Professional Documents

Culture Documents

Annual Report 2020 Balance Sheet

Uploaded by

ghayur khanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report 2020 Balance Sheet

Uploaded by

ghayur khanCopyright:

Available Formats

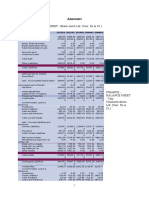

Vertical Analysis

Consolidated Statement of Financial Position

(Rs in Mn) 2020 2019 2018 2017 2016 2015

Rs. % Rs. % Rs. % Rs. % Rs. % Rs. %

EQUITY AND LIABILITIES

EQUITY

Share capital 13,353 10.1 13,353 10.5 13,353 11.3 13,353 11.9 13,309 12.9 13,309 12.5

Share Premium 3,385 2.6 3,385 2.7 3,385 2.9 3,385 3.0 3,132 3.0 3,132 3.0

Exchange revaluation reserves - - - - 409 0.3 83 0.1 11 0.0 14 0.0

Hedging reserve - - - - - - - - - - (4) (0.0)

Remeasurement of post employment benefits (50) (0.0) (57) (0.0) (45) (0.0) (47) (0.0) (27) (0.0) (40) (0.0)

Unappropriated Profits 30,043 22.8 26,598 20.9 28,421 24.1 25,696 23.0 25,223 24.5 25,921 24.4

46,731 35.5 43,279 34.1 45,523 38.7 42,470 38.0 41,648 40.5 42,332 39.9

NON-CURRENT LIABILITIES

Borrowings 13,514 10.3 22,192 17.5 25,715 21.8 22,784 20.4 29,380 28.6 25,290 23.8

Deferred taxation 11,678 8.9 12,183 9.6 7,099 6.0 9,388 8.4 7,492 7.3 5,888 5.5

Deferred liabilities 273 0.2 257 0.2 254 0.2 240 0.2 226 0.2 197 0.2

Provision for GIDC 10,510 8.0 19,458 5.3 - - - - - - - -

35,975 27.3 34,632 27.3 33,068 28.1 32,412 29.0 37,098 36.1 31,375 29.6

CURRENT LIABILITIES

Trade and other payables 30,219 22.9 18,228 14.3 29,095 24.7 21,966 19.6 14,969 14.6 17,702 16.7

Accrued interest / mark-up 263 0.2 588 0.5 426 0.4 595 0.5 584 0.6 852 0.8

Taxation - net - - - - 3,408 2.9 913 0.8 1,104 1.1 2,593 2.4

Current portion of

- Borrowings 10,062 7.6 8,760 6.9 5,096 4.3 8,120 7.3 5,172 5.0 10,737 10.1

- Deferred liabilities 54 0.0 56 0.0 51 0.0 50 0.0 49 0.0 48 0.0

- Provision for GIDC 6,927 5.3 19,658 15.3

Short-term borrowings 425 0.3 1,986 1.6 1,010 0.9 5,264 4.7 1,910 1.9 75 0.1

Unclaimed dividend 57 0.0 60 0.0 66 0.1 25 0.0 20 0.0 6 0.0

Loan from Holding Company 1,000 0.8 - - - - - - - - - -

Derivative financial instruments - - - - - - - - 250 0.2 366 0.3

49,007 37.2 49,136 38.7 39,152 33.3 36,933 33.0 24,058 23.4 32,379 30.5

TOTAL EQUITY AND LIABILITIES 131,713 100.0 127,047 100.0 117,743 100.0 111,815 100.0 102,804 100.0 106,086 100.0

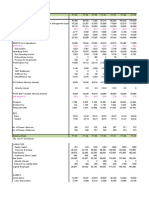

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 65,646 49.8 65,940 51.9 68,203 57.9 68,923 61.6 70,168 68.3 72,199 68.1

Intangible assets 5,165 3.9 5,071 4.0 4,488 3.8 4,475 4.0 4,451 4.3 4,462 4.2

Deferred taxation - - - - - - - - - - 73 0.1

Long-term loans and advances 81 0.1 164 0.1 143 0.1 135 0.1 121 0.1 160 0.2

70,892 53.8 71,175 56.8 72,834 61.9 73,533 65.8 74,740 72.7 76,894 72.5

CURRENT ASSETS

Stores, spares and loose tools 6,499 4.9 5,285 4.2 5,325 4.5 5,280 4.7 4,887 4.8 4,639 4.4

