Professional Documents

Culture Documents

19473-2000-Amendment of The Revised Schedule of

Uploaded by

PhilAeonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19473-2000-Amendment of The Revised Schedule of

Uploaded by

PhilAeonCopyright:

Available Formats

December 1, 2000

REVENUE MEMORANDUM ORDER NO. 56-00

SUBJECT : Amendment of the Revised Schedule of Suggested Compromise

Penalties Under Revenue Memorandum Order (RMO) No. 1-90, Dated

November 28, 1989, for Violation of Section 264 of the National

Internal Revenue Code of 1997 Relating to the Printing, Possession,

Use and Issuance of Sales or Commercial Invoices

TO : All Internal Revenue Officers and Others Concerned

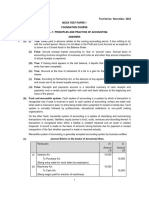

SE CTI O N 1. Schedule Of Suggested Compromise Penalties Relating To

Compliance Requirements On the Printing, Possession, Use And Issuance Of Sales Or

Commercial Invoices. — Pursuant to Section 204 of the National Internal Revenue Code

of 1997, the schedule of suggested compromise penalties under RMO No. 1-90, for

violation of Section 264 of the said Code concerning the printing, possession, use and

issuance of sales or commercial invoices is hereby amended, as follows:

CODE NATURE OF CRIMINAL PENALTY AMOUNT OF COMPROMISE

IMPOSED UPON

SEC. VIOLATION PENALTY

CONVICTION

Specific First Second

violation Offense Offense

Fine of not less than

Failure or Refusal to a) For failure to

One Thousand Pesos

(P1,000.00) but not

issue Receipts or Sales issue receipts or

more than Fifty

or Thousand Pesos

sales or

Commercial (P50,000.00) and suffer

imprisonment of not

Invoices; Violations commercial

less than two (2)

years but not more than

related to the Printing of invoices

four (4) years.

such Receipts or

Invoices and

other violations.

Sec. 264 P10,000.00 P20,000.00

b) For refusal to

issue receipts or

sales or

commercial

Sec. 264 invoices P25,000.00 P50,000.00

c) For issuance

of receipts that

do not truly

reflect and/or

contain all the

information

required to be

shown therein P1,000.00 P2,500.00

If the duplicate

CD Technologies Asia, Inc. 2018 cdasiaonline.com

copy of the

invoice is blank

but the original

copy thereof is

detached from

the booklet and

cannot be

accounted for P10,000.00 P20,000.00

—————— ——————

If the amount

of the

transaction

stated in the

taxpayer's copy

is understated

versus the

amount per

copy of the

invoice issued

Not qualified

to the

for

purchaser compromise

d) (i) For

possession or

use of

unregistered

receipts or

Sec. 264 invoices; P10,000.00 P20,000.00

ii) Use of

unregistered

cash register

machines in lieu

of invoices or

receipts P25,000.00 P50,000.00

—————— ——————

e) For

possession or

use of multiple

or double

Not qualified

receipts or

for

invoices compromise

f) for printing or

causing, aiding

or abetting the

printing of:

1) Receipts or

invoices without

authority from

the BIR P10,000.00 P20,000.00

2) Double or

multiple sets of

Not qualified

receipts or

CD Technologies Asia, Inc. 2018 cdasiaonline.com

invoices for

compromise

3) Receipts or

invoices not

bearing any of

Sec. 264 the following: P5,000.00 P10,000.00

a. Consecutive

numbers

b. Name of

Taxpayer

c. Business

Style

d. Business

address of the

person or entity

to use the same

e. Taxpayer

Identification

No.

f. Name,

address, date,

authority no. of

the printer and

inclusive serial

numbers of the

batch or receipts

printed.

SECTION 2. The schedule of compromise penalties herein prescribed shall not

prevent the Commissioner or his duly authorized representative from accepting a

compromise amount higher than as provided hereof. A compromise offer lower than

the prescribed amount may be accepted after approval by the Commissioner of

Internal Revenue or his duly authorized representative.

SECTION 3. All offers of compromise shall be made by accomplishing the form

as shown in Annex "A".

SECTION 4. Strict compliance herewith is enjoined.

SECTION 5. Effectivity. — This Order shall take effect immediately.

(SGD.) DAKILA B. FONACIER

Commissioner of Internal Revenue

ANNEX A

OFFER OF COMPROMISE

Date: _____________

The Regional Director/Assistant Commissioner

Name of Office: _______________________

Dear Sir:

CD Technologies Asia, Inc. 2018 cdasiaonline.com

The undersigned representing ___________________________ hereby

(Name of Taxpayer)

acknowledge the apprehension made by the Revenue O cer/s under Apprehension Slip No.

