Professional Documents

Culture Documents

FSA Assignment 1 Solution

Uploaded by

Daniyal ZafarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FSA Assignment 1 Solution

Uploaded by

Daniyal ZafarCopyright:

Available Formats

COMSATS University Islamabad (Wah campus)

Financial Statement Analysis (MGT-537)

Financial Statement Analysis and Valuation (ACC-556)

BAF-6+8 & BBA-6+7+8 Semester

Assignment 01 (Solution)

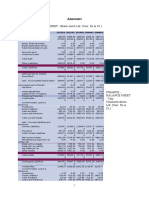

Particulars Y-o-Y analysis Index # trend analysis Common size analysis

2018 2019 %

y-o-y chang %Chang 2018

Assets change e 2018 2019 e % 2019%

Current assets $ $ $

100.0

Cash & short term investments 75574 74442 -1132 -1.50 0 98.50 -1.50 1.81 1.64

100.0 114.7

Receivables 91642 105166 13524 14.76 0 6 14.76 2.20 2.32

143325 156324 12999 100.0 109.0

Merchandise inventories 4 4 0 9.07 0 7 9.07 34.33 34.45

100.0

Prepaid expenses & other current assets 128676 118537 -10139 -7.88 0 92.12 -7.88 3.08 2.61

172914 186138 13224 100.0 107.6

Total Current assets 6 9 3 7.65 0 5 7.65 41.42 41.02

Property

100.0 112.5

Land 210427 236876 26449 12.57 0 7 12.57 5.04 5.22

100.0 113.1

Buildings 305006 345001 39995 13.11 0 1 13.11 7.31 7.60

100.0 121.2

Leasehold improvements 459711 557504 97793 21.27 0 7 21.27 11.01 12.29

178913 202391 23477 100.0 113.1

Fixtures & equipment 6 4 8 13.12 0 2 13.12 42.86 44.61

100.0 107.4

Transport equipment 173576 186485 12909 7.44 0 4 7.44 4.16 4.11

Year to Year 115549 114440 100.0 Change Analysis

Property under capital lease 3 9 -11084 -0.96 0 99.04 -0.96 27.68 25.22

By analyzing the above

409334 449418 40084 100.0 109.7

comparative 9 9 0 9.79 0 9 9.79 98.06 99.05 balance sheet of

year 2018 and 173113 189433 16319 100.0 109.4 2019, a huge

rise of 53.08% in Less: Accumulated depreciation & ammortization 8 3 5 9.43 0 3 9.43 41.47 41.75 notes and

debentures has 236221 259985 23764 100.0 110.0 been observed

in year 2019, Total property , Net 1 6 5 10.06 0 6 10.06 56.59 57.30 meaning that

firm has opted long term debt

instead of 100.0 100.1 loans/borrowing

from banks, Excess of cost over net assets acquired 16557 16588 31 0.19 0 9 0.19 0.40 0.37 along with that

100.0

Other assets 66449 59396 -7053 -10.61 0 89.39 -10.61 1.59 1.31

417436 453722 36286 100.0 108.6 100.0

Total assets 3 9 6 8.69 0 9 8.69 0 100.00

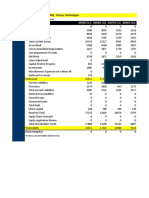

Liabilities and Stock holder's equity

95.26% of firms notes and debentures going to mature in 2019, which put additional burden on firm’s liabilities. As far as asset side is concerned nominal improvements in assets observed in

fixed assets, which means the new long term borrowing 53.8% which firm has issued are invested in projects and which is also evident from negative amount in investment (1.50) %. Hopefully

firm project pay back income would be evident in upcoming year financial reports.

Index Number Trend Analysis

By analyzing the above comparative balance sheet of year 2018 and 2019, where 2018 is base year with 100 index value and in 2019 it is observed a rise of 53.08% in notes and debentures,

along with that 95.26% of firms notes and debentures going to mature in 2019.Since we have only one year 2019 to see the trend from base year 2018, The overall figures show positive trend in

both assets and liabilities except cash, prepaid expenses and other assets which depicted negative trend in assets and Notes and income tax payables also showing downward trend.