Stock-in-trade 7,533 5.7 12,478 9.8 11,538 9.8 7,636 6.8 6,799 6.6 7,029 6.6

Trade debts 2,906 2.2 14,175 11.2 9,110 7.7 5,419 4.8 7,585 7.4 2,262 2.1

Derivative financial instruments - - - - - - - - - - 29 0.0

Loans, advances, deposits and prepayments 2,189 1.7 2,949 2.3 1,363 1.2 1,157 1.0 683 0.7 595 0.6

Other receivables 8,304 6.3 9,412 7.4 9,067 7.7 8,807 7.9 6,986 6.8 1,359 1.3

Taxes recoverable 2,858 2.2 2,542 2.0 - - - - - - 705 0.7

Accrued income 158 0.1 106 0.1 54 0.0 25 0.0 - - - -

Short-term Investments 26,763 20.3 5,512 4.3 7,722 6.6 8,163 7.3 1,040 1.0 11,650 11.0

Cash and bank balances 3,611 2.7 3,413 2.7 730 0.6 1,795 1.6 84 0.1 924 0.9

60,821 46.2 55,872 44.0 44,909 38.1 38,282 34.2 28,064 27.3 29,192 27.5

TOTAL ASSETS 131,713 100.0 127,047 100.0 117,743 100.0 111,815 100.0 102,804 100.0 106,086 100.0

214 PERFORMANCE REVIEW REPORT EFERT ANNUAL REPORT 2020 215

You might also like

- As Per Our Report Attached For and On Behalf of The Board of DirectorsDocument26 pagesAs Per Our Report Attached For and On Behalf of The Board of DirectorsAnup Kumar SharmaNo ratings yet

- Shell Pakistan Limited Balance Sheet As at December 31, 2009Document39 pagesShell Pakistan Limited Balance Sheet As at December 31, 2009Saadia Anwar AliNo ratings yet

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Document60 pagesShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- Financials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009Document2 pagesFinancials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009BasappaSarkarNo ratings yet

- Internal Variance Analysis For Media Times LimitedDocument4 pagesInternal Variance Analysis For Media Times LimitedHarri2011No ratings yet

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNo ratings yet

- Bluestar PNLDocument6 pagesBluestar PNLg23033No ratings yet

- Cost of Project & Means of Finance Annexure-1Document12 pagesCost of Project & Means of Finance Annexure-1Siddharth RanaNo ratings yet

- Balance Sheet: Total Assets Total EquityDocument6 pagesBalance Sheet: Total Assets Total EquityDeepak MatlaniNo ratings yet

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Document6 pagesChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNo ratings yet

- KOMAC - Statements of Income ( 2010)Document1 pageKOMAC - Statements of Income ( 2010)Abhinav MehraNo ratings yet

- Region VII Balance Sheets for Multiple Electric CooperativesDocument6 pagesRegion VII Balance Sheets for Multiple Electric CooperativesKevin HernandezNo ratings yet

- Hausi Sky Enterprise Financial ForecastDocument14 pagesHausi Sky Enterprise Financial ForecastPutri NickenNo ratings yet

- Balance Sheet of Engro FoodsDocument20 pagesBalance Sheet of Engro FoodsMuhib NoharioNo ratings yet

- Balance Sheet of Cholamandalam Investment and Finance CompanyDocument7 pagesBalance Sheet of Cholamandalam Investment and Finance CompanyTaranjit Singh SohalNo ratings yet

- 3rd Quarter Report 2021 2022Document12 pages3rd Quarter Report 2021 2022শ্রাবনী দেবনাথNo ratings yet

- ClairantDocument2 pagesClairantABHAY KUMAR SINGHNo ratings yet

- Balance Sheet of Bandhan BankDocument4 pagesBalance Sheet of Bandhan BankAditya Kumar SahNo ratings yet

- Balance Sheet of Bandhan BankDocument4 pagesBalance Sheet of Bandhan BankAditya Kumar SahNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- January 24 Supporting Docs 2Document1 pageJanuary 24 Supporting Docs 2Chris NorthcraftNo ratings yet

