Professional Documents

Culture Documents

Anuradha Singh PGSF1910 ER

Uploaded by

adarshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anuradha Singh PGSF1910 ER

Uploaded by

adarshCopyright:

Available Formats

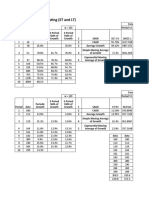

Calculating year wise Sharpe Ratio

Period Date Nifty 50 Portfolio Value

Week 1 4-Sep 11333.85 1059908.5

Week 2 11-Sep 11464.45 208803.5

Week 3 18-Sep 11504.95 228900.5

Week 4 25-Sep 11050.25 237719.75

Week 5 1.10.20 11416.95 242188.5

Average

Standard Deviation

BETA

Sharpe Ratio

Average Rm % Average Rp % Risk Free Rate % Excess Return %

11.3 5254.0 3.46 5250.51

Calculation of Treynor Index

Average Rm % Average Rp % Risk Free Rate % Excess Return %

11.3 5254.0 3.46 5250.51

Calculation of Jensen’s Alpha

Average Rm % Average Rp % Risk Free Rate % Beta

11.3 5254.0 3.46 -3.59

Calculation of Selectivity & Timing of the scheme

Return on

Date investment (Rp) Risk Free Rate Rp-Rf

4-Sep 0

11-Sep -4175.6 3.46 -4179.0525

18-Sep 500.5 3.46 497.0316

25-Sep 200.3 3.46 196.8895

1.10.20 97.8 3.46 94.2917

Regression output and interpretation

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.90650807454661

R Square 0.8217568892182

Adjusted R Square 0.6435137784364

Standard Error 156.664252800438

Observations 5

ANOVA

df SS MS

Regression 2 226308.267389068 113154.133694534

Residual 2 49087.376211039 24543.6881055195

Total 4 275395.643600107

Coefficients Standard Error t Stat

Intercept -102.79150606215 97.1023985219932 -1.0585887437051

Rm-Rf 1.6906475688164 0.627870957564596 2.69266725661932

(Rm-Rf)^2 0.01039058363215 0.004326414010565 2.4016618859812

Since both the coefficient is positive thus market timing and selectivity is there.

Annualised Rm Annualised Rp

29646.8392825812 Price Relative NSE

59.919621311382 -4175.5925157691 0.01145711992597

18.369830214271 500.491610533348 0.003526434471132

-205.515017449 200.349496833777 -0.040324325399114

172.56080179182 97.7516592542269 0.032646041108201

11.3 5254.0

158.6 13771.8

-3.59

Sharpe Ratio

0.38

Treynor Index

-1463%

Excess Return % Jensen’s alpha Alpha/Beta

5250.51 5278.77% -14.71

Market Return Risk Free

(Rm) Rate Rm-Rf (Rm-Rf)^2

0 0

59.92 3.46 56.46 3187.7

18.37 3.46 14.91 222.3

-205.52 3.46 -208.98 43670.6

172.56 3.46 169.10 28595.1

F Significance F

4.6103150108515 0.1782431107818

P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0%

0.4007507283638 -520.58940612802 315.006394 -520.58940613 315.006394003726

0.1146783271313 -1.0108631206793 4.39215826 -1.0108631207 4.39215825831212

0.1382965698043 -0.0082244734204 0.02900564 -0.0082244734 0.029005640684733

ming and selectivity is there.

Price Relative Portfolio SLOPE

-1.62454424430544

0.091893792996015

0.037805047524377

0.018623889730905 -5.849729

BETA -3.589319 <== Merrill Lynch

You might also like

- Practical Management Science 6th Edition Winston Solutions ManualDocument11 pagesPractical Management Science 6th Edition Winston Solutions ManualMeganJohnsontqpmf89% (9)

- Case Study: PERT MUSTANG 1Document11 pagesCase Study: PERT MUSTANG 1adarsh100% (1)

- CHP 4 5 CasesDocument8 pagesCHP 4 5 Casesnabilredascribd50% (2)

- mMD0HzEQEeiXDAqlnjuZaA PerformanceMeasures PracticeQuiz data-SOLUTIONSDocument3 pagesmMD0HzEQEeiXDAqlnjuZaA PerformanceMeasures PracticeQuiz data-SOLUTIONSjadgugNo ratings yet

- Eightcheck-3Wp Assay Sheet: Normal LevelDocument5 pagesEightcheck-3Wp Assay Sheet: Normal LevelLeonard OnsikNo ratings yet

- Tutorial 07-Capital BudgetingDocument2 pagesTutorial 07-Capital BudgetingShekhar Singh0% (1)

