Professional Documents

Culture Documents

Assessment 1

Uploaded by

mega0 ratings0% found this document useful (0 votes)

4 views1 pageThis document contains 4 questions for an assessment. Question 1 asks about the definition of taxation and its principles. Question 2 asks about determining residential status in Nepal and defining public expenditures. Question 3 provides income information for an individual and asks to calculate their tax liability. Question 4 asks about determining residential status for a UK citizen based on their travel dates to Nepal.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 4 questions for an assessment. Question 1 asks about the definition of taxation and its principles. Question 2 asks about determining residential status in Nepal and defining public expenditures. Question 3 provides income information for an individual and asks to calculate their tax liability. Question 4 asks about determining residential status for a UK citizen based on their travel dates to Nepal.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageAssessment 1

Uploaded by

megaThis document contains 4 questions for an assessment. Question 1 asks about the definition of taxation and its principles. Question 2 asks about determining residential status in Nepal and defining public expenditures. Question 3 provides income information for an individual and asks to calculate their tax liability. Question 4 asks about determining residential status for a UK citizen based on their travel dates to Nepal.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

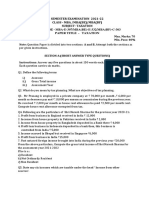

Assessment-1

Attempt all the questions. Each question carries 5 marks.

1. What is taxation? What are the principles of taxation?

2. When is a person resident in Nepal? What do you mean by public expenditures?

3. Ms. Shruti has a salary income of Rs. 9,00,000 p.a. in the year 2076/77. She

retired in the end of the year and received Rs. 25,00,000 as retirement payment.

Her contribution to Approved Retirement Fund for the year was Rs. 80,000. She

also paid a life insurance premium of Rs. 40,000 for the year. Calculate her

income tax liability for the income year 2076/77?

4. John, a citizen of UK, arrives Kathmandu on 5th Ashad 2077 and returns on 20

Magh 2077. What is residential status of John in the income year 2076/77 and

2077/78?

You might also like

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- Paper 7: Direct Tax Laws & International Taxation: Questions and AnswersDocument19 pagesPaper 7: Direct Tax Laws & International Taxation: Questions and Answersneeraj sharmaNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- Correct AnswerDocument20 pagesCorrect AnswerToji ThomasNo ratings yet

- Bos 58983Document20 pagesBos 58983Kartik0% (1)

- Financial PlanningDocument3 pagesFinancial PlanningManish PatelNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Computation of Total IncomeDocument13 pagesComputation of Total IncomeamitpdabkeNo ratings yet

- 5 Sem Bcom - Income TaxDocument46 pages5 Sem Bcom - Income TaxVikranthNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- Class Assignment TaxationDocument1 pageClass Assignment Taxationnimitajinjala27No ratings yet

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Taxation (India) : Monday 2 June 2008Document9 pagesTaxation (India) : Monday 2 June 2008jtemu_1No ratings yet

- Total Computation QB by CA Pranav ChandakDocument37 pagesTotal Computation QB by CA Pranav ChandakSurajNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Post Office Savings Scheme - Problems - SharedDocument1 pagePost Office Savings Scheme - Problems - SharedgauravNo ratings yet

- Retirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Document17 pagesRetirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Harshi SoniNo ratings yet

- Assignment 2 FPTMDocument1 pageAssignment 2 FPTMSiva SankariNo ratings yet

- Assignment For Residential StatusDocument4 pagesAssignment For Residential StatusRaj HanumanteNo ratings yet

- Wealth Management Case StudiesDocument5 pagesWealth Management Case StudiesLeela Sri NaveenNo ratings yet

- Taxation Cia 3Document27 pagesTaxation Cia 3Soumya KesharwaniNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- FBF Spring 2015 Inclass 4Document2 pagesFBF Spring 2015 Inclass 4peter kongNo ratings yet

- Mid TermDocument1 pageMid TermSHAWKATMANZOORNo ratings yet

- FOF Assgt 2 30102022 070850pmDocument4 pagesFOF Assgt 2 30102022 070850pmMughal777No ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Income Tax FinalDocument20 pagesIncome Tax FinalSiddarood KumbarNo ratings yet

