Professional Documents

Culture Documents

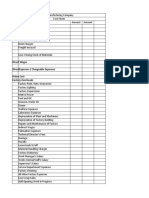

Cost Sheet 1

Uploaded by

ARUNSANKAR NCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Sheet 1

Uploaded by

ARUNSANKAR NCopyright:

Available Formats

From the following particulars calculate (1) prime cost (2) factory cost (3) cost of production and

(4) cost of

sales

Particulars Rs Particulars Rs

Direct Raw Materials 33,000 Depreciation of office building 1,000

Direct wages 35,000 Depreciation of delivery van 200

Direct Expenses 3,000 Bad debts 100

Factory Rent 7,500 Advertising 300

Indirect wages (Factory) 10,500 Salaries of salesman 1,500

Factory lighting 2,050 Upkeeping of delivery van 700

Factory Heating 1,500 Bank charges 100

Power (Factory) 4,400 Commission on sales 1,500

Office stationery 900 Rent and Rates (Office) 500

Directors’ Remuneration (Factory) 2,000 Loose tools - written off 600

Directors’ Remuneration (Office) 4,000 Output (tonnes)

Factory Cleaning 1,000 (Sales @ Rs.40 per unit) 5,000

Sundry Office Expenses 200

Factory Stationery 750

Water supply (Factory) 1,300

Factory Insurance 1,100

Office insurance 500

Legal Expenses (Office) 400

Rent of warehouse 300

Depreciation of Plant & Machinery 2,000

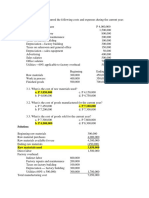

Kerala Ltd. receives an enquiry from M/S XYZ % Co. to supply 10,000 To cars and ask for the selling price at

which the company can supply the same. The estimated cost is given below:

Particulars Rs

Direct Material 30,000

Direct Labour 24,000

Direct Expense 15,000

Factory overheads -80 % of Direct Labour cost

Administration overheads -20% of works cost

Selling & Distribution overhead -10% of works cost

The company intends to earn a profit of 25% on the cost in respect of units ordered.

You are required to work out the selling price to be quoted to M/S XYZ & Co.by preparing a cost sheet.

You might also like

- RagragsakanDocument6 pagesRagragsakanRazel Hijastro86% (7)

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Security Analysis and Portfolio ManagementDocument2 pagesSecurity Analysis and Portfolio ManagementARUNSANKAR NNo ratings yet

- Once Upon A Timein AmericaDocument335 pagesOnce Upon A Timein Americaqwerty-keysNo ratings yet

- Cost Sheet and Single and Output CostingDocument21 pagesCost Sheet and Single and Output CostingHard WorkoutNo ratings yet

- Interview With Hohepa Mapiria Joseph - Joe - Murphy Royal Regent 7 July 2003Document61 pagesInterview With Hohepa Mapiria Joseph - Joe - Murphy Royal Regent 7 July 2003kiwiit100% (8)

- Cost Sheet Practical Solevd QuestionsDocument6 pagesCost Sheet Practical Solevd QuestionsMansi VermaNo ratings yet

- Case Study of AmoebiasisDocument16 pagesCase Study of AmoebiasisGlorielle ElvambuenaNo ratings yet

- Peter Zumthor - Thinking Architecture PDFDocument33 pagesPeter Zumthor - Thinking Architecture PDFDiana Sterian73% (11)

- III Job Order CostingDocument66 pagesIII Job Order CostingJoshuaGuerrero0% (1)

- English For AB SeamenDocument96 pagesEnglish For AB SeamenLiliyaNo ratings yet

- Non-Probability Sampling: Definition, Types, Examples, and AdvantagesDocument13 pagesNon-Probability Sampling: Definition, Types, Examples, and AdvantagesARUNSANKAR NNo ratings yet

- Cost Sheet 19.08.2020Document6 pagesCost Sheet 19.08.2020VISHAGAN MNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Cost Sheet ProblemsDocument1 pageCost Sheet ProblemsK DIVYANo ratings yet

- Cost-V Sem BBMDocument10 pagesCost-V Sem BBMAR Ananth Rohith BhatNo ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Module 2 - Problems On Cost SheetDocument8 pagesModule 2 - Problems On Cost SheetSupreetha100% (1)

- Illustration Questions 7Document3 pagesIllustration Questions 7mohammedahalys100% (1)

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- Module 2 - Problems On Cost Sheet New 2019 PDFDocument7 pagesModule 2 - Problems On Cost Sheet New 2019 PDFJibin JoseNo ratings yet

- Cost Sheet & Single or Output Costing: Rs. RsDocument23 pagesCost Sheet & Single or Output Costing: Rs. RsKnshk SnghNo ratings yet

- Cost HeetDocument4 pagesCost HeetYuvnesh KumarNo ratings yet

- ACMA Unit 7 Problems - Cost Sheet PDFDocument3 pagesACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNo ratings yet

- Introduction To Cost AccountingDocument5 pagesIntroduction To Cost AccountingDaniel Jackson100% (1)

