Professional Documents

Culture Documents

Salient Features of CREATE Law

Uploaded by

Jean Tomugdan0 ratings0% found this document useful (0 votes)

73 views2 pagesThe key amendments in the Tax Code under the CREATE bill include changes to corporate income tax rates, fiscal incentives for registered business enterprises, and value-added tax exemptions. Specifically, the bill lowers corporate income tax rates, provides longer tax holidays and deductions for new businesses, expands VAT exemptions for essential goods, and reduces percentage taxes for non-VAT taxpayers. It aims to stimulate investment and economic activity by simplifying tax rules and reducing tax burdens for corporations and businesses.

Original Description:

Original Title

Salient-Features-of-CREATE-law

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe key amendments in the Tax Code under the CREATE bill include changes to corporate income tax rates, fiscal incentives for registered business enterprises, and value-added tax exemptions. Specifically, the bill lowers corporate income tax rates, provides longer tax holidays and deductions for new businesses, expands VAT exemptions for essential goods, and reduces percentage taxes for non-VAT taxpayers. It aims to stimulate investment and economic activity by simplifying tax rules and reducing tax burdens for corporations and businesses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views2 pagesSalient Features of CREATE Law

Uploaded by

Jean TomugdanThe key amendments in the Tax Code under the CREATE bill include changes to corporate income tax rates, fiscal incentives for registered business enterprises, and value-added tax exemptions. Specifically, the bill lowers corporate income tax rates, provides longer tax holidays and deductions for new businesses, expands VAT exemptions for essential goods, and reduces percentage taxes for non-VAT taxpayers. It aims to stimulate investment and economic activity by simplifying tax rules and reducing tax burdens for corporations and businesses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

The key amendments in the Tax Code under the CREATE bill include, but not limited to,

the following:

1. Corporate income tax (CIT)

a. Adoption of graduated CIT rate effective 1 July 2020:

i. 20% CIT for domestic corporations with total assets of PHP100m and below, and with

net taxable income of PHP5m and below

ii. 25% CIT for other domestic corporations

b. 25% CIT for resident and non-resident foreign corporations effective 1 July 2020

c. Reduction of minimum corporate income tax (MCIT) to 1% from 1 July 2020 to 30 June

2023

d. Reduction of CIT for proprietary, non-profit educational institutions and hospitals to 1%

from 1 July 2020 to 30 June 2023

e. Tax exemption of foreign-sourced dividends of domestic corporations subject to certain

conditions

f. Clarification on the types of reorganizations covered by tax-free exchanges under

Section 40(C)(2) of the Tax Code

g. Repeal of improperly accumulated earnings tax (IAET)

h. Repeal of 10% special income tax rate on regional operating headquarters (ROHQ)

starting 1 January 2022

2. Fiscal incentives

a. Uniform fiscal incentives for newly registered business enterprises (RBE)

i. Income tax holiday (ITH) for 4 to 7 years

ii. 5% gross income tax (GIT) or enhanced deductions for 10 years

b. Total period of incentive availment has been increased to a maximum of 17 years. The

length of the period of incentives takes into account the location and type of the

registered activity

c. Highly-desirable projects with a minimum investment capital of PHP50bn or those that

can generate at least 10,000 employees, can enjoy a superior incentive package for up

to 40 years which includes ITH for a maximum of 8 years

d. Sunset period for existing RBEs:

i. Firms enjoying ITH can continue to enjoy the same within the remaining ITH period

ii. Firms enjoying 5% GIT can continue to enjoy the same for 10 years

e. Existing RBEs may re-apply for the fiscal incentives under the CREATE bill after the

lapse of the sunset period

f. Approval of fiscal incentives for new projects or activities with investment capital of

PHP1bn and below shall be delegated to their respective Investment Promotion

Agencies (IPA). Fiscal incentives application for projects or activities with investment

capital exceeding PHP1bn shall be subject to the approval of the Fiscal Incentives

Review Board (FIRB)

g. Duty exemption on certain importations, VAT exemption on importations, and VAT zero-

rating on local purchases shall still apply

3. Value-added tax (VAT) and Percentage Tax

a. VAT-exemption on the sale or importation of digital or electronic reading materials

b. VAT-exemption on the sale or importation of drugs, vaccines and medical devices

specifically prescribed and directly used for the treatment of COVID-19 registered with

and approved by the FDA from 1 January 2021 to 31 December 2023

c. VAT-exemption on the sale or importation of medicines for cancer, mental illness,

tuberculosis, and kidney diseases to take effect on 1 January 2021 instead of 1 January

