Professional Documents

Culture Documents

CA Inter Group 1 Accounts Marathon

Uploaded by

Nikitaa SanghviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Inter Group 1 Accounts Marathon

Uploaded by

Nikitaa SanghviCopyright:

Available Formats

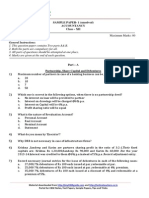

INTER GROUP 1 MARATHON 1

Hire Purchase

1. On 1st April, 2007 X purchased a machine on the hire purchase system the cash price being

Rs.11,000. Payment was to be made Rs.3,000 down and the balance in 4 annual Instalments

of Rs.2,000 each plus interest. Interest is chargeable @ 10% p.a.

2. QP May 2019 (Q 2a)

M/s Amar bought six Scooters from M/s Bhanu on 1st April, 2015 on the following terms:

Down payment `3,00,000

1st instalment payable at the end of 1st year `1,59,000

2nd instalment payable at the end of 2nd year `1,47,000

3rd instalment payable at the end of 3rd year `1,65,000

Interest is charged at the rate of 10% per annum.

M/s Amar provides depreciation @ 20% per annum on the diminishing balance method.

On 31st March, 2018 M/s Amar failed to pay the 3rd instalment upon which M/s Bhanu

repossessed two Scooters. M/s Bhanu agreed to leave the other four Scooters with M/s Amar

and adjusted the value of the repossessed Scooters against the amount due. The Scooters

taken over were valued on the basis of 30% depreciation per annum on written down value.

The balance amount remaining in the vendor's account after the above adjustment was paid

by M/s Amar after 5 months with interest @15% per annum.

M/s Bhanu incurred repairing expenses of `15,000 on repossessed scooters and sold scooters

for ` 1,05,000 on 25th April, 2018.

You are required to :

1. Calculate the cash price of the Scooters and the interest paid with each instalment.

2. Prepare Scooters Account and M/s Bhanu Account in the books of M/s Amar.

3. Prepare Goods Repossessed Account in the books of M/s Bhanu.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 2

Profit or Loss Prior to Incorporation

1. The accounts were made up to 31st December, 2007. The company was incorporated on 1st

May, 2007 to take over a business from the preceding 1st January. Total sales for the year

were Rs 12,00,000. It is ascertained that the sales for November and December are one and

half times the average of those for the year, while those for February and April are only

half the average.

2. Star Ltd was incorporated on 1st July, 2007 to acquire a running business with effect from

1st April, 2007. The accounts for the year ended 31st March, 2008 disclosed the following:

There was a gross profit of Rs 3,00,000.

The sales for the year amounted to Rs 12,00,000 of which Rs 2,40,000 were for the first six

months,

The expenses debited to the Profit and Loss Account included — directors' fees: Rs 15,000;

bad debts: Rs 3,600; advertising: Rs 12,000 (under a contract amounting to Rs 1,000 per

month); salaries and general expenses: Rs 64,000; preliminary expenses written off Rs 5,000:

and donation to a political party given by the company Rs.5,000.

Prepare a statement showing the amount of profit made before and after incorporation.

3. ICAI Module Illustration No. 5

ABC Ltd. took over a running business with effect from 1 st April 2013. The company was

incorporated on 1st August 2013. The following summarized Profit and Loss Account has

been prepared for the year ended 31.3.2014:

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 3

Particulars Rs. Particulars Rs.

To Salaries 48000 By Gross profit 320000

To Stationery 4800

To Travelling expenses 16800

To Advertisement 16000

To Miscellaneous trade expenses 37800

To Rent (office buildings) 26400

To Electricity charges 4200

To Director’s fee 11200

To Bad debts 3200

To Commission to selling agents 16000

To Tax Audit fee 6000

To Debenture interest 3000

To Interest paid to vendor 4200

To Selling expenses 25200

To Depreciation on fixed assets 9600

To Net profit 87600

Total 320000 Total 320000

Additional information:

(a) Total sales for the year which amounted to 1920000 arose evenly upto the date of 30.9.2013.

There after they spurted to record an increase of two- third during the rest of the year.

(b) Rent of office building was paid @ 2000 per month upto September 2013 and thereafter it

was increased by 400 per month.

(c) Travelling expenses include 4800 towards sales promotion.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 4

(d) Depreciation includes 600 for assets acquired in the post incorporation period.

(e) Purchase consideration was discharged by the company on 30th September 2013 by issuing

equity shares of 10 each.

Prepare Statement showing calculation of profits and allocation of expenses between pre and

post incorporation periods.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 5

Investment Accounts

1. In 2011, M/s. Wye Ltd. issued 12% fully paid debentures of ` 100 each, interest being payable

half yearly on 30th September and 31st March of every accounting year.

On 1st December, 2012, M/s. Bull & Bear purchased 10,000 of these debentures at ` 101

cum-interest price, also paying brokerage @ 1% of cum-interest amount of the purchase.

On 1st March, 2013 the firm sold all of these debentures at ` 106 cum-interest price, again

paying brokerage @ 1 % of cum-interest amount. Prepare Investment Account in the books

of M/s. Bull & Bear for the period 1st December, 2012 to 1st March, 2013.

