Professional Documents

Culture Documents

Antony Waste Co Research Paper

Uploaded by

Prakash chandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Antony Waste Co Research Paper

Uploaded by

Prakash chandraCopyright:

Available Formats

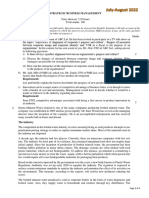

Antony Waste Handling Cell Ltd IPO Analysis

Issue Opens: Dec 21, 2020; Issues closed: Dec 23, 2020; Price Band: 313-315

Issue Details Company Overview: Antony Waste Handling Cell Ltd

Face Values ₹5 incorporated in 2001. It is the second-largest player

Indian Municipal Solid Waste. It owns a fleet of 1,147

Price Band ₹313-315

vehicles, of which 969 were equipped with GPS

Issue Size ₹300Cr technology. Business activities of Antony Waste are

Bid Lot 47 Equity Share divided into 3 categories. Which are the following:

Issue Type 100% Book Building

1. MSW( Municipal Solid Waste Management)

C&T Project: The work of this project is

Company Management collecting bins from household and

communities.

Mr. Jose Jacob

2. MSM Processing project: The work of this

Kallarakal Chairman & MD

project is shorting and recycling the bins.

Mr. Shiju Jacob 3. Mechanized sweeping Project: Complete

Kallarakal CFO

cleaning operation is done in this project.

The objective of the Offer

1. The main objective of the fundraising to invest money in waste to energy project to its subsidiary AG

Enviro and ALESPL at Pimple Chinchwad in Maharashtra.

2. To reduce the consolidated borrowing of the company.

Straight of the Business

1. This company is the second-largest player In Indian Municipal Solid Waste.

2. Consistent track record of MSW project execution: Antony Waste company

have an Asia biggest processing plant at Kanjurmark, Mumbai which has

processed more than 7.63 million metric tons since its inception in 2010 till

November 15, 2020 ( Frost & Sullivan Report).

3. Diversification of the business: As on November 15, 2020, 18 projects are ongoing. Among 18

projects 14 for MSW( Municipal Solid Waste Management) C&T Project, 2 for MSM Processing

project and 4 for Mechanized sweeping Project.

4. Growth Opportunity in Municipal Solid Waste Management Sector: Government of India also

want to increase the participation of the private company to manage waste. According to the

Frost & Sullivan Report MSM management market is 5000cr (in 2020). Which is expected to go

9800cr in 2025.

Swachh Bharat Mission aims to achieve 100% collection, transportation, processing and disposal

of municipal waste across 4,041 cities/towns in the country (Frost & Sullivan Report). In the

present time, only 30-35% of municipal solid waste gets process in India.

Financials of the Company

Rs Crore

Financial

Parameters FY18 FY19 FY20 H1FY21

Revenue 291 299 465 215

EBITDA 84 91 140 60

EBITDA

29 30 30 28

Margin

PAT 40 35 62 29

The financial condition of this company is looking good. Compare to the 2018 data with 2020

revenue and profit after tax (PAT) has increased.

Key Risk:

1. Antony waste company depends upon the state and central government. If the budget

allocation of MSW project decline that will be the adverse impact for Antony waste

company.

2. This company is dealing with a limited number of customers.

3. Company is going to invest IPO amount in waste to energy project but the company don’t

have experience in this project.

4. The company have required high working capital for doing this business. If the company fail

to pay the debt amount that will be an adverse impact on the business.

