Professional Documents

Culture Documents

Edullantes, Midterm Tax

Edullantes, Midterm Tax

Uploaded by

Lourdios Edullantes0 ratings0% found this document useful (0 votes)

10 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesEdullantes, Midterm Tax

Edullantes, Midterm Tax

Uploaded by

Lourdios EdullantesCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Brokenshire College SOCSKSARGEN, Inc.

CED Avenue National Highway Lagao, General Santos City

Business and Transfer Taxation

Tax 101 /Tax 2– Midterm Examination

Teacher: William B. Cayanong Jr., CPA

Name: Lourdios J, Edullantes BSA-2

General Directions: Answer what is being asked in the problem.

Strictly follow the instructions. You have only one hour (1 hour and

15 minutes) to finish the exam. Any form of cheating (same

wordings/explanation with the other classmates, sources borrowed in

the internet) is highly discouraged. Once proved, will automatically

be zero. Good Luck!

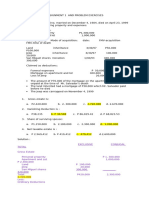

Problem 1:

1. Frank Sinatra, a Filipino decedent, left the following to his

surviving spouse.

Properties by the decedent Amount

Residential House and lot (Family Home) 3,000,000

Inherited Property from his father (exclusive)

received within 5 years at 2,000,000,

subjected to estate tax 2,500,000

Other Properties including 300,000 death

benefits under R.A 4917 15,300,000

Mortgage assumed 100,000

Losses 225,000

Medical Expenses paid (within one year) 600,000

Claims against insolvent person 200,000

Claims against the estate 300,000

Transfer for Public Use 150,000

Given the data above, Construct the following:

1. Construct a property schedule under Absolute Community

Property with its corresponding Ordinary and Special

Deductions. Use the prescribed format in presenting the

data.

exclusive commnal

Ordinary deductions

Inherited Property from his father 2,000,000 2,500,000

(exclusive) received within 5 years

at 2,000,000, subjected to estate

tax

Other Properties including 300,000 300,000

death benefits under R.A 4917

Mortgage assumed 100,000

Losses 225,000

Claims against insolvent person 200,000

Claims against the estate 300,000

(Vanishing deductions)

Transfer for Public Use (150,000)

Special deductions

Residential House and lot (family 300,000

home)

Medical Expenses paid (within one 600,000

year)

2. From the table constructed, Identify the following:

a.Total Exclusive Property 3,725,000

b.Total Community Property 2,650,000

c.Total Properties 300,000

d.Total Ordinary Deductions 3,125,000

e.Total Special Deductions 900,000

f.Vanishing Deductions 150,000

g.Share of the Surviving Spouse 1,325,000

h. Net Taxable Estate 7,700,000

You might also like

- A Feasibility Study Kangkong Snack1.1Document35 pagesA Feasibility Study Kangkong Snack1.1Lourdios Edullantes85% (13)

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2anon_52232085033% (3)

- Investment MISMODocument1 pageInvestment MISMOLourdios EdullantesNo ratings yet

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- Module 1 - Deductions From Gross EstateDocument68 pagesModule 1 - Deductions From Gross EstateKat Miranda100% (1)

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- Taxn03b DrillDocument1 pageTaxn03b Drillsmosaldana.cvtNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Midterm - Business Tax - ProblemsDocument7 pagesMidterm - Business Tax - Problemsargene.malubayNo ratings yet

- Chapter 3 - Problems - Deductions From The Gross EstateDocument4 pagesChapter 3 - Problems - Deductions From The Gross Estatefatima.hernandezva752No ratings yet

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- Estate TaxDocument8 pagesEstate TaxIELTSNo ratings yet

- Pingol TAX11Document2 pagesPingol TAX11Kristyl Ivy PingolNo ratings yet

- TaxationDocument7 pagesTaxationAltair ColtraineNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- Estate Tax (Single) ReportDocument18 pagesEstate Tax (Single) ReportPatricia RodriguezNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Prelim TaskDocument8 pagesPrelim TaskHeidi KaterineNo ratings yet

- Deductions From Gross EstateDocument16 pagesDeductions From Gross EstateJebeth RiveraNo ratings yet