2023

d. Adjustment on the threshold of VAT-exemption on sale of real property to account for

inflation, as follows:

i. Residential lots from PHP1.5m to PHP2.5m

ii. House and lot, and other residential dwellings from PHP2.5m to PHP4.2m

e. Reduction of percentage tax for non-VAT taxpayers from 3% to 1% starting 1 July 2020

to 30 June 2023

You might also like

- Key amendments in the Tax Code under the CREATE billDocument2 pagesKey amendments in the Tax Code under the CREATE billJean TomugdanNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Create Bill 1Document2 pagesCreate Bill 1Nurse NotesNo ratings yet

- Tax Alert No. 91 (Senate Bill (SB) No. 1357 or The Corporate Recovery and Tax Incentives For Enterprises Act (CREATE) )Document9 pagesTax Alert No. 91 (Senate Bill (SB) No. 1357 or The Corporate Recovery and Tax Incentives For Enterprises Act (CREATE) )Karina PulidoNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- Corporate Recovery and Tax Incentives For Enterprises (Create) BillDocument15 pagesCorporate Recovery and Tax Incentives For Enterprises (Create) BillRonn Robby RosalesNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Create LawDocument14 pagesCreate Lawmariaerica.toledoNo ratings yet

- CREATE Salient ProvisionsDocument3 pagesCREATE Salient ProvisionsAldrin Santos AntonioNo ratings yet

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Document11 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Rolly Balagon Caballero100% (1)

- Briefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActDocument56 pagesBriefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActEdward GanNo ratings yet

- CREATE LAW - Short IntroDocument3 pagesCREATE LAW - Short IntroBenjie DavilaNo ratings yet

- Everything You Need To Know About CREATE Act in The PhilippinesDocument4 pagesEverything You Need To Know About CREATE Act in The PhilippinesMaricrisNo ratings yet

- Summarized Updates From CREATE LawDocument3 pagesSummarized Updates From CREATE LawJansel ParagasNo ratings yet

- For Domestic Corporations: 1. Salient Features of The CREATE LawDocument6 pagesFor Domestic Corporations: 1. Salient Features of The CREATE LawJean Tomugdan100% (1)

- Let's Talk Tax: Regular Corporate Income TaxDocument3 pagesLet's Talk Tax: Regular Corporate Income TaxEldren CelloNo ratings yet

- Research On CREATE LawDocument7 pagesResearch On CREATE LawalbycadavisNo ratings yet

- CREATE Act summary: Key tax reforms and incentivesDocument10 pagesCREATE Act summary: Key tax reforms and incentivesTreb LemNo ratings yet

- CREATE Bill: Early Christmas gift for businessesDocument5 pagesCREATE Bill: Early Christmas gift for businessesJane HandumonNo ratings yet

- House committee approves TRABAHO bill lowering corporate tax to 20% by 2029Document6 pagesHouse committee approves TRABAHO bill lowering corporate tax to 20% by 2029Andrew James Tan LeeNo ratings yet

- Carpolaw Com Everything You Need To Know About Create Act in The PhilippinesDocument8 pagesCarpolaw Com Everything You Need To Know About Create Act in The PhilippinesShane TabunggaoNo ratings yet

- Create Act: Corporate Recovery & Tax Incentives For EnterprisesDocument6 pagesCreate Act: Corporate Recovery & Tax Incentives For EnterprisesDanica RamosNo ratings yet

- Corporate Recovery and Tax Incentives For EnterprisesDocument5 pagesCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNo ratings yet

- Ce TaxDocument65 pagesCe Taxryl100% (1)

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreDocument9 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreAlicia Jane NavarroNo ratings yet

- Taxpayer's checklist for TRAIN law changesDocument6 pagesTaxpayer's checklist for TRAIN law changesChrislynNo ratings yet

- In Brief: Recent DevelopmentsDocument7 pagesIn Brief: Recent DevelopmentsScar IceNo ratings yet

- Tax Updates Under CREATE LawDocument4 pagesTax Updates Under CREATE LawSandy ArticaNo ratings yet

- Pedrocillo, Anne Abbygail V. CREATE LAWDocument2 pagesPedrocillo, Anne Abbygail V. CREATE LAWAnne Abbygail PedrocilloNo ratings yet

- 2020NMBE Taxation With AnswersDocument21 pages2020NMBE Taxation With AnswersWilsonNo ratings yet

- EY Tax Booklet, 2022Document65 pagesEY Tax Booklet, 2022Sabbir Ahmed PrimeNo ratings yet