You might also like

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Antony Waste Handling CellDocument17 pagesAntony Waste Handling CellShweta KerkettaNo ratings yet

- WEL COM EYO U in TH IS PRE SEN Tati ONDocument19 pagesWEL COM EYO U in TH IS PRE SEN Tati ONhaseeb zainNo ratings yet

- CPSE Conclave PresentationDocument44 pagesCPSE Conclave PresentationkumarsaurabhvermaNo ratings yet

- SHRM TcilDocument1 pageSHRM TcilKotwal Mohit KotwalNo ratings yet

- Jusbin: Lean Start-Up Management (Mgt1022) Te1 Slot Winter Semester 2019-20Document25 pagesJusbin: Lean Start-Up Management (Mgt1022) Te1 Slot Winter Semester 2019-20Teja PeddiNo ratings yet

- Coal India LimitedDocument92 pagesCoal India LimitedChanchal K Kumar100% (3)

- CASE ANALYSIS: Big Builder's Conglomerates Inc.: Criteria Performance Indicators Points 3 2 Total 5Document1 pageCASE ANALYSIS: Big Builder's Conglomerates Inc.: Criteria Performance Indicators Points 3 2 Total 5Jilliane MaineNo ratings yet

- 02 Task Performance 1Document2 pages02 Task Performance 1Emperor SavageNo ratings yet

- 20 B C P R ( 68) : Udget Apital ART Eceipts Lakh CRDocument5 pages20 B C P R ( 68) : Udget Apital ART Eceipts Lakh CRBASIC LIFENo ratings yet

- First Draft IT Gap Assessment 14.09.2020 1.0Document157 pagesFirst Draft IT Gap Assessment 14.09.2020 1.0Rajesh SanghiNo ratings yet

- Jan - MarDocument23 pagesJan - Marsanayaseen yaseenNo ratings yet

- AWHCL Annual Report 2021Document240 pagesAWHCL Annual Report 2021rahul rajNo ratings yet

- Earthworm (A Mascot of Clean Ahmedabad)Document33 pagesEarthworm (A Mascot of Clean Ahmedabad)Akash RughaniNo ratings yet

- BKT b2b Project ReportDocument17 pagesBKT b2b Project ReportAshok Kumar0% (1)

- Additional Question-ImpairmentDocument6 pagesAdditional Question-Impairmentirdinaazman27No ratings yet

- Crieteria Name: Organization 1 State Bank of India (Sbi)Document14 pagesCrieteria Name: Organization 1 State Bank of India (Sbi)Mahi SolankiNo ratings yet

- Dokumen - Tips Detailed Project Report Coir Entrusted The Task of Preparation of DetailedDocument55 pagesDokumen - Tips Detailed Project Report Coir Entrusted The Task of Preparation of DetailedRam ManiNo ratings yet

- Ambuja Cement Annual Report 2016Document228 pagesAmbuja Cement Annual Report 2016Amit PandeyNo ratings yet

- Binani Cement Limited: SynopsisDocument16 pagesBinani Cement Limited: SynopsisGaurav JoshiNo ratings yet

- Lok SabhaDocument8 pagesLok SabhaAjeeta SrivastavaNo ratings yet

- JS20 SBR Me2 - QDocument9 pagesJS20 SBR Me2 - QNik Hanisah Zuraidi AfandiNo ratings yet

- Financial Consultant Ashok V Dhoot&Company. Chartered Accountants. Vyapari Dharamshala Complex Gandhi Chowk. LATUR-413512 (M.S) 91-2382-244673/254673Document15 pagesFinancial Consultant Ashok V Dhoot&Company. Chartered Accountants. Vyapari Dharamshala Complex Gandhi Chowk. LATUR-413512 (M.S) 91-2382-244673/254673SHARMA TRAVELS LATURNo ratings yet

- Biz PlanDocument4 pagesBiz Planapi-3700769No ratings yet

- UnionBudget - 2020 21 01022020Document11 pagesUnionBudget - 2020 21 01022020g_ayyanarNo ratings yet

- CSR Coal IndiaDocument18 pagesCSR Coal IndiapratikshaNo ratings yet

- Paper 10 Financial ManagementDocument10 pagesPaper 10 Financial ManagementJoseph OsakoNo ratings yet

- Business EnvironmentDocument18 pagesBusiness Environmenttempduc177No ratings yet

- TN One Note SmeDocument23 pagesTN One Note SmeSenthil KumarNo ratings yet

- New PRDocument52 pagesNew PRPayal 51No ratings yet

- Pid 39 Panchratna 14 Jul-Sep17Document21 pagesPid 39 Panchratna 14 Jul-Sep17pmlprasadNo ratings yet