2. On 1st April, 2010 Singh had 20,000 equity shares in X Limited. Face value of the shares

was Rs. 10 each but their book value was Rs. 16 per share. On 1st June 2010, Singh purchased

5,000 more equity shares in the company at a premium of Rs. 4 per share. On 30th June

2010 the Directors of X Limited, announced a bonus and right issue. Bonus was declared at

the rate of one equity share for every five shares held and these shares were received on

2nd August, 2010.

The terms of the right issue were:

a. Right shares to be issued to the existing holders on 10th August 2010.

b. Right issue would entitle the holders to subscribe to additional equity shares in the company

@ 1 share per every 3 held at Rs. 15 per share. The whole sum being payable by 30th

September, 2010.

c.Existing share holders may to the extent of their entitlement either fully or in part, transfer

their rights to outsiders.

d. Singh exercised his option under the rights issue for 50% of his entitlements and the

balance of rights sold to Anant for a consideration of Rs. 1.50 per right.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 6

e.Dividends for the year ended 31st March 2010 @ 15% were declared by the company and

received by Singh on 20th October, 2010.

f. On 1st November 2010 Singh sold 20,000 equity shares at a premium of Rs. 3 per share

g. Market price of shares as on 31st December 2010 was Rs. 14.

Show the investment account as it would appeared in Singh's books as on 31.12.2010 and value

the shares held on that date.

3. Smart Investments made the following investments in the year 20X1-X2 : 12% State

Government Bonds having nominal value Rs. 100

01.04.20X1 Opening Balance (1200 bonds) book value of Rs. 126,000

12th April Purchased 2,000 bonds @ Rs. 100 cum interest

30.09.20X1 Sold 1,500 bonds at Rs.105 ex interest

Interest on the bonds is received on 30th June and 31st Dec. each year.

Equity Shares of X Ltd.

15.04.20X1 Purchased 5,000 equity shares @ Rs. 200 on cum right basis Brokerage of 1%

was paid in addition (Nominal Value of shares Rs. 10)

03.06.20X1 The company announced a bonus issue of 2 shares for every 5 shares held.

16.08.20X1 The company made a rights issue of 1 share for every 7 shares held at Rs. 250

per share. The entire money was payable by 31.08.20X1.

22.8.20X1 Rights to the extent of 20% was sold @ Rs. 60. The remaining rights were

subscribed.

02.09.20X1 Dividend @ 15% for the year ended 31.03.20X1 was received on 16.09.20X1

15.12.20X1 Sold 3,000 shares @ Rs. 300. Brokerage of 1% was incurred extra.

15.01.20X2 Received interim dividend @ 10% for the year 20X1 –X2

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 7

31.03.20X2 The shares were quoted in the stock exchange @ Rs. 220

Prepare Investment Accounts in the books of Smart Investments. Assume that the average

cost method is followed.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 8

Insurance Claim

1. On 1st April, 2015 the stock of Shri Ramesh was destroyed by fire but sufficient records

were saved from which following particulars were ascertained:

Particulars Rs.

Stock at cost-1st January, 2014 73,500

Stock at cost-31st December, 2014 79,600

Purchases-year ended 31st December, 2014 3,98,000

Sales-year ended 31st December, 2014 4,87,000

Purchases-1-1-2015 to 31-3-2015 1,62,000

Sales-1-1-2015 to 31-3-2015 2,31,200

In valuing the stock for the Balance Sheet at 31st December, 2014 Rs. 2,300 had been written

off on certain stock which was a poor selling line having the cost Rs. 6,900. A portion of these

goods were sold in March, 2015 at loss of Rs. 250 on original cost of Rs. 3450. The remainder

of this stock was now estimated to be worth its original cost. Subject to the above exception,

gross profit had remained at a uniform rate throughout the year.

The value of stock salvaged was Rs. 5,800. The policy was for Rs. 50,000 and was subject to

the average clause. Work out the amount of the claim of loss by fire.

2. A fire engulfed the premises of a business of M/S Kite Ltd. in the morning, of 1st October,

2017. The entire stock was destroyed except, stock salvaged of ` 50,000. Insurance Policy

was for ` 5,00,000 with average clause.

The following information was obtained from the records saved for the period from 1st April

to 30th Sep.2017

Particulars `

Sales 27,75,000

Purchases 18,75,000

Carriage inward 35,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 9

Carriage outward 20,000

Wages 40,000

Salaries 50,000

Stock in hand on 31st March 2017 3,50,000

Additional Information

i. Sales upto 30th September, 2017, includes ` 75,000 for which goods had not been dispatched.

ii. On 1st June, 2017, goods worth ` 1,98,000 sold to Hari on approval basis which was included

in sales but no approval has been received in respect of 2/3 rd of the goods sold to him till

30th September, 2017.

iii. Purchases upto 30th September, 2017 did not include ` 1,00,000 for which purchase invoices

had not been received from suppliers, through goods have been received in godown.

iv. Past records show the gross profit rate of 25% on sales.

You are required to prepare the statement of claim for loss of stock for submission to

the Insurance Company.

3. A fire occurred on 1st February, 2014, in the premises of Pioneer Ltd., a retail store and

business was partially disorganized upto 30th June, 2014. The company was insured under a

loss of profits for Rs. 1,25,000 with a six months period indemnity. From the following

information, compute the amount of claim under the loss of profit policy.

Particulars Rs.

