Professional Documents

Culture Documents

Audited Financials Dec 2022

Uploaded by

EdwinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audited Financials Dec 2022

Uploaded by

EdwinCopyright:

Available Formats

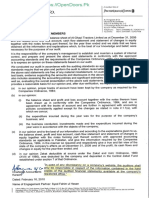

KENYA WOMEN MICROFINANCE BANK PLC

AUDITED FINANCIAL STATEMENTS AS AT 31 DECEMBER 2022

GROUP BANK

31-Dec-2022 31-Dec-2021 31-Dec-2022 31-Dec-2021

A) STATEMENT OF PROFIT OR (LOSS) AND KShs. '000' KShs. '000' KShs. '000 KShs. '000'

1.0

OTHER COMPREHENSIVE INCOME

Income Access to financing of

insurance premiums

1.1 Interest on Loan Portfolio 4,034,756 4,294,305 4,034,756 4,294,305

1.2 Fees and Commissions on Loans 599,777 991,532 535,914 928,779

1.3 Government Securities 912 629 - -

with KWFT Bima Loan

1.4 Deposit and Balances with Banks and Financial Inst. 256,673 229,320 251,952 220,601

1.5 Other Investments - - 24,575 102,923

1.6 Other Operating Income 592,700 149,112 592,452 145,289

1.7 Non - Operating Income 14,443 2,398 14,443 2,398

1.8 Total Income 5,499,261 5,667,296 5,454,092 5,694,296

2.0 Expenses - -

2.1 Interest and Fee Expense on Deposits 1,186,140 968,915 1,186,140 968,915

2.2 Other Fees and Commissions expense 22,935 56,919 22,935 56,919

2.3 Provision for Loan Impairment 195,699 89,728 195,699 89,728

2.4 Staff Costs 1,699,623 1,740,917 1,683,133 1,706,721

2.5 Director’s Emoluments 148,191 125,730 148,191 125,730

2.6 Rental Charges 272,076 301,646 272,076 301,646

2.7 Depreciation Charges 274,815 387,666 274,523 387,308

2.8 Amortization Charges 64,453 63,582 63,459 63,412

2.9 Other Administrative Expense 1,213,316 1,091,668 1,207,668 1,069,930

2.10 Non-Operating Expense - - - -

2.11 Total Expenses 5,077,248 4,826,771 5,053,824 4,770,309

3.0 Operating Profit 422,013 840,525 400,268 923,987

4.0 Interest and Fee Expense on Borrowings 503,547 788,102 503,547 788,102

4.1 Net Foreign Exchange Loss/(gain) (28,756) 15,421 (28,756) 15,421

5.0 Profit (Loss) before Tax (52,777) 37,002 (74,523) 120,463

6.0 Current Tax (18,336) 18,243 (4,333) 26,369

7.0 Net Profit / (Loss) After Taxes and Before Donations) (71,113) 55,245 (78,855) 146,832

8.0 Grant Income 21,946 46,228 21,946 46,228

9.0 Net Profit/(Loss) After Taxes (49,167) 101,473 (56,909) 193,060

-

Other Comprehensive Income 137,473 - 137,473 -

Revaluation surplus (41,242) - (41,242) -

Deferred Tax on Revaluation surplus 47,064 101,473 39,322 193,060

B) STATEMENT OF FINANCIAL POSITION

1.0 ASSETS

1.1 Cash and bank balances 2,364,670 1,976,914 2,364,670 1,976,914

1.2 Short term deposits with banks 3,343,218 3,990,110 3,343,218 3,990,110

1.3 Government securities 10,084 10,084 - -

1.4 Advances to customers 15,809,923 15,128,945 15,809,923 15,128,945

1.5 Due from related organisations - - - -

1.6 Other receivables 584,171 429,000 606,046 445,798

1.7 Tax Recoverable 281,084 257,573 272,253 241,536

1.8 Deferred Tax 434,723 477,911 434,062 475,304

1.9 Other investment 10,000 10,000 10,000 10,000

1.10 Investment in associate company 1,000 1,000

1.11 Intangible assets 168,753 193,275 165,115 190,540

1.12 Right of use 593,195 699,925 593,195 699,925

1.13 Property and equipment 3,730,430 3,802,237 3,729,153 3,800,522

1.14 Total Assets 27,330,250 26,975,974 27,328,634 26,960,594

2.0

2.1

LIABILITIES

Customer deposits 18,540,013 17,682,606 18,596,849 17,737,476

