Professional Documents

Culture Documents

Far 6789

Far 6789

Uploaded by

King Mercado0 ratings0% found this document useful (0 votes)

13 views2 pagesOriginal Title

FAR 6789

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesFar 6789

Far 6789

Uploaded by

King MercadoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

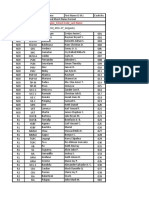

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

FINANCIAL ACCOUNTING AND REPORTING — VALDWSIY/VALIW/ESCALA/SANTOS/DELA CRUZ,

SELF TEST - LIABILITIES

1. In package of the products, an entity included coupons that may be presented at retail stores to obtain

discounts. Retailers were reimbursed for the face amount of coupons redeemed plus 10% of that

amount for handling costs, The entity honored requests for coupon redemption by retailers up to

three months after the consumer expiration date. The entity estimated that 70% of all coupons issued

would ultimately be redeemed. The consumer expiration date is December 31, 2020. The total face

amount of coupons issued was P6,000,000 and the total payments to retailers during 2020 amounted

to P2,200,000. What amount should be reported as liability for unredeemed coupons on December

31, 2020?

a, 3,080,000

b. 2,000,000

©. 2,420,000

a. 0

. An entity frequently borrowed from the bank in order to maintain sufficient operating cash. The

following loans were at a 12% interest rate with interest payable at maturity. The entity repaid each

loan on scheduled maturity date.

Date loan Amount Maturity date Term of loan

November 1, 2019 500,000 October 31, 2020 l year

February 1, 2020 1,500,000 July 31,2020 6 months

May 1, 2020 3,000,000 January 31, 2021 9 months

The entity recorded interest expense when the loans are repaid. As a result, interest expense of

P150,000 was recorded in 2020. If no correction is made, by what amount would interest expense

be understated for 2020?

a. 380,000

b. 230,000

©. 240,000

d. 350,000

An entity reported in the first year of operations pretax financial income of P6,000,000. The current

‘year tax rate is 30% and the enacted rate for future years is 25%.

Tax return Accounting record

Uncollectible accounts expense 200,000 300,000

Depreciation expense 800,000 500,000

Tax exempt interest revenue - 150,000

1. Whatis the current tax expense?

a, 1,695,000

b. 1,755,000

c. 1,740,000

4. 1,600,000

2. What is the net deferred tax expense or benefit?

a. 75,000 expense

b. 25,000 benefit

50,000 expense .

4, $0,000 benefit

3. What is the total tax expense?

a. 1,755,000

b. 1,462,500

©. 1,795,000

d. 1,745,000

6789

Page 2

4. On January 1, 2020, an entity entered into an 8-year lease of a floor of building with useful life of 15

years with the following terms:

‘Annual rental for the first three years payable at the end of each year 300,000

‘Annual rental for the next five years payable at the end of each year 400,000

Implicit interest rate 10%

PV of an ordinary annuity of | at 10% for three periods 2.49

PV of an ordinary annuity of | at 10% for five periods 3.79

PV of | at 10% for three periods 0.75

1. What is the interest expense for 2020?

a. 188,400

b. 226,300

c. 151,600

d. 169,725

2. What is the lease liability on December 31, 2020?

a. 1,772,400

b. 1,649,640

c. 1,584,000

4. 1,514,604

3. What is the interest expense for 20237

a. 151,460

b. 126,606

c. 164,964

4. 200,000

5. An entity provided the following information for the current year:

Current service cost 500,000

Past service cost during the year 300,000

Interest on PBO 600,000

Interest income on plan assets 350,000

Loss on plan settlement before normal retirement date 250,000

Present value of benefit obligation settled in advance 950,000

Actual return on plan assets 850,000

‘Actuarial loss on PBO during the year 200,000

Contribution to the plan 1,500,000

Benefits paid to retirees 1,000,000

Discount or settlement rate 10%

1. What is the employee benefit expense for the current year?

a. 1,300,000

b. 1,050,000

c. 1,500,000

d. 1,100,000

nv

What is the net remeasurement of the defined benefit plan for the current year?

a. $00,000 gain

b. 500,000 loss

©. 300,000 gain

d. 300,000 loss

3. What is the fair value of plan assets at year-end?

a. 3,650,000

b. 4,650,000

c. 4,900,000

d. 5,850,000

4. What is the projected benefit obligation at year-end?

a. 5,650,000

b. 6,650,000

c. 6,400,000

d. 6,450,000

END 6789

You might also like

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- AFAR Self Test - 9003Document6 pagesAFAR Self Test - 9003King MercadoNo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- AFAR Self Test - 9004Document4 pagesAFAR Self Test - 9004King MercadoNo ratings yet

- 5 6338963844441833811Document22 pages5 6338963844441833811Phia CameroNo ratings yet

- AT.03-06 - Transaction CyclesDocument5 pagesAT.03-06 - Transaction CyclesKing MercadoNo ratings yet

- Cpar b86 Preweek - ApDocument12 pagesCpar b86 Preweek - ApKing MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchDocument24 pagesPractical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchKing Mercado100% (8)

- MAS-07 Standard Costing (Answers)Document1 pageMAS-07 Standard Costing (Answers)King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchDocument26 pagesPractical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchKing MercadoNo ratings yet

- AT.03-03 - The Accountancy ProfessionDocument4 pagesAT.03-03 - The Accountancy ProfessionKing MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesDocument20 pagesPractical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesKing Mercado100% (5)

- Code No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)Document4 pagesCode No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)King MercadoNo ratings yet

- CPAR B86 Preweek - FAR Theories 1Document10 pagesCPAR B86 Preweek - FAR Theories 1King MercadoNo ratings yet

- 1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseDocument5 pages1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseKing MercadoNo ratings yet

- Cpar b86 Preweek - at 2Document12 pagesCpar b86 Preweek - at 2King MercadoNo ratings yet

- Cpar b86 Preweek - AfarDocument14 pagesCpar b86 Preweek - AfarKing MercadoNo ratings yet

- CPAR B86 Preweek - AP Answer KeyDocument6 pagesCPAR B86 Preweek - AP Answer KeyKing MercadoNo ratings yet

- Cpar b86 Preweek - FarDocument16 pagesCpar b86 Preweek - FarKing MercadoNo ratings yet

- 1019 PRTC Afar PWDocument7 pages1019 PRTC Afar PWKing MercadoNo ratings yet

- Reasonable Reasonable Assurance AssuranceDocument26 pagesReasonable Reasonable Assurance AssuranceKing MercadoNo ratings yet

- Aicpa Aud Moderate2015Document25 pagesAicpa Aud Moderate2015King MercadoNo ratings yet

- CPAR B86 Preweek - MAS Answer KeyDocument1 pageCPAR B86 Preweek - MAS Answer KeyKing MercadoNo ratings yet

- FAR 6704 (Bullet Review)Document8 pagesFAR 6704 (Bullet Review)King MercadoNo ratings yet

- NOLOLDocument11 pagesNOLOLPaula VillarubiaNo ratings yet

- FAR Resa First PB B39 SolutionsDocument11 pagesFAR Resa First PB B39 SolutionsKing MercadoNo ratings yet

- FAR Final PB SolutionDocument4 pagesFAR Final PB SolutionKing MercadoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)