Professional Documents

Culture Documents

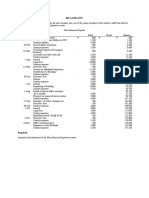

Bandaraike Manufacturing Company

Bandaraike Manufacturing Company

Uploaded by

Kris Anne Delos SantosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bandaraike Manufacturing Company

Bandaraike Manufacturing Company

Uploaded by

Kris Anne Delos SantosCopyright:

Available Formats

Bandaraike Manufacturing Company

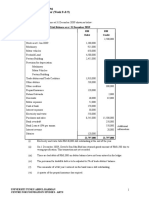

Land and Building Accounts

December 31, 2015

Admin

Particulars Per books Land Building expense

Jan-31 Land and building 98,000 A 10,800 100,000 7,000

Frb-28 Cost of removal of old building 1,500 B 1,500 500 500

May-01 Partial payment of new construction 35,000 C 1,000 5,000

May-01 Legal feess 2,000 D 300

Jun-01 Second payment on new construction 30,000 C 2,500

Jun-01 Insurance premium 1,800 E

Jun-01 Special tax assesstment 2,500 F

Jul-01 General expenses 12,000 G

Jun-30 Final payment of new construction 35,000 C

Dec-31 Asset write up 12,500 H

Sub Total 230,300

Dec-31 Depreciation 2,300 I

228,000

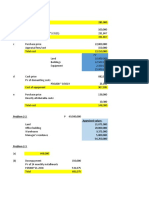

Computation:

Cash 48,000

500 shares of stocks @ market value P120 per shares 60,000

108,000

#1 Land 108,000

Land and building A 98,000

Premium 10,000

#2 Land 1,500

Land and building B 1,500

#3 Building 100,000

Land and building C 100,000

Computation:

Cost of organiation 500

Purchase of land 1,000

Legal work 500

2000

#4 Land 1,000

Organization cost 500

Building 500

Land and building D 2,000

#5 Insurance expense 900

Land ( 1,800/ 12 months x 2 months) 300

prepaid insurance 600

Land and Building E 1,800

#6 Land 2,500

Land and building F 2,500

#7 Buidling 5,000

Admin expense 7,000

Land and building G 12,000

#8 Retained earnings 12,500

Land and building H 12,500

#9 Land and building (230,000 x 1%) 2,300 I

Accumulated depreciation (105,800 x 1%) 1,058

Depreciation (1,058 - 2,300) 1,242

Insurance Prepaid Retained Allowance Additional paid Adjusted

expense Insurance earnings Total in capital Depreciation Balance

600 900 12,500 1,058 10,000 1,242

You might also like

- Business Consulting Toolkits Welcome Free SampleDocument43 pagesBusiness Consulting Toolkits Welcome Free Samplericardo navarrete50% (2)

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- You Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Document4 pagesYou Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Nguyễn GiangNo ratings yet

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersDocument10 pagesAUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersVincent Larrie MoldezNo ratings yet

- 8Document85 pages8Alex liao100% (2)

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Design A Zoo Metric PDFDocument34 pagesDesign A Zoo Metric PDFsplorrkNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Chapter 7 TBDocument25 pagesChapter 7 TBJaasdeepSingh0% (1)

- Swing Trading - Master the Best Techniques & Strategies to Create Your Passive Income With Swing Trading 2020 (کتاب دوست)Document182 pagesSwing Trading - Master the Best Techniques & Strategies to Create Your Passive Income With Swing Trading 2020 (کتاب دوست)Rasheed doustam76% (17)

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- Intermediate Accounting Unit4 - Topic5Document7 pagesIntermediate Accounting Unit4 - Topic5Lea PolinarNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- Investment Property ProblemsDocument3 pagesInvestment Property ProblemsAbigail TalusanNo ratings yet

- Ias 16Document3 pagesIas 16Christian TanzoNo ratings yet

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- CP10Document6 pagesCP10hosnearanaznin07No ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- Gabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuDocument3 pagesGabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuGJ MendozaNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- Akm IwelDocument7 pagesAkm IwelIwel NetriNo ratings yet

