Professional Documents

Culture Documents

FOUR Igotanoffer McKinsey Cases

Uploaded by

Usman AzizCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FOUR Igotanoffer McKinsey Cases

Uploaded by

Usman AzizCopyright:

Available Formats

McKinsey Case Interview

Case Interviews

igotanoffer.com

Case interviews

Copyright © IGotAnOffer Ltd.

How to make the most of the sample cases

Our sample cases are based on past McKinsey case interviews to ensure you train

with the most realistic material possible. Here are a few tips to make the most of

them:

1. No calculator

The cases are designed to be completed by yourself or with a partner interviewing

you. In both situations, you should aim to solve the full case without a calculator

and without looking at the answer key.

2. Do cases out loud

If you are practicing by yourself, you should both play the role of the interviewer

and of the interviewee and you should speak out loud. This might sound a little odd

but candidates who force themselves to use this technique are progressing much

faster than others because it better reproduces the conditions of the interview.

3. Complete the case in 30 to 40mins

McKinsey interviews usually last between 45 and 60 minutes. The personal

experience part of the interview takes 25% of the time on average and the case

interview takes the remaining 75%. We therefore strongly advise you to complete

each of the following cases in 30 to 40 minutes.

4. Study the answer key carefully

After completing the case, you should study the answer key in details. You need to

pay attention both to the content of the answers and to the way it is communicated.

Most candidates are only focused on the content and whether they got to the right

answer. But in reality, your interviewer will also evaluate you on how you

communicate. Do not hesitate to repeat parts of the answer out loud. This will help

you develop a habit of communicating in a structured way.

5. Do cases multiple times

Finally, do the cases multiple times. You might think that you will remember the

answers, but if you wait a couple of days you probably won’t remember them very

Copyright © IGotAnOffer Ltd. 2

well. In our experience, it is better to do 20 cases and to learn a lot from them than

40 cases without spending time analysing the best way to answer them.

Doing cases a second time will enable you to keep track of your progress and to

double check that you are not making the same mistakes twice. We also

recommend that you keep a notebook where you write down what you've learned

at the end of each case. You can then refer back to it when you do a case for the

second time.

Finally, we are here to answer any of your questions, so if you get stuck trying to

understand the explanations in the answer key, just drop us a line

at: support@igotanoffer.com. We’ll be happy to fill any gaps!

Copyright © IGotAnOffer Ltd. 3

Table of Contents

Case #1 - Meditech ................................................................................................................. 5

Case #2 – Alset ......................................................................................................................15

Case #3 – Zeta Bank .............................................................................................................26

Case #4 – Quidi Market .......................................................................................................38

Case #5 - Electron .................................................................................................................49

Copyright © IGotAnOffer Ltd. 4

Case #1 - Meditech

1. Situation

Your client is a pharmaceutical company called Meditech. It supplies European

hospitals with machines to store and analyse blood at a price of approximately

$10k per machine. The profits for the whole industry have been declining over the

past two years and Meditech is looking for new ways to increase profitability.

The CEO is considering entering a new market with a device called the Gloucoskov.

People who suffer from diabetes can use this device at home in order to monitor

their glucose levels. The device will be priced at $120 and customers will also have

to purchase disposable paper stripes.

2. Framework development

What areas would you investigate to determine whether Meditech should enter this

new market?

3. Quantitative question – Data provided

Question 3.a.

Meditech wants your team to investigate if the UK could be a good market for the

Gloucoskov. What is the size of the UK market for this new product today, in two

years and in four years? Assume the price of the device will drop by 33% and 45% of

the initial price within two and four years respectively.

Question 3.b.

Your team has collected information about Meditech’s competitors in the UK. This

information is presented in the table below:

Copyright © IGotAnOffer Ltd. 5

UK sales for monitoring diabetes devices

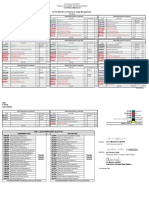

Companies 4 years 3 years 2 years 1 year ago Present

ago ago ago

A $900,000 $1,800,000 $2,600,000 $3,000,000 $3,100,000

B $1,000,000 $1,900,000 $2,500,000 $3,000,000 $3,000,000

C $500,000 $700,000 $1,200,000 $1,500,000 $1,600,000

D $1,000,000 $1,100,000 $1,200,000 $1,300,000 $1,300,000

Others $1,500,000 $1,600,000 $1,800,000 $1,850,000 $1,850,000

Total $4,900,000 $7,100,000 $9,300,000 $10,650,000 $10,850,000

What are some of the insights you can draw from this table and how could they

affect Meditech’s decision to enter the new market?

Meditech also provided you with the following information:

• R&D cost for the Gloucoskov device: $30m

• Variable cost: $40 / device

• Targeted payback period if selling the device at $120: 5 years

4. Creativity question

What are some of the things Meditech could do to make selling the Gloucoskov

devices more profitable?

5. Recommendation

After eight weeks of rigorous analysis it is time for your team to present its findings

to Meditech’s CEO. What would you tell the CEO?

Copyright © IGotAnOffer Ltd. 6

Answers

1. Situation

Before answering the framework question, you should:

• Play back the company situation

• Define the case objective

To play back the company situation, you should summarise what your interviewer

told you. This will enable you to avoid any misunderstandings. In addition, you

could also ask follow up questions that will help you get a better grip on the

situation. For instance, you could ask:

• Does Meditech design, manufacture and distribute the Gloucoskov devices?

Or does it outsource any parts of the process?

• Is the product ready to be launched or is still under development?

• Does Meditech plan to launch the product worldwide or in a specific

geography?

Prior to diving into the framework question, it is also advisable to further define the

objective of the case. Examples of questions you could ask include:

• I understand the CEO wants to increase profitability. Do we know by how

much and by when he wants to increase profitability?

• I understand the CEO wants us to focus on new markets. Can you confirm

there aren’t any other devices than the Gloucoskov he wants us to analyse?

2. Framework development

To answer framework questions, you should:

• Ask for some time to gather your thoughts

• Extract the main elements from the case question and situation

• Break down these elements into simple components

In this situation, the main elements that can be extracted from the case question

and situation include:

Copyright © IGotAnOffer Ltd. 7

A. The CEO wants to increase the company’s profitability. Analysing if the

market you are entering is profitable is therefore essential

B. In addition, entering new markets or launching new devices in healthcare

usually requires regulatory approvals. As a consequence, this area is also

likely to be very important

Let’s now breakdown these main elements into sub components:

A. Market profitability

1. Revenue

a. Number of units sold: What is the market size for diabetes devices?

Who are the biggest competitors in the market? What can Meditech do

to capture a high market share?

b. Price: Are customers willing to pay $120 for the device? Does this price

enable Meditech to recover its costs? How much does the competition

charge for similar devices?

2. Costs

a. Upfront costs: Could Meditech acquire a company to get into this new

market quicker?

b. Fixed costs: How much is Meditech expected to spend to develop its

Gloucoskov devices? Does Meditech need a new manufacturing unit

for its Gloucoskov devices?

c. Variable costs: How high are raw materials and labour costs to

manufacture the Gloucoskov device? Can Meditech take advantage of

its existing assets in order to reduce variable costs (i.e. use the same

distribution channels)?

B. Regulation

1. Regulatory approvals: Does Meditech need regulatory approvals to launch

the Gloucoskov? What are the different approvals required and the chances

of success for each approval?