Actual turnover from 1st February to 30th June, 2014 80,000

Turnover from 1st February to 30th June, 2013 2,00,000

Turnover from 1st February, 2013 to 31st January, 2014 4,50,000

Net Profit for last financial year 70,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 10

Insured standing charges for last financial year 56,000

Total standing charges for last financial year 64,000

Turnover for the last financial year 4,20,000

The company incurred additional expenses amounting to Rs. 6,700 which reduced the loss

in turnover. There was also a saving during the indemnity period of Rs. 2,450 in the insured

standing charges as a result of the fire.

There had been a considerable increase in trade since the date of the last annual accounts

and it has been agreed that an adjustment of 15% be made in respect of the upward trend

in turnover.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 11

Branch Accounting

1. From the following particulars relating to Patiala Branch for the year ending 31.12.2007,

prepare Branch Account in the books of head office

2. Relax Ltd. supply goods to its New Delhi branch at cost plus 25%. All cash sales at branch

are daily remitted to the head office, and the latter directly pays all the branch expenses.

From the following particulars, show by Debtors System the result of the branch operations

for the year ended December 31, 2007 :

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 12

3. X Ltd. of Calcutta has a branch at Delhi. Goods are invoiced to the branches at cost plus

331/3%. The branch remits all cash received to the head office and ail expenses are paid

by the head office.

From the following particulars prepare Branch Stock Account, Branch Adjustment Account,

Branch Debtors' Account and Branch Profit and Loss Account in the books of the head

office (all figures in rupees):

4. M/s Rani & Co. has head office at Singapore and branch at Delhi (India). Delhi branch is

an integral foreign operation of M/s Rani & Co., Delhi branch furnishes you with its Trial

Balance as on 31st March, 2019 and the additional information there after :

Dr. Cr.

Rupees in thousands

Stock on 1st April, 2018 600 —

Purchases and Sales 1,600 2,400

Sundry Debtors and Creditors 800 600

Bills of Exchange 240 480

Wages 1,120 —

Rent, rates and taxes 720 —

Sundry Expenses 320 —

Computers 600 —

Bank Balance 520 —

Singapore Office a/c — 3,040

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 13

Total 6,520 6,520

Additional information:

(a) Computers were acquired from a remittance of Singapore dollar 12,000 received from

Singapore Head Office and paid to the suppliers. Depreciate Computers at the rate of

40% for the year.

(b) Closing Stock of Delhi branch was ` 15,60,000 on 31st March,2019

(c) The Rates of Exchange may be taken as follows :

(i) On 1.4.2018 @ `50 per Singapore Dollar

(ii) On 31.3.2019 @`52 per Singapore Dollar

(iii) Average Exchange Rate for the year @ ` 51 per Singapore Dollar

(iv) Conversion in Singapore Dollar shall be made up to two decimal accuracy.

(d) Delhi Branch Account showed a debit balance of Singapore Dollar 59,897.43 on 31.3.2019

in the Head office books and there were no items pending for reconciliation.

In the books of Head office, you are required to prepare :

(1) Revenue statement for the year ended 31st March, 2019. (in Singapore Dollar)

(2) Balance Sheet as on that date, (in Singapore Dollar)

Head office Branch

Dr. Cr. Dr. Cr.

Goods sent to Branch 1,50,000 -

Goods recd. from H.O. A/c Branch A/c - 1,40,000

Head office A/c 1,12,000 78,500

- - -

On analysis of Branch A/c in Head office books and Head office A/c in branch books, you find:

➢ Goods valued `10,000 sent by head office has not been received by brand, hence not recorded in the branch

books.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 14

➢ ` 15,000 remitted by the branch has not been received, hence not recorded in the head office books.

➢ Direct collection of ` 10,500 from a customer of the branch by Head office not informed to the branch,

hence not recorded by the branch.

➢ A sum of ` 14,500 paid by branch to the suppliers of head office not recorded at Head office.

➢ Head office expenditure allocation to the branch `12,000 not recorded in the

branch.

` 7,500 being FD interest of head office received by the branch on oral instructions from H.O., not recorded in the

head office books.

5. Pass necessary Journal entries in the books of an independent Branch of M/s TPL Sons,

wherever required, to rectify or adjust the following transactions: (RTP Nov 2018)

(i) Branch paid ` 5,000 as salary to a Head Office Manager, but the amount paid has

been debited by the Branch to Salaries Account.

(ii) A remittance of ` 1,50,000 sent by the Branch has not received by Head Office on

the date of reconciliation of Accounts.

(iii) Branch assets accounts retained at head office, depreciation charged for the year `

15,000 not recorded by Branch.

(iv) Head Office expenses ` 75,000 allocated to the Branch, but not yet been recorded

by the Branch.

(v) Head Office collected ` 60,000 directly from a Branch Customer. The intimation of

the fact has not been received by the Branch.

(vi) Goods dispatched by the Head office amounting to ` 50,000, but not received by the

Branch till date of reconciliation.

(vii) Branch incurred advertisement expenses of ` 10,000 on behalf of other Branches, but

not recorded in the books of Branch.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 15

(viii) Head office made payment of ` 16,000 for purchase of goods by branch, but not

recorded in branch books.

6. Ring Bell Ltd. Delhi has a Branch at Bombay where a separate set of books is used. The

following is the trial balance extracted on 31st December, 2012.

