Professional Documents

Culture Documents

Basadre AssignmentCh6

Basadre AssignmentCh6

Uploaded by

Jessa BasadreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basadre AssignmentCh6

Basadre AssignmentCh6

Uploaded by

Jessa BasadreCopyright:

Available Formats

Basadre, Jessa

BSA 3rd yr

Managerial Accounting

Assignment no. 3 Absorption and Variable costing

TRUE OR FALSE

1. True 6. False

2. True 7. False

3. False 8. True

4. False 9. False

5. False 10. False

MULTIPLE CHOICE

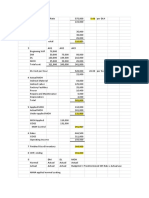

1. ANSWER: B. $ 46,500 6. ANSWER: C. $ 60,000

Sales $ 127,500 Sales $ 120,000

Less costs of the period: Less: Prime costs 32,000

Direct materials 12,000 Variable OH 18,000

Direct labor 18,000 Variable M&A 10,000

Variable overhead 30,000 Contribution margin $ 60,000

Fixed overhead 21,000

Gross margin $ 46,500 7. ANSWER: B. $ 48,000

Contribution margin $ 60,000

2. ANSWER: B. $ 60,000 Fixed overhead (directly related)

(12,000)

Direct materials $ 12.000 (30,000 X 40%)

Direct labor 18,000 Segment margin $ 48,000

Variable overhead 30,000

8. ANSWER: B. $ 108,000 and $ 92,000

Variable cost of goods available $ 60,000 Sales $ 182,000

3. ANSWER: C. $ 67,500

Less: Prime costs 41,000

Sales $ 127,500 Variable OH 18,000

Less: Variable cost of goods available 60,000 Variable M&A 15,000

Contribution margin $ 67,500 Contribution margin $ 108,000

4. ANSWER: C. $ 67,500 Contribution margin $ 108,000

Sales $ 127,500 Fixed overhead (directly related)

16,000

Less: Variable cost of goods available 60,000 (40,000 X 40%)

VC Manufacturing margin $ 67,500 Segment margin $ 92,000

5. ANSWER: D. $ 67,500 AND $ 59,500 9. ANSWER: C. $ 904,000

Sales $ 127,500 Profit (Absorption costing) $ 728,000

Less: Variable cost of goods available 60,000 Fixed OH beginning 1,456,000

VC Manufacturing margin $ 67,500 Fixed OH ending (1,280,000)

Profit (Variable costing) $ 904,000

Sales $ 127,500 10. ANSWER: B. $ 552,000

Less: Variable cost of goods available 60,000 Profit (Variable costing) $ 728,000

Variable marketing cost 8,000 Fixed OH beginning (1,456,000)

Contribution margin $ 59,500 Fixed OH ending 1,280,000

Profit (Absorption costing) $ 552,000

11. ANSWER: B. taking a special order at less than

full price.

EXERCISES

1.

SEGMENTED INCOME STATEMENT (Absorption Costing)

X Y Z

Sales $ 50,000 $ 375,000 $ 140,000

Less COGS:

Prime costs $ 10,000 $ 270,000 $ 20,000

Variable overhead 10,000 60,000 60,000

Fixed overhead 5,000 25,000 25,000 355,000 20,000 100,000

Gross margin 25,000 20,000 40,000

Fixed admin. (30%) 3,000 9,000 6,000

Net operating income (loss) $ 22,000 $ 11,000 $ 34,000

2.

SEGMENTED INCOME STATEMENT (Variable Costing)

X Y Z

Sales $ 50,000 $ 375,000 $ 140,000

Less variable costs:

Prime costs 10,000 270,000 20,000

Variable overhead 10,000 60,000 60,000

Contribution margin 30,000 45,000 60,000

Less fixed costs:

Fixed overhead 5,000 25,000 20,000

Fixed admin. (30%) 3,000 9,000 6,000

Net operating income (loss) $ 22,000 $ 11,000 $ 34,000

3. In computing for the gross margin under absorption costing, fixed overhead is treated as a product cost, thus, it

is included in the cost of goods sold which is deducted from sales. While to get the contribution margin, under

variable costing, products costs consist solely of variable production costs, thus, only variable costs are deducted

from sales, and fixed costs are deducted after.

4. When product Y is discontinued, the net operating income for the companywide will only be $14,000, which is

lesser compared to the previous net operating income of $25,000. Therefore, product Y should not be

discontinued.

SHOULD PRODUCT Y BE DISCONTINUED?

