Professional Documents

Culture Documents

2 Million / 40%) + $5 Million Post-Money Valuation $7 Million

Uploaded by

Shabnam ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Million / 40%) + $5 Million Post-Money Valuation $7 Million

Uploaded by

Shabnam ShahCopyright:

Available Formats

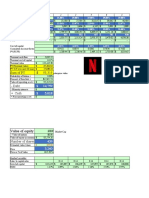

Year 2009 2010 2011 2012 P 2013 P 2014 P 2015 P 2016 P 2017 P Formulas

Revenue $ 9.00 $ 22.00 $ 63.00 $ 137.00 $ 198.00 $ 260.00 $ 335.00 $ 425.00 $ 525.00 NI = Capital Expenditure +Increase in Net Working Capital - Dereciation

Year-on-year Growth 144% 186% 117% 45% 31% 29% 27% 24% IR = NI / Net Income Beta 1.50

COGS $ 4.20 $ 10.90 $ 37.20 $ 82.40 $ 117.10 $ 153.40 $ 194.30 $ 242.30 $ 290.00 GV = CFs+1 / (r- Year-on-year Growth) Treasury Rate 0.05

Gross Profit $ 4.80 $ 11.10 $ 25.80 $ 54.60 $ 80.90 $ 106.60 $ 170.70 $ 182.70 $ 235.00 CFs+1 = Free Cash Flw * (1+ Year-on-Year Growth)/(r-year-on-year growth) Market Risk Premium 0.06

Operating Expense $ 279.00 $ 4.32 $ 8.50 $ 15.76 $ 20.78 $ 29.90 $ 41.85 $ 57.35 $ 77.15 NPV of firm at exit = (CF1/(1+R)+ (CF2/(1+R)^2) + ….+ (CFn/(1+R)^n + ….+ ((CFs + GV)/(1+R)^s-t) r 0.093

EBITDA $ 2.01 $ 6.78 $ 17.30 $ 38.84 $ 60.12 $ 76.70 $ 98.85 $ 125.35 $ 157.85 CFs+1 -712.452

Deprciation and Amortization $ 0.05 $ 0.11 $ 0.32 $ 0.69 $ 0.99 $ 1.30 $ 1.68 $ 2.13 $ 2.63

EBIT $ 1.97 $ 6.67 $ 16.99 $ 38.16 $ 59.13 $ 75.40 $ 97.18 $ 123.23 $ 155.23

EBIT Margin 22% 30% 27% 28% 30% 29% 29% 9% 30%

Interest expense $ - $ - $ - $ - $ - $ - $ - $ - $ -

Profit before taxes $ 1.97 $ 6.67 $ 16.99 $ 38.16 $ 59.13 $ 75.40 $ 97.18 $ 123.23 $ 155.23

Taxes $ 0.59 $ 2.00 $ 5.10 $ 11.45 $ 17.74 $ 22.62 $ 29.15 $ 36.97 $ 46.57

Net Incom $ 1.38 $ 4.67 $ 11.89 $ 26.71 $ 41.39 $ 52.78 $ 68.02 $ 86.26 $ 108.66

Capital Expenditure $ 1.00 $ 1.45 $ 1.90 $ 2.45 $ 3.10 $ 3.83

Increase in Net Working Capital $ 6.00 $ 8.67 $ 11.39 $ 14.67 $ 18.61 $ 22.99

Free Cash Flow $ 20.39 $ 32.26 $ 40.80 $ 52.58 $ 66.67 $ 84.46

1. What is the value of the firm under venture capital method?

Amount Invested 2million pre money Evaluation5million ($2 million / 40%) + $5 million Post-money valuation = $7 million

Equity Stake 40% 7million value of te firm

2. What is the value of the firm under venture capital method?

NI $ 6.31 $ 9.13 $ 11.99 $ 15.44 $ 19.58 $ 24.19

IR 0.236241 0.22058468 0.227169 0.226992 0.226988 0.222621

GV 4846.61

NPV of firm at exit -211.84

3. Is Everest Partners justified in asking for 30% equity stake?

Pre Money Value $ 63.00

Investment $ 30.00

Post Money Value $ 93.00

Share % of VC 32.26%

Share % of founders 67.74%

EverestPartener is justified for asking 30% equty stake Since 30% equity stake is less than 32.26%.

