operator as Common Carrier, Exempt from Local Business TaxDocument15 pagesSC Rules Pipeline Operator as Common Carrier, Exempt from Local Business TaxCy PanganibanNo ratings yet

- Credit Policies and ProceduresDocument47 pagesCredit Policies and ProceduresAlisterpNo ratings yet

- Court Rules Continuing Suretyship Agreement Covers Successive TransactionsDocument20 pagesCourt Rules Continuing Suretyship Agreement Covers Successive TransactionsJec Luceriaga BiraquitNo ratings yet

- H.H. Hollero Construction v. GSISDocument1 pageH.H. Hollero Construction v. GSISkenn TenorioNo ratings yet

- AdDip Insurance March2010Document27 pagesAdDip Insurance March2010Lo ThomasNo ratings yet

- CPF-MC ApplicationDocument4 pagesCPF-MC ApplicationJeyavikinesh SelvakkuganNo ratings yet

- Gratuity ActDocument9 pagesGratuity ActMonil DesaiNo ratings yet

- Neha BistDocument31 pagesNeha BistSupreme ComputerNo ratings yet

- Duties and Authority of PrincipalDocument9 pagesDuties and Authority of Principalfadilahmuhidi0% (1)

- Nominee AgreementDocument5 pagesNominee AgreementIhsan SerqNo ratings yet

- Agriculture Business Plan WorkbookDocument28 pagesAgriculture Business Plan Workbookaxm046950% (2)

- Solved Lewis Signed A Contract For The Rights To All TimberDocument1 pageSolved Lewis Signed A Contract For The Rights To All TimberAnbu jaromiaNo ratings yet

- Auto Confirmation of Coverage - Ahmad HleihelDocument2 pagesAuto Confirmation of Coverage - Ahmad Hleiheladamsjennifer734No ratings yet

- Zekarias MekonnenDocument68 pagesZekarias MekonnenSamuel TekalignNo ratings yet

- Supply of Pipes: Tender No.: Jrmm188151Document47 pagesSupply of Pipes: Tender No.: Jrmm188151shyamNo ratings yet

- LIC's Jeeven Umang (T-945) Benefit IllustrationDocument5 pagesLIC's Jeeven Umang (T-945) Benefit Illustrationdaggumati rajesh varmaNo ratings yet

- Term Paper11Document9 pagesTerm Paper11Suzona Asad BrishtiNo ratings yet