0% found this document useful (1 vote)

767 views40 pagesSSS - R1A - Form (EDocFind - Com)

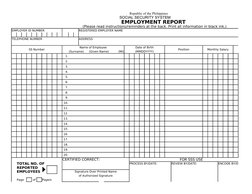

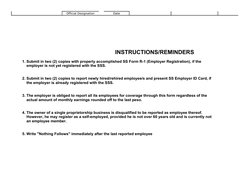

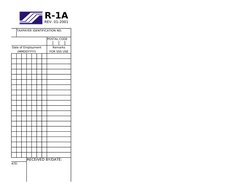

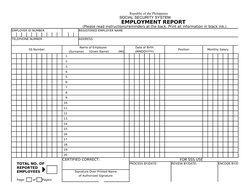

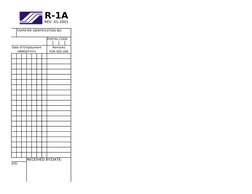

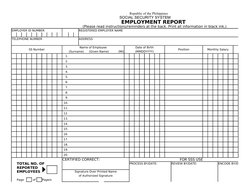

This document is an employment report submitted to the Social Security System of the Philippines by a registered employer. It contains sections for the employer's identification number and contact information. Most of the form is taken up with tables to list the employer's employees. For each, it requests the employee's name, social security number, date of birth, position, and monthly salary. The employer certifies the report is correct before submission. Instructions on the back remind the employer to submit required registration forms and coverage of all employees regardless of earnings.

Uploaded by

percy_naranjo_2Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (1 vote)

767 views40 pagesSSS - R1A - Form (EDocFind - Com)

This document is an employment report submitted to the Social Security System of the Philippines by a registered employer. It contains sections for the employer's identification number and contact information. Most of the form is taken up with tables to list the employer's employees. For each, it requests the employee's name, social security number, date of birth, position, and monthly salary. The employer certifies the report is correct before submission. Instructions on the back remind the employer to submit required registration forms and coverage of all employees regardless of earnings.

Uploaded by

percy_naranjo_2Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd