Professional Documents

Culture Documents

L1-Practice Problem-Process Costing-Single Department Cost of Production Report

L1-Practice Problem-Process Costing-Single Department Cost of Production Report

Uploaded by

lalalalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L1-Practice Problem-Process Costing-Single Department Cost of Production Report

L1-Practice Problem-Process Costing-Single Department Cost of Production Report

Uploaded by

lalalalaCopyright:

Available Formats

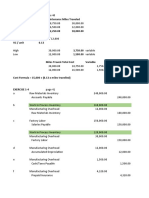

L1-Practice Problem-Process Costing

Single Department Cost of Production Report

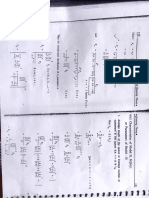

A. Prepare the cost of production report for the month ended February 28, 2020 assuming that the

company uses FIFO method.

Bass Company

Cost of Production Report

For the Month Ended February 28,2020

(FIFO METHOD)

PRODUCTION DATA Physical Units Direct Materials Conversion

Beg. WIP inventory 1,000

Started into production 8,400

Units to account for 9,400

Units completed & transferred

Beg. WIP inventory 1,000 600 800

Started into production 8,100 8,100 8,100

Ending WIP inventory 300 225 180

Units accounted for 9,400 8,925 9,080

COST DATA Total Direct Materials Conversion

Cost in Beg.WIP inventory ₱ 5,006.30

Current period cost 86,354.00 62,928.00 23,426.00

Total cost to account for ₱ 91,360.30

Divided by EUP 8,925 9,080

Cost per EUP ₱ 9.63 ₱ 7.05 ₱ 2.58

COST ASSIGNMENT

Transferred out:

Beg. WIP inventory costs ₱ 5,006.30

Cost to complete:

Direct Materials (600 x P7.05) ₱ 4,230.45

Conversion (800 x P2.58) 2,063.96 ₱ 6,294.42

Started and completed (8,100 x P9.63) 78,008.77 ₱ 89,309.49

Ending WIP inventory:

Direct Materials (225 x P7.05) 1,586.42

Conversion (180 x P2.58) 464.39 2,050.81

Total cost accounted for ₱ 91,360.30

B. Prepare the entries for the direct material, direct labor, and overhead cost assigned to production

during February as well as the transfer of the completed goods during February using the FIFO method.

Work in Process Inventory ₱ 62,928.00

Raw Material Inventory ₱ 62,928.00

Work in Process Inventory 13,070.00

Wages Payable 13,070.00

Work in Process Inventory 10,356.00

Manufacturing Overhead 10,356.00

Finished Goods Inventory 89,309.49

Work in Process Inventory 89,309.49

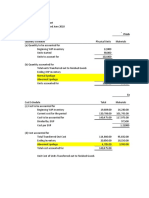

C. Prepare the cost of production report for the month ended February 28, 2020 assuming that the

company uses weighted-average method.

Bass Company

Cost of Production Report

For the Month Ended February 28,2020

(Weighted-average Method)

PRODUCTION DATA Physical Units Direct Materials Conversion

Beg. WIP inventory 1,000

Started into production 8,400

Units to account for 9,400

Units completed & transferred 9,100 9,100 9,100

Ending WIP inventory 300 225 180

Units accounted for 9,400 9,325 9,280

COST DATA Total Direct Materials Conversion

Cost in Beg.WIP inventory ₱ 5,006.30 4,133.20 873.10

Current period cost 86,354.00 62,928.00 23,426.00

Total cost to account for ₱ 91,360.30 67,061.20 24,299.10

Divided by EUP 9,325 9,280

Cost per EUP ₱ 9.809987 ₱ 7.191550 ₱ 2.618438

COST ASSIGNMENT

Transferred out (9,100 x P9.809987) ₱ 89,270.88

Ending WIP inventory:

Direct Materials (225 x P7.191550) 1,618.10

Conversion (180 x P2.618438) 471.32 2,089.42

Total cost accounted for ₱ 91,360.30

D. Prepare the entries for the direct material, direct labor, and overhead cost assigned to production

during February as well as the transfer of the completed goods during February using the weighted

average method.

Work in Process Inventory ₱ 62,928.00

Raw Material Inventory ₱ 62,928.00

Work in Process Inventory 13,070.00

Wages Payable 13,070.00

Work in Process Inventory 10,356.00

Manufacturing Overhead 10,356.00

Finished Goods Inventory 89,270.88

Work in Process Inventory 89,270.88

You might also like

- Management AccountingDocument6 pagesManagement AccountingJohn Allen Cruz Caballa100% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- OM Presentation: Honda Vs ToyotaDocument40 pagesOM Presentation: Honda Vs ToyotaParandeep Chawla100% (3)

- Homework Answers PDF FreeDocument37 pagesHomework Answers PDF FreeMarie Frances SaysonNo ratings yet

- Latourneau Company (Cost Classification) PDFDocument3 pagesLatourneau Company (Cost Classification) PDFCeline Versace100% (3)

- Practice Problems (Spoilage in Process Costing)Document3 pagesPractice Problems (Spoilage in Process Costing)lalalalaNo ratings yet

- LEC 2 Additions, Spoilage, Rework, and ScrapDocument37 pagesLEC 2 Additions, Spoilage, Rework, and ScrapKelvin CulajaráNo ratings yet

- Practice Problem-Two-Departments-Weighted Average MethodDocument2 pagesPractice Problem-Two-Departments-Weighted Average MethodlalalalaNo ratings yet

- ACCT3203 Contemporary Managerial Accounting: Lecture Illustration Examples With SolutionsDocument11 pagesACCT3203 Contemporary Managerial Accounting: Lecture Illustration Examples With SolutionsJingwen YangNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- Practice Problems-Two Departments-Fifo MethodDocument3 pagesPractice Problems-Two Departments-Fifo MethodlalalalaNo ratings yet

- -Document3 pages-IsmayaCahyaningPutriNo ratings yet

- Go, Mai Leah Vanessa - BA203 - Chap6Document10 pagesGo, Mai Leah Vanessa - BA203 - Chap6christian BagoodNo ratings yet

- BS230 - Assignment #2Document8 pagesBS230 - Assignment #2Malcolm TumanaNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- L1 - Assignment 1 - Process CostingDocument2 pagesL1 - Assignment 1 - Process CostinglalalalaNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingKrizia Mae FloresNo ratings yet

- 5 Week Activity Additions Spoilage Rework ScrapDocument3 pages5 Week Activity Additions Spoilage Rework ScrapAlrac GarciaNo ratings yet

- Chapter 13-1, 13-7 & 13-9Document5 pagesChapter 13-1, 13-7 & 13-9Elaine Fiona VillafuerteNo ratings yet

- PT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFDocument1 pagePT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFBulan julpi suwellyNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Remson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditDocument2 pagesRemson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditMarcus McWile MorningstarNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Assignment #1Document5 pagesAssignment #1Crizelda BauyonNo ratings yet

- Soal Process Costing 3Document3 pagesSoal Process Costing 3Mita PutryanaNo ratings yet

- SpoilageDocument25 pagesSpoilageAllen Rae GonzalesNo ratings yet

- CostCon ProblemsDocument3 pagesCostCon ProblemsElla Mae SaludoNo ratings yet

- Activity in JITDocument3 pagesActivity in JITEross Jacob SalduaNo ratings yet

- QUIZZERDocument4 pagesQUIZZERchowchow123No ratings yet

- C1C022025 FebbyanaAndra AkuntansiBiaya 3DDocument6 pagesC1C022025 FebbyanaAndra AkuntansiBiaya 3DdarlaaNo ratings yet

- Dente Q2Document3 pagesDente Q2hanna fhaye denteNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- AaaaDocument7 pagesAaaadiane camansagNo ratings yet

- PS 1Document2 pagesPS 1Kelvin CulajaráNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- COSTCO Section 1Document11 pagesCOSTCO Section 1Paula BautistaNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Registration No: Q1. Multiple Choice Questions (Marks 10)Document4 pagesRegistration No: Q1. Multiple Choice Questions (Marks 10)Fami FamzNo ratings yet

- RCA Sol Sample Exam PDFDocument5 pagesRCA Sol Sample Exam PDFdiane camansagNo ratings yet

- Chapter 5 Assignment Cost AccountingDocument3 pagesChapter 5 Assignment Cost AccountingSydnei HaywoodNo ratings yet

- June 17, 2020 Trial 1Document10 pagesJune 17, 2020 Trial 1fghhnnnjmlNo ratings yet

- AC - CostAcctg Process Costing - Production LossesDocument10 pagesAC - CostAcctg Process Costing - Production LossesEloisa Joy MoredoNo ratings yet

- Process Costing Indiv AssignmentDocument7 pagesProcess Costing Indiv AssignmentKylie Luigi Leynes BagonNo ratings yet

- Elyssa Reahna E. Veloz - Tla3.2Document8 pagesElyssa Reahna E. Veloz - Tla3.2jyendrinaNo ratings yet

- 06 Cost Accounting System FTDocument18 pages06 Cost Accounting System FTnsm2zmvnbbNo ratings yet

- Manufacturing OperationsDocument14 pagesManufacturing OperationsGet BurnNo ratings yet