- Local Media1556764160936285934Document5 pagesLocal Media1556764160936285934Prince PierreNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Suggested Solutions June 2007Document12 pagesSuggested Solutions June 2007kalowekamoNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementCieLo PulmaNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Answer Key of Ppe Recognition ProblemDocument19 pagesAnswer Key of Ppe Recognition ProblemJaneNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- Contract AccountDocument3 pagesContract Accountoluwafemioyeyemi077No ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Accounting 1Document5 pagesAccounting 1afiatika ayyiNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- aNSWER 2Document5 pagesaNSWER 2Sinclair faith galarioNo ratings yet

- Answer 6Document5 pagesAnswer 6Sinclair faith galarioNo ratings yet

- Review Questions For B2 C1Document12 pagesReview Questions For B2 C1abuumgweno1803No ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Investment-Property-Non-Current-Asset-Held-For-Sale AnswersDocument6 pagesInvestment-Property-Non-Current-Asset-Held-For-Sale AnswersEvelina Del RosarioNo ratings yet

- Problem 9 Requirement 1: Adjusting EntriesDocument7 pagesProblem 9 Requirement 1: Adjusting EntriesJobby JaranillaNo ratings yet

- Notes - Audit of PpeDocument4 pagesNotes - Audit of PpeLeisleiRagoNo ratings yet

- CH 2 Answers PDFDocument5 pagesCH 2 Answers PDFLian Blakely CousinNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Debt RestructureDocument1 pageDebt Restructurehae1234No ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANNo ratings yet

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Acctg 100C 08Document2 pagesAcctg 100C 08Maddie ManganoNo ratings yet

- Measuring Business IncomeDocument3 pagesMeasuring Business Incomeeater PeopleNo ratings yet

- Kandy Co Draft FSMT and MobyDocument4 pagesKandy Co Draft FSMT and MobyAliNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Session 22 - Study GuideDocument2 pagesSession 22 - Study Guidebadette PaningbatanNo ratings yet

- Mgt-Letter - Illustrative MGT LetterDocument3 pagesMgt-Letter - Illustrative MGT Letterbadette PaningbatanNo ratings yet

- "Avoid Surprises On Deferred Income Taxes" by Lucy L. Chan and Armin F. Tulio (October 24, 2011)Document3 pages"Avoid Surprises On Deferred Income Taxes" by Lucy L. Chan and Armin F. Tulio (October 24, 2011)badette PaningbatanNo ratings yet

- Aqueduct - 2018-fs - For Discussion and AdjustentDocument553 pagesAqueduct - 2018-fs - For Discussion and Adjustentbadette PaningbatanNo ratings yet

- ACCADocument12 pagesACCAbadette PaningbatanNo ratings yet

- 2016-Recon Retained EarningsDocument4 pages2016-Recon Retained Earningsbadette PaningbatanNo ratings yet

- Notes To Financial StatementsDocument17 pagesNotes To Financial Statementsbadette Paningbatan100% (1)

- Session 21. Study GuideDocument2 pagesSession 21. Study Guidebadette PaningbatanNo ratings yet

- 2016 CoverDocument1 page2016 Coverbadette PaningbatanNo ratings yet

- 2016 CoverDocument1 page2016 Coverbadette PaningbatanNo ratings yet

- Josefa de La Cruz: 0210 Dimapakali Road, Ututan Village Mabantut, Cavite CityDocument2 pagesJosefa de La Cruz: 0210 Dimapakali Road, Ututan Village Mabantut, Cavite Citybadette PaningbatanNo ratings yet

- Benjamin Yu vs. NLRC and Jade Mountain Products Company Limited, Et - AlDocument15 pagesBenjamin Yu vs. NLRC and Jade Mountain Products Company Limited, Et - Albadette PaningbatanNo ratings yet

- 2016-Recon Retained EarningsDocument1 page2016-Recon Retained Earningsbadette PaningbatanNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument2 pagesCover Sheet: For Audited Financial Statementsbadette PaningbatanNo ratings yet

- Item Surplus AccountDocument3 pagesItem Surplus Accountbadette PaningbatanNo ratings yet

- Bacolod MillersDocument1 pageBacolod Millersbadette Paningbatan0% (1)

- Sinabalbalan Company Working Papers - Patent December 31, 2015Document2 pagesSinabalbalan Company Working Papers - Patent December 31, 2015badette PaningbatanNo ratings yet