You might also like

- Outreach NetworksDocument3 pagesOutreach NetworksPaco Colín50% (2)

- Outreach Networks Case DardenDocument3 pagesOutreach Networks Case DardenPaco Colín100% (1)

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Current Financial Analysis and ValuationDocument30 pagesCurrent Financial Analysis and ValuationAbhinav PandeyNo ratings yet

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Document3 pagesThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderNo ratings yet

- ABNB ValuationDocument4 pagesABNB ValuationKasturi MazumdarNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethNo ratings yet

- Historical ProjectionsDocument2 pagesHistorical ProjectionshekmatNo ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Task 2Document1 pageTask 2killian.influNo ratings yet

- Cav 2022 Q1-1Document5 pagesCav 2022 Q1-1arjun guptaNo ratings yet

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Nestle Model Group 5Document129 pagesNestle Model Group 5Aayushi ChandwaniNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Coffee Shop Financial PlanDocument27 pagesCoffee Shop Financial PlankkornchomNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Ejercicio Estados Financieros Vertical y Horizontal 22 SepDocument5 pagesEjercicio Estados Financieros Vertical y Horizontal 22 Sepgracy yamileth vasquez garayNo ratings yet

- Case 2 - Lady M-2Document11 pagesCase 2 - Lady M-2Joanne LinNo ratings yet

- FY10 Financial Report For Mar 2010 Commission MeetingDocument1 pageFY10 Financial Report For Mar 2010 Commission MeetingDuaneBoniferNo ratings yet

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- Colgate PalmolivDocument8 pagesColgate PalmolivAnshika SinghNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Declining Checks IndustryDocument2 pagesDeclining Checks IndustryHEM BANSALNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgeNo ratings yet

- PPC Forecast ModelDocument7 pagesPPC Forecast ModelOpeyemi Akinkunmi BeckleyNo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Titan Company Limited Intrinsic Value Estimation and WACC CalculationDocument6 pagesTitan Company Limited Intrinsic Value Estimation and WACC CalculationKS UnofficialNo ratings yet

- Varun BeveragesDocument16 pagesVarun BeveragesPuneet GirdharNo ratings yet

- Nestle India Financial Model 1690555420Document24 pagesNestle India Financial Model 1690555420Shrikant GuptaNo ratings yet

- Amazon Financial Statements 2005-2019 - AMZNDocument2 pagesAmazon Financial Statements 2005-2019 - AMZNVinita AgrawalNo ratings yet

- Beron - FinancialForecastingDocument25 pagesBeron - FinancialForecastingKat BeronNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- BF 07arDocument86 pagesBF 07arAlexander HertzbergNo ratings yet

- Adani Total GasDocument13 pagesAdani Total GasShiv LalwaniNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- BD Assignment Team C - Fabian and SalmaDocument2 pagesBD Assignment Team C - Fabian and SalmaSarah AnantaNo ratings yet

- Bac DCFDocument7 pagesBac DCFVivek GuptaNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04No ratings yet

- Robertson Tool Company Financial AnalysisDocument17 pagesRobertson Tool Company Financial AnalysisWasp_007_007No ratings yet

- Numbers document converted to Excel sheetsDocument5 pagesNumbers document converted to Excel sheetsJeremy smithNo ratings yet

- Toy World Inc Pro Forma Income StatementDocument3 pagesToy World Inc Pro Forma Income StatementAkshay WahalNo ratings yet

- Raw Input Calculated Financial Projections and ValuationDocument5 pagesRaw Input Calculated Financial Projections and ValuationFırat ŞıkNo ratings yet

- Outreach Networks Case Study SolutionDocument2 pagesOutreach Networks Case Study SolutionEaston Griffin0% (1)

- Income Statement and Balance Sheet AnalysisDocument4 pagesIncome Statement and Balance Sheet Analysisbittesh chakiNo ratings yet

- Estimated Equity Returns From The Acquisition of PGM ($ Millions) LBO Method (LEVERED)Document3 pagesEstimated Equity Returns From The Acquisition of PGM ($ Millions) LBO Method (LEVERED)Sumeet BhatereNo ratings yet