- Cost SheetDocument20 pagesCost SheetVannoj AbhinavNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Cost Sheet Questions - AssignmentDocument5 pagesCost Sheet Questions - AssignmentDiptee ShettyNo ratings yet

- Entrada Gericho TP-Costing-1Document3 pagesEntrada Gericho TP-Costing-1jessalyn carranzaNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Day 2 - COST - TEMPLATEDocument27 pagesDay 2 - COST - TEMPLATEum23328No ratings yet

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDocument11 pagesSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Cost Sheet QuestionsDocument4 pagesCost Sheet QuestionsAbhishekNo ratings yet

- Mumbai University - TYBCOM - Sem 5 - Cost AccountingDocument19 pagesMumbai University - TYBCOM - Sem 5 - Cost Accountingpritika mishraNo ratings yet

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Assignment AMA PDFDocument2 pagesAssignment AMA PDFPritesh Ranjan Sahoo100% (1)

- TUTORIAL ManufacturingDocument9 pagesTUTORIAL ManufacturingmaiNo ratings yet

- Cost Sheet Problems: Prepare Cost Sheet On The Basis of Following InfoDocument6 pagesCost Sheet Problems: Prepare Cost Sheet On The Basis of Following InfoBrad johnsonNo ratings yet

- Cost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000Document10 pagesCost Sheet Proforma Details Total Cost Per Unit Rs Rs Rs Add Less Less Less 75000amolNo ratings yet

- Particulars Rs. in (000) Particulars Rs. inDocument2 pagesParticulars Rs. in (000) Particulars Rs. inLikitha Kiran PeramNo ratings yet

- Completed (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkDocument4 pagesCompleted (James P) Phouvanai Inthavongsa - Year 10 Accounting IGCSE Opt 3 Week 7 HomeworkYolo LeetNo ratings yet

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- HW 1 MGT202Document4 pagesHW 1 MGT202Rajnish Pandey0% (1)

- Costing Aug2015Document2 pagesCosting Aug2015A BPNo ratings yet

- Cost SheetDocument4 pagesCost Sheetpravinmore1589No ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- CHP 1 - Problems Introduction To Cost AccountingDocument20 pagesCHP 1 - Problems Introduction To Cost AccountingMelissa CutinaNo ratings yet

- Manufacturing Excercise 3Document2 pagesManufacturing Excercise 3Meg sharkNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- Acc Assign Sem 2Document7 pagesAcc Assign Sem 2xuanylimNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Cost Sheet Final ProblemsDocument7 pagesCost Sheet Final ProblemsDanzo ShahNo ratings yet

- Cost Accounting 3Document3 pagesCost Accounting 3sharu SKNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Cost Accounting I-5. Case StudyDocument12 pagesCost Accounting I-5. Case StudyYusuf B'aşaranNo ratings yet

- Eos Elements of Cost Accounting Acc203Document3 pagesEos Elements of Cost Accounting Acc203Emilia JacobNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- Time: 2 Hours) (Max. Marks: 50 Instructions To The CandidatesDocument16 pagesTime: 2 Hours) (Max. Marks: 50 Instructions To The CandidatesSiddhant PowleNo ratings yet

- Accounting For Manufctuirng - PQ)Document6 pagesAccounting For Manufctuirng - PQ)usama sarwerNo ratings yet

- Problem Set 1 PDFDocument3 pagesProblem Set 1 PDFrenjith0% (2)

- 1 Costing - AssignmentDocument2 pages1 Costing - AssignmentNaman0% (1)

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Cost and Management Accounting CIA 1.1Document5 pagesCost and Management Accounting CIA 1.1Kanika BothraNo ratings yet

- Entrepreneurial FinanceDocument11 pagesEntrepreneurial FinanceARUNSANKAR NNo ratings yet

- Programme Schedule: National Conference On Baking and FinanceDocument4 pagesProgramme Schedule: National Conference On Baking and FinanceARUNSANKAR NNo ratings yet

- Derivaitves IntroductionDocument23 pagesDerivaitves IntroductionARUNSANKAR NNo ratings yet

- C. Magesh Kumar - Miim - confFINANCIAL BEHAVIOURS OF STOCK MARKET INVESTORSDocument8 pagesC. Magesh Kumar - Miim - confFINANCIAL BEHAVIOURS OF STOCK MARKET INVESTORSARUNSANKAR NNo ratings yet

- Introduction To Financial DerivativesDocument25 pagesIntroduction To Financial DerivativesARUNSANKAR NNo ratings yet

- Red Ribbon ClubDocument3 pagesRed Ribbon ClubARUNSANKAR NNo ratings yet

- Derivatives: Meaning, Features, and Importance: 1. What Are Derivatives? 2. Why Invest in Derivative Contracts?Document5 pagesDerivatives: Meaning, Features, and Importance: 1. What Are Derivatives? 2. Why Invest in Derivative Contracts?ARUNSANKAR NNo ratings yet

- Working Capital ManagementDocument1 pageWorking Capital ManagementARUNSANKAR NNo ratings yet