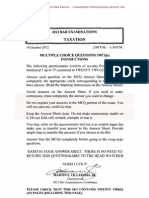

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- Highlights of the CREATE Law: Tax Reforms and IncentivesDocument3 pagesHighlights of the CREATE Law: Tax Reforms and IncentivesChristine Rufher FajotaNo ratings yet

- Corporate Income TaxationDocument43 pagesCorporate Income TaxationRose May AdanNo ratings yet

- Philippine Tax System Changes Under RA 10963Document17 pagesPhilippine Tax System Changes Under RA 10963franz mallariNo ratings yet

- Income Taxation Group2 MM2BDocument4 pagesIncome Taxation Group2 MM2BKorine Gain MarutaNo ratings yet

- Notes in Tax On IndividualsDocument4 pagesNotes in Tax On IndividualsPaula BatulanNo ratings yet

- 2012 Bar Examinations On TaxationDocument19 pages2012 Bar Examinations On Taxationjamaica_maglinteNo ratings yet

- Tax Rates and Exemptions for Corporations Under CREATE LawDocument18 pagesTax Rates and Exemptions for Corporations Under CREATE Lawjdy managbanagNo ratings yet

- Summary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoDocument6 pagesSummary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoNievelita OdasanNo ratings yet

- Revenue Regulations on Bayanihan Act Tax IncentivesDocument2 pagesRevenue Regulations on Bayanihan Act Tax IncentivesHannaNo ratings yet

- Income Taxation Midterm ExamDocument8 pagesIncome Taxation Midterm ExamJean Diane JoveloNo ratings yet

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- Succession and Transfer Taxes GuideDocument97 pagesSuccession and Transfer Taxes GuideKen AsadonNo ratings yet

- Withholding Tax: Taxation LawDocument21 pagesWithholding Tax: Taxation LawB-an JavelosaNo ratings yet

- 7 Types of Income Tax Corporations May PayDocument4 pages7 Types of Income Tax Corporations May PayNikolai DanielovichNo ratings yet

- Ey Indonesia - Tax Alert - Omnibus - E-Blast PDFDocument11 pagesEy Indonesia - Tax Alert - Omnibus - E-Blast PDFlarryNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)Document4 pagesTax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)thepoetsedgeNo ratings yet

- Bangladesh Income Tax Guide 2020 EYDocument60 pagesBangladesh Income Tax Guide 2020 EYAsif Assistant Manager100% (1)

- Write-Up CITIRA BillDocument3 pagesWrite-Up CITIRA BillMaeJoNo ratings yet

- Corporate Tax Rates PhilippinesDocument14 pagesCorporate Tax Rates PhilippinesJoyce Anne GarduqueNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- finance-act-2021-major-highlightsDocument6 pagesfinance-act-2021-major-highlightsAyodeji BabatundeNo ratings yet

- Faqs - Create LawDocument13 pagesFaqs - Create LawMichy De GuzmanNo ratings yet

- Budget - Salient Features - 2011!12!28 (1) .02Document3 pagesBudget - Salient Features - 2011!12!28 (1) .02Ruchira SonawaneNo ratings yet

- TAX Final PreboardDocument23 pagesTAX Final PreboardEDUARDO JR. VILLANUEVANo ratings yet

- CREATE Law lowers corporate income tax ratesDocument5 pagesCREATE Law lowers corporate income tax ratesyejiNo ratings yet

- Expansion 2Document1 pageExpansion 2Jean TomugdanNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehicleJean TomugdanNo ratings yet

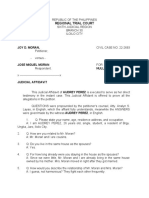

- AffidavitDocument1 pageAffidavitJean TomugdanNo ratings yet

- Audrey PerezDocument4 pagesAudrey PerezJean TomugdanNo ratings yet

- 2 - CONSTI 2 Cases Digests 1Document116 pages2 - CONSTI 2 Cases Digests 1Jean TomugdanNo ratings yet

- Michael Padua vs. People of The Philippines G.R. No. 168546, July 23, 2008Document2 pagesMichael Padua vs. People of The Philippines G.R. No. 168546, July 23, 2008Jean TomugdanNo ratings yet

- For Domestic Corporations: 1. Salient Features of The CREATE LawDocument6 pagesFor Domestic Corporations: 1. Salient Features of The CREATE LawJean Tomugdan100% (1)

- OrdinanceDocument2 pagesOrdinanceJean TomugdanNo ratings yet

- OrdinanceDocument2 pagesOrdinanceJean TomugdanNo ratings yet

- Adime Malnutrition and OncolgyDocument6 pagesAdime Malnutrition and Oncolgyapi-300587226100% (1)