Head Office Trial Balance

` `

Share Capital (Authorised: 10,000 Equity Shares of ` 100 each): 8,00,000

Issued: 8,000 Equity Shares

Profit & Loss Account -1-1-2012 25,310

General Reserve 1,00,000

Fixed Assets 5,30,000

Stock 2,22,470

Debtors and Creditors 50,500 21,900

Profit for 2012 52,200

Cash Balance 62,730

Branch Current Account 1,33,710

9,99,410 9,99,410

Branch Trial Balance

` `

Fixed Assets 95,000

Profit for 2012 31,700

Stock 50,460

Debtors and Creditors 19,100 10,400

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 16

Cash Balance 6,550

Head Office Current Account 1,29,010

1,71,110 1,71,110

The difference between the balances of the Current Account in the two sets of books is

accounted for as follows:

a) Cash remitted by the Branch on 31st December, 2012, but received by the Head Office on

1st January 2013 - ` 3,000.

b) Stock stolen in transit from Head Office and charged to Branch by the Head Office, but

not credited to Head Office in the Branch books as the Branch Manager declined to admit

any liability (not covered by insurance) - ` 1,700.

Give the Branch Current Account in Head Office books after incorporating Branch Trial Balance

through journal. Also prepare the company’s Balance Sheet as on 31 st December, 2012.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 17

Departmental Accounts

1. M/s. Delta is a Departmental Store having three departments X, Y and Z. The information

regarding three departments for the year ended 31 st March, 2018 are given below:

Particulars Dept. X Dept. Y Dept. Z

Opening Stock 18,000 12,000 10,000

Purchases 66,000 44,000 22,000

Debtors at end 7,500 5,000 5,000

Sales 90,000 67,500 45,000

Closing Stock 22,500 8,750 10,500

Value of furniture in each Department 10,000 10,000 5,000

Floor space occupied by each Dept. (in sq. ft.) 1,500 1,250 1,000

Number of employees in each Department 25 20 15

Electricity consumed by each Department (in units) 300 200 100

Additional Information:

Particulars Amount (`)

Carriage inwards 1,500

Carriage outwards 2,700

Salaries 24,000

Advertisement 2,700

Discount allowed 2,250

Discount received 1,800

Rent, Rates and Taxes 7,500

Depreciation on furniture 1,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 18

Electricity Expenses 3,000

Labor welfare expenses 2,400

Prepare Departmental Trading and Profit & Loss Account for the year ended 31st March 2018

after providing provision for Bad Debts at 5%.

2. QP Nov 2018

Axe Limited has four departments, A,B,C and D. Department A sells goods to other departments

at a profit of 25% on cost. Department B sells goods to other department at a profit of 30%

on sales. Department C sells goods to other departments at a profit of 10% on cost, Department

D sells goods to other department at a profit of 15% on sales.

Stock lying at different departments at the year-end was as follows

Department Department Department Department

A B C D

Transfer from Department A - 45,000 50,000 60,000

Transfer from Department B 50,000 - - 75,000

Transfer from Department C 33,000 22,000 - -

Transfer from Department D 40,000 10,000 65,000 -

Departmental managers are entitled to 10% commission on net profit subject to unrealized

profit on departmental sales being eliminated. Departmental profits after charging manager’s

commission, but before adjustment of unrealized profit are as under :

Particulars `

Department A 2,25,000

Department B 3,37,500

Department C 1,80,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 19

Department D 4,50,000

Calculate the correct departmental profits after charging Manager’s commission.

3. ABC Ltd. has several departments. Goods supplied to each department are debited to

a Memorandum Departmental Stock Account at cost plus a fixed percentage (mark-up) to

give the normal selling price. The amount of mark-up is credited to a Memorandum

Departmental Markup account. If the selling price of goods is reduced below its normal

selling prices, the reduction (mark-down) will require adjustment both in the stock account

and the mark-up account. The mark-up for department X for the last three years has been

20%. Figures relevant to department X for the year ended 31st March, 2019 were as follows;

Stock as on 1st April 2018 at cost ` 1,50,000

Purchases at cost ` 4,30,000

Sales ` 6,50,000

It is further ascertained that:

1. Shortage of stock found in the year ending 31.3.2019, costing ` 4,000 were written off.

2. Opening stock on 1.4.2018 including goods costing ` 12,000 had been sold during the

year and had been marked-down in the selling price by ` 1,600. The remaining stock had

been sold during the year.

3. Goods purchased during the year were marked down by ` 3,600 from a cost of ` 30,000.

Marked-down stock costing ` 10,000 remained unsold on 31.3.2019.

4. The departmental closing stock is to be valued at cost subject to adjustment for mark-

up and mark-down.

You are required to prepare for the year ended 31st March, 2019 :

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 20

i. Departmental Trading Account for department X for the year ended 31st March,

2019 in the books of head office.

ii. Memorandum Stock Account for the year ended 31st March, 2019.

iii. Memorandum Mark-Up account for the year ended 31st March, 2019.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 21

Single Entry

1. The following balance appeared in the books of M/s Sunshine Traders:

Particulars As on As on

31-03-2018 31-03-2019

(`) (`)

Land and Building 2,50,000 2,50,000

Plant and Machinery 1,10,000 1,65,000

Office Equipment 52,500 42,500

Sundry Debtors 77,750 1,10,250

Creditors for Purchases 47,500 ?

Provision for office expenses 10,000 7,500

Stock ? 32,500

Long Term loan from ABC Bank @

10% per annum 62,500 50,000

Bank 12,500 ?

