Professional Documents

Culture Documents

Accounting Financial 2

Uploaded by

jonathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Financial 2

Uploaded by

jonathanCopyright:

Available Formats

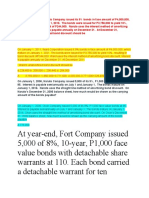

Answer each of these unrelated questions.

(a)

On January 1, 2015, Yang Corporation sold a building that cost ¥25,000,000 and that had

accumulated depreciation of ¥10,000,000 on the date of sale. Yang received as consideration a

¥24,000,000 non-interest-bearing note due on January 1, 2018. There was no established

exchange price for the building, and the note had no ready market. The prevailing rate of interest

for a note of this type on January 1, 2015, was 9%. At what amount should the gain from the sale

of the building be reported?

Ans

The present value of the note = ¥24,000,000 / (1 + 0.09)^3

= ¥24,000,000 / 1.295029

= ¥18,532,403

Actual cost of building = ¥25,000,000 - ¥10,000,000

= ¥15,000,000

Gain form the sale of the building = ¥18,532,403 - ¥15,000,000

= ¥3,532,403

(b)

On January 1, 2015, Yang Corporation purchased 300 of the ¥100,000 face value, 9%, 10-year

bonds of Walters Inc. The bonds mature on January 1, 2025, and pay interest annually beginning

January 1, 2016. Yang purchased the bonds to yield 11%. How much did Yang pay for the

bonds?

Ans :

Par value of the bonds = 300 x ¥100,000

= ¥30,000,000

Annual interest on bond = ¥30,000,000 x 9%

= ¥2,700,000

Market value = Present value of interest + Present Value of maturity

=

(c)

Yang Corporation bought a new machine and agreed to pay for it in equal annual installments of

¥400,000 at the end of each of the next 10 years. Assuming that a prevailing interest rate of 8%

applies to this contract, how much should Yang record as the cost of the machine?

Ans

Cost of the machine = ¥400,000 x (1-(1/1.08)^10) / 0.08

= ¥400,000 x (0.536807) / 0,08

= ¥2,684,035

(d)

Yang Corporation purchased a special tractor on December 31, 2015. The purchase agreement

stipulated that Yang should pay ¥2,000,000 at the time of purchase and ¥500,000 at the end of

each of the next 8 years. The tractor should be recorded on December 31, 2015, at what amount,

assuming an appropriate interest rate of 12%?

Ans

Present value = ¥2,000,000 + (¥500,000 x 4.9676)

= ¥2,000,000 + ¥2,483,800

= ¥4,483,800

(e)

Yang Corporation wants to withdraw ¥12,000,000 (including principal) from an investment fund

at the end of each year for 9 years. What should be the required initial investment at the

beginning of the first year if the fund earns 11%?

Ans

Present value of annuity = ¥12,000,000 x (1-(1.11)^9)/0.11

= ¥12,000,000 x (5.537047532)

= ¥66,444,570

You might also like

- Bond ValuationDocument51 pagesBond ValuationRudy Putro100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Amino AcidsDocument17 pagesAmino AcidsSiddharth Rohilla100% (2)

- 1000MCQ With Answer On Accounts & Finance For BankersDocument182 pages1000MCQ With Answer On Accounts & Finance For BankersCITIZEN2No ratings yet

- Aromatic CompoundsDocument55 pagesAromatic CompoundsNadine Bacalangco100% (1)

- Undying Quickstart 02Document17 pagesUndying Quickstart 02elmerg99No ratings yet

- Value at Risk - Theory and IllustrationsDocument75 pagesValue at Risk - Theory and IllustrationsMohamed Amine ElmardiNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Acctg 201 Midterm Quiz 3Document10 pagesAcctg 201 Midterm Quiz 3Minie KimNo ratings yet

- Auditing Problem Final Exam With Answer Only, No SolutionDocument23 pagesAuditing Problem Final Exam With Answer Only, No SolutionRheu Reyes100% (1)

- Notes Payable and Bonds Payable - Quiz - With Answers - For PostingDocument8 pagesNotes Payable and Bonds Payable - Quiz - With Answers - For PostingWinny PoeNo ratings yet