______ dated _____ for ____________________________________________________________

(State the violation/infraction)

and since it was a _______ offense, I hereby offer to pay a compromise penalty amounting to P

________ Pesos: _______________________

(Amount in Words)

_______________________

Signature over Printed Name

TIN: _________________

Accepted:

_____________________

Regional Director/ACIR

CD Technologies Asia, Inc. 2018 cdasiaonline.com

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Legal Studies Unit 1 NotesDocument2 pagesLegal Studies Unit 1 NotesadmiralaffieNo ratings yet

- ChecklistDocument6 pagesChecklistMerlina PalinoNo ratings yet

- Personal Information Protection and Electronic Documents ActDocument2 pagesPersonal Information Protection and Electronic Documents ActQuiz Ontario100% (7)

- Practical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawDocument21 pagesPractical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawPhilAeonNo ratings yet

- Practical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawDocument21 pagesPractical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawPhilAeonNo ratings yet

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- Dole Department Circular No. 001-12: PurposeDocument3 pagesDole Department Circular No. 001-12: PurposePhilAeonNo ratings yet

- Franchise AccountingDocument5 pagesFranchise Accountingnephtalie92% (12)

- Cielo Corp accounting adjustmentsDocument3 pagesCielo Corp accounting adjustmentsCarina Mae Valdez ValenciaNo ratings yet

- Clinton Family Foundation 2016 Form 990Document30 pagesClinton Family Foundation 2016 Form 990Joe Schoffstall0% (1)

- Query of Atty. Karen M. Silverio-Buffe, Former Clerk of Court - Branch 81, Romblon, Romblon - On The Prohibition From Engaging in The Private Practice of Law.Document6 pagesQuery of Atty. Karen M. Silverio-Buffe, Former Clerk of Court - Branch 81, Romblon, Romblon - On The Prohibition From Engaging in The Private Practice of Law.Rose De JesusNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Cash and Cash EquivalentsDocument18 pagesCash and Cash EquivalentsNoella Marie BaronNo ratings yet

- FM 3-09-30 (Observed Fire and FS at BN TF and Below)Document381 pagesFM 3-09-30 (Observed Fire and FS at BN TF and Below)Franco Jon100% (1)

- GFHJJBDocument4 pagesGFHJJBFaboyede Temmy100% (1)

- CIR v. Ayala HotelsDocument20 pagesCIR v. Ayala HotelsnoonalawNo ratings yet

- Partnership (Questions Only)Document23 pagesPartnership (Questions Only)JeromeNo ratings yet

- Compromise Penalty - RMO 7-2015 PDFDocument12 pagesCompromise Penalty - RMO 7-2015 PDFEmmanuel A. RemolacioNo ratings yet

- Yao Ka Sin Trading Vs CADocument3 pagesYao Ka Sin Trading Vs CARaymart SalamidaNo ratings yet

- Details of Project Proposal For Implementating Legal Literacy Training Programme For Women & GirlsDocument2 pagesDetails of Project Proposal For Implementating Legal Literacy Training Programme For Women & GirlsMinatiBindhani100% (3)

- Opium' in The Anglo-Chinese Conflict. RakshitDocument6 pagesOpium' in The Anglo-Chinese Conflict. RakshitShivanshNo ratings yet

- Universal Miniatures RulesDocument10 pagesUniversal Miniatures RulesfranzylandNo ratings yet

- Reconcilliation Part1Document25 pagesReconcilliation Part1019. Disha Das fybafNo ratings yet

- New Lawyer MCLE GuidelinesDocument2 pagesNew Lawyer MCLE GuidelinesAugie Lusung100% (1)

- Application For Authority To Print Receipts & Invoices - Bureau of Internal RevenueDocument6 pagesApplication For Authority To Print Receipts & Invoices - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Notes On Application For Authority To Print ReceiptsDocument3 pagesNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNo ratings yet

- Penalties - Expired AtpDocument1 pagePenalties - Expired AtpCherry ChaoNo ratings yet

- The Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeDocument25 pagesThe Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeJoyceMendozaNo ratings yet

- Department of Finance Revises Government FeesDocument3 pagesDepartment of Finance Revises Government FeesPranjal PatilNo ratings yet

- CA-Inter-Adv-Account-A-MTP-1-Nov23-castudynotes-comDocument16 pagesCA-Inter-Adv-Account-A-MTP-1-Nov23-castudynotes-comkuvira LodhaNo ratings yet

