Professional Documents

Culture Documents

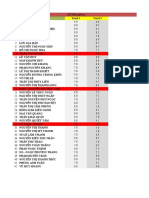

Year (Period) Yield To Maturity (%) Spot Rate (%) Year (Period) Yield To Maturity (%) Spot Rate %

Uploaded by

Bahawal Khan Jamali0 ratings0% found this document useful (0 votes)

31 views1 pageThe document provides a table showing Treasury security yields and spot rates for maturities ranging from 6 months to 10 years. Some spot rates are missing from the table. Questions ask to: calculate the missing spot rates, determine the one-year forward rate starting in year 4, and calculate the price of a 6%, 6-year Treasury security.

Original Description:

Original Title

spot rate

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a table showing Treasury security yields and spot rates for maturities ranging from 6 months to 10 years. Some spot rates are missing from the table. Questions ask to: calculate the missing spot rates, determine the one-year forward rate starting in year 4, and calculate the price of a 6%, 6-year Treasury security.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views1 pageYear (Period) Yield To Maturity (%) Spot Rate (%) Year (Period) Yield To Maturity (%) Spot Rate %

Uploaded by

Bahawal Khan JamaliThe document provides a table showing Treasury security yields and spot rates for maturities ranging from 6 months to 10 years. Some spot rates are missing from the table. Questions ask to: calculate the missing spot rates, determine the one-year forward rate starting in year 4, and calculate the price of a 6%, 6-year Treasury security.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

You observe the yields of the following Treasury securities (all yields are shown on a bond-

equivalent basis):

Year Yield to Spot Rate Year Yield to Spot Rate

(Period) Maturity (%) (%) (Period) Maturity (%) %

0.5 (1) 5.25 5.25 5.5 (11) 7.75 7.97

1.0 (2) 5.50 5.50 6.0 (12) 8.00 8.27

1.5 (3) 5.75 5.76 6.5 (13) 8.25 8.59

2.0 (4) 6.00 ? 7.0 (14) 8.50 8.92

2.5 (5) 6.25 ? 7.5 (15) 8.75 9.25

3.0 (6) 6.50 ? 8.0 (16) 9.00 9.61

3.5 (7) 6.75 6.82 8.5 (17) 9.25 9.97

4.0 (8) 7.00 7.10 9.0 (18) 9.50 10.36

4.5 (9) 7.25 7.38 9.5 (19) 9.75 10.77

5.0 (10) 7.50 7.67 10.0 (20) 10.00 11.20

All the securities maturing from 1.5 years on are selling at par. The 0.5 and 1.0-year securities

are zero-coupon instruments. Answer the below questions.

A. Calculate the missing spot rates.

B. What is one-year forward rate starting in the fourth year?

C. What should be the price of 6%, six year treasury security be.

You might also like

- Lecture 4Document3 pagesLecture 4Abdul Khalique SolangiNo ratings yet

- About Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Document19 pagesAbout Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Parv SalechaNo ratings yet

- Winfield RefuseDocument5 pagesWinfield RefuseAbhishek BaratamNo ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- Bangladesh: Interest Rates Selected IndicatorsDocument12 pagesBangladesh: Interest Rates Selected IndicatorsMahmoda ZannatNo ratings yet

- Euroland - PlanilhaDocument4 pagesEuroland - PlanilhaIsrael VianaNo ratings yet

- Ch. 34: International Financial Management Problem 1Document4 pagesCh. 34: International Financial Management Problem 1Mukul KadyanNo ratings yet

- Microprocessor Systems (EE222C) Pre-Finals Student Name Serial Number Registra Tion No. Quiz 1 (10) Quiz 2 (10) Quiz 3Document4 pagesMicroprocessor Systems (EE222C) Pre-Finals Student Name Serial Number Registra Tion No. Quiz 1 (10) Quiz 2 (10) Quiz 3Sarmad HassanNo ratings yet

- Example Loan PricingDocument4 pagesExample Loan PricingNino NatradzeNo ratings yet

- Month Average Market Month: BOG TBC BOGDocument4 pagesMonth Average Market Month: BOG TBC BOGNino NatradzeNo ratings yet