Capital 4,65,250 ?

Other information was as follows:

Particulars In (`)

Collection from Sundry Debtors 4,62,500

Payments to Creditors for Purchases 2,62,500

Payment of office Expenses 21,000

Salary paid 16,000

Selling Expenses paid 7,500

Total sales 6,25,000

Credit sales (80% of Total sales)

Credit Purchases 2,70,000

Cash Purchases (40% of Total Purchases)

Gross Profit Margin was 25% on cost

Discount Allowed 2,750

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 22

Discount Received 2,250

Bad debts 2,250

• Depreciation to be provided as follows:

Land and Machinery 5% per annum

Plant and Machinery 10% per annum

Office Equipment 15% Per annum

• On 01.10.2018 the firm sold machine having Book Value ` 20,000 (as on 31.03.2018) at a

loss of ` 7,500. New machine was purchased on 01.01.2019.

• Office equipment was sold at its book value on 01.04.2018.

• Loan was partly repaid on 31.03.2019 together with interest for the year.

You are required to prepare :

i. Trading and Profit & Loss account for the year ended 31st March, 2019.

ii. Balance Sheet as on 31st March 2019

2. Aman, a readymade garment trader, keeps his books of account under single entry system.

On the closing on 31st March 2017 his statement of affairs stood as follows:

Liabilities Amount (`) Assets Amount (`)

Aman’s capital 4,80,000 Building 3,25,000

Loan 1,50,000 Furniture 50,000

Creditors 3,10,000 Motor Car 90,000

Stock 2,00,000

Debtors 1,70,000

Cash in hand 20,000

Cash at bank 85,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 23

9,40,000 9,40,000

Riots occurred and a fire broke out on the evening of 31 March, 2018, destroying the books of

accounts. On that day, the cashier had absconded with the available cash. You are furnished

with the following information:

i. Sales for the year ended 31% March, 2018 were 20% higher than the previous year’s

sales, out of which, 20% sales were for cash. He always sells his goods at cost plus 25%.

There were no cash purchases.

ii. Collection from debtors amounted to ` 14,00,000, out of which ` 3,50,000 was received

in cash.

iii. Business expenses amounted to ` 2,00,000 of which ` 50,000 were outstanding on 31st

March 2018 and ` 60,000 paid by cheques.

iv. Gross profit as per last year’s audited accounts was ` 3,00,000.

v. Provide depreciation on building and furniture at 5% each and motor car at 20%.

vi. His private records and the Bank Pass Book disclosed the following transaction for the

year 2017-18:

Particulars `

Payment to creditors (paid by cheques) 13,75,000

Personal drawings (paid by cheques) 75,000

Repairs (paid by cash) 10,000

Travelling expenses (paid by cash) 15,000

Cash deposited in bank 7,15,000

Cash withdrawn from bank 1,20,000

vii. Stock level was maintained at ` 3,00,000 all throughout the year.

viii. The amount defalcated by the cashier is to be written off to the Profit and Loss Account.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 24

You are required to prepare Trading and Profit and Loss A/c for the year ended 31% March,

2018 and Balance Sheet as on that date of Aman. All the workings should form part of the

answer.

3. Archana Enterprises maintain their books of accounts under single entry system. The

Balance Sheet as on 31st March 2018 was as follows.

Amount Amount

Liabilities Assets

(`) (`)

Capital A/c 6,75,000 Furniture & fixtures 1,50,000

Trade creditors 7,57,500 Stock 9,15,000

Outstanding exp. 67,500 Trade debtors 3,12,000

Prepaid insurance 3,000

Cash in hand & at bank 1,20,000

15,00,000 15,00,000

The following was the summary of cash and bank book for the year ended 31st March, 2019:

Amount Amount

Receipts Payments

(`) (`)

Cash in hand & at on 1st April,

1,20,000 Payment to trade creditors 1,24,83,000

2018

Cash sales 1,10,70,000 Sundry expenses paid 9,31,050

Receipts from trade debtors 27,75,000 Drawings 3,60,000

Cash in hand & at Bank on 31st

1,90,950

March, 2019

1,39,65,000 1,39,65,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 25

Additional Information:

i. Discount allowed to trade debtors and received from trade creditors amounted to ` 54,000

and ` 42,500 respectively, (for the year ended 31st March, 2019)

ii. Annual fire insurance premium of ` 9,000 was paid every year on 1st August for the

renewal of the policy.

iii. Furniture & fixtures were subject to depreciation @15% p.a. on diminishing balance

method.

iv. The following are the balances as on 31st March, 2019 :

Stock ` 9,75,000

Trade debtors ` 3,43,000

Outstanding expenses ` 55,200

v. Gross profit ratio of 10% on sales is maintained throughout the year.

You are required to prepare Trading and Profit & Loss account for the year ended 31 st March

2019, and Balance Sheet as on that date.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 26

Cash Flow Statement

1. Question 5 (ICAI Illustration No 5)

Prepare cash flow statement of M/s MNT Ltd. for the year ended 31 st March, 2015 with the

help of the following information:

(1) Company sold goods for cash only.

(2) Gross Profit Ratio was 30% for the year, gross profit amounts to 3,82,500.

(3) Opening inventory was lesser than closing inventory by 35,000.

(4) Wages paid during the year 4,92,500.

