Professional Documents

Culture Documents

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

shalabhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

shalabhCopyright:

Available Formats

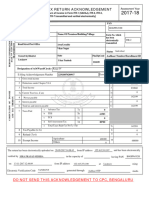

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2017-18

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

SNEH BANSAL

PERSONAL INFORMATION AND THE

BBKPB9803L

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-3

TRANSMISSION

B-19

electronically

transmitted

Road/Street/Post Office Area/Locality

Rajendra Nagar Status Individual

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

BAREILLY

UTTAR PRADESH 243001 XXXX XXXX 8751

Designation of AO (Ward / Circle) Ward 2(2) Original or Revised ORIGINAL

E-filing Acknowledgement Number 234808560071017 Date(DD-MM-YYYY) 07-10-2017

1 Gross Total Income 1 559922

2 Deductions under Chapter-VI-A 2 151170

3 Total Income 3 408750

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 11201

5 Interest Payable 5 219

6 Total Tax and Interest Payable 6 11420

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 3831

c TCS 7c 0

d Self Assessment Tax 7d 7370

e Total Taxes Paid (7a+7b+7c +7d) 7e 11201

8 Tax Payable (6-7e) 8 219

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture 0

10

Others 17311 17311

VERIFICATION

I, SNEH BANSAL son/ daughter of Bijli Mal , holding Permanent Account Number BBKPB9803L

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2017-18. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 07-10-2017 Place Bareilly

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 139.167.15.33

Date

Seal and signature of BBKPB9803L03234808560071017C197D9CC443866F9883F39EEB704D1AFA4C7CC1B

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address shrikumar_ca@yahoo.co.in

You might also like

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormramanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Itr-V Aaifp5094r 2007-08 2554600241007Document1 pageItr-V Aaifp5094r 2007-08 2554600241007dharmendraganatra2No ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- ITR-V Indian Income Tax Return Verification FormDocument1 pageITR-V Indian Income Tax Return Verification FormDhananjay JaiswalNo ratings yet

- 2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - ItrvDocument1 page2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - Itrvramesh jothyNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryShankar SagarNo ratings yet

- 2019 10 01 09 58 27 324 - 1569904107324 - XXXPD6098X - Acknowledgement PDFDocument1 page2019 10 01 09 58 27 324 - 1569904107324 - XXXPD6098X - Acknowledgement PDFMukesh kumar DewraNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATIONDocument1 pageINDIAN INCOME TAX RETURN VERIFICATIONShantanu MetayNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryGanesh DasaraNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- 2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFDocument1 page2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFsonal aNo ratings yet

- Gita Singh IndividualDocument1 pageGita Singh IndividualjccchhhNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formsriram tennetiNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATION FORMDocument1 pageINDIAN INCOME TAX RETURN VERIFICATION FORMramarao_pandNo ratings yet

- Deepak Bansal PDFDocument1 pageDeepak Bansal PDFPARDEEP JINDALNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Anmol KhannaNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement Summarysayesha chandNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormSahana SkNo ratings yet

- 2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDocument1 page2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDedaram FulwariyaNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATIONDocument1 pageINDIAN INCOME TAX RETURN VERIFICATIONSunil PeerojiNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATION FORMDocument1 pageINDIAN INCOME TAX RETURN VERIFICATION FORMKumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruyogesh baghelNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATION FORMDocument3 pagesINDIAN INCOME TAX RETURN VERIFICATION FORMsrinivas maguluriNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Indian ITR-4 Return AcknowledgementDocument1 pageIndian ITR-4 Return AcknowledgementvishalNo ratings yet

- 2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFDocument1 page2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFsampreethpNo ratings yet

- INDIAN INCOME TAX RETURN VERIFICATION FORMDocument1 pageINDIAN INCOME TAX RETURN VERIFICATION FORMCA Sree Harsha BVNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Yatra Registration Letter - UTDBDocument1 pageYatra Registration Letter - UTDBshalabhNo ratings yet

- Notice of AgmDocument1 pageNotice of AgmshalabhNo ratings yet

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 134760Document4 pagesComputation of Total Income (Revised) Income From House Property (Chapter IV C) 134760shalabhNo ratings yet