- Busi 2083Document2 pagesBusi 2083Amandeep GillNo ratings yet

- Case 1. Landers CompanyDocument3 pagesCase 1. Landers CompanyMavel DesamparadoNo ratings yet

- UntitledDocument14 pagesUntitledJomar PenaNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- 12 CasDocument7 pages12 CasLakshay SharmaNo ratings yet

- ExercisesDocument7 pagesExercisesMaryjane De GuzmanNo ratings yet

- Acc 104Document12 pagesAcc 104PATRICIA CHUANo ratings yet

- #9499Document1 page#9499lalalalaNo ratings yet

- #9498Document1 page#9498lalalalaNo ratings yet

- #9002Document2 pages#9002lalalalaNo ratings yet

- #9004Document1 page#9004lalalalaNo ratings yet

- PRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2CDocument2 pagesPRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2ClalalalaNo ratings yet

- 4 Edited Proposal of ThesisDocument36 pages4 Edited Proposal of ThesisAyalew LakeNo ratings yet

- Impacts of Marine Pollution To Shipping Operation and Marine EnvironmentDocument8 pagesImpacts of Marine Pollution To Shipping Operation and Marine EnvironmentizuanNo ratings yet

- Topic 3a Supply Chain Management v1 6sept2019 LLDocument54 pagesTopic 3a Supply Chain Management v1 6sept2019 LLlucy elsa2213No ratings yet

- UntitledDocument18 pagesUntitledapi-115033750No ratings yet

- International Business EnvironmentDocument15 pagesInternational Business EnvironmentWint Yee khaingNo ratings yet

- Queuing Theory P4Document10 pagesQueuing Theory P4Akash DubeyNo ratings yet

- Tarun KantDocument3 pagesTarun KantSarvagaya MadhwalNo ratings yet

- Marketing Management 13th Edition Kotler Test BankDocument25 pagesMarketing Management 13th Edition Kotler Test BankMatthewMossfnak100% (51)

- Right To The CoreDocument5 pagesRight To The CoreJitesh AgarwalNo ratings yet

- 92 SCOPE PRO Attendee VirtualEventBrochure 01262021Document16 pages92 SCOPE PRO Attendee VirtualEventBrochure 01262021Mubeen NavazNo ratings yet

- Eyerus AnbesDocument34 pagesEyerus AnbesWubshet amareNo ratings yet

- Mast GlobalDocument3 pagesMast GlobalPiyush ChandraNo ratings yet

- Milk For The NationDocument59 pagesMilk For The Nationmihin.wimalasena100% (2)

- Introductory Presentation Alexis Global 20230916Document19 pagesIntroductory Presentation Alexis Global 20230916Dhairya GandhiNo ratings yet

- Adani Ports & SEZDocument40 pagesAdani Ports & SEZVishal MittalNo ratings yet

- Chapter 1: The Study of Accounting Information SystemsDocument36 pagesChapter 1: The Study of Accounting Information SystemsAliah CyrilNo ratings yet

- Epal Cp2 Pallet: Facts & Figures Handling MarkingsDocument2 pagesEpal Cp2 Pallet: Facts & Figures Handling MarkingsHugo Alfredo Ordóñez ChocanoNo ratings yet

- GWC AR2016 EnglishDocument68 pagesGWC AR2016 EnglishAAGNo ratings yet

- Intro To Sales ManagementDocument14 pagesIntro To Sales ManagementshaikhfaisalNo ratings yet

- Erp, CRM, SCM: Source: O'Brien, James. Introduction To Information Systems, 12e, 2005Document17 pagesErp, CRM, SCM: Source: O'Brien, James. Introduction To Information Systems, 12e, 2005Priyadarshini SahooNo ratings yet

- BHU ProspectusDocument28 pagesBHU Prospectusrahul100% (1)

- Edible Oil CaseDocument16 pagesEdible Oil CaseShahadat Hossain ShahinNo ratings yet

- Basic Managerial Roles and SkillsDocument15 pagesBasic Managerial Roles and SkillsAsim Majeed100% (2)

- Project Scope Statement - For A Metro ProjectDocument2 pagesProject Scope Statement - For A Metro ProjectAnindo Chakraborty60% (5)

- Keltron ProjectDocument97 pagesKeltron ProjectAfsal Abdul Salam90% (10)

- Request For Proposal - FinalDocument43 pagesRequest For Proposal - FinalAlberto DominguezNo ratings yet

- Business Blueprint RequirementsDocument6 pagesBusiness Blueprint Requirementsmehedi_orchid100% (1)

- Chapter 9 - Transportation ManagementDocument67 pagesChapter 9 - Transportation ManagementArman0% (1)

- Proposed Design of A Storage Warehouse in Quezon CityDocument35 pagesProposed Design of A Storage Warehouse in Quezon CityChichi Saturinas Balasta100% (1)