(5) Office and selling expenses paid during the year75,000.

(6) Dividend paid during the year 30,000 (including dividend distribution tax.)

(7) Bank loan repaid during the year 2,15,000 (included interest 15,000)

(8) Trade payables on 31st March,2014 exceed the balance on 31st March, 2015 by 25,000.

(9) Amount paid to trade payables during the year 4,60,000.

(10) Tax paid during the year amounts to 65,000 (Provision for taxation as on 31.03.2015

45,000).

(11) Investments of 7,00,000 sold during the year at a profit of 20,000.

(12) Depreciation on fixed assets amounts to 85,000.

(13) Plant and machinery purchased on 15November,2014 for 2,50,000.

(14) Cash and Cash Equivalents on 31st March,2014 2,00,000.

(15) Cash and Cash Equivalents on 31stMarch,2015 6,07,500.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 27

2. Question 6 (ICAI Illustration No 6)

The following data were provided by the accounting records of Ryan Ltd. at year-end, March

31,2015: Income Statement

Sales 698000

Cost of Goods Sold (520000)

Gross Margin 178000

Operating Expenses

(including depreciation expenses of Rs.37000) (147000)

31000

Other income/(Expenses)

Interest Expenses Paid (23000)

Interest Income Received 6000

Gain on sale of investment 12000

Loss on sale of plant (3000)

(8000)

23000

Income Tax (7000)

Total 16000

Comparative Balance Sheets

Particulars 31st March 2015 31st March 2014

Assets

Plant Assets 715000 505000

Less: Accumulated Depreciation (103000) (68000)

612000 437000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 28

Investments (Long term) Current Assets: Inventory 115000 127000

144000 110000

Accounts receivable 47000 55000

Cash 46000 15000

Prepaid expenses 1000 5000

965000 749000

Liabilities

Share Capital 465000 315000

Reserves and surplus 140000 132000

Bonds 295000 245000

Current liabilities:

Accounts payable 50000 43000

Accrued liabilities 12000 9000

Income taxes payable 3000 5000

965000 749000

Analysis of selected accounts and transactions during 2014-15

1. Purchased investments for 78,000.

2. Sold investments for 1,02,000. These investments cost 90,000.

3. Purchased plant assets for 1,20,000.

4. Sold plant assets that cost 10,000 with accumulated depreciation of 2,000 for 5,000.

5. Issued 1,00,000 of bonds at face value in an exchange for plant assets on 31 st March,

2015.

6. Repaid 50,000 of bonds at face value at maturity.

7. Issued 15,000 shares of 10 each.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 29

8. Paid cash dividends 8,000.

Prepare Cash Flow Statement as per AS-3 (Revised), using indirect method.

3. Question 4 (ICAI Illustration No 4)

The following summary cash account has been extracted from the company’s accounting records:

Summary Cash Account

Particulars (’000)

Balance at 1.3.2014 35

Receipts from customers 2,783

Issue of Shares 300

Sale of Fixed Asset 128

3,246

Payment to suppliers 2,047

Payment for fixed asset 230

Payments for overheads 115

Wages And Salaries 69

Taxation 243

Dividends 80

Repayment of bank loan 250 (3,034)

Balance at 31.12.2014 212

PrepareCashFlowStatementofthiscompanyHillsLtd.fortheyearended31stMarch,2015

inaccordancewithAS-3(Revised).

The company does not have any cash equivalents.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 30

Redemption of Preference Shares and Bonus Shares

1. The capital structure of a company consists of 20,000 Equity Shares of Rs. 10 each fully

paid up and 1,000 8% Redeemable Preference Shares of Rs. 100 each fully paid up (issued

on 1.4.20X1).

Undistributed reserve and surplus stood as: General Reserve Rs. 80,000; Profit and Loss

Account Rs. 20,000; Investment Allowance Reserve out of which Rs. 5,000, (not free for

distribution as dividend) Rs. 10,000; Securities Premium Rs. 2,000, Cash at bank amounted

to Rs. 98,000. Preference shares are to be redeemed at a Premium of 10% and for the

purpose of redemption, the directors are empowered to make fresh issue of Equity Shares

at par after utilising the undistributed reserve and surplus, subject to the conditions that a

sum of Rs. 20,000 shall be retained in general reserve and which should not be utilised.

Pass Journal Entries to give effect to the above arrangements and also show how the

relevant items will appear in the Balance Sheet of the company after the redemption carried

out.

2. Following is the extract of the Balance Sheet of Preet Ltd. as at 31st March, 2015.

Authorised Capital Rs.

15,000 12% Preference shares of Rs. 10 each 1,50,000

1,50,000 Equity shares of Rs. 10 each 15,00,000

16,50,000

Issued and Subscribed capital :

12,000 12% Preference shares of Rs. 10 each fully paid 1,20,000

1,35,000 Equity shares of Rs. 10 each, Rs. 8 paid up 10,80,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 31

Reserves and surplus :

General Reserve 1,80,000

Capital redemption Reserve 60,000

Securities premium (Collected in cash) 37,500

Profit and Loss Account 3,00,000

On 1st April, 2015, the Company has made final call @ Rs. 2 each on 1,35,000 equity

shares. The call money was received by 20 th April, 2015. Thereafter, the company decided

to capitalize its reserves by way of bonus at the rate of one share for every four shares

held.