- TVM QuestionsDocument4 pagesTVM QuestionsSultan AwateNo ratings yet

- Rajesh Sharma Income: They Spend Their Annual Expenses 2lac Included Children Studied ExpensesDocument6 pagesRajesh Sharma Income: They Spend Their Annual Expenses 2lac Included Children Studied ExpensesAmriksinghChandNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- TTP Unit IDocument41 pagesTTP Unit IAafreen SiddiquiNo ratings yet

- Retirement Planning Ver1 4Document8 pagesRetirement Planning Ver1 4acservomotorNo ratings yet

- The Income Tax ActDocument32 pagesThe Income Tax Actapi-3832224No ratings yet

- Case - DDocument2 pagesCase - Dmoneshivangi29No ratings yet

- Questions On Retirement Planning - Set 1Document3 pagesQuestions On Retirement Planning - Set 1Swati ChoudharyNo ratings yet

- Income From Other SourcesDocument4 pagesIncome From Other SourcesKiran UpadhyayNo ratings yet

- Income Tax SumsDocument2 pagesIncome Tax SumsPragya AbiNo ratings yet

- Annuities Examples in Retirement Planning.... DDDDDocument9 pagesAnnuities Examples in Retirement Planning.... DDDDattaullahNo ratings yet

- CFP Mock Test Retirement PlanningDocument9 pagesCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- ICAI MCQ's INCOME TAX CA INTER MAY - NOV 2024Document49 pagesICAI MCQ's INCOME TAX CA INTER MAY - NOV 2024Anil Reddy100% (1)

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Income TaxDocument19 pagesIncome TaxAkash VisputeNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Products of NepalDocument14 pagesProducts of NepalmegaNo ratings yet

- Business Law - SS2020Document5 pagesBusiness Law - SS2020megaNo ratings yet

- Assignment 2: Mega BhattaraiDocument6 pagesAssignment 2: Mega BhattaraimegaNo ratings yet

- An Strategic Analysis On "Let's Eat" Mobile Restaurant Initiation and OperationDocument14 pagesAn Strategic Analysis On "Let's Eat" Mobile Restaurant Initiation and OperationmegaNo ratings yet

- Book Review: Nepal's Foreign Policy and Its NeighboursDocument7 pagesBook Review: Nepal's Foreign Policy and Its NeighboursmegaNo ratings yet

- Part One: Labor Law of Nepal (Labor Act 2074 (2017) and Labor and Employment Policy, 2062) Section 1Document2 pagesPart One: Labor Law of Nepal (Labor Act 2074 (2017) and Labor and Employment Policy, 2062) Section 1megaNo ratings yet

- What Is Taxation? What Are The Principles of Taxation?Document5 pagesWhat Is Taxation? What Are The Principles of Taxation?megaNo ratings yet

- Law Mid TermDocument14 pagesLaw Mid TermmegaNo ratings yet

- Business Communications - SS2020Document5 pagesBusiness Communications - SS2020megaNo ratings yet

- Ethical Issues in Sales Advertisements: Reebok'S AdvertismentDocument3 pagesEthical Issues in Sales Advertisements: Reebok'S AdvertismentmegaNo ratings yet

- Labor Law HRM PresentationDocument24 pagesLabor Law HRM PresentationmegaNo ratings yet

- Labor LawDocument38 pagesLabor LawmegaNo ratings yet

- Letter WritingDocument3 pagesLetter WritingmegaNo ratings yet

- Managment Acc FinalsDocument12 pagesManagment Acc FinalsmegaNo ratings yet

- Law BoardsDocument20 pagesLaw BoardsmegaNo ratings yet

- Impacts of News in Nepalese SocietyDocument17 pagesImpacts of News in Nepalese SocietymegaNo ratings yet

- Investment AssignmentDocument16 pagesInvestment AssignmentmegaNo ratings yet

- Economics BoardsDocument26 pagesEconomics BoardsmegaNo ratings yet

- Communication ExamDocument7 pagesCommunication Exammega100% (1)

- Finance BoardsDocument13 pagesFinance BoardsmegaNo ratings yet

- Final Food TruckDocument22 pagesFinal Food TruckmegaNo ratings yet

- Business Proposal of Real Estate: Done by Ishwor ChettriDocument23 pagesBusiness Proposal of Real Estate: Done by Ishwor ChettrimegaNo ratings yet

- Business Law AssignmentDocument5 pagesBusiness Law AssignmentmegaNo ratings yet

- Business Comm FinalsDocument10 pagesBusiness Comm FinalsmegaNo ratings yet