- Chap 3 PDFDocument7 pagesChap 3 PDFSahilJainNo ratings yet

- Investment Appraisal QB 1-24Document20 pagesInvestment Appraisal QB 1-24Md. Rabiul HoqueNo ratings yet

- Annual Report - 31.032018Document49 pagesAnnual Report - 31.032018Abi TamilNo ratings yet

- G4 - Waste Segregator - ReportDocument23 pagesG4 - Waste Segregator - ReportJinendra KumarNo ratings yet

- CCL1Document65 pagesCCL1abhishek kunalNo ratings yet

- 3D SSS Assignment F1M 01Document1 page3D SSS Assignment F1M 01Abhedya JakkanwarNo ratings yet

- Integrated Green Energy Solutions LTD ABN 23 003 669 163Document10 pagesIntegrated Green Energy Solutions LTD ABN 23 003 669 163Trebob GardayaNo ratings yet

- Public Expenditure Accountability in The Telecom SectorDocument18 pagesPublic Expenditure Accountability in The Telecom Sectorg c agnihotriNo ratings yet

- Annual Report On Corporate Social Responsibility (CSR)Document11 pagesAnnual Report On Corporate Social Responsibility (CSR)Akhil AnandNo ratings yet

- Deskripsi Dan Spesifikasi CiptaanDocument10 pagesDeskripsi Dan Spesifikasi CiptaanPuput Dani Prasetyo AdiNo ratings yet

- Business Plan ECCL PDF FinalDocument219 pagesBusiness Plan ECCL PDF Finalم. هاني الحطاميNo ratings yet

- DRAFT JK Cements LTD Online InternshipDocument37 pagesDRAFT JK Cements LTD Online InternshipLIANo ratings yet

- Report On E - WasteDocument9 pagesReport On E - WastemanishkayalNo ratings yet

- Management Accounting and Finance 3B..3.11Document5 pagesManagement Accounting and Finance 3B..3.11MphoyaBadimo MphoyaBadimoNo ratings yet

- SBM July-Aug-2022Document5 pagesSBM July-Aug-2022FahadNo ratings yet

- Question Paper MarkedDocument25 pagesQuestion Paper MarkedSakshi GargNo ratings yet

- GAMMONDocument212 pagesGAMMONAshish SalunkheNo ratings yet

- Project Final Report SampleDocument71 pagesProject Final Report Sampleavinash singhNo ratings yet

- 9609 w18 in 33Document4 pages9609 w18 in 33Wajiha NadeemNo ratings yet

- Top Stories Leader Speak: HCC Approves Lavasa IPO Worth Rs20bnDocument6 pagesTop Stories Leader Speak: HCC Approves Lavasa IPO Worth Rs20bnAkhil AgarwalNo ratings yet

- Unsolicited Proposal:: Initialization of Privatization For Economic Development of State (IPEDS)Document6 pagesUnsolicited Proposal:: Initialization of Privatization For Economic Development of State (IPEDS)Mohammad AlamNo ratings yet

- SIP RINL Final1Document88 pagesSIP RINL Final1jyotiNo ratings yet

- Production of Biomass Pallets For Thermal Energy ApplicationDocument10 pagesProduction of Biomass Pallets For Thermal Energy ApplicationRajesh PantNo ratings yet

- Business Responsibility ReportDocument9 pagesBusiness Responsibility Reportraghunandhan.cvNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- Annual Report - 2018 2019 PDFDocument300 pagesAnnual Report - 2018 2019 PDFShekhar BanisettiNo ratings yet

- Management Decision & Control - Paper 11Document8 pagesManagement Decision & Control - Paper 11Jacob Baraka OngengNo ratings yet

- Model Project Proposal3Document21 pagesModel Project Proposal3Suresh AMNo ratings yet

- BusplanDocument38 pagesBusplanCrissa MorescaNo ratings yet

- Achieving Superior QualityDocument2 pagesAchieving Superior QualityPradeep ChintuNo ratings yet