- Chapter 3Document12 pagesChapter 3Briggs Navarro BaguioNo ratings yet

- 04chapter5estatetax 140813184942 Phpapp01Document30 pages04chapter5estatetax 140813184942 Phpapp01charlieaizaNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Toaz - Info Donors Tax PRDocument2 pagesToaz - Info Donors Tax PRMark John BetitoNo ratings yet

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Yeah Yeah Yeah Yeah YeahDocument7 pagesYeah Yeah Yeah Yeah YeahMika MolinaNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Prelim TaskDocument4 pagesPrelim TaskJohn Francis RosasNo ratings yet

- Quiz3 Chpater3Document4 pagesQuiz3 Chpater3argene.malubayNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Maristella GatonNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Angelica Nicole TamayoNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- 1st Monthly Transfer TaxDocument13 pages1st Monthly Transfer TaxAlexandra Nicole IsaacNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Compilation TaxDocument2 pagesCompilation TaxKaye Ann JavierNo ratings yet

- Deductions From Gross EstateDocument14 pagesDeductions From Gross EstatePierreNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Business and Transfer Taxation Gross Estate (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Gross Estate (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Session 6 Exercise DrillDocument3 pagesSession 6 Exercise DrillAbigail Ann PasiliaoNo ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- Estate Tax - DeductionDocument6 pagesEstate Tax - Deductionある種の ジャマンドロンNo ratings yet

- MidtermDocument13 pagesMidtermAlexandra Nicole IsaacNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Nov 98 QueDocument5 pagesNov 98 QueAndré Le RouxNo ratings yet

- Test Bank 1 UpdatedDocument5 pagesTest Bank 1 UpdatedSumanting GarnethNo ratings yet

- House PropertyDocument36 pagesHouse PropertyRahul Tanver0% (1)

- CTT EXAMINATION REVIEWER - Compilation of MCQsDocument22 pagesCTT EXAMINATION REVIEWER - Compilation of MCQsJames RelletaNo ratings yet

- Midterm With Answer Exam CompressDocument13 pagesMidterm With Answer Exam CompressMark John BetitoNo ratings yet

- Acclaw QuizDocument4 pagesAcclaw QuizJasmine PeraltaNo ratings yet

- Tutorial Letter No 1-2003Document1 pageTutorial Letter No 1-2003André Le RouxNo ratings yet

- RESA 41 - Tax First Preboard (May 2021) (Key Answer)Document17 pagesRESA 41 - Tax First Preboard (May 2021) (Key Answer)Aldrine CasilangNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- INVENTORIESDocument28 pagesINVENTORIESLourdios EdullantesNo ratings yet

- Empowered Globalization AutosavedDocument1 pageEmpowered Globalization AutosavedLourdios EdullantesNo ratings yet

- Elec 4 Midterm ActivityDocument3 pagesElec 4 Midterm ActivityLourdios EdullantesNo ratings yet

- Chapter IiiDocument9 pagesChapter IiiLourdios EdullantesNo ratings yet

- 120 THDocument2 pages120 THLourdios EdullantesNo ratings yet

- Rizal ModuleDocument42 pagesRizal ModuleLourdios EdullantesNo ratings yet

- Youth CampDocument4 pagesYouth CampLourdios EdullantesNo ratings yet

- Elec1 Summary InsightDocument2 pagesElec1 Summary InsightLourdios EdullantesNo ratings yet

- Prelim Lesson 1-3Document50 pagesPrelim Lesson 1-3Lourdios EdullantesNo ratings yet

- Brokenshire College Socsksargen, IncDocument14 pagesBrokenshire College Socsksargen, IncLourdios EdullantesNo ratings yet

- CHAPTER102002Document16 pagesCHAPTER102002Lourdios EdullantesNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Brokenshire College SOCSKSARGEN, INC.: Ced Avenue, National Highway, Lagao, General Santos CityDocument2 pagesBrokenshire College SOCSKSARGEN, INC.: Ced Avenue, National Highway, Lagao, General Santos CityLourdios EdullantesNo ratings yet

- Midterm Acctg105 PDFDocument3 pagesMidterm Acctg105 PDFLourdios EdullantesNo ratings yet

- Johari Window ModelDocument2 pagesJohari Window ModelLourdios EdullantesNo ratings yet

- Final Exam Instructions: Use IF Formula Only.: Apps Total Download Cost Per Apps Total SalesDocument3 pagesFinal Exam Instructions: Use IF Formula Only.: Apps Total Download Cost Per Apps Total SalesLourdios EdullantesNo ratings yet