- Classmate Stationery - WikipediaDocument2 pagesClassmate Stationery - WikipediashalabhNo ratings yet

- 7) The SWOT Analysis of ITC Limited Is As Follows:: StrengthsDocument2 pages7) The SWOT Analysis of ITC Limited Is As Follows:: Strengthsshalabh100% (2)

- 4) Marketing Mix of ClassmateDocument1 page4) Marketing Mix of ClassmateshalabhNo ratings yet

- Classmate Stationery - WikipediaDocument2 pagesClassmate Stationery - WikipediashalabhNo ratings yet

- Chapter 9 InvestmentsDocument18 pagesChapter 9 InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Debentures and ChargesDocument2 pagesDebentures and ChargesAnshuman ChakrabortyNo ratings yet

- ACCA F3 - Accruals, Prepayments, Debts & AllowancesDocument34 pagesACCA F3 - Accruals, Prepayments, Debts & AllowanceschrislinNo ratings yet

- Taxes, Tax Laws, and Tax AdministrationDocument8 pagesTaxes, Tax Laws, and Tax AdministrationAilene MendozaNo ratings yet

- Demand Note: FOR VALUE RECEIVED, The UndersignedDocument1 pageDemand Note: FOR VALUE RECEIVED, The UndersignedkismadayaNo ratings yet

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Non Performing Assets Project MBADocument69 pagesNon Performing Assets Project MBAsrikanthmogilla1285% (34)

- Amicus BriefDocument40 pagesAmicus BriefForeclosure FraudNo ratings yet

- Salary Slip (31109291 April, 2018)Document1 pageSalary Slip (31109291 April, 2018)Hassan RanaNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFDocument104 pagesTest Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFKristine Lirose Bordeos100% (1)

- Presentation On Stock MarketDocument25 pagesPresentation On Stock Marketsunil pancholi85% (47)

- Types of Financial Institutions and Their Role in Economic DevelopmentDocument3 pagesTypes of Financial Institutions and Their Role in Economic Developmentwahid_04050% (2)

- Schedule TDocument2 pagesSchedule Tapi-457375876No ratings yet

- Periodic Inventory System Journal EntriesDocument16 pagesPeriodic Inventory System Journal EntriesAnonymous 2k0o6az6l50% (2)

- Tally Lesson 1Document13 pagesTally Lesson 1kumarbcomca100% (1)

- Eclectica FundDocument5 pagesEclectica FundZerohedge100% (9)

- Impact of Foreign Aid On PakistanDocument19 pagesImpact of Foreign Aid On Pakistanalpha97100% (6)

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Vision and MissionDocument10 pagesVision and MissionMun YeeNo ratings yet

- Chapter 3 Tutorial QuestionsDocument3 pagesChapter 3 Tutorial QuestionsMilanNo ratings yet

- 17 Checked Law On Free Zones Ed CDocument7 pages17 Checked Law On Free Zones Ed CBulgantamir TuvshinjargalNo ratings yet

- NISM Investment Adviser Level 1 - Series X-A Study Material NotesDocument26 pagesNISM Investment Adviser Level 1 - Series X-A Study Material NotesSRINIVASAN69% (16)

- Levy and Collection of Tax PDFDocument113 pagesLevy and Collection of Tax PDFRupasinghNo ratings yet

- Chicago Bridge and Iron Company, Ltd. v. Ruben B. Wheatley, Commissioner of Finance, 430 F.2d 973, 3rd Cir. (1970)Document8 pagesChicago Bridge and Iron Company, Ltd. v. Ruben B. Wheatley, Commissioner of Finance, 430 F.2d 973, 3rd Cir. (1970)Scribd Government DocsNo ratings yet

- Warren Buffett's Timeless Lessons for InvestorsDocument3 pagesWarren Buffett's Timeless Lessons for Investorsbrijsing0% (1)

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- Cash Budgeting Notes and QuestionsDocument39 pagesCash Budgeting Notes and Questions邹尧No ratings yet

- Thomas Anderson - Taking On The BanksDocument158 pagesThomas Anderson - Taking On The BankszazatoNo ratings yet

- BANK ACCOUNT FUNDAMENTALSDocument93 pagesBANK ACCOUNT FUNDAMENTALSMuthu KumaranNo ratings yet