- Ronak L & Yash FADocument9 pagesRonak L & Yash FAronakNo ratings yet

- Balance Sheet and Income Statement AnalysisDocument9 pagesBalance Sheet and Income Statement AnalysisHarshit MalviyaNo ratings yet

- Finance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrDocument26 pagesFinance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrDaman Deep Singh ArnejaNo ratings yet

- Shankar Cement Balance Sheet AnalysisDocument7 pagesShankar Cement Balance Sheet AnalysisSONA MBANo ratings yet

- Corporate Finance Learning 3-3 Statements ModelDocument37 pagesCorporate Finance Learning 3-3 Statements Modelmichael odiemboNo ratings yet

- Financial Statement: Bajaj Auto LTDDocument20 pagesFinancial Statement: Bajaj Auto LTDrohanNo ratings yet

- Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetDocument4 pagesTaiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetHarry KilNo ratings yet

- T V S Motor Co. Ltd. profits and appropriation analysis 2017-2021Document4 pagesT V S Motor Co. Ltd. profits and appropriation analysis 2017-2021Rahul DesaiNo ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Financial InfoDocument4 pagesFinancial InfoPawan SinghNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Breakdown of Income by Region and Account for 2012Document5 pagesBreakdown of Income by Region and Account for 2012Clark de GuzmanNo ratings yet

- Bright Line Sol.Document3 pagesBright Line Sol.Sudesh SharmaNo ratings yet

- Cash Flow Analysis Love VermaDocument8 pagesCash Flow Analysis Love Vermalove vermaNo ratings yet

- SultanaDocument12 pagesSultanaMAHAVEER SOLUTIONNo ratings yet

- Revised 2024-2026 MTEFDocument7 pagesRevised 2024-2026 MTEFMayowa DurosinmiNo ratings yet

- New Heritage Doll Capital Budgeting AnalysisDocument11 pagesNew Heritage Doll Capital Budgeting AnalysisYamid Esneider Barrera SeguraNo ratings yet

- Indus Motor Company Ltd. Financial Statement AnalysisDocument4 pagesIndus Motor Company Ltd. Financial Statement AnalysisTaha AfzalNo ratings yet

- 4th Quarterly Report 074-75-StatementDocument1 page4th Quarterly Report 074-75-StatementDamodarNo ratings yet

- Income Statement PSODocument4 pagesIncome Statement PSOMaaz HanifNo ratings yet

- Case Study on DSCR AnalysisDocument7 pagesCase Study on DSCR AnalysisVISHAL PATILNo ratings yet

- HCL Technologies Ltd financial analysisDocument6 pagesHCL Technologies Ltd financial analysisAswini Kumar BhuyanNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- Corporate Finance: Assignment - 1Document12 pagesCorporate Finance: Assignment - 1Ashutosh SharmaNo ratings yet

- Audited Financials Dec 2022Document1 pageAudited Financials Dec 2022EdwinNo ratings yet

- Declining BalanceDocument15 pagesDeclining BalanceGigih Adi PambudiNo ratings yet

- Financial Analysis 2015Document5 pagesFinancial Analysis 2015Walter NyakwakaNo ratings yet

- Navy Federal Bank Statement TemplateDocument1 pageNavy Federal Bank Statement TemplateLoubango MikeNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- Annual Report of Acs Group PDFDocument458 pagesAnnual Report of Acs Group PDFManyNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- TapScanner 04-28-2021-12.05Document1 pageTapScanner 04-28-2021-12.05ghayur khanNo ratings yet

- TapScanner 04-28-2021-11.55Document2 pagesTapScanner 04-28-2021-11.55ghayur khanNo ratings yet

- TapScanner 04-28-2021-12.07Document1 pageTapScanner 04-28-2021-12.07ghayur khanNo ratings yet

- Basic Beliefs of Islam PDFDocument4 pagesBasic Beliefs of Islam PDFMuhammad sulemanNo ratings yet

- All About Indian Administrative System - GK Notes For Bank & SSC Exams! - Testbook Blog PDFDocument7 pagesAll About Indian Administrative System - GK Notes For Bank & SSC Exams! - Testbook Blog PDFArathi NittadukkamNo ratings yet

