0% found this document useful (0 votes)

215 views1 pageNucor Thin-Slab Casting Financial Overview

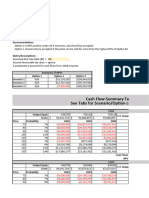

This document presents pro-forma costs and profits projections for a new thin-slab casting facility from 1987 to 2000. It projects revenues, operating income, depreciation expenses, profit sharing expenses, pre-tax income, net income, capital expenditures, start-up expenses, changes in working capital, cash flows, cumulative investments, book value and net present value of cash flows. Key assumptions include provisions for working capital at 12% of revenues, a tax rate of 34%, depreciation over 15 years with maintenance at half that rate, and a weighted after-tax cost of capital of 11%.

Uploaded by

Andrew ChoiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

215 views1 pageNucor Thin-Slab Casting Financial Overview

This document presents pro-forma costs and profits projections for a new thin-slab casting facility from 1987 to 2000. It projects revenues, operating income, depreciation expenses, profit sharing expenses, pre-tax income, net income, capital expenditures, start-up expenses, changes in working capital, cash flows, cumulative investments, book value and net present value of cash flows. Key assumptions include provisions for working capital at 12% of revenues, a tax rate of 34%, depreciation over 15 years with maintenance at half that rate, and a weighted after-tax cost of capital of 11%.

Uploaded by

Andrew ChoiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd