Professional Documents

Culture Documents

Where Did The Money Go?: Where Is Investment Flowing in

Where Did The Money Go?: Where Is Investment Flowing in

Uploaded by

Shivam JadhavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Where Did The Money Go?: Where Is Investment Flowing in

Where Did The Money Go?: Where Is Investment Flowing in

Uploaded by

Shivam JadhavCopyright:

Available Formats

WHERE IS

INVESTMENT FLOWING IN

EDUCATION TECHNOLOGY?

Venture capital investment Technology holds enormous promise for education. It can:

in education technology

(ed-tech) has soared

over the last five

years. A breakdown of the personalize increase access engage the achieve scale

spending over time reveals and enhance

student

to a high-quality

education

disengaged at lower cost

pockets of intense attention learning

as well as areas of dramatic

concentration. Understand-

ing these patterns will help $4.5 $ 32%

investors and companies billion Compound annual growth

rate (CAGR) for total private

chart their future course. Total private investment investment in ed-tech from

in ed-tech in 2015 2011 through 2015

A network analysis of the

connections between

individual ed-tech

WHERE DID THE company investments at

MONEY GO? three points in

time shows growth in

segments of the market.

Large, dense clusters of

the same color indicate

segments receiving a high

degree of investor

INVESTMENTS ARE attention.

GROWING MORE 1995 COMPANIES

781

CONCENTRATED… Early players include providers and

distributors of digital content.

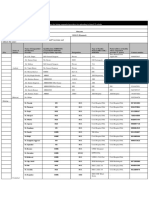

…by segment of the market

Number of Private investment

companies 2011–2015

in 2015 (CAGR)

Multimedia content $2.3B

delivery and platforms 343

(34%)

Online courses and $1.9B

tutoring 421 (19%)

Business management $1.9B

and financial 179 (127%)

technologies

Systems management,

2005 1,587

COMPANIES

$1.5B

security, and 305 Emerging areas include blended

(10%)

infrastructure learning and LMS tools and business

management and financial technologies.

Higher education

programs and services 222

$0.8B

(49%)

64%

of investment

Blended learning and $0.8B

learning management 433 (20%)

system (LMS) tools

Language and literacy $0.7B

programs 125 (97%)

Academic-standards- $0.7B

based and Common 331 (100%)

Core programs

Adaptive curricula and $0.6B

92

machine learning (46%)

Social platforms and $0.5B

56

learning communities (7%)

2015 3,163

COMPANIES

Programs for special- $0.5B Games, social platforms and learning

needs populations 103

(–1%) communities, and language and literacy

programs emerge.

Career and vocational $0.4B

133

education (27%)

Games $0.2B

112

(–6%)

Providers and distri- $0.2B

butors of curricula and 294

(–3%)

educational materials

14 <$0.1B

Interactive stimulators

(–100%)

and sensors

INVESTMENTS ARE

ALSO GROWING MORE

CONCENTRATED...

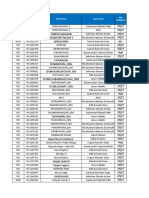

…by sector …by country

The preschool through secondary school

Private investment (2011–2015) 97%

(Share of total investment) of investments were

market has received the most investment concentrated in

5

from 2011 through 2015, but higher

education has grown the fastest as a

percentage of total investment, led by rapid

growth in online learning and business US Canada countries

management and financial technologies. $10.1B $0.4B

(77%) (3%)

UK India China

Share of total investment

$0.2B $0.6B $1.2B

(Private investment) (2%) (5%) (10%)

2011

50% 11% 20% 19% <1%

($736M) ($161M) ($289M) ($288M) ($4M)

2015

3

Preschool Alternative

Adult

OUT 4 DOLLARS

through school

secondary learning 2%

school 14% ($102M) went to US ed-tech companies from 2011 through 2015

35% ($629M)

($1,608M) Higher The rest of the world faces major challenges—and

education Other institutional

19% important opportunities—in catching up to these

30%

($1,348M) ($857M) leading recipients of ed-tech investment.

HOW TO NAVIGATE

THE FUTURE OF

EDUCATION TECHNOLOGY

Place focused bets Embrace blended Grow strategically

Invest in areas of the learning Scale up projects in

market where education Connect the virtual one geographic area

technology can achieve a and physical worlds in before considering

balance of lower costs and ways that measurably international

improved student improve learning. expansion targeted

outcomes. to local needs.

NOTES AND SOURCES

This infographic is based on BCG research conducted as part of New Vision for Education: Fostering Social and Emotional Learning through Technology, a report

from the World Economic Forum, written in collaboration with BCG.

Our definition of education technology comprises the following sectors: preschool through secondary school, higher education, adult learning, other

institutional, and alternative school. Investment in the “other institutional” segment includes mostly business management and systems management

technologies. Investment in consumer products is spread across all five categories but is concentrated in the preschool through secondary school segment.

Data comes from Capital IQ and company websites and includes investments from January 1, 2011, through December 31, 2015. Detailed breakdowns of

education technology investments come from using specific keywords and filters in the Quid software tool to identify the ed-tech space.

Read BCG’s latest insights, analysis, and viewpoints at bcgperspectives.com

© The Boston Consulting Group, Inc. 2016. All rights reserved.

To find the latest BCG content and register to receive e-alerts on this topic or others,

please visit bcgperspectives.com. Please direct questions to socialmedia@bcg.com.

You might also like

- Blume Ventures Edtech Report OptDocument77 pagesBlume Ventures Edtech Report OptRajan GulatiNo ratings yet

- Inc42 Edtech Report SampleDocument19 pagesInc42 Edtech Report SampleAjai Srivastava67% (3)

- AAR L1 TM Sample PDFDocument119 pagesAAR L1 TM Sample PDFShailyn Rincon de HernandezNo ratings yet

- PSAT 2019 - Oct 16 With AnswersDocument54 pagesPSAT 2019 - Oct 16 With AnswersHassan MahmoudiNo ratings yet

- (External) Blume Ventures EdTech ReportDocument77 pages(External) Blume Ventures EdTech ReportSatya SagarNo ratings yet

- Where You May Get It Wrong When Writing EnglishDocument219 pagesWhere You May Get It Wrong When Writing EnglishShivam JadhavNo ratings yet

- Blume Edtech Report 2022Document68 pagesBlume Edtech Report 2022enpass100% (1)

- Marketing Strategy Project Assignment Final1921 - 5 - 6 - 920210313101901Document8 pagesMarketing Strategy Project Assignment Final1921 - 5 - 6 - 920210313101901Shivam JadhavNo ratings yet

- All JD 2019 For StudentsDocument110 pagesAll JD 2019 For StudentsShivam JadhavNo ratings yet

- TLE - Interpret Layout Areas of Front Office ReceptionDocument17 pagesTLE - Interpret Layout Areas of Front Office Receptionlor roa50% (2)

- Swot & PestelDocument4 pagesSwot & PestelUrvashi AroraNo ratings yet

- Format For Listing Empaneled Providers For Uploading in State/UT WebsiteDocument8 pagesFormat For Listing Empaneled Providers For Uploading in State/UT WebsiteVijay KumarNo ratings yet

- The DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationFrom EverandThe DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySuci Putri LNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySan Yee Mon KyawNo ratings yet

- NBPE Investor Presentation - April 2023vFDocument50 pagesNBPE Investor Presentation - April 2023vFAvinash sinyalNo ratings yet

- Information Economics: Frans Richard Kodong, S.T., M.KomDocument75 pagesInformation Economics: Frans Richard Kodong, S.T., M.KomMs VioletNo ratings yet

- Centra Software-Case PresentationDocument11 pagesCentra Software-Case PresentationIIMB SumitNo ratings yet

- Wei2018 Copy 3Document1 pageWei2018 Copy 3newc1236No ratings yet

- Information Technology's Impact On Business Performance As Measured by TOBIN'SQDocument4 pagesInformation Technology's Impact On Business Performance As Measured by TOBIN'SQInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Special Note: Financing Deep TechDocument8 pagesSpecial Note: Financing Deep TechMyGoalsNo ratings yet

- The Investors That Matter Still Want You To Focus On The Long TermDocument5 pagesThe Investors That Matter Still Want You To Focus On The Long TermAzNo ratings yet

- DI CIO-Insider Tech-BudgetsDocument11 pagesDI CIO-Insider Tech-BudgetsjrmiztliNo ratings yet

- Analysis From A Hackett ReportDocument22 pagesAnalysis From A Hackett ReportSharma AkshayNo ratings yet

- Axiata IAR2022Document119 pagesAxiata IAR2022Priscilla KitNo ratings yet

- The Muggles - The Product AlchemyDocument7 pagesThe Muggles - The Product Alchemypriyansh.y2028iNo ratings yet

- Component Business Models - IBMDocument19 pagesComponent Business Models - IBMapi-3826257No ratings yet

- Technology: TCS/INFY FY21 AR Analysis: A Year of Digital AccelerationDocument12 pagesTechnology: TCS/INFY FY21 AR Analysis: A Year of Digital AccelerationdevaNo ratings yet

- Mumbai Angels - IntroDocument22 pagesMumbai Angels - IntroamarmaaNo ratings yet

- Inc42 Edtech Report UpdatedDocument79 pagesInc42 Edtech Report UpdatedShillong HoaxNo ratings yet

- Improving Smes Performance Through Supply Chain Flexibility and Market Agility: It Orchestration PerspectiveDocument13 pagesImproving Smes Performance Through Supply Chain Flexibility and Market Agility: It Orchestration PerspectiveAli ZakirNo ratings yet

- Bouwmanetal. DefinitiefDocument22 pagesBouwmanetal. DefinitiefShree SellerNo ratings yet

- Startups Beyond BordersDocument6 pagesStartups Beyond Borderscassandraoll92No ratings yet

- Tech Mahindra: CMP: INR496 Betting On Mega TrendsDocument6 pagesTech Mahindra: CMP: INR496 Betting On Mega TrendsNishant JainNo ratings yet

- Aditum Venture Capital Fund FlyerDocument2 pagesAditum Venture Capital Fund FlyerAdil KhanNo ratings yet

- Elearning Battle Card PDFDocument5 pagesElearning Battle Card PDFJOOOOONo ratings yet

- Digital Telecommunication Revolution Innovation KPMG Oct 2018Document104 pagesDigital Telecommunication Revolution Innovation KPMG Oct 2018jagdeepsethiNo ratings yet

- Materiality Matrix: Methodology: 1. Identification of Main ChallengesDocument2 pagesMateriality Matrix: Methodology: 1. Identification of Main ChallengesAnkit SinghalNo ratings yet

- InfralinePlus April2017Document76 pagesInfralinePlus April2017SurendranathNo ratings yet

- Digital Transformation in The Defense IndustryDocument23 pagesDigital Transformation in The Defense IndustrysemanurbiladaNo ratings yet

- IT Consolidation Report (Final)Document7 pagesIT Consolidation Report (Final)Rafizah Md DaudNo ratings yet

- Gbs313-White Paper-Ph 829 19027819USENDocument18 pagesGbs313-White Paper-Ph 829 19027819USENAYU SINAGANo ratings yet

- CAIXABANK Iberian Conference T TECH PDFDocument22 pagesCAIXABANK Iberian Conference T TECH PDFJuan CarlosNo ratings yet

- Ford and Terris, Knowledge Design in Smaal FirmDocument14 pagesFord and Terris, Knowledge Design in Smaal FirmFerra Maryana StienasNo ratings yet

- Tata Consultancy Services: Selling CertaintyDocument10 pagesTata Consultancy Services: Selling CertaintyPraharsh ShahNo ratings yet

- Divide and Conquer: Rethinking IT StrategyDocument10 pagesDivide and Conquer: Rethinking IT Strategyg_gaviriaNo ratings yet

- LinkedIn Learning-Strategy Tradeoffs at A Multi-Sided PlatformDocument33 pagesLinkedIn Learning-Strategy Tradeoffs at A Multi-Sided PlatformFertuNo ratings yet

- BlueBox Funds - BlueBox Global Technology FundDocument2 pagesBlueBox Funds - BlueBox Global Technology Fundfilipe.game.97No ratings yet

- Digital Business Management BrochureDocument8 pagesDigital Business Management BrochureULTIMATE SUPER HERO SERIES USHSNo ratings yet

- Module 4-6-Training For AI Ethics - Bangkok & Indonesia Feb Mar 2023 - FinalDocument100 pagesModule 4-6-Training For AI Ethics - Bangkok & Indonesia Feb Mar 2023 - FinalRachell Ann UsonNo ratings yet

- Digital Business Management BrochureDocument8 pagesDigital Business Management Brochuresaarthakt57No ratings yet

- Next in Insurance Overview 01 04 22Document9 pagesNext in Insurance Overview 01 04 22verdiNo ratings yet

- 2012 Digital Marketing Conferences May21Document5 pages2012 Digital Marketing Conferences May21nirbandubaiNo ratings yet

- Interactive Entertainment and Metaverses: Report 3Document11 pagesInteractive Entertainment and Metaverses: Report 3YouTubePocket PocketNo ratings yet

- Annual Report 2018 2019Document253 pagesAnnual Report 2018 2019Ankaj AroraNo ratings yet

- NIIT Investor Presentation - November 2019Document37 pagesNIIT Investor Presentation - November 2019Kallol MukherjeeNo ratings yet

- 2021 in Retrospect PresentationDocument17 pages2021 in Retrospect PresentationshravshankarNo ratings yet

- How Does The Positioning of Information Technology Firms in StratDocument35 pagesHow Does The Positioning of Information Technology Firms in StratjuanlusNo ratings yet

- Annual Report FY23Document287 pagesAnnual Report FY23Preethi LoganathanNo ratings yet

- Swot & PestelDocument4 pagesSwot & PestelUrvashi Arora100% (1)

- DI TMT Digital Transformation Series No 11 Digital Platform As Growth LeverDocument20 pagesDI TMT Digital Transformation Series No 11 Digital Platform As Growth LeverAnh VuNo ratings yet

- Powered by Data: Digital Transformation in Aerospace & DefenseDocument9 pagesPowered by Data: Digital Transformation in Aerospace & DefenseAli YurNo ratings yet

- D.A. Davidson Automotive Technology ReportDocument23 pagesD.A. Davidson Automotive Technology ReportStanosNo ratings yet

- Battery Ventures State of Cloud Software Spending Report March 2023Document48 pagesBattery Ventures State of Cloud Software Spending Report March 2023xyzNo ratings yet

- Strategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementFrom EverandStrategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementNo ratings yet

- Strategic IT Leadership - Leading High-Performing Teams and Driving Business GrowthFrom EverandStrategic IT Leadership - Leading High-Performing Teams and Driving Business GrowthNo ratings yet

- Business Development Associate JDDocument2 pagesBusiness Development Associate JDShivam JadhavNo ratings yet

- GD Topics 1Document2 pagesGD Topics 1Shivam JadhavNo ratings yet

- Defect Free Unique Site Count From Oct 20 To Jan 21Document8 pagesDefect Free Unique Site Count From Oct 20 To Jan 21Shivam JadhavNo ratings yet

- Unschoolers Report (Responses)Document3 pagesUnschoolers Report (Responses)Shivam JadhavNo ratings yet

- A and B Can Do A Piece of Work in 72 DaysDocument2 pagesA and B Can Do A Piece of Work in 72 DaysShivam JadhavNo ratings yet

- Revisiting Customer Analytics Capability For Data-Driven RetailingDocument13 pagesRevisiting Customer Analytics Capability For Data-Driven RetailingShivam JadhavNo ratings yet

- Q) Explain RAMI 4.0 in Brief With ExampleDocument1 pageQ) Explain RAMI 4.0 in Brief With ExampleShivam JadhavNo ratings yet

- Layba's Offer LetterDocument1 pageLayba's Offer LetterShivam JadhavNo ratings yet

- Kesavananda Bharti Sripadagalavaru vs. State of Kerala, 1973Document3 pagesKesavananda Bharti Sripadagalavaru vs. State of Kerala, 1973Shivam JadhavNo ratings yet

- A Case Study On Marketing Strategy of Xiaomi: September 2019Document8 pagesA Case Study On Marketing Strategy of Xiaomi: September 2019Shivam JadhavNo ratings yet

- Sector Intelligence: Impact of COVID-19: Education and TrainingDocument8 pagesSector Intelligence: Impact of COVID-19: Education and TrainingShivam JadhavNo ratings yet

- MBA MARKETING1 - ShrinathGidde - 2019-2009-0001-0010 Indian ConstitutionDocument8 pagesMBA MARKETING1 - ShrinathGidde - 2019-2009-0001-0010 Indian ConstitutionShivam JadhavNo ratings yet

