Professional Documents

Culture Documents

Manufacturing Excercise 3

Uploaded by

Meg sharkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manufacturing Excercise 3

Uploaded by

Meg sharkCopyright:

Available Formats

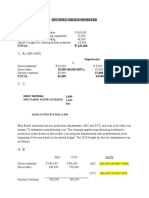

Century Tuna Company incurred the following costs and expenses during the current year:

Raw materials purchase P 4,000,000

Direct labor 1,500,000

Indirect labor – factory 800,000

Factory repairs and maintenance 200,000

Taxes on factory building 100,000

Depreciation – factory building 300,000

Taxes on salesroom and general office 150,000

Depreciation – sales equipment 50,000

Advertising 400,000

Sales salaries 500,000

Office salaries 700,000

Utilities – 60% applicable to factory overhead 500,000

Beginning Ending

Raw materials 300,000 450,000

Work in process 400,000 350,000

Finished goods 500,000 700,000

3.1. What is the cost of raw materials used?

a. P 3,850,000 c. P 4,150,000

b. P 4,000,000 d. P 4,750,000

3.2. What is the cost of goods manufactured for the current year?

a. P 7,450,000 c. P 7,100,000

b. P 7,200,000 d. P 7,300,000

3.3. What is the cost of goods sold for the current year?

a. P 7,300,000 c. P 7,600,000

b. P 6,900,000 d. P 8,300,000

Solution:

Beginning raw materials 300,000

Raw material purchases 4,000,000

Raw materials available for use 4,300,000

Ending raw materials (450,000)

Raw materials used 3,850,000

Direct labor 1,500,000

Factory overhead:

Indirect labor 800,000

Factory repairs and maintenance 200,000

Taxes on factory building 100,000

Depreciation — factory building 300,000

Utilities (60% x 500,000) 300,000 1,700,000

Total manufacturing cost 7,050,000

Beginning work in process 400,000

Ending work in process (350,000)

Cost of goods manufactured 7,100,000

Beginning finished goods 500,000

Goods available for sale 7,600,000

Ending finished goods (700,000)

Cost of goods sold 6,900,000

You might also like

- Computing CosgDocument6 pagesComputing CosgAngelica BayaNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- Cost Accounting DrillsDocument13 pagesCost Accounting DrillsViky Rose EballeNo ratings yet

- Answer To Exercises To AnswerDocument9 pagesAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNo ratings yet

- Practice Problems For Chapter 2 Part 1Document3 pagesPractice Problems For Chapter 2 Part 1Elisha MonteroNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Activity Based Costing-ExerciseDocument4 pagesActivity Based Costing-ExerciseKevin James Sedurifa OledanNo ratings yet

- Bacostmx-1tay2223-Midterms Quiz 1 ReviewerDocument4 pagesBacostmx-1tay2223-Midterms Quiz 1 ReviewerCzarina Jean ConopioNo ratings yet

- Cost Sheet 19.08.2020Document6 pagesCost Sheet 19.08.2020VISHAGAN MNo ratings yet

- Assignment ABC CostingDocument2 pagesAssignment ABC CostingdonneriNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Cost Sheet QuestionsDocument4 pagesCost Sheet QuestionsAbhishekNo ratings yet

- ACMA Unit 7 Problems - Cost Sheet PDFDocument3 pagesACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNo ratings yet

- Ch2 - Cost Accounting - Horngren'sDocument16 pagesCh2 - Cost Accounting - Horngren'svipinkala1No ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Additional Answers Exercises COGM-COGS-JEs PDFDocument2 pagesAdditional Answers Exercises COGM-COGS-JEs PDFNicola Erika EnriquezNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Job Order Costing Practice and Lecture QuestionDocument10 pagesJob Order Costing Practice and Lecture QuestionManaal HussainNo ratings yet

- Parcor Quiz Manufacturing Operations ProblemDocument1 pageParcor Quiz Manufacturing Operations ProblemArman Dizon100% (1)

- Quiz Absorption and Variable CostingDocument2 pagesQuiz Absorption and Variable CostingPISONANTA KRISETIANo ratings yet

- Cost of Goods ManufacturedDocument13 pagesCost of Goods ManufacturedNah HamzaNo ratings yet