- Divine Intervention Episode 5 Cardio A Physiology1Document18 pagesDivine Intervention Episode 5 Cardio A Physiology1Swisskelly1No ratings yet

- DAVAO DOCTORS COLLEGE NURSING DRUG STUDYDocument3 pagesDAVAO DOCTORS COLLEGE NURSING DRUG STUDYJerremy LuqueNo ratings yet

- VolvoTD70 Service Manual EngineDocument110 pagesVolvoTD70 Service Manual EngineHeikki Alakontiola87% (47)

- Brochure HMS LIME 12-04-22 V21Document14 pagesBrochure HMS LIME 12-04-22 V21i10 Sport PlusNo ratings yet

- SITHPAT006 Student LogbookDocument46 pagesSITHPAT006 Student LogbookÇrox Rmg PunkNo ratings yet

- Census of India 2011 Village and Town Level Data for Purba Champaran District, BiharDocument368 pagesCensus of India 2011 Village and Town Level Data for Purba Champaran District, BiharRahul SharmaNo ratings yet

- Bengal PresentationDocument37 pagesBengal PresentationManish KumarNo ratings yet

- New Grad RN Resume ObjectiveDocument5 pagesNew Grad RN Resume Objectiveafjzcgeoylbkku100% (2)

- Food Hydrocolloids: Long Chen, Yaoqi Tian, Yuxiang Bai, Jinpeng Wang, Aiquan Jiao, Zhengyu JinDocument11 pagesFood Hydrocolloids: Long Chen, Yaoqi Tian, Yuxiang Bai, Jinpeng Wang, Aiquan Jiao, Zhengyu JinManoel Divino Matta Jr.No ratings yet

- 3edited My Class Note 1 On Blood BankDocument46 pages3edited My Class Note 1 On Blood BankmatewosNo ratings yet

- Econ Double Regulating ValvesDocument18 pagesEcon Double Regulating ValvesElimKaAdda100% (1)

- Caterpillar C18 ACERTDocument2 pagesCaterpillar C18 ACERTMauricio Gomes de Barros60% (5)

- If You Have Guts Then Dare To Be DIFFERENTDocument20 pagesIf You Have Guts Then Dare To Be DIFFERENTChirag Saiya (PHILOSOPHER) - SPIRITUAL Speaker and Writer100% (1)

- Assignment 8 SolutionsDocument7 pagesAssignment 8 SolutionsCarlos Israel Esparza AndradeNo ratings yet

- TLIA3907B - Receive and Store Stock - Learner GuideDocument42 pagesTLIA3907B - Receive and Store Stock - Learner Guideromerofred100% (4)

- Brick AssDocument12 pagesBrick AssInaf NafiNo ratings yet

- Mental HealthDocument146 pagesMental HealthAnggraeni Beti Dwi LestariNo ratings yet

- Axell Wireless Cellular Coverage Solutions BrochureDocument8 pagesAxell Wireless Cellular Coverage Solutions BrochureBikash ShakyaNo ratings yet

- MetallizationDocument51 pagesMetallizationjust4u2cjoshy67% (3)

- Laurie BakerDocument12 pagesLaurie BakerchaplinNo ratings yet

- All India Integrated Test Series: JEE (Main) - 2022Document17 pagesAll India Integrated Test Series: JEE (Main) - 2022Beyond ur imagination100% (1)

- July 28Document8 pagesJuly 28thestudentageNo ratings yet

- Toyota Extra Care Factory Vehicle Service PlansDocument5 pagesToyota Extra Care Factory Vehicle Service PlansAnjihartsNo ratings yet

- AcetophenoneDocument3 pagesAcetophenonepriteshpatNo ratings yet

- Guide To Rural England - ShropshireDocument54 pagesGuide To Rural England - ShropshireTravel Publishing100% (2)

- Self-Confidence and Satisfaction Among Nursing Students With The Use of High Fidelity Simulation at Arab American University, PalestineDocument10 pagesSelf-Confidence and Satisfaction Among Nursing Students With The Use of High Fidelity Simulation at Arab American University, PalestineArianna Jasmine MabungaNo ratings yet

- Literature Review Sustainable DevelopmentDocument5 pagesLiterature Review Sustainable DevelopmentJade NelsonNo ratings yet

- Predictor PlatesDocument40 pagesPredictor PlatesrambabuNo ratings yet

- Standard QAPDocument9 pagesStandard QAPsivaNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)