- Bonds Payable 1Document2 pagesBonds Payable 1els emsNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Intermediate Accounting 2Document27 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Activity 3.4 Simple Annuity: Answer The Following Problems. Show Your Solutions. (15 PTS)Document5 pagesActivity 3.4 Simple Annuity: Answer The Following Problems. Show Your Solutions. (15 PTS)Blanche Faith C. MARGATE75% (4)

- Answer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parDocument5 pagesAnswer: P 4,800,000.: Nondetachable Warrants Givingthebondholderstherighttopurchase16,000p100parGenelayn TalabocNo ratings yet

- Bab 14Document4 pagesBab 14tutykaykay67% (3)

- Engineering EconomyDocument23 pagesEngineering EconomyHajji Bañoc100% (1)

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Assignment Time Value of MoneyDocument1 pageAssignment Time Value of MoneyKim DoyoungNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- Intermediate Acctg Quiz 1Document4 pagesIntermediate Acctg Quiz 1Frenzy PopperNo ratings yet

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Midterm Exam MWF Released To StudentsDocument3 pagesMidterm Exam MWF Released To StudentsAliah AutenticoNo ratings yet

- p1 24 Bonds PayableDocument5 pagesp1 24 Bonds PayablePrincess MangudadatuNo ratings yet

- 12 Acctg Ed 1 - Notes Receivable PDFDocument17 pages12 Acctg Ed 1 - Notes Receivable PDFNath BongalonNo ratings yet

- TQ U11 DA Plant Master 2019 PDFDocument4 pagesTQ U11 DA Plant Master 2019 PDFhelenNo ratings yet

- CHP 6 - Time Value of MoneyDocument11 pagesCHP 6 - Time Value of MoneyShahnawaz KhanNo ratings yet

- Assignment 1Document4 pagesAssignment 1Tiancong DuNo ratings yet

- REVIEWERDocument13 pagesREVIEWERCamille BagueNo ratings yet

- Final Exam IntermediateDocument24 pagesFinal Exam IntermediateIrene Grace Edralin AdenaNo ratings yet

- Chapter 6-Receivables 2Document4 pagesChapter 6-Receivables 2Emma Mariz Garcia100% (7)

- Bonds PayableDocument2 pagesBonds PayableEyra MercadejasNo ratings yet

- ReceivablesDocument4 pagesReceivablesKentaro Panergo NumasawaNo ratings yet

- CH 10Document2 pagesCH 10fukchuntse40No ratings yet

- Chapter 14 QuizDocument7 pagesChapter 14 QuizSherri BonquinNo ratings yet

- Activity Retirement of Bonds PayableDocument3 pagesActivity Retirement of Bonds PayableCris Ann Marie ESPAnOLANo ratings yet

- Chapter 16 Team ProblemDocument4 pagesChapter 16 Team ProblemRachel KleinNo ratings yet

- MathDocument12 pagesMathGosaye Desalegn0% (1)

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Math One:: Requirement: Taxable Income From House Property For The Year Ended OnDocument2 pagesMath One:: Requirement: Taxable Income From House Property For The Year Ended OnFozle Rabby 182-11-5893No ratings yet

- 22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnDocument11 pages22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnTuấn NguyễnNo ratings yet

- CH 06 TutoriaDocument31 pagesCH 06 TutoriaSana Khan100% (1)

- Class 2 AnswersDocument4 pagesClass 2 AnswersБота ОмароваNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Business Calculations L2 Past Paper Series 4 2013Document8 pagesBusiness Calculations L2 Past Paper Series 4 2013Benz BaharomNo ratings yet

- I. Rental Method of Valuation: Capitalized Value Net Rent Year's PurchaseDocument3 pagesI. Rental Method of Valuation: Capitalized Value Net Rent Year's PurchasebhushrutiNo ratings yet

- Quiz - Chapter 10 - Investments in Debt Securities - Ia 1 - 2020 EditionDocument3 pagesQuiz - Chapter 10 - Investments in Debt Securities - Ia 1 - 2020 EditionJennifer RelosoNo ratings yet

- Borrowing CostsDocument32 pagesBorrowing CostsSelu Semahle NdlondloNo ratings yet