X Y Z TOTAL X Z TOTAL

Sales $ 50,000 $ 375,000 $ 140,000 $ 565,000 $50,000 $140,000 $190,000

Less variable costs:

Prime costs 10,000 270,000 20,000 30,000 10,000 20,000 30,000

Variable overhead 10,000 60,000 60,000 130,000 10,000 60,000 70,000

Contribution margin 30,000 45,000 60,000 135,000 30,000 60,000 90,000

Less fixed costs:

Fixed overhead 5,000 25,000 20,000 50,000 5,000 20,000 25,000

Fixed admin. (30%) 3,000 9,000 6,000 18,000 3,000 6,000 9,000

Segmented operating income

22,000 11,000 34,000 67,000 22,000 34,000 56,000

(loss)

Less common costs (70%) 7,000 21,000 14,000 42,000 10,920 31,080 42,000

Net operating income (loss) $ 15,000 $ -10,000 $ 20,000 $ 25,000 $ 11,080 $ 2,920 $ 14,000

You might also like

- Problem Solving With McKinsey MethodDocument23 pagesProblem Solving With McKinsey MethodRafiq Batcha96% (27)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Project On Hair SprayDocument27 pagesProject On Hair SprayRohit VargheseNo ratings yet

- 2.2 Cost Sheet ProblemsDocument7 pages2.2 Cost Sheet ProblemsApparao ChNo ratings yet

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- Job Order Cost Accounting: True-False StatementsDocument48 pagesJob Order Cost Accounting: True-False StatementsValerie Marquez100% (4)

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- Inventories Are Asfollows:: Gu Errero/German/De J Esu S/Lim/Ferrer/Laco/ValixDocument28 pagesInventories Are Asfollows:: Gu Errero/German/De J Esu S/Lim/Ferrer/Laco/ValixJaira EbronNo ratings yet

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- Installment Sales Consignment Sales Construction ContractsDocument4 pagesInstallment Sales Consignment Sales Construction ContractsShaene GalloraNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Preliminary Costing in SAP Product Costing - Detailed Overview - SkillstekDocument12 pagesPreliminary Costing in SAP Product Costing - Detailed Overview - Skillstekrudy suryaNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- Chapter 7 & 8Document29 pagesChapter 7 & 8Mary Ann F. MendezNo ratings yet

- AC and VC Plus CVPDocument6 pagesAC and VC Plus CVPEunice CoronadoNo ratings yet

- AnswersDocument4 pagesAnswersAbdulmajed Unda MimbantasNo ratings yet

- Jomar Box Company: Sales 7000x$60 $420,000Document1 pageJomar Box Company: Sales 7000x$60 $420,000MarjonNo ratings yet

- Homework Chapter 6Document6 pagesHomework Chapter 6Lê Vũ Phương DungNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- VARAIBLE COSTING (Solutions)Document8 pagesVARAIBLE COSTING (Solutions)Mohammad UmairNo ratings yet

- Answer: B: Conservative Cost (1,000,000 X 45%) 450,000Document12 pagesAnswer: B: Conservative Cost (1,000,000 X 45%) 450,000DarleneNo ratings yet

- Pham Le Thuy Duong - HW9Document4 pagesPham Le Thuy Duong - HW9Dương PhạmNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- 3271010Document4 pages3271010mohitgaba19No ratings yet

- Student Solutions Chapter 8 Cost Volume Profit AnalysisDocument7 pagesStudent Solutions Chapter 8 Cost Volume Profit AnalysisAasir NaQvi100% (1)

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Tugas IndividuDocument3 pagesTugas IndividuRangga Dhia MajduddinNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Chapter 6 - Class ActivitiesDocument5 pagesChapter 6 - Class Activitiesmauricio ricardoNo ratings yet

- Variable CostingDocument4 pagesVariable CostingKhairul Ikhwan DalimuntheNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- INSTALLMENT SALES UpdatedDocument26 pagesINSTALLMENT SALES UpdatedMichael BongalontaNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- CVP Analysis QA AllDocument63 pagesCVP Analysis QA Allg8kd6r8np2No ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- Break-Even Occurs Between The Production Volume Interval of 20,000 To 30,000Document6 pagesBreak-Even Occurs Between The Production Volume Interval of 20,000 To 30,000kripsNo ratings yet

- Chapter 7 Homework ADocument2 pagesChapter 7 Homework ALong BuiNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- Chapter12 AnalysisDocument25 pagesChapter12 AnalysisJan ryanNo ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Solved Problems: OlutionDocument9 pagesSolved Problems: OlutionSweta PandeyNo ratings yet

- Example 5 FeedbackDocument3 pagesExample 5 FeedbackGrechen UdigengNo ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- Exercise 5-1: Total Per UnitDocument18 pagesExercise 5-1: Total Per UnitSaransh Chauhan 23No ratings yet

- Group 2 - Breakeven AnalysisDocument4 pagesGroup 2 - Breakeven AnalysisCamille VergaraNo ratings yet

- Breakeven Problems - SolutionsDocument2 pagesBreakeven Problems - Solutionsrenee Benjamin-GibbsNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Jawaban Kuis UTS - LengkapDocument4 pagesJawaban Kuis UTS - Lengkapdago atasNo ratings yet

- Absorption & Marginal Costing-1Document6 pagesAbsorption & Marginal Costing-1田淼No ratings yet

- Management Accounting 1Document4 pagesManagement Accounting 1Tax TrainingNo ratings yet

- Problems 1-30: Input Boxes in TanDocument46 pagesProblems 1-30: Input Boxes in TanSindhu JattNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- 6 LeveragesDocument9 pages6 LeveragesAishu SathyaNo ratings yet