2. Technology standards: Are there technological standards that Meditech

needs to respect to obtain certain certifications (E.g.: ISO)?

Copyright © IGotAnOffer Ltd. 8

3. Distribution regulation: Can Meditech sell its Gloucoskov devices directly to

customers or does it have to distribute them via third parties (E.g.:

Pharmacies)?

This framework includes a number of elements that can be prioritised in order of

importance. Here the first priority is to understand if the market is profitable. If it

isn’t then it will not be interesting for Meditech to launch the Gloucoskov devices.

However, if it is profitable, it then makes sense to worry about the regulation.

3. Quantitative question – Data provided

Question 3.a.

To answer maths questions, you should:

• Map out the calculations you are going to do

• Present your plan to your interviewer to get feedback before starting the

calculations

• Do your calculations and simplify the numbers when possible

If a plan does not come to you naturally when trying to answer the question, it is ok

to ask your interviewer for a few seconds to gather your thoughts.

Here is a potential plan you could have shown to your interviewer for this specific

question:

1. Estimate number of people with diabetes in the UK

2. Estimate number of monitoring devices sold per year

3. Estimate market value today, in two years and in four years

Let’s now do the calculations and simplify the numbers when possible:

1. Number of people with diabetes in the UK

• There are about 60m people in the UK

• The UK population can be split in 5 age groups of equal sizes assuming 75

as life expectancy. Each group can be assumed to have the same number

of people.

Copyright © IGotAnOffer Ltd. 9

o 0 – 15

o 16 – 30

o 31 – 45

o 46 – 60

o 61 – 75

• People above the age of 60 are older and therefore probably more likely

to suffer from diabetes. Let’s assume that 5% of people in this age group

suffers from the disease. For the other age groups, let’s assume that 1%

of the group is a diabetes sufferer.

• The number of diabetes sufferers in the UK is therefore:

o 60m x 20% x 5% + 60m x 80% x 1% = 1.08m people

2. Number of monitoring devices sold per year

• Assuming patients replace their monitoring kit every 10 years on average,

10% of patients will buy a new kit every year.

• The number of devices sold yearly is therefore:

o 1.08m x 10% = 108,000 or about 100,000

3. Market value today, in two years and in four years

• We can assume the suggested selling price of $120 for the Gloucoskov is

the average market price and therefore the current market size is:

a. 100,000 x $120 = $12m

b. In 2 years, the market size will be: 100,000 x $120 x (1 – 0.33) =

$8m

c. In 4 years: 100,000 x $120 x (1 – 0.45) = $6.6m

Once you found the answer to the maths question, you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

In this case, the size of the market seems to be falling rapidly. If our price

assumptions are correct, it will almost halve in 4 years. This suggests the market is

not very attractive for Meditech unless it manages to decrease its production costs

as rapidly as the price falls. A potential next step could be to analyse where this

price reduction comes from and if it is due to intense competition in the market.

Copyright © IGotAnOffer Ltd. 10

IGotAnOffer Special Tip

Assumptions

You need to make assumptions to answer this question (e.g. percentage of

diabetes sufferers in each age group). These assumptions should be anchored to

some sort of argument whenever possible (e.g. older people are more likely to

have diabetes).

Before actually diving in the calculation, you should check whether your

interviewer is ok with your assumptions or not. The easiest way to do this is

through eye contact. If you look at your interviewer you will quickly realise if he

agrees with the assumption you have just made or not.

Rounding up / down

You can round numbers up or down to make your calculations easier within

reason. A good rule of thumb is that you should not round numbers up or down

by more than 10%. As you do this you should keep an eye on your interviewers’

reactions to make sure he is comfortable with your estimates

Question 3.b.

At the start of a data interpretation question, you need to make sure you

understand the headers, axes and units of the graphs you will be interpreting.

Whenever possible, you should read tables horizontally first and focus on

extracting trends from the totals. You can then switch to reading the table vertically

to extract complimentary insights.

Here are some insights that can be extracted by reading the table horizontally:

• First of all, looking at the total market size we notice that the market has

more than doubled over the past four years. That being said, growth has

slowed down over the past two years

Copyright © IGotAnOffer Ltd. 11

• The individual companies all grew every year until a year ago. Some of them

did not grow in the past year. This is consistent with the trend observed on

the total market size and raises concerns about the attractiveness of the

market

The following trends can also be extracted by reading the table vertically:

• Four years ago, four big players of similar sizes accounted for approximately

60% of the market. The remaining 40% was probably distributed among

many smaller companies

• Three years ago, companies A and B started to clearly grow market share vs.

the rest of the competition. Today companies A and B account for about 55%

of the market. This high market concentration could raise barriers to entry

for Meditech

The information provided also indicates that Meditech intends to achieve a pay

back of five years for its investment. The number of devices that needs to be sold to

break even in five years can be calculated as follows:

• # units = Fixed cost / (Selling price – Variable cost)

= $30m / ($120 - $40) = 375k

Once you have analysed the data at hand you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

Here, Meditech needs to sell 375k units over five years and therefore 75k units on

average every year for five years to break even. The UK total market size is about

100k according to the previous question. It is therefore unrealistic for Meditech to

break even in five years by entering the UK market, as it will need to capture 75% of

the market. If Meditech wants to enter the UK market it therefore needs to lower

the cost of its Gloucoskov device to be able to break even with a lower market. This

could be the next area we focus.

4. Creativity question

Copyright © IGotAnOffer Ltd. 12

To answer creativity questions, you should:

• Ask for some time to gather your thoughts if necessary

• Develop a simple mini framework

• Brainstorm within this mini framework

In this case, we can think of two areas to make the Gloucoskov more profitable:

1. Increasing revenue by:

• Adding valuable features to the device such as a mobile app recording the

test results

• Providing a service that automatically sends stripes to the device user

before he runs out

• Launching in more markets than just the UK

2. Decreasing costs by:

• Acquiring existing players and minimising manufacturing expenses

• Selling directly to customers rather than through a network of distributors

• Outsourcing part or all the manufacturing as it decreases capital

expenditure

Once you have developed the ideas above, you should:

• Prioritise them by impact

• And highlight risks related to them if necessary

In this case, it could make sense to start by exploring ways to increase revenue, as

an important jump in profitability seems to be needed. This jump in profitability is

less likely to come from the cost side where improvements are usually incremental.

One risk the bear in mind as we explore ways to increase revenue is that some of

the ideas we listed involve upfront costs that will further decrease profitability in

the short-term.

5. Recommendation

Copyright © IGotAnOffer Ltd. 13

The recommendation is a critical part of the case. Almost without exceptions, this is

what your conclusion should contain:

1. Give your recommendation statement first

2. Then provide supporting arguments, ideally three or more

3. And finally, talk about next steps (additional analysis, potential risks, etc.)

The initial analysis indicates that Meditech should not enter the UK home-kit

diabetes market for the following reasons:

1. It needs to capture virtually the whole market to break even in five years

which is not realistic

2. The value of the home-kit diabetes market seems to be plateauing making

suggesting that competition is likely to be increasingly fierce over time

3. There are already two big players in the market (companies A and B) and it

will be difficult for a new player like Meditech to take a large share of the

market away from them

However, there are further areas that could be explored to solve Meditech’s

profitability issue:

1. It could analyse other markets than the UK

2. It could think about buying one of the existing players

3. It could also explore ways to fix the profitability of its current product

IGotAnOffer Special Tip

Note that in most cases, there is no right or wrong conclusion. As long as you

follow the method above and give a good rational for your conclusion, your

interviewer will accept it.

Outlining next steps is important. This is something all consultants do at the end

of projects to sell on the next project. Including that in your conclusion will show

your interviewer that you are aware of how actual projects work!

Copyright © IGotAnOffer Ltd. 14

Case #2 – Alset

1. Situation

Alset is the 3rd largest automotive company in the world. Alset has recently been

experiencing a decline in profitability in the SUV (Sports Utility Vehicle) category. Its

CEO wants to identify the reasons behind this decline and bring the profit margin of

the SUV category back to where it was two years ago.

Note: SUVs are large 4 by 4 vehicles originally designed to drive in the mountain or

forest. Customers in urban areas have also adopted them.

2. Framework development

What are the areas you would look at to identify the reasons for the profit margin

decline in the SUV category?

3. Quantitative question – Data provided

Question 3.a.

The CEO believes that one of the reasons for the decline in Alset’s profit margin is

the growth in manufacturing costs. He asked your team to look into each

manufacturing facility to verify his hypothesis.

Which manufacturing facility is producing at the lowest cost?

Copyright © IGotAnOffer Ltd. 15

Manufacturing Cost per Facility ($m)

Oldcastle,

1,550

Reeds, 2,800

Perminton,

2 000

Northampton,

1,400

Nacaster, 800

Facility Oldcastle Perminton Nacaster Northampton Reeds

SUVs

250,000 200,000 100,000 70,000 280,000

manufactured

Question 3.b.

A group of analysts from your team collected the data below regarding the cost per

SUV of Alset’s competitors and the total cost for each company for 2015. What are

some of the insights that can be concluded from the data?

Cost Per SUV Sold

14,000

12,000

10,000

8,000

$

6,000

4,000

2,000

0

Panther WMB Alset Ronda Gexus Nord

Manufacturing SG&A R&D

Copyright © IGotAnOffer Ltd. 16

Panther WMB Alset Ronda Gexus Nord

Total cost

11.50 14.70 11.07 11.00 12.10 13.91

($bn)

4. Creativity question

What could Alset do to increase sales in the SUV category?

5. Recommendation

Alset’s CEO is meeting your team tomorrow to discuss your findings and he wants

to know whether it’s possible for his company to increase the profit margin of the

SUV category and what they need to do in order to achieve this. What is your

recommendation?

Copyright © IGotAnOffer Ltd. 17

Answers

1. Situation

Before answering the framework question, you need to:

• Play back the company situation

• Define the case objective

To play back the company situation, you should summarise what your interviewer

told you. This will enable you to avoid any misunderstandings about the situation.

In addition, you could also ask follow up questions that will help you get a better

grip on the situation. For instance, you could ask:

• Has the decline in profit affected all categories or is it specific to SUVs?

• Have Alset’s competitors experienced similar issues?

Prior to diving into the framework question, it is also advisable to further define the

objective of the case. Examples of questions you could ask include:

• I understand the CEO wants us to get profitability back to where it was two

years ago. But how much is profitability today? And how much was it two

years ago?

• By when does the CEO want to return to historical profitability levels?

• Can you confirm we are only interested in improving the profitability of the

SUV category?

2. Framework development

To answer framework questions, you should:

• Ask for some time to gather your thoughts

• Extract the main elements from the case question and situation

• Break down these elements into simple components

In this situation, there are two potential drivers behind the decrease in profits:

A. SUV industry total profits: The SUV industry as a whole might be experiencing

difficulties which could partly explain why Alset is experiencing declining

profits

Copyright © IGotAnOffer Ltd. 18

B. Alset’s share of total profits: Alset might be underperforming and losing

ground in the SUV category against its peers

Let’s now breakdown these main elements into sub components:

A. SUV industry total profits

1. Revenues

a. Number of units: How many SUVs are sold every year? Is the

number of SUVs sold growing / shrinking?

b. Price: What is the average price of an SUV? Is the price growing /

shrinking?

c. Which company is the market leader?

2. Costs

a. What is the average cost of an SUV? Is the cost growing / shrinking?

b. Which company has got the best-cost structure?

B. Alset’s share of total profits

1. Revenues

a. Number of units: How many SUVs did Alset sell over the past few

years? Has this number been growing / shrinking?

b. Price: At what price is Alset selling its SUVs?

c. What type of SUVs does Alset market? Luxury, entry price, etc.?

2. Costs

a. What is the average production cost for an Alset SUV? Is the cost

growing / shrinking?

For this particular framework it is necessary to analyse both areas to make a

conclusion on Alset’s profits. As a consequence prioritising one part of the

framework vs. the other adds no value.

Copyright © IGotAnOffer Ltd. 19

3. Quantitative question – Data provided

Question 3.a

To answer maths questions, you should:

• Map out the calculations you are going to do

• Present your plan to your interviewer to get feedback before starting the

calculations

• Do your calculations and simplify the numbers when possible

If a plan does not come to you naturally when trying to answer the question, it is ok

to ask your interviewer for a few seconds to gather your thoughts.

Here is a potential plan you could have shown to your interviewer for this specific

question:

• Calculate the cost per SUV for each facility

• Identify the lowest cost per SUV facility

Let’s now do the calculations and simplify the numbers when possible.

The cost per SUV can be calculated by dividing the total cost of each facility by the

number of vehicles it produces:

• Oldcastle: 1,550,000 / 250 = $6,200 / SUV

• Perminton: 2,000,000 / 200 = $10,000 / SUV

• Nacaster: 800,000 / 100 = $8,000 / SUV

• Northampton: 1,400,000 / 70 = $20,000 / SUV

• Reeds: 2,800,000 / 280 = $10,000 / SUV

Oldcastle is therefore the lowest-cost facility. In fact, Oldcastle is about 70%

cheaper than Northampton; 40% cheaper than Perminton and Reeds; and 25%

cheaper than Nacaster.

Once you found the answer to the maths question, you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

Copyright © IGotAnOffer Ltd. 20

Oldcastle has managed to develop a better cost structure than other facilities. This

is particularly impressive given it is not the facility with the largest scale.

Understanding how Oldcastle manages to produce at such a low cost could

therefore help determining a path to return to profitability. Similarly, understanding

why large facilities such as Northampton produce at high cost would also prove to

be very helpful.

Potential drivers of Oldcastle good profitability include: new machinery, lower cost

of labour, cheaper real estate, etc. We could look into this as a next step in the

analysis.

Question 3.b

At the start of a data interpretation question, you need to make sure you

understand the headers, axes and units of the graphs you will be interpreting.

Whenever possible, you should read tables and graphs horizontally first and focus

on extracting trends from the totals. You can then switch to reading the table

vertically to extract complimentary insights.

In this particular case, the graph is simple enough to be analysed in one go. We can

extract the following insights:

• Manufacturing costs are the largest contributor to the total cost per SUV for

every company

• Alset has the highest cost per SUV mainly because of proportionally higher

manufacturing costs than its competitors. This confirms our previous

hypothesis that understanding why Oldcastle performs so well could help

improving profitability

• Ronda has the lowest total cost and manufacturing cost per SUV. But it also

has the highest R&D costs. This might indicate that high expenditure in R&D

leads to better product designs and therefore lower manufacturing costs.