- Capf Paper 2 e - Book TotalDocument347 pagesCapf Paper 2 e - Book TotalUsman Ahmad KhanNo ratings yet

- Event Policies Interim GuidelinesDocument3 pagesEvent Policies Interim Guidelinesniel doriftoNo ratings yet

- Philips - 32pfl3403d 27 TP 1.2Document6 pagesPhilips - 32pfl3403d 27 TP 1.2JuanKaNo ratings yet

- Accounting NotesDocument4 pagesAccounting NotesGhulam MustafaNo ratings yet

- S06 e 1 Usha DeepDocument3 pagesS06 e 1 Usha DeepVinay SrivastavaNo ratings yet

- Coca ColaDocument31 pagesCoca ColaAnmol JainNo ratings yet

- ED Advanced 1 - WorkbookDocument135 pagesED Advanced 1 - WorkbookAdriana Rosa PailloNo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Understanding Web Application SecurityDocument12 pagesUnderstanding Web Application SecuritySpyDr ByTeNo ratings yet

- Ebook Corporate Financial Management 5Th Edition Glen Arnold Test Bank Full Chapter PDFDocument28 pagesEbook Corporate Financial Management 5Th Edition Glen Arnold Test Bank Full Chapter PDFdextrermachete4amgqg100% (9)

- Marine InsuranceDocument83 pagesMarine Insuranceasifanis100% (3)

- Sample Paper of IBPDocument2 pagesSample Paper of IBPFarhan Razzaq75% (40)

- Urethane Thinner A: Product DescriptionDocument1 pageUrethane Thinner A: Product DescriptionValeriyNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDimple KhandheriaNo ratings yet

- Crimpro - Warrantless ArrestDocument84 pagesCrimpro - Warrantless ArrestMarie Mariñas-delos Reyes50% (2)

- Volume 42, Issue 5 - February 4, 2011Document48 pagesVolume 42, Issue 5 - February 4, 2011BladeNo ratings yet

- Serban Nichifor: Forbidden Forest Interludes 1936-1939Document13 pagesSerban Nichifor: Forbidden Forest Interludes 1936-1939Serban NichiforNo ratings yet

- نموذج استلام عهدة 136 - Custody Receipt Form TOOL & EQUIPMENTDocument1 pageنموذج استلام عهدة 136 - Custody Receipt Form TOOL & EQUIPMENTmctmcNo ratings yet

- Philippine Education and Development Throughout HistoryDocument107 pagesPhilippine Education and Development Throughout HistoryZiennard GeronaNo ratings yet

- Dr. Faustus As Tragic HeroDocument2 pagesDr. Faustus As Tragic HeroNour FalasteenNo ratings yet

- XI Legal StudiesDocument18 pagesXI Legal StudiesShreyaDixitNo ratings yet

- TM-3534 AVEVA 12-1 - Diagrams AdministrationDocument108 pagesTM-3534 AVEVA 12-1 - Diagrams AdministrationWelingtonMoraesNo ratings yet

- Rbi Guidelines On NRODocument6 pagesRbi Guidelines On NROGahininathJagannathGadeNo ratings yet

- Handbook of Quality Procedures Before EPO enDocument73 pagesHandbook of Quality Procedures Before EPO enaffashNo ratings yet

- FULL Download Ebook PDF International Corporate Governance by Marc Goergen PDF EbookDocument37 pagesFULL Download Ebook PDF International Corporate Governance by Marc Goergen PDF Ebookdwayne.lancaster40797% (30)

- Kautilya and Modern EconomicsDocument5 pagesKautilya and Modern EconomicssreejithNo ratings yet

- Edited-Preschool LiteracyDocument22 pagesEdited-Preschool LiteracyEdna ZenarosaNo ratings yet

- Judicial Interference ComplaintDocument6 pagesJudicial Interference ComplaintNC Policy WatchNo ratings yet

- Legitimacy: Importance & Sources: Submitted By:-Mranal SharmaDocument13 pagesLegitimacy: Importance & Sources: Submitted By:-Mranal Sharmamranal sharmaNo ratings yet