- Principles of Engineering EconomicsDocument17 pagesPrinciples of Engineering EconomicsbestnazirNo ratings yet

- Trabajo de EstadisticaDocument6 pagesTrabajo de EstadisticaJonathan Andres BRAVO SERRANONo ratings yet

- Tabel1 30Document2 pagesTabel1 30Ulfi MulianeNo ratings yet

- GDP TrendDocument8 pagesGDP TrendAditi BansalNo ratings yet

- Lecture 03 Bond Price VolatilityDocument45 pagesLecture 03 Bond Price Volatilityandrewchen336No ratings yet

- DBD205-1703515-Sarita-DHA-DHA1-Unit 2-2018Document2 pagesDBD205-1703515-Sarita-DHA-DHA1-Unit 2-2018saritaNo ratings yet

- Take-Home Assignment - MBA 1133 Statistics For BusinessDocument4 pagesTake-Home Assignment - MBA 1133 Statistics For BusinessIsuru KasthurirathneNo ratings yet

- Dimensions of The Plates Used Test Average Thickness (MM) Average Width (MM)Document3 pagesDimensions of The Plates Used Test Average Thickness (MM) Average Width (MM)karthikeyan08No ratings yet

- Shorenstein Yale Slides 2Document15 pagesShorenstein Yale Slides 2Anton FortichNo ratings yet

- Print/Copy To Excel:: Previous YearsDocument3 pagesPrint/Copy To Excel:: Previous Yearssharmavikram876No ratings yet

- PNG Large Offshore Gas FieldDocument36 pagesPNG Large Offshore Gas FieldserahsalmonminakNo ratings yet

- The Gold RushDocument4 pagesThe Gold Rushsiddharth sharmaNo ratings yet

- Dr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Document16 pagesDr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Ankitesh Kumar TiwariNo ratings yet

- DFI and Evolution of ICICI From A DFIDocument50 pagesDFI and Evolution of ICICI From A DFIManoj BharadwajNo ratings yet

- Historical Profit Rates 2020Document5 pagesHistorical Profit Rates 2020Hassan RaXaNo ratings yet

- DCF Calculation v2Document1 pageDCF Calculation v2lkamalNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- FD Shareable - PartnerDocument10 pagesFD Shareable - PartnerkhareanamiNo ratings yet

- Previous Years : Reliance Industrie SDocument13 pagesPrevious Years : Reliance Industrie SAditya KumarNo ratings yet

- UAS CTRS ESC (2021-2-Total Score - NIM Only)Document15 pagesUAS CTRS ESC (2021-2-Total Score - NIM Only)zackNo ratings yet

- Comparing Decimals Workbook, Level 1Document102 pagesComparing Decimals Workbook, Level 1Tinh LeNo ratings yet

- Grade 6 Fractions To Percents CDocument2 pagesGrade 6 Fractions To Percents CcindyNo ratings yet

- Consommation1 AngDocument1 pageConsommation1 AngEMS Metalworking MachineryNo ratings yet

- TablasDocument4 pagesTablas太No ratings yet

- EstatisticaDocument3 pagesEstatisticaEverton CarmonaNo ratings yet

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Tarea Excel Datos No AgrupadosDocument4 pagesTarea Excel Datos No AgrupadosWALTER SUEL ARROYONo ratings yet

- PC 2 Grupo BDocument2 pagesPC 2 Grupo BVALERIA SULLCA ASTOPI�ANNo ratings yet

- Quitan Clarence Beed 3-C Activity in EDUC 8Document3 pagesQuitan Clarence Beed 3-C Activity in EDUC 8Lhara Alberto BalanciaNo ratings yet

- Sleeping Beauties Bonds - Walt Disney CompanyDocument15 pagesSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- Vlookup vs. Index/Match: Construction Schedule (# of Months) Amount To Be Spent in Month 5Document1 pageVlookup vs. Index/Match: Construction Schedule (# of Months) Amount To Be Spent in Month 5bato ceraNo ratings yet

- Global Basel 3 Implementation TimelineDocument1 pageGlobal Basel 3 Implementation TimelineUsraUmairNo ratings yet

- Vdocuments - MX Chiraigh Din 1Document8 pagesVdocuments - MX Chiraigh Din 1muhamaad.ali.javedNo ratings yet