Benefits

2.2 Borrowings 4,603,460 5,384,856 4,603,460 5,384,856

2.3 Deferred income - - - - • Lifts the burden of lump sum insurance

2.4 Deferred tax liability - - - -

2.5

2.6

Tax payable

Lease liability

-

675,634

-

783,626

-

675,634

-

783,626

premium payment

• Immediate access to annual insurance

2.7 Due to related organisations - - - -

2.8 Other liabilities 885,211 546,017 859,626 500,894

2.9 Total Liabilities 24,704,318 24,397,106 24,735,571 24,406,853

3.0 SHARE CAPITAL & RESERVES

cover

3.1 Share capital 185,929 185,929 185,929 185,929

3.2 Share premium 2,850,824 2,850,824 2,850,824 2,850,824 • Flexible repayment period for the

3.3 Retained earnings (529,167) (504,562) (562,036) (529,689)

3.4

3.5

Revaluation reserve

Statutory reserve

96,231

17,128

-

46,676

96,231

17,128

-

46,676

insurance premium

4,987

• Flexible mode of payment e.g Postdated

3.5 Other reserves 4,987

3.7 Total Shareholders' funds 2,625,932 2,578,868 2,593,063 2,553,741

4.0 TOTAL LIABILITIES AND EQUITY 27,330,250 26,975,974 27,328,634 26,960,594 cheques, standing oders

C) OTHER DISCLOSURES

1 NON-PERFORMING LOANS AND ADVANCES • Valuation of vehicles is free

(a) Gross Non-Performing Loans and Advances 4,413,496 4,255,478

(b)

Less:

Interest in Suspense

-

-

-

-

• Enhances business cash flow

4,413,496

(c)

(d)

Total Non-Performing Loans and Advances (a-b)

Impairment Loss Allowance 749,833

4,255,478

614,746 management

(e) Net Non-Performing Loans (c-d) 3,663,663 3,640,732

(f) Realizable Value of Securities 3,579,093 3,570,553

(g) Net NPLs Exposure (e-f) 84,570 70,179

Repayment Period

2 INSIDER LOANS AND ADVANCES

78,060 123,665

(a) Directors, Shareholders and Associates

131,107 190,137

(b) Employees

209,167 313,802

• Minimum 6 months

(c) Total Insider Loans, Advances and Other Facilities

3 OFF-BALANCE SHEET ITEMS

(a) Guarantees and Commitments 139,878 144,746

(b)

(c)

Other Contingent Liabilities

Total Contigent Liabilities

18,949

158,827

30,344

175,089

• Maximum of 10 months

4 CAPITAL STRENGTH

(a) Core Capital 2,044,642 2,030,761

(b) Minimum Statutory Capital 60,000 60,000

(c) Excess/(Deficiency) (a-b) 1,984,642 1,970,761

(d) Supplementary Capital 808,579 1,069,814 Visit any of our 229 KWFT offices countrywide today or call

(e) Total Capital (a+d) 2,853,221 3,100,575 us on our 24hr hotline 0703 067 700 / 0730 167 700

(f) Total Risk Weighted Assets 20,066,458 19,313,442

11.0% 11.4%

(g) Core Capital/ Total Deposit Liabilities The above statement of Profit or Loss and Other Comprehensive Income and Statement of

8.0% 8.0%

(h) Minimum Statutory Ratio Financial Position are extracts of the Company's Financial statements as audited by

3.0% 3.4%

(i) Excess/(Deficiency) (g-h)

10.2% 10.5% Deloitte & Touche and received an unqualified opinion.

(j) Core Capital/ Total Risk Weighted Assets

(k) Minimum Statutory Ratio 10.0% 10.0%

0.2% 0.5% The financial statements were approved by the Board of Director on 24th March 2023 and

(l) Excess/(Deficiency) (j-k)

(m) Total Capital/ Total Risk Weighted Assets 14.2% 16.05% signed on its behalf by

(n) Minimum Statutory Ratio 12.0% 12.0%

(O) Excess/(Deficiency) (m-n) 2.2% 4.1% Mr. Mwangi Githaiga Dr. Jaine Mwai

Adjusted Core Capital/ Total Deposit Liabilities* 11.0% 11.5% Managing Director Chairperson