- Sri LankaDocument1 pageSri Lankabadette PaningbatanNo ratings yet

- Able Company Reconciliation With Supplier's Account December 31, 2015 Voucher Accounts Payable Receivable Particulars Per Client Per SupplierDocument1 pageAble Company Reconciliation With Supplier's Account December 31, 2015 Voucher Accounts Payable Receivable Particulars Per Client Per Supplierbadette PaningbatanNo ratings yet

- Skylab ProblemDocument1 pageSkylab Problembadette PaningbatanNo ratings yet

- Business Ethics Case Study 1Document10 pagesBusiness Ethics Case Study 1badette PaningbatanNo ratings yet

- Date Particulars Amount Machine A Machine B Machine C Machine D Machine A Cost Others Cost Others Cost Others Cost OthersDocument1 pageDate Particulars Amount Machine A Machine B Machine C Machine D Machine A Cost Others Cost Others Cost Others Cost Othersbadette PaningbatanNo ratings yet

- Cost AnalysisDocument10 pagesCost Analysissuchitracool1No ratings yet

- Winning Without Losing Preorder Gift BookDocument23 pagesWinning Without Losing Preorder Gift Bookcarlos_645331947No ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- C013 ProblemsDocument3 pagesC013 ProblemsTushar KumarNo ratings yet

- Chapter 13 MC PracticalDocument16 pagesChapter 13 MC PracticalAyesha BajwaNo ratings yet

- Axis of Evil: Wrong Kind of Green Avaaz Ceres PurposeDocument5 pagesAxis of Evil: Wrong Kind of Green Avaaz Ceres PurposeJay Thomas TaberNo ratings yet

- About Sumuni To MOLSDocument3 pagesAbout Sumuni To MOLSYohannesNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsGoverdhan ShresthaNo ratings yet

- 3.1 - Public Money, Private Deals - Public Sector Financing Trends - Gautrain - William DachsDocument21 pages3.1 - Public Money, Private Deals - Public Sector Financing Trends - Gautrain - William DachsabdulahmedmustaphaNo ratings yet

- Chronological Resume Example 1Document3 pagesChronological Resume Example 1Nuon Rathy KPNo ratings yet

- Mocktest 10Document11 pagesMocktest 10KIEN NGUYENDACCHINo ratings yet

- FINMAR Final Term Money Market Instruments Part IDocument7 pagesFINMAR Final Term Money Market Instruments Part IMark Angelo BustosNo ratings yet

- My Internship ReportDocument64 pagesMy Internship Reportmk6656556No ratings yet

- 12-02-10 Order Dismissing TPS 3rd Circuit AppealDocument6 pages12-02-10 Order Dismissing TPS 3rd Circuit AppealjoeMcoolNo ratings yet

- Dividend Swaps and Futures - Colin Bennett PDFDocument48 pagesDividend Swaps and Futures - Colin Bennett PDFArnaud AmatoNo ratings yet

- Working CapitalDocument18 pagesWorking CapitalAbhilasha MathurNo ratings yet

- MGT 531 Assignment 1Document4 pagesMGT 531 Assignment 1Abdul Haq AlviNo ratings yet

- PM Quiz 4Document3 pagesPM Quiz 4Daniyal NasirNo ratings yet

- Broad Power of AttorneyDocument6 pagesBroad Power of Attorneyanon_974142023No ratings yet

- EFQM EIPM Framework For Exc Ext ResourcesDocument40 pagesEFQM EIPM Framework For Exc Ext ResourceslesanNo ratings yet

- Future and Options in Derevative Mod1Document48 pagesFuture and Options in Derevative Mod1jatingediaNo ratings yet

- Gamboa v. Teves, 652 SCRA 690 (2011)Document172 pagesGamboa v. Teves, 652 SCRA 690 (2011)inno KalNo ratings yet

- Oliver Ianne Dola CruzDocument3 pagesOliver Ianne Dola CruzPjei MendozaNo ratings yet

- VIX As A PredictorInsightsDocument9 pagesVIX As A PredictorInsightsSandipNo ratings yet

- Mech Vii Engineering Economics (10me71) SolutionDocument30 pagesMech Vii Engineering Economics (10me71) SolutionVikas Gowda100% (1)

- Activity - Consolidated Financial Statement Part 1Document10 pagesActivity - Consolidated Financial Statement Part 1PaupauNo ratings yet