But it might also just be that Ronda has its manufacturing facilities in areas

where labour and real estate costs are low

• Alset has both the lowest total cost and the highest cost per SUV. It is

therefore the company that sells the least number of SUVs. This indicates

Copyright © IGotAnOffer Ltd. 21

that contrary to the CEO’s assumption, Alset might have more than a cost

problem

• WMB has the highest total cost but the second to lowest cost per SUV. This

indicates it is likely to be the market leader

Once you have analysed the data at hand you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

In summary, it seems that Alset has the highest cost per SUV of the group of peers

studied. This is mainly because of high manufacturing costs that are likely to hurt

profitability. However, Alset also seems to have lower sales than their direct

competitor, which means it probably also needs to improve demand for its

products.

We have already found that analysing Oldcastle could give us ways to decrease

Alset’s costs. A potential next step could be to analyse ways in which Alset can

improve its profitability by growing revenues.

IGotAnOffer Special Tip:

You should not hesitate to summarise where your analysis is standing when you

feel you are coming to a natural transition point between questions. This will

help you keep an eye on the broader objective of the case. And it will also keep

your interviewer on board with your progress.

Consultants very often do that in client meetings or at various points during

client projects to make sure everyone is kept on the same page. This is a best

practice you should not hesitate to replicate in case interviews.

4. Creativity question

To answer creativity questions, you should:

Copyright © IGotAnOffer Ltd. 22

• Ask for some time to gather your thoughts if necessary

• Develop a simple mini framework

• Brainstorm within this mini framework

In this case, Alset could explore the following solutions to increase sales in the SUV

category:

1. Short-term:

• Increase advertising activities. This could include launching new TV

spots, or sponsoring a major automotive event or increasing spending

on online marketing and social media

• Focus on growth markets. Some countries such as China probably

experience a booming demand for SUVs and Alset needs to make sure

it is well positioned there

• Refresh the current SUV models. Slightly update the exterior and

interior designs of the current model to reflect the latest trends and

boost sales

2. Long-term:

• Identify gaps in the market. Analyse the demand for different types of

SUVs as well as the offer from the competition. And identify specific

gaps in the market that could be addressed by Alset

• Launch new SUVs in identified gaps. This could include sporty design,

connected car, new hybrid or electric motors, etc.

• Building the brand. Today’s consumers are examining more factors

when buying cars such as sustainability and corporate responsibility. It

seems important for Alset to adopt these principles and communicate

on its efforts in this space

Once you have developed the ideas above, you should:

• Prioritise them by impact

• And highlight risks related to them if necessary

Copyright © IGotAnOffer Ltd. 23

In terms of prioritisation, it makes sense to first focus on the short-term actions, as

they are easier to implement than the long-term ones. It should also be highlighted

that there are some risks involved related to these actions. The main one is that

most of them require some form of investment. As a consequence, in the very near

term these actions are likely to degrade profitability.

IGotAnOffer Special Tip:

If you do not feel that you have enough context from your interviewer to

brainstorm relevant ideas it is ok to ask a few questions to clarify the company’s

situation. This will help you get specific ideas that are well adapted to the

company. Your interviewer will value this, as general ideas are usually less

effective than specific ones.

For instance, here you could have asked: “When did Alset launch its latest SUV

model?” or “Which countries is the company currently focusing on?” or “Does the

company have any vehicles with hybrid or electric motors?” etc.

5. Recommendation

The recommendation is a critical part of the case. Almost without exceptions, this is

what your conclusion should contain:

4. Give your recommendation statement first

5. Then provide supporting arguments, ideally three or more

6. And finally, talk about next steps (additional analysis, potential risks, etc.)

This initial analysis indicates that it seems possible for Alset to increase its profit

margin in the SUV category by focusing on the following:

• Reduce the manufacturing cost in underperforming facilities like

Northampton by adopting the success factors of other facilities like Oldcastle

Copyright © IGotAnOffer Ltd. 24

• Use the savings to increase the R&D budget. This should help further

decrease manufacturing costs in the long-term and create a virtuous

profitability increase loop

• Identify market gaps in the SUV category and fill them with new SUV models

to boost Alset’s sales

This recommendation is based on initial findings and could be consolidated by

further analysing certain areas. Next steps could include:

• Understanding if the SUV industry as a whole is profitable and growing. This

should give a good indication of whether the SUV segment is the right

segment for Alset to focus on

• Understanding how much of Alset’s total profits are driven by the sales of

SUVs. This should also give a good indication of whether Alset should

continue pursuing SUVs or if it should redeploy its efforts in other areas

IGotAnOffer Special Tip:

Note that in most case interviews, there is no right or wrong conclusion. As long

as you follow the method above and give a good rationale for your conclusion,

your interviewer will accept it.

Outlining next steps is important. This is something all consultants do at the end

of projects to sell on the next project. Including that in your conclusion will show

your interviewer that you are aware of how actual projects work!

Copyright © IGotAnOffer Ltd. 25

Case #3 – Zeta Bank

1. Situation

Your client is Zeta Bank, a major UK bank. Zeta Bank’s aging IT system and its

myriad of new products has increased the complexity of its operations. A lot of

simple tasks such as changing a customer address or updating a customer on the

status of his loan application require manual intervention. This has led to an

increase in customer complaints about service quality and response times.

The Chief Information Officer (CIO) wants to increase next year’s IT budget to

develop digital tools that will decrease manual intervention to answer simple

customer questions. The CEO also wishes to improve customer service because he

is planning to expand Zeta Bank’s presence globally. That being said he is

concerned that the £5m increase in the CIO’s budget will not deliver the expected

improvement in customer satisfaction.

2. Framework development

What areas would you look at to address the CEO’s concerns?

3. Quantitative question – Data provided

The analytics team at Zeta Bank collected data on customers who call the bank for

simple queries that require a lot of manual intervention from the Operations team

to resolve. It then calculated average processing and resolution times:

Queries regarding Processing Resolution time Queries per

time (h) (h) month

Loan applications 2 48 150

Online banking 2 24 300

Credit cards 1 2 500

Change of contact details 10 11 100

Copyright © IGotAnOffer Ltd. 26

The time between a customer making a query and the operations team starting

work on the query is called the “Processing time”. The time between a customer

making a query and the query being fully resolved is the “Resolution time”.

The analytics team at Zeta Bank also provided you with the customer survey below.

Customers who had to call Zeta Bank for each type of query described above were

asked two questions:

• How much of an inconvenience was it to call us for this query and to wait for

our reply? (1 = low, 5 = high)

• How likely are you to leave Zeta Bank because you had to call us for this

query and to wait for our reply? (1 = very unlikely, 5 = very likely)

Zeta Bank Customer Survey

Loan applications

Online banking

Credit cards

Change of contact details

0 1 2 3 4 5 6

Likelihood of leaving Level of inconvenience

Question 3.a.

The CIO wants to know which type of query the operations team spends the most

time on and how many FTEs it accounts for?

An FTE (Full Time Equivalent) is the hours worked by an employee on a full time

basis.

Question 3.b.

Copyright © IGotAnOffer Ltd. 27

What are some of the insights you can drive from the customer survey presented

above?

4. Creativity question

Zeta Bank’s main IT team is based in the UK but it also has a software development

team in China. The CEO is considering using the team in China to develop the digital

tools the CIO is asking for. What factors should the CEO consider before making

that decision?