- Cost of Goods Sold 9,100,000.00 Gross Margin 4,500,000.00Document2 pagesCost of Goods Sold 9,100,000.00 Gross Margin 4,500,000.00vipinkala1No ratings yet

- Module 1 ExamDocument4 pagesModule 1 ExamTabatha Cyphers100% (2)

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Cost Accounting Prelims Practice Solving 1 50 1Document24 pagesCost Accounting Prelims Practice Solving 1 50 1Marjorie PalmaNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Overhead Analysis Solution 1Document2 pagesOverhead Analysis Solution 1Humphrey OsaigbeNo ratings yet

- Hand-Out 4 - ABC and Support Cost AllocationDocument2 pagesHand-Out 4 - ABC and Support Cost AllocationJerric CristobalNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Probs AnswerDocument4 pagesProbs AnswerLABASBAS, Alexidaniel I.No ratings yet

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDocument11 pagesSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- Job Order Costing (2-1 To 2-11)Document8 pagesJob Order Costing (2-1 To 2-11)Mhekylha's AñepoNo ratings yet

- E19 1 E19 2 E19 4 E19 5 E19 12Document5 pagesE19 1 E19 2 E19 4 E19 5 E19 12Amit JindalNo ratings yet

- Statement COGSDocument2 pagesStatement COGSlaurentinus fikaNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Cost Sheet 1Document1 pageCost Sheet 1ARUNSANKAR NNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 3Document10 pagesKey To Corrections - LEVEL 2 MODULE 3UFO CatcherNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Group 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Document31 pagesGroup 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Carla TalanganNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Review of Cost Acctg 1 PDF FreeDocument5 pagesReview of Cost Acctg 1 PDF FreeEu NiceNo ratings yet

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- Cost Accounting 1 SW No. 4 With AnswersDocument1 pageCost Accounting 1 SW No. 4 With AnswersApril NudoNo ratings yet

- First Voyage Around The World: Antonio PigafettaDocument30 pagesFirst Voyage Around The World: Antonio PigafettaMeg sharkNo ratings yet

- Week 1Document9 pagesWeek 1Meg sharkNo ratings yet

- Pre-Test: Lesson 2Document8 pagesPre-Test: Lesson 2Meg sharkNo ratings yet

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDocument8 pages1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkNo ratings yet

- L1L2 IntroDocument94 pagesL1L2 IntroMeg sharkNo ratings yet

- Pas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsDocument5 pagesPas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- Philippine History: Pre-Colonial PeriodDocument84 pagesPhilippine History: Pre-Colonial PeriodMeg sharkNo ratings yet

- Pas 20 Government Grant: Conceptual Framework and Accounting StantardsDocument6 pagesPas 20 Government Grant: Conceptual Framework and Accounting StantardsMeg sharkNo ratings yet

- Impairment of Assets: Cconceptual Framework and Reporting StandardDocument4 pagesImpairment of Assets: Cconceptual Framework and Reporting StandardMeg sharkNo ratings yet

- PFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardDocument7 pagesPFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardMeg sharkNo ratings yet

- Investment Property: Conceptual Framework and Reporting StandardDocument3 pagesInvestment Property: Conceptual Framework and Reporting StandardMeg sharkNo ratings yet

- Investment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsDocument6 pagesInvestment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- Unbalanced TransportationDocument24 pagesUnbalanced TransportationMeg sharkNo ratings yet

- Degenerate TransportationDocument21 pagesDegenerate TransportationMeg sharkNo ratings yet

- Pas 7 - Statement of Cashflow: Conceptual Framework and Accounting StandardsDocument7 pagesPas 7 - Statement of Cashflow: Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- Cfas Pas 41 AgricultureDocument4 pagesCfas Pas 41 AgricultureMeg sharkNo ratings yet

- Cfas Pas 2 InventoriesDocument5 pagesCfas Pas 2 InventoriesMeg sharkNo ratings yet

- LP Assignment MethodDocument22 pagesLP Assignment MethodMeg sharkNo ratings yet

- Forecasting: Management ScienceDocument23 pagesForecasting: Management ScienceMeg sharkNo ratings yet

- Linear Inequalities (N)Document13 pagesLinear Inequalities (N)Meg sharkNo ratings yet