- Operations Strategy: Parameters On Which Company Is CompetingDocument3 pagesOperations Strategy: Parameters On Which Company Is CompetingShivam JadhavNo ratings yet

- ONGC Recruitment 2022 For Technician ApprenticeDocument12 pagesONGC Recruitment 2022 For Technician ApprenticeSudarshan bhadaneNo ratings yet

- Finalcip 2Document14 pagesFinalcip 2Marilyn Claudine BambillaNo ratings yet

- Resolution of ThanksDocument3 pagesResolution of ThanksJoarichNo ratings yet

- Electronics and Management Systems New2Document1 pageElectronics and Management Systems New2HariprasaathNo ratings yet

- MAT-150 Lesson Plan TemplateDocument2 pagesMAT-150 Lesson Plan Templatennpw9rjgsvNo ratings yet

- Mpm1d Course Outline PanchiDocument1 pageMpm1d Course Outline PanchiKiruNo ratings yet

- Pope, (2002) Three Approaches From Europe - Waldorf, Montessori and Reggio Emilia Solo Dos PaginassDocument4 pagesPope, (2002) Three Approaches From Europe - Waldorf, Montessori and Reggio Emilia Solo Dos PaginassBea MFNo ratings yet

- GenMath11 Q1 Mod17 KDoctoleroDocument20 pagesGenMath11 Q1 Mod17 KDoctoleroNicoleNo ratings yet

- Congruent AnglesDocument7 pagesCongruent AnglesJAMAICA ATUTUBONo ratings yet

- Catch Up Friday Plan 2Document4 pagesCatch Up Friday Plan 2Christian Dela Rosa OrdillasNo ratings yet

- Business Statistics: Module 4. Z-Test Page 1 of 7Document7 pagesBusiness Statistics: Module 4. Z-Test Page 1 of 7ArahNo ratings yet

- 2019 Grade 11 Mathematics Third Term Test Paper With Answers Western ProvinceDocument24 pages2019 Grade 11 Mathematics Third Term Test Paper With Answers Western Provincethanujadamsara2007No ratings yet

- FirstMSE 20Document1 pageFirstMSE 20Kaushal BaldhaNo ratings yet

- Grade 8 Class Orientation PPT 2021Document66 pagesGrade 8 Class Orientation PPT 2021Charmaine Prinsipe SantosNo ratings yet

- Scoring and Interpretation of Test ScoresDocument13 pagesScoring and Interpretation of Test ScoresSarimNo ratings yet

- Lighthouse-Maths-Information-Pack 2022Document7 pagesLighthouse-Maths-Information-Pack 2022api-333476717No ratings yet

- Flame Case Conference-2023Document7 pagesFlame Case Conference-2023hardiNo ratings yet

- Sri Krishna College of Engineering & Technology (Autonomous)Document1 pageSri Krishna College of Engineering & Technology (Autonomous)woodksdNo ratings yet

- Sample EDPM SBA (Scholarship)Document2 pagesSample EDPM SBA (Scholarship)ShanealNo ratings yet

- Education PsychologyDocument8 pagesEducation PsychologyIness Billyon34No ratings yet

- A2 UNIT 2 Test Answer Key StandardDocument2 pagesA2 UNIT 2 Test Answer Key StandardMartu RomeroNo ratings yet

- Ts Neet 2023 Cutt Off Marks by Considering All RoundsDocument2 pagesTs Neet 2023 Cutt Off Marks by Considering All RoundsVishnu vardhanNo ratings yet

- Marianne Ference: Early Childhood EducatorDocument1 pageMarianne Ference: Early Childhood Educatorapi-546831448No ratings yet

- Theory of ChangeDocument8 pagesTheory of ChangeThelma SalvacionNo ratings yet

- Summative Assessment in English 10: ABRA HIGH SCHOOL-Sinalang Extension Palao, Bangued, AbraDocument2 pagesSummative Assessment in English 10: ABRA HIGH SCHOOL-Sinalang Extension Palao, Bangued, AbraMichael AmoresNo ratings yet

- English Grade3 Unit8 Having Fun Number Games LESSON PLANDocument3 pagesEnglish Grade3 Unit8 Having Fun Number Games LESSON PLANЖулдыз АбишеваNo ratings yet