5. Recommendation

After two months of rigorous analysis it’s time for your team to present its findings

to the CEO and CIO of Zeta Bank. What would you tell them?

Copyright © IGotAnOffer Ltd. 28

Answers

1. Situation

Before answering the framework question, you should:

• Play back the company situation

• Define the case objective

To play back the company situation, you should just summarise what your

interviewer told you. This will enable you to avoid any misunderstandings. In

addition, you could also ask follow up questions that will help you get a better grip

on the situation. For instance, you could ask:

• What is the total CIO budget? How material is a £5m increase in that budget?

• Has the volume of customer complaints only recently increased or have they

been an on-going issue?

• Has the CIO run similar digital initiatives in the past? Were these initiatives

successful in improving customer satisfaction?

Prior to diving into the framework question, it is also advisable to further define the

objective of the case. Examples of questions you could ask include:

• I understand the CEO wants to improve customer satisfaction. Do we know

how customer satisfaction is measured today? And by how much it changed

in recent years?

• I understand the CEO is concerned that the digital tools proposed by the CIO

will not improve customer satisfaction. Does he think that the tools per se

will not make a difference to customer satisfaction? Or does he think his

team lacks the skills to roll out and use these tools?

Copyright © IGotAnOffer Ltd. 29

IGotAnOffer Special Tips

Asking the right questions to your interviewer at the beginning of the case can

unveil parts of the framework your interviewer has in mind. As you become

more and more comfortable with case interviews, the questions you ask at the

beginning should both aim to clarify the situation and objectives but they should

also help you develop your framework.

2. Framework development

To answer framework questions, you should:

• Ask for some time to gather your thoughts

• Extract the main elements from the case question and situation

• Break down these elements into simple components

In this situation, the main elements that can be extracted from the case question

and situation include:

A. First, the overarching goal of the CEO is to improve customer satisfaction. It

would therefore be helpful to understand the fundamental drivers behind

the decrease in customer satisfaction

B. Second, the CEO actually wants to know if the digital tools suggested by the

CIO would help increase satisfaction. Analysing these digital tools is therefore

important

Let’s now breakdown these main elements into sub components:

A. Customer satisfaction

1. Internal environment

a. Customer expectations: what are customers’ expectations for Zeta

Bank’s products? And for the quality of its customer service?

Copyright © IGotAnOffer Ltd. 30

b. Service performance: where exactly does Zeta Bank’s products or

customer service fall short of these expectations? Are there any

obvious pain points in the customer experience leading to a lot of

queries?

2. External environment

a. Competition: how does Zeta Bank’s customer satisfaction ratings

compare to competitors’? Is the bank losing customers because of low

customer satisfaction compared to its peers?

b. Best practices: are there customer service best practices that Zeta

Bank has not adopted yet and could roll out?

B. Digital tools

1. New technology: what sort of tools is the CIO planning on rolling out exactly?

How are they addressing the main customer pain points? How will these

improvements be measured?

2. Daily operations: Can Zeta Bank run these digital tools alongside its legacy

IT systems? Is this going to cause any issues in the day-to-day operations?

3. Skills: Does Zeta Bank have people in house to develop these tools or is the

development going to be outsourced? Does the CIO have any experience in

rolling out this type of tools?

4. Cost: How will the £5m requested by the CIO be used? What is the expected

financial return of this investment in digital tools? Have alternative plans

been studied?

Copyright © IGotAnOffer Ltd. 31

IGotAnOffer Special Tip

Your interviewer will often ask you follow up questions after you have laid out

your framework. A typical question he could ask is if there are additional areas

that are not part of the initial framework that could be explored.

The framework above mainly focuses on technology. Your interviewer might

therefore ask you: “What other solutions do you think could be considered

beyond rolling out new technology?”

Additional ideas you could give could include: improving the training of

customer service employees to enhance customer satisfaction; increasing

customer service staff, etc.

3. Quantitative question – Data provided

Question 3.a.

You should clearly lay out your plan to identify the query category taking up the

most time before diving into any calculation. Here you can simply:

• Calculate the time spent per query for each category

• Calculate the total time spent on each category per month

• Convert this time into a number of FTEs per year for the top category

The time spent by the operations team per query for each category is simply the

total resolution time minus the processing time:

• Loan applications: 48 - 2 = 46 h / query

• Online banking: 24 - 2 = 22 h / query

• Credit cards: 2 - 1 = 1 h / query

• Change of contact details: 11 - 10 = 1 h / query

Copyright © IGotAnOffer Ltd. 32

The total time spent on each category per month is simply the number of queries

per month times the time per query:

• Loan applications: 46 x 150 = 6,900 hours

• Online banking: 22 x 300 = 6,600 hours

• Credit cards: 1 x 500 = 500 hours

• Change of contact details: 1 x 100 = 100 hours

Loan applications are therefore the category taking up the most time per month. In

order to convert this number of hours into a number of FTEs you can simply

assume that 1 FTE works 8 hours a day and 20 days a month.

FTEs needed for the loan application category:

• 6,900 (hours/month) / (8 (hours/day) x 20 (days/month)) = 43 FTEs

“Loan applications” therefore account for 43 FTEs. “Online banking” also accounts

for about 40 FTEs. Together, these two categories count towards more than 90% of

the total FTEs needed. As a consequence, developing digital tools to handle these

types of queries automatically will save the most cost to the bank. At this point, it

might be interesting to analyse if “Loan applications” and “Online banking” are also

the two categories that really dissatisfy customers.

Question 3.b.

Here is a simple plan you could follow to drive as many insights as possible from

the survey:

1. First focus on the two questions asked in the survey individually

2. Then focus on combining the insights from each question asked

3. And finally relate your findings back to the other questions in the case

Let’s focus on the “Likelihood of leaving“ question first. The category with the worst

rating is “Online banking”. This indicates that Zeta Bank is falling short of customers’

expectations in online banking. It seems that customers consider they should not

have to contact the bank for a query regarding online banking. They probably

Copyright © IGotAnOffer Ltd. 33

consider that they should have been able to resolve their query by themselves

directly online.

In terms of level of inconvenience, “Loan applications”, “Online banking” and “Credit

cards” were all rated 4 or 5. This seems to reflect that customers are generally

annoyed with having to call the bank.

Overall, there does not seem to be a direct correlation between the level of

inconvenience and the customers’ likelihood to leave the bank. This might reflect

that customers are ready to endure some inconvenience for certain specific queries

but not for others. In other words, customers seem to have different service

expectations for different query categories.

The CEO’s objective is to improve customer satisfaction. As a consequence, Zeta

Bank should probably focus its efforts on the categories for which customers are

most likely to leave: “Online banking” and “Credit card”. These categories also

happen to be the ones with the highest number of queries per month and “Online

banking” is the second largest consumer of FTEs according to our earlier calculation

that confirms they are good areas to focus on.

4. Creativity question

Creativity questions are best answered using a simple framework. This will ensure

that you cover the question comprehensively. It is ok to ask for some time at the

beginning of a creativity question to put a simple framework together if it does not

come to you naturally. Once you identified a framework, you can then brainstorm

in each of its different sections to answer your interviewer’s question.

The factors the CEO needs to consider in order to make his decision can be split

into two categories: quantitative and qualitative.