- Entrep Mind Chapter 6Document3 pagesEntrep Mind Chapter 6Yeho ShuaNo ratings yet

- Chapter 11 NISMDocument12 pagesChapter 11 NISMKiran VidhaniNo ratings yet

- Averting Financial Crises: Advice From Classical Economists: Ederal EserveDocument6 pagesAverting Financial Crises: Advice From Classical Economists: Ederal EserveNguyen Anh VuNo ratings yet

- Cosmoprof North America 2012Document316 pagesCosmoprof North America 2012probeautyassociationNo ratings yet

- Startups Are Hiring RemotelyDocument14 pagesStartups Are Hiring RemotelyMaheen ChaudhryNo ratings yet

- Qatar Airways NotesDocument4 pagesQatar Airways Noteszigova1997No ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- MGTI619 - Internship Report-Management Organization Analysis Report (DGKCC)Document27 pagesMGTI619 - Internship Report-Management Organization Analysis Report (DGKCC)zrdNo ratings yet

- PEXQ1277 Virtual - Cat - RemanU-Flier - DPC (Cat Dealer)Document1 pagePEXQ1277 Virtual - Cat - RemanU-Flier - DPC (Cat Dealer)Limosh BsNo ratings yet

- CW61160Bx10000mm Horizontal Lathe Machine: Hebei Yawo Machinery Manufacturing Co., LTDDocument3 pagesCW61160Bx10000mm Horizontal Lathe Machine: Hebei Yawo Machinery Manufacturing Co., LTDaz marine servicesNo ratings yet

- Communication Plan, Raters Training, Coaching Styles: Human Resource ManagementDocument2 pagesCommunication Plan, Raters Training, Coaching Styles: Human Resource ManagementAreeba NisarNo ratings yet

- Tax Invoice: Original For RecipientDocument3 pagesTax Invoice: Original For RecipientS V ENTERPRISESNo ratings yet

- New Marketing RealitiesDocument16 pagesNew Marketing Realitiesomaik fahimNo ratings yet

- 7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Document2 pages7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Ken MarcaidaNo ratings yet

- How To Earn Money Blogging? (Top 10 Ways To Easily Earn $1k+ Per Month)Document34 pagesHow To Earn Money Blogging? (Top 10 Ways To Easily Earn $1k+ Per Month)Raginee Summoogum100% (1)

- Prashant Gautam Resume PDFDocument1 pagePrashant Gautam Resume PDFRaghav DobhalNo ratings yet

- 6 Mark Grade Boundary:: MarkschemeDocument22 pages6 Mark Grade Boundary:: Markschemeqi huangNo ratings yet

- Foundation OBDocument35 pagesFoundation OBSushant VermaNo ratings yet

- State of The Game Industry 2021Document29 pagesState of The Game Industry 2021spotNo ratings yet

- Production Control Objectives: ITTS-QMS-PR13-F04Document2 pagesProduction Control Objectives: ITTS-QMS-PR13-F04zainahmedscribdNo ratings yet

- Letter of Invitation - DraftDocument3 pagesLetter of Invitation - DraftAidel BelamideNo ratings yet

- Training Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Document6 pagesTraining Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Gamel DeanNo ratings yet

- Application of Queuing Theory in Construction: June 2012Document8 pagesApplication of Queuing Theory in Construction: June 2012ضیاء گل مروتNo ratings yet

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedNo ratings yet

- "Barcode" Web Service: ManualDocument64 pages"Barcode" Web Service: ManualЕгон ЧарнојевићNo ratings yet

- Kelvin Lau MWI +RRDocument18 pagesKelvin Lau MWI +RRUniversityJCNo ratings yet

- ITBiz 2022 Session 1 Introduction - SMK PDFDocument43 pagesITBiz 2022 Session 1 Introduction - SMK PDFTommyNo ratings yet

- Specifications: PartsDocument1 pageSpecifications: PartsReza RezaNo ratings yet