- Assignment Bonds PayableDocument5 pagesAssignment Bonds PayableLourdios EdullantesNo ratings yet

- Edullantes Chapter-6-QuizDocument8 pagesEdullantes Chapter-6-QuizLourdios EdullantesNo ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Aditya Birla Sun LifeDocument9 pagesAditya Birla Sun LifeShrikant ShelkeNo ratings yet

- 15 Interest Annuity and AmortizationDocument12 pages15 Interest Annuity and AmortizationMr.Clown 107No ratings yet

- LIC S Jeevan Akshay VII Sales BrochureDocument16 pagesLIC S Jeevan Akshay VII Sales BrochureKALIA PRADHANNo ratings yet

- Statement 215910Document2 pagesStatement 215910Seyxeli SeliyevNo ratings yet

- Advising Slip DiscountDocument1 pageAdvising Slip DiscountMd. YeamenNo ratings yet

- Wa0018.Document7 pagesWa0018.jar070888No ratings yet

- AccountStatement 1007629365 Apr06 213815 PDFDocument4 pagesAccountStatement 1007629365 Apr06 213815 PDFShyam Lal MandhyanNo ratings yet

- Acct Statement - XX6955 - 13072023Document9 pagesAcct Statement - XX6955 - 13072023iblfinserv0No ratings yet

- FinancialInclusion RecentInitiativesandAssessmentDocument39 pagesFinancialInclusion RecentInitiativesandAssessmentShaneel AnijwalNo ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Current AccountsDocument3 pagesCurrent Accountssyllahassane01No ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalch.hamzagorya.794No ratings yet

- QFIX PAYMENT RECEIPT 0KFSQY3VJ224468 JulyDocument1 pageQFIX PAYMENT RECEIPT 0KFSQY3VJ224468 JulygowripricolNo ratings yet

- Investment Income and Expenses: (Including Capital Gains and Losses)Document76 pagesInvestment Income and Expenses: (Including Capital Gains and Losses)Kenny Svatek100% (1)

- Bombay Mercantile Co-Operative Bank LTDDocument78 pagesBombay Mercantile Co-Operative Bank LTDaadil shaikhNo ratings yet

- Ibs Rahang 1 28/02/23Document2 pagesIbs Rahang 1 28/02/23sharifah atiqahNo ratings yet

- Chapter 2 Non Current LiabilitiesDocument46 pagesChapter 2 Non Current Liabilitiessamuel hailu100% (1)

- Personal Financial StatementDocument2 pagesPersonal Financial StatementJoVic2020No ratings yet

- Xii Ca Model KeyDocument3 pagesXii Ca Model Keyapmmontage112No ratings yet

- IAJ-UPLC MCLE Form No. 2A Pre-Enlistment Registration Confirmation January Program (UPLC Feb. 7, 9, 14, 21 & 28, 2023)Document2 pagesIAJ-UPLC MCLE Form No. 2A Pre-Enlistment Registration Confirmation January Program (UPLC Feb. 7, 9, 14, 21 & 28, 2023)KristineNo ratings yet

- Chapter 6 Homework RQ.06.12 The Employer Must Do Which of The Following With Unclaimed Paychecks?Document17 pagesChapter 6 Homework RQ.06.12 The Employer Must Do Which of The Following With Unclaimed Paychecks?Pavan KumarNo ratings yet

- Chapter 15 - Capital ManagementDocument29 pagesChapter 15 - Capital ManagementImtiaz JahanNo ratings yet

- KCB - Acct.stmt - Online.details - 2023-10-27T150536.463 FartunDocument6 pagesKCB - Acct.stmt - Online.details - 2023-10-27T150536.463 FartunBENNo ratings yet

- IndiaFirst Life Fortune Plus Plan - BrochureDocument14 pagesIndiaFirst Life Fortune Plus Plan - BrochuretantaraazNo ratings yet

- TransactionSummary 915020007543226 160523031507-q4Document1 pageTransactionSummary 915020007543226 160523031507-q4RAJNo ratings yet

- Econ 3Document45 pagesEcon 3Trebob GardayaNo ratings yet

- Personal Financial Literacy (6th Grade)Document20 pagesPersonal Financial Literacy (6th Grade)Selvi RamasamyNo ratings yet

- MTN LettersDocument1 pageMTN LettersraihanahmdrNo ratings yet