- I Will Teach You To Be Rich by Ramit Sethi Book Summary PDFDocument8 pagesI Will Teach You To Be Rich by Ramit Sethi Book Summary PDFOnnoSaikatNo ratings yet

- NAGADocument135 pagesNAGAraajiNo ratings yet

- Child MortalityDocument10 pagesChild MortalityRithik TiwariNo ratings yet

- Regression ModelDocument1 pageRegression Modelapi-3712367No ratings yet

- Period Demand 4 Period MA Forecast Error Revised ForecastDocument16 pagesPeriod Demand 4 Period MA Forecast Error Revised ForecastF13 NIECNo ratings yet

- Phân Tích Tương QuanDocument5 pagesPhân Tích Tương QuanMinh Nguyen PhucNo ratings yet

- Forecasting MathDocument40 pagesForecasting MathMohoua SRNo ratings yet

- Beta AsnmntDocument185 pagesBeta Asnmntjsehmi0288No ratings yet

- 23 RP TDS#Document7 pages23 RP TDS#RahayantiNo ratings yet

- Marker A B RF Log BM A: Chart TitleDocument2 pagesMarker A B RF Log BM A: Chart TitleJancokNo ratings yet

- AnalyticsDocument4 pagesAnalyticsm3gp13 yoNo ratings yet

- HamidDocument3 pagesHamidAbdullahNo ratings yet

- Session6 SolutionsDocument12 pagesSession6 Solutionsdhruv mahashayNo ratings yet

- Anurag 2Document6 pagesAnurag 2Ankit MaheshwariNo ratings yet

- S5. ForecastingDocument9 pagesS5. Forecastingvulienquan0312No ratings yet

- RegressionDocument6 pagesRegressiondineshdaniNo ratings yet

- Am ActivityDocument12 pagesAm ActivityGrace CaritNo ratings yet

- 2010 To 2019 Yearly Price Analysis of MRF LTDDocument23 pages2010 To 2019 Yearly Price Analysis of MRF LTDharish anjanNo ratings yet

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing Cellsdavid sikharulidzeNo ratings yet

- 3 Stage Model Coca-ColaDocument9 pages3 Stage Model Coca-Colaaditya agarwalNo ratings yet

- Fallas de Filtro de CombustibleDocument14 pagesFallas de Filtro de CombustibleJuan Francisco Requejo ZevallosNo ratings yet

- N Way Anova SAS SAmpleDocument6 pagesN Way Anova SAS SAmplekpfernandico.metslogisticsNo ratings yet

- Least Square MethodDocument9 pagesLeast Square MethodJanarthanan VtNo ratings yet

- Anova Summary OutputDocument6 pagesAnova Summary OutputS R SainiNo ratings yet

- bIRUL LAG - 1Document3 pagesbIRUL LAG - 1Kurniawan ArikaNo ratings yet

- Nama: Bernadetha Daud S NIM: B13.336 Prodi/jurusan: S1/AkuntansiDocument8 pagesNama: Bernadetha Daud S NIM: B13.336 Prodi/jurusan: S1/AkuntansiBernadetha Paula Daud SaputriNo ratings yet

- UjiDocument54 pagesUjiwidyaluhur94No ratings yet

- Quantity Sold Price Advertising 8500 2 2800 4700 5 200 5800 3 400 7400 2 500 6200 5 3200 7300 3 1800 5600 4 900Document3 pagesQuantity Sold Price Advertising 8500 2 2800 4700 5 200 5800 3 400 7400 2 500 6200 5 3200 7300 3 1800 5600 4 900sankeerthana annemNo ratings yet

- Cijena Line Fit Plot: Regression StatisticsDocument2 pagesCijena Line Fit Plot: Regression StatisticsDora ZidarNo ratings yet

- Year Net Income Current Assets Current Liab Non Curr Assets Non Curr Liab SalesDocument11 pagesYear Net Income Current Assets Current Liab Non Curr Assets Non Curr Liab SalesNishit RelanNo ratings yet

- FinalBUSN 6120Document13 pagesFinalBUSN 6120iceNo ratings yet

- Dupont FinalDocument5 pagesDupont FinalbiccyNo ratings yet

- Book 1Document3 pagesBook 1thakur paudelNo ratings yet

- Infra Budget and Econ GrowthDocument7 pagesInfra Budget and Econ Growthsatria setiawanNo ratings yet

- Excel WorkbookDocument17 pagesExcel WorkbookChaseNo ratings yet

- Problema DummyDocument15 pagesProblema DummyIon BataNo ratings yet

- Regression StatisticsDocument14 pagesRegression StatisticsAbhishek NegiNo ratings yet