- P5 MTP 1 For Nov 23 Answers @CAInterLegendsDocument20 pagesP5 MTP 1 For Nov 23 Answers @CAInterLegendsraghavagarwal2252No ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Ires Karel M. Macadaeg BSHM-1Document3 pagesIres Karel M. Macadaeg BSHM-1Serii StrongNo ratings yet

- FINMANDocument16 pagesFINMANRonan NabloNo ratings yet

- CA Foundation Accounts A MTP 2 June 2023Document12 pagesCA Foundation Accounts A MTP 2 June 2023Vranda RastogiNo ratings yet

- MTP 15 28 Answers 1703566022Document11 pagesMTP 15 28 Answers 1703566022nilesh.nkj1325No ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- PC3 9Document11 pagesPC3 9ScribdTranslationsNo ratings yet

- AnswersDocument10 pagesAnswersmonster gamerNo ratings yet

- MTP 4 28 Answers 1682339051Document9 pagesMTP 4 28 Answers 1682339051Suryanshi BaranwalNo ratings yet

- Compromise Penalty RMO 7 2015Document12 pagesCompromise Penalty RMO 7 2015Bernadette JaoNo ratings yet

- 1 Sinamban v. China Banking Corp.Document11 pages1 Sinamban v. China Banking Corp.Sarah C.No ratings yet

- Assignment Part 2 Checked and AdjustedDocument3 pagesAssignment Part 2 Checked and AdjustedDarwin Dionisio ClementeNo ratings yet

- Sps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Document10 pagesSps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Albertjohn ZamarNo ratings yet

- Bonifacio v. CIRDocument3 pagesBonifacio v. CIRAntonio TopacioNo ratings yet

- Revenue Memorandum Order No. 01-90 PDFDocument9 pagesRevenue Memorandum Order No. 01-90 PDFCheska VergaraNo ratings yet

- Penalties & ProsecutionDocument9 pagesPenalties & Prosecutions4sahith100% (1)

- Activity 2Document5 pagesActivity 2Ashley Timbreza BetitaNo ratings yet

- 1998 AnnualfinancialstatementDocument80 pages1998 AnnualfinancialstatementEwing Township, NJNo ratings yet

- VAT Authority of BangladeshDocument17 pagesVAT Authority of BangladeshLisa MaysuraNo ratings yet

- Franchise Accounting Journal EntriesDocument5 pagesFranchise Accounting Journal Entriesdes arellanoNo ratings yet

- Tax Guide for Professionals: A Quick Primer on Filing Requirements and PaymentsDocument8 pagesTax Guide for Professionals: A Quick Primer on Filing Requirements and PaymentsDanica FranciaNo ratings yet

- Task 6: Income Statement and Cash Flow StatementDocument3 pagesTask 6: Income Statement and Cash Flow StatementScribdTranslationsNo ratings yet

- Pilmico Vs CIRDocument9 pagesPilmico Vs CIRERNIL L BAWANo ratings yet

- PC3 29Document12 pagesPC3 29ScribdTranslationsNo ratings yet

- 71859bos57825 Inter P5aDocument16 pages71859bos57825 Inter P5aVishnuNo ratings yet

- Estanislao and Africa Sinamban Petitioners VS China Banking Corporation RespondentDocument12 pagesEstanislao and Africa Sinamban Petitioners VS China Banking Corporation Respondentmondaytuesday17No ratings yet

- Suggested Solutions June 2007Document12 pagesSuggested Solutions June 2007kalowekamoNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Appendices CoffeeDocument11 pagesAppendices CoffeeGian CarloNo ratings yet

- Expenses Paid or Incurred in Carrying On Any Trade or Business" That (Those) Expenses "Must Also, Meet The Further Test of Reasonableness in Amount""Document12 pagesExpenses Paid or Incurred in Carrying On Any Trade or Business" That (Those) Expenses "Must Also, Meet The Further Test of Reasonableness in Amount""Reia RuecoNo ratings yet

- Court Desicion-269847-2020Document16 pagesCourt Desicion-269847-2020Merdilyn AngelesNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Exercise JournalizingDocument2 pagesExercise JournalizingQueency RamirezNo ratings yet

- Date Debit Note No. Name of Supplier L.F. Amount: © The Institute of Chartered Accountants of IndiaDocument9 pagesDate Debit Note No. Name of Supplier L.F. Amount: © The Institute of Chartered Accountants of IndiaShubham PadolNo ratings yet

- PAL Tax Exemption UpheldDocument15 pagesPAL Tax Exemption UpheldEvan NervezaNo ratings yet