- Selling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRDocument6 pagesSelling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRSoumya Ranjan PandaNo ratings yet

- Chapter 9 Exercises: Exercise 9 1Document8 pagesChapter 9 Exercises: Exercise 9 1karenmae intangNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Solution MaNUALDocument14 pagesSolution MaNUALanasbadboy10No ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Audit Probs 4 (Final Exam)Document6 pagesAudit Probs 4 (Final Exam)YameteKudasaiNo ratings yet

- Answer c22Document3 pagesAnswer c22Võ Huỳnh BăngNo ratings yet

- 3 - Managerial Accounting - Decision MakingDocument14 pages3 - Managerial Accounting - Decision Makingx67dv5jqw4No ratings yet

- Preconditions For An AuditDocument9 pagesPreconditions For An AuditJessa BasadreNo ratings yet

- Audit Accounts ReceivableDocument18 pagesAudit Accounts ReceivableJessa BasadreNo ratings yet

- Assignment 2Document2 pagesAssignment 2Jessa BasadreNo ratings yet

- Pe Workout PlanDocument2 pagesPe Workout PlanJessa BasadreNo ratings yet

- 20 Dangerous Exercises Exercises Alternative Positions Squat Jumps - Strengthens The Entire LowerDocument7 pages20 Dangerous Exercises Exercises Alternative Positions Squat Jumps - Strengthens The Entire LowerJessa BasadreNo ratings yet

- A Review Paper On Managerial EconomicsDocument3 pagesA Review Paper On Managerial EconomicsJessa BasadreNo ratings yet

- Seven Environmental PrinciplesDocument1 pageSeven Environmental PrinciplesJessa BasadreNo ratings yet

- Critique PaperDocument2 pagesCritique PaperJessa BasadreNo ratings yet

- Reflection ReedDocument1 pageReflection ReedJessa BasadreNo ratings yet

- Activity 8.1Document1 pageActivity 8.1Jessa BasadreNo ratings yet

- St. Paul University Surigao St. Paul University System 8400 Surigao CityDocument2 pagesSt. Paul University Surigao St. Paul University System 8400 Surigao CityJessa BasadreNo ratings yet

- Strat Final RequirementDocument6 pagesStrat Final RequirementMJ Navida RiveraNo ratings yet

- Book Part IIDocument236 pagesBook Part IIAsmaNo ratings yet

- Acc223-Standard Costing-ApplicationsDocument4 pagesAcc223-Standard Costing-ApplicationsDonabelle MarimonNo ratings yet

- D10 CacDocument4 pagesD10 CacaskermanNo ratings yet

- AgriPinay Simple Business PlanDocument6 pagesAgriPinay Simple Business PlanKristy Dela PeñaNo ratings yet

- Manufacturing Accounts PDFDocument2 pagesManufacturing Accounts PDFJohn0% (1)

- Manufacturing Operations - Theory ReviewerDocument4 pagesManufacturing Operations - Theory Reviewerquinn ezekielNo ratings yet

- Lecture 5&6Document14 pagesLecture 5&6ngyx-ab22No ratings yet

- BSR 2021 ConstructionDocument119 pagesBSR 2021 ConstructionGamini KodikaraNo ratings yet

- Analysing and Managing CostsDocument30 pagesAnalysing and Managing CostsSANG HOANG THANHNo ratings yet

- At Its Sutter City Plant Yuba Machine Company Manufactures NutDocument2 pagesAt Its Sutter City Plant Yuba Machine Company Manufactures NutAmit PandeyNo ratings yet

- You and Your ArchitectDocument16 pagesYou and Your ArchitectNetwork ProNo ratings yet

- 209a - Standard Costing and Variance AnalysisDocument62 pages209a - Standard Costing and Variance AnalysisMara Shaira SiegaNo ratings yet

- SR-2014 Post GST Comparision-1 - Part 2Document44 pagesSR-2014 Post GST Comparision-1 - Part 2Sagarika SahooNo ratings yet

- 28 Cas 13 Cost Accounting Standard On Cost of Service Cost CentreDocument7 pages28 Cas 13 Cost Accounting Standard On Cost of Service Cost CentrekoshaleshwarNo ratings yet

- Cost Elements: Illustration 2: Examples of Direct Material Costs Examples Direct MaterialsDocument9 pagesCost Elements: Illustration 2: Examples of Direct Material Costs Examples Direct MaterialsDaniel KerandiNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- AcumaticaERP ManufacturingDocument263 pagesAcumaticaERP ManufacturingcrudbugNo ratings yet

- Cost NotesDocument49 pagesCost NotesHarriniNo ratings yet

- Catering Management - Factors Affecting Cost ControlDocument6 pagesCatering Management - Factors Affecting Cost ControlPraveen100% (2)

- Job CostingDocument11 pagesJob Costingbellado0% (1)

- Budgeting Problems PDFDocument5 pagesBudgeting Problems PDFER Aditya DasNo ratings yet