Common Size Analysis

The common size balance sheet analysis shows that in year 2018 firms total assets divided into 41 % current assets and 57 % Non-current assets, same division has been observed in year

2019.While on Liability side we can see that in 2018 the ratio of debt equity is 67% debt and 33% equity, same ratio is observed in year 2019.Which means that firm financing relies on Debt

(borrowings, loans, credits).

You might also like

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- FCFF Vs FCFE Reconciliation TemplateDocument2 pagesFCFF Vs FCFE Reconciliation TemplateLalit KheskwaniNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Community Based Nutrition CMNPDocument38 pagesCommunity Based Nutrition CMNPHamid Wafa100% (4)

- Bank ATM Use CasesDocument12 pagesBank ATM Use Casessbr11No ratings yet

- Tata Motors - Ratio AnalysisDocument6 pagesTata Motors - Ratio AnalysisAshvi AgrawalNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- Adani PowerDocument9 pagesAdani PowerCa Aspirant Shaikh UsamaNo ratings yet

- Annexure: FINANCE - BALANCE SHEET - Bharti Airtel LTD (Curr: Rs in CR.)Document26 pagesAnnexure: FINANCE - BALANCE SHEET - Bharti Airtel LTD (Curr: Rs in CR.)Daman Deep Singh ArnejaNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Trend AnalysisDocument5 pagesTrend Analysisabbas ali100% (1)

- GDP 8th PlanDocument1 pageGDP 8th PlanDavid WykhamNo ratings yet

- Balance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- CashFlow - StandaloneDocument3 pagesCashFlow - StandaloneSourav RajeevNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- UntitledDocument10 pagesUntitlednupur malhotraNo ratings yet

- Table 4.4 Common Size Balance Sheet Statement: 45 Source ComputedDocument1 pageTable 4.4 Common Size Balance Sheet Statement: 45 Source ComputedManoj KumarNo ratings yet

- P80 1 Inch X 0 GT205S ProductDocument1 pageP80 1 Inch X 0 GT205S ProductRamonYadierRivasNo ratings yet

- School: LIM Department of ManagementDocument21 pagesSchool: LIM Department of Managementanuj_lpuNo ratings yet

- SINGRAULIDocument5 pagesSINGRAULITaneyaa ManuchaNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1AMegoz 25No ratings yet

- Nike Case Study VrindaDocument4 pagesNike Case Study VrindaAnchal ChokhaniNo ratings yet

- Pratyaksh Mishra 12209726Document16 pagesPratyaksh Mishra 12209726pratyaksh mishraNo ratings yet

- Maruti Suzuki Balance SheetDocument6 pagesMaruti Suzuki Balance SheetMasoud AfzaliNo ratings yet

- Common Size Balance Sheet: Equity and LiabilityDocument6 pagesCommon Size Balance Sheet: Equity and LiabilityAbimanyu ShenilNo ratings yet

- Walchandnagar Industries LTD: Industry:Engineering - Heavy - General - LargeDocument24 pagesWalchandnagar Industries LTD: Industry:Engineering - Heavy - General - LargearpanmajumderNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- Ratio Analysis Ibrahim Fibres LTDDocument4 pagesRatio Analysis Ibrahim Fibres LTDanon_607941No ratings yet

- Balling / Brix - Density - Oechsle - BauméDocument1 pageBalling / Brix - Density - Oechsle - BauméRemus GheorghițăNo ratings yet

- Comercio Al Por Mayor Y MenorDocument7 pagesComercio Al Por Mayor Y MenorLuis Texis RamirezNo ratings yet

- Ronak L & Yash FADocument9 pagesRonak L & Yash FAronakNo ratings yet

- Ahmed Abd ElmoneimDocument13 pagesAhmed Abd Elmoneimmohamed ashorNo ratings yet

- Godwari IspatDocument251 pagesGodwari IspatHarsh 'Bumma' BhammerNo ratings yet

- Balance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MDocument18 pagesBalance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- Group 9 - ONGC - MA ProjectDocument11 pagesGroup 9 - ONGC - MA ProjectShubham JainNo ratings yet