- SOALDocument2 pagesSOALjwtrmdhnNo ratings yet

- MTP I AnswersDocument16 pagesMTP I AnswersEediko ConsultingNo ratings yet

- Doing Business Guide: MaltaDocument21 pagesDoing Business Guide: MaltaPhilAeonNo ratings yet

- Recent Guidance - SEC Provides Analytical Tools For Assessing Digital Assets (Harvard Law Review)Document9 pagesRecent Guidance - SEC Provides Analytical Tools For Assessing Digital Assets (Harvard Law Review)PhilAeonNo ratings yet

- A Focus On Dually Registered or "Hybrid" Challenges: Part TwoDocument12 pagesA Focus On Dually Registered or "Hybrid" Challenges: Part TwoPhilAeonNo ratings yet

- Philippines Factsheet PDFDocument22 pagesPhilippines Factsheet PDFjayrenielNo ratings yet

- Allocation and Tenure Instruments On Forest LandsDocument162 pagesAllocation and Tenure Instruments On Forest LandsPhilAeonNo ratings yet

- DENR Source Book on Forest Land Allocation InstrumentsDocument162 pagesDENR Source Book on Forest Land Allocation InstrumentsPhilAeonNo ratings yet

- Department of Environment and Natural Resources: Visayas Avenue, Diliman, Quezon City 1100Document9 pagesDepartment of Environment and Natural Resources: Visayas Avenue, Diliman, Quezon City 1100PhilAeonNo ratings yet

- Jurisdiction of Surrogates Court Over Inter Vivos Trusts (SCPA Vs SVA)Document6 pagesJurisdiction of Surrogates Court Over Inter Vivos Trusts (SCPA Vs SVA)PhilAeonNo ratings yet

- DENR Administrative Order on Rules and Regulations Governing Special Uses of ForestlandsDocument15 pagesDENR Administrative Order on Rules and Regulations Governing Special Uses of ForestlandsPhilAeonNo ratings yet

- Disclosures Fee Schedule TrustcoDocument12 pagesDisclosures Fee Schedule TrustcoPhilAeonNo ratings yet

- CER Ified Copy: Office of The SecretaryDocument6 pagesCER Ified Copy: Office of The SecretaryPhilAeonNo ratings yet

- Patent Strategies For Cryptocurrencies and Blockchain TechnologyDocument10 pagesPatent Strategies For Cryptocurrencies and Blockchain TechnologyPhilAeonNo ratings yet

- Jurisdiction of Surrogates Court Over Inter Vivos Trusts (SCPA Vs SVA)Document6 pagesJurisdiction of Surrogates Court Over Inter Vivos Trusts (SCPA Vs SVA)PhilAeonNo ratings yet

- Disclosures Fee Schedule TrustcoDocument12 pagesDisclosures Fee Schedule TrustcoPhilAeonNo ratings yet

- Petitioners Respondents: Second DivisionDocument9 pagesPetitioners Respondents: Second DivisionPhilAeonNo ratings yet

- Declaring A Stat of Public H LTH em RG NC Throughout e H PP Nes"Document8 pagesDeclaring A Stat of Public H LTH em RG NC Throughout e H PP Nes"PhilAeonNo ratings yet

- Warehouse 1 of 8: Guidelines: 1 2 3Document11 pagesWarehouse 1 of 8: Guidelines: 1 2 3PhilAeonNo ratings yet

- 19534-1998-Amendments To Revenue Memorandum Order Nos.Document2 pages19534-1998-Amendments To Revenue Memorandum Order Nos.PhilAeonNo ratings yet

- F - Electric Rate SettingDocument27 pagesF - Electric Rate SettingPhilAeonNo ratings yet

- MC 2010-14 - Standardization of Requirements and Enhancement of Public Participation in The Streamlined Implementation of The Philippine EIS SystemDocument17 pagesMC 2010-14 - Standardization of Requirements and Enhancement of Public Participation in The Streamlined Implementation of The Philippine EIS SystemPacific Spectrum100% (1)

- Ibp Cebu Chapter ID Request Form Ibp Cebu Chapter ID Request FormDocument1 pageIbp Cebu Chapter ID Request Form Ibp Cebu Chapter ID Request FormPhilAeonNo ratings yet

- Panel 2 Minimizing Trustee RiskDocument110 pagesPanel 2 Minimizing Trustee RiskPhilAeonNo ratings yet

- 19556-1999-Clarified Procedures in The Issuance ofDocument2 pages19556-1999-Clarified Procedures in The Issuance ofPhilAeonNo ratings yet