- Assignment 3 AnswersDocument8 pagesAssignment 3 Answerstrangnth92No ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- STT Name GVNN (10%) Speaking Test (10%) : Total 1 Total 2Document6 pagesSTT Name GVNN (10%) Speaking Test (10%) : Total 1 Total 2Tuấn PhùngNo ratings yet

- Ejercicio de ManteniemientoDocument6 pagesEjercicio de ManteniemientoCarlos Alberto Plasencia PlasenciaNo ratings yet

- Ejercicio de ManteniemientoDocument6 pagesEjercicio de ManteniemientoCarlos Alberto Plasencia PlasenciaNo ratings yet

- Pronostico Series de TiempoDocument6 pagesPronostico Series de Tiemposayuri martinez dominguezNo ratings yet

- Subtopic 2 - Moving AverageDocument21 pagesSubtopic 2 - Moving AverageKim VincereNo ratings yet

- Oil CapacitiesDocument1 pageOil Capacitiesdemos70No ratings yet

- US Shoe Size To India India Travel ForumDocument1 pageUS Shoe Size To India India Travel ForumLizi AleksandriaNo ratings yet

- GSFS Historical ICD LDS DecDocument5 pagesGSFS Historical ICD LDS DecKunal Abhilashbhai DelwadiaNo ratings yet

- UPDATEDocument44 pagesUPDATEDiky AgustianNo ratings yet

- Cost AnalysisDocument11 pagesCost Analysisshivang.goyal02No ratings yet

- Existencia01 11 2023Document11 pagesExistencia01 11 2023adriana.abreu.mendez.1624No ratings yet

- Chapter 6 (10) : Making Capital Investment DecisionsDocument21 pagesChapter 6 (10) : Making Capital Investment DecisionsHoàng Như NgọcNo ratings yet

- Tabel1 25Document2 pagesTabel1 255LoV3No ratings yet

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsFrom EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsNo ratings yet

- Research Proposal: Impacts of Information Technology On Business Performance of Small-Sized Agribusiness FirmsDocument2 pagesResearch Proposal: Impacts of Information Technology On Business Performance of Small-Sized Agribusiness FirmsBahawal Khan JamaliNo ratings yet

- Security Analysis Bba-Iv (Elective Finance)Document21 pagesSecurity Analysis Bba-Iv (Elective Finance)Bahawal Khan JamaliNo ratings yet

- Solution To Problems Chapter 03Document4 pagesSolution To Problems Chapter 03Bahawal Khan JamaliNo ratings yet

- Bba in Finance and Accounting ProblemsDocument4 pagesBba in Finance and Accounting ProblemsBahawal Khan JamaliNo ratings yet

- TIme Table OnlineDocument1 pageTIme Table OnlineBahawal Khan JamaliNo ratings yet

- Proven Tips To Lose Weight Without Exercise or Fad Diets': 1-Chew Thoroughly and Slow DownDocument1 pageProven Tips To Lose Weight Without Exercise or Fad Diets': 1-Chew Thoroughly and Slow DownBahawal Khan JamaliNo ratings yet

- Coursera For Pakistan: Confidential - Do Not ShareDocument40 pagesCoursera For Pakistan: Confidential - Do Not ShareBahawal Khan JamaliNo ratings yet

- Employee Engagement A Review Paper On Factors AffeDocument8 pagesEmployee Engagement A Review Paper On Factors AffeBahawal Khan JamaliNo ratings yet

- Facebook: A Case Study of Strategic Leadership: SSRN Electronic Journal April 2011Document36 pagesFacebook: A Case Study of Strategic Leadership: SSRN Electronic Journal April 2011Bahawal Khan JamaliNo ratings yet

- Research ProposalDocument24 pagesResearch ProposalBahawal Khan JamaliNo ratings yet

- Mcas 2018 Gr6 Math PT WebDocument17 pagesMcas 2018 Gr6 Math PT WebBahawal Khan JamaliNo ratings yet

- Daily DAWN News Vocabulary With Urdu Meaning (05 June 2020)Document4 pagesDaily DAWN News Vocabulary With Urdu Meaning (05 June 2020)Bahawal Khan JamaliNo ratings yet