- Atlas Honda Financial AnalysisDocument24 pagesAtlas Honda Financial AnalysisSyed Huzayfah FaisalNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Annual Report 2020 Balance SheetDocument1 pageAnnual Report 2020 Balance Sheetghayur khanNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.) : Company: Akzo Nobel India LTD Industry: Paints / VarnishesDocument48 pagesCompany Finance Balance Sheet (Rs in CRS.) : Company: Akzo Nobel India LTD Industry: Paints / VarnishesTEJAS PHAFATNo ratings yet

- Omaxe 1Document2 pagesOmaxe 1Shreemat PattajoshiNo ratings yet

- Fnancial AnalysisDocument4 pagesFnancial AnalysisGuudax YareNo ratings yet

- Depriciation Function ADocument6 pagesDepriciation Function ADeep BusaNo ratings yet

- 2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Document6 pages2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Shirish BaisaneNo ratings yet

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Document109 pagesTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Cost of Project & Means of Finance Annexure-1Document12 pagesCost of Project & Means of Finance Annexure-1Siddharth RanaNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Balance Sheet of Engro FoodsDocument20 pagesBalance Sheet of Engro FoodsMuhib NoharioNo ratings yet

- Sungreen PresentationDocument24 pagesSungreen PresentationSANJOY MONDALNo ratings yet

- VERTICAL LIABILITIES 1Document4 pagesVERTICAL LIABILITIES 1NL CastañaresNo ratings yet

- Kalindee Rail Nirman: Balance SheetDocument9 pagesKalindee Rail Nirman: Balance Sheetrajat_singlaNo ratings yet

- Arch PharmalabsDocument6 pagesArch PharmalabsChandan VirmaniNo ratings yet

- FCFF Vs FCFE Reconciliation Template: Strictly ConfidentialDocument2 pagesFCFF Vs FCFE Reconciliation Template: Strictly ConfidentialvishalNo ratings yet

- Project 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015Document4 pagesProject 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015rohitNo ratings yet

- Coal India LimitedDocument6 pagesCoal India LimitedAbhipsa Madhavi YadavNo ratings yet

- Gross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment DepreciationDocument11 pagesGross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment Depreciationanmolsaini01No ratings yet

- Alro SA (ALR RO) - Adj HighlightsDocument147 pagesAlro SA (ALR RO) - Adj HighlightsAlexLupescuNo ratings yet

- Comparative Balance SheetDocument14 pagesComparative Balance SheetsweetdipudeepmalaNo ratings yet

- Fsa Lectures (Notes) : Introduction To Financial Statement AnalysisDocument13 pagesFsa Lectures (Notes) : Introduction To Financial Statement AnalysisDaniyal ZafarNo ratings yet

- FSA Assignment 2Document16 pagesFSA Assignment 2Daniyal ZafarNo ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- Quiz #1 SolutionDocument2 pagesQuiz #1 SolutionDaniyal ZafarNo ratings yet

- Islamic Law of Contracts-IIIDocument6 pagesIslamic Law of Contracts-IIIDaniyal ZafarNo ratings yet

- Organisations Across The World Cannot Function Without FundsDocument4 pagesOrganisations Across The World Cannot Function Without FundsDaniyal ZafarNo ratings yet

- Introduction To Islamic FinanceDocument23 pagesIntroduction To Islamic FinanceDaniyal ZafarNo ratings yet

- Definition, Prohibition, Classification, and MisconceptionsDocument22 pagesDefinition, Prohibition, Classification, and MisconceptionsDaniyal ZafarNo ratings yet

- The External Assessment Chapter OutlineDocument10 pagesThe External Assessment Chapter OutlineDaniyal ZafarNo ratings yet

- The Business Vision and Mission Chapter OutlineDocument6 pagesThe Business Vision and Mission Chapter OutlineDaniyal ZafarNo ratings yet

- Ont Page (Student Introduction Page)Document2 pagesOnt Page (Student Introduction Page)Daniyal ZafarNo ratings yet

- The Business Vision and Mission Chapter OutlineDocument6 pagesThe Business Vision and Mission Chapter OutlineDaniyal ZafarNo ratings yet

- Home Assignment # 1 Chapter # 1 The Nature of Strategic ManagementDocument2 pagesHome Assignment # 1 Chapter # 1 The Nature of Strategic ManagementDaniyal ZafarNo ratings yet