1. Quantitative:

• Cost: What are the cost implications of using the software development

team in China? Will it be cheaper / more expensive than using another

Zeta Bank team or a third party?

Copyright © IGotAnOffer Ltd. 34

• Time: How long will it take for the development team in China to

complete the project?

• Capacity: Does the team in China have sufficient capacity to take this

project on next year? Or would extra personnel need to be hired?

2. Qualitative:

• Project management: Who will lead the management of the project? The

team in the UK or in China? What are the dynamics between the two

teams?

• Communication: Given this is a critical project, how can the team in

China and the team in the UK best communicate? Won’t time differences

be an issue when the tools need to be rolled out in the UK?

• Team skills: Are the skills of the team in China similar to the ones of the

team in the UK? Can they develop the same type of tools in the same

timeline?

• Tools maintenance: How will futures updates to the tools be handled if

they are used mostly in the UK but the software developers are in China?

How will the customer feedback received in the UK be transferred back to

the development team in China?

Before deciding, the most important thing to determine is if the China team has got

the right skills to develop the tools and if it is realistic for them to maintain the

digital tools in the future taking the customer feedback on board. The risk of having

the team in China develop the software is that it adds communication and time

difference complexities to a project that seems critical to improve customer

satisfaction.

Copyright © IGotAnOffer Ltd. 35

IGotAnOffer Special Tip:

Notice here how after brainstorming different ideas we are summarising the

most important things to understand before the CEO decides. In addition, we

are also highlighting the risks related to the CEO’s ideas.

Prioritising ideas and highlighting risks are two really helpful habits in creativity

questions. We definitely encourage you to emulate these habits.

5. Recommendation

Your conclusion should be structured as follows:

1. Give your conclusion statement first

2. Then provide three or more supporting arguments

3. And finally, talk about next steps (additional analysis, opportunities

encountered during the case, etc.)

Based on our initial analysis, Zeta Bank should develop digital tools with a particular

focus on improving how queries regarding “Online banking”, “Loan applications”

and “Credit cards” are handled. There are two main reasons for suggesting this:

• First, “Online banking” and “Credit card” are the two categories for which

customers are most likely to leave the bank if they are dissatisfied.

Developing digital tools to handle such queries is therefore likely to help

improving customer satisfaction.

• Then, “Online banking” and “Loan applications” account for more than 90% of

FTEs dedicated to handling customer queries. Developing digital tools to

handle such queries will therefore decrease costs.

This recommendation is based on initial findings and could be consolidated by

further analysing certain areas. Next steps could include:

Copyright © IGotAnOffer Ltd. 36

• First, Zeta Bank could analyse by how much the digital tools will reduce the

resolution time

• Second, it could try to estimate if it will increase customer satisfaction and by

how much

• Third, it needs to understand if £5m is the right cost estimate for the

development of the tools and if it should use an internal team or an external

company to develop the tools

Copyright © IGotAnOffer Ltd. 37

Case #4 – Quidi Market

1. Situation

Your client is Quidi Market (QM), a small supermarket chain in the North East

England that opened its first shops in the 1980s in Gateshead and Darlington. The

chain is known for its friendly staff, local products and support to the local

communities.

In the past five years big super market chains from the South of England have been

expanding in the North East. QM is a family-owned business and its owner is

concerned that his business will not be able to compete with the large supermarket

chains. He fears he will not be able to keep his business up and running as it

happened with other small supermarkets in other areas of England where the big

chains recently established themselves.

2. Framework development

What areas would you look at to assess how much of a threat the arrival of large

super market chains is to QM?

3. Quantitative question – Data provided

Question 3.a.

The National Consumer Agency in England considers that a city is under served

when it has less than 1 supermarket per 10,000 people. Below that number, people

need to travel long distances to find a supermarket.

Your team has collected the information below about the population of five cities in

the North East of England and the number of supermarkets per city. The total

number of supermarkets includes QM shops.

QM’s owner wants to invest in one of these cities and open new shops. Which city

would you recommend?

Copyright © IGotAnOffer Ltd. 38

Total # of Total # of QM

City Population

supermarkets supermarkets

Newcastle 280,000 45 15

Sunderland 275,000 35 15

North Tyneside 200,000 20 8

Gateshead 205,000 20 10

Darlington 105,000 20 12

Population Trends in North East England

330,000

280,000

Newcastle

230,000

Sunderland

180,000 Gateshead

North Tyneside

130,000 Darlington

80,000

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

Question 3.b.

QM’s owner is planning to invest £5m in new stores in one of the above locations.

He wants to open small and big stores. Each small store will yield £100k in annual

profits compared to £200k for a large store. The owner wants the ratio of the

number of small to big stores to be 3:1. How many stores of each kind does QM

need to open to achieve a 5-year payback?

4. Creativity question

Copyright © IGotAnOffer Ltd. 39

QM’s owner also wants to decrease costs to be in a healthy financial position to face

the large chains getting into the region. What are the different costs that could be

cut?

5. Recommendation

After four months of analysis, QM’s owner wants to know what are the best ways

for his team to respond to the entry of large chains in the region. What would you

tell him?

Copyright © IGotAnOffer Ltd. 40

Answers

1. Situation

Before answering the framework question, you should:

• Play back the company situation

• Define the case objective

To play back the company situation, you should summarise what your interviewer

told you. This will enable you to avoid any misunderstandings. In addition, you

could also ask follow up questions that will help you get a better grip on the

situation. For instance, you could ask:

• How many stores do QM and the large chains have in the North East

respectively?

• What is the typical size of a QM store and of a large chain store?

• Is QM in a healthy financial position at the moment?

Prior to diving into the framework question, it is also advisable to further define the

objective of the case. Examples of questions you could ask include:

• I understand the owner of QM is concerned about the competition. Do we

know more specifically what the owner is worried about? Is it lower prices,

more products variety or bigger stores?

• I understand QM is a family owned business. Does the owner want the

business to remain independent or would he consider selling to a large

chain?

Copyright © IGotAnOffer Ltd. 41

IGotAnOffer Special Tips

Asking the right questions to your interviewer at the beginning of the case can

unveil parts of the framework your interviewer has in mind. As you become

more and more comfortable with case interviews, the questions you ask at the

beginning should both aim to clarify the situation and objectives but they should

also help you develop your framework.

Here for instance, the last question on whether the owner would consider an

acquisition can unveil a lot about the direction in which your interview is going to

take the case.

2. Framework development

To answer framework questions, you should:

• Ask for some time to gather your thoughts

• Extract the main elements from the case question and situation

• Break down these elements into simple components

In this situation, the main elements that can be extracted from the case question

and situation include:

A. QM’s owner is worried about the competitive threat represented by the

arrival of the large supermarket chains. Understanding the competition in

detail and how it is positioned vs. QM is therefore important

B. The other main area to look at is the competitive response that QM can

launch to counter the arrival of the large chains

Let’s now breakdown these main elements into sub components:

A. Competitive threat:

1. Price: How price-aggressive are large chains compared to QM? Do they

run more promotions and discount more products?

Copyright © IGotAnOffer Ltd. 42

2. Products: Do competitors have more product variety than QM? Do they

compete with QM on local products, one of the company’s strengths?

3. Stores: Do competitors have similar types of stores than QM? Do they

locate their stores in similar areas as QM?

4. Service: Do competitors offer more services than QM such as online

shopping, click and collect, etc.?