Show necessary journal entries in the books of the company and prepare the extract of

the balance sheet as on 30th April, 2015 after bonus issue.

3. The following is the summarized Balance Sheet of Trinity Ltd. as at 31.3.20X1:

Liabilities Rs. Assets Rs.

Share Capital Fixed Assets

Authorised Gross Block 3,00,000

10,000 10% Redeemable Preference Less : Depreciation 1,00,000

Shares of Rs. 10 each 1,00,000 2,00,000

90,000 Equity Shares of Rs. 10 each 9,00,000 Investments 1,00,000

10,00,000 Current Asset & Loan &

Advance

Issued, Subscribed & Paid-up Inventory 45,000

Capital

10,000 10% Redeemable Preference Trade receivables 25,000

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 32

Shares of Rs. 10 each 1,00,000 Cash and Bank Balances 50,000

10,000 Equity Shares of Rs. 10 each 1,00,000

(A) 2,00,000

Reserves and Surplus

General Reserve 1,20,000

Securities Premium 70,000

Profit and Loss A/c 18,500

(B) 2,08,500

Current Liabilities and Provisions 11,500

(C)

Total (A + B + C) 4,20,000 Total 4,20,000

For the year ended 31.3.20X2, the company made a net profit of Rs. 35,000 after providing

Rs. 20,000 depreciation.

The following additional information is available with regard to company’s operation:

1. The preference dividend for the year ended 31.3.20X2 was paid.

2. Except cash and bank balances other current assets and current liabilities as on

31.3.20X2, was the same as on 31.3.20X1.

3. The company redeemed the preference shares at a premium of 10%.

4. The company issued bonus shares in the ratio of one share for every equity share held

as on 31.3.20X2.

5. To meet the cash requirements of redemption, the company sold investments.

6. Investments were sold at 90% of cost on 31.3.20X2.

You are required to prepare necessary journal entries to record redemption and issue of

bonus shares.

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

INTER GROUP 1 MARATHON 33

4. A company offers new shares of Rs. 100 each at 25% premium to existing shareholders on

one for four bases. The cum-right market price of a share is Rs. 150. Calculate the value of

a right. What should be the ex-right market price of a share?

CA Anand Bhangariya www.cavidya.com 84218 84218 / 75887 75887

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- Accounting Ipcc May10 Paper1Document55 pagesAccounting Ipcc May10 Paper1Luvangel HeartNo ratings yet

- RTP-CAP II June 2017 Revision Test PaperDocument12 pagesRTP-CAP II June 2017 Revision Test PaperbinuNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- REVISION TEST PAPER: ACCOUNTING FOR DEPARTMENTSDocument153 pagesREVISION TEST PAPER: ACCOUNTING FOR DEPARTMENTSshankar k.c.No ratings yet

- CAF-6 Mock Paper by SkansDocument6 pagesCAF-6 Mock Paper by SkansMehak AliNo ratings yet

- AHLCON PUBLIC SCHOOL Accountancy Class XII AssignmentDocument59 pagesAHLCON PUBLIC SCHOOL Accountancy Class XII Assignmentrajat0% (1)

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- +2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845Document9 pages+2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845vanshkapoorr3No ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Accountancy Revision Test (Partnership Fundamentals) Part-2Document3 pagesAccountancy Revision Test (Partnership Fundamentals) Part-2kadyangogi1No ratings yet

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- Partnership Accounts Problems and SolutionsDocument4 pagesPartnership Accounts Problems and SolutionsSmita AdhikaryNo ratings yet

- Sample Paper Accountancy Class XIIDocument6 pagesSample Paper Accountancy Class XIIAcHu TanNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Accounting Test 7 CH 9 Nov 2022 Test Paper 1648898390Document5 pagesAccounting Test 7 CH 9 Nov 2022 Test Paper 1648898390Gaurav JhaNo ratings yet

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- Financial Reporting AnalysisDocument3 pagesFinancial Reporting AnalysisPRIYA KUMARINo ratings yet

- Business Law RTP of IcaiDocument66 pagesBusiness Law RTP of IcaitpsbtpsbtpsbNo ratings yet

- Debentures Questions 1Document3 pagesDebentures Questions 1Ishant GargNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- 12 Accountancy sp04Document45 pages12 Accountancy sp04Priyansh AryaNo ratings yet

- File 9563Document29 pagesFile 9563dhananijeneelNo ratings yet

- Investment Account NewDocument19 pagesInvestment Account NewNeha MoolchandaniNo ratings yet

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Partnership Revision Sheet Accounting Class 12Document4 pagesPartnership Revision Sheet Accounting Class 12PainNo ratings yet

- Partnership Fundamentals: Interest on Capital, Drawings, and Profit DistributionDocument4 pagesPartnership Fundamentals: Interest on Capital, Drawings, and Profit DistributionBHUMIKA JAINNo ratings yet

- CBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiDocument7 pagesCBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiAmlan ChakravortyNo ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- CBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019Document25 pagesCBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019SWAPNIL BHASKERNo ratings yet

- Practice Paper 5 Class Xii AccountancyDocument8 pagesPractice Paper 5 Class Xii AccountancyDinesh KumarNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- GKJ Accounts Xii - Rs 68.00Document67 pagesGKJ Accounts Xii - Rs 68.00sintisharma67No ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- 1st Semester Accounts Selected Question PDFDocument32 pages1st Semester Accounts Selected Question PDFVernon Roy100% (1)