- 4 - Notes ReceivableDocument10 pages4 - Notes Receivablejoneth.duenasNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- متوسطة 2 - د. أحمدDocument4 pagesمتوسطة 2 - د. أحمدLT pudgeNo ratings yet

- Actg 4 Bonds Payable4Document2 pagesActg 4 Bonds Payable4RAMOS, Jann Julianne D.No ratings yet

- Week 4 Discussion ProblemsDocument10 pagesWeek 4 Discussion ProblemsGokul Kumar100% (1)

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- CA Inter Group 1 Accounts MarathonDocument33 pagesCA Inter Group 1 Accounts MarathonNikitaa SanghviNo ratings yet

- Exercise Ch16Document6 pagesExercise Ch16thanhtrucNo ratings yet

- AFAR 2nd Monthly AssessmentDocument7 pagesAFAR 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- Soal Se Akm 2 PDFDocument3 pagesSoal Se Akm 2 PDFrakhaNo ratings yet

- Entity A Issues Convertible Bonds With Face Amount ofDocument1 pageEntity A Issues Convertible Bonds With Face Amount ofNicole AguinaldoNo ratings yet

- Chapter 3Document11 pagesChapter 3Marianna UcedaNo ratings yet

- Solubility and Polarity C11!4!5Document8 pagesSolubility and Polarity C11!4!5doctorguy770% (1)

- The Beginners Guide To Investing in The Nigerian Stock MarketDocument50 pagesThe Beginners Guide To Investing in The Nigerian Stock MarketMuhammad Ghani100% (1)

- Calcul Sochastique en Finance: Peter Tankov Peter - Tankov@polytechnique - Edu Nizar Touzi Nizar - Touzi@polytechnique - EduDocument238 pagesCalcul Sochastique en Finance: Peter Tankov Peter - Tankov@polytechnique - Edu Nizar Touzi Nizar - Touzi@polytechnique - EduordicompuuterNo ratings yet

- QuizDocument7 pagesQuizHo Yuen TangNo ratings yet

- Ortho Classic Catalog Rev MDocument240 pagesOrtho Classic Catalog Rev MGloria Diana Aguilar PizzurnoNo ratings yet

- 14.1 Multiple-Choice and Bimodal Questions: Diff: 1 Page Ref: Sec. 14.2Document53 pages14.1 Multiple-Choice and Bimodal Questions: Diff: 1 Page Ref: Sec. 14.2Megan WitwerNo ratings yet

- Assignment 2Document1 pageAssignment 2foqia nishatNo ratings yet

- SPM Chemistry Definition ListDocument3 pagesSPM Chemistry Definition ListLooiNo ratings yet

- Reduction With Rieke ZincReduction With Rieke ZincDocument3 pagesReduction With Rieke ZincReduction With Rieke ZinciramshaguftaNo ratings yet

- Agency MBS Outlook 2014Document27 pagesAgency MBS Outlook 2014analyst28No ratings yet

- Bond MathematicsDocument1 pageBond Mathematicsdick4chickssNo ratings yet

- FIN221 Chapter 3 - (Q&A)Document15 pagesFIN221 Chapter 3 - (Q&A)jojojoNo ratings yet

- Alkyl Halide QuestionsDocument6 pagesAlkyl Halide QuestionsAaron Lee100% (1)

- TUGAS Organic Synthesis-1Document28 pagesTUGAS Organic Synthesis-1Dia N SariNo ratings yet

- Covalent Vs Non CovalentDocument3 pagesCovalent Vs Non CovalentezajihaNo ratings yet

- Lab. 12 NylonDocument4 pagesLab. 12 NyloncsnNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument20 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456No ratings yet

- Solid SolutionDocument9 pagesSolid SolutionAnkita EnlightenedNo ratings yet

- Hult2007 Enzyme Promiscuity Mechanism and ApplicationsDocument8 pagesHult2007 Enzyme Promiscuity Mechanism and ApplicationsRoshiio Espinoza100% (1)

- Convertible Securities Today - by John CalamosDocument15 pagesConvertible Securities Today - by John CalamosLiou KevinNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument79 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownzeeshanNo ratings yet

- Ruzicka CP Estimation MethodDocument11 pagesRuzicka CP Estimation MethodAndreea Cristina PetcuNo ratings yet