- GF 2Document2 pagesGF 2peuangulaNo ratings yet

- PLANINGDocument6 pagesPLANINGnurul fitriaNo ratings yet

- LK Residual Plot M Residual Plot: Regression StatisticsDocument6 pagesLK Residual Plot M Residual Plot: Regression StatisticsfazarNo ratings yet

- Data Kelas Viic Dan ViigDocument10 pagesData Kelas Viic Dan ViigDwi Setiawati RadjakNo ratings yet

- Mutual FundDocument3 pagesMutual Fundta8213107No ratings yet

- BF - Second ClassDocument14 pagesBF - Second ClassArrow NagNo ratings yet

- Non-Linear Regression Salary AnalysisDocument4 pagesNon-Linear Regression Salary AnalysisRyanNo ratings yet

- Natural Logs SPSSDocument6 pagesNatural Logs SPSSAlbertNo ratings yet

- PLUM - Ordinal Regression: WarningsDocument3 pagesPLUM - Ordinal Regression: WarningsAnastasia WijayaNo ratings yet

- Regresi Optika Geometri Pada LensaDocument13 pagesRegresi Optika Geometri Pada LensajiahahNo ratings yet

- Decision ScienceDocument11 pagesDecision ScienceRachita RajNo ratings yet

- Tabel 1. Kondisi Awal Reservoir: Pi PB TR °api o Oi Boi Rsi SG Psig Psig °F at 60 °F GR/CC CP BBL/STB SCF/STB LapisanDocument5 pagesTabel 1. Kondisi Awal Reservoir: Pi PB TR °api o Oi Boi Rsi SG Psig Psig °F at 60 °F GR/CC CP BBL/STB SCF/STB LapisanAbdu Rizky MahulauwNo ratings yet

- Regression StatisticsDocument30 pagesRegression StatisticsWahyu Satyaning BudhiNo ratings yet

- PLUM - Ordinal Regression: WarningsDocument3 pagesPLUM - Ordinal Regression: WarningsAnastasia WijayaNo ratings yet

- F-Test Two-Sample For Variances: Variable 1 Variable 2Document5 pagesF-Test Two-Sample For Variances: Variable 1 Variable 2Syed Jauhar NaqviNo ratings yet

- Fig9 4Document4 pagesFig9 4HaseebAshfaqNo ratings yet

- 1Document6 pages1prem rajNo ratings yet

- Beta Microsoft-1Document4 pagesBeta Microsoft-1Heitham OmarNo ratings yet

- Ict ExcelDocument6 pagesIct ExcelRomelyn Modesto SagudenNo ratings yet

- AVIVADocument5 pagesAVIVAHAFIS JAVEDNo ratings yet

- Chapter 3 Regression Analysis Exam 12.4.22Document10 pagesChapter 3 Regression Analysis Exam 12.4.22patrick husseinNo ratings yet

- Report On Valagro Biosciences PVT LTD: Submitted by Adarsh KR Tiwari Under The Supervision of Sandeep Gurjar Submitted ToDocument23 pagesReport On Valagro Biosciences PVT LTD: Submitted by Adarsh KR Tiwari Under The Supervision of Sandeep Gurjar Submitted ToadarshNo ratings yet

- Summer Internship Project Report: Swarnika JainDocument42 pagesSummer Internship Project Report: Swarnika JainadarshNo ratings yet

- Modern Retail Companies For Agri Inputs (1/2) : Modern Retail Company Product/ Services Retailed Brief About OperationDocument4 pagesModern Retail Companies For Agri Inputs (1/2) : Modern Retail Company Product/ Services Retailed Brief About OperationadarshNo ratings yet

- Summer Intership Project Proposal: PGDM-SM 2019-2021Document14 pagesSummer Intership Project Proposal: PGDM-SM 2019-2021adarshNo ratings yet

- Akkufinal - Peanut ButterDocument9 pagesAkkufinal - Peanut ButteradarshNo ratings yet

- Question Number 2:: Brand Identity PrismDocument8 pagesQuestion Number 2:: Brand Identity PrismadarshNo ratings yet

- Women of Childbearing Age Children Under Age 5Document7 pagesWomen of Childbearing Age Children Under Age 5adarshNo ratings yet

- A) How Ow Benchmarking Can Help Organizations? What Are The Various Ways To Do Benchmarking?Document6 pagesA) How Ow Benchmarking Can Help Organizations? What Are The Various Ways To Do Benchmarking?adarshNo ratings yet