- Cornerstones of Cost Management, 3E: Product and Service Costing: Job-Order SystemDocument46 pagesCornerstones of Cost Management, 3E: Product and Service Costing: Job-Order SystemEhtesham HaqueNo ratings yet

- Textile Industry ProjectDocument19 pagesTextile Industry ProjectMohammad Ajmal AnsariNo ratings yet

- Rewards and Realities of German Cost Accounting PDFDocument8 pagesRewards and Realities of German Cost Accounting PDFMIHAJA Fabrice100% (1)

- AssignmentDocument13 pagesAssignmentsaqib razaNo ratings yet

- Chapter 02 TestbankDocument45 pagesChapter 02 Testbanks11186706No ratings yet

- Kape Kultura - Industry Analysis - FINALDocument8 pagesKape Kultura - Industry Analysis - FINALAndrea Lyn Salonga CacayNo ratings yet

- Management Accounting: Budgeting For Planning & ControlDocument42 pagesManagement Accounting: Budgeting For Planning & ControlNurvia Dwi RahmawatiNo ratings yet

- MSQ-03 - Standard Costs and Variance AnalysisDocument13 pagesMSQ-03 - Standard Costs and Variance AnalysisJenica SaludesNo ratings yet

- Soal Akuntansi ManajemenDocument7 pagesSoal Akuntansi ManajemenInten RosmalinaNo ratings yet

- Accounting PracticequestionsDocument7 pagesAccounting PracticequestionsAngel Halili GustiloNo ratings yet

- Cost MCQDocument74 pagesCost MCQSimple Abc100% (1)

- Overhead ControlDocument24 pagesOverhead ControlBishnuNo ratings yet

- Student: Teacher: Matter: Year:: Larry M. Walther Christopher J. SkousenDocument2 pagesStudent: Teacher: Matter: Year:: Larry M. Walther Christopher J. SkousenLaura MartínezNo ratings yet

- Budget Administration Performance AnalysDocument70 pagesBudget Administration Performance Analysseblewongel demissie100% (1)

- CA - AML - 1 & 2 - Genap 2018-2019Document18 pagesCA - AML - 1 & 2 - Genap 2018-2019ImeldaNo ratings yet

- 105 11 Inventory LIFO Vs FIFODocument2 pages105 11 Inventory LIFO Vs FIFOziuziNo ratings yet

- Ross12e Chapter03 TB AnswerkeyDocument44 pagesRoss12e Chapter03 TB AnswerkeyÂn TrầnNo ratings yet

- 4277187Document4 pages4277187mohitgaba19No ratings yet

- Activity Based CostingDocument75 pagesActivity Based CostingMohd Fuad Mohd Salleh, UniselNo ratings yet

- Chapter 3Document143 pagesChapter 3Ashik Uz ZamanNo ratings yet

- 1-2 COGS Vs SALESDocument4 pages1-2 COGS Vs SALESFrancis Flores HurtadoNo ratings yet

- David JDocument18 pagesDavid JLucky LuckyNo ratings yet

- QUIZ 1 Absorption CostingDocument1 pageQUIZ 1 Absorption CostingJohn Carlo CruzNo ratings yet

- Cost Audit ReportDocument39 pagesCost Audit ReportOlatunji AdewaleNo ratings yet

- Chap 004Document15 pagesChap 004Ahmad Restu FauziNo ratings yet

- Clsbe Universidade Católica Portuguesa: Test 3Document8 pagesClsbe Universidade Católica Portuguesa: Test 3Inês VilafanhaNo ratings yet

- Robert Kiyosaki - Cashflow Management SecretsDocument23 pagesRobert Kiyosaki - Cashflow Management SecretsPrekash Menon100% (6)

- Cost Accounting 2 Final Exam PDFDocument10 pagesCost Accounting 2 Final Exam PDFNina Ricci AraracapNo ratings yet

- F - Valuation template-POSTED - For Replicate WITHOUT FORMULASDocument4 pagesF - Valuation template-POSTED - For Replicate WITHOUT FORMULASSunil SharmaNo ratings yet

- @cmalogics Paper 8 Cost AccountingDocument260 pages@cmalogics Paper 8 Cost AccountingMehak Kaushikk100% (1)