Adjusted Core Capital/Total Risk Weighted Assets* 10.2% 10.6%

Adjusted Total Capital/ Total Risk Weighted Assets* 14.1% 16.1%

5 LIQUIDITY

(a) Liquidity Ratio 19.5% 25.6%

(b) Minimum Statutory Ratio 20.0% 20.0%

(c) Excess/(Deficiency) (a-b) -0.5% 5.6%

Kenya Women Microfinance Bank is Regulated by the Central Bank of Kenya

You might also like

- Cash Flow Analysis and StatementDocument127 pagesCash Flow Analysis and Statementsnhk679546100% (6)

- Dynamic Asset AllocationDocument7 pagesDynamic Asset AllocationdraknoirrdNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- Preliminary Due Diligence ChecklistDocument7 pagesPreliminary Due Diligence Checklistekatamadze1972No ratings yet

- Payslip Details for Amit Chaudhary in February 2011Document1 pagePayslip Details for Amit Chaudhary in February 2011Parveen KumarNo ratings yet

- Financial Institutions Analysis of SwitzerlandDocument66 pagesFinancial Institutions Analysis of Switzerlandmizan5150% (2)

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Med NetDocument3 pagesMed Netnitin_munNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- UBL Annual Consolidated Financial Statments 2022Document92 pagesUBL Annual Consolidated Financial Statments 2022abdullahazaim55No ratings yet

- United Bank 2021 Financial ResultsDocument91 pagesUnited Bank 2021 Financial ResultsAftab JamilNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Numinus FS Q1 Nov 30, 2022 FINALDocument26 pagesNuminus FS Q1 Nov 30, 2022 FINALNdjfncnNo ratings yet

- Preparation of Financial StatementsDocument12 pagesPreparation of Financial StatementsPrincessNo ratings yet

- Indus Motor Company Ltd. Financial Statement AnalysisDocument4 pagesIndus Motor Company Ltd. Financial Statement AnalysisTaha AfzalNo ratings yet

- Consolidated Financial Statements Mar 09Document15 pagesConsolidated Financial Statements Mar 09Naseer AhmadNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- HBL Financial Statements for the nine months ended September 30, 2022Document69 pagesHBL Financial Statements for the nine months ended September 30, 2022Irfan MasoodNo ratings yet

- Balance Sheet & P & LDocument3 pagesBalance Sheet & P & LSatish WagholeNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- Kel Annual AccountsDocument14 pagesKel Annual AccountsmrordinaryNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- First Bank of Nigeria Unaudited Balance Sheet June 2010Document1 pageFirst Bank of Nigeria Unaudited Balance Sheet June 2010Kunle AdegboyeNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- Rafiki MFB Audited Financials FY 2022 31.03.2023Document1 pageRafiki MFB Audited Financials FY 2022 31.03.2023EdwinNo ratings yet

- Financial Statement Analysis and WACC CalculationDocument4 pagesFinancial Statement Analysis and WACC CalculationSergio Andres Cortes ContrerasNo ratings yet

- NIB Bank Unconsolidated Financial StatementsDocument77 pagesNIB Bank Unconsolidated Financial StatementsMUHAMMAD IQBALNo ratings yet

- VIB - Section2 - Group5 - Final Project - ExcelDocument70 pagesVIB - Section2 - Group5 - Final Project - ExcelShrishti GoyalNo ratings yet

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocument6 pagesHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKNo ratings yet

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Document3 pagesStatement of Financial Position Statement of Profit or Loss: As at 30 June 2021 For The Year Ended 30 June 2021Saljook AslamNo ratings yet

- HUBCO Financial Statements Analysis 2015-2020Document97 pagesHUBCO Financial Statements Analysis 2015-2020Omer CrestianiNo ratings yet

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Document7 pagesUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Sonali Bank Balancesheet 2019Document9 pagesSonali Bank Balancesheet 2019DHAKA COLLEGENo ratings yet

- Unaudited Financial Results (Quarterly)Document1 pageUnaudited Financial Results (Quarterly)Rubin PoudelNo ratings yet

- Year Ended December 31, 1994 1995 1996 1997 1998 1999Document19 pagesYear Ended December 31, 1994 1995 1996 1997 1998 1999NISCHAL UPRETINo ratings yet

- 2006 BafDocument3 pages2006 BafGulraiz HanifNo ratings yet

- Pakistan Petroleum LTDDocument43 pagesPakistan Petroleum LTDMuheeb AhmadNo ratings yet