- Do Not Hesitat To Consult Patra Sir Quality of The Report: Don't Go For Short CutsDocument3 pagesDo Not Hesitat To Consult Patra Sir Quality of The Report: Don't Go For Short CutsadarshNo ratings yet

- Adarsh Tiwari (5'11'') (180 CMS)Document1 pageAdarsh Tiwari (5'11'') (180 CMS)adarshNo ratings yet

- Agrochemical AdarshDocument7 pagesAgrochemical AdarshadarshNo ratings yet

- Decision Tree L11 PDFDocument40 pagesDecision Tree L11 PDFadarshNo ratings yet

- Chapter 06 PDFDocument24 pagesChapter 06 PDFadarshNo ratings yet

- Final Exam Prep OpsDocument9 pagesFinal Exam Prep OpsadarshNo ratings yet

- Chapter 10 PDFDocument9 pagesChapter 10 PDFadarshNo ratings yet

- Chapter 07Document14 pagesChapter 07adarshNo ratings yet

- Chapter 05Document24 pagesChapter 05adarshNo ratings yet

- Chapter 04Document9 pagesChapter 04adarshNo ratings yet

- 8 Examples of Accountability - SimplicableDocument10 pages8 Examples of Accountability - SimplicableadarshNo ratings yet

- ACCN 101 ASSIGNMENT GROUP OF 1o.docx2Document37 pagesACCN 101 ASSIGNMENT GROUP OF 1o.docx2Simphiwe KarrenNo ratings yet

- IFRS For Power UtilitiesDocument14 pagesIFRS For Power Utilitiesmittaldivya167889No ratings yet

- Musa Moshref and Shaniqua Hollins Have Operated A Successful FirmDocument2 pagesMusa Moshref and Shaniqua Hollins Have Operated A Successful FirmMuhammad ShahidNo ratings yet

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- Premier University: Term Paper On "Stock Market in Bangladesh"Document51 pagesPremier University: Term Paper On "Stock Market in Bangladesh"Kamrul HasanNo ratings yet

- 20 Pips Daily Price Action Forex Breakout StrategyDocument4 pages20 Pips Daily Price Action Forex Breakout StrategyJoseph KachereNo ratings yet

- Statutory Liquidity Ratio (SLR) : What Is SLR? Approved Securities by Rbi For SLR Objective For Maintaining SLRDocument3 pagesStatutory Liquidity Ratio (SLR) : What Is SLR? Approved Securities by Rbi For SLR Objective For Maintaining SLRDhaval224No ratings yet

- Business ApplicationDocument1 pageBusiness ApplicationBảo Châu VươngNo ratings yet

- Session 18 Risk Return Portfolio BetaDocument157 pagesSession 18 Risk Return Portfolio BetahimanshNo ratings yet

- 1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsDocument22 pages1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsAbdulAzeemNo ratings yet

- Mid CORFINDocument16 pagesMid CORFINRichard LazaroNo ratings yet

- Business Finance Week 2Document18 pagesBusiness Finance Week 2Milo CuaNo ratings yet

- W2 - Key Tutorial 3Document5 pagesW2 - Key Tutorial 3Rules of Survival MALAYSIANo ratings yet

- Bank of Rajasthan - ICICI BankDocument12 pagesBank of Rajasthan - ICICI BanksawmyaNo ratings yet

- Limitation of Ratio AnalysisDocument5 pagesLimitation of Ratio AnalysisMir Wajahat AliNo ratings yet

- Credit Risk ManagementDocument63 pagesCredit Risk ManagementNagireddy KalluriNo ratings yet

- 2020 NoertjahyanaDocument9 pages2020 NoertjahyanaAli AzizNo ratings yet

- 2020 Intrinsic Value CalculatorDocument4 pages2020 Intrinsic Value CalculatorManas BhatnagarNo ratings yet

- Financial Modelling - ExcelDocument39 pagesFinancial Modelling - ExcelEric ChauNo ratings yet

- Abcor MedhaDocument11 pagesAbcor MedharamanNo ratings yet

- Module IIIDocument32 pagesModule IIIPrema GowdaNo ratings yet

- Valuation of SecuritiesDocument31 pagesValuation of Securitiesmansi sainiNo ratings yet

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Document20 pagesStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderNo ratings yet

- Fabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Document24 pagesFabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Maria Nikka GarciaNo ratings yet

- How To Analyze Bank Nifty Option ChainDocument3 pagesHow To Analyze Bank Nifty Option ChainSonuNo ratings yet

- Banking and Marketing TermsDocument17 pagesBanking and Marketing TermsVigya JindalNo ratings yet