5. Other markets: In other areas of England, what happened to the local

players when the large supermarkets entered their region? What

techniques did the large supermarkets use to dominate the market?

B. QM response:

1. Consolidate current position

a. Reinforce what makes QM different including: the friendly staff,

local products and support to the community

b. Keep up with customers’ demand for new services such as online

shopping, click and collect, etc.

c. Refurbish current stores and adapt store format to evolving

customer needs if required

2. Scale up

a. Open new stores in strategic locations to gain in scale and be able

to compete with the larger competitors

b. Alternatively, if QM needs to grow very fast, it could also acquire

one or several other local supermarket chains

c. QM could also create partnerships with other chains to buy

products together and therefore gain scale and lower costs

This framework includes a number of elements that can be prioritised in order of

importance.

In this case, understanding the scale of the threat represented by large chains is

really the priority. Once this has been determined an appropriate response can be

designed for QM.

Copyright © IGotAnOffer Ltd. 43

3. Quantitative question – Data provided

Question 3.a.

This question is a mix of maths and data interpretation.

Let’s first calculate the number of supermarkets per 10,000 people and then extract

insights from the graph.

Cities can be ranked by their number of supermarkets per 10,000 people:

1. Darlington: (20 / 105k) x 10k = 1.9 supermarket per 10,000 people

2. Newcastle: 1.6

3. Sunderland: 1.3

4. Gateshead: 1.0

5. North Tyneside: 1.0

Gateshead and North Tyneside are therefore close to be underserved and seem

like good targets to open new stores.

Here are some insights that can be extracted by reading the graph:

1. Darlington’s population looks set to decrease, which will likely increase its 1.9

ratio in the near future. This makes the city unattractive for new investments

2. Newcastle’s population is going to increase. This will help decreasing its 1.6

ratio in the mid-term and might make it a more attractive investment in a few

years

3. Sunderland’s population will stay the same over the next few years meaning

its 1.3 ratio is likely to stay unattractive in the near term

4. Gateshead has got the fastest growing population and is underserved. This

makes it extremely attractive for investments

5. North Tyneside is underserved but its population is decreasing making it a

less attractive opportunity than Gateshead

Once you have analysed the data at hand you need to:

Copyright © IGotAnOffer Ltd. 44

• Relate the result back to the broader case question

• Suggest next steps in the analysis

Based on the analysis above, Gateshead is clearly the best city to invest in. It both

has a growing population and is currently underserved in terms of number of

supermarkets.

An additional area we could look at is the market penetration of QM in the different

cities. There is a small risk of cannibalisation if QM adds a lot of stores in a city

where its penetration is already very high. But given Gateshead is underserved and

growing this risk seems limited.

Question 3.b.

To answer maths questions, you should:

• Map out the calculations you are going to do

• Present your plan to your interviewer to get feedback before starting the

calculations

• Do your calculations and simplify the numbers when possible

If a plan does not come to you naturally when trying to answer the question, it is ok

to ask your interviewer for a few seconds to gather your thoughts.

Here is a potential plan you could have shown to your interviewer for this specific

question:

1. Layout the basic equation for the payback period

2. Express the relationship between the number of small to big stores as an

equation

3. Inject the store ratio equation in the payback equation

Let’s now do the calculations and simplify the numbers when possible.

• The payback period equation is:

o Payback period = Initial investment / Annual profits

o 5yr = £5m / (£0.1m / yr x A + £0.2m / yr x B)

Copyright © IGotAnOffer Ltd. 45

o Where A is the number of small stores and B the number of large

stores

• The ratio of small to big stores is 3:1. If A is the number of small stores and B

the number of big stores:

o A = 3B

• Let’s now replace A by B in the payback equation:

o 5yr = £5m / (£0.1m / yr x 3B + £0.2m / yr x B)

o 5yr = £5m / (£0.5m / yr x B)

o B = 1 / 0.5 = 2

• The number of large stores is therefore 2. Given A = 3B, it follows that the

number of small stores is 3 x 2 = 6

Therefore, QM could open 8 stores in total, 2 big and 6 small, in order to achieve a

5-year payback period for a £5m investment.

Once you found the answer to the maths question, you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

Investing in new store is a good idea to consolidate QM’s position and fight back the

entrance of new players. However, if eight stores were built in Gateshead the

number of stores in the city would increase by 80%. This is probably very aggressive

and might lead to reaching the saturation point of the market. A good next step in

the analysis could be to analyse if it would be an interesting idea to install some of

these new stores in cities where QM is not already present.

4. Creativity question

To answer creativity questions, you should:

• Ask for some time to gather your thoughts if necessary

• Develop a simple mini framework

• Brainstorm within this mini framework

In this case, QM could explore the following options to cut costs:

Copyright © IGotAnOffer Ltd. 46

1. Fixed Costs

• Real estate: QM’s owner could try to lower the rents paid by renewing

and lengthening the company’s leases. If QM owns some of its stores it

could consider selling them to generate cash in the short-term

• Equipment (i.e. fridges, checkout registers): QM should consider leasing

its equipment to avoid having to replace it every time a new technology

comes out. It could also partner with other retailers to lease the same

equipment and obtain better prices

• Utilities: QM could take measures to increase its energy efficiency and

therefore decrease its electricity bills. It could achieve this by using energy

efficient lighting, closed fridges, etc. These initiatives might carry some

cost initially and then pay for themselves over the course of a few months

2. Variable Costs

• Product costs: QM could reduce product costs by making its suppliers

compete harder for its business. QM could also create partnerships with

other retailers and gain scale to get better prices

• Advertising: QM could reduce its advertising to the minimum given it is

already known in the region. The downside of doing this is that it might

lose visibility as new players enter the region

• Labour: QM could try to naturally decrease its labour costs by not

replacing people who retire and by stopping to hire new employees in the

short-term. For instance, it could install automatic tills in its current stores

as well as its new stores and reshuffle its current cashiers across its stores

Once you have developed the ideas above, you should:

• Prioritise them by impact

• And highlight risks related to them if necessary

In this case, it makes sense to focus a lot of attention on product costs and real

estate costs, as they are likely the highest costs QM incurs. It should also be

highlighted that some of the cost cutting measures suggested require an initial

investment. As a consequence, in the very near term some of these actions are

likely to degrade profitability.

Copyright © IGotAnOffer Ltd. 47

5. Recommendation

The recommendation is a critical part of the case. Almost without exceptions, this is

what your conclusion should contain:

1. Give your recommendation statement first

2. Then provide supporting arguments, ideally three or more

3. And finally, talk about next steps (additional analysis, potential risks, etc.)

The initial analysis indicates that QM should expand in Gateshead in response to

the market entry of large chains for three reasons:

• First, Gateshead is quasi under served with currently only one supermarket

per 10,000 people. It is therefore very likely that there is enough demand for

QM to roll out new stores

• Then, Gateshead’s population is forecasted to grow over the next 15 years

making it attractive for investment

• Finally, expanding could help QM gain in scale and reduce its cost per store.

For instance, it could get better deals from suppliers thanks to its scale and it

could roll out automatic tills and split its staff across its current and new

stores to decrease staff costs

However, there are further areas that could be explored. Next steps could include:

• Making sure that QM has got the financial resources to expand in Gateshead.