- Chapter 2Document32 pagesChapter 2AhmedNo ratings yet

- Dialog Axiata Q4 2021 Financial ResultsDocument15 pagesDialog Axiata Q4 2021 Financial ResultsgirihellNo ratings yet

- Consolidated Financial Statements Mar 11Document17 pagesConsolidated Financial Statements Mar 11praynamazNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Financial Statements 2021Document6 pagesFinancial Statements 2021Shehzad QureshiNo ratings yet

- 17 Philguarantee2021 Part4b Akpf FsDocument4 pages17 Philguarantee2021 Part4b Akpf FsYenNo ratings yet

- Lady Case Exhibit SBR 1Document7 pagesLady Case Exhibit SBR 1Kanchan GuptaNo ratings yet

- XLS EngDocument5 pagesXLS EngBharat KoiralaNo ratings yet

- NRSP Microfinance Bank Limited Balance Sheet and Profit & Loss HighlightsDocument15 pagesNRSP Microfinance Bank Limited Balance Sheet and Profit & Loss Highlightsshahzadnazir77No ratings yet

- AGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKDocument30 pagesAGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKMubashar TNo ratings yet

- Tab D - Detailed Financial StatementsDocument13 pagesTab D - Detailed Financial Statementsarellano lawschoolNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- FAUJI FOOD 30 JUNE 2023Document3 pagesFAUJI FOOD 30 JUNE 2023mrordinaryNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- Financial Statement SingerDocument13 pagesFinancial Statement SingerAnuja PasandulNo ratings yet

- The Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Document13 pagesThe Bank of Punjab: Interim Condensed Balance Sheet As at September 30, 2008Javed MuhammadNo ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- 09 Philguarantee2021 Part1 FsDocument5 pages09 Philguarantee2021 Part1 FsYenNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Hand Protection PLC Financial ReportDocument8 pagesHand Protection PLC Financial ReportasankaNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- Form PDF 157539400270722Document41 pagesForm PDF 157539400270722Vidushi JainNo ratings yet

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- An Introduction To Basic Farm Financial Statements: Income StatementDocument11 pagesAn Introduction To Basic Farm Financial Statements: Income StatementAbdi Aliyi100% (1)

- G. Manasa YadavDocument8 pagesG. Manasa YadavmubeenuddinNo ratings yet

- Scotia Sensitivities DeckDocument22 pagesScotia Sensitivities DeckForexliveNo ratings yet

- Warrant Buffet: Investment StrategyDocument16 pagesWarrant Buffet: Investment StrategyYassir SlaouiNo ratings yet

- Role of Commercial Banks in The Economic Development of IndiaDocument5 pagesRole of Commercial Banks in The Economic Development of IndiaGargstudy PointNo ratings yet

- ) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not DeterminedDocument20 pages) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not Determinedايهاب غزالةNo ratings yet

- AKM - Kelompok 5Document8 pagesAKM - Kelompok 5lailafitriyani100% (1)

- Centralization and Decentralization in Purchasing ManagementDocument4 pagesCentralization and Decentralization in Purchasing ManagementhammadNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- Invoice 26Document2 pagesInvoice 26asim khanNo ratings yet

- 2014 Complete Annual Report PDFDocument264 pages2014 Complete Annual Report PDFChaityAzmeeNo ratings yet

- Branch and Unit BankingDocument1 pageBranch and Unit BankingSheetal Thomas100% (1)

- CowlDocument3 pagesCowlPrasetyo Indra SuronoNo ratings yet

- KPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The BasicsDocument40 pagesKPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The Basicshui7411No ratings yet

- Question Bank 2019 With AnswersDocument373 pagesQuestion Bank 2019 With AnswersAkhil MadavanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Omkesh PanchalNo ratings yet

- Society GeneralDocument11 pagesSociety GeneralSadia JafriNo ratings yet

- Final Ojt ReportDocument57 pagesFinal Ojt ReportLove GumberNo ratings yet

- Checkout - Y-StrapDocument3 pagesCheckout - Y-Strapsup nessNo ratings yet

- Life and Death Outline Natalie ChoateDocument27 pagesLife and Death Outline Natalie ChoateHilton GrandNo ratings yet

- Sterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Document2 pagesSterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Sterling Bank PLCNo ratings yet

- Integrated and Non Integrated System of AccountingDocument46 pagesIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)