- Home Assignment # 1 Chapter # 1 The Nature of Strategic ManagementDocument2 pagesHome Assignment # 1 Chapter # 1 The Nature of Strategic ManagementDaniyal ZafarNo ratings yet

- Project Writing GuidlinesDocument6 pagesProject Writing GuidlinesDaniyal ZafarNo ratings yet

- Project Writing GuidlinesDocument6 pagesProject Writing GuidlinesDaniyal ZafarNo ratings yet

- Library Project DocumentationDocument31 pagesLibrary Project DocumentationAnonymous ysOMpRZNo ratings yet

- Project Writing GuidlinesDocument6 pagesProject Writing GuidlinesDaniyal ZafarNo ratings yet

- New Doc 08-19-2020 14.18.53Document2 pagesNew Doc 08-19-2020 14.18.53Daniyal ZafarNo ratings yet

- BcuDocument25 pagesBcuyadvendra dhakadNo ratings yet

- A History of The Church Part 1 (1) Coverage of Midterm ExamDocument117 pagesA History of The Church Part 1 (1) Coverage of Midterm ExamMary CecileNo ratings yet

- Flores Vs Drilon G R No 104732 June 22Document1 pageFlores Vs Drilon G R No 104732 June 22Henrick YsonNo ratings yet

- MCSE Sample QuestionsDocument19 pagesMCSE Sample QuestionsSuchitKNo ratings yet

- Turb Mod NotesDocument32 pagesTurb Mod NotessamandondonNo ratings yet

- Spoken Word (Forever Song)Document2 pagesSpoken Word (Forever Song)regNo ratings yet

- Robbins FOM10ge C05Document35 pagesRobbins FOM10ge C05Ahmed Mostafa ElmowafyNo ratings yet

- Assignments Is M 1214Document39 pagesAssignments Is M 1214Rohan SharmaNo ratings yet

- Electric Car Project Proposal by SlidesgoDocument46 pagesElectric Car Project Proposal by Slidesgoayusht7iNo ratings yet

- Your Song.Document10 pagesYour Song.Nelson MataNo ratings yet

- Diec Russias Demographic Policy After 2000 2022Document29 pagesDiec Russias Demographic Policy After 2000 2022dawdowskuNo ratings yet

- Keong Mas ENGDocument2 pagesKeong Mas ENGRose Mutiara YanuarNo ratings yet

- Essential Nutrition The BookDocument115 pagesEssential Nutrition The BookTron2009No ratings yet

- Muscle Building MythsDocument5 pagesMuscle Building MythsKarolNo ratings yet

- The Municipality of Santa BarbaraDocument10 pagesThe Municipality of Santa BarbaraEmel Grace Majaducon TevesNo ratings yet

- SoapDocument10 pagesSoapAira RamoresNo ratings yet

- Gothic Fiction Oliver TwistDocument3 pagesGothic Fiction Oliver TwistTaibur RahamanNo ratings yet

- Use Case Diagram ShopeeDocument6 pagesUse Case Diagram ShopeeAtmayantiNo ratings yet

- VC++ Splitter Windows & DLLDocument41 pagesVC++ Splitter Windows & DLLsbalajisathyaNo ratings yet

- Phil. Organic ActDocument15 pagesPhil. Organic Actka travelNo ratings yet

- Daily Mail 2022-10-25Document74 pagesDaily Mail 2022-10-25mohsen gharbiNo ratings yet

- Assisted Reproductive Technology945Document35 pagesAssisted Reproductive Technology945Praluki HerliawanNo ratings yet

- 14 BibiliographyDocument22 pages14 BibiliographyvaibhavNo ratings yet

- MSDS Blattanex GelDocument5 pagesMSDS Blattanex GelSadhana SentosaNo ratings yet

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Document1 pageTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IINo ratings yet

- BeneHeart D3 Defibrillator Product BrochureDocument4 pagesBeneHeart D3 Defibrillator Product BrochureJasmine Duan100% (1)

- Vistas 1-7 Class - 12 Eng - NotesDocument69 pagesVistas 1-7 Class - 12 Eng - Notesvinoth KumarNo ratings yet

- Singleton v. Cannizzaro FILED 10 17 17Document62 pagesSingleton v. Cannizzaro FILED 10 17 17Monique Judge100% (1)