We should make sure that the expansion does not weaken QM financially

before the arrival of the large chains

• Understanding in more detail how large chains managed to get market share

in other regions they recently got into could help enhance QM’s competitive

response

• Looking into potential acquisitions of other local chains or into partnerships

with these chains could also help QM drive costs down

Copyright © IGotAnOffer Ltd. 48

Case #5 - Electron

1. Situation

Your client is a high-tech British start-up called Electron. Electron launched the first

cooking thermometer in the UK two years ago and it was a huge success. A cooking

thermometer is used to measure the internal temperature of meat when cooking.

The CEO of Electron thinks the UK market is extremely competitive. He aims to

maintain market share in the UK between 2015 and 2020. At the same time, he

wants to enter at least two new markets and is considering countries in continental

Europe and Asia. His overall aim is to quadruple sales between 2015 and 2020.

He is convinced that to achieve his vision he needs to add new innovative products

to Electron’s portfolio and to diversify the company’s culture by hiring international

employees. Currently Electron hires 40 British employees based in London and

outsources the manufacturing of its product to a manufacturer in the UK. Electron’s

CEO hired your team to help him define a strategy in order to achieve his vision.

2. Framework development

What key factors would you analyse to design the CEO’s strategy?

3. Quantitative question – Data provided

Electron’s CEO decided that the countries he wants to enter are China and

Germany. Your team collected the information below about Electron’s competition

in these countries.

2014 Cooking thermometer sales ($m)

China Germany

Xi- H- S-

Others iWarme KlugL VatenT eKoch Other

Ion Chen Glim

170 150 20 5 20 12 10 8 9

Copyright © IGotAnOffer Ltd. 49

Assume that the population in China and Germany is respectively 1,360m and 80m

inhabitants and that the average price of a cooking thermometer is $50 and $80

respectively in these two countries.

Question 3.a

What is the market penetration of cooking thermometers in each country?

Question 3.b

The CEO believes that Electron can capture 10% of the German and Chinese

markets in 2015.

Is it realistic? Would it put Electron on track to achieve its 2020 revenue target? In

2014 Electron had revenues of $15m.

4. Creativity question

What measures can be taken to reduce the risks related to entering the German

and Chinese markets?

5. Recommendation

It’s time for your team to present your findings to Electron’s CEO. What are your

recommendations for Electron’s strategy?

Copyright © IGotAnOffer Ltd. 50

Answers

1. Situation

Before answering the framework question, you need to:

• Play back the company situation

• Define the case objective

To play back the company situation, you should summarise what your interviewer

told you. This will enable you to avoid any misunderstandings about the situation.

In addition, you could also ask follow up questions that will help you get a better

grip on the situation. For instance, you could ask:

• Is there any particular reason why the CEO is only considering Europe and

Asia and not the US for example?

• Has Electron already started developing new products or is it just focused on

the kitchen thermometer?

• Does Electron have any stores or does it only sell its product online?

Prior to diving into the framework question, it is also advisable to further define the

objective of the case. Examples of questions you could ask include:

• I understand that the CEO wants to quadruple sales by 2020. Do we know

what sales are today?

• Does the CEO only have a sales target or does he also have a profit target in

mind for 2020?

• The CEO seems to be expecting most of the sales growth in the next 5 years

to come from the UK. Can you confirm that’s right?

2. Framework development

To answer framework questions, you should:

• Ask for some time to gather your thoughts

• Extract the main elements from the case question and situation

• Break down these elements into simple components

Copyright © IGotAnOffer Ltd. 51

In this situation, the main elements correspond to the means the CEO wants to use

quadruple sales by 2020. These means include:

• Entering two new markets – one in Asia and one in Europe

• Diversifying the product portfolio

• Diversifying the company’s culture with international employees

Therefore, the three areas that can be used to structure your framework are new

markets, products and company culture.

Let’s now breakdown these main elements into sub components:

A. New markets:

1. Market size: What is the size of the market and the customer segments

for Electron’s products in different countries? Are customers in those

markets early adopters of smart kitchen technology? Given Electron’s

products are related to cooking, is there a strong cooking culture in these

countries?

2. Competition: How many competitors does Electron have in the different

countries? How concentrated is this competition? How do their products

compare to Electron’s (price, features)?

3. Barriers to entry: Are there any legal issues preventing Electron from

entering the targeted markets?

B. New Products

1. When: Is it wise for Electron to invest in the development of new products

before entering the new markets? Or should it launch the smart

thermometer in new markets first and then reinvest some of the

revenues in developing new products?

2. What: Should Electron focus only on smart kitchen related appliances or

should it launch smart home products too? Is the vision of the company

to become a specialist leader in smart kitchen appliances or does it want

to play across more markets?

3. Where: Where should the company design and manufacture its new

products? Should it move the manufacturing to a lower cost facility than

Copyright © IGotAnOffer Ltd. 52

in the UK? Should Electron launch its new products in the UK or in one of

its new markets?

C. Company culture

• Diversity: How can Electron ensure that it attracts diverse talent in terms

gender, nationality, ethnicity, etc.?

• Inclusiveness: How can Electron create an inclusive working culture

where diversity is celebrated?

• Values: How can Electron ensure that its values are preserved while it

transforms into a more diverse place to work at?

This framework includes a number of elements that can be prioritised in order of

importance.

Developing new products and building a more diverse culture both take time. As a

consequence, it probably makes sense to first focus on taking Electron’s existing

product, the cooking thermometer, and trying to sell it in new markets. This is the

area of the framework that is most likely to deliver sales growth in the short term.

3. Quantitative question – Data provided

Question 3.a

To answer maths questions, you should:

• Map out the calculations you are going to do

• Present your plan to your interviewer to get feedback before starting the

calculations

• Do your calculations and simplify the numbers when possible

If a plan does not come to you naturally when trying to answer the question, it is ok

to ask your interviewer for a few seconds to gather your thoughts.

Here, for each country we simply need to calculate:

4. The value of the cooking thermometers market

5. The number of cooking thermometers sold

6. The number of households in each country

Copyright © IGotAnOffer Ltd. 53

7. The market penetration

Let’s estimate the market penetration for each country following the steps above:

1. Value of the cooking thermometers market:

• The market value can be calculated by adding the sales of competitors

in each country

• China: 170 + 150 + 20 = $340m

• Germany: 5 + 20 + 12 + 10 + 8 + 9 = $64m

2. Number of cooking thermometers sold:

• The number of cooking thermometers can be calculated by dividing

the market value by the price of a cooking thermometer

• China: $340m / $50 = 6.8m

• Germany: $64m / $80 = 0.8m

3. Number of households:

• The number of households can be calculated by dividing the

population by the number of people per household. Four people per

household can be assumed as a simplification assumption

• China: 1,360m / 4 = 340m

• Germany: 80m / 4 = 20m

4. Market penetration:

• The market penetration can be calculated by dividing the number of

thermometers by the number of households:

• China: 6.8m / 340m = 2%

• Germany 0.8m / 20m = 4%

Once you found the answer to the maths question, you need to:

• Relate the result back to the broader case question

• Suggest next steps in the analysis

The CEO wants to enter at least two new markets. The market penetration for

China and Germany is respectively 2% and 4%. It is difficult to know by how much

this penetration can grow and how much opportunity there is left in these two

countries. Comparing these penetrations to the UK’s penetration or to other

countries could provide more information on this.

Copyright © IGotAnOffer Ltd. 54