- 19524-1998 - Issuance of Permit To Print Sales InvoicesDocument1 page19524-1998 - Issuance of Permit To Print Sales InvoicesPhilAeonNo ratings yet

- Philippines Corporate Governance in The Time of COVID19Document11 pagesPhilippines Corporate Governance in The Time of COVID19PhilAeonNo ratings yet

- 19594-1997-Guidelines On TIN and Correspondence IssuanceDocument11 pages19594-1997-Guidelines On TIN and Correspondence IssuancePhilAeonNo ratings yet

- Mock Trial Script: ProsecutionDocument11 pagesMock Trial Script: ProsecutionLuap Dlorah Bilocura FerrerNo ratings yet

- Home Assignment of Family Law Triple Talaq: Submitted By:-NAME - Anurag Trivedi Class - Bba-Llb ROLL NO. - B-29Document9 pagesHome Assignment of Family Law Triple Talaq: Submitted By:-NAME - Anurag Trivedi Class - Bba-Llb ROLL NO. - B-29vishvesh100% (2)

- Manny Pacquiao: Force/55433236/1Document1 pageManny Pacquiao: Force/55433236/1Ronald McflurryNo ratings yet

- ICASA Exemptsion ApplicationDocument10 pagesICASA Exemptsion ApplicationAllen John BurroughsNo ratings yet

- In The Case Study of Malicious Prosecution of DDocument8 pagesIn The Case Study of Malicious Prosecution of DGayathri SNo ratings yet

- Kekerasan Intelektual Dalam Islam (Telaah Terhadap Peristiwa Mihnah Mu'Tazilah)Document18 pagesKekerasan Intelektual Dalam Islam (Telaah Terhadap Peristiwa Mihnah Mu'Tazilah)MUCHAMMAD SABILUL KHAIR 2019No ratings yet

- Juan Crisostomo Ibarra's Return to the PhilippinesDocument5 pagesJuan Crisostomo Ibarra's Return to the PhilippinesCodeSeekerNo ratings yet

- Maxwell AFB Unmanned Aerial Vehicles UAV Maxwell AFB List of Reference LnksDocument21 pagesMaxwell AFB Unmanned Aerial Vehicles UAV Maxwell AFB List of Reference LnksAnonymous mfgFBX9XNo ratings yet

- LAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsDocument12 pagesLAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsanneNo ratings yet

- The Rise of Dalit EnterpriseDocument11 pagesThe Rise of Dalit EnterpriseAbhishek SinghNo ratings yet

- Ra 9262 Cases: Rustan Ang vs. Ca and Irish Sagud G.R. No. 182835 April 20, 2010 FactsDocument18 pagesRa 9262 Cases: Rustan Ang vs. Ca and Irish Sagud G.R. No. 182835 April 20, 2010 FactsRegion PersonnelNo ratings yet

- Second Amended Plan (3.8.21)Document223 pagesSecond Amended Plan (3.8.21)Metro Puerto RicoNo ratings yet

- Amit Sahni Vs Commissioner With Highlight 1Document13 pagesAmit Sahni Vs Commissioner With Highlight 1Nitin GoyalNo ratings yet

- Legends of Islam-Salahuddin AyubiDocument21 pagesLegends of Islam-Salahuddin AyubiRifaqat RihatNo ratings yet

- Olivia Velez v. Gregory L. Coler, in His Official Capacity As Secretary of The Florida State Department of Health and Rehabilitative Services, 978 F.2d 647, 11th Cir. (1992)Document5 pagesOlivia Velez v. Gregory L. Coler, in His Official Capacity As Secretary of The Florida State Department of Health and Rehabilitative Services, 978 F.2d 647, 11th Cir. (1992)Scribd Government DocsNo ratings yet

- Form Medical Malpractice Insurance enDocument2 pagesForm Medical Malpractice Insurance ensyed imdadNo ratings yet

- Christine Joyce Mendoza: Authorized PersonDocument1 pageChristine Joyce Mendoza: Authorized PersonTintin MendozaNo ratings yet

- This Is Halloween: Alto SaxophoneDocument5 pagesThis Is Halloween: Alto SaxophoneTrice NeelyNo ratings yet

- I Am Not Throwing Away My Shot Lyrics/ Drinking Game LogicDocument4 pagesI Am Not Throwing Away My Shot Lyrics/ Drinking Game LogicRylieNo ratings yet

- Vladimir Propp'S Fairy Tale FunctionsDocument2 pagesVladimir Propp'S Fairy Tale FunctionsRulzishor RulzishoaraNo ratings yet