- Finance SpecializationDocument12 pagesFinance SpecializationARUNSANKAR NNo ratings yet

- Data 1Document49 pagesData 1ARUNSANKAR NNo ratings yet

- FDRMDocument41 pagesFDRMARUNSANKAR NNo ratings yet

- The Thump of Talent Management in Supervisory Level Recital An Investigation Sandwiched Between Chosen Automobile Firms, With Reference To Krishnagiri District, Tamil Nadu, IndiaDocument12 pagesThe Thump of Talent Management in Supervisory Level Recital An Investigation Sandwiched Between Chosen Automobile Firms, With Reference To Krishnagiri District, Tamil Nadu, IndiaARUNSANKAR NNo ratings yet

- Securtiy Analysis and Portfolio Management (SAPM) Notes & Ebook - Second Year Sem 4Document307 pagesSecurtiy Analysis and Portfolio Management (SAPM) Notes & Ebook - Second Year Sem 4ARUNSANKAR NNo ratings yet

- International FinanceDocument252 pagesInternational FinanceARUNSANKAR NNo ratings yet

- Project Management and ControlDocument2 pagesProject Management and ControlARUNSANKAR NNo ratings yet

- Inventory ManagementDocument23 pagesInventory ManagementARUNSANKAR NNo ratings yet

- Measurement and ScalingDocument13 pagesMeasurement and ScalingARUNSANKAR NNo ratings yet

- Observation As A Method To Study The Child: S.Prasannakumar PH.D., Assistant Professor Nerie-Ncert ShillongDocument34 pagesObservation As A Method To Study The Child: S.Prasannakumar PH.D., Assistant Professor Nerie-Ncert ShillongARUNSANKAR NNo ratings yet

- Manuale捲板機Document96 pagesManuale捲板機Andy WuNo ratings yet

- Soil MechDocument21 pagesSoil MechAhsan AbbasNo ratings yet

- Lubi Dewatering PumpDocument28 pagesLubi Dewatering PumpSohanlal ChouhanNo ratings yet

- Ksiidc and KssidcDocument13 pagesKsiidc and KssidckasperNo ratings yet

- Mico - Hydraulic Power Brake Systems For ForkliftsDocument4 pagesMico - Hydraulic Power Brake Systems For ForkliftsJenner Volnney Quispe Chata100% (1)

- How To Use KEATDocument5 pagesHow To Use KEATAamir KhanNo ratings yet

- SPE 166182 Radio Frequency Identification (RFID) Leads The Way in The Quest For Intervention Free Upper Completion InstallationDocument9 pagesSPE 166182 Radio Frequency Identification (RFID) Leads The Way in The Quest For Intervention Free Upper Completion InstallationjangolovaNo ratings yet

- Gorbachev's "Grand Bargain"Document1 pageGorbachev's "Grand Bargain"The Fatima CenterNo ratings yet

- Exercise No. 2 (DCC First and Second Summary)Document3 pagesExercise No. 2 (DCC First and Second Summary)Lalin-Mema LRNo ratings yet

- 2020 LBG q1 Ims Pillar 3 DisclosuresDocument8 pages2020 LBG q1 Ims Pillar 3 DisclosuressaxobobNo ratings yet

- Sample Invoice PDFDocument3 pagesSample Invoice PDFMarcus OlivieraaNo ratings yet

- Maulana Azad Library, Aligarh Muslim UniversityDocument38 pagesMaulana Azad Library, Aligarh Muslim Universitybijesh babuNo ratings yet

- Professional Education: St. Louis Review Center, IncDocument10 pagesProfessional Education: St. Louis Review Center, IncEarshad Shinichi IIINo ratings yet

- Q&A FractureDocument13 pagesQ&A FractureRed JimenoNo ratings yet

- MAPEH 1 (4th Quarter)Document27 pagesMAPEH 1 (4th Quarter)JESSELLY VALESNo ratings yet

- Expanding The Product Range of Leena by Bata (Report)Document104 pagesExpanding The Product Range of Leena by Bata (Report)Rabya TauheedNo ratings yet

- The Real World An Introduction To Sociology Test Bank SampleDocument28 pagesThe Real World An Introduction To Sociology Test Bank SampleMohamed M YusufNo ratings yet

- Student Exam FormDocument4 pagesStudent Exam FormRaj Kumar TeotiaNo ratings yet

- A Gandhari Version of The Rhinoceros Sutra - Salomon.thieuDocument29 pagesA Gandhari Version of The Rhinoceros Sutra - Salomon.thieuTRAN NGOCNo ratings yet

- Program 2019 MTAPTL Annual Convention PDFDocument3 pagesProgram 2019 MTAPTL Annual Convention PDFrichardlfigueroaNo ratings yet

- Agmt - Spa Schedule HDocument20 pagesAgmt - Spa Schedule Hapi-340431954No ratings yet

- Lesson 4.2 - Operations On Modular ArithmeticDocument12 pagesLesson 4.2 - Operations On Modular ArithmeticMYLS SHRYNN ELEDANo ratings yet

- YazdiDocument7 pagesYazditrs1970No ratings yet