- 5 Concrete ExampleDocument3 pages5 Concrete ExampleTobias ManunureNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Original invoice for clutch parts and shippingDocument1 pageOriginal invoice for clutch parts and shippingjavier alvarezNo ratings yet

- Bank of IndiaDocument4 pagesBank of Indiavivek75% (8)

- Presidential Initiative For Artificial Intelligence & Computing (PIAIC) Presidential Initiative For Artificial Intelligence & Computing (PIAIC)Document2 pagesPresidential Initiative For Artificial Intelligence & Computing (PIAIC) Presidential Initiative For Artificial Intelligence & Computing (PIAIC)Aamir Naveed AkramNo ratings yet

- Format cash flow statement indirect methodDocument4 pagesFormat cash flow statement indirect methodandreqwNo ratings yet

- Preqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFDocument78 pagesPreqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFPaulo MottaNo ratings yet

- OBLICON - Article 1195 - 1271Document5 pagesOBLICON - Article 1195 - 1271Dhaniella De GuzmanNo ratings yet

- Problem 3Document4 pagesProblem 3Rio De LeonNo ratings yet

- Secured Credit WestbrookDocument13 pagesSecured Credit WestbrookBill Coleman100% (1)

- Risk Management Presentation April 22 2013Document156 pagesRisk Management Presentation April 22 2013George LekatisNo ratings yet

- Still Searching For Optimal Capital StructureDocument26 pagesStill Searching For Optimal Capital Structureserpent222No ratings yet

- BDPL4103 Introductory Investment Management - Jan 22Document10 pagesBDPL4103 Introductory Investment Management - Jan 22SOBANAH A/P CHANDRAN STUDENTNo ratings yet

- Comprehensive Problem-Special JournalsDocument5 pagesComprehensive Problem-Special JournalsFebrian ManuelNo ratings yet

- Chapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The BusinessDocument52 pagesChapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The Businessaladdin oidacraNo ratings yet

- Annual Report: GSP Finance Company (Bangladesh) LimitedDocument101 pagesAnnual Report: GSP Finance Company (Bangladesh) LimitedSakib AhmedNo ratings yet

- Chart of AccountDocument5 pagesChart of Accountsana82966534100% (1)

- Ethnography Number 9 Alan Klima Introduc PDFDocument53 pagesEthnography Number 9 Alan Klima Introduc PDFKTNo ratings yet

- Ad Account Question PaperDocument3 pagesAd Account Question PaperAbdul Lathif0% (1)

- Fs AnalysisDocument14 pagesFs Analysisyusuf pashaNo ratings yet

- Money MastersDocument53 pagesMoney Masterssoumyabrata dasNo ratings yet

- INSEAD-ValueCreation2 0Document29 pagesINSEAD-ValueCreation2 0Henri GolionoNo ratings yet

- Islamic Banking Vs Conventional BankingDocument17 pagesIslamic Banking Vs Conventional BankingFarrukh Ahmed Qureshi100% (19)

- Birth Certificates Are Federal Bank NotesDocument6 pagesBirth Certificates Are Federal Bank Noteskaos100% (1)

- Transactions Date Description Type Amount Available William TurbinDocument5 pagesTransactions Date Description Type Amount Available William TurbinJanelle GarrisonNo ratings yet

- PayPal vs. SkrillDocument3 pagesPayPal vs. Skrillmyron kipropNo ratings yet

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- Ibanking Laws Preweek Handout Number 69Document2 pagesIbanking Laws Preweek Handout Number 69John DoeNo ratings yet

- Notes On Interest RatesDocument3 pagesNotes On Interest RatesKhawar Munir GorayaNo ratings yet

- 2016 Nomura Summer Internship ProgramDocument25 pages2016 Nomura Summer Internship ProgramTing-An KuoNo ratings yet

- Should Salte Proceed with New Machinery ProjectDocument7 pagesShould Salte Proceed with New Machinery ProjecttaikhoanscribdNo ratings yet

- Checkpoint Exam 3 (Study Sessions 16-19, 1)Document11 pagesCheckpoint Exam 3 (Study Sessions 16-19, 1)Bảo TrâmNo ratings yet