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- Worksheet 1-Fundamentals of PartnershipDocument6 pagesWorksheet 1-Fundamentals of Partnershipshakir surtiNo ratings yet

- Accounts..std 12Document3 pagesAccounts..std 12Abhishek SharmaNo ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- Final May 2019 C4Document22 pagesFinal May 2019 C4sweya juliusNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Foreign Branch AccountsDocument40 pagesForeign Branch AccountsNikitaa SanghviNo ratings yet

- RR EmployeeDocument8 pagesRR EmployeeNikitaa SanghviNo ratings yet

- AS Marathon (TRG) PDFDocument84 pagesAS Marathon (TRG) PDFMahendraNo ratings yet

- RR OH Absorption CostingDocument12 pagesRR OH Absorption CostingNikitaa SanghviNo ratings yet

- Summary Notes MainDocument208 pagesSummary Notes MainNikitaa SanghviNo ratings yet

- RR AbcDocument4 pagesRR AbcNikitaa SanghviNo ratings yet

- RR OH Absorption CostingDocument10 pagesRR OH Absorption CostingNikitaa SanghviNo ratings yet

- CA Inter Costing Important Question For May22 @canotes IpccDocument100 pagesCA Inter Costing Important Question For May22 @canotes IpccChhaya JajuNo ratings yet

- Magsumbol vs. People 743 SCRA 188, November 26, 2014Document6 pagesMagsumbol vs. People 743 SCRA 188, November 26, 2014CHENGNo ratings yet

- Chapter 4 Canadian Constitutional Law IntroDocument62 pagesChapter 4 Canadian Constitutional Law Introapi-241505258No ratings yet

- Islamic Cultural Centre Architectural ThesisDocument4 pagesIslamic Cultural Centre Architectural Thesisrishad mufas100% (1)

- Benjamin Dent Arrest Press ReleaseDocument2 pagesBenjamin Dent Arrest Press ReleaseRyan GraffiusNo ratings yet

- Doas LandDocument3 pagesDoas LandRudolfNo ratings yet

- Gmis CalendarDocument4 pagesGmis CalendarAnonymous Yw2XhfXvNo ratings yet

- Skit On Importance of Learning ArabicDocument5 pagesSkit On Importance of Learning ArabicHafsa Mumtaz ChawlaNo ratings yet

- Toy Story 1995Document15 pagesToy Story 1995TOPPTC 63No ratings yet

- Chords - Songbook of CFCDocument13 pagesChords - Songbook of CFCral paguerganNo ratings yet

- Notes On Internal ReconstructionDocument7 pagesNotes On Internal ReconstructionAli NadafNo ratings yet

- Supreme Court of the Philippines upholds constitutionality of Act No. 2886Document338 pagesSupreme Court of the Philippines upholds constitutionality of Act No. 2886OlenFuerteNo ratings yet

- Arvin Lloyd D. SuniegaDocument3 pagesArvin Lloyd D. SuniegaApril Joy Sumagit HidalgoNo ratings yet

- Chain of LightDocument10 pagesChain of LightHs MichaelNo ratings yet

- Financial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )Document17 pagesFinancial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )GUDDUNo ratings yet

- Marang, TerengganuaDocument2 pagesMarang, TerengganuaCharles M. Bélanger NzakimuenaNo ratings yet

- Chapter 1 IntroductionDocument60 pagesChapter 1 IntroductionAndrew Charles HendricksNo ratings yet

- Using Debate To Enhance Students SpeakingDocument15 pagesUsing Debate To Enhance Students SpeakingCafe SastraNo ratings yet

- Shiela V. SiarDocument35 pagesShiela V. SiarCrimson BirdNo ratings yet

- Process Flowchart in Firearms License ApplicationDocument15 pagesProcess Flowchart in Firearms License ApplicationPatrick RamosNo ratings yet

- Chapter 3Document9 pagesChapter 3Safitri Eka LestariNo ratings yet

- Inspired Love Presentation - Adam GiladDocument191 pagesInspired Love Presentation - Adam GiladJohn100% (1)

- Top 7 Tips To Food Cost ControlDocument8 pagesTop 7 Tips To Food Cost ControlSubhasis BhaumikNo ratings yet

- Energy Management Systems Manual: (Company Name) AddressDocument48 pagesEnergy Management Systems Manual: (Company Name) AddressRavi ShankarNo ratings yet

- Forensic Accounting and Fraud Control in Nigeria: A Critical ReviewDocument10 pagesForensic Accounting and Fraud Control in Nigeria: A Critical ReviewKunleNo ratings yet

- Titus Edison M. CalauorDocument5 pagesTitus Edison M. CalauorTay Wasnot TusNo ratings yet

- Assessing Contribution of Research in Business To PracticeDocument5 pagesAssessing Contribution of Research in Business To PracticeAga ChindanaNo ratings yet

- Cutting Edge STARTER - New SyllabusDocument6 pagesCutting Edge STARTER - New SyllabusJCarlos LopezNo ratings yet

- Project Management - Harvard Management orDocument68 pagesProject Management - Harvard Management ortusharnbNo ratings yet

- LiquidityDocument26 pagesLiquidityPallavi RanjanNo ratings yet

- Securitization of IPDocument8 pagesSecuritization